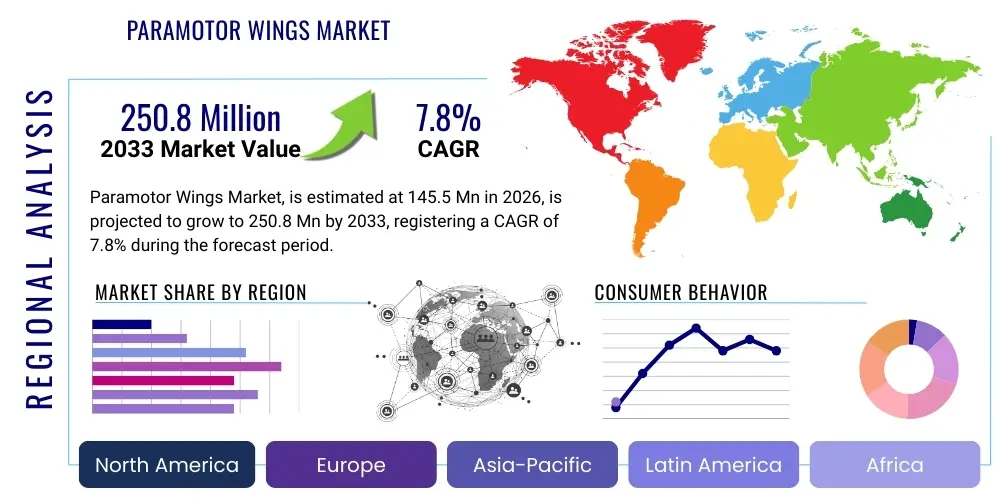

Paramotor Wings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441355 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Paramotor Wings Market Size

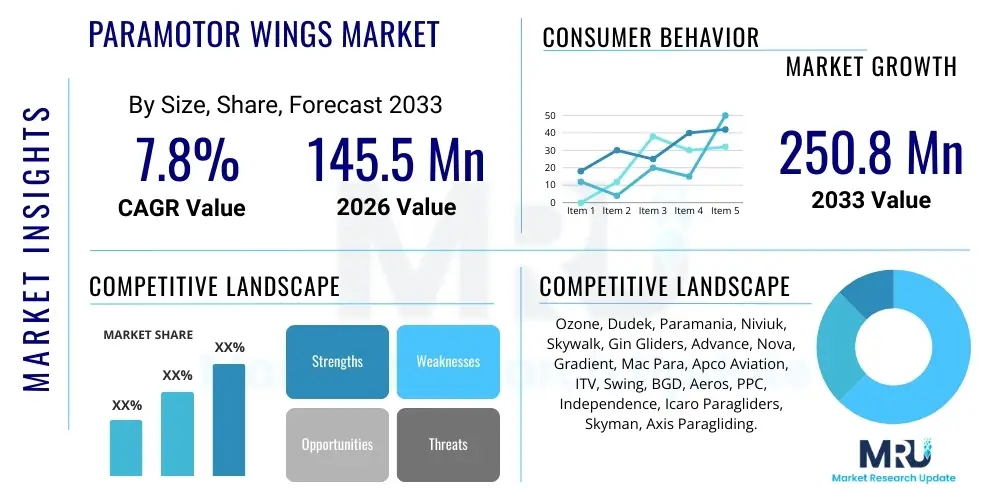

The Paramotor Wings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 145.5 Million in 2026 and is projected to reach USD 250.8 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the increasing accessibility of paramotoring as a recreational sport, coupled with technological advancements leading to safer and more performance-oriented wing designs. The rising disposable incomes in emerging economies and the expanding global tourism sector also contribute substantially to the market expansion, making specialized high-performance wings a sought-after commodity.

Paramotor Wings Market introduction

The Paramotor Wings Market encompasses the design, manufacturing, and distribution of specialized fabric wings utilized in powered paragliding (PPG). These wings, structurally similar to standard paragliding canopies but optimized for operation with a motorized fan unit (paramotor), are crucial components that provide lift and directional control. The core product incorporates advanced textile technologies, primarily high-tenacity ripstop nylon and complex line systems, ensuring durability, lightweight characteristics, and precise aerodynamic profiles. Manufacturers focus intensely on achieving high aspect ratios for improved glide performance while maintaining robust passive safety features necessary for motorized flight operations.

Major applications of paramotor wings extend beyond recreational flight, prominently including aerial surveying, lightweight search and rescue operations, surveillance activities, and specialized agricultural tasks such such as precision crop spraying in difficult-to-access terrain. The market is segmented based on wing type (e.g., beginner, intermediate, advanced/competition), design (reflex profile, semi-reflex), and material composition. The inherent benefit of paramotoring, offering affordable and accessible personal aviation, drives demand. Unlike traditional aircraft, paramotors require minimal runway space and infrastructure, offering unparalleled flexibility and portability, which further solidifies their application across various sectors globally.

Driving factors for this market include stringent safety regulations that necessitate the replacement of older, non-compliant wings, continuous innovation in lightweight engine technology making propulsion systems more efficient, and the increasing organization of international paramotoring competitions and events, which fuels demand for cutting-edge competition-grade wings. Furthermore, the robust growth of pilot training schools globally ensures a steady pipeline of new users entering the market, requiring initial and progression-level equipment. The emphasis on fuel efficiency and reduced noise pollution in newer paramotor setups also indirectly boosts the market for optimized, aerodynamically superior wing designs.

Paramotor Wings Market Executive Summary

The Paramotor Wings Market exhibits robust business trends characterized by increased vertical integration among major manufacturers, who are now often producing both the motor units and the wings, ensuring optimized compatibility and performance packages. There is a noticeable shift towards sustainable manufacturing practices, utilizing recycled materials in wing construction where possible, aligning with broader consumer ecological preferences. Segment trends indicate a substantial surge in demand for intermediate and advanced reflex profile wings, which offer enhanced speed stability and efficiency, catering to the growing base of experienced pilots seeking cross-country flight capabilities. The safety segment, focusing on high-visibility color schemes and passive safety technologies like easy inflation and collapse resistance, remains a foundational and non-negotiable driver across all product categories, securing continuous replacement cycles based on mandated longevity and safety inspections.

Regionally, North America and Europe dominate the market due to established paramotoring cultures, high per capita spending on recreational aviation, and clear regulatory frameworks facilitating safe operation. However, the Asia Pacific (APAC) region, particularly countries like China and India, is emerging as the fastest-growing market segment. This accelerated growth is attributed to rising interest in adventure sports, increasing affluence among younger populations, and significant government investments in recreational infrastructure and pilot licensing programs. The competitive landscape is fragmented, with several highly specialized European and North American companies maintaining technological leadership through continuous R&D efforts focused on material science and computational fluid dynamics (CFD) modeling for enhanced aerodynamic efficiency and structural integrity.

Key market participants are strategically focusing on geographical expansion and product diversification. Mergers and acquisitions are infrequent but targeted, usually involving material suppliers or specialized design firms to gain intellectual property advantage. Pricing strategies are highly competitive, especially in the entry-level segment, where volume sales are critical. Conversely, high-performance wings command premium pricing based on technological exclusivity and certification complexity. The market’s resilience is demonstrated by its quick recovery post-global economic slowdowns, highlighting the enduring appeal of accessible personal aviation. Long-term profitability hinges on maintaining rigorous quality control and adapting swiftly to evolving global aviation standards and regulatory compliance requirements.

AI Impact Analysis on Paramotor Wings Market

User inquiries regarding AI's influence in the Paramotor Wings Market primarily center on how artificial intelligence can enhance wing design optimization, improve safety systems, and streamline pilot training. Common questions revolve around the use of machine learning (ML) in predicting canopy performance under various atmospheric conditions, the integration of AI-driven sensors for real-time flight anomaly detection, and the potential for automated wing manufacturing quality control. Users express high expectations that AI modeling will drastically reduce the physical prototyping cycle, leading to faster innovation and the development of highly customized, personalized wings that dynamically adjust their profile based on immediate environmental inputs. Concerns often touch upon the complexity of certifying AI-enhanced systems under existing strict aviation regulations and the potential for over-reliance on automated systems, thereby diminishing core pilot skills.

The application of sophisticated AI algorithms, particularly in CFD modeling, is revolutionizing the initial design phase of paramotor wings. Traditional iterative design processes, which relied heavily on physical testing, are being superseded by ML models capable of simulating thousands of permutations of profile shapes, line configurations, and material stresses in a fraction of the time. This allows manufacturers to achieve unparalleled optimization of lift-to-drag ratios and stability characteristics before cutting any fabric. Furthermore, AI is critical in analyzing vast datasets generated from telemetry systems, identifying subtle correlations between pilot input, wing behavior, and environmental conditions, leading directly to safer, more predictable wing performance across diverse operational envelopes.

In manufacturing and pilot training, AI offers significant efficiency gains. Automated vision systems powered by AI are deployed for defect detection during the cutting and sewing processes, ensuring that material tolerances and line lengths meet exact specifications, thereby improving overall quality control and reducing manufacturing waste. For training, AI-driven flight simulators provide highly realistic, adaptive scenarios based on real-world incident data, allowing novice pilots to practice emergency procedures with greater fidelity. This integration of predictive analytics and automated quality assurance mechanisms is elevating the standard of equipment safety and manufacturing precision across the entire industry supply chain.

- AI-enhanced Computational Fluid Dynamics (CFD) modeling accelerating wing profile optimization.

- Machine Learning algorithms predicting material stress and fatigue under varied flight conditions.

- Integration of AI sensors for real-time passive safety systems, potentially detecting and mitigating asymmetric collapses.

- Automated quality control systems utilizing computer vision for precision manufacturing and defect detection.

- AI-driven flight simulators providing adaptive, personalized training scenarios for new pilots.

- Predictive maintenance analytics for early identification of line wear and canopy degradation.

- Optimization of material cutting layouts to minimize wastage and environmental footprint.

DRO & Impact Forces Of Paramotor Wings Market

The Paramotor Wings Market is driven by several synergistic factors, prominently including the rising global adoption of adventure tourism and paramotoring being a highly accessible form of recreational aviation, often requiring less restrictive licensing compared to traditional general aviation. Technological improvements, such as the introduction of lighter, stronger fabrics (e.g., specialized high-density Nylon 6.6) and enhanced reflective wing designs (reflex profiles), further drive market dynamism by offering superior speed, fuel efficiency, and stability, thereby expanding the potential application space. However, the market faces significant restraints, chiefly regulatory hurdles involving restricted airspace designations and increasing requirements for mandatory certifications and periodic safety inspections, which increase the total cost of ownership for end-users. Opportunities arise from the burgeoning use of paramotoring in commercial applications like drone delivery support and environmental monitoring, areas that demand specialized, heavy-lift wing configurations and rigorous durability standards, opening up profitable niche markets. The primary impact forces shaping the industry are the intense competitive rivalry among established manufacturers pushing for aerodynamic superiority, coupled with the critical bargaining power of regulators defining safety standards and operational limitations worldwide.

One major driver is the continuous commitment by manufacturers to enhance the passive safety features of their wings. This commitment is not merely a competitive edge but often a prerequisite for operating in highly regulated jurisdictions, especially across Western Europe and North America. Innovations like self-cleaning air intakes, which prevent debris ingestion, and improved flare authority at landing speeds, significantly reduce accident rates, thereby encouraging greater participation from risk-averse demographics. Furthermore, the economic advantage of paramotoring over fixed-wing or rotary aviation for low-altitude, short-duration tasks reinforces its status as a cost-effective solution, stimulating demand from paramilitary, agricultural, and surveying organizations seeking budget-friendly aerial platforms. These operational efficiencies make new wing purchases economically justifiable for commercial entities.

Restraints are heavily influenced by the high initial cost of quality paramotor wing sets and the limited operational lifespan mandated by safety guidelines, typically around 300 to 500 hours of flight time, leading to predictable replacement cycles but representing a significant recurring expense for frequent flyers. Weather dependency remains a practical constraint, limiting flight operations and utilization rates, particularly in regions prone to strong winds or turbulent air masses. Market opportunities are robust, however, centered on developing specialized wings for high-altitude operations and electric paramotor systems, which require ultra-lightweight and highly efficient wing designs to maximize battery range. The impact forces are also shaped by the supplier power of technical fabric providers, as the performance and longevity of a wing are directly tied to the proprietary coatings and weave density of the cloth, leading to strong reliance on a few specialized textile mills.

Segmentation Analysis

The Paramotor Wings Market is meticulously segmented across multiple dimensions to reflect the diverse needs of pilots, applications, and performance requirements globally. Key segmentation criteria include the type of wing based on pilot skill level (Beginner, Intermediate, Advanced/Competition), the aerodynamic profile design (Reflex, Semi-Reflex, Standard), the load capacity and size (Small, Medium, Large, Tandem), and the specific material construction and longevity rating. This granular segmentation allows manufacturers to target specific demographic cohorts—ranging from professional instructors requiring durable training wings to competition pilots demanding cutting-edge, high-aspect ratio canopies optimized for speed and glide efficiency under high throttle settings. Understanding these segments is vital for assessing market growth vectors and allocating resources for product development and marketing.

The segmentation by aerodynamic profile, specifically the rise of reflex technology, is critically important. Reflex wings offer unparalleled pitch stability and collapse resistance at high speeds, making them the preferred choice for cross-country flying and heavy payloads, including tandem flights and commercial applications. Conversely, standard profile wings, characterized by their ease of inflation and high passive safety, dominate the beginner and training sectors. Geographic segmentation reveals strong preferences for specific wing characteristics based on prevalent local flying conditions; for instance, regions with frequent thermal activity might favor wings with enhanced maneuverability, while flat regions often prioritize speed and efficiency inherent in reflex designs. The ongoing refinement of sizing segmentation, driven by the increasing availability of lightweight titanium and carbon fiber motor frames, allows for more precise pairing of pilot weight, motor power, and wing surface area, maximizing overall performance envelope and safety margins.

The material segmentation is undergoing a silent revolution, moving towards advanced composite fabrics treated with specialized polymer coatings to enhance UV resistance, air impermeability, and overall tear strength. These high-end materials, while increasing manufacturing costs, significantly extend the operational life of the wing, offering better value proposition for commercial operators and reducing long-term environmental impact. Tandem wings, designed for carrying two individuals, form a specialized sub-segment demonstrating accelerated growth, driven by the popularity of introductory scenic flights offered by commercial operators and training schools. Each segment is continually influenced by certification standards from bodies like the Paragliding Manufacturers Association (PMA) and regional airworthiness authorities, which dictate design parameters and necessary safety features for market acceptance and legal operation.

- By Wing Type:

- Beginner Wings (High Passive Safety, Low Aspect Ratio)

- Intermediate Wings (Balanced Performance, Moderate Aspect Ratio)

- Advanced/Competition Wings (High Performance, High Aspect Ratio, Reflex Profile)

- By Aerodynamic Profile:

- Reflex Profile Wings

- Semi-Reflex Profile Wings

- Standard/Classic Profile Wings

- By Application:

- Recreational and Sport Flying

- Training and Instruction

- Commercial Operations (Aerial Surveying, Search and Rescue, Agriculture)

- By Size/Load Capacity:

- Single Pilot (Small, Medium, Large)

- Tandem/Two-Seater

- Heavy-Lift/Utility (Specialized Commercial)

- By Region:

- North America (NA)

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Paramotor Wings Market

The Paramotor Wings Value Chain is characterized by highly specialized stages, beginning with upstream material supply. Upstream analysis focuses predominantly on the textile manufacturers who produce high-tenacity polyester and nylon fabrics (such as Porcher Sport Skytex or Dominico Textiles). These suppliers hold significant leverage due to the proprietary nature of their specialized coatings, which determine the fabric's air permeability, UV resistance, and overall longevity—critical parameters for flight safety and performance. Manufacturing involves precision laser cutting, intricate sewing processes to ensure the exact shape and profile of the wing, and the complex assembly of high-strength suspension lines (typically Dyneema or Aramid fibers). Quality control at this stage is paramount, involving rigorous testing of material tension and seam integrity before certification bodies like the DGAC or EN conduct flight tests for safety approval.

The midstream focuses on the Paramotor Wing manufacturers themselves, who act as integrators, leveraging their intellectual property in aerodynamic design and computational modeling. These companies manage complex certification logistics and maintain extensive global distribution networks. Downstream activities involve reaching the end-user through various distribution channels. Direct channels include manufacturer-owned online stores and flagship retail centers, often providing superior customization options and direct technical support. Indirect channels, which form the bulk of market penetration, rely heavily on authorized dealers, professional paramotoring schools, and specialized adventure sports retailers, who play a crucial role in providing local support, maintenance services, and pilot instruction, thereby facilitating sales and adoption.

The sales ecosystem relies heavily on training schools and instructors, who often serve as powerful key opinion leaders, recommending specific brands and models to their student base, effectively acting as primary sales agents. This indirect channel is essential for maintaining brand loyalty and disseminating safety information. The entire chain is highly sensitive to external factors, including currency exchange rates (as most specialized components are sourced globally) and international shipping logistics. Furthermore, the mandatory requirement for periodic re-trimming and line replacement services creates a vital after-market service component, contributing significantly to the overall long-term revenue stream for authorized distributors and specialized maintenance centers.

Paramotor Wings Market Potential Customers

The primary segment of potential customers for the Paramotor Wings Market comprises recreational pilots, ranging from newly licensed trainees acquiring their first wing to seasoned enthusiasts seeking upgrades for better performance or specialized capabilities like advanced aerobatics or competitive racing. These individual buyers prioritize ease of use, safety ratings, and the reputation of the brand for reliability and after-sales support. Their purchasing decisions are highly influenced by peer recommendations, flight instructor endorsements, and performance benchmarks published in specialized aviation magazines and online forums, leading to pronounced brand loyalty within the community, especially for high-end competition wings.

A rapidly expanding customer base includes commercial operators and governmental entities. Commercial buyers include companies specializing in aerial photography, high-resolution topographical mapping, and utility line inspection, where the low operational cost and portability of paramotors offer a competitive advantage over helicopters or manned drones. These commercial users demand wings with exceptional durability, high payload capacity (often requiring specialized tandem or heavy-lift designs), and extended lifespan ratings, necessitating materials that can withstand rigorous, sustained use under varied climatic conditions. Reliability and minimal downtime are crucial metrics for this segment.

Furthermore, military and public safety organizations represent a strategic niche market. Paramotors are increasingly employed by search and rescue (SAR) teams, border patrol agencies, and certain special operations units for rapid, low-altitude reconnaissance, particularly in rugged or inaccessible terrains where traditional vehicles are impractical. These institutional buyers focus on camouflage or low-signature wings, extreme temperature tolerance, and stringent compliance with military specification standards (Mil-Spec). Training schools globally constitute another foundational customer segment, requiring bulk purchases of robust, easy-to-manage entry-level wings designed to withstand the wear and tear associated with intensive student use and frequent ground handling exercises, prioritizing longevity over peak performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 250.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ozone, Dudek, Paramania, Niviuk, Skywalk, Gin Gliders, Advance, Nova, Gradient, Mac Para, Apco Aviation, ITV, Swing, BGD, Aeros, PPC, Independence, Icaro Paragliders, Skyman, Axis Paragliding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Paramotor Wings Market Key Technology Landscape

The technological landscape of the Paramotor Wings Market is characterized by continuous refinement in aerodynamic modeling and material innovation, aiming primarily for enhanced passive safety and superior efficiency. The core technology revolves around Computational Fluid Dynamics (CFD), which allows designers to simulate complex airflow patterns and optimize the wing's profile (camber, thickness, aspect ratio) with high precision, maximizing lift while minimizing drag. A pivotal innovation is the refinement of the reflex profile design, where the trailing edge is upturned. This structure mechanically increases pitch stability at high speeds and resists frontal collapse, enabling pilots to utilize the full speed range of their motor efficiently, which is crucial for cross-country flights and navigating turbulent air masses prevalent during daytime operations.

Material technology remains a critical determinant of performance and longevity. Modern paramotor wings utilize advanced high-tenacity nylon or polyester fabrics, often incorporating ripstop structures to prevent tears from propagating. These fabrics are treated with specialized polymer coatings (such as silicone or polyurethane) to maintain extremely low air permeability, which is essential for preserving the wing's intended aerodynamic shape over its certified lifespan. The technological challenge lies in developing coatings that maximize longevity and UV resistance without adding excessive weight or stiffness, as a supple fabric is crucial for easy and reliable inflation during launch. The transition towards lighter weight lines (e.g., Aramid or Dyneema) with reduced diameter further minimizes drag, contributing directly to better glide ratios and reduced fuel consumption.

The integration of technology extends beyond the canopy structure itself into auxiliary components such as risers and trims systems. Modern wings feature complex speed systems and trimmers that allow pilots dynamic control over the wing's angle of attack and profile, enabling fine-tuning for specific flight conditions or maneuvers. Furthermore, the adoption of sophisticated laser cutting machines ensures manufacturing precision, guaranteeing that every cell and line attachment point is dimensionally accurate to the millimeter, which is vital for maintaining the certified flight characteristics. The future technology trajectory is likely to focus on smart textiles that incorporate embedded sensors for real-time monitoring of wing deformation or stress points, providing predictive maintenance alerts and further enhancing overall flight safety.

Regional Highlights

- Europe: Europe stands as the dominant market for Paramotor Wings, largely driven by mature paramotoring cultures in countries such as France, Germany, and the United Kingdom. This region benefits from high population density, established training infrastructures, and a high concentration of leading manufacturers (e.g., Ozone, Dudek, Niviuk). Strict safety regulations and mandatory periodic inspections contribute to a robust replacement market. The European Union's standardized airworthiness requirements (like EN certification) facilitate trade and bolster consumer confidence in product quality and safety, underpinning sustained growth, especially in the advanced and competition segments fueled by frequent international events.

- North America (NA): The North American market, dominated by the United States, exhibits rapid growth characterized by a strong recreational flying community and increasing adoption for agricultural spot spraying and wildlife monitoring. The large geographic area makes paramotoring an attractive method for personal transport and aerial observation in remote locations. Key growth factors include favorable regulatory interpretations (e.g., Part 103 exemptions for ultralight vehicles in the US) and a culture that embraces personal aviation and adventure sports, leading to high demand for powerful reflex wings suitable for varied terrain and long-distance flying.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by surging interest in extreme sports in economies like China, South Korea, and Southeast Asian nations. Increasing disposable incomes, improving flight infrastructure, and relaxation of certain airspace restrictions are accelerating market penetration. While the market is currently price-sensitive, focusing initially on entry-level and training wings, there is a burgeoning segment seeking high-performance equipment as the pilot population matures, offering significant untapped potential for advanced manufacturers.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth, particularly in Brazil and Argentina, where paramotoring is popular for scenic flights and utility applications in large farming regions. Challenges include inconsistent regulation and economic volatility, but the market is sustained by strong local communities and the cost-effectiveness of paramotors compared to other light aircraft. Emphasis is placed on rugged, durable wings capable of handling less-than-ideal launching and landing environments.

- Middle East and Africa (MEA): This region is characterized by nascent but emerging markets, often driven by government applications, particularly border surveillance and security operations in desert environments. The high solar exposure and heat necessitate wings made from specialized, highly UV-resistant materials. Recreational growth is concentrated in areas with high tourism investment, catering to adventure tourists and specialized flight experiences, though regulatory environments remain complex and fragmented.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Paramotor Wings Market.- Ozone Gliders

- Dudek Paragliding

- Paramania Paragliding

- Niviuk Paragliders

- Skywalk Paragliders

- Gin Gliders

- Advance Paragliders

- Nova Paragliding

- Gradient Paragliding

- Mac Para Technology

- Apco Aviation

- ITV Parapente

- Swing Paragliders

- BGD (Bruce Goldsmith Design)

- Aeros Gliders

- PPC (Powered Paragliding Company)

- Independence Paragliding

- Icaro Paragliders

- Skyman Paragliders

- Axis Paragliding

Frequently Asked Questions

Analyze common user questions about the Paramotor Wings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Paramotor Wings Market?

The Paramotor Wings Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period from 2026 to 2033, driven by recreational adoption and technological advancements in wing efficiency and safety.

Which technological innovation is most significantly impacting modern paramotor wing design?

The refinement of the Reflex Profile technology is the most significant innovation, offering superior pitch stability and high-speed collapse resistance, which is essential for maximizing performance and safety in motorized cross-country flight operations.

What are the primary restraints affecting the expansion of the Paramotor Wings Market?

Primary restraints include complex and varying airspace regulations across different jurisdictions, the high initial investment cost required for quality equipment, and the operational limitations imposed by weather dependency, restricting flight frequency and use cases.

How is the Paramotor Wings Market segmented by application?

The market is segmented by application into Recreational and Sport Flying, Professional Training and Instruction, and specialized Commercial Operations, which includes aerial surveying, search and rescue, and agricultural services.

Which region currently leads the global Paramotor Wings Market in terms of market share?

Europe currently leads the Paramotor Wings Market, attributable to its deeply entrenched paramotoring culture, robust regulatory framework, and the presence of numerous leading specialized manufacturing and design companies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager