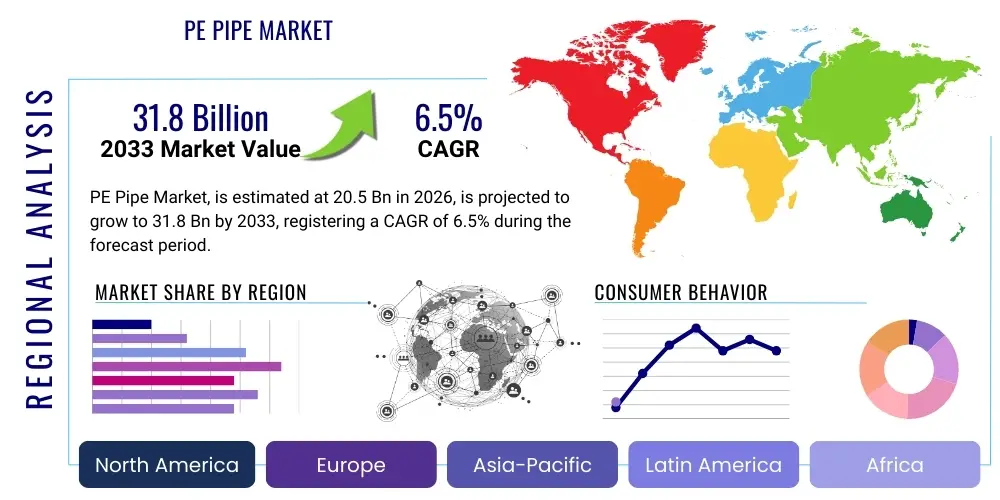

PE Pipe Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443445 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

PE Pipe Market Size

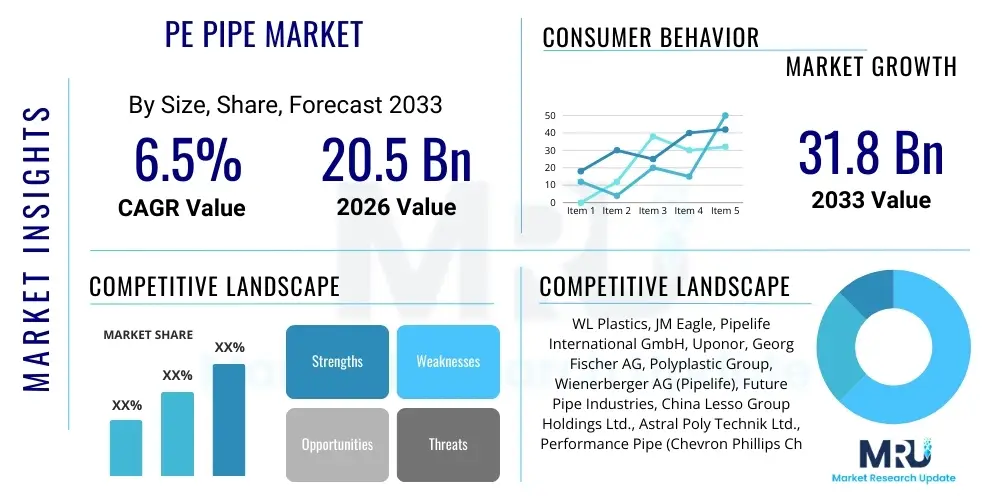

The PE Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

PE Pipe Market introduction

The Polyethylene (PE) Pipe Market encompasses the manufacturing, distribution, and utilization of piping systems made from various forms of polyethylene polymer, primarily High-Density Polyethylene (HDPE), Medium-Density Polyethylene (MDPE), and Low-Density Polyethylene (LDPE). These pipes are favored globally due to their exceptional properties, including high resistance to corrosion, chemical inertness, flexibility, and lightweight nature, making them a superior alternative to traditional materials like steel, concrete, and PVC in numerous infrastructure projects. The market growth is intricately linked to global infrastructural development, particularly in water management, gas distribution, and wastewater conveyance systems, driven by increasing urbanization and the necessity to replace aging infrastructure networks worldwide. The inherent resilience and longevity of PE materials address critical requirements for sustainable and reliable utility management across continents.

PE pipes are essential components in critical infrastructure across diverse sectors. Major applications include potable water supply and distribution networks, where their leak-free jointing capability (via fusion welding) ensures long-term integrity and purity, addressing severe global non-revenue water issues. They are extensively used in oil and gas gathering lines and distribution systems, especially for natural gas, owing to their resilience, robust pressure ratings, and superior resistance to abrasion and stress cracking under varying pressures and temperatures. Furthermore, the agricultural sector relies heavily on LDPE and HDPE pipes for efficient micro-irrigation systems, maximizing water usage efficiency and significantly enhancing crop yield in areas facing acute water scarcity challenges, making them crucial components for global food security initiatives.

Key benefits driving market penetration include their expected long service life, typically exceeding 50 to 100 years, offering a low life-cycle cost compared to metallic options which suffer from internal and external corrosion. Another driving factor is their environmental advantage due to lower installation energy requirements and full recyclability at the end of their functional life. Driving factors for market expansion include stringent government regulations mandating the replacement of leakage-prone metallic pipelines to enhance public safety and resource preservation, significant global investment in smart city projects requiring advanced, sensor-ready utility infrastructure, and the rising global demand for reliable and clean water delivery systems. Technological advancements in PE pipe manufacturing, such as the development of higher performance pressure classes like PE 100 RC and PE 4710, continue to enhance the product's suitability for demanding, high-stakes applications.

PE Pipe Market Executive Summary

The PE Pipe market is characterized by robust and sustained growth, fueled predominantly by escalating global infrastructure spending focused on modernizing water and gas utility networks, especially in emerging economies. Business trends highlight a significant strategic shift towards specialized PE grades like PE 100 RC (Resistance to Crack) which allow for safer, faster, and more cost-effective installation techniques, particularly trenchless technology. Key manufacturers are increasingly focusing on vertical integration, extending their control from raw resin compounding upstream to offering complete system solutions, including advanced electrofusion fittings and certified installation services downstream, thereby securing higher profit margins and ensuring quality control across the entire supply chain. Sustainability mandates and circular economy principles are also forcing innovations toward incorporating certified recycled content without compromising the structural integrity or pressure rating of the final pipe product, a crucial competitive differentiator in highly regulated developed markets.

Regionally, the Asia Pacific (APAC) stands out indisputably as the primary engine for volumetric growth, driven by massive urbanization, high rates of industrialization, and unprecedented government investments in fundamental infrastructure across countries like China, India, and Vietnam. These markets prioritize new network construction and expansion. North America and Europe, while mature, maintain stable growth rates, focusing primarily on replacing millions of miles of aging pipelines inherited from the mid-20th century. The demand in these regions is stable, highly regulated, and centered on premium, large-diameter products offering advanced durability, high pressure capabilities, and essential traceability features crucial for managing complex, interconnected utility grids. Meanwhile, developing economies in Latin America and the Middle East & Africa (MEA) are seeing accelerated adoption, particularly in agricultural irrigation and large-scale public health and sanitation projects, supported substantially by multilateral development bank funding and private-public partnerships.

Segment trends confirm that the Water Supply application segment remains the foundational pillar, commanding the largest overall market share due to critical public health requirements and extensive network renewal programs aimed at mitigating non-revenue water (NRW) losses. Concurrently, the Oil and Gas segment, particularly natural gas distribution and midstream gathering lines, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the global energy transition favoring gas as a cleaner fuel and the inherent superior safety benefits of non-corroding PE pipes for conveying volatile substances under pressure. Material segmentation analysis reveals High-Density Polyethylene (HDPE) maintains its dominance due to its exceptional versatility and superior strength-to-density ratio, making it the preferred choice across high-pressure water, gas, and industrial applications. Furthermore, there is an increasing technological focus on large diameter pipes (above 630 mm) to cater to the growing need for high-volume, long-distance transmission lines serving sprawling metropolitan areas.

AI Impact Analysis on PE Pipe Market

Common user inquiries regarding the transformative impact of Artificial Intelligence (AI) on the PE Pipe market revolve primarily around enhancing system resilience, ensuring zero-defect manufacturing, and stabilizing volatile supply chains. Users frequently ask how advanced AI algorithms and machine learning models can process massive datasets from IoT sensors embedded in pipeline networks to predict potential failures, identifying minor material stresses or ground movements long before they result in catastrophic leaks, thereby revolutionizing reactive maintenance practices. Another significant user concern is the integration of AI-powered non-destructive testing (NDT) and machine vision systems directly into the extrusion line to ensure highly accurate, real-time quality control, automatically rejecting non-compliant sections and dramatically minimizing waste. Furthermore, users are keen on understanding how AI models can forecast market dynamics, optimizing feedstock procurement based on highly volatile petrochemical futures indices, streamlining complex international logistics, and providing optimal inventory management strategies for large infrastructure projects, thereby significantly de-risking financial exposure for manufacturers and distributors. The overarching expectation is that AI will introduce unprecedented levels of precision, operational efficiency, predictive capability, and material utilization across the entire PE pipe lifecycle, moving the industry toward a truly smart infrastructure paradigm.

- AI-driven Predictive Maintenance: Analyzing continuous sensor data (pressure transients, acoustic signatures, temperature variations) within installed PE pipeline networks using deep learning models to forecast component aging, stress points, and potential failure times, enabling precise, proactive intervention and dramatically extending useful asset life.

- Automated Manufacturing Quality Control (NDT): Utilizing high-resolution machine vision and AI algorithms to analyze ultrasonic and radiographic inspection data during the extrusion process in milliseconds, guaranteeing consistent pipe wall thickness, identifying microscopic material defects, and ensuring complete compliance with mandated pressure and dimension standards in real-time.

- Supply Chain and Procurement Optimization: Employing sophisticated AI algorithms for dynamic demand forecasting across regional markets, optimizing the acquisition of polyethylene resin feedstock based on complex, rapidly changing petrochemical indices, and optimizing logistical routes for just-in-time delivery to remote infrastructure development sites, mitigating risks associated with material scarcity and price spikes.

- Digital Twin Modeling and Simulation: Creation of comprehensive virtual replicas (Digital Twins) of both the manufacturing plant floor and the installed subterranean PE pipe network for simulating various stress scenarios (e.g., seismic activity, high internal pressure surges, temperature extremes), assessing long-term material fatigue, and optimizing network design and hydraulic performance prior to physical implementation.

- Enhanced Fusion Welding Integrity Monitoring: Implementation of AI systems that monitor and analyze critical parameters (fusion temperature profiles, pressure hold times, cooling curves) during electrofusion or butt fusion processes, guaranteeing the molecular structural integrity of the joint interface, which is the most common point of failure, thereby achieving a genuinely homogeneous and leak-proof system.

DRO & Impact Forces Of PE Pipe Market

The strategic dynamics of the global PE Pipe Market are fundamentally shaped by a complex and often conflicting array of encouraging drivers, challenging restraints, promising opportunities, and consequential external impact forces. A primary market driver is the accelerating global imperative for sustainable water management, necessitated by increasing water scarcity and the need to conserve resources, which mandates the replacement of old, severely leaking infrastructure with durable, leak-free PE piping systems. Furthermore, extensive government mandates supporting critical infrastructure replacement, particularly in developed nations where cast iron and concrete networks often exceed their operational life span of 50 years, provide a significant and non-cyclical impetus for continuous demand. The inherent material advantages of PE—superior corrosion resistance, minimal maintenance requirements, and excellent seismic performance—continue to solidify its position as the preferred material choice over traditional, brittle alternatives across utility sectors.

Conversely, the market growth momentum is significantly constrained by specific economic and regulatory challenges. The pronounced volatility in the price of raw materials, primarily petrochemical derivatives like crude oil and natural gas, which directly determine the cost of polyethylene resin, critically impacts manufacturing costs, making long-term fixed-price project planning highly difficult and reducing overall profit margins. Furthermore, intense, often localized, competition from established alternative materials such as specialized ductile iron pipes, fiberglass reinforced plastic (FRP), and highly advanced composite piping systems remains persistent, requiring continuous innovation to maintain market share. Additionally, the substantial initial high capital expenditure required for sophisticated, high-output PE pipe manufacturing and specialized equipment for advanced fusion welding and installation techniques can sometimes slow the adoption rate, particularly within public utilities in financially constrained developing markets.

Opportunities for strategic growth are substantial, particularly driven by the continuous global proliferation and refinement of trenchless installation technologies (such as Horizontal Directional Drilling and pipe bursting), which drastically reduce construction time, minimize costs, and lower the environmental impact, all factors that capitalize on the inherent flexibility of PE pipes. The burgeoning trend of integrating "smart piping" systems, incorporating advanced IoT sensors for real-time monitoring of flow, pressure, temperature, and even material stress, represents a high-value opportunity, shifting manufacturers towards offering monitoring services rather than just physical products. Furthermore, the relentless development and commercial adoption of ultra-high-performance PE grades, specifically PE 100 RC and PE 4710, which offer unparalleled durability and resistance to crack propagation, continues to unlock lucrative applications in extremely demanding, high-pressure, and high-temperature environments previously reserved exclusively for robust metallic pipes, expanding the total addressable market significantly. These interconnected forces collectively dictate the competitive dynamics and future strategic direction of the global PE pipe industry.

Segmentation Analysis

The Polyethylene Pipe market is critically segmented across several technical and application dimensions, providing a granular framework for understanding diverse demand drivers, technological requirements, and competitive landscapes globally. Segmentation by material type meticulously distinguishes between the varying densities of polyethylene—HDPE, MDPE, LDPE, and PEX—each possessing unique mechanical, thermal, and chemical properties that dictate their suitability for specific pressure ratings and environments. Application segmentation illuminates the sectors driving fundamental demand, with public utilities (water and sewage) and the energy sector (oil and gas distribution) forming the core, supplemented by specialized demand from agriculture and industrial processing. Finally, diameter and grade segmentation allow manufacturers and investors to differentiate between high-volume transmission lines versus local service connections and between standard pressure ratings and ultra-high-performance specifications necessary for critical infrastructure.

- Material Type:

- High-Density Polyethylene (HDPE): Dominant for high-pressure water, gas, and industrial applications due to high strength-to-density ratio.

- Medium-Density Polyethylene (MDPE): Primarily used for low-to-medium pressure natural gas distribution due to superior safety and fracture resistance.

- Low-Density Polyethylene (LDPE): Used extensively in low-pressure applications, mainly micro-irrigation systems and general drainage where flexibility is key.

- Cross-Linked Polyethylene (PEX): Specialized use in hot and cold indoor plumbing, radiant heating, and niche industrial liquid transport.

- Application:

- Water Supply and Distribution: Largest segment, covering potable water transmission, purification, and municipal distribution networks.

- Oil and Gas (Natural Gas Distribution, Gathering Lines): High growth area driven by pipeline modernization and expansion of urban gas grids.

- Sewage and Drainage: Applications in municipal sewer systems, storm water management, and industrial effluent disposal.

- Irrigation and Agriculture: Use in large-scale farm irrigation, greenhouses, and water transfer systems requiring high UV resistance.

- Industrial (Mining, Chemical Processing): Specialized use for slurry transport, tailings management, and aggressive chemical processing lines.

- Diameter:

- Small Diameter (Up to 160 mm): Residential service connections, drip irrigation, and internal plumbing (PEX).

- Medium Diameter (160 mm to 630 mm): Standard distribution mains for gas and water within urban areas.

- Large Diameter (Above 630 mm): Critical transmission lines for high-volume water and high-capacity industrial conveyance.

- Grade:

- PE 80: Older standard, still used for less critical, lower pressure applications.

- PE 100: Global standard for high-pressure applications (PN 10 to PN 25).

- PE 100 RC (Resistance to Crack): Premium grade allowing installation without sand bedding, enhancing project efficiency.

- PE 4710: North American standard for superior stress crack resistance and higher temperature tolerance.

- Installation Type:

- Trenchless Installation: Utilizes techniques like HDD, pipe bursting, and sliplining, capitalizing on PE flexibility.

- Open Trench Installation: Traditional method used in new construction areas or where access is unrestricted.

Value Chain Analysis For PE Pipe Market

The comprehensive value chain for the PE Pipe market originates upstream with the highly centralized petrochemical industry, which converts hydrocarbon feedstocks (crude oil, natural gas) into ethylene monomer. This critical component is then polymerized by major global chemical companies into various grades of polyethylene resin (HDPE, MDPE, LDPE). The supply and pricing stability of these foundational resins are critical, as they constitute the dominant raw material cost for pipe manufacturers, making the upstream phase highly sensitive to global oil and gas market fluctuations. Specialized compounding firms then intervene, processing the raw resin into highly refined, pipe-grade compounds by incorporating performance additives such as UV stabilizers, antioxidants, and thermal stabilizers to meet stringent industry standards (e.g., ISO 4427, ASTM F714) required for longevity and specific application performance.

The midstream segment is dominated by specialized pipe manufacturing companies who utilize advanced, energy-intensive extrusion machinery to form the pipes, alongside injection molding processes for producing essential fittings, couplers, and joints. Success in this stage is determined by operational efficiency, scale of production, and rigid adherence to quality control procedures, utilizing technologies like high-speed extrusion lines and integrated ultrasonic NDT systems to ensure dimensional accuracy and zero defects. Distribution channels are bifurcated: direct sales channels handle large-scale, often custom-specified municipal and gas utility contracts, requiring significant technical consultation and on-site support. Indirect sales rely on a network of specialized industrial distributors, construction wholesalers, and local plumbing suppliers who manage inventory, logistics, and supply smaller construction or maintenance projects, ensuring broad market reach.

Downstream analysis focuses heavily on the installation and utilization phases. Professional contractors and utility maintenance teams execute installation, leveraging specialized welding techniques (butt fusion, electrofusion) to create a monolithic, leak-proof system. The accelerating adoption of trenchless installation methods places a premium on contractors skilled in techniques like Horizontal Directional Drilling (HDD), driving demand for installation training and specialized equipment. End-users, who are the ultimate buyers—including municipal water authorities, private utility companies, large agricultural consortia, and mining firms—drive demand based on infrastructure modernization schedules, regulatory compliance deadlines, and capital investment budgets. The long service life of the product means the after-market segment is primarily focused on repair, maintenance, and increasingly, the provision of real-time monitoring services via integrated IoT technology, shifting the downstream focus toward asset management and long-term service contracts.

PE Pipe Market Potential Customers

The primary and most consistent customers for PE pipes are massive public sector entities, specifically municipal and governmental water and wastewater authorities across urban, suburban, and regional jurisdictions. These authorities represent the largest market segment due to the continuous and non-discretionary necessity of maintaining and expanding public health infrastructure, driven by population growth and the critical requirement to replace millions of miles of outdated, highly corrosive, and high-leakage legacy pipes (cast iron, asbestos cement). Their procurement is characterized by large, multi-year volume tenders, stringent technical specifications (often requiring PE 100 or PE 100 RC), and a strong preference for manufacturers who can guarantee high quality, long-term supply, and localized support services to meet their extensive network needs. Reliability, minimal life-cycle cost, and compliance with drinking water regulations are the foremost purchasing criteria for this segment.

Another crucial customer group resides within the global energy sector, particularly natural gas transmission and distribution companies, along with midstream gathering line operators in the oil industry. For natural gas utilities, the exceptional safety record, non-corrosive properties, and superior durability of MDPE and HDPE pipes make them indispensable for expanding and modernizing low and medium-pressure distribution grids in densely populated urban and residential areas, mandated by increasingly strict safety regulations globally. The oil and gas extraction sector utilizes PE pipes for non-critical flow lines, produced water disposal (brine lines), and specific slurry transport applications, valuing the material's strong chemical resistance to various drilling fluids and corrosive well outputs, along with the ease and speed of deployment in remote, often challenging, geographical locations.

Furthermore, the agricultural industry, encompassing large commercial farms, irrigation districts, and governmental land management bodies, constitutes a rapidly expanding customer segment, particularly in water-stressed regions. These buyers utilize LDPE and small-to-medium diameter HDPE pipes extensively for efficient, localized drip irrigation systems and long-distance water conveyance, driven by the urgency to improve water use efficiency and combat desertification. The mining sector also stands as a significant industrial customer, where PE pipes are preferred for transporting abrasive slurries, aggressive chemical leachates, and managing dewatering operations. Construction firms act as significant intermediate buyers, procuring various diameter and grade PE pipes and fittings according to the precise specifications outlined by consulting engineers for residential, commercial, and large-scale industrial facility construction projects, linking manufacturer supply directly to real estate and industrial development cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WL Plastics, JM Eagle, Pipelife International GmbH, Uponor, Georg Fischer AG, Polyplastic Group, Wienerberger AG (Pipelife), Future Pipe Industries, China Lesso Group Holdings Ltd., Astral Poly Technik Ltd., Performance Pipe (Chevron Phillips Chemical Company), KWH Pipe (Borealis), Plasson, BlueBrute (IPEX), GF Piping Systems, Sekisui Chemical Co., Ltd., Rehau AG, Polypipe Group plc, Supreme Industries Ltd., Pars Ethylene Kish Co., Egeplast International GmbH, Radius Systems Ltd., Ashirvad Pipes Pvt. Ltd. (Aloysius), Gulf Plastic Industries (GULFPLAST), Aalborg CSP A/S, Vinidex Pty Ltd., Polieco Group, Mainline Pipe & Supply Co., Censtar Pipeline Technology Co., Ltd., Tianjin Junxing Pipe Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PE Pipe Market Key Technology Landscape

The technological evolution within the PE Pipe market is strategically focused on three core areas: advanced material engineering, high-precision manufacturing efficiency, and transformative installation methods, all designed to maximize the life-cycle value and operational reliability of pipe networks. In material science, the pivotal advancement is the widespread commercialization of high-performance resins such as PE 100 RC (Resistance to Crack) and North America’s PE 4710. These materials significantly enhance resistance to catastrophic failure mechanisms like slow crack growth and environmental stress cracking, allowing for direct burial and trenchless installation techniques without the costly and time-consuming requirement of specialized sand bedding. Further innovation includes developing multi-layer and barrier pipe technologies, where co-extrusion allows for combining different polymer layers to achieve specific performance characteristics, such as internal abrasive resistance or external chemical barrier properties, broadening PE pipe utilization in highly specialized industrial applications.

Manufacturing technology emphasizes maximizing output quality and throughput speed. The current technological landscape is defined by the implementation of high-speed, large-diameter extrusion lines equipped with advanced, fully automated gravimetric dosing and control systems that ensure near-perfect uniformity in pipe wall thickness and weight consistency, minimizing material waste and ensuring compliance with strict pressure tolerances. Integrated, non-contact measurement and quality assurance systems, utilizing laser scanners and phased array ultrasonic testing (PAUT), are standard practice, providing continuous, 100% inspection of the pipe body for microscopic flaws and dimensional deviations in real-time. Moreover, significant advancements in specialized fittings technology, particularly the evolution of next-generation electrofusion couplers featuring integrated heating elements and barcode tracking, ensure that joint integrity—a critical factor for system resilience—is consistently achieved through standardized, machine-controlled welding parameters.

Installation technology is increasingly dominated by refined trenchless methods, facilitated directly by the inherent flexibility and monolithic jointing capability of PE pipes. Techniques such as horizontal directional drilling (HDD), pipe bursting, and slip-lining are crucial for minimizing public disruption and reducing construction timelines in congested urban centers. Current technological focus includes developing specialized pipe segments and joint designs optimized for extreme pulling forces encountered during long-distance trenchless installation runs, alongside the creation of AI-powered modeling software to optimize bore path planning and stress management during drilling operations. Most critically, the emergence of "smart piping" systems, which embed fiber optic cables or micro-sensors into the pipe wall, enabling real-time monitoring of internal hydraulic parameters (pressure and flow) and external conditions (ground strain and seismic movement), is transforming the industry toward proactive, data-driven asset management, ensuring maximum operational uptime and longevity.

Regional Highlights

The global PE Pipe market displays significant regional differentiation in terms of market size, growth drivers, and preferred material specifications, reflecting local infrastructure maturity and regulatory mandates. Asia Pacific (APAC) holds the largest market share and is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR) globally. This growth is predominantly fueled by rapid, large-scale urbanization, massive governmental spending on new utility infrastructure expansion (especially in water resource management and sanitation), and the need to connect rural populations to modern utility grids in high-density countries such as China, India, and Indonesia. APAC demand is primarily focused on new network construction, driving high volume consumption across all diameter ranges, supported by strong governmental policy backing infrastructure development funds.

North America and Europe represent highly sophisticated, mature markets where demand is driven less by expansion and primarily by continuous replacement and modernization cycles. In North America, stringent federal and state regulations governing pipeline safety (particularly for natural gas) and water loss mitigation necessitate the widespread replacement of outdated metallic and cement pipes with high-performance PE materials, specifically the locally developed PE 4710 grade. European market growth is highly influenced by EU directives prioritizing environmental protection and water conservation, driving high adoption rates of premium materials like PE 100 RC and demanding superior quality control across manufacturing and installation, with a strong focus on eliminating non-revenue water.

The remaining regions, Latin America and the Middle East & Africa (MEA), are characterized as high-potential emerging markets. Latin America sees steady demand linked to large-scale mining operations (which require chemically resistant pipes for slurry and waste transport) and municipal efforts to improve water and sanitation accessibility in major cities like São Paulo and Mexico City. The MEA region is heavily influenced by significant investments in the oil and gas sector (for distribution and gathering lines) and critical infrastructure projects aimed at addressing severe regional water scarcity, often utilizing PE pipes for extensive, long-distance water transmission from desalination plants and major agricultural schemes, frequently funded by governmental oil revenue or international development agencies, driving demand for robust, UV-resistant HDPE solutions.

- Asia Pacific (APAC): Highest volume market with the fastest growth trajectory, driven by demographic expansion, large-scale public housing and utility projects, and necessity-driven demand for agricultural irrigation systems. China and India are the dominant manufacturing and consuming nations.

- North America: Market stability maintained by continuous pipeline replacement cycles mandated by safety and environmental laws, high adoption of trenchless methods, and preference for advanced materials like PE 4710 for high-pressure gas and water applications in the US and Canada.

- Europe: Focus on premium, sustainable solutions (PE 100 RC) and innovative technologies to reduce water leakage in existing networks. Highly regulated market structure with Germany, the UK, and Nordic countries leading in technological standardization and adoption.

- Middle East & Africa (MEA): Growth strongly tied to massive investments in oil and gas infrastructure expansion, coupled with critical municipal projects addressing water scarcity through desalination connectivity and water distribution network expansion across the Gulf Cooperation Council (GCC) states and high-growth African economies.

- Latin America: Demand concentrated in industrial sectors, specifically mining (slurry and tailings management), and ongoing municipal projects focused on expanding basic water and sanitation services, with economic growth fluctuating based on commodity prices and governmental stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PE Pipe Market.- WL Plastics

- JM Eagle

- Pipelife International GmbH

- Uponor

- Georg Fischer AG

- Polyplastic Group

- Wienerberger AG (Pipelife)

- Future Pipe Industries

- China Lesso Group Holdings Ltd.

- Astral Poly Technik Ltd.

- Performance Pipe (Chevron Phillips Chemical Company)

- KWH Pipe (Borealis)

- Plasson

- BlueBrute (IPEX)

- GF Piping Systems

- Sekisui Chemical Co., Ltd.

- Rehau AG

- Polypipe Group plc

- Supreme Industries Ltd.

- Pars Ethylene Kish Co.

- Egeplast International GmbH

- Radius Systems Ltd.

- Ashirvad Pipes Pvt. Ltd. (Aloysius)

- Gulf Plastic Industries (GULFPLAST)

- Aalborg CSP A/S

- Vinidex Pty Ltd.

- Polieco Group

- Mainline Pipe & Supply Co.

- Censtar Pipeline Technology Co., Ltd.

- Tianjin Junxing Pipe Group

Frequently Asked Questions

Analyze common user questions about the PE Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of PE pipes over traditional materials like PVC or metal?

PE pipes offer superior corrosion resistance, high flexibility, excellent seismic performance, and a service life potentially exceeding 100 years. Crucially, their ability to be joined through heat fusion creates permanently leak-free, monolithic systems, drastically reducing non-revenue water (NRW) loss and long-term maintenance expenses compared to jointed, susceptible metallic systems.

Which application segment accounts for the highest demand in the PE Pipe Market?

The Water Supply and Distribution segment consistently generates the highest volume demand globally. This is primarily driven by massive, non-discretionary municipal investment in replacing aging potable water infrastructure and expanding clean water access to meet urbanization and public health requirements worldwide.

How is trenchless technology influencing the PE Pipe market growth?

Trenchless installation technologies, such as Horizontal Directional Drilling (HDD) and pipe bursting, are fundamentally dependent on the flexibility and durability of PE pipes. These methods dramatically reduce construction costs, minimize environmental and traffic disruption in dense urban areas, and accelerate project delivery, serving as a powerful and continuous catalyst for market adoption.

What is PE 100 RC, and why is it important for infrastructure projects?

PE 100 RC (Resistance to Crack) is a specialized, high-performance polyethylene grade engineered for superior resistance to slow crack growth and point loading. Its importance lies in allowing direct burial and trenchless installation without the need for costly, time-consuming sand bedding, which significantly lowers overall infrastructure project costs while guaranteeing higher long-term network security.

What impact does the volatility of raw material prices have on PE Pipe manufacturers?

Polyethylene resin cost, derived directly from highly volatile petrochemical feedstocks (crude oil and natural gas), represents the largest operational expense for pipe manufacturers. High volatility necessitates sophisticated risk mitigation strategies, including forward contracts and hedging, and often leads to the implementation of dynamic pricing models to maintain competitive stability and protect essential profit margins amidst fluctuating input costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- PE Pipe Market Size Report By Type (PE 100, PE 80, Other), By Application (Water Supply Pipe, Sewage & Drainage Pipe, Oil & Gas Pipe, Agriculture Pipe, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- PE Pipe Market Statistics 2025 Analysis By Application (Water Supply Pipe, Sewage & Drainage Pipe, Oil & Gas Pipe, Agriculture Pipe), By Type (PE 100, PE 80, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- PE Pipe Resin Market Statistics 2025 Analysis By Application (Water Supply Pipe, Sewage & Drainage Pipe, Oil & Gas Pipe, Agriculture Pipe), By Type (PE 100, PE 80, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pe Pipe Resin Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Low Density Polyethylene(LDPE), High Density Polyethylene(HDPE), Linear Low Density Polyethylene(LLDPE), Polypropylene (PP)), By Application (Industrial, Medical, Automobile, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- HDPE Pipe Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (3" -6, 7-12"), By Application (Potable Water, Gas, Electrical Conduit), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager