PCR Laboratory Workstations Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441535 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

PCR Laboratory Workstations Market Size

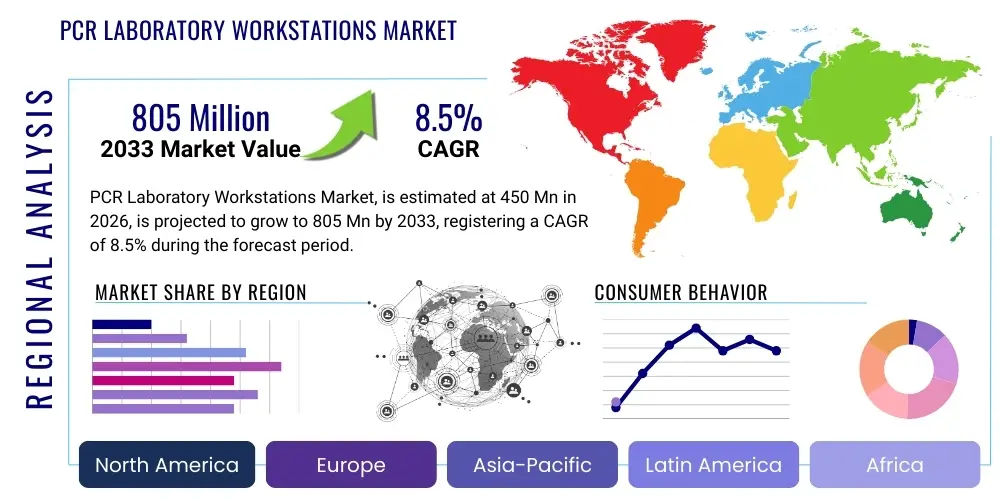

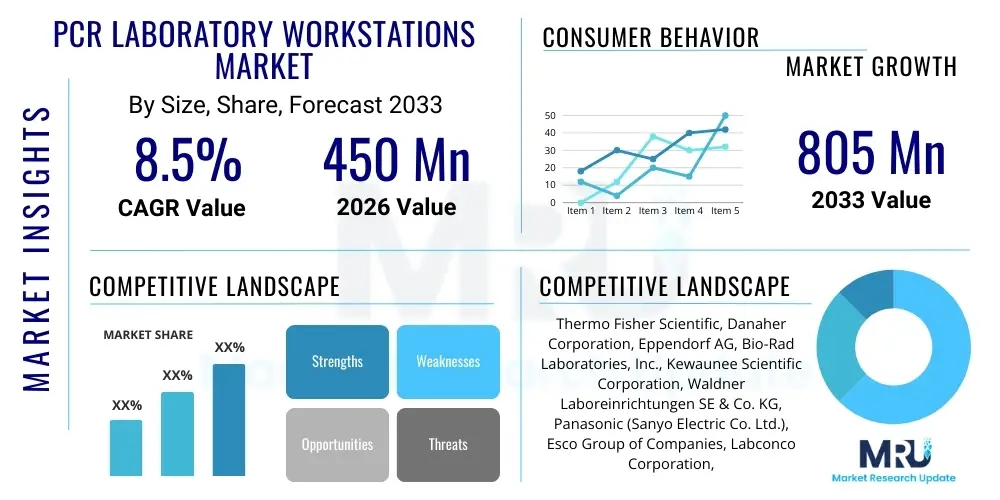

The PCR Laboratory Workstations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to the increasing global incidence of infectious diseases, the expansion of molecular diagnostics capabilities in developing nations, and continuous technological advancements aimed at minimizing cross-contamination during highly sensitive amplification processes. The fundamental necessity for reliable, contamination-free environments for nucleic acid preparation and manipulation positions specialized PCR workstations as indispensable tools across clinical, research, and industrial laboratory settings.

PCR Laboratory Workstations Market introduction

The PCR Laboratory Workstations Market encompasses specialized laminar flow enclosures designed to provide an isolated, clean environment essential for performing Polymerase Chain Reaction (PCR) setup and analysis. These workstations are critical instruments used to prevent external contaminants, particularly amplified nucleic acid products (amplicons), from compromising sensitive molecular biology experiments. They typically feature UV sterilization capabilities, HEPA filtration systems, and defined workflow zones to ensure the highest levels of accuracy and reliability in genetic analysis. Major applications span clinical diagnostics for pathogen detection, fundamental biomedical research, forensic science, and quality control in pharmaceutical and agricultural biotechnology. The driving factors include the proliferation of personalized medicine initiatives, escalating demand for high-throughput diagnostic screening, and stringent regulatory requirements mandating contamination control in molecular testing labs, which collectively underscore the value proposition of these controlled laboratory environments.

PCR Laboratory Workstations Market Executive Summary

The global PCR Laboratory Workstations market demonstrates significant dynamism, driven by accelerated investment in genomic sequencing and molecular biology research across industrialized and emerging economies. Key business trends include the increasing adoption of automated workstations capable of integrating robotics for high-throughput liquid handling, thereby reducing human error and improving operational efficiency, particularly in large-scale diagnostic facilities. Regionally, North America and Europe maintain market dominance due to established healthcare infrastructure and high R&D spending, while the Asia Pacific region is emerging as the fastest-growing market segment, fueled by rising infectious disease burdens and substantial governmental efforts to enhance diagnostic capacity. Segment trends highlight a shift toward specialized, customizable configurations, with the highest growth observed in the pharmaceutical and biotechnology end-user segment, reflecting the critical need for pristine environments in drug discovery and therapeutic development pipelines. The market is consolidating around providers offering integrated solutions that combine workstations with advanced digital monitoring and workflow management tools, emphasizing quality assurance and traceability.

AI Impact Analysis on PCR Laboratory Workstations Market

Common user questions regarding the impact of Artificial Intelligence (AI) on PCR Laboratory Workstations frequently center on how AI can enhance workflow optimization, predict and prevent contamination events, and integrate complex data streams generated during high-throughput PCR processes. Users are keenly interested in whether AI can move beyond simple automation to truly augment the reliability of results by monitoring environmental variables in real-time. Key concerns revolve around the cybersecurity implications of integrating AI-driven software with sensitive research data and the initial capital expenditure required for sophisticated, AI-enabled systems. The overarching expectation is that AI will transform these workstations from passive protective enclosures into intelligent hubs for molecular assay execution and quality assurance, significantly improving laboratory efficiency and diagnostic throughput by reducing manual intervention and streamlining data analysis pipelines.

The integration of AI into PCR laboratory workstations is expected to revolutionize standard operating procedures by offering predictive maintenance and advanced environmental controls. AI algorithms can analyze historical operational data, including temperature fluctuations, humidity levels, air flow patterns, and usage cycles, to predict potential equipment failure or contamination risks before they manifest. Furthermore, intelligent dispensing and pipetting protocols, optimized using machine learning, can dynamically adjust liquid handling parameters based on reagent viscosity and sample volume, ensuring unparalleled precision and minimizing waste. This shift moves the workstation beyond basic physical containment toward proactive, data-driven contamination management, fundamentally changing the operational landscape of molecular diagnostics and research laboratories globally.

- AI optimizes real-time contamination monitoring using sensor data fusion.

- Predictive maintenance schedules for HEPA filters and UV lamps are generated by AI models.

- Machine learning algorithms enhance robotic liquid handling precision within automated workstations.

- AI facilitates automated error detection and self-correction during high-throughput assay setup.

- Integration of laboratory information management systems (LIMS) is streamlined through AI-driven data processing.

DRO & Impact Forces Of PCR Laboratory Workstations Market

The market for PCR Laboratory Workstations is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces shaping its competitive landscape. The primary drivers include the exponential increase in global molecular diagnostic testing, necessitated by ongoing and emerging infectious disease threats, and the widespread adoption of gene expression and mutation analysis in research settings. Simultaneously, opportunities arise from the ongoing trend toward miniaturization, the development of integrated portable PCR systems for field use, and the incorporation of advanced automation features, which appeal to high-throughput clinical laboratories. These forces are moderated by significant restraints, predominantly high initial acquisition costs for advanced automated systems, complex regulatory hurdles concerning diagnostic equipment standardization, and the specialized training required for laboratory personnel to operate and maintain these sophisticated enclosures effectively.

A significant driving force is the global surge in genomic research funding, particularly in oncology and personalized medicine. As researchers increasingly utilize quantitative PCR (qPCR) and digital PCR (dPCR) for highly sensitive quantification, the need for an absolutely clean workspace becomes paramount to ensure data integrity. This intensified requirement for precision drives the demand for premium, certified workstations that offer multi-stage filtration and rigorous sterilization protocols. The imperative to adhere to global quality standards, such as ISO 14644 for cleanrooms, further pushes laboratories to invest in high-quality, validated PCR workstations, solidifying their market position as essential capital expenditure items rather than optional accessories.

Conversely, one major restraint involves the stringent budgetary constraints faced by academic and public health laboratories, especially in developing regions. While the benefits of contamination control are clear, the significant upfront investment coupled with high maintenance costs, particularly related to HEPA filter replacement and routine validation, can deter smaller organizations from purchasing top-tier workstations. This constraint creates an opportunity for manufacturers to innovate through modular, scalable, and economically viable entry-level solutions that maintain high-performance characteristics. The overall impact forces suggest a bifurcated market: rapid expansion in high-income research sectors demanding automation, countered by slow but steady growth in emerging markets seeking robust, cost-effective standard units.

Segmentation Analysis

The PCR Laboratory Workstations market is comprehensively segmented based on various technical and commercial factors, allowing for a precise understanding of market dynamics and targeted strategic planning. Key segmentation variables include the product type, distinguishing between standard manual enclosures and highly sophisticated automated robotic systems; configuration, separating benchtop models suitable for smaller labs from large floor-standing units used in high-volume facilities; and end-user vertical, analyzing adoption rates across clinical diagnostics, academic research, and the biotechnology industry. Analyzing these segments provides crucial insights into technological adoption rates, regional demand patterns, and the specific functional requirements demanded by different laboratory environments worldwide.

The segmentation by product type is particularly informative regarding future market potential. Standard PCR workstations, while foundational, are experiencing moderate growth, primarily driven by replacement cycles and new laboratory setups in smaller institutions. In contrast, Automated/Robotic Workstations are projected to exhibit significantly higher CAGR, reflecting the industry-wide push towards industrialization of molecular testing, minimizing human handling variability, and facilitating 24/7 operation capabilities. This automation segment targets large reference laboratories and contract research organizations (CROs) that prioritize scalability and turnaround time above initial capital cost. Understanding these differentiations is vital for manufacturers focusing on specific price points and complexity levels in their product development roadmaps.

- By Product Type:

- Standard Workstations (Manual)

- Automated/Robotic Workstations

- By Configuration:

- Benchtop Workstations

- Floor-Standing/Large Enclosures

- By End-User:

- Hospitals and Diagnostic Centers

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Forensic and Public Health Laboratories

- Contract Research Organizations (CROs)

- By Application:

- Clinical Diagnostics (Infectious Diseases, Oncology)

- Genomics and Proteomics Research

- Quality Control and Food Safety Testing

Value Chain Analysis For PCR Laboratory Workstations Market

The value chain for the PCR Laboratory Workstations market begins with the upstream suppliers responsible for providing critical raw materials and specialized components, such as high-grade stainless steel for construction, advanced polymer composites, sophisticated sensor technology, and crucially, high-efficiency particulate air (HEPA) filters and UV sterilization systems. Success in the upstream segment relies heavily on maintaining rigorous quality control standards to ensure the longevity and performance of the final laboratory product. Disruptions in the supply of microprocessors or specialized robotics components can significantly impact the manufacturing timelines and cost structures, particularly for automated workstations that rely on complex electronics and software integration for seamless operation and workflow management in demanding laboratory environments.

Moving downstream, the value chain involves the manufacturing, assembly, and rigorous testing phases, followed by distribution and final deployment. Distribution channels are typically bifurcated into direct sales models, often utilized by large multinational corporations for key accounts and specialized high-end automated systems requiring complex installation and service contracts, and indirect channels relying on regional distributors and specialized laboratory equipment dealers. These dealers play a vital role in market penetration into smaller clinical labs and academic centers, providing localized sales support, installation, and essential maintenance services. The after-market service and validation segment, including calibration, filter replacement, and system certification, constitutes a critical revenue stream and source of customer retention in this highly regulated industry.

The market heavily relies on technical expertise across the entire chain. Direct distribution ensures better control over the client relationship and facilitates highly customized solutions tailored to specific laboratory throughput and biosafety requirements, often seen in high-security forensic or public health facilities. Conversely, indirect channels benefit from the regional distributor's existing network and ability to manage logistics and inventory efficiently in diverse geographical markets. Optimization of the distribution process, particularly reducing lead times for complex configurations and spare parts, is a key competitive differentiator that impacts overall customer satisfaction and procurement decision-making in capital equipment purchases.

PCR Laboratory Workstations Market Potential Customers

The primary end-users and potential customers for PCR Laboratory Workstations are defined by their engagement in nucleic acid amplification and molecular biology research or diagnostics requiring stringent contamination control. This includes a broad spectrum of institutions, from high-throughput clinical diagnostic centers that rely on rapid and accurate pathogen detection to specialized university research laboratories conducting fundamental studies in genomics, transcriptomics, and epigenetics. Pharmaceutical and biotechnology companies represent a highly lucrative customer base, utilizing these workstations extensively during drug discovery and development phases, particularly for quality assurance of biological products and large-scale genetic screening of cell lines, where contamination risk can jeopardize years of research investment and regulatory compliance.

Hospitals and diagnostic centers form the backbone of the market demand, driven by the continuous need for rapid and reliable testing for infectious diseases, including viral, bacterial, and fungal pathogens. The adoption of advanced workstations in these settings is accelerated by the push for decentralized testing capabilities and the integration of molecular diagnostics into routine clinical workflow management. Furthermore, governmental public health and forensic laboratories constitute a steady customer segment, mandated to maintain the highest levels of accuracy and chain-of-custody integrity when handling sensitive biological evidence or monitoring population-level disease prevalence. These specific customer requirements often necessitate customized solutions that meet unique regulatory or biosafety level specifications.

Emerging customer segments include contract research organizations (CROs) and specialized food and agricultural testing laboratories. CROs frequently require flexibility and high capacity to handle diverse client projects, leading to demand for modular and automated systems that can quickly adapt to varying assay formats. Food safety labs utilize PCR for rapid detection of foodborne pathogens, requiring workstations that can handle complex sample matrices while maintaining cross-contamination integrity. Targeting these specialized sectors requires manufacturers to emphasize versatility, certification standards, and integration capabilities with existing laboratory infrastructure management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Eppendorf AG, Bio-Rad Laboratories, Inc., Kewaunee Scientific Corporation, Waldner Laboreinrichtungen SE & Co. KG, Panasonic (Sanyo Electric Co. Ltd.), Esco Group of Companies, Labconco Corporation, NuAire, Inc., Heal Force Bio-Meditech Holdings Limited, Air Science LLC, Sheldon Manufacturing, Inc., BINDER GmbH, Baker Company, The, Cleaver Scientific Ltd., Memmert GmbH + Co. KG, Miele & Cie. KG, Bigneat International Ltd., Jeio Tech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PCR Laboratory Workstations Market Key Technology Landscape

The technological landscape of the PCR Laboratory Workstations market is continuously evolving, focused primarily on maximizing contamination control efficiency, enhancing user ergonomics, and facilitating integration with upstream and downstream molecular workflows. Central to these workstations is the utilization of advanced high-efficiency particulate air (HEPA) or ultra-low particulate air (ULPA) filtration systems, which guarantee a particle-free working environment, typically achieving ISO Class 5 air quality or better within the enclosure. Furthermore, modern workstations increasingly incorporate intelligent airflow management systems, such as non-turbulent vertical laminar flow patterns, designed to prevent the backflow of room air and ensure the workspace remains sterile during active use, a critical feature for highly sensitive techniques like quantitative PCR (qPCR) where even minute contamination can invalidate results.

Beyond air filtration, the incorporation of highly effective sterilization technologies represents a significant innovation trend. Most contemporary workstations feature integrated short-wave germicidal UV-C light systems, often controlled through programmable timers, designed to denature any residual DNA or RNA contaminants on internal surfaces before and after use. The latest technological advancements focus on automating the decontamination cycle and ensuring UV safety features are rigorously implemented to protect the operator. Furthermore, touch screen interfaces, integrated programmable logic controllers (PLCs), and remote monitoring capabilities are becoming standard, enabling sophisticated control over airflow velocity, temperature regulation, and monitoring of filter life and performance metrics in real time.

The most transformative technology involves the migration towards robotic integration. Automated PCR workstations now utilize precise robotic arms and multi-channel liquid handlers capable of executing complex pipetting protocols, master mix preparation, and plate stamping without human intervention. This shift addresses the persistent issue of human-induced contamination and significantly boosts throughput for large-scale genetic screening and diagnostic testing. Key features here include vision systems for accurate well location, integrated thermal cyclers, and connectivity standards (like LIMS compatibility) that allow the workstation to function as a fully autonomous module within a larger automated laboratory ecosystem, driving efficiency and analytical robustness.

Regional Highlights

North America currently holds the largest market share in the PCR Laboratory Workstations market, a dominance supported by substantial funding for biomedical research, the presence of major biotechnology and pharmaceutical industry leaders, and a highly sophisticated healthcare infrastructure prioritizing molecular diagnostics. The region, particularly the United States, is a key early adopter of advanced automated workstations and novel digital PCR technologies, driven by stringent regulatory frameworks concerning laboratory quality (such as CLIA and CAP standards) and high demand for personalized medicine applications. High R&D expenditure by academic institutions and private firms focused on complex genetic diseases and rapid pandemic preparedness further cements North America’s position as a mature and technologically demanding market segment.

Europe represents the second-largest market, characterized by robust government healthcare spending and strong regulatory bodies, such as the European Medicines Agency (EMA), which enforce high standards for clinical trials and diagnostic testing. Countries like Germany, the UK, and France are critical markets due to their large pharmaceutical manufacturing bases and leading academic research institutions. The regional market growth is steady, emphasizing efficiency and energy conservation in laboratory equipment. There is a discernible trend towards standardized, highly ergonomic workstations that comply with European Union directives on safety and environmental sustainability, ensuring manufacturers focus not only on contamination control but also on long-term operational costs and environmental impact reduction strategies.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by improving healthcare access, significant governmental investment in infrastructure development, particularly in emerging economies like China, India, and South Korea, and a high prevalence of infectious diseases necessitating widespread molecular testing capabilities. Local manufacturers are gaining prominence, often competing on cost-effectiveness, although multinational corporations dominate the high-end automated segment. The growing pharmaceutical and contract manufacturing sectors in APAC are demanding higher quality, certified workstations to align with global quality standards, creating substantial opportunities for both standard and automated product segments across the region.

Latin America (LATAM) and the Middle East & Africa (MEA) constitute emerging markets offering substantial future growth potential. In LATAM, market growth is driven by increasing investment in clinical laboratories and diagnostics modernization programs, though economic volatility remains a constraint. Key areas, including Brazil and Mexico, show steady adoption rates. In the MEA region, the market expansion is closely tied to oil revenue-funded healthcare expansion projects and efforts to establish regional biotechnology hubs, particularly in the UAE and Saudi Arabia. Adoption in these regions focuses on reliable, easily maintained systems suitable for challenging environmental conditions, often requiring robust service and support infrastructure from the manufacturers.

- North America: Market leader, driven by personalized medicine, high R&D funding, and early adoption of automation.

- Europe: Stable growth, focused on regulatory compliance, energy efficiency, and established pharma/biotech sectors.

- Asia Pacific (APAC): Fastest growing, boosted by healthcare infrastructure investment, high disease burden, and expanding contract manufacturing.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets, focused on infrastructure modernization and basic diagnostic capacity building.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PCR Laboratory Workstations Market.- Thermo Fisher Scientific

- Danaher Corporation (through subsidiaries)

- Eppendorf AG

- Bio-Rad Laboratories, Inc.

- Kewaunee Scientific Corporation

- Waldner Laboreinrichtungen SE & Co. KG

- Panasonic (Sanyo Electric Co. Ltd.)

- Esco Group of Companies

- Labconco Corporation

- NuAire, Inc.

- Heal Force Bio-Meditech Holdings Limited

- Air Science LLC

- Sheldon Manufacturing, Inc.

- BINDER GmbH

- Baker Company, The

- Cleaver Scientific Ltd.

- Memmert GmbH + Co. KG

- Miele & Cie. KG

- Bigneat International Ltd.

- Jeio Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PCR Laboratory Workstations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a PCR Laboratory Workstation?

The primary function of a PCR Laboratory Workstation is to provide an isolated, contamination-free environment utilizing HEPA filtration and UV sterilization. This controlled workspace prevents the introduction of external contaminants, particularly amplified nucleic acids (amplicons), ensuring the accuracy and reliability of sensitive molecular biology experiments and diagnostic testing.

How do Automated PCR Workstations differ from Standard Manual Enclosures?

Automated workstations incorporate robotics and sophisticated liquid handling systems to perform PCR setup autonomously, minimizing human error and significantly increasing throughput capacity. Standard manual enclosures rely on the operator for all preparation steps, primarily offering environmental protection rather than workflow automation.

Which end-user segment drives the highest growth in the PCR Workstations Market?

The Pharmaceutical and Biotechnology Companies segment is projected to drive the highest growth, fueled by intense R&D activities in drug discovery, genetic screening, and quality control processes that demand the highest standards of contamination prevention and high-throughput capabilities provided by advanced workstations.

What are the key technological advancements shaping the future of these workstations?

Key technological advancements include the integration of AI for predictive maintenance and workflow optimization, enhanced sensor technology for real-time monitoring of air quality, and the development of integrated, modular systems that seamlessly link various steps of the molecular diagnostic workflow, leading to fully automated sample-to-result platforms.

What is the main restraint impacting the widespread adoption of high-end PCR Workstations?

The main restraint is the high initial capital expenditure associated with automated and highly certified workstations, coupled with ongoing maintenance costs, particularly for HEPA filter replacement and system validation, which presents a significant barrier for smaller laboratories and institutions with restrictive budgets globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager