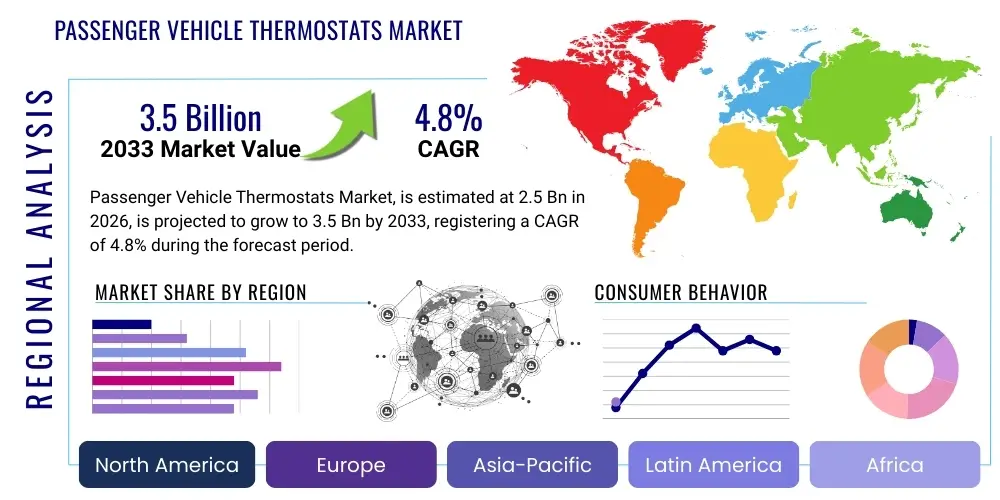

Passenger Vehicle Thermostats Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441101 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Passenger Vehicle Thermostats Market Size

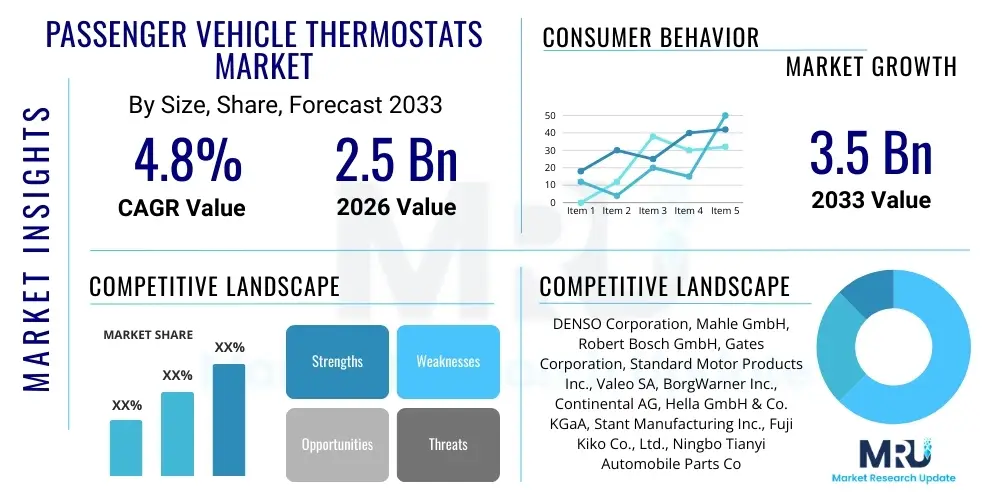

The Passenger Vehicle Thermostats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Passenger Vehicle Thermostats Market introduction

The Passenger Vehicle Thermostats Market encompasses the production, distribution, and utilization of thermal regulation devices crucial for maintaining optimal engine operating temperatures in light-duty vehicles. Thermostats are essential components within the engine cooling system, regulating coolant flow between the engine block and the radiator. Historically, these components were purely mechanical, relying on wax pellets to expand and contract. However, modern automotive design, driven by stringent emission standards and the demand for enhanced fuel efficiency, has rapidly shifted the focus towards highly precise, electronically controlled thermostats (ECTs).

The primary application of these devices is managing engine temperature to maximize efficiency and minimize harmful emissions. When an engine is cold, the thermostat restricts coolant flow to the radiator, allowing the engine to reach its ideal operating temperature quickly. Once the optimal temperature is achieved, the thermostat opens, enabling the cooling process. Benefits derived from advanced thermostat technology include faster engine warm-up times, which reduces cold-start wear and improves cabin heating performance. Furthermore, precise temperature control allows engines to operate reliably under varying load conditions, extending engine lifespan and supporting advanced engine concepts like turbocharging and direct injection systems.

Major driving factors fueling this market include the global increase in vehicle production, particularly in emerging economies, and the mandatory incorporation of sophisticated thermal management systems necessary to comply with Euro 7 and CAFE standards. The consistent replacement cycle for thermostats, which typically have a lifespan shorter than the vehicle itself due to exposure to high heat and chemical corrosion from coolants, also provides a stable aftermarket revenue stream. The transition toward hybrid and mild-hybrid passenger vehicles, which require dedicated thermal management for battery packs and power electronics in addition to the traditional combustion engine, is fundamentally transforming product complexity and market opportunity.

Passenger Vehicle Thermostats Market Executive Summary

The Passenger Vehicle Thermostats Market is characterized by robust technological evolution, moving away from conventional mechanical units toward high-precision electronic and mapping thermostats. Current business trends indicate a consolidation among Tier 1 suppliers specializing in comprehensive thermal management modules, driven by Original Equipment Manufacturers (OEMs) seeking integrated solutions for both Internal Combustion Engine (ICE) and hybrid powertrains. Strategic partnerships focusing on lightweight materials, such as polymer-based housings replacing traditional metals, are critical for meeting vehicle weight reduction targets mandated by fuel economy regulations. Furthermore, the push for system redundancy and fail-safe operation is accelerating the development and adoption of high-reliability components, ensuring market stability despite fluctuating raw material costs.

Regionally, Asia Pacific (APAC), particularly China and India, maintains its position as the primary growth engine due to surging passenger vehicle sales, rapid urbanization, and increased disposable income leading to higher new vehicle registrations. North America and Europe, while representing mature markets, are driving innovation due to aggressive regulatory frameworks focusing on reduced carbon footprints and high-efficiency engine performance. European markets, in particular, show a high penetration rate of electronically controlled thermostats (ECTs) across new vehicle platforms. Latin America and the Middle East and Africa (MEA) are witnessing steady growth, primarily driven by replacement demand in aging vehicle fleets and increasing local assembly operations demanding sophisticated component supply chains.

Segment-wise, the market sees dominant revenue contribution from the OEM channel, although the aftermarket remains vital for older vehicles and repair services. By product type, the electronic thermostat segment is projected to experience the fastest CAGR, surpassing traditional wax-based thermostats in overall market value within the forecast period. This shift is directly attributable to the superior precision, rapid response time, and integration capabilities offered by ECTs, which are indispensable for optimizing engine operations under highly demanding conditions imposed by modern engine mapping software. The material segment favors engineered plastics and specific alloys that offer excellent thermal resistance and longevity.

AI Impact Analysis on Passenger Vehicle Thermostats Market

Common user questions regarding AI’s impact on the Passenger Vehicle Thermostats Market frequently revolve around optimization, predictive maintenance, and next-generation thermal control loops. Users inquire how AI algorithms can predict thermostat failure before it occurs, thereby reducing costly engine damage and unscheduled downtime. Furthermore, there is significant interest in how machine learning could enable thermostats to dynamically adjust coolant flow based on real-time driving conditions, external temperature data, and driver behavior (e.g., city driving versus highway cruising), moving beyond fixed temperature mappings. Users also query the role of AI in the manufacturing process, specifically in quality control and process optimization to reduce defects and improve component reliability.

AI is set to revolutionize thermal management systems by providing predictive capabilities and enabling ultra-precise, adaptive control mechanisms previously unattainable by standard microprocessors. Integration of AI algorithms allows vehicle Engine Control Units (ECUs) to process vast datasets—including engine load history, exhaust gas temperature, ambient conditions, and even geographical data—to preemptively adjust the thermostat opening and closing rates. This adaptive thermal control not only ensures the engine operates continuously at its maximum efficiency point, dramatically boosting fuel economy and lowering emissions, but also maximizes the performance lifespan of critical components. Moreover, AI-driven diagnostics will transform the aftermarket by enabling highly accurate remote prognostics, shifting maintenance from reactive repair to proactive intervention, thus improving vehicle reliability and customer satisfaction.

- AI-driven predictive maintenance modeling minimizes thermostat failure rates and unscheduled vehicle downtime.

- Machine learning optimizes real-time thermal control based on dynamic driving patterns and environmental factors.

- AI enhances manufacturing quality control processes, detecting microscopic defects in thermal component assemblies.

- Integration with Vehicle-to-Everything (V2X) communication allows thermostats to adjust based on route topography and traffic predictions.

- Adaptive thermal mapping enabled by AI supports optimal performance for complex hybrid powertrain thermal loops.

DRO & Impact Forces Of Passenger Vehicle Thermostats Market

The Passenger Vehicle Thermostats Market is primarily driven by rigorous global emission standards and the concurrent need for improved fuel economy, necessitating sophisticated thermal control devices. Restraints include the high initial cost and integration complexity of advanced electronic thermostats compared to simpler mechanical units, particularly impacting cost-sensitive vehicle segments. Opportunities lie in the burgeoning market for electric and hybrid vehicle thermal management, which requires multiple, precise thermostat units for battery, power electronics, and cabin HVAC systems. The major impact force is regulatory pressure, which mandates continuous technological upgrades across all components that affect engine efficiency and environmental performance. These dynamics force manufacturers to invest heavily in R&D to maintain competitive advantage.

Drivers: The global legislative push, such as the implementation of Euro 7 standards in Europe and stringent CAFE targets in the US, compels OEMs to utilize electronic thermostats for achieving precise temperature control, critical for minimizing nitrogen oxide (NOx) and particulate emissions. Furthermore, consumer demand for enhanced vehicle performance and durability translates directly into a requirement for superior thermal management to protect complex, high-output engines (e.g., turbocharged gasoline direct injection engines). The expanding global vehicle parc, particularly in high-growth regions like Southeast Asia and Latin America, ensures a steady increase in both OEM fitting and aftermarket replacement demand for thermostats.

Restraints: The market faces restraints including volatility in the prices of key raw materials, such as brass, copper, and specialized polymers, which affects manufacturing costs and profitability margins. Another significant challenge is the ongoing global semiconductor shortage, which impacts the production scalability of highly integrated electronic thermostats dependent on advanced sensor and microcontroller technology. Moreover, the long lifespan of mechanical thermostats, particularly in developing markets, slows the pace of full conversion to more expensive electronic counterparts, especially in the aftermarket segment where price sensitivity is high.

Opportunity: The rapid global electrification of the passenger vehicle fleet presents a massive opportunity. Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) require dedicated and highly redundant thermal management loops to ensure battery safety and optimal operating temperature range, creating new specialized demand for multi-port and integrated fluid management modules that include sophisticated thermostats and valves. Furthermore, the development of smart, connected vehicles opens avenues for selling premium, data-enabled thermal components that can integrate seamlessly with vehicle diagnostics systems, allowing for remote monitoring and software-defined maintenance.

Segmentation Analysis

The Passenger Vehicle Thermostats Market is highly segmented based on product type, vehicle type, sales channel, and material type, reflecting the diverse requirements of modern automotive platforms. Product segmentation highlights the technological transition currently underway, differentiating between traditional, robust mechanical units and highly responsive, integration-ready electronic components. The segmentation by sales channel—OEM versus Aftermarket—is crucial for understanding market dynamics, as OEMs prioritize technology and performance, while the aftermarket is primarily driven by price and availability. Vehicle segmentation, focusing on different passenger vehicle types and powertrain configurations, reveals varying levels of thermostat complexity and demand intensity across the global vehicle fleet.

- By Product Type:

- Mechanical Thermostats (Wax Pellet Type)

- Electronic Thermostats (ECTs)

- Mapping Thermostats (Advanced ECTs)

- By Vehicle Type:

- Sedans and Hatchbacks

- SUVs and MPVs

- Luxury Vehicles

- Hybrid Vehicles

- Electric Vehicles (Focused on Cooling Valves/Modules)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket and OES)

- By Material Type:

- Metal (Brass, Stainless Steel)

- Plastic (High-Performance Engineering Polymers)

- Hybrid Materials

Value Chain Analysis For Passenger Vehicle Thermostats Market

The value chain for the Passenger Vehicle Thermostats Market begins with raw material sourcing, which involves securing specialized metals (e.g., copper, stainless steel) and high-grade engineering polymers (e.g., Polyphenylene Sulfide (PPS), Polyamide (PA)). Upstream activities are concentrated among specialized component suppliers providing wax elements, sensors, and electronic control units. This phase requires rigorous adherence to automotive quality standards (e.g., IATF 16949). The subsequent manufacturing and assembly phase is dominated by Tier 1 automotive suppliers who integrate these components into finished thermostat units or complex thermal management modules, often involving precision molding and high-tolerance assembly processes to ensure leak-proof and reliable operation under extreme temperatures.

Downstream activities center around distribution and end-user penetration. Distribution channels are bifurcated into the highly structured OEM supply chain, where components are delivered directly to vehicle assembly plants on a Just-In-Time (JIT) basis, and the fragmented aftermarket. The aftermarket utilizes a network of wholesale distributors, specialized parts dealers, and repair shops. Direct sales characterize the OEM segment, focusing on long-term contracts and technology collaboration. Indirect sales channels, crucial for the aftermarket, rely on comprehensive global logistics networks to ensure rapid availability of replacement parts across diverse geographical locations. The efficiency of the distribution network is paramount in the aftermarket to capture the service demand promptly.

In essence, the OEM channel represents a direct, highly controlled distribution path emphasizing reliability and customization, whereas the aftermarket distribution is indirect, relying on multiple layers of intermediaries. Key to profitability in both channels is maintaining high product quality, as thermostat failure can lead to catastrophic engine overheating. Upstream stability regarding semiconductor and specialized plastic supply is critical, particularly for electronic thermostats, while downstream success hinges on efficient inventory management and strong relationships with large automotive wholesalers and regional repair chains.

Passenger Vehicle Thermostats Market Potential Customers

The primary customers in the Passenger Vehicle Thermostats Market are categorized into Original Equipment Manufacturers (OEMs) and the expansive Aftermarket segment, each presenting distinct purchasing criteria and volume demands. OEMs, including global automotive giants such as Volkswagen Group, Toyota Motor Corporation, and General Motors, represent the largest volume purchasers. They demand bespoke, high-performance, technologically integrated thermostat modules tailored to specific engine architecture and increasingly, for hybrid and electric vehicle battery thermal management systems. Their purchasing decisions are heavily influenced by quality certifications, ability to scale production, price negotiation leverage, and shared R&D capabilities for future platforms.

The secondary, but highly resilient, customer base resides in the Aftermarket, which includes independent garages, franchised dealerships (operating as OES – Original Equipment Supplier), large-scale wholesale distributors, and specialized performance part retailers. These customers primarily purchase replacement thermostats for vehicle maintenance and repair. Their priorities are focused on availability, cost-effectiveness, breadth of product catalog covering various model years, and reliability equivalent to or exceeding the original part. The Aftermarket demand is non-cyclical, driven by the aging vehicle fleet and typical component wear-out rates, providing consistent revenue for suppliers.

Furthermore, specialized engineering firms and powertrain system developers occasionally serve as niche customers, procuring high-precision, highly configurable thermal components for testing new engine designs or optimizing existing thermal loops for enhanced performance tuning. These buyers prioritize technical specifications, precision engineering, and the ability of the thermostat to withstand extreme operating parameters. Ultimately, the market success relies on strategically servicing both the high-volume, quality-driven OEM segment and the price-sensitive, availability-critical aftermarket distribution network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DENSO Corporation, Mahle GmbH, Robert Bosch GmbH, Gates Corporation, Standard Motor Products Inc., Valeo SA, BorgWarner Inc., Continental AG, Hella GmbH & Co. KGaA, Stant Manufacturing Inc., Fuji Kiko Co., Ltd., Ningbo Tianyi Automobile Parts Co., Ltd., TAMA Manufacturing Co., Ltd., Vernet SAS, First Four Group, ACDelco, Cummins Inc., Schaeffler AG, Eberspächer Group, Mitsubishi Electric Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Passenger Vehicle Thermostats Market Key Technology Landscape

The technological landscape of the Passenger Vehicle Thermostats Market is increasingly sophisticated, driven by the need for microsecond responsiveness and integration within complex thermal management circuits. The primary technological shift involves the widespread adoption of Electronic Thermostats (ECTs) which utilize integrated heating elements (Positive Temperature Coefficient resistors) and advanced sensors. These sensors communicate real-time temperature data to the Engine Control Unit (ECU), allowing the system to open or close the thermostat with high precision, often faster than traditional wax elements can react. This precise control is vital for mitigating engine knocking and achieving instantaneous efficiency improvements.

Further evolution is seen in "Mapping Thermostats," which are a highly advanced subset of ECTs. Mapping thermostats are controlled by engine maps stored in the ECU, enabling the thermal system to run the engine at a variable, optimized temperature rather than a fixed setpoint. For instance, the system might run cooler under high load (preventing overheating and improving performance) and warmer under low load (improving fuel economy and reducing emissions). This requires sophisticated control algorithms and high-reliability actuators. Additionally, the increasing use of engineered plastics (like highly reinforced PA66 and PPS) in housing construction is crucial for reducing weight and improving corrosion resistance compared to traditional metal assemblies.

The advent of integrated thermal management modules is another defining technological trend. Instead of separate components, modern systems often combine the thermostat, cooling pump, temperature sensors, and complex flow control valves into a single, compact unit. This modular approach simplifies vehicle assembly, reduces potential leak points, and optimizes the communication between the components. For hybrid and electric vehicles, the technology landscape focuses on multi-port cooling valves and dedicated low-temperature cooling circuits, ensuring the sensitive battery packs and power electronics are maintained within their narrow optimal thermal window, demanding exceptionally reliable and fast-acting thermal regulation components.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, largely driven by high-volume manufacturing in China and India. The region benefits from substantial investment in new vehicle production facilities and strong consumer demand. While mechanical thermostats still hold a significant share in cost-sensitive segments, regulatory harmonization and the influx of global OEMs are rapidly accelerating the adoption of electronic thermostats in new mid-range and premium vehicles. Furthermore, China’s aggressive push into Electric Vehicles guarantees sustained demand for complex thermal management solutions.

- Europe: Europe is the epicenter of technological innovation, characterized by high penetration of electronic and mapping thermostats due to stringent Euro 6 and upcoming Euro 7 emissions legislation. The focus here is on maximizing fuel efficiency (CO2 reduction) and incorporating lightweight, modular thermal components. Germany, France, and the UK are key markets, leading the way in adopting advanced integrated thermal modules that manage both engine and exhaust heat recovery systems, emphasizing precision and regulatory compliance.

- North America: This region presents a mature market characterized by robust demand for large SUVs and light trucks, where heavy-duty thermal management is critical. The market is driven by strict CAFE standards pushing manufacturers towards high-efficiency components. The aftermarket is particularly strong in North America due to the large existing vehicle fleet and high average vehicle age, ensuring a stable revenue stream for replacement parts. The adoption of ECTs is high in newer model years, complementing high-performance turbocharged engines.

- Latin America (LATAM): LATAM represents a moderate growth market, primarily influenced by economic stability in Brazil and Mexico, which serve as regional automotive manufacturing hubs. The market relies heavily on mechanical thermostats in entry-level vehicles but is gradually transitioning to electronic controls. Aftermarket demand is substantial, often driven by the need for durable, cost-effective replacement units suitable for varying fuel quality and road conditions.

- Middle East and Africa (MEA): This region experiences steady growth, primarily due to expanding vehicle ownership in the GCC countries and South Africa. High ambient temperatures necessitate robust and reliable thermal management systems. The demand is concentrated in replacement parts for imported vehicles, although local assembly operations are slowly increasing, driving OEM demand for resilient and high-specification thermostats capable of handling extreme heat loads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Passenger Vehicle Thermostats Market.- DENSO Corporation

- Mahle GmbH

- Robert Bosch GmbH

- Gates Corporation

- Standard Motor Products Inc.

- Valeo SA

- BorgWarner Inc.

- Continental AG

- Hella GmbH & Co. KGaA

- Stant Manufacturing Inc.

- Fuji Kiko Co., Ltd.

- Ningbo Tianyi Automobile Parts Co., Ltd.

- TAMA Manufacturing Co., Ltd.

- Vernet SAS

- First Four Group

- ACDelco

- Cummins Inc.

- Schaeffler AG

- Eberspächer Group

- Mitsubishi Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Passenger Vehicle Thermostats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electronic passenger vehicle thermostats?

The primary difference lies in control mechanism. Mechanical thermostats use a temperature-sensitive wax element to passively open and close based on coolant temperature. Electronic thermostats (ECTs) use sensors and an integrated heating element controlled by the engine's ECU, allowing for active, precise, and variable temperature regulation essential for modern emission standards.

How is the growth of Electric Vehicles (EVs) impacting the demand for traditional thermostats?

While pure EVs eliminate the need for traditional engine coolant thermostats, they introduce complex thermal management requirements for battery packs, power electronics, and cabin heating. This shifts demand toward specialized cooling valves, multi-port fluid control modules, and highly reliable low-temperature thermostats, maintaining overall market sophistication and value.

Which geographical region holds the largest market share for passenger vehicle thermostats?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by the high volume of passenger vehicle production and sales in countries such as China and India. This large manufacturing base generates significant demand for both OEM integration and aftermarket replacement components.

What key regulations are driving the technological transition in the thermostat market?

Key regulations driving technological change include global standards like Euro 6 and upcoming Euro 7 in Europe, and CAFE (Corporate Average Fuel Economy) standards in the US. These mandates require extreme precision in engine thermal management to achieve mandatory reductions in fuel consumption and harmful nitrogen oxide (NOx) emissions, necessitating the use of advanced electronic thermostats.

What is a 'Mapping Thermostat' and why are OEMs adopting them?

A Mapping Thermostat is an advanced electronic thermostat that allows the engine ECU to dynamically adjust the operating temperature based on load, speed, and driving conditions, rather than maintaining a single fixed temperature. OEMs adopt them because they enable critical optimization, running the engine cooler during high loads for performance and hotter during light loads for maximum fuel efficiency and emission control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager