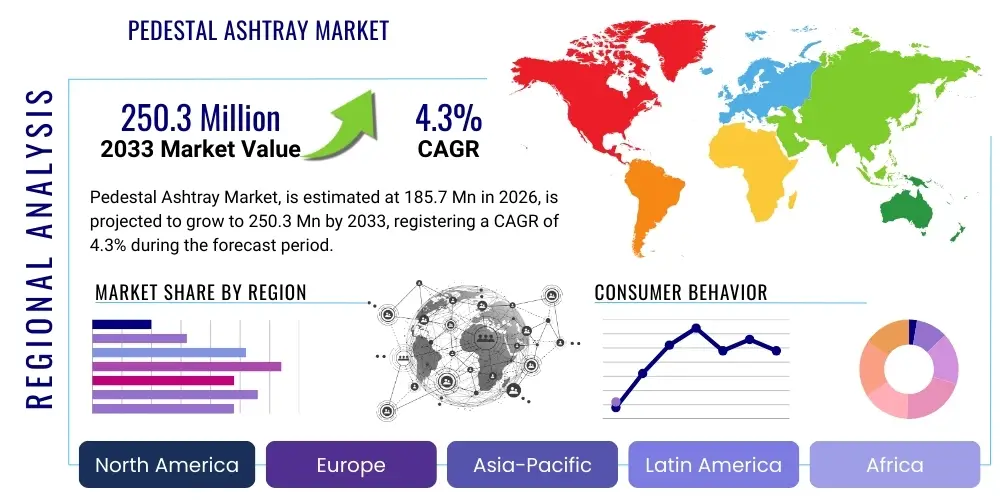

Pedestal Ashtray Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441864 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Pedestal Ashtray Market Size

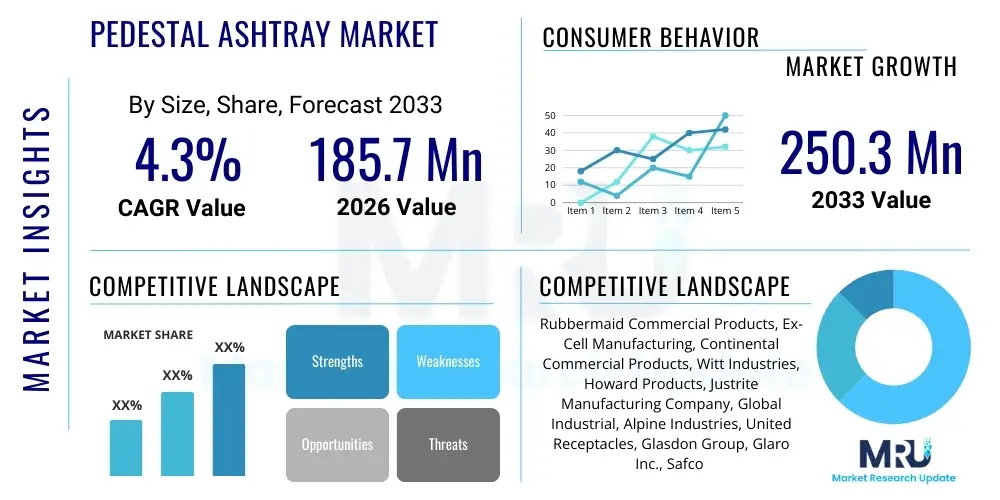

The Pedestal Ashtray Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.3% between 2026 and 2033. The market is estimated at USD 185.7 Million in 2026 and is projected to reach USD 250.3 Million by the end of the forecast period in 2033.

Pedestal Ashtray Market introduction

The Pedestal Ashtray Market encompasses the manufacturing, distribution, and sale of specialized receptacles designed for the safe disposal of smoking materials, particularly in regulated outdoor and commercial environments. These products, characterized by their freestanding design and vertical structure, serve a crucial function in maintaining public cleanliness, reducing fire hazards, and ensuring compliance with increasingly stringent anti-littering and public health ordinances globally. The market growth is inherently linked to urban development, the expansion of commercial infrastructure such as hospitality venues, corporate campuses, and transit hubs, and the mandated provision of designated smoking areas (DSAs).

Pedestal ashtrays are primarily utilized in semi-public and private commercial spaces where smoking is prohibited indoors but permitted in specific exterior locations. Key applications include airports, restaurants, hotel courtyards, healthcare facility entrances, and government buildings. Product evolution is driven by materials science, focusing on durability, weather resistance (UV and corrosion), and fire safety features, often incorporating stainless steel, heavy-gauge aluminum, or fire-resistant plastics. The market currently favors designs that are both functional—offering easy maintenance and secure waste containment—and aesthetically pleasing, integrating seamlessly into modern architectural landscapes.

Major driving factors influencing sustained demand include continuous investment in commercial and municipal infrastructure, strict enforcement of clean air acts requiring DSAs, and the need for durable, low-maintenance solutions for waste management. The key benefit these products offer is enhanced public safety through effective cigarette butt extinguishment and containment, minimizing environmental pollution, and improving the overall aesthetic quality of public and private outdoor spaces. Manufacturers are increasingly focusing on sustainable material sourcing and ergonomic designs to cater to institutional buyers prioritizing longevity and minimal operational upkeep.

Pedestal Ashtray Market Executive Summary

The Pedestal Ashtray Market demonstrates steady resilience, underpinned by persistent global demand from the commercial and institutional sectors. Key business trends indicate a strong move toward high-design, tamper-proof, and weather-resistant models, particularly those featuring heavy-duty stainless steel construction favored for their longevity and minimal environmental impact over their lifecycle. The primary market growth is concentrated in areas undergoing rapid urbanization and infrastructure modernization, where regulatory compliance mandates the installation of specialized waste receptacles. Market players are competing not just on price, but increasingly on design innovation, material quality, and integrated features like concealed liners and patented extinguishing methods that enhance safety and ease of maintenance.

Regionally, Asia Pacific (APAC) stands out as a high-growth market, driven by massive new construction projects in hospitality and transportation sectors across emerging economies, coupled with increasing regulatory adoption mirroring Western standards for public cleanliness. North America and Europe, while mature, remain dominant in value share, characterized by high demand for premium, often architecturally specified, products that meet stringent local fire safety and environmental standards. Regional trends show Europe pioneering the demand for highly sustainable and recycled-content materials, whereas North America focuses heavily on robust, high-capacity models suitable for large corporate campuses and public venues.

Segment trends reveal that the Freestanding segment, due to its flexibility in placement and higher capacity capabilities, maintains the largest market share by product type. In terms of material, the Metal segment, particularly stainless steel, continues to dominate due to its superior durability and fire resistance, essential factors for institutional purchasers. The Commercial End-Use sector, encompassing hotels, offices, and retail complexes, is the predominant application segment, consistently driving innovation towards aesthetically refined and user-friendly designs that align with corporate branding and interior/exterior design schemes.

AI Impact Analysis on Pedestal Ashtray Market

Common user questions regarding AI's impact on the Pedestal Ashtray Market frequently center on whether a traditional, low-tech product can benefit from advanced computational capabilities. Users inquire about how AI can optimize production processes, streamline supply chain logistics for raw materials (steel, plastics), and whether AI could integrate these seemingly simple waste management units into broader smart city infrastructure networks. Concerns often revolve around the economic viability of applying AI to a low-margin product, alongside expectations for AI-driven predictive maintenance and inventory management for large-scale institutional buyers to reduce replacement costs and minimize stockouts.

The primary influence of AI is observed not in the operational functionality of the ashtray itself, but upstream in manufacturing and downstream in large-scale facility management. In manufacturing, AI-powered systems are used to analyze quality control data derived from automated visual inspections during fabrication, ensuring uniform coating thickness, welding integrity, and material consistency, particularly crucial for weather resistance. This leads to reduced defect rates and optimized material usage, thereby offsetting rising raw material costs and making the final product more competitive in terms of longevity and quality assurance for commercial clients.

Furthermore, for major distributors and facility management companies responsible for thousands of units across multiple sites (e.g., airport authorities or nationwide hotel chains), AI-driven predictive analytics optimize servicing schedules. By integrating data on pedestrian traffic flow, weather patterns, and historical emptying frequency, AI algorithms can predict optimal maintenance routes and schedules, significantly reducing operational costs and ensuring the receptacles are emptied before overflow occurs, thereby enhancing sanitation and user experience. This integration transforms the simple receptacle into a data point within a larger, efficient urban maintenance system.

- AI-driven optimization of production schedules, minimizing waste material during metal stamping and coating processes.

- Predictive maintenance analytics for facility managers to optimize emptying routes based on usage patterns and sensor data (if smart liners are integrated).

- Enhanced supply chain forecasting to stabilize inventory levels of stainless steel and anti-corrosion paints, mitigating price volatility.

- Automated quality control (QC) via machine vision to detect micro-cracks or fabrication flaws, ensuring product longevity and compliance with fire safety standards.

- Modeling of product placement efficacy in new commercial developments to comply with local regulations while maximizing visibility and convenience for users.

DRO & Impact Forces Of Pedestal Ashtray Market

The Pedestal Ashtray Market is principally driven by regulatory mandates and robust growth in the commercial sector, while facing structural limitations from evolving smoking alternatives and fluctuating material costs. Drivers include increasingly stringent enforcement of fire safety and public cleanliness regulations worldwide, which necessitate designated, safe receptacles in all commercial and institutional outdoor spaces. Opportunities are emerging through material innovation, specifically the integration of sustainable, recycled content, and the development of high-capacity, low-maintenance designs that appeal to facility managers seeking long-term cost efficiencies. Restraints primarily encompass the shift towards non-combustible smoking products (vaping and e-cigarettes), which reduce the need for traditional butt disposal, and the occasional high initial cost associated with premium, architecturally robust metal units compared to simpler wall-mounted alternatives.

Impact forces are heavily skewed by legislative action and infrastructure investment cycles. Government regulation is the foremost force; whenever a new public health law designates specific outdoor smoking areas, demand for compliant pedestal units surges. Conversely, any regulatory action that bans outdoor smoking entirely, though rare, poses a significant threat. Economic downturns can temper growth, as commercial construction slows down, impacting the primary consumer base. The competitive landscape is fragmented, with localized manufacturers competing against global brands; competition intensity is high, focusing on product durability, aesthetic value, and compliance certification, rather than sheer technological advancement.

The market also faces ongoing internal impact forces from material price volatility, particularly for stainless steel and heavy-gauge metals, which affects manufacturing profitability and pricing stability for end-users. Manufacturers are constantly seeking methods to internalize these costs, either through improved supply chain hedging or through innovation in material use, such as using powder-coated aluminum which offers corrosion resistance at a lighter weight. However, the foundational need for safe butt containment in high-traffic areas ensures the market's stability, making regulatory compliance the dominant external impact force shaping future investments and product development efforts.

Segmentation Analysis

The Pedestal Ashtray Market is systematically segmented based on material composition, product type, and primary end-use application, reflecting the diverse requirements of institutional and commercial buyers globally. The material segmentation delineates products made from durable metals, offering superior fire resistance and longevity, versus those constructed from plastics, which provide cost-effectiveness and chemical resistance. Product type segmentation distinguishes between the flexibility of freestanding models and the permanence of fixed/integrated units. The end-use analysis is crucial, highlighting the dominant demand from high-traffic commercial environments compared to less frequent demand from residential or light industrial settings.

This structured segmentation allows manufacturers to target specific market niches—for example, focusing on high-end stainless steel freestanding units for luxury hotels (Commercial application) or durable, injection-molded plastic units for public parks and recreational areas (Institutional/Municipal application). The ongoing demand for aesthetically appealing and functional units is driving the premium segments, while mass-market penetration remains stable through basic, high-capacity plastic alternatives. Understanding these segments is key to strategic development, pricing, and distribution channel selection within the global market landscape.

- By Material:

- Metal (Stainless Steel, Powder-Coated Steel, Aluminum)

- Plastic (High-Density Polyethylene - HDPE, Fiberglass)

- By Product Type:

- Freestanding/Floor Standing

- Integrated/Fixed Mount

- By End-Use Application:

- Commercial (Hospitality, Corporate Offices, Retail)

- Institutional (Government Buildings, Healthcare, Education)

- Industrial

- Residential

- By Capacity:

- Low Capacity (Up to 1.5 Gallons)

- Medium Capacity (1.5 to 4 Gallons)

- High Capacity (4 Gallons and Above)

Value Chain Analysis For Pedestal Ashtray Market

The value chain for the Pedestal Ashtray Market begins with the Upstream Analysis, which focuses primarily on sourcing critical raw materials, predominantly various grades of sheet metal (stainless steel being the premium choice due to corrosion resistance and aesthetic appeal) and specialized engineering plastics (like fire-retardant HDPE or fiberglass composites). Key activities at this stage include negotiating long-term contracts with global metal suppliers and chemical companies to mitigate price volatility and ensure material quality compliant with fire safety standards (e.g., UL listings). Efficiency in this stage significantly impacts the final product cost, given that raw material accounts for a substantial portion of the manufacturing expenditure, especially for heavy-duty metal units.

Midstream activities involve core manufacturing processes: metal cutting, stamping, welding, assembly, and specialized finishing, such as powder coating or anti-UV treatment, crucial for product durability in outdoor environments. Manufacturers often invest heavily in robotic welding and automated painting systems to achieve consistency and economies of scale. Downstream analysis encompasses the complex distribution network. Products are channeled through both direct sales (large institutional orders from corporations, government entities) and indirect channels, primarily relying on wholesale distributors, janitorial supply companies, office product retailers, and increasingly, e-commerce platforms specializing in facilities management and safety equipment. The choice of channel depends largely on the volume and type of customer, with high-volume commercial clients often preferring direct engagement for customized orders.

The success of the value chain is increasingly dependent on efficient logistics and strong partnerships with facility management service providers who often recommend specific product lines during maintenance contracts. E-commerce platforms provide a crucial direct-to-consumer channel for smaller businesses and residential buyers, driving transparency in pricing and accessibility to niche product lines. Robust post-sale service and warrantee offerings further solidify the value chain, as commercial buyers prioritize products backed by extensive guarantees against weather damage and defects, reflecting the perceived necessity of high durability in this market segment.

Pedestal Ashtray Market Potential Customers

The primary consumers and end-users of pedestal ashtrays are large institutional and commercial entities that manage high-traffic outdoor areas and are mandated by local health and safety regulations to provide designated, safe smoking receptacles. This includes the massive Hospitality sector, encompassing hotels, resorts, and convention centers, which require aesthetically pleasing, high-capacity units integrated into landscaping and entrance areas. Corporate campuses, large office parks, and major retail centers also represent significant buyer segments, prioritizing durable, vandal-resistant, and easily maintainable models to uphold corporate image and public safety standards.

Beyond the core commercial market, the Institutional sector, comprising government facilities, airports, hospitals, educational institutions, and public parks, forms the bedrock of consistent demand. Airports and hospitals, in particular, demand strict adherence to fire safety certifications and often procure specialized, heavy-duty metal units designed for high volume usage and maximum fire safety. These buyers focus intensely on total cost of ownership (TCO), favoring products that offer long lifecycles, superior corrosion resistance, and simplified cleaning procedures, justifying the investment in premium-priced stainless steel or highly durable composite materials over cheaper alternatives.

Furthermore, smaller but growing segments include industrial facilities and multi-unit residential complexes (apartments, condominiums). Industrial settings focus purely on functionality and compliance, often opting for rugged, high-capacity metal units built to withstand harsh environments. The expanding residential segment, driven by stricter landlord regulations regarding common areas, seeks smaller, often decorative or integrated pedestal units suitable for patio areas or shared outdoor spaces. Ultimately, the buying decision is overwhelmingly influenced by regulatory compliance, durability specifications, and the necessity to manage combustible waste safely and cleanly in public view.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.7 Million |

| Market Forecast in 2033 | USD 250.3 Million |

| Growth Rate | 4.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubbermaid Commercial Products, Ex-Cell Manufacturing, Continental Commercial Products, Witt Industries, Howard Products, Justrite Manufacturing Company, Global Industrial, Alpine Industries, United Receptacles, Glasdon Group, Glaro Inc., Safco Products, Smokers' Outpost, Cleanit, Suncast Commercial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pedestal Ashtray Market Key Technology Landscape

Despite being a fundamentally low-tech product, the Pedestal Ashtray Market leverages specific technological advancements primarily focused on material science and safety engineering to enhance product performance and longevity. A critical technological aspect is the utilization of advanced metal alloys and specialized protective coatings. Manufacturers employ high-grade stainless steel (often 304 grade) for maximum corrosion resistance, especially vital in coastal or high-humidity environments. Surface treatments include multi-stage powder coating processes that utilize electrostatic application for superior adhesion, followed by curing processes designed to resist chipping, fading from UV exposure, and damage from common cleaning chemicals, thereby extending the product’s lifecycle significantly beyond standard painted units.

Another essential technological innovation relates to fire safety and extinguishing mechanisms. Modern pedestal ashtrays incorporate internal oxygen-restricting designs or weighted, self-extinguishing cones. These mechanisms are engineered to rapidly starve discarded smoking materials of oxygen, preventing smoldering and eliminating the risk of internal fires or ignition hazards, a feature frequently mandated by insurance providers and commercial building codes. This passive fire suppression technology often involves complex internal geometries and heat dissipation structures that are proprietary to leading manufacturers, significantly differentiating their products based on safety ratings and certifications (e.g., Factory Mutual approval).

Furthermore, product design incorporates elements of ergonomic and facility management technology. These include patented internal liner systems that utilize specialized bag retention clips and hinged tops for quick, hands-free emptying, minimizing the labor required for maintenance and reducing employee exposure to waste. While full 'smart' integration (IoT sensors) is nascent, the design trend involves modular components, allowing facility managers to easily replace damaged parts (e.g., base weights, tops, snuff plates) rather than requiring full unit replacement. This focus on modularity and field-replaceable components is a strategic technological shift aimed at lowering the total cost of ownership for commercial buyers.

Regional Highlights

- North America: This region holds a significant share of the global market, driven by strict OSHA regulations and high investment in corporate and public infrastructure. The U.S. and Canada prioritize durable, high-capacity, heavy-duty metal units that comply with specific ADA accessibility standards. Demand is particularly robust in the hospitality, healthcare, and educational sectors, emphasizing high aesthetic value and certified fire safety ratings (FM approved products).

- Europe: Europe is characterized by a strong emphasis on design, sustainability, and adherence to specific national environmental regulations (e.g., WEEE compliance). Western European countries often demand products made from recycled or highly recyclable materials. Germany, the UK, and France show high consumption of sleek, architecturally integrated stainless steel designs, reflecting a preference for products that blend seamlessly into urban street furniture and corporate environments.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive infrastructure development, rapid urbanization, and rising adoption of public health and safety standards in emerging economies like China, India, and Southeast Asia. The market here is bifurcated, with high demand for premium, imported units in tier-one cities and a parallel high volume market for cost-effective, durable plastic units in developing areas. Regulatory harmonization across the region is a key growth factor.

- Latin America (LATAM): Growth in LATAM is steady, tied closely to tourism infrastructure expansion and commercial real estate development in countries like Mexico and Brazil. The demand focuses on weather-resistant materials due to diverse climate conditions, requiring strong anti-corrosion features. Price sensitivity is higher compared to North America, leading to a strong preference for durable, mid-range plastic and powder-coated steel units.

- Middle East and Africa (MEA): This region shows specialized demand, particularly in the Gulf Cooperation Council (GCC) states, driven by mega-projects in leisure, tourism, and transportation sectors (e.g., airports, luxury hotels). Extreme climate resistance (high heat and sun exposure) is paramount. Demand here leans towards high-capacity, heavy-gauge metal units with superior UV stability and heat dissipation characteristics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pedestal Ashtray Market.- Rubbermaid Commercial Products

- Ex-Cell Manufacturing

- Continental Commercial Products

- Witt Industries

- Howard Products (Division of R.J. Schinner Co.)

- Justrite Manufacturing Company

- Global Industrial (Subsidiary of Systemax Inc.)

- Alpine Industries

- United Receptacles

- Glasdon Group

- Glaro Inc.

- Safco Products

- Smokers' Outpost (Sub-brand of Commercial Zone Products)

- Cleanit

- Suncast Commercial

- Bobrick Washroom Equipment

- Zoro Tools

- Reliance Foundry Co. Ltd.

- Smarter Spaces

- Outdoor Design Group

Frequently Asked Questions

Analyze common user questions about the Pedestal Ashtray market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for commercial pedestal ashtrays?

The primary driver is the stringent enforcement of fire safety codes and public cleanliness regulations globally, which mandate the installation of safe, designated smoking receptacles in all commercial and institutional outdoor areas such as airports, hotels, and corporate campuses, compelling facility managers to invest in compliant units.

Which material type dominates the market, and why is it preferred by commercial buyers?

Metal, specifically high-grade stainless steel and heavy-gauge powder-coated steel, dominates the market. Commercial buyers prefer metal due to its superior durability, inherent fire resistance, vandal-proof characteristics, and ability to withstand extreme outdoor weather conditions, offering the lowest total cost of ownership over time.

How is the rise of e-cigarettes and vaping impacting the Pedestal Ashtray Market?

The growing adoption of e-cigarettes and vaping acts as a restraint, as these alternatives reduce the volume of combustible waste (cigarette butts) requiring disposal. However, conventional smoking persists globally, ensuring continued essential demand for traditional pedestal units, particularly in regulated public zones where proper disposal remains mandatory.

What technological features are essential for modern pedestal ashtray designs?

Essential modern features include advanced self-extinguishing mechanisms (oxygen-restricting cones) for fire safety, specialized anti-corrosion powder coatings for weather resistance, and ergonomic internal liners or modular designs that simplify maintenance, reduce cleaning time, and minimize operational labor costs for facility staff.

Which geographic region presents the highest growth opportunities for manufacturers?

The Asia Pacific (APAC) region, driven by rapid urbanization, massive commercial infrastructure investments (e.g., new hotels, airports), and the increasing alignment of local public health standards with international regulatory benchmarks, offers the highest growth potential for market penetration and volume sales.

How do buyers evaluate the total cost of ownership (TCO) for pedestal ashtrays?

Buyers evaluate TCO by calculating the initial purchase price, factoring in the product's expected lifespan, and assessing maintenance costs, including the frequency and ease of emptying, resistance to vandalism/weather, and replacement costs of liners or modular components. High-durability stainless steel units often justify a higher initial price based on lower long-term maintenance and replacement needs.

What is the significance of the Freestanding segment over Fixed Mount units?

The Freestanding segment holds a larger market share due to its flexibility. These units can be easily relocated to adjust to changing traffic flows or seasonal regulatory requirements without structural modification, and they typically offer higher capacity, making them ideal for high-volume commercial and institutional entrances.

Are there specific certifications required for pedestal ashtrays in commercial use?

Yes, especially in North America and parts of Europe, commercial units often require specific fire safety certifications, such as Factory Mutual (FM) approval or Underwriters Laboratories (UL) ratings, which verify that the receptacle’s design effectively prevents fires by safely containing and extinguishing smoking materials.

What role does aesthetic design play in purchasing decisions within the hospitality sector?

In the hospitality sector (hotels, resorts, upscale restaurants), aesthetic design is paramount. Pedestal ashtrays must integrate seamlessly with high-end architectural and landscape designs. Buyers prioritize sleek, modern stainless steel finishes or custom-colored units that reinforce brand image and enhance the overall ambiance of outdoor guest areas.

How does the volatile pricing of stainless steel affect the market?

The volatile pricing of stainless steel directly impacts manufacturers' profit margins and product pricing stability, particularly for premium, heavy-duty metal units. This volatility encourages manufacturers to seek robust supply chain management strategies and explore cost-effective alternatives like heavy-gauge powder-coated aluminum or advanced composites.

What constitutes the primary Upstream activity in the market value chain?

The primary Upstream activity involves the procurement and strategic sourcing of key raw materials, including bulk stainless steel sheets, aluminum billets, specialized anti-corrosion coatings, and engineered plastics, necessitating strong supplier relationships to manage quality assurance and price risks effectively.

In the context of facility management, how can AI influence the usage of these products?

AI primarily influences the logistical aspect for large institutional users by analyzing usage patterns (via integrated smart sensors or historical data) to generate optimized, predictive maintenance schedules. This ensures receptacles are serviced efficiently, prevents overflow, reduces labor costs, and maintains sanitation standards across expansive properties.

Why is the healthcare facility segment a significant buyer of premium units?

Healthcare facilities are significant buyers because stringent internal regulations often require highly controlled, designated smoking areas immediately outside buildings. They prioritize premium units with verifiable fire safety certifications and superior hygiene features to mitigate risks and maintain a clean, professional environment for visitors and patients.

What distinguishes the plastic pedestal ashtray segment?

Plastic pedestal ashtrays, typically made from HDPE or fiberglass, are distinguished by their lower cost, resistance to rust and chemical corrosion, and lighter weight. They are generally favored in price-sensitive municipal applications or where portability and ease of handling are prioritized over high-end aesthetic value.

How is the market responding to increasing consumer and regulatory pressure for sustainability?

The market is responding by developing units made from high percentages of recycled content, particularly recycled aluminum and post-consumer plastics. Additionally, manufacturers are focusing on designing products that are fully recyclable at the end of their long lifespan, appealing to green procurement mandates from institutional buyers.

What key factors lead to product obsolescence in this market?

Obsolescence is typically driven by physical damage (vandalism, impact), corrosion leading to structural failure, or aesthetic degradation (fading, chipping) that no longer meets commercial appearance standards. Regulatory changes demanding new safety features can also render older, non-compliant models obsolete in certain jurisdictions.

What is the main challenge facing new entrants into the Pedestal Ashtray Market?

The main challenge is establishing credibility and achieving the necessary safety certifications (like FM or UL approval), which require significant investment and time. Furthermore, existing distribution channels are dominated by established brands with long-standing relationships with major janitorial and facility supply wholesalers.

How does anti-vandalism feature influence product design?

Anti-vandalism heavily influences the design through the use of heavy-gauge materials, internal weighting systems for stability, hidden mounting points (Fixed Mount units), and tamper-resistant locking mechanisms for the waste receptacle access, all aimed at deterring theft and physical damage in public spaces.

What are the typical capacity requirements for high-traffic environments like airports?

Airports and other high-traffic transit hubs require High Capacity units (typically 4 gallons and above) to handle the immense volume of waste generated between maintenance cycles. These must be paired with superior fire safety features due to the high density of users and the critical nature of the environment.

In what ways do regulatory mandates affect innovation in product design?

Regulatory mandates often drive innovation by requiring specific features, such as minimum height requirements (ADA compliance), specific material fire ratings, and sealed designs to prevent odor and pest issues. This compels manufacturers to constantly refine internal mechanisms and select certified raw materials to ensure market access.

What is the difference between direct and indirect distribution channels for these products?

Direct distribution involves manufacturers selling large volumes directly to institutional buyers (e.g., government, large corporate chains). Indirect distribution utilizes intermediaries such as wholesalers, janitorial supply distributors, and e-commerce platforms, serving smaller businesses and facilitating broader market reach.

Why is corrosion resistance a crucial factor for the longevity of a pedestal ashtray?

Corrosion resistance is crucial because most pedestal ashtrays are permanently exposed to outdoor elements, including rain, snow, salt air (coastal areas), and harsh cleaning chemicals. Superior resistance (e.g., provided by 304 stainless steel or specialized powder coatings) is necessary to prevent premature degradation and maintain structural integrity.

How do manufacturers ensure the hygienic maintenance of their products?

Manufacturers ensure hygienic maintenance by designing units with fully enclosed waste compartments, smooth internal surfaces for easy cleaning, and user-friendly internal liners or concealed bag systems. Some advanced models include odor-absorbing filters or specialized sealing mechanisms to minimize exposure to waste and control odor emission.

What impact do macroeconomic factors, such as commercial construction rates, have on the market?

Macroeconomic factors, specifically the rate of new commercial construction (offices, hotels, retail centers), have a direct and significant positive correlation with market growth. New construction projects generate mandatory initial demand for outdoor waste management and smoking receptacles to comply with building codes and facility design specifications.

What are the key differences between the institutional and commercial end-use segments?

The institutional segment (government, healthcare) often prioritizes compliance, fire safety ratings, and longevity, often purchasing in large tenders. The commercial segment (hospitality, retail) prioritizes aesthetic appeal, branding integration, and user experience, often favoring higher design value units.

How important are spare parts and customer service in the purchasing decision?

Spare parts availability and robust customer service are highly important, especially for large corporate and institutional clients who manage hundreds of units. The ability to easily source replacement tops, liners, or snuff plates extends the life of the entire unit and is a critical factor in lowering the TCO, often favoring established market leaders.

How is competition typically structured within the pedestal ashtray market?

Competition is fragmented and moderately intense, structured around product quality, pricing, and distribution network strength. Global brands compete primarily on certified quality, design innovation, and extensive warranties, while smaller, regional players compete effectively on lower manufacturing costs and specialized material applications.

What opportunities exist for manufacturers regarding climate change mitigation?

Opportunities exist in developing products that are explicitly designed to withstand increasing climate extremes (e.g., more intense UV radiation, higher precipitation), ensuring materials remain stable and functional. Furthermore, optimizing product weight and packaging logistics reduces the carbon footprint across the supply chain.

Why is Latin America often characterized by a strong demand for mid-range products?

LATAM is characterized by strong demand for durable, mid-range products because while regulatory compliance is growing, price sensitivity remains high. Buyers seek robust, functional units (often powder-coated steel) that offer a good balance between cost and resistance to localized high humidity and tropical climates.

How do manufacturers cater to customization demands from large corporate clients?

Manufacturers cater to large corporate clients by offering extensive customization options, including specific corporate colors via specialized powder coatings, laser etching or branding application, and custom sizing or mounting specifications, ensuring the receptacles align perfectly with organizational branding and facility guidelines.

What role does the capacity segmentation play in procurement?

Capacity segmentation dictates suitability for the environment: Low capacity is for small offices or residential use, Medium capacity is standard for most commercial settings, and High capacity is essential for high-volume public areas (e.g., stadiums, convention centers), where maintenance frequency must be minimized without risk of overflow.

What are the primary factors restraining market growth in developed economies?

The primary restraints in developed economies are market saturation, stringent anti-smoking legislation that restricts designated areas, and the consumer shift towards e-cigarettes and vaping, collectively capping the explosive growth seen in emerging markets.

How has e-commerce influenced the market's distribution dynamics?

E-commerce has significantly increased distribution efficiency for low-volume buyers and regional resellers, providing instant price comparison and rapid fulfillment for standard models, challenging traditional janitorial supply distributors who rely heavily on catalog sales and regional warehousing.

What is the strategic importance of using specialized anti-UV coatings for plastic units?

Anti-UV coatings are strategically vital for plastic units (like HDPE) to prevent material degradation, brittleness, and color fading when exposed to prolonged sunlight. This ensures the unit retains its structural integrity and aesthetic appearance throughout its intended outdoor lifespan, crucial for maintaining corporate image.

How do manufacturers balance aesthetic appeal with mandatory safety features?

Manufacturers balance these elements through integrated design—concealing functional safety components (like the extinguishing mechanism and heavy base weights) within a stylish external shell. For instance, using sleek stainless steel panels and subtle ventilation designs ensures compliance without compromising architectural harmony.

What are the typical materials used for internal liners and why?

Internal liners are typically made from galvanized steel, heavy-duty plastic, or aluminum. Galvanized steel is favored for durability and resistance to heat from smoldering material, while plastic liners are preferred for their lighter weight and chemical resistance, facilitating easier and faster maintenance by staff.

Why is the forecast CAGR considered moderate despite ongoing urbanization?

The CAGR is moderate because while urbanization drives initial demand, the shift toward non-combustible smoking methods (vaping) in many key demographics acts as a natural offset. Furthermore, the products themselves are highly durable, leading to long replacement cycles which temper recurring demand in mature markets.

How does the market address the issue of improper waste disposal (i.e., trash placed in the ashtray)?

Design features address improper disposal by utilizing small, restricted entry apertures (snuff plates) that are optimized only for cigarette butts, physically deterring users from discarding larger items of general trash, thus preserving the function of the unit and preventing fire hazards.

What specific challenges does the Middle East and Africa (MEA) region present?

MEA presents challenges related to extreme climatic conditions, requiring units to be highly resistant to high temperatures, intense sand abrasion, and often elevated levels of atmospheric dust and humidity. Logistics and local regulatory variances also add complexity to distribution and compliance.

Why is modularity becoming a key trend in product design?

Modularity is a key trend because it allows facility managers to quickly and cost-effectively replace only the damaged components (e.g., a dented base or a rusted top) rather than discarding the entire unit. This significantly enhances the product's long-term sustainability profile and lowers maintenance costs.

How do manufacturers ensure product quality consistency across different material segments?

Quality consistency is ensured through certified manufacturing processes, including ISO 9001 compliance, rigorous pre-treatment cleaning before coating, and standardized testing protocols for UV exposure, salt spray corrosion resistance, and impact durability, regardless of whether the final product is metal or plastic.

What is the significance of the "Base Year" 2025 in the market report?

The Base Year 2025 serves as the most recent benchmark for comprehensive market data collection and analysis, upon which the future growth projections (CAGR) and forecast market size estimates for the period 2026-2033 are calculated, ensuring the forecast is anchored to current market realities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager