Patient Engagement Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441458 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Patient Engagement Software Market Size

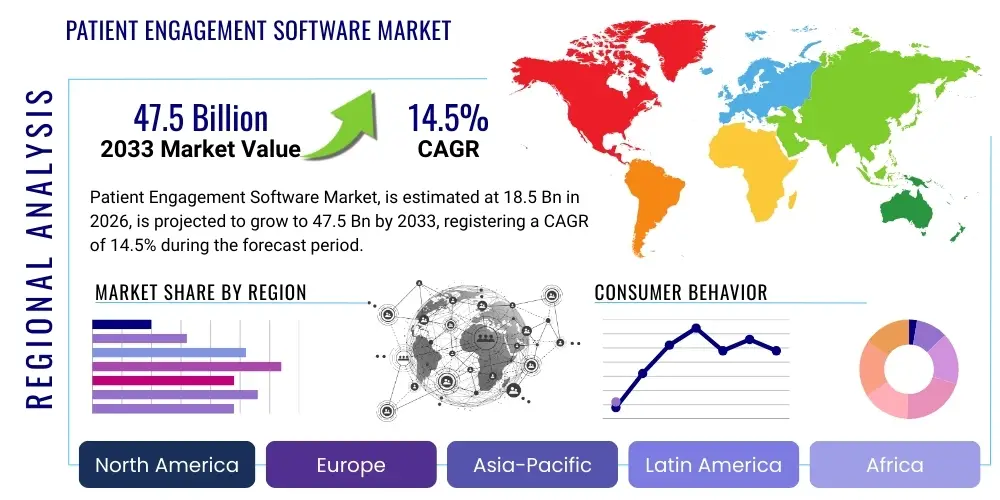

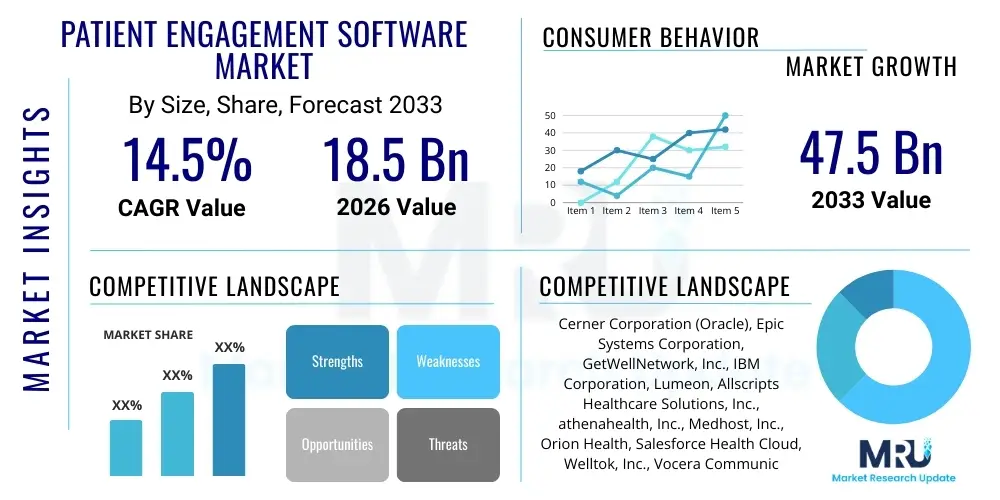

The Patient Engagement Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $47.5 Billion by the end of the forecast period in 2033.

Patient Engagement Software Market introduction

The Patient Engagement Software Market encompasses a range of digital solutions designed to foster proactive communication, education, and collaboration between patients and healthcare providers. These tools, which include patient portals, remote monitoring systems, and digital health applications, are essential for improving health outcomes by empowering patients to take an active role in their care management. The primary function of this software is to streamline administrative tasks, enhance appointment scheduling, facilitate secure messaging, and deliver personalized health information, ultimately leading to higher patient satisfaction and reduced operational costs for healthcare organizations globally. The integration of these platforms across hospitals, clinics, and ambulatory care settings is driven by the necessity for efficient healthcare delivery in an increasingly complex regulatory and demographic landscape.

Major applications for patient engagement software span chronic disease management, preventive care coordination, mental health support, and post-discharge follow-up. By providing access to electronic health records (EHRs), lab results, and educational content, the software acts as a central hub for patient interaction. Key benefits include improved medication adherence, fewer readmissions, and enhanced overall care quality. The move towards value-based care models, where reimbursement is tied to patient outcomes rather than service volume, heavily incentivizes the adoption of these robust digital engagement platforms as they provide measurable data on patient compliance and satisfaction levels.

Driving factors propelling market growth include the rapid global adoption of mobile health technologies, increasing prevalence of chronic diseases requiring continuous monitoring, and substantial governmental initiatives promoting digital health infrastructure. Furthermore, growing consumer demand for seamless, personalized healthcare experiences similar to those found in other service industries is compelling providers to invest heavily in user-friendly and highly accessible patient engagement solutions. Interoperability with existing health IT systems, such as EHRs, remains a crucial technical requirement driving further product development and integration within the healthcare ecosystem.

Patient Engagement Software Market Executive Summary

The Patient Engagement Software Market is experiencing robust growth driven by the global shift toward value-based healthcare, which prioritizes preventative care and patient accountability. Current business trends highlight significant merger and acquisition activities focused on integrating specialized solutions, particularly those offering advanced AI-driven features like predictive analytics and conversational interfaces. Healthcare providers are increasingly moving away from siloed applications to unified, modular platforms that can scale across various care settings, emphasizing cloud-based delivery models for enhanced flexibility and reduced capital expenditure. Investment in cybersecurity and data privacy features is paramount, reflecting stringent global regulations like GDPR and HIPAA, and ensuring consumer trust in digital health interactions remains high.

Regionally, North America maintains market dominance due to high digital literacy rates, mandatory regulatory frameworks promoting EHR adoption, and substantial healthcare IT spending. However, the Asia Pacific region is anticipated to demonstrate the highest Compound Annual Growth Rate, fueled by massive government investments in digital infrastructure, rising disposable incomes, and the urgent need to expand accessible healthcare services to large, often rural, populations. European markets are characterized by stringent privacy requirements but show strong potential driven by national digital health strategies aimed at reducing system inefficiencies and improving cross-border patient data exchange.

Segment trends reveal that standalone patient portals remain a significant component, but integrated platforms offering comprehensive care coordination and telehealth capabilities are gaining market share rapidly. By application, chronic disease management is the largest and fastest-growing segment, requiring sophisticated remote patient monitoring (RPM) and personalized intervention tools. The services component, specifically consulting and implementation services, is also expanding significantly as providers require expert assistance in customizing and integrating complex software suites into their existing clinical workflows.

AI Impact Analysis on Patient Engagement Software Market

User inquiries regarding the integration of Artificial Intelligence (AI) into Patient Engagement Software primarily focus on personalization capabilities, automation of routine communications, and the ethical implications surrounding data use and algorithmic bias. Users commonly ask how AI can move beyond simple chatbots to truly personalize health journeys, predict potential patient risks (like non-adherence or readmission), and ensure that automated interactions feel empathetic rather than robotic. Concerns often revolve around the security of sensitive data processed by AI algorithms and the need for explainable AI (XAI) to build trust among both patients and clinicians. The overarching expectation is that AI will be the primary catalyst for transitioning passive patient engagement tools into proactive, intelligent health coaching systems that reduce clinical burden while improving quality of life.

The implementation of AI is revolutionizing patient interactions by enabling intelligent virtual assistants (IVAs) and natural language processing (NLP) tools that can handle a vast array of common patient questions, ranging from medication schedules to understanding complex diagnoses. This automation significantly frees up clinical staff to focus on complex care tasks requiring human expertise. Furthermore, AI-driven predictive analytics utilize patient data, including demographic, clinical, and behavioral information, to identify high-risk individuals who require immediate outreach or proactive intervention programs. This targeted approach is crucial for managing chronic conditions effectively and preventing costly emergency room visits or hospitalizations.

AI's role also extends to content delivery optimization and accessibility. Machine learning algorithms analyze engagement metrics to determine the most effective communication channel (e.g., SMS, email, secure portal message) and timing for each individual patient, ensuring that educational materials or reminders are consumed effectively. This hyper-personalization, coupled with AI-powered diagnostics that can triage symptoms based on patient-reported data, dramatically enhances the efficiency and efficacy of the entire engagement lifecycle, paving the way for truly adaptive and continuous patient relationship management platforms.

- AI-powered chatbots and virtual assistants handle initial triage and frequently asked questions (FAQs), drastically reducing administrative load on healthcare staff.

- Predictive analytics identify patients at high risk of readmission or non-adherence, enabling proactive, targeted interventions.

- Natural Language Processing (NLP) enhances patient feedback analysis and understanding of complex clinical queries submitted via text or voice.

- Machine Learning (ML) algorithms personalize communication timing, content, and delivery mechanism for optimal engagement and health literacy improvement.

- AI facilitates automated scheduling and rescheduling, optimizing clinical capacity and reducing patient wait times.

- Ethical AI frameworks are required to mitigate algorithmic bias and ensure equitable access to personalized digital care recommendations.

- Computer vision and remote monitoring utilize AI to interpret data from wearables and sensors, alerting providers to critical physiological changes in real-time.

DRO & Impact Forces Of Patient Engagement Software Market

The dynamics of the Patient Engagement Software Market are shaped by a powerful confluence of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate market evolution. Key drivers include the overwhelming shift in healthcare payer models from fee-for-service to value-based care, which mandates verifiable patient outcomes and engagement levels. This transition, coupled with the increasing patient expectation for digitized, consumer-grade healthcare experiences, accelerates the need for robust software solutions. Additionally, the rising prevalence of chronic diseases globally requires continuous, remote monitoring and management tools, which engagement platforms are ideally suited to provide. These drivers create an expansive demand base across acute, ambulatory, and long-term care settings.

Conversely, significant restraints hinder growth and adoption. The initial high cost of implementation, integration challenges with fragmented legacy Electronic Health Records (EHR) systems, and resistance to change among some healthcare professionals pose substantial barriers, particularly for smaller independent practices. Moreover, the critical complexity of ensuring data privacy and adhering to disparate global regulatory mandates (such as HIPAA in the US and GDPR in Europe) forces vendors to invest heavily in security infrastructure, which can inflate product costs and complicate market entry. These restraints necessitate sophisticated integration expertise and significant capital expenditure from end-users.

Opportunities within the market center on advancements in complementary technologies and underserved segments. The proliferation of 5G networks and sophisticated Internet of Medical Things (IoMT) devices creates opportunities for superior remote patient monitoring (RPM) and telehealth functionalities, broadening the scope of engagement beyond basic communication. Furthermore, focusing on behavioral health and precision medicine applications offers specialized market niches with high growth potential. The shift toward hybrid care models—blending in-person visits with continuous virtual interaction—is a major force compelling sustained innovation and investment in highly interactive, seamless patient engagement ecosystems.

Segmentation Analysis

The Patient Engagement Software Market is comprehensively segmented based on components, delivery mode, application, end-user, and core functionality, reflecting the diverse needs of the healthcare ecosystem. Component segmentation delineates the market between software solutions and supporting services, with services such as implementation, consulting, and training forming a rapidly expanding segment crucial for effective deployment. By delivery mode, the dominance of cloud-based deployment is evident, driven by its scalability, lower upfront costs, and superior accessibility compared to traditional on-premise installations, especially beneficial for multi-site healthcare organizations requiring centralized data management.

Application-based segmentation highlights areas of acute clinical focus. Chronic disease management, which includes conditions like diabetes and hypertension, represents the largest revenue share due to the necessity for ongoing patient education, lifestyle modifications, and medication adherence tracking. Wellness and prevention, another key application, focuses on proactive health management through personalized reminders, healthy living guides, and preventative screening scheduling, reflecting the preventative focus of modern healthcare. These applications directly align with the core mission of patient engagement: moving patients from passive recipients of care to active participants in their health journey.

The end-user segmentation primarily covers hospitals and clinics, payers, and individual patients/consumers. Hospitals and clinical networks remain the primary consumers, seeking integrated solutions to manage high patient volumes and improve institutional performance metrics such as readmission rates and patient satisfaction scores. As the market matures, the differentiation among vendors is increasingly based on platform features such as integration capabilities (e.g., seamless EHR connectivity), user interface design, and the incorporation of advanced technologies like AI for sophisticated communication and triage protocols.

- Component:

- Software (Stand-alone, Integrated Platforms)

- Services (Consulting, Implementation, Training, Support & Maintenance)

- Delivery Mode:

- Cloud-based

- On-premise

- Application:

- Health Management (Wellness, Prevention)

- Chronic Disease Management

- Financial Health Management

- Inpatient & Hospital Care Management

- Outpatient Care Management

- End-User:

- Hospitals and Providers

- Payers and Health Systems

- Patients/Consumers

- Other End-Users (Pharmaceutical Companies, Employer Groups)

Value Chain Analysis For Patient Engagement Software Market

The value chain for the Patient Engagement Software Market begins upstream with core technology development and foundational infrastructure providers. This stage involves software developers specializing in healthcare IT, cloud service providers (like AWS, Azure, Google Cloud) offering secure, scalable infrastructure, and data security firms ensuring compliance with stringent regulatory standards (HIPAA, GDPR). Upstream suppliers are focused on creating proprietary algorithms for data analytics, user interface components optimized for diverse patient populations, and robust APIs for seamless integration with legacy clinical systems. Investment at this stage focuses heavily on R&D for predictive analytics and advanced interoperability features.

Midstream activities encompass the actual development, customization, and integration of the software solutions. This phase is dominated by core vendors who build the platform modules (e.g., portals, RPM tools, scheduling applications). Crucially, midstream players also involve implementation service providers and specialized integration consultants who tailor the generic software to the specific clinical workflows and data architecture of individual hospitals or health systems. Effective integration services are critical to unlocking the software's full value, as improper deployment can lead to data silos and user frustration among both clinicians and patients.

Downstream activities involve distribution, marketing, and final deployment to end-users (Hospitals, Clinics, Payers). Distribution channels are predominantly direct, where large vendors maintain dedicated sales teams to negotiate complex enterprise contracts with health systems. However, indirect channels, including strategic partnerships with EHR vendors and technology distributors, are becoming increasingly important for reaching smaller practices or specialty clinics. The value chain concludes with post-sales support and continuous maintenance services, ensuring high uptime and user adoption, which ultimately determines the realized value and patient outcome improvements offered by the software.

Patient Engagement Software Market Potential Customers

The primary customer base for Patient Engagement Software consists of large, integrated healthcare delivery networks (IDNs) and multi-specialty hospitals seeking enterprise-wide solutions to manage complex populations and adhere to quality metrics. These organizations require sophisticated platforms capable of integrating with multiple clinical systems and offering high scalability across various locations and service lines, focusing heavily on reducing readmission rates and improving HCAHPS scores (patient satisfaction surveys). Their purchasing decisions are heavily influenced by proven ROI concerning operational efficiency and measurable improvements in patient health outcomes, particularly in chronic care management.

Another significant segment comprises Health Insurance Payers (private and governmental). Payers utilize these platforms to drive preventative care, manage population health risks, and lower overall healthcare expenditure by encouraging healthier behavior among their members. For payers, the software serves as a powerful tool for risk stratification, targeted communication campaigns promoting annual checkups, and optimizing adherence programs, thereby aligning with their financial incentives to maintain member wellness and reduce high-cost utilization events.

Furthermore, specialized clinics, ambulatory surgical centers, and long-term care facilities represent a growing customer segment. While they may require less complex, more specialized solutions than large hospitals, they nonetheless need tools for efficient scheduling, patient education before and after procedures, and secure communication. Finally, pharmaceutical and biotech companies are increasingly adopting engagement software to support clinical trial recruitment, adherence monitoring for novel therapies, and post-market surveillance, broadening the customer landscape beyond traditional providers and payers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $47.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cerner Corporation (Oracle), Epic Systems Corporation, GetWellNetwork, Inc., IBM Corporation, Lumeon, Allscripts Healthcare Solutions, Inc., athenahealth, Inc., Medhost, Inc., Orion Health, Salesforce Health Cloud, Welltok, Inc., Vocera Communications (Stryker), CipherHealth, Oneview Healthcare, Change Healthcare, Health Catalyst, Kyruus, Relatient, Optum (UnitedHealth Group), PatientPoint. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Patient Engagement Software Market Key Technology Landscape

The technological landscape of the Patient Engagement Software Market is rapidly evolving, driven by the need for more personalized, secure, and integrated interactions. A foundational element is advanced integration technologies, specifically APIs (Application Programming Interfaces) that facilitate seamless data exchange between patient engagement platforms and core clinical systems like Electronic Health Records (EHRs) and Practice Management Systems (PMS). Adherence to standards such as FHIR (Fast Healthcare Interoperability Resources) is crucial, ensuring that patient data flows securely and accurately across disparate healthcare applications, thus preventing data fragmentation and improving the clinical utility of the engagement data collected.

Beyond integration, the increasing reliance on Artificial Intelligence (AI) and Machine Learning (ML) is transformative. These technologies power conversational interfaces, predictive analytics for risk stratification (identifying patients likely to miss appointments or suffer adverse events), and hyper-personalized educational content delivery. AI is moving engagement from reactive status (responding to patient queries) to proactive care management (suggesting interventions before problems arise). Concurrently, the proliferation of Mobile Health (mHealth) applications and telemedicine infrastructure ensures that engagement tools are accessible via smartphones, incorporating features like secure video consultation and asynchronous messaging, crucial for expanding care access in remote or underserved areas.

Finally, the security architecture is paramount, necessitating the widespread adoption of cloud-based secure infrastructure compliant with global privacy regulations. Key technologies here include advanced encryption, tokenization of sensitive patient data, and robust authentication mechanisms (like multi-factor authentication) to protect patient identity and health information. Furthermore, the growth of Remote Patient Monitoring (RPM) and the Internet of Medical Things (IoMT) is compelling vendors to build platforms capable of ingesting and analyzing high-volume, continuous data streams from wearables and home monitoring devices, integrating this biometric data seamlessly into the patient's personalized engagement journey and the provider's clinical dashboard.

Regional Highlights

North America currently dominates the Patient Engagement Software Market, primarily due to the mandated transition to Electronic Health Records (EHRs) and the widespread adoption of digital health solutions driven by high healthcare expenditure and technological readiness. Regulatory mandates, particularly in the United States, encouraging the use of certified EHRs and promoting interoperability through initiatives like Meaningful Use, have established a strong foundation for patient portal usage and sophisticated engagement tools. The presence of major market players, coupled with significant venture capital investment in digital health startups, further solidifies the region’s leadership in innovation and market maturity, driving the continuous integration of advanced features like AI and telehealth capabilities.

Europe represents a mature yet complex market characterized by strong governmental pushes for national digital health strategies, such as the UK’s NHS digital initiatives and Germany's focus on e-health services. Market growth in Europe is steady, constrained slightly by stringent data privacy regulations (GDPR), which require vendors to implement robust data protection measures. However, the region benefits from universal healthcare systems actively seeking to improve efficiency, reduce elective procedure waiting lists, and manage aging populations through effective remote monitoring and personalized digital health pathways. Western European countries are leading adoption, while Eastern Europe presents emerging opportunities as digital infrastructure modernizes.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This accelerated expansion is fueled by rising government investments in smart health cities, improving digital literacy, and the urgent need to provide scalable healthcare solutions to massive, diverse populations often located across vast geographic distances. Countries like China, India, and Japan are witnessing rapid implementation of mHealth and telemedicine, driven by both private sector investment and national digital transformation programs aiming to bypass infrastructure limitations using mobile technology for basic and continuous patient engagement. The market potential here is enormous, especially in addressing chronic conditions and access to primary care.

- North America: Market leader driven by regulatory mandates (HIPAA, HITECH Act), high penetration of EHRs, and significant adoption of advanced technologies like AI and remote patient monitoring (RPM).

- Europe: Growth influenced by national e-health strategies and aging populations; stringent GDPR compliance necessitates localized and secure cloud solutions.

- Asia Pacific (APAC): Highest expected CAGR due to increasing government digitalization spending, rapid adoption of mHealth in populous countries (China, India), and expanding digital infrastructure.

- Latin America (LATAM): Emerging market characterized by increasing private healthcare investment and high smartphone penetration driving demand for mobile-centric engagement solutions.

- Middle East and Africa (MEA): Growth focused primarily in high-income Gulf Cooperation Council (GCC) countries, driven by healthcare modernization visions and high technology readiness levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Patient Engagement Software Market.- Cerner Corporation (Oracle)

- Epic Systems Corporation

- GetWellNetwork, Inc.

- IBM Corporation

- Lumeon

- Allscripts Healthcare Solutions, Inc.

- athenahealth, Inc.

- Medhost, Inc.

- Orion Health

- Salesforce Health Cloud

- Welltok, Inc.

- Vocera Communications (Stryker)

- CipherHealth

- Oneview Healthcare

- Change Healthcare

- Health Catalyst

- Kyruus

- Relatient

- Optum (UnitedHealth Group)

- PatientPoint

Frequently Asked Questions

Analyze common user questions about the Patient Engagement Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Patient Engagement Software?

The central driver is the global transition to value-based care models, which necessitates measurable patient outcomes and higher patient accountability, making digital engagement tools essential for chronic disease management and readmission reduction.

How does AI improve the effectiveness of patient engagement platforms?

AI significantly enhances personalization through predictive analytics, identifying high-risk patients for targeted intervention, and powering intelligent virtual assistants that automate routine communications and triage complex inquiries, improving efficiency and user experience.

What are the main security concerns associated with this software?

The main concerns revolve around data privacy and compliance with regulations like HIPAA and GDPR. Vendors must ensure robust data encryption, secure interoperability via FHIR standards, and stringent access controls to protect sensitive health information (PHI).

Which geographical region holds the largest market share currently?

North America currently holds the largest market share, attributed to mandatory digital health infrastructure adoption, significant healthcare IT expenditure, and mature regulatory frameworks supporting widespread patient engagement platform deployment.

What is the difference between a standalone portal and an integrated platform?

A standalone portal offers basic functionality like appointment viewing and secure messaging. An integrated platform connects seamlessly with EHRs, billing systems, and telehealth services, offering comprehensive care coordination and data synchronization across the entire healthcare ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager