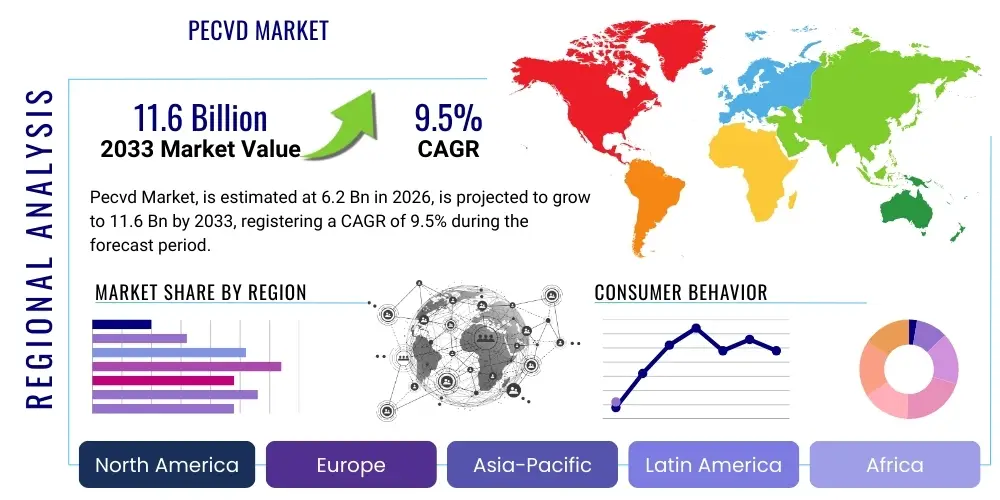

Pecvd Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443520 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Pecvd Market Size

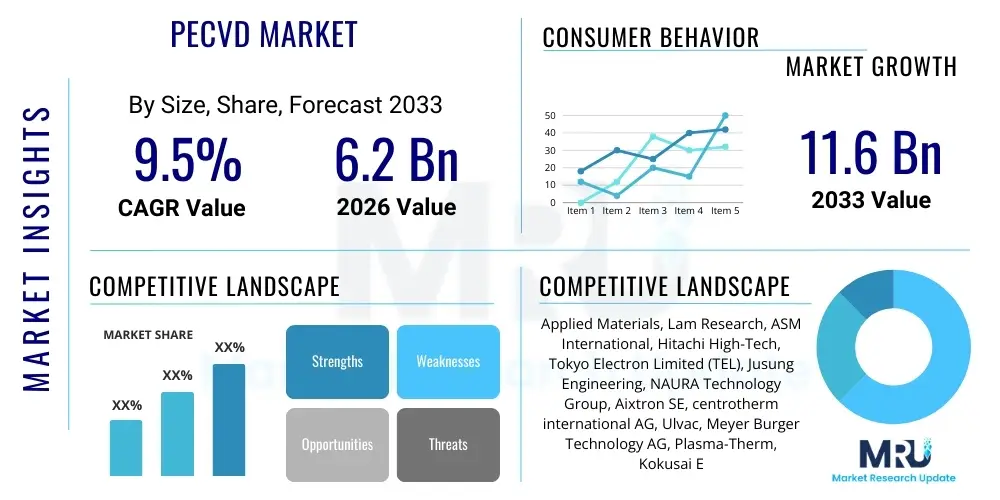

The Pecvd Market (Plasma-Enhanced Chemical Vapor Deposition Market) is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This robust growth trajectory is underpinned by surging global demand for advanced semiconductor devices, high-efficiency solar cells, and sophisticated microelectronic components necessary for next-generation technologies like 5G, artificial intelligence, and electric vehicles. PECVD systems are fundamental to these sectors due to their capability to deposit high-quality thin films at lower processing temperatures compared to traditional CVD methods, which is crucial for protecting sensitive substrates and enabling complex device architectures.

The market is estimated at $6.2 Billion in 2026, driven by continuous capacity expansion in leading foundries across Asia Pacific and specialized fabrication facilities globally. Investment cycles in the semiconductor industry, particularly those focused on sub-10nm nodes and advanced packaging, necessitate the procurement of highly efficient and precise PECVD tools, thus inflating the market size. Furthermore, the burgeoning demand for Micro-LEDs and OLED displays, which utilize PECVD extensively for encapsulation and passivation layers, contributes significantly to the market valuation, establishing a strong commercial footing for specialized equipment providers.

The market is projected to reach $11.6 Billion by the end of the forecast period in 2033. This substantial forecast value reflects anticipated technological advancements, including the adoption of spatial PECVD and atomic layer deposition (ALD) hybrid systems, which promise enhanced uniformity and reduced defect rates. Long-term strategic governmental support for domestic chip manufacturing (e.g., in the U.S. and EU) further guarantees sustained capital expenditure in deposition equipment. The expanding application scope in biomedical coatings and flexible electronics also opens new high-value segments, ensuring the market maintains a high-growth momentum throughout the 2026-2033 period.

Pecvd Market introduction

The Plasma-Enhanced Chemical Vapor Deposition (PECVD) Market encompasses the sales, manufacturing, and servicing of equipment utilized for depositing thin films onto substrate materials under plasma conditions. PECVD is a crucial process in microfabrication, offering superior film properties like high density, excellent step coverage, and low-temperature processing capabilities, essential for modern semiconductor manufacturing and photovoltaic production. The fundamental principle involves introducing precursor gases into a vacuum chamber, where radio frequency (RF) energy creates plasma, dissociating the gas molecules into reactive radicals that subsequently react on the heated substrate surface to form a solid thin film. This technology facilitates the deposition of various materials, including silicon nitride ($\text{SiN}_x$), silicon oxide ($\text{SiO}_2$), amorphous silicon ($\text{a-Si}$), and other specialized dielectric and conductive layers.

Major applications of PECVD systems span across several high-tech industries. In semiconductor manufacturing, it is indispensable for inter-layer dielectrics (ILDs), passivation layers, hard masks, and capping layers, supporting the creation of complex integrated circuits (ICs), memory devices (DRAM, NAND), and micro-electro-mechanical systems (MEMS). Within the solar sector, PECVD is vital for depositing anti-reflection coatings and passivation layers onto silicon wafers, significantly improving the efficiency of solar photovoltaic (PV) cells. Beyond electronics, PECVD is employed in the manufacturing of high-brightness LEDs (HB-LEDs) for surface protection, in biocompatible coatings for medical devices, and in the nascent field of flexible and stretchable electronics, illustrating its broad utility and critical role in advanced manufacturing ecosystems globally.

The primary benefits driving the widespread adoption of PECVD technology include its ability to achieve film deposition at temperatures significantly lower than thermal CVD, minimizing thermal damage to sensitive components and enabling processing on diverse substrate materials, such as polymers or previously metallized surfaces. The process offers high throughput and excellent control over film thickness and composition, which are critical parameters for achieving high device yield and performance. Furthermore, key driving factors propelling the market forward include the rapid proliferation of IoT devices requiring specialized sensors and low-power ICs, the global transition towards renewable energy necessitating efficient PV cell production, and the sustained technological race among leading chip manufacturers to develop smaller, faster, and more complex logic and memory chips, all of which depend heavily on advanced thin-film deposition capabilities provided by sophisticated PECVD tools.

Pecvd Market Executive Summary

The PECVD Market is characterized by intense technological innovation, driven predominantly by cyclical investment patterns in the global semiconductor industry and increasing regulatory support for sustainable energy technologies. Current business trends indicate a strong focus on developing high-density plasma systems and integrating advanced process control mechanisms, such as real-time in-situ monitoring and AI-driven predictive maintenance, to improve equipment utilization and deposition uniformity crucial for advanced node fabrication. Leading manufacturers are emphasizing cluster tool architectures that allow for seamless integration of multiple processing steps, enhancing overall throughput and reducing cleanroom footprint. Furthermore, strategic mergers, acquisitions, and collaborative research agreements between equipment vendors and leading chip foundries are defining the competitive landscape, ensuring that next-generation PECVD solutions are tailored to specific manufacturing requirements, particularly for areas like heterogeneous integration and 3D stacking technologies.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by massive government investment in semiconductor self-sufficiency in countries like China, and the expansion of established manufacturing hubs in South Korea, Taiwan, and Japan. This region accounts for the largest share of PECVD equipment deployment, largely due to the concentration of major contract manufacturers (foundries) and extensive solar cell production facilities. North America and Europe, while smaller in market share, are experiencing significant growth driven by new governmental initiatives (e.g., the CHIPS Act and European Chips Act) aimed at reshoring semiconductor manufacturing capacity and boosting domestic R&D efforts. These regions are primarily focused on high-value, specialized PECVD applications, including advanced materials research, power electronics manufacturing (SiC/GaN), and next-generation flexible displays, leading to high capital expenditure per unit installed base.

Segment trends highlight the critical growth of the semiconductor application segment, which demands ultra-high vacuum and highly precise control, thus driving demand for more expensive, technologically complex systems. Within the technology types, Direct PECVD systems remain dominant due to their maturity and applicability across standard processes, but Remote PECVD (RPECVD) is gaining traction, especially in applications requiring minimal ion bombardment damage, such as sensitive gate oxide deposition or low-temperature encapsulation in flexible electronics. The solar segment is experiencing revitalization, particularly with the shift towards high-efficiency structures like PERC and TOPCon, where specialized PECVD processes are essential for superior passivation layers, ensuring sustained demand for high-throughput, large-area processing tools adapted specifically for photovoltaic applications.

AI Impact Analysis on Pecvd Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the PECVD market reveals significant interest centered on optimizing process control, predicting equipment failures, and automating complex recipe development. Users frequently inquire about how AI can mitigate the inherent variability in plasma processes, improve deposition uniformity across large wafers, and reduce the consumption of expensive precursor gases. Key concerns include the accessibility and cost of implementing AI infrastructure, the need for standardized data collection protocols across different tool vendors, and the impact of AI on the role of process engineers. The general expectation is that AI will transition PECVD operations from reactive maintenance and manual tuning to a highly predictive, automated, and self-optimizing manufacturing paradigm, leading to substantial gains in yield, equipment uptime, and faster time-to-market for new semiconductor designs.

The direct impact of AI implementation within the PECVD manufacturing ecosystem is multifaceted. Primarily, AI algorithms are being employed to analyze vast datasets generated by sensors within the reaction chamber—monitoring plasma parameters, gas flow rates, substrate temperature, and RF power—to establish highly accurate correlations between input parameters and resulting film quality. This allows for real-time process correction, minimizing deviations from target specifications and significantly enhancing the uniformity and repeatability of thin film deposition, which is paramount for high-volume manufacturing of advanced integrated circuits. Machine learning models, specifically, are adept at detecting subtle anomalies in system performance, offering predictive maintenance capabilities that forecast component degradation or potential equipment malfunctions, thereby drastically reducing unscheduled downtime, a critical metric in capital-intensive semiconductor fabrication.

Furthermore, AI is revolutionizing recipe development and experimentation. Traditional PECVD process qualification often involves lengthy design-of-experiment (DOE) iterations guided by expert knowledge. AI-driven optimization platforms, however, utilize evolutionary algorithms and Bayesian optimization techniques to intelligently navigate the multi-dimensional parameter space, quickly identifying optimal settings for achieving desired film properties (stress, refractive index, density) with fewer experimental runs. This capability accelerates the adoption of new materials and processes, supporting faster integration of next-generation device architectures and positioning AI not just as a tool for efficiency, but as an enabler for innovation within the demanding thin-film landscape.

- Real-time Process Optimization: AI algorithms adjust plasma parameters dynamically to ensure optimal film uniformity and composition, minimizing material waste.

- Predictive Maintenance: Machine learning models analyze sensor data to forecast equipment failure, increasing tool uptime and reducing high-cost emergency repairs.

- Automated Recipe Generation: AI accelerates the development of new deposition recipes, reducing the time required for process qualification for new device nodes.

- Defect Classification and Reduction: Computer vision and ML techniques enhance in-situ defect detection and categorization, improving overall manufacturing yield.

- Energy Efficiency Management: AI systems optimize power usage of RF generators and vacuum pumps based on processing load, contributing to sustainable fabrication practices.

DRO & Impact Forces Of Pecvd Market

The dynamics of the PECVD market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively constitute the Impact Forces influencing strategic direction and investment decisions. A primary driver is the accelerating demand from the semiconductor industry for smaller critical dimensions and 3D device structures, such as FinFETs and GAAFETs, which mandate precise, low-temperature, and damage-free thin film deposition—areas where PECVD excels. This demand is intrinsically linked to the global rollout of 5G and future 6G networks, the expansion of cloud computing infrastructure, and the mass adoption of AI accelerators, all requiring exponentially increasing chip production. Concurrently, the robust growth in the electric vehicle (EV) market and power electronics sector (utilizing SiC and GaN substrates) necessitates specialized PECVD coatings for high-power device protection and insulation, establishing sustained, high-value demand.

Conversely, the market faces significant restraints, primarily stemming from the extremely high capital expenditure required for purchasing and installing advanced PECVD cluster tools. These systems are complex, require highly specialized cleanroom infrastructure, and involve considerable ongoing operational costs associated with precursor gases, maintenance, and power consumption. Furthermore, the technological learning curve for operating and maintaining these precision tools is steep, leading to a shortage of highly skilled technical personnel, particularly in emerging manufacturing geographies. Another restraint involves the inherent challenge of particle generation and contamination within plasma environments, which necessitates sophisticated vacuum controls and cleaning protocols to maintain high manufacturing yields, often adding to the system complexity and operational expense.

Opportunities within the PECVD market are largely concentrated in emerging and specialized application areas. The transition in the solar industry towards highly efficient cell architectures (e.g., heterojunction and tandem cells) offers a substantial opportunity, as these designs rely heavily on optimized PECVD processes for superior passivation layers and tunnel junctions. Furthermore, the advent of flexible electronics, roll-to-roll manufacturing, and advanced packaging techniques (like wafer-level packaging and system-in-package) presents new avenues for PECVD tool vendors. Developing solutions tailored for these large-area, low-temperature, and non-planar substrates represents a high-growth segment. Addressing the sustainability aspect through development of energy-efficient plasma sources and utilizing lower global warming potential (GWP) precursor gases also constitutes a crucial opportunity for competitive differentiation and market leadership.

Segmentation Analysis

The PECVD market is comprehensively segmented based on various factors, including the type of deposition system, the specific application area, the material deposited, and the geographical region. Analyzing these segments provides strategic insights into market maturity, growth potential, and competitive intensity across different industry verticals. The segmentation by type typically differentiates between systems based on how the plasma is generated and delivered, such as Direct PECVD systems, which expose the substrate directly to the plasma, and Remote PECVD (RPECVD) systems, which generate plasma upstream, minimizing ion damage on the sensitive substrate surface. The application segmentation reveals the primary drivers of demand, where the semiconductor and solar PV sectors consistently dominate, followed by niche but rapidly growing segments like LED manufacturing and medical device coatings.

Further granularity in segmentation involves classifying the market based on the material deposited, such as Silicon Nitride, Silicon Oxide, Amorphous Silicon, and specialized low-k or high-k dielectric films. The demand for specific materials is directly correlated with technological advancements; for example, the need for stress-free $\text{SiN}_x$ films is high in advanced logic manufacturing, while large volumes of amorphous silicon deposition are required in the flat panel display industry. Understanding the regional segmentation is crucial, as it reflects varying governmental policies, manufacturing capacities, and technological adoption rates globally. Asia Pacific leads due to its dominant manufacturing footprint, while North America and Europe focus heavily on specialized, high-margin equipment tailored for R&D and foundry reshoring initiatives, shaping distinct market profiles and investment strategies within each segment.

- By Technology Type:

- Direct PECVD

- Remote PECVD (RPECVD)

- High-Density Plasma PECVD (HD-PECVD)

- Spatial ALD/PECVD Hybrid

- By Application:

- Semiconductor Manufacturing (Foundries, Memory, Logic)

- Solar Photovoltaics (PV)

- LED Manufacturing

- Flat Panel Displays (FPD)

- Medical and Biomedical Devices

- MEMS and Sensor Fabrication

- By Film Material:

- Silicon Nitride ($\text{SiN}_x$)

- Silicon Oxide ($\text{SiO}_2$)

- Amorphous Silicon ($\text{a-Si}$)

- Oxide-Nitride-Oxide (ONO) Stacks

- Other Dielectric Films

- By Substrate Size:

- 150 mm and Below

- 200 mm

- 300 mm (Wafers)

- Large Area Substrates (FPD/Solar)

Value Chain Analysis For Pecvd Market

The Value Chain of the PECVD market is intricate and capital-intensive, starting with the upstream suppliers and culminating in the downstream end-users of the deposited thin films. Upstream analysis focuses on the provision of critical raw materials and subsystems necessary for PECVD equipment manufacturing and operation. This includes high-purity precursor gases (e.g., silane, ammonia, nitrous oxide), specialized vacuum components (pumps, valves, seals), high-frequency RF power generators and matching networks, and advanced control electronics. The competitiveness and innovation within this segment are highly dependent on material purity and supply chain resilience, as defects or impurities at this stage directly impact the yield and performance of the final deposited films. Major equipment vendors rely on a limited number of specialized suppliers for these critical, high-precision components, creating strategic partnerships vital for system integration and performance optimization.

The midstream segment is dominated by the Original Equipment Manufacturers (OEMs) who design, fabricate, and integrate the complex PECVD cluster tools. This segment involves intensive Research and Development (R&D) to improve plasma efficiency, process uniformity, throughput, and system reliability. Distribution channels for PECVD equipment are predominantly direct, involving extensive sales negotiations, installation, and long-term service contracts between the OEM and the end-user (fab owner). Given the multi-million dollar cost of these systems, the sales cycle is long and requires substantial technical support and customization to meet specific fabrication requirements. Indirect distribution, though less common for primary equipment sales, involves partnerships with local distributors or agents, particularly in smaller or emerging regional markets, primarily for spare parts, consumables, and minor ancillary equipment.

Downstream analysis focuses on the end-users: the semiconductor foundries, IDMs (Integrated Device Manufacturers), solar cell manufacturers, and display producers that operate the PECVD tools to deposit functional thin films on their products. The demand derived from the downstream sector is inelastic and closely tied to global consumer electronics, IT infrastructure, and energy transition trends. The quality of the film deposited by the PECVD tool determines the final device performance (e.g., transistor speed, battery life, or solar cell efficiency), making the PECVD process a strategic bottleneck. Strong relationships between OEMs and these high-volume manufacturers are essential, often involving joint development programs to fine-tune equipment for proprietary processes and next-generation device scaling, solidifying the importance of service and support throughout the equipment lifecycle.

Pecvd Market Potential Customers

The primary potential customers and end-users of PECVD equipment are large-scale manufacturing entities operating in high-technology fields where precise thin-film deposition is a core requirement for device functionality. Semiconductor foundries, such as TSMC, Samsung Foundry, GlobalFoundries, and Intel, represent the largest and most strategically important customer base, constantly investing in the latest generation of PECVD tools to maintain parity in advanced logic and memory manufacturing (e.g., 3nm, 5nm nodes). These customers require high-throughput, 300mm wafer-capable systems with extreme control over film stress and conformity, driving the technological frontier of the market. Integrated Device Manufacturers (IDMs) like Texas Instruments or Micron also constitute a significant customer group, purchasing equipment for their internal fabrication facilities to produce specific components like microcontrollers, specialty memory, or analog devices, requiring robust and customizable tool sets.

Beyond traditional semiconductors, the solar photovoltaic (PV) industry is a massive consumer of PECVD equipment, particularly manufacturers specializing in high-efficiency silicon solar cells. Companies focusing on advanced architectures such as Passivated Emitter Rear Cell (PERC), Tunnel Oxide Passivated Contact (TOPCon), and Heterojunction with Intrinsic Thin layer (HJT) rely on large-area PECVD systems to deposit crucial passivation and anti-reflection coatings. The continuous global push for solar capacity expansion, coupled with fierce competition driving the need for higher cell efficiency, ensures sustained demand from this sector. This segment requires different specifications than semiconductor fabs, often focusing on maximizing wafer-per-hour output and handling larger, non-standard substrate sizes (e.g., M10 or G12 wafers).

Other vital customer segments include manufacturers of Flat Panel Displays (FPDs), especially those involved in OLED and Micro-LED production, where PECVD is essential for thin film encapsulation (TFE) layers to prevent moisture and oxygen ingress. Additionally, MEMS manufacturers, LED lighting producers, and specialized medical device companies (e.g., for biocompatible coatings or implantable sensors) represent specialized, high-margin niche markets. These customers often prioritize low-temperature processing and customized batch or cluster tools tailored for their specific material and substrate requirements, showcasing the diverse applications and end-user spectrum reliant on advanced PECVD technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.2 Billion |

| Market Forecast in 2033 | $11.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials, Lam Research, ASM International, Hitachi High-Tech, Tokyo Electron Limited (TEL), Jusung Engineering, NAURA Technology Group, Aixtron SE, centrotherm international AG, Ulvac, Meyer Burger Technology AG, Plasma-Therm, Kokusai Electric, Oxford Instruments, Beneq, Semicore Equipment, Hanmi Semiconductor, CVD Equipment Corporation, Veeco Instruments, SPTS Technologies (KLA). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pecvd Market Key Technology Landscape

The PECVD market is characterized by a rapidly evolving technology landscape focused on achieving higher throughput, superior film quality, and reduced thermal budgets. A foundational technology utilized is the high-frequency Radio Frequency (RF) plasma generation, which is essential for dissociating precursor gases efficiently. Contemporary systems are increasingly adopting dual-frequency RF (e.g., low-frequency and high-frequency) or microwave plasma sources to independently control ion energy and radical flux. This sophisticated control is critical for minimizing substrate damage while ensuring excellent film density and step coverage, particularly relevant for trench filling in advanced logic devices. Furthermore, system designs are shifting towards modular, cluster-based architectures, allowing multiple process chambers to share vacuum loading and wafer handling systems, thereby increasing overall fabrication efficiency and flexibility.

A key area of technological advancement involves the migration towards Remote PECVD (RPECVD) and variants like Thermal-PECVD hybrids. RPECVD generates plasma away from the substrate, using long-lived radicals for deposition. This minimizes damage from ion bombardment, making it indispensable for depositing sensitive layers, such as high-k gate dielectrics or passivation layers on delicate compound semiconductors like GaAs or GaN, where electrical performance is highly sensitive to surface defects. Another vital technological trend is the convergence and integration with Atomic Layer Deposition (ALD) techniques. Hybrid systems, sometimes referred to as Plasma-Enhanced ALD (PEALD) or Spatial ALD, utilize plasma to enhance reactivity, enabling the deposition of ultra-thin, highly conformal films with atomic-level precision, a requirement for scaling beyond 7nm nodes and achieving superior uniformity in 3D NAND architectures. These advanced systems represent the high-end segment of the market and command premium pricing due to their unparalleled performance characteristics.

Moreover, the integration of advanced metrology and process control systems defines the cutting edge of PECVD technology. This includes the use of spectroscopic ellipsometry, optical emission spectroscopy (OES), and quartz crystal microbalances (QCMs) integrated in-situ to provide real-time monitoring of film thickness, refractive index, and plasma characteristics. This data feeds into sophisticated control algorithms, increasingly augmented by machine learning, enabling self-correcting processes that maintain tighter tolerances over extended production runs. Continuous innovation also targets environmental and cost efficiencies through the development of chamber cleaning technologies that reduce PFC gas consumption (such as NF3) and by engineering precursors that offer better material selectivity and lower global warming potential (GWP), aligning technological advancement with global sustainability requirements and optimizing the total cost of ownership (TCO) for manufacturers.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global PECVD market, commanding the largest share due to the concentration of major semiconductor manufacturing hubs (Taiwan, South Korea, China) and extensive solar photovoltaic production capacity. Government initiatives promoting chip independence (e.g., China's Made in China 2025 plan) are driving massive capital expenditures in new fab construction and tool installation. The region is characterized by high-volume manufacturing of both memory (NAND, DRAM) and advanced logic, necessitating continuous investment in high-throughput 300mm PECVD systems.

- North America: North America represents a crucial market driven by R&D, advanced material science, and the recent resurgence in domestic semiconductor manufacturing spurred by legislation like the CHIPS Act. Demand here focuses heavily on specialized, high-performance PECVD systems for advanced packaging, MEMS, compound semiconductors (GaN/SiC), and leading-edge technology development, often preferring Remote PECVD systems for damage-sensitive processes.

- Europe: The European market, supported by the European Chips Act, is strategically growing its fabrication capacity, particularly in automotive electronics, industrial sensors, and power management devices. Key demand areas include specialized PECVD equipment for Silicon Carbide (SiC) and Gallium Nitride (GaN) power device manufacturing, as well as significant investment in solar technology R&D focused on advanced perovskite and heterojunction architectures.

- Latin America, Middle East, and Africa (LAMEA): While smaller in comparison, LAMEA presents nascent growth opportunities, particularly driven by localized solar PV expansion projects and initial investments in specialty electronics manufacturing and research institutions. Growth is often concentrated in high-value, specialized applications rather than high-volume IC manufacturing, relying mainly on imported equipment and technical expertise from established regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pecvd Market.- Applied Materials

- Lam Research

- ASM International

- Hitachi High-Tech

- Tokyo Electron Limited (TEL)

- Jusung Engineering

- NAURA Technology Group

- Aixtron SE

- centrotherm international AG

- Ulvac

- Meyer Burger Technology AG

- Plasma-Therm

- Kokusai Electric

- Oxford Instruments

- Beneq

- Semicore Equipment

- Hanmi Semiconductor

- CVD Equipment Corporation

- Veeco Instruments

- SPTS Technologies (KLA)

Frequently Asked Questions

Analyze common user questions about the Pecvd market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of PECVD over traditional Chemical Vapor Deposition (CVD)?

The primary advantage of PECVD is its ability to deposit high-quality thin films at significantly lower operating temperatures (typically below 400°C), utilizing plasma energy to catalyze the reaction. This low-temperature capability is critical for processing substrates sensitive to heat, such as those already containing metal interconnects, polymers, or delicate compound semiconductor layers, essential for modern device fabrication.

How is the growth of the electric vehicle (EV) sector impacting the PECVD market?

The EV sector drives demand for PECVD by requiring advanced power electronics utilizing materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). PECVD is essential for depositing reliable, high-integrity dielectric and passivation layers on these power devices, ensuring high voltage tolerance, thermal stability, and long-term reliability required for electric vehicle powertrains and charging infrastructure, thereby increasing equipment adoption.

Which geographical region dominates the PECVD market, and why?

The Asia Pacific (APAC) region dominates the PECVD market. This dominance is attributed to the high concentration of leading semiconductor foundries and memory manufacturers (primarily in Taiwan, South Korea, and China), coupled with massive investments in solar PV capacity expansion. APAC’s continuous capital expenditure in high-volume manufacturing ensures it retains the largest market share for PECVD equipment procurement.

What are the key technological trends influencing the future design of PECVD systems?

Key technological trends include the increased adoption of Remote PECVD (RPECVD) for reduced plasma damage, the integration of hybrid Plasma-Enhanced ALD (PEALD) capabilities for ultra-conformal films, and the incorporation of Artificial Intelligence (AI) and machine learning for predictive maintenance and automated, real-time process optimization to boost manufacturing yield and equipment utilization rates.

What films are most commonly deposited using PECVD technology in semiconductor manufacturing?

In semiconductor manufacturing, the films most commonly deposited via PECVD include Silicon Nitride ($\text{SiN}_x$) used primarily for passivation, diffusion barriers, and hard masks; Silicon Oxide ($\text{SiO}_2$) used as inter-layer dielectrics (ILDs) and for electrical isolation; and Amorphous Silicon ($\text{a-Si}$) layers for specific device structures or doping applications in thin-film transistors (TFTs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plasma-enhanced Chemical Vapor Deposition (PECVD) Equipment Market Statistics 2025 Analysis By Application (Semiconductor Industry, Solar Industry), By Type (Anode PECVD Systems, Cathode PECVD Systems), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Solar Cell Production Equipment Market Statistics 2025 Analysis By Application (Conventional Monocrystalline Cells, Conventional Polycrystalline Cells, PERC Cells), By Type (Velvet Cleaning Equipment, Diffusion Furnace, Etching Equipment, Laser Slotting Equipment, PECVD Equipment, Screen Printing Equipment, Rapid Sintering Furnace, Automatic Sorting Machine, Automatic Load&Unload Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager