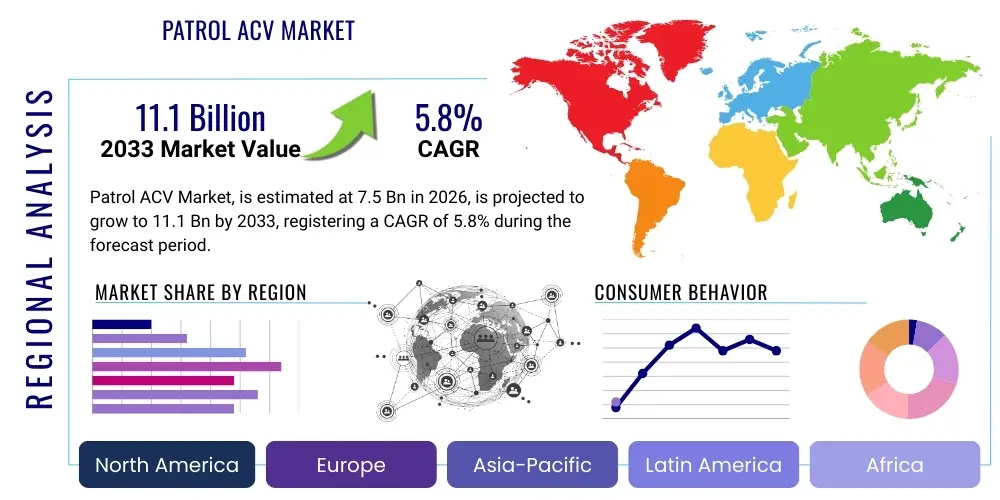

Patrol ACV Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441659 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Patrol ACV Market Size

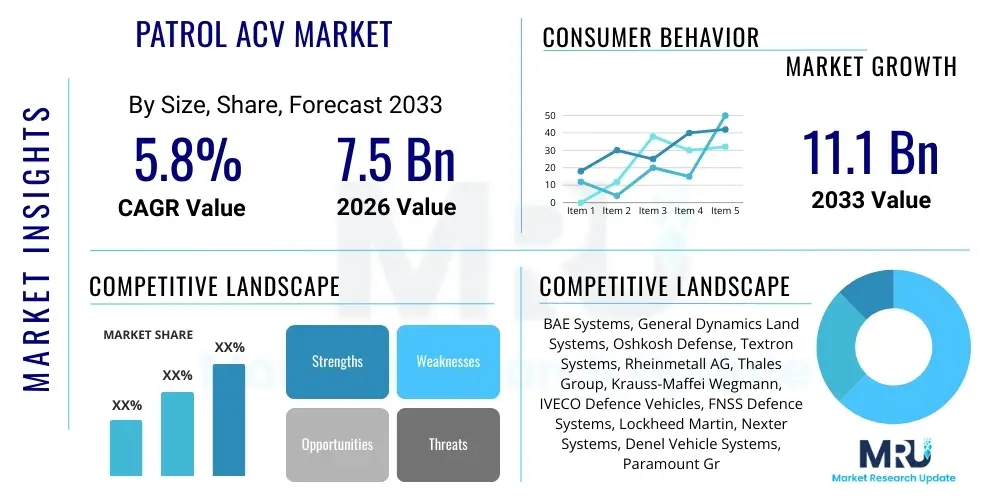

The Patrol ACV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033.

Patrol ACV Market introduction

The Patrol Armored Combat Vehicle (ACV) Market encompasses the design, manufacture, and deployment of protected wheeled and tracked vehicles primarily utilized for security, reconnaissance, rapid reaction, and internal policing duties by military, paramilitary, and specialized law enforcement agencies. These vehicles are characterized by a balance of mobility, protection (against small arms fire, mines, and IEDs), and operational flexibility, differentiating them from heavy main battle tanks or specialized transport vehicles. Patrol ACVs serve as critical assets in asymmetric warfare environments, urban security operations, and border control missions where quick deployment and crew safety are paramount.

Product description highlights advanced armor solutions, modular design architectures, and integrated communication systems (C4ISR). Modern Patrol ACVs leverage technologies such as appliqué armor packages, ballistic glass, and V-shaped hulls for enhanced survivability against emerging threats. Key applications include border surveillance, convoy escort, counter-terrorism operations, and maintaining order in politically volatile regions. The evolution of this market is strongly tied to global defense spending trends, particularly the modernization of legacy fleets in developed nations and initial procurement cycles in emerging economies facing heightened internal and external security challenges.

The primary benefits of utilizing Patrol ACVs include increased personnel safety, enhanced mission capability in hazardous environments, and extended operational reach compared to unarmored vehicles. Driving factors stimulating market growth include persistent geopolitical instability, the need for enhanced force protection against unconventional threats like IEDs, and rapid technological advancements in vehicle platforms, propulsion systems, and weapon station integration. Furthermore, increasing defense budgets globally, driven by perceived threats and strategic competition, consistently fuel demand for robust and adaptable patrol vehicles capable of performing diverse roles across various terrains.

Patrol ACV Market Executive Summary

The Patrol ACV market is currently defined by shifting procurement priorities focused on survivability and technological integration, moving away from purely heavy armor towards lightweight, highly mobile, and networked platforms. Key business trends include the strong preference for wheeled ACVs due to their lower maintenance costs, better on-road performance, and greater strategic mobility compared to tracked alternatives. Furthermore, defense contractors are increasingly focusing on offering comprehensive support and modernization packages (MRO – Maintenance, Repair, and Overhaul) throughout the vehicle lifecycle, establishing long-term revenue streams and deeper integration with defense ministries. The competition remains intense, characterized by large defense primes acquiring niche technology providers to bolster their C4ISR and specialized armor capabilities.

Regionally, North America and Europe remain key procurement hubs, driven by continuous fleet modernization programs and the replacement of Cold War-era equipment. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by significant defense spending increases by nations such as India, China, and Australia, primarily addressing maritime and territorial disputes, thereby increasing the demand for highly adaptable reconnaissance and patrol vehicles. The Middle East and Africa (MEA) region shows high, albeit volatile, demand, largely concentrated on internal security mandates and counter-insurgency operations, favoring vehicles optimized for harsh desert environments and high levels of mine protection.

Segmentation trends reveal a strong emphasis on the Application segment, with Border Patrol and Internal Security driving the highest volume of purchases, reflecting global concerns over transnational crime and migration control. In terms of components, the integration of advanced C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems is becoming a mandatory requirement, pushing up the average unit cost of Patrol ACVs. The market is evolving towards modularity, allowing the same platform to be quickly reconfigured for roles ranging from personnel carrier to ambulance or specialized weapons platform, maximizing fleet flexibility and reducing logistical burden for end-users.

AI Impact Analysis on Patrol ACV Market

Common user questions regarding AI's impact on the Patrol ACV market frequently revolve around how artificial intelligence will enhance autonomy, improve real-time situational awareness, and potentially replace human roles in high-risk reconnaissance and patrol missions. Users are concerned about the integration costs, reliability of autonomous decision-making in complex environments, and the ethical implications of using AI in lethal targeting systems mounted on ACVs. Key expectations focus on AI-driven data fusion from onboard sensors, predictive maintenance capabilities to increase vehicle uptime, and the development of semi-autonomous teaming capabilities where human operators oversee multiple unmanned ACV patrols (MUM-T). The central theme is the transition from human-driven, reactive platforms to AI-assisted, proactive, and potentially autonomous security assets.

The direct integration of Artificial Intelligence is revolutionizing Patrol ACVs by transforming them into highly intelligent, data-driven nodes within a larger networked battlespace. AI algorithms are essential for processing the massive influx of data collected by Electro-Optical/Infrared (EO/IR) sensors, radar, and acoustic detection systems mounted on these vehicles, enabling faster and more accurate threat identification than human operators alone can achieve under duress. This enhanced processing power significantly improves the vehicle’s ability to conduct advanced reconnaissance, automatically classify targets, and optimize patrol routes based on real-time environmental factors and historical threat assessments. Consequently, the operational tempo and effectiveness of patrol missions are dramatically increased, minimizing human exposure to danger.

Furthermore, AI is pivotal in developing sophisticated predictive logistics and maintenance systems for ACV fleets. By continuously monitoring the performance parameters of critical vehicle subsystems—engine health, transmission wear, weapon system functionality, and armor integrity—AI models can forecast potential failures long before they occur. This transition from schedule-based to condition-based maintenance (CBM) optimizes resource allocation, reduces the total cost of ownership (TCO) for defense ministries, and drastically improves fleet readiness rates, which is crucial for continuous border security and internal patrol operations where vehicle availability is non-negotiable. The impact extends beyond the vehicle itself, influencing the training and simulation environments utilized by ACV crews, incorporating AI-driven scenarios for immersive and realistic operational preparation.

- Enhanced Situational Awareness: AI fusion of sensor data (Lidar, Radar, EO/IR) providing 360-degree, real-time threat detection and classification.

- Predictive Maintenance (CBM): Utilization of machine learning to analyze subsystem health data, forecasting failures and optimizing maintenance schedules, drastically increasing vehicle uptime.

- Semi-Autonomous Operation (MUM-T): Development of manned-unmanned teaming capabilities, allowing Patrol ACVs to coordinate with unmanned ground vehicles (UGVs) or aerial systems (UASs) using AI for coordinated patrol paths.

- Optimized Route Planning: AI algorithms assessing terrain, threat density, weather, and traffic patterns in real-time to generate the safest and most efficient patrol routes.

- Automated Weapon Targeting: AI assistance in rapid target acquisition and tracking for remotely operated weapon stations (RWS), reducing cognitive load on the crew.

- Advanced Training Simulation: AI-driven scenario generation and personalized feedback for ACV crews in high-fidelity virtual training environments.

- Cybersecurity Integration: AI monitoring network traffic and behavioral patterns within the vehicle’s C4ISR suite to detect and neutralize cyber threats autonomously.

DRO & Impact Forces Of Patrol ACV Market

The Patrol ACV Market is primarily driven by escalating global security concerns, including persistent regional conflicts, the rise of transnational terrorism, and heightened border disputes, compelling governments to prioritize investments in highly survivable and rapid-response vehicles. However, the market faces significant restraints stemming from high procurement and long-term maintenance costs, budget constraints in developing nations, and increasingly complex regulatory hurdles related to arms exports and technology transfer. The opportunities lie primarily in technological modernization, the demand for modular vehicle architectures, and the adoption of electric or hybrid propulsion systems to meet modern operational requirements for stealth and fuel efficiency. These factors collectively create a dynamic impact environment characterized by strategic defense procurement cycles and rapid technological obsolescence.

Drivers: A primary driver is the necessity for enhanced crew protection against evolving asymmetric threats, particularly sophisticated improvised explosive devices (IEDs) and anti-tank guided missiles (ATGMs). The global defense community recognizes that traditional lightly armored vehicles are inadequate, fueling demand for MRAP (Mine-Resistant Ambush Protected) features integrated into patrol platforms. Additionally, the replacement cycle for aging fleets, particularly in NATO and allied nations that acquired ACVs following the initial post-Cold War reductions, provides sustained demand. The shift towards multi-role capabilities allows ACVs to justify their investment by serving in various capacities—from light attack to medical evacuation—thereby expanding their procurement scope across different branches of military and internal security forces.

Restraints: The most significant restraint is the stringent fiscal climate and extensive budgetary scrutiny facing many governments, leading to prolonged procurement timelines and cost reduction pressures on manufacturers. Furthermore, complex technological integration, especially related to C4ISR systems and active protection systems (APS), increases the unit cost and training requirements, potentially limiting adoption by smaller or less technologically advanced defense forces. Export controls, particularly concerning sensitive technologies like high-grade armor and advanced sensor packages, also restrict market accessibility for manufacturers, especially when dealing with regions flagged for political instability or human rights concerns. The high operational logistics burden, including the need for specialized parts and lengthy supply chains, also acts as a constraint.

Opportunities: Major opportunities reside in emerging technologies and the concept of modularity. The opportunity to integrate hybrid or electric drive trains offers reduced noise signature, lower fuel dependency, and higher torque, critical for urban and special operations patrol roles. Modular designs, where the ACV chassis can accommodate various mission kits (e.g., surveillance module, mortar carrier, medical bay) on the same platform, provide defense organizations unparalleled flexibility and operational cost savings. Furthermore, focused efforts on selling complete technological ecosystems, including training simulators, long-term servicing contracts, and data analytics tools, represent a significant revenue opportunity for key market players moving forward, cementing long-term relationships with government clients.

Segmentation Analysis

The Patrol ACV Market is systematically segmented based on Type, Application, and critical Components, providing a nuanced view of demand patterns and technological emphasis across different operational needs globally. Analyzing these segments helps stakeholders understand where investment is concentrated, revealing strong growth in wheeled platforms and a decisive shift towards border patrol applications. The interplay between platform size and required C4ISR capabilities dictates procurement decisions, where smaller, highly mobile wheeled vehicles dominate internal security needs, while larger, more protected variants are favored for high-intensity reconnaissance or border defense roles.

The segmentation by Component is increasingly crucial, as the value contribution of software, sensors, and electronic warfare suites often outweighs the material cost of the hull and engine. This shift underscores the transition of Patrol ACVs from simple armored transport to sophisticated mobile information and combat systems. Understanding these subdivisions is vital for market forecasting, as the rate of technological obsolescence in C4ISR systems is far faster than that of vehicle hulls, driving recurrent upgrade cycles and sustained aftermarket revenue opportunities for specialized electronics manufacturers.

- By Type: Wheeled ACVs, Tracked ACVs, Amphibious ACVs

- By Application: Border Patrol, Internal Security, Counter-Insurgency, Reconnaissance, Light Attack

- By Component: Hull & Structure, Engine & Power Train, Weapons Systems (RWS, Turrets), C4ISR Systems (Communication, Sensors, EW), Suspension & Running Gear

- By Weight Class: Light (under 10 tons), Medium (10-25 tons), Heavy (over 25 tons)

Value Chain Analysis For Patrol ACV Market

The value chain for the Patrol ACV market begins with extensive upstream activities involving raw material sourcing, specializing in high-grade ballistic steels, composite materials, and advanced aluminum alloys required for protection. This stage also includes the development and manufacture of proprietary components like specialized engines, transmissions, and advanced suspension systems optimized for rugged off-road performance. Key upstream players are typically specialized metallurgical companies, component manufacturers (e.g., engine manufacturers like Cummins or Caterpillar, transmission specialists like Allison), and armor technology providers. Their performance dictates the vehicle's protective capabilities and overall mobility characteristics.

The midstream process is dominated by Original Equipment Manufacturers (OEMs), the major defense contractors responsible for integrating all components, conducting system testing, and assembling the final vehicle platforms. This stage involves significant investment in R&D, system engineering, and compliance with stringent military specifications and quality controls. Midstream activities also encompass the integration of highly complex C4ISR and electronic warfare systems, often sourced from specialized electronics subcontractors. The efficiency and modularity of the manufacturing process here are critical determinants of the final vehicle cost and delivery timeline.

Downstream activities center on distribution, sales, and comprehensive post-sale support. Distribution channels are predominantly direct, involving government-to-business (G2B) contracts negotiated directly with defense ministries or national procurement agencies. Indirect channels are limited but exist through foreign military sales (FMS) facilitated by governments (e.g., U.S. State Department) or through strategic international partnerships and joint ventures, particularly in regions requiring technology transfer or local content requirements. Post-sale support, including long-term maintenance, spare parts supply, training, and modernization/upgrade packages, represents a crucial and highly profitable segment of the downstream value chain, ensuring the operational readiness of the ACV fleet throughout its expected 20-30 year service life.

Patrol ACV Market Potential Customers

The primary end-users and buyers of Patrol ACVs are national defense departments and specialized military branches requiring protected mobility for frontline operations, reconnaissance, and rapid deployment. These customers prioritize survivability, operational reliability in diverse climates, and integration capability with existing network architectures. Procurement decisions are highly strategic, involving multi-year budget cycles and comprehensive trials to ensure vehicles meet specific national defense mandates, often leading to large volume, multi-billion-dollar contracts that sustain manufacturers for decades.

A secondary, yet rapidly expanding, customer base includes internal security forces, paramilitary organizations, and border patrol agencies. These buyers, typically falling under Ministries of Interior or equivalent homeland security agencies, focus heavily on wheeled, highly maneuverable platforms (often 4x4 or 6x6 configurations) optimized for urban and high-threat policing environments. Their requirements emphasize rapid ingress/egress capabilities, non-lethal crowd control integration, and lower profile designs compared to heavy military versions. The increasing global focus on domestic security and countering transnational threats ensures sustained demand from this segment, especially in regions experiencing political instability or high levels of organized crime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BAE Systems, General Dynamics Land Systems, Oshkosh Defense, Textron Systems, Rheinmetall AG, Thales Group, Krauss-Maffei Wegmann, IVECO Defence Vehicles, FNSS Defence Systems, Lockheed Martin, Nexter Systems, Denel Vehicle Systems, Paramount Group, ST Engineering, L3Harris Technologies, Navistar Defense, Hanwha Defense, Turkish Aerospace Industries (TAI), Patria, Mitsubishi Heavy Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Patrol ACV Market Key Technology Landscape

The Patrol ACV market is currently undergoing a transformative technological shift, moving from legacy mechanical systems to digital, networked platforms utilizing advanced sensor fusion and modular protection technologies. A core technological focus is the optimization of survivability without sacrificing mobility. This includes the widespread adoption of modular appliqué armor packages that can be scaled up or down depending on the mission profile and threat level. Crucially, Active Protection Systems (APS), which use radar to detect incoming threats (like RPGs) and neutralize them before impact, are moving from being exclusive to heavy vehicles to being standard features on high-end patrol ACVs, drastically increasing crew survivability in urban combat scenarios.

Propulsion technology is another key area of innovation. While traditional diesel engines remain dominant, there is significant R&D investment directed towards hybrid-electric drive trains. These systems offer several operational advantages for patrol duties: they enable long-range quiet watch (silent mode for reconnaissance), reduce the vehicle’s thermal and acoustic signature, and provide substantial on-board electrical power necessary to run sophisticated C4ISR and electronic warfare equipment that modern warfare demands. The ability to generate and store large amounts of power is vital for maintaining network connectivity and running energy-intensive sensor suites for extended patrol durations, making power management a central technological concern.

Furthermore, digital architecture and open standards are fundamental to the latest generation of Patrol ACVs. Vehicles are being built around a robust digital backbone, allowing for seamless integration of COTS (Commercial Off-The-Shelf) software and hardware upgrades, ensuring long-term relevance and reducing proprietary lock-in for end-users. This technological framework supports sophisticated C4ISR capabilities, including secure satellite communications, high-bandwidth data links, and advanced battlefield management systems (BMS). The integration of AI for predictive diagnostics, sensor fusion, and autonomous navigation assistance positions the modern Patrol ACV not merely as a fighting platform, but as a crucial, networked node on the digital battlefield, enhancing decision superiority for commanding officers during complex patrol missions.

Regional Highlights

The global Patrol ACV market exhibits distinct regional dynamics driven by unique geopolitical landscapes, economic capacities, and specific operational threats faced by national defense forces.

North America (U.S. and Canada): This region is characterized by high defense budgets and a strong emphasis on continuous technological modernization and replacement programs. The U.S. Department of Defense is the largest single buyer globally, driving demand for technologically advanced wheeled vehicles that emphasize rapid deployability, network integration, and exceptional crew protection (e.g., JLTV program influence). The market here is mature, focused heavily on sustainment, upgrade kits, and integrating cutting-edge technologies like hybrid propulsion and AI-assisted C4ISR. Contracts are dominated by large domestic players like General Dynamics and Oshkosh, maintaining significant R&D investments to keep pace with evolving threats, ensuring the region remains a benchmark for technological sophistication in Patrol ACVs.

The demand in North America is stable, prioritizing quality and capability over absolute unit cost reduction. Procurement cycles often involve substantial spending on specialized mission variants, such as those equipped for chemical, biological, radiological, and nuclear (CBRN) reconnaissance or specialized explosive ordnance disposal (EOD) support. Furthermore, the focus on interoperability with NATO and global partners means that specifications often adhere to rigorous international standards, influencing the design trends globally. The continued emphasis on rapid deployment capabilities mandates lighter, more air-transportable platforms that can be quickly moved to global hot spots for expeditionary patrol missions.

Europe: The European market is highly fragmented but unified by the collective need for enhanced defense capabilities following heightened tensions in Eastern Europe. NATO members are systematically increasing defense spending towards the 2% GDP target, leading to robust procurement activities aimed at replacing aging legacy fleets with modular, multi-role wheeled vehicles (e.g., 8x8 platforms being adapted for patrol/reconnaissance duties). Western European nations focus on quality manufacturing and integrating European defense standards (EDA) compliant systems, favoring established continental manufacturers like Rheinmetall, Nexter, and IVECO. There is a strong regional trend towards standardizing logistics and vehicle platforms across multinational forces.

Eastern Europe, driven by proximity to geopolitical flashpoints, shows accelerated demand, often prioritizing rapid acquisition and proven survivability features, sometimes favoring MRAP-style protection. The European market sees significant cooperation between governments and manufacturers to develop next-generation platforms featuring advanced blast protection and integrated electronic countermeasure systems suitable for complex, dense urban environments common across the continent. Political considerations and industrial offset requirements often play a substantial role in contract awards within European procurement processes.

Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising internal and external security concerns, significant increases in military budgets (especially in India, Australia, and South Korea), and territorial disputes. Nations in this region are rapidly modernizing their ground forces, seeking versatile Patrol ACVs capable of operating in diverse terrains, from dense jungles to high-altitude areas. Procurement in APAC often involves requirements for local production or technology transfer, leading to joint ventures between local defense enterprises and major international OEMs. Australia, for instance, has invested heavily in sophisticated protected mobility vehicles to support expeditionary forces and border security efforts.

The sheer scale of military expenditure in countries like China and India ensures persistent high demand. Demand drivers include coastal and border security, counter-insurgency operations, and the need for disaster relief capabilities where robust armored transport is required. Unlike the mature Western markets, APAC includes many countries undertaking first-time major fleet upgrades, making them receptive to the latest generation of modular designs and networking technologies. The strategic imperative to counter regional peer competitors drives substantial investment in reconnaissance variants equipped with long-range surveillance and sophisticated sensor packages.

Middle East and Africa (MEA): This region is characterized by consistent, high demand driven primarily by persistent internal conflicts, counter-terrorism operations, and securing critical national infrastructure. MEA customers place extreme emphasis on mine protection and IED resistance, making MRAP capabilities mandatory. The operational environment often demands high reliability in extreme heat and dusty conditions. Countries with substantial oil revenues (like Saudi Arabia and UAE) are investing heavily in modernizing their fleets, often acquiring sophisticated systems from U.S. and European manufacturers, sometimes adapted with regional-specific cooling and filtering systems.

The African sub-segment sees demand concentrated among nations participating in UN peacekeeping missions or addressing internal tribal conflicts and terrorist group activities. Procurement here is often constrained by budget, leading to strong interest in rugged, cost-effective platforms, often sourced from South African or Turkish defense firms known for specialized armor solutions. Technology transfer and local assembly requirements are becoming increasingly important negotiating points in major MEA procurement deals, reflecting a desire to build indigenous defense industrial capabilities.

Latin America: The Latin American market for Patrol ACVs is generally smaller and driven primarily by internal security missions, counter-narcotics operations, and border control, rather than large-scale conventional military buildup. Demand favors lighter, more agile 4x4 and 6x6 wheeled vehicles that can navigate challenging road infrastructure and dense urban areas. Budgetary limitations often lead to a focus on refurbishment and life extension programs for existing fleets, but modernization programs are emerging, particularly in countries like Brazil and Chile, focused on standardizing equipment and improving survivability features in high-risk zones. International suppliers often need to offer flexible financing and comprehensive maintenance packages to secure contracts in this region.

- North America: Focus on high-tech integration, networked C4ISR, and fleet modernization (JLTV replacements).

- Europe: Driven by standardized NATO requirements, defense spending increase, and replacement of Cold War-era fleets; strong emphasis on modularity.

- Asia Pacific (APAC): Highest growth potential fueled by geopolitical tensions, territorial disputes, and major defense budget increases (India, China, Australia).

- Middle East & Africa (MEA): Strong demand for high MRAP protection, robust performance in desert conditions, driven by internal security and counter-terrorism.

- Latin America: Focus on internal security, counter-narcotics, and cost-effective, agile wheeled platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Patrol ACV Market.- BAE Systems

- General Dynamics Land Systems

- Oshkosh Defense

- Textron Systems

- Rheinmetall AG

- Thales Group

- Krauss-Maffei Wegmann

- IVECO Defence Vehicles

- FNSS Defence Systems

- Lockheed Martin

- Nexter Systems

- Denel Vehicle Systems

- Paramount Group

- ST Engineering

- L3Harris Technologies

- Navistar Defense

- Hanwha Defense

- Turkish Aerospace Industries (TAI)

- Patria

- Mitsubishi Heavy Industries

Frequently Asked Questions

Analyze common user questions about the Patrol ACV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Patrol ACV market?

The primary driver is the increasing threat posed by improvised explosive devices (IEDs) and anti-tank weapons in asymmetric warfare environments, necessitating procurement of platforms with enhanced Mine-Resistant Ambush Protected (MRAP) capabilities and advanced Active Protection Systems (APS) to ensure crew survivability during patrol and reconnaissance missions globally.

How is technological innovation impacting the future design of Patrol ACVs?

Innovation is focusing heavily on digital backbone architectures, enabling seamless integration of advanced Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems, alongside the adoption of hybrid-electric propulsion for increased stealth and exportable power capacity for sophisticated onboard electronics.

Which Patrol ACV segment is exhibiting the fastest growth trajectory?

The Wheeled ACVs segment, particularly the 4x4 and 6x6 configurations, is experiencing the fastest growth, driven by their superior logistical footprint, lower operating costs, and enhanced strategic mobility compared to tracked vehicles, making them ideal for border patrol and internal security applications across Asia Pacific and Europe.

What role does the aftermarket and sustainment segment play for manufacturers?

The aftermarket, encompassing maintenance, repair, overhaul (MRO), and lifecycle modernization programs, represents a critical and highly stable revenue stream. Manufacturers often secure long-term sustainment contracts that can equal or exceed the initial vehicle procurement value, ensuring fleet readiness for defense customers over decades of service.

What are the key differences between military patrol ACVs and internal security variants?

Military patrol ACVs prioritize heavy ballistic and mine protection, weapon station integration, and extreme off-road performance. Internal security variants, used by police or paramilitary forces, emphasize agility, lower profile designs, and integrated systems for non-lethal crowd control and urban maneuverability, often utilizing slightly lighter armor protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager