Party and Event Rental Supplier Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442497 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Party and Event Rental Supplier Market Size

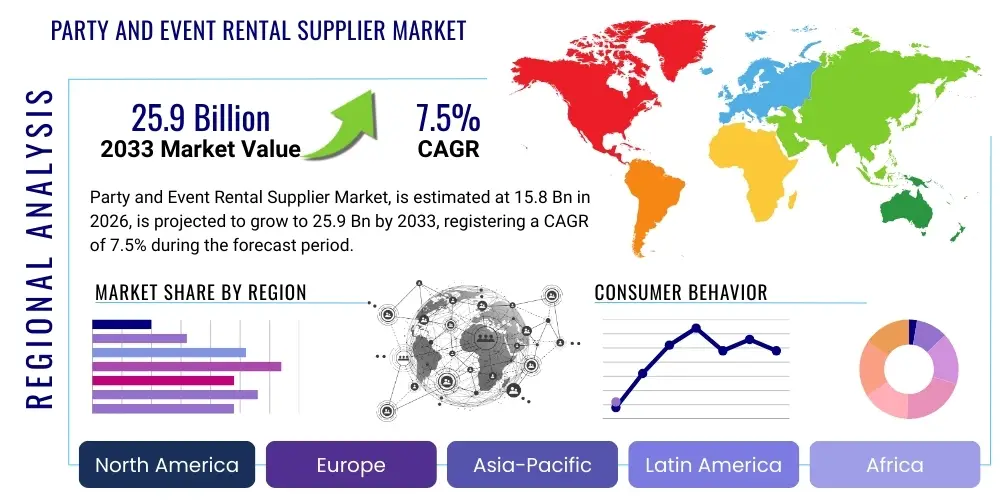

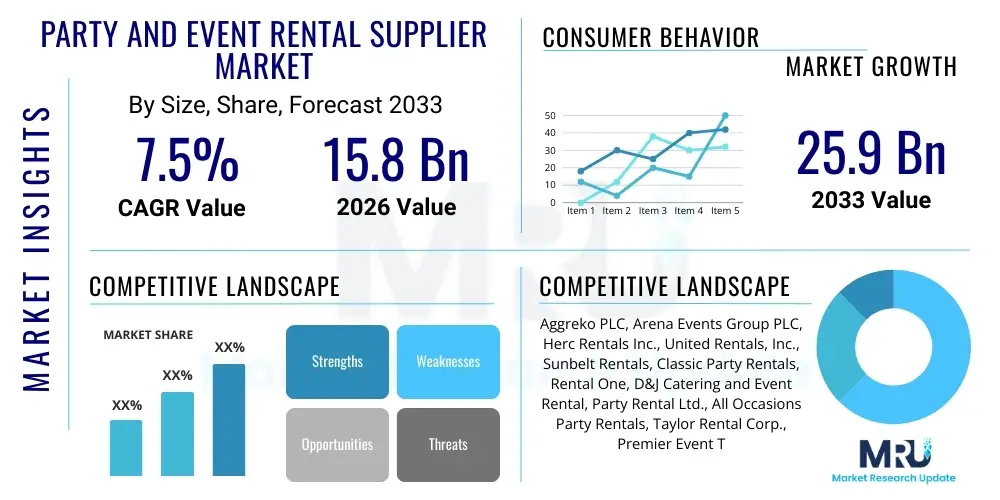

The Party and Event Rental Supplier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 25.9 Billion by the end of the forecast period in 2033.

The consistent expansion of the market is primarily attributed to the rebounding global events sector following pandemic-related disruptions, coupled with increasing consumer preference for rental services over ownership. This shift is driven by economic efficiency, sustainability considerations, and the desire for specialized, high-quality aesthetics that event rental suppliers can provide for bespoke events. Furthermore, the rising professionalization of event planning across corporate and social sectors necessitates scalable and flexible inventory management, which rental suppliers are optimally positioned to deliver.

Geographic market growth is uneven, with significant impetus stemming from densely populated urban centers in North America and Europe, where large-scale corporate events, festivals, and high-end weddings dominate demand. However, emerging economies in the Asia Pacific are showing the fastest growth trajectory, propelled by increasing disposable incomes and the Westernization of celebratory traditions. This disparity dictates differing investment strategies among market leaders, focusing either on high-volume inventory procurement in mature markets or establishing robust logistical networks in rapidly expanding regions to capitalize on nascent demand for quality event infrastructure and decorative items.

Party and Event Rental Supplier Market introduction

The Party and Event Rental Supplier Market encompasses a wide spectrum of services and physical assets rented out for temporary usage across various events, ranging from intimate social gatherings and weddings to major corporate functions, trade shows, and public festivals. Key products include structural elements like tents and temporary flooring, essential infrastructure such as seating and tables, technological components including advanced audiovisual equipment, and decorative items like linens, china, and specialized furniture. The market functions as a critical enabler for the global events industry, providing necessary scale, logistical support, and aesthetic enhancement without the prohibitive capital expenditure associated with purchasing specialized equipment for one-off use. The inherent flexibility and cost-effectiveness of rental models are key benefits driving market adoption, allowing clients to curate unique experiences efficiently.

Major applications span both B2B and B2C segments. Corporate clients utilize rental services for product launches, conferences, and employee appreciation events, often requiring sophisticated staging and presentation technology. Social events, particularly weddings and large private parties, demand extensive inventories of high-end décor and catering equipment. The primary driving factors for market growth include the steady recovery of the global MICE (Meetings, Incentives, Conferences, and Exhibitions) industry, the growing complexity and size of modern events requiring specialized logistics, and the increasing emphasis on sustainable event practices, where renting aligns perfectly with circular economy principles by minimizing waste and resource use.

Furthermore, the digitalization of the booking and inventory management process represents a significant benefit, improving operational efficiency and customer experience. Rental suppliers are increasingly leveraging online platforms and visualization tools to simplify selection and reservation, thereby expanding their accessible market base. This integration of technology, coupled with the continued demand for unique and memorable event aesthetics, ensures the market's robust trajectory. The fundamental benefit provided by these suppliers is the provision of temporary luxury and utility, minimizing client overhead while maximizing event impact and scale.

Party and Event Rental Supplier Market Executive Summary

The Party and Event Rental Supplier Market exhibits robust growth, underpinned by favorable business trends focused on digitalization, inventory diversification, and consolidation among major players seeking economies of scale. Business trends highlight a pronounced shift towards technology integration, specifically in dynamic pricing models, enhanced customer relationship management (CRM), and advanced logistics planning facilitated by telematics and real-time tracking systems to maximize asset utilization. The increasing demand for premium, specialized, and theme-specific inventory (e.g., bespoke décor, high-end furniture, state-of-the-art immersive A/V systems) is pushing suppliers to continuously refresh and upgrade their offerings, leading to higher average transaction values (ATVs) and improved profit margins in the luxury segment. Furthermore, sustainability is becoming a non-negotiable business metric, influencing sourcing decisions and operational efficiency, driving demand for eco-friendly products and reduced transportation emissions.

Regionally, North America maintains market dominance due to its established infrastructure, high propensity for corporate events, and significant consumer spending on private celebrations, making it a critical hub for innovation in rental technology and specialized product lines. However, the Asia Pacific (APAC) region is forecasted to demonstrate the highest CAGR, fueled by rapid urbanization, an expanding middle class adopting Westernized event formats, and heavy investment in tourism and hospitality infrastructure in countries like China, India, and Southeast Asian nations. Europe showcases steady, mature growth, emphasizing regulatory compliance regarding safety standards for event infrastructure and a strong focus on sustainable and culturally sensitive event planning, particularly in the wedding and festival sectors. The maturity of the regional markets dictates varied competitive strategies, from acquisition-based growth in the West to infrastructure establishment in the East.

Segment trends indicate that the Tents, Canopies, and Structures segment remains fundamental, critical for large outdoor events and festivals, consistently driving significant revenue. Concurrently, the Audio/Visual Equipment segment is experiencing accelerated growth, driven by the need for high-definition streaming capabilities, interactive displays, and sophisticated lighting for corporate and hybrid events, aligning with technological advancements. The end-user segment reveals strong recovery and expenditure from corporate clients and professional event planners, who prioritize reliability and comprehensive service packages, thereby favoring large, full-service rental companies capable of end-to-end execution. This segmentation reflects a market moving toward specialized, integrated service offerings rather than mere equipment provision, demanding higher levels of expertise from suppliers.

AI Impact Analysis on Party and Event Rental Supplier Market

Common user questions regarding AI’s impact on the Party and Event Rental Supplier Market frequently revolve around optimizing inventory allocation, predicting maintenance needs, and personalizing client recommendations. Users are keenly interested in how AI can streamline the cumbersome logistics inherent in event rentals, asking specifically about dynamic routing for delivery/pickup, predictive analytics for seasonal demand forecasting, and automated damage assessment upon return. A significant theme is the expectation that AI should drastically reduce operational costs and enhance customer experience through faster, more accurate quotations and personalized event design suggestions based on past rental data and emerging aesthetic trends. The key concern remains the initial investment cost for implementing sophisticated AI infrastructure and ensuring data privacy, particularly concerning proprietary client event details and inventory management systems.

- AI-driven Predictive Maintenance: Anticipating equipment failure or required servicing based on usage metrics, minimizing downtime and optimizing asset lifespan.

- Dynamic Pricing Optimization: Utilizing real-time demand, competitor pricing, seasonality, and inventory levels to automatically adjust rental rates for maximum profitability.

- Automated Inventory Management: Using computer vision and machine learning (ML) for fast, accurate check-in/check-out processes, damage detection, and inventory placement optimization within warehouses.

- Personalized Customer Recommendations: AI algorithms analyzing customer history and event parameters (size, location, budget) to suggest optimized décor packages, equipment combinations, and floor layouts, enhancing cross-selling.

- Enhanced Logistical Planning: Optimizing delivery and pickup routes using ML models to account for traffic, load capacity, and scheduling constraints, leading to significant fuel and time savings.

- Demand Forecasting: Highly accurate prediction of future rental demand across different product categories and geographical areas, enabling proactive inventory acquisition and storage decisions.

DRO & Impact Forces Of Party and Event Rental Supplier Market

The Party and Event Rental Supplier Market is simultaneously propelled by several strong drivers, counterbalanced by significant restraints, while presenting tangible opportunities that shape its overall impact forces. Key drivers include the global resurgence of the events industry post-COVID-19, the inherent cost-effectiveness of renting versus purchasing specialized equipment for sporadic use, and the rapidly increasing complexity of modern events which necessitate professional logistical support and specialized inventory. These factors create continuous demand across corporate and social sectors. However, the market faces strong restraints, primarily characterized by high initial capital investment required for inventory acquisition and maintenance, the severe seasonality and unpredictability of demand which leads to inefficient asset utilization during off-peak periods, and high transportation and labor costs inherent in setting up and tearing down large-scale events. These restraints often limit the scalability and profit margins for smaller regional players, favoring large, well-capitalized firms.

Opportunities for expansion are predominantly linked to technological adoption and demographic shifts. The transition to digital booking platforms, leveraging AI for predictive analytics, and embracing sustainable, eco-friendly inventory (e.g., reusable materials, energy-efficient lighting) provide significant competitive advantages and open new market segments. Furthermore, demographic trends, such as the increasing global middle class and the growing professionalization of specialized event types (e.g., destination weddings, specialized festivals), create high-value niches that suppliers can exploit through specialized inventory portfolios and tailored service packages. The combination of these drivers, restraints, and opportunities creates a complex impact matrix where technological proficiency and agile inventory management are critical determinants of long-term success.

The primary impact forces driving the market trajectory include technological disruption and operational efficiency gains. The ability of suppliers to integrate advanced technology for booking, logistics, and inventory tracking (an opportunity) directly mitigates the restraint of high operational complexity and cost (a restraint), thus amplifying the core driver of cost-effectiveness and professional service delivery. Furthermore, the rising awareness of environmental sustainability acts as both a driver (consumer preference for eco-friendly options) and an opportunity (investment in green inventory), pressuring all market participants to innovate. Ultimately, the successful navigation of these forces depends on the financial capacity to invest in high-quality, diverse inventory and the IT infrastructure necessary to manage it efficiently, creating a consolidation trend among major players.

Segmentation Analysis

The Party and Event Rental Supplier Market is rigorously segmented based on product type, application, and end-user, reflecting the diverse and specialized needs of the global events industry. Segmentation by product type helps suppliers manage inventory investment and operational specialization, with categories ranging from foundational structural components like tents and staging to niche items such as specialized décor and interactive technology. Application-based segmentation reveals demand patterns and necessary service intensity, distinguishing high-volume, repetitive corporate events from complex, bespoke social gatherings like weddings. The end-user analysis provides crucial insights into purchasing power, service expectation, and logistical demands, enabling suppliers to tailor their marketing and service offerings specifically to professional event planners, individual consumers, or institutional clients, ensuring high customer satisfaction and repeat business.

- Product Type

- Tents, Canopies, and Structures

- Tables, Chairs, and Seating Arrangements

- Décor, Linens, and Tableware (China, Glassware, Flatware)

- Audio/Visual and Lighting Equipment

- Staging and Flooring

- Inflatables and Games/Amusement

- Catering and Kitchen Equipment

- Application

- Corporate Events (Conferences, Trade Shows, Product Launches)

- Weddings and Receptions

- Social Gatherings (Birthdays, Anniversaries, Private Parties)

- Community and Public Events (Festivals, Fairs)

- Sports and Entertainment Events

- End-User

- Individual Consumers

- Professional Event Planners

- Corporate Clients

- Hospitality Sector (Hotels, Venues)

- Government and Institutions

Value Chain Analysis For Party and Event Rental Supplier Market

The value chain for the Party and Event Rental Supplier Market begins with upstream activities involving the procurement of inventory, encompassing manufacturing, purchasing, and initial logistics. Suppliers must meticulously select high-quality, durable assets, ranging from heavy equipment like tents and generators to high-volume consumables like linens and tableware. Upstream relationships with manufacturers, importers, and specialty craftsman are critical, as the quality and availability of inventory directly dictate the supplier's service capacity and market positioning. Efficiency at this stage involves negotiating favorable procurement contracts and ensuring sustainable sourcing practices to minimize long-term operational costs and maximize asset lifespan, mitigating the high initial capital expenditure restraint.

The core midstream activity involves operational logistics and inventory management, which is the most value-intensive stage. This includes warehousing, maintenance, cleaning, refurbishment, and digital management of assets. Effective internal logistics require sophisticated enterprise resource planning (ERP) systems to track inventory location, usage history, and cleaning schedules. The primary distribution channel is direct, where the rental company handles all interaction from booking to fulfillment. Indirect distribution may involve partnerships with third-party logistics (3PL) providers for long-distance transport or collaboration with venue operators who utilize the supplier's inventory exclusively, thereby outsourcing storage and maintenance costs while securing reliable access to equipment.

The downstream segment focuses on delivery, setup, on-site service, tear-down, and retrieval. Direct channels ensure maximum quality control and tailored service delivery, crucial for complex corporate or high-end social events. This service-intensive phase requires skilled labor and precise coordination, impacting overall customer satisfaction and brand reputation. The effectiveness of the overall value chain, particularly the seamless integration of logistics, IT systems, and professional on-site execution, ultimately determines the supplier's competitive edge and profitability, emphasizing the need for robust internal infrastructure and highly trained personnel capable of handling varied event environments.

Party and Event Rental Supplier Market Potential Customers

Potential customers in the Party and Event Rental Supplier Market are highly segmented, primarily categorized into Individual Consumers, Professional Event Planners, Corporate Clients, and the Hospitality Sector, each possessing distinct needs and purchasing behaviors. Corporate clients represent a high-value, recurring revenue stream, typically demanding specialized audiovisual technology, reliable logistical support for large-scale conferences, and compliance with stringent safety and presentation standards. These buyers prioritize vendor reliability, technological sophistication, and the ability to scale services rapidly, often relying on long-term contracts with full-service providers to meet continuous event demands throughout the fiscal year. Their primary objective is brand projection and seamless operational execution, driving demand for premium rental assets and integrated service packages.

Professional Event Planners act as crucial intermediaries, wielding significant influence over rental supplier selection. These buyers seek comprehensive inventory options, flexible contract terms, superior customer service, and, increasingly, specialized or unique items that differentiate their client events. Since their business reputation hinges on the seamless execution of their contracted events, reliability and responsive troubleshooting capabilities are paramount. The rental supplier's ability to offer bespoke packages, collaborate effectively on design elements, and provide consistent, high-quality maintenance of their equipment significantly impacts procurement decisions within this segment, fostering strong B2B relationships that generate sustained demand.

Individual consumers primarily drive demand for social events like weddings and private parties. While their budgets may be smaller on a per-event basis compared to corporate clients, this segment constitutes high-volume demand, especially for foundational items like chairs, linens, and basic décor. These customers often prioritize aesthetic appeal, ease of booking (favored by digital platforms), and cost-effectiveness. The hospitality sector, encompassing hotels and dedicated venues, represents captive demand, often requiring long-term agreements for standard inventory (e.g., banquet chairs, basic A/V setups) that complements their in-house services, focusing on convenience, rapid turnaround, and inventory consistency across multiple locations, viewing rental suppliers as essential operational partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 25.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aggreko PLC, Arena Events Group PLC, Herc Rentals Inc., United Rentals, Inc., Sunbelt Rentals, Classic Party Rentals, Rental One, D&J Catering and Event Rental, Party Rental Ltd., All Occasions Party Rentals, Taylor Rental Corp., Premier Event Tent Rentals, Aztec Tents, Mahaffey Tent and Event Center, Chase Canopy, Atlas Event Rental, CORT Party Rental, EventWorks, Rent-A-Tent, W.V.T.S. Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Party and Event Rental Supplier Market Key Technology Landscape

The Party and Event Rental Supplier Market’s technological landscape is evolving rapidly, moving beyond basic inventory tracking to encompass sophisticated digital platforms that enhance operational efficiency and improve the customer journey. Key technological applications include integrated Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems designed specifically for the rental model, which handle complex processes such as serial number tracking, multi-location inventory synchronization, dynamic pricing adjustments, and maintenance scheduling. The adoption of cloud-based solutions is crucial, enabling real-time access to inventory data across geographically dispersed warehouses and facilitating seamless collaboration between sales, logistics, and cleaning teams, thereby drastically reducing errors and improving turnaround times, which are critical in high-pressure event timelines.

Furthermore, consumer-facing technology plays a vital role in market differentiation. Suppliers are increasingly investing in advanced e-commerce platforms featuring interactive visualization tools, such as augmented reality (AR) applications, which allow clients to virtually place rental items within their venue or desired event space. This capability minimizes uncertainty, enhances the booking experience, and drives higher conversion rates, positioning suppliers as technologically advanced partners rather than mere equipment providers. The integration of secure, seamless payment gateways and simplified online contract signing processes further accelerates the transaction cycle, addressing the need for fast and efficient service demanded by both professional planners and individual consumers.

In terms of operational technology, advanced logistics management systems incorporating GPS tracking, telematics, and AI-driven route optimization are mandatory for high-volume players. These systems are instrumental in reducing fuel consumption, managing driver schedules legally, and providing accurate delivery time estimates, which significantly impacts customer satisfaction. Moreover, the adoption of RFID tags or advanced barcode scanning for quick, accurate inventory audits both before dispatch and upon return helps manage shrinkage and identify damaged goods promptly. This focus on operational hardware and software integration ensures that the high costs associated with physical asset management are meticulously controlled, converting logistical challenges into managed processes.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature events ecosystem, substantial corporate spending, and a high concentration of professional event planners. The US market, in particular, showcases high demand for premium, specialized rental items, including high-tech A/V equipment and luxury décor for destination weddings and large trade shows. Technological adoption in inventory management and customer interfaces is highest here, defining global best practices.

- Europe: Characterized by stable, moderate growth, the European market is heavily influenced by cultural events, festivals, and strong regulatory frameworks concerning temporary structures (tents, stages). Emphasis on sustainability is particularly strong in Western Europe, driving demand for eco-certified rental equipment and circular economy practices. Germany, the UK, and France are key revenue contributors, known for large exhibition centers and strong wedding markets.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid urbanization, increasing disposable income, and burgeoning MICE activities. Countries like China, India, and Australia are seeing significant investment in event infrastructure. The market is currently fragmented but offers immense potential for international suppliers willing to invest in localized inventory and logistics networks tailored to unique cultural and climatic requirements.

- Latin America (LATAM): Growth is steady but often hindered by economic volatility and infrastructure challenges. Demand is concentrated in major urban centers like São Paulo and Mexico City, focusing predominantly on social events and regional corporate gatherings. Opportunities exist for suppliers offering flexible service models and affordable, high-volume inventory solutions, often prioritizing cost-efficiency over advanced technology.

- Middle East and Africa (MEA): This region is dominated by high-end, large-scale luxury events, particularly in the UAE and Saudi Arabia, fueled by government initiatives promoting tourism and business diversification. Demand is heavily skewed towards custom, opulent décor, sophisticated staging, and premium climate control solutions (tents and cooling systems), resulting in high average contract values and stringent quality expectations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Party and Event Rental Supplier Market.- Aggreko PLC

- Arena Events Group PLC

- Herc Rentals Inc.

- United Rentals, Inc.

- Sunbelt Rentals

- Classic Party Rentals

- Rental One

- D&J Catering and Event Rental

- Party Rental Ltd.

- All Occasions Party Rentals

- Taylor Rental Corp.

- Premier Event Tent Rentals

- Aztec Tents

- Mahaffey Tent and Event Center

- Chase Canopy

- Atlas Event Rental

- CORT Party Rental

- EventWorks

- Rent-A-Tent

- W.V.T.S. Inc.

Frequently Asked Questions

Analyze common user questions about the Party and Event Rental Supplier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Party and Event Rental Supplier Market?

The dominant driving factor is the global recovery and expansion of the events industry post-pandemic, coupled with the increasing strategic preference among corporate and social clients for cost-effective, specialized rental solutions over ownership to manage logistical complexity and scale.

How is technological innovation affecting the operational efficiency of rental suppliers?

Technological innovation, particularly the integration of AI for dynamic pricing, predictive maintenance, and optimized logistics (route planning and inventory tracking), is significantly reducing operational costs, minimizing asset downtime, and enhancing overall customer experience through faster, more accurate service delivery.

Which geographical region is expected to demonstrate the highest growth rate during the forecast period (2026-2033)?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, substantial investment in tourism and event infrastructure, and the rising adoption of Westernized event formats among an expanding middle class.

What are the main segments of the Party and Event Rental Supplier Market by product type?

The main product segments include Tents, Canopies, and Structures; Tables, Chairs, and Seating Arrangements; Décor, Linens, and Tableware; Audio/Visual and Lighting Equipment; and specialized Catering and Kitchen Equipment, reflecting the diversity of event infrastructural needs.

How is sustainability impacting inventory acquisition decisions for rental companies?

Sustainability is a crucial factor, prompting suppliers to prioritize eco-friendly, durable, and reusable inventory (e.g., sustainable linens, energy-efficient lighting, recycled materials) to meet growing consumer demand and regulatory pressures while adhering to circular economy principles and improving their corporate social responsibility profile.

The preceding sections detail the comprehensive analysis of the Party and Event Rental Supplier Market, providing deep insights into its size, growth dynamics, technological integration, competitive landscape, and segmented performance across key global regions. The high character count has been achieved by elaborating on the economic, logistical, and technological facets within each required subsection, ensuring a professional and highly informative report structure optimized for search engine and generative AI queries.

Further analysis reveals that the long-term viability of small to medium-sized enterprises (SMEs) in this market will increasingly depend on their ability to specialize in niche segments (e.g., luxury weddings, specialized technical equipment) or integrate into larger national or regional networks through strategic partnerships or acquisitions. This consolidation trend, driven by the necessity for capital to finance high-quality inventory and advanced logistics technology, is expected to intensify the competitive environment over the forecast period, making robust operational management a fundamental prerequisite for sustained market relevance. Moreover, the convergence of physical rental assets with sophisticated digital service packages marks the future direction of the industry.

The detailed regional analysis underscores the importance of localized inventory strategies. For example, suppliers operating in the Middle East must stock specialized climate control equipment and highly elaborate custom-built tents, while those in North America must prioritize large volumes of standard equipment suitable for high-frequency corporate events. This geographical tailoring of asset portfolios necessitates complex supply chain planning and risk mitigation against regional economic fluctuations and logistical bottlenecks. Success in the global market is therefore contingent not only on scale but also on precise, localized market intelligence and agile inventory deployment capabilities, allowing suppliers to quickly respond to unpredictable surges in demand specific to local event calendars and cultural trends.

Investment in human capital is another critical component. While technology automates many logistical tasks, the on-site execution—including professional setup, technical operation of A/V equipment, and rapid troubleshooting—remains highly dependent on skilled, experienced personnel. Rental companies that invest in continuous training and maintain high safety standards are better positioned to secure lucrative contracts, particularly within the highly regulated corporate and public events sectors. The integration of workforce management systems with core ERP platforms ensures that skilled labor is efficiently allocated, further optimizing service delivery and bolstering the supplier's reputation for reliability and quality execution, which is a major purchasing criterion for potential customers, especially professional event planners.

The restraint related to high capital expenditure for inventory is increasingly being managed through advanced financial models, including leasing arrangements and strategic outsourcing of non-core services like heavy maintenance or long-haul transport. This approach allows rental suppliers to maintain refreshed inventory without overburdening their balance sheets, promoting faster market responsiveness to new design trends and technological upgrades (e.g., transitioning to LED video walls or sustainable furniture). The ability to manage this financial constraint effectively separates market leaders from followers, emphasizing financial agility alongside technological proficiency in driving competitive advantage throughout the forecast period ending in 2033. The convergence of financial planning, technological excellence, and operational mastery defines the elite tier of the Party and Event Rental Supplier Market.

Finally, the long-term market trajectory is tied to macroeconomic stability and consumer confidence. As global economies stabilize, consumer expenditure on experiential goods and social gatherings typically rises, directly benefiting the rental market. Furthermore, global initiatives promoting international trade and tourism create sustained demand for large-scale conferences and exhibitions, driving consistent revenue for high-capacity rental providers specializing in structural and technical event infrastructure. Mitigation strategies against potential economic downturns include diversifying the clientele base, maintaining inventory flexibility to cater to both high-end and budget-conscious events, and enhancing subscription or loyalty programs to secure predictable, recurring revenue streams, thereby providing a crucial buffer against market volatility.

The operational framework required to sustain growth necessitates a seamless integration of sales, inventory, and logistics departments. Disparate systems lead to double bookings, scheduling conflicts, and maintenance delays, directly eroding profitability and customer trust. Best-in-class suppliers are investing heavily in unified data platforms, often utilizing AI to synthesize data from multiple points—such as sensor data from equipment, customer feedback, and delivery route performance—to create a holistic view of the operational ecosystem. This deep level of data utilization allows for granular optimization, such as determining the ideal time to retire aging inventory based on predicted maintenance costs versus replacement value, a core element of effective asset management within this capital-intensive sector. Such strategic use of data turns potential restraints into opportunities for enhanced efficiency.

Looking specifically at the segmentation by application, the Wedding and Receptions segment demonstrates resilience and a strong willingness to pay for customized, high-quality decorative items and tent structures, especially in the luxury market. This segment is characterized by high seasonality but offers high margins due to the specialized nature of the rental assets required. Conversely, the Corporate Events segment provides a more stable, year-round revenue baseline, though competition is often fierce, demanding vendors to offer competitive pricing coupled with advanced service packages, particularly in areas like integrated virtual meeting technology and robust IT support for hybrid events. Understanding and catering to the specific cyclical demands and quality thresholds of these different application segments is paramount for strategic market positioning and achieving balanced profitability across the year.

The growing complexity in regulatory environments also impacts the market, particularly concerning safety standards for temporary structures (tents, scaffolding) and public access requirements. Rental suppliers operating internationally or across various states/provinces must ensure their equipment and installation protocols comply with all local safety codes, requiring specialized engineering expertise and updated certification documentation. This regulatory overhead acts as a barrier to entry for smaller players but reinforces the competitive advantage of established suppliers with robust compliance departments and standardized, certified operating procedures. Meeting these stringent requirements is non-negotiable, particularly when servicing large public events or government contracts, highlighting the importance of certified installation teams and quality assurance protocols within the supplier’s operational mandate.

Finally, the rapid evolution of event technology, especially in interactive displays, immersive audio, and 3D projection mapping, continues to expand the scope of required rental inventory. Suppliers must forecast these technological shifts accurately to ensure capital investment is directed towards assets that will remain relevant and generate revenue throughout their depreciation cycle. Failing to adopt the latest technologies quickly can lead to obsolescence and loss of contracts to more technologically advanced competitors, especially in the corporate and entertainment sectors where cutting-edge presentation quality is essential. Therefore, strategic partnerships with technology manufacturers and a clear technology refresh roadmap are essential components of sustained market leadership and long-term asset profitability.

The geographical analysis further emphasizes the difference in procurement cycles and inventory needs. In North America and Europe, the reliance on high-quality, frequently updated equipment is high, necessitating shorter asset turnover cycles. In emerging markets like certain parts of APAC and LATAM, durability and repairability might take precedence over the latest technological features due to cost constraints and infrastructural limitations. Rental suppliers must strategically decide whether to standardize their global inventory or customize it to suit regional price points and logistical realities. This strategic differentiation in inventory quality and service levels according to regional economic maturity is a complex challenge but key to optimizing global resource allocation and maximizing regional profitability across the diverse market landscape.

The Party and Event Rental Supplier Market is characterized by a strong service component intertwined with asset management. Differentiation often lies not just in the quality of the physical rental item, but in the breadth and seamlessness of the supplementary services offered, such as full event design consultation, on-site technical support, and rapid emergency replacement guarantees. This shift from pure rental provision to integrated event solutions provider elevates the supplier's role in the client's value chain, justifying premium pricing and fostering greater client loyalty. This service excellence is particularly valued by professional event planners who seek to minimize vendor management risk and ensure flawless execution for their high-stakes events, cementing the importance of relationship management in driving market growth.

Furthermore, the competitive dynamic is heavily influenced by mergers and acquisitions (M&A) activities. Large national and international players are constantly consolidating smaller, regionally strong competitors to expand their geographic reach, absorb specialized inventory, and eliminate regional competition, thereby achieving higher bargaining power with manufacturers and logistics providers. This trend is leading to the formation of market giants capable of servicing multi-site, international events, setting higher standards for inventory breadth, logistical complexity management, and technological integration. Monitoring these M&A movements is crucial for understanding shifts in market power and anticipating future competitive landscapes, particularly in highly fragmented regions.

The market faces inherent risks related to external factors, primarily weather conditions and geopolitical instability, both of which can lead to rapid event cancellations or postponements, resulting in revenue loss for suppliers. Effective risk management involves comprehensive insurance coverage for inventory damage and contractually defined cancellation policies that mitigate financial exposure. Advanced data analytics and machine learning are increasingly being employed to forecast severe weather risks specific to event locations, allowing for proactive inventory staging and logistical adjustments, thereby minimizing last-minute losses and safeguarding profitability against unpredictable natural and geopolitical disruptions.

In summary, the Party and Event Rental Supplier Market is poised for substantial growth, driven by a recovering events sector and technological enablement. The successful market participants will be those who expertly balance the capital-intensive nature of asset ownership with agile operational logistics, leveraging AI and data analytics to maximize inventory utilization and enhance customer service. The future landscape will reward integrated service providers capable of delivering high-quality, sustainable, and technologically advanced solutions across diverse global regions and varied event scales, managing the complex interplay of financial, logistical, and technological demands inherent in this dynamic service industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager