Pelargonic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442325 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Pelargonic Acid Market Size

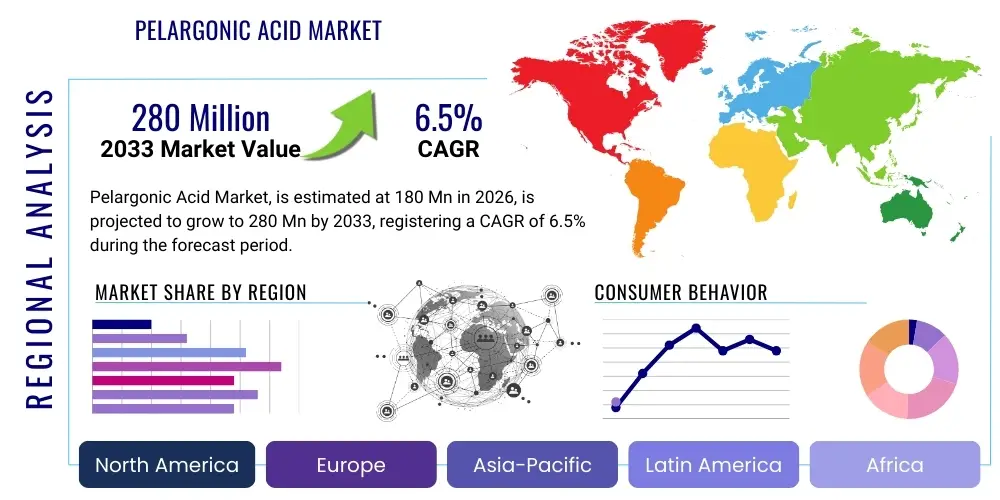

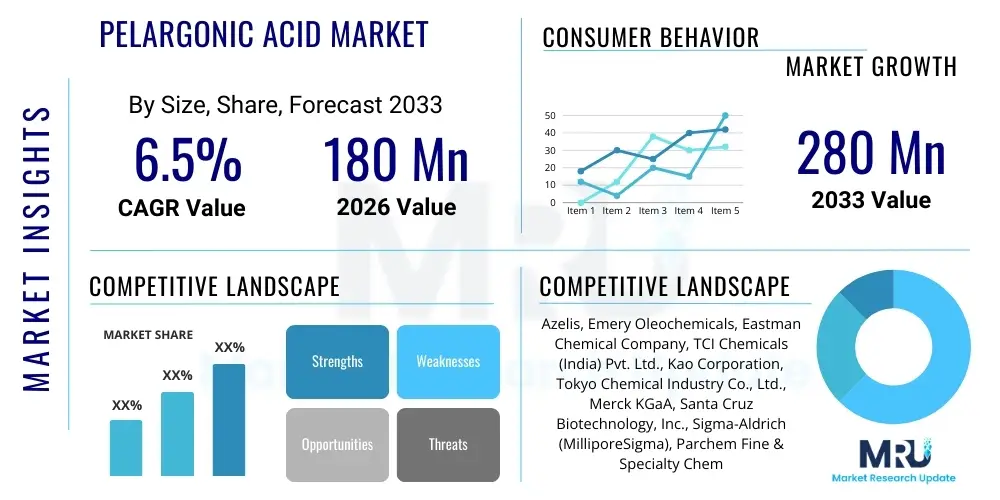

The Pelargonic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 180 million in 2026 and is projected to reach USD 280 million by the end of the forecast period in 2033. This substantial growth trajectory is primarily driven by the escalating global demand for environmentally friendly and bio-based chemical intermediates, particularly within the agricultural and specialized lubricant sectors. Pelargonic acid, also known as nonanoic acid, is a nine-carbon fatty acid that serves as a crucial building block for numerous high-value applications, including biodegradable herbicides, advanced plasticizers for polymer synthesis, and high-performance synthetic lubricants essential for modern machinery and aerospace applications. The regulatory landscape, especially in developed economies of North America and Europe, heavily favors biodegradable solutions, thereby creating a sustained demand influx for Pelargonic acid over conventional, less sustainable alternatives.

The valuation reflects robust expansion across key application segments. While the herbicide application segment remains the largest volume consumer due to the effectiveness of pelargonic acid as a non-selective, fast-acting, and environmentally benign weed killer, the highest growth rates are anticipated in its use as a feedstock for polyol esters (POE) and advanced esters used in synthetic lubricants and coolants. These esters offer superior thermal stability, oxidation resistance, and lower volatility compared to mineral oils, making them indispensable in demanding industrial environments, including refrigeration compressors and high-temperature engine oils. Furthermore, its utilization as an intermediate in the production of specialty polymers and flavoring agents contributes significantly to the overall market valuation, highlighting the chemical's versatility.

Pelargonic Acid Market introduction

Pelargonic acid (nonanoic acid, C9H18O2) is a saturated carboxylic acid historically derived through the ozonolysis of oleic acid or, less commonly, via petrochemical oxidation processes. It is recognized as a vital component in the realm of green chemistry due to its biodegradable nature and relatively low toxicity profile, making it a preferred substitute for various conventional chemicals facing stringent environmental regulations. The product typically appears as a colorless, oily liquid with a mild, distinctive odor. Market dynamics are heavily influenced by feedstock availability, production technology advancements—particularly the shift towards sustainable, bio-based routes using vegetable oils—and regulatory frameworks governing chemical use in agriculture and manufacturing. The increasing environmental consciousness among consumers and industries alike is fundamentally reshaping demand, pushing manufacturers towards bio-derived pelargonic acid sources.

Major applications for Pelargonic acid are highly diverse, spanning agriculture, polymer manufacturing, automotive, and personal care. In agriculture, it functions as a highly effective contact herbicide, rapidly disrupting plant cell walls and leading to dehydration and death, suitable for organic farming and specialized weed control applications. As a chemical intermediate, it is esterified to produce plasticizers, such as dioctyl nonanoate (DON), which offer excellent flexibility, permanence, and reduced migration in polyvinyl chloride (PVC) products, crucial for items requiring high longevity and safety standards. Moreover, its role in the synthesis of high-performance polyol ester lubricants cannot be overstated, providing critical performance characteristics required in aviation oils, refrigeration lubricants, and automotive engine lubricants.

The core benefits driving the market include superior biodegradability, low mammalian toxicity, and high performance in specialized applications. Key driving factors encompass increasing regulatory mandates worldwide restricting the use of petrochemical-derived products in consumer-facing and environmental applications; the accelerating adoption of sustainable agricultural practices, particularly in North America and Europe; and the robust expansion of the synthetic lubricants sector requiring high-specification base oils for electric vehicles (EVs) and industrial machinery. The intersection of environmental responsibility and technical performance requirements positions Pelargonic acid as a high-growth chemical commodity moving forward.

Pelargonic Acid Market Executive Summary

The Pelargonic Acid Market is characterized by strong fundamental business trends centered on sustainability and high-performance chemical development. Strategic investments are increasingly focused on optimizing bio-based production routes to mitigate supply chain risks associated with petrochemical feedstock price volatility and to capitalize on the premium pricing often afforded to green chemicals. Major industry players are pursuing vertical integration strategies, securing long-term supply agreements for fatty acid precursors and investing in advanced catalytic technologies to enhance purity and yield. Mergers and acquisitions are frequent among smaller specialized chemical producers and large multinational corporations aiming to consolidate market share, acquire proprietary bio-processing expertise, and expand geographical presence, particularly in rapidly industrializing regions like Asia Pacific.

Regionally, the market exhibits divergent demand patterns. North America and Europe are pivotal drivers, largely due to stringent environmental policies bolstering the demand for Pelargonic acid-based bio-herbicides and non-phthalate plasticizers. The emphasis here is heavily on regulatory compliance and the replacement of legacy toxic chemicals. Conversely, the Asia Pacific region, led by China and India, demonstrates exponential growth, primarily fueled by the rapid expansion of manufacturing sectors—automotive, construction, and electronics—which require substantial volumes of high-performance synthetic lubricants and durable polymer additives. While environmental compliance is gaining traction in APAC, the primary demand driver remains industrial scale and performance optimization, leading to significant investment in regional production facilities to meet localized industrial needs.

Segment-wise, the market is structurally dominated by the application segment focused on Esters, primarily synthetic lubricants and plasticizers, which collectively account for the majority of the revenue share due to the high unit value and volume demand from industrial sectors. However, the Herbicides segment is projected to register the fastest volume CAGR over the forecast period, driven by regulatory bans on glyphosate and other controversial conventional pesticides, necessitating the rapid adoption of effective, eco-friendly alternatives. Technical Grade Pelargonic Acid dominates the product type segment, although demand for High Purity Grade is accelerating, spurred by sensitive applications in food contact materials and personal care formulations requiring minimal impurity levels.

AI Impact Analysis on Pelargonic Acid Market

Common user questions regarding AI's impact on the Pelargonic Acid Market often revolve around optimizing the complex chemical synthesis process, predicting raw material price fluctuations, and accelerating the discovery of novel, high-efficacy formulations for end-user products like herbicides and lubricants. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can improve yield in bio-based production routes, which typically involve fermentation or complex oxidation steps sensitive to process parameters. Key themes include the implementation of predictive maintenance for continuous flow reactors, AI-driven quality control for achieving high-purity grades required by pharmaceutical and cosmetic applications, and supply chain resiliency planning given the dependence on agricultural commodities (vegetable oils). The consensus expectation is that AI will primarily serve as an efficiency multiplier, reducing operational costs and enabling faster commercialization of specialized Pelargonic acid derivatives, particularly through sophisticated molecular modeling.

AI’s utility extends significantly into the research and development pipeline. In formulating new herbicide blends, ML algorithms can rapidly screen thousands of potential adjuvant combinations to maximize the contact activity and penetration speed of Pelargonic acid, thereby improving field performance and reducing application rates. For synthetic lubricants, AI/ML models are being used to predict the thermal oxidative stability and viscosity index characteristics of novel Pelargonic acid esters before they are synthesized, dramatically cutting down laboratory experimentation time and expense. This capability is critical for meeting the demanding specifications of modern industrial and aerospace applications where chemical stability under extreme conditions is non-negotiable. Consequently, AI is transforming Pelargonic acid from a bulk chemical intermediate into a highly customizable component for high-value specialty products.

Furthermore, AI is crucial for enhancing sustainability and transparency within the Pelargonic acid value chain. By integrating sensor data from agricultural sources (for oleic acid precursors) through manufacturing plants to distribution networks, AI systems offer end-to-end visibility. This allows companies to optimize energy consumption during high-temperature processing, minimize waste generation, and accurately track the origin and carbon footprint of bio-based Pelargonic acid, fulfilling the rigorous auditing requirements of green chemistry certifications. The capability to predict market supply-demand imbalances using large datasets also provides a strategic advantage, allowing manufacturers to adjust production volumes proactively, ensuring stable pricing and reliable delivery for key downstream partners.

- Enhanced Process Optimization: AI/ML algorithms improve reaction yields in both bio-based and petrochemical synthesis routes, reducing energy consumption and operational variability.

- Predictive Maintenance: AI monitors reactor performance and equipment health in continuous production facilities, minimizing downtime and increasing asset utilization.

- Advanced Formulation Discovery: Machine learning accelerates the screening and optimization of new Pelargonic acid-based herbicide and lubricant formulations, targeting specific performance metrics.

- Supply Chain Resilience: Predictive analytics anticipate fluctuations in feedstock (vegetable oil) pricing and availability, enabling strategic sourcing and inventory management.

- Quality Control Automation: AI-powered spectroscopy and imaging systems ensure the consistent production of high-purity Pelargonic acid grades required for sensitive applications.

DRO & Impact Forces Of Pelargonic Acid Market

The Pelargonic Acid Market is governed by a robust set of dynamic forces, summarized by strong drivers centered on environmental sustainability, moderate restraints related to raw material costs and competition, and significant growth opportunities in specialized high-end applications. The primary driver is the accelerating shift towards sustainable chemicals, particularly the replacement of conventional, persistent herbicides with biodegradable Pelargonic acid formulations in globally significant agricultural markets. This regulatory-driven impetus, coupled with heightened consumer preference for bio-based products, creates a foundational demand layer for nonanoic acid. However, a significant restraint involves the fluctuating global prices of key feedstocks, predominantly oleic acid (derived from vegetable oils like palm or sunflower) and the chemical commodity price cycles of petroleum derivatives. These variations directly impact the profitability margins of manufacturers and introduce supply chain volatility, particularly concerning the bio-based production segment which is sensitive to agricultural output variability. Despite these challenges, the versatility and technical superiority of Pelargonic acid derivatives in high-performance sectors like aviation lubricants present vast untapped opportunities, allowing the market to command premium pricing for specialized products.

Impact forces are currently dominated by regulatory tailwinds favoring bio-based alternatives. The European Union's REACH regulation and similar legislative actions in North America are forcing a chemical transition, making the inherently biodegradable nature of Pelargonic acid a critical competitive advantage over substitutes like certain phthalate plasticizers or harsher chemical herbicides. This regulatory pressure acts as a powerful external force, compelling downstream manufacturers to reformulate their products using nonanoic acid derivatives. Simultaneously, the growing sophistication of the synthetic lubricants market is an internal impact force. As industries adopt complex machinery, requiring lubricants capable of handling extreme temperatures and pressures (e.g., in electric vehicle gearboxes or high-speed manufacturing robots), the superior performance characteristics provided by polyol esters derived from Pelargonic acid become indispensable, establishing a high barrier to entry for conventional, mineral-based substitutes.

The market also faces competition from other medium-chain fatty acids and their derivatives, particularly in the plasticizer and lubricant space, which can sometimes offer marginally lower costs, although often at the expense of reduced performance or environmental compliance. However, the unique nine-carbon structure of Pelargonic acid grants its derivatives specific performance advantages, such as excellent low-temperature fluidity and superior thermal stability, securing its niche in specialized, high-specification markets. The opportunity for significant market expansion lies in developing new high-purity applications, such as intermediates in pharmaceutical synthesis or as components in advanced materials, which currently represent minor segments but hold tremendous potential for high-margin revenue generation, further solidifying Pelargonic acid’s strategic importance in the specialty chemicals landscape.

Segmentation Analysis

The Pelargonic Acid Market is systematically segmented based on Product Type, Application, and End-Use Industry, providing a granular view of market dynamics and growth pockets. Segmentation by Product Type typically distinguishes between Technical Grade and High Purity Grade Pelargonic Acid. Technical grade constitutes the largest volume segment, catering mainly to bulk industrial applications such as the manufacture of general-purpose plasticizers and lower-specification lubricants. High Purity Grade, while smaller in volume, commands a significant premium and is essential for specialized end-uses like cosmetics, flavor and fragrance synthesis, and high-performance synthetic esters where impurity tolerances are extremely low and strict regulatory compliance is mandatory. The overall market growth is increasingly favoring the high-purity segment due to rising quality standards across all major end-use sectors.

The Application segmentation is the most critical determinant of market revenue distribution. This segment includes Herbicides, Plasticizers, Synthetic Lubricants, Esters (other than lubricants/plasticizers), and Miscellaneous applications. Herbicides represent a rapidly growing volume segment, particularly in organic and sustainable agriculture markets where Pelargonic acid provides an effective, fast-acting solution for non-selective weed control. Synthetic Lubricants and Plasticizers collectively form the largest revenue-generating application due to the high-value nature of the resultant esters and their widespread adoption in automotive, aerospace, and construction industries. The performance benefits offered by Pelargonic acid-based polyol esters (POE) in demanding environments continue to drive steady investment and technology innovation within this segment.

Finally, the End-Use Industry analysis highlights the final consumers of Pelargonic acid derivatives. Key end-use sectors include Automotive and Transportation (for lubricants, brake fluids), Agriculture (for herbicides), Construction and Manufacturing (for PVC plasticizers and industrial lubricants), and Cosmetics and Personal Care (for emollients and ingredients). The Automotive sector, particularly the transition to electric vehicles which require specialized thermal management fluids and lubricants, is expected to exhibit dynamic growth, driving demand for high-performance Pelargonic acid esters. The ongoing global infrastructural development also underpins steady demand from the Construction and Manufacturing segment for durable plasticizer solutions.

- Product Type:

- Technical Grade Pelargonic Acid

- High Purity Grade Pelargonic Acid

- Application:

- Herbicides (Non-Selective Contact Herbicides)

- Plasticizers (Non-Phthalate Alternatives, e.g., DON)

- Synthetic Lubricants and Functional Fluids (Polyol Esters, Complex Esters)

- Flavors and Fragrances

- Esters (Chemical Intermediates)

- End-Use Industry:

- Agriculture

- Automotive and Transportation

- Construction and Manufacturing

- Personal Care and Cosmetics

- Others (Pharmaceuticals, Specialized Polymers)

Value Chain Analysis For Pelargonic Acid Market

The Pelargonic Acid Value Chain begins with the Upstream Analysis, which focuses primarily on the sourcing of raw materials. Traditionally, Pelargonic acid was derived from petrochemical feedstocks, but the modern market is increasingly reliant on bio-based sources, primarily oleic acid derived from vegetable oils such as high-oleic sunflower oil, palm oil, or tallow. The quality and purity of the sourced oleic acid are crucial, as they directly impact the efficiency of the subsequent oxidation or ozonolysis process. Therefore, robust relationships with agricultural suppliers and refineries are essential for ensuring a stable and cost-effective supply. Price volatility in agricultural commodities presents a significant challenge at this initial stage, necessitating strategic hedging and long-term procurement contracts to stabilize manufacturing costs. Specialized chemical manufacturers often invest in purification technologies to ensure the intermediate fatty acid profile is optimized for Pelargonic acid production.

The core manufacturing process involves chemical conversion—either through catalytic oxidation of the feedstock or, increasingly, through bio-catalytic methods. Once manufactured, the crude Pelargonic acid undergoes rigorous purification and fractionation processes to achieve the required Technical Grade or High Purity Grade specifications, a step that adds significant value and complexity. Distribution Channels are bifurcated into Direct and Indirect sales. Large, integrated chemical companies typically utilize Direct Distribution to service major clients in the automotive, agricultural, and specialized lubricant sectors, maintaining close technical relationships to tailor product specifications. Indirect Distribution involves specialized chemical distributors and regional agents who cater to smaller batch requirements, diverse geographical regions, and fragmented end-user markets, particularly those in the cosmetic and personal care industries, effectively providing localized technical support and inventory management.

Downstream Analysis focuses on the transformation of Pelargonic acid into final products. This transformation involves esterification processes to create high-value derivatives such as polyol esters (for lubricants), dioctyl nonanoate (for plasticizers), and various flavor/fragrance esters. The final end-users—ranging from herbicide formulators to automotive lubricant blenders and PVC compound manufacturers—constitute the ultimate demand drivers. The complexity and high-performance requirements of these downstream applications mean that technical service and application expertise are critical components of the value chain, differentiating suppliers based on their ability to offer customized solutions and regulatory guidance regarding the final product's use and disposal.

Pelargonic Acid Market Potential Customers

Potential customers for Pelargonic acid are highly diversified, reflecting its wide range of applications as a chemical intermediate, but can be broadly categorized into several key end-user segments based on their primary purchasing driver, which is usually either performance requirements or regulatory compliance. Major customers include large multinational Agrochemical Formulators, who purchase bulk Pelargonic acid for inclusion in their proprietary, fast-acting, non-selective herbicide product lines, targeting both conventional and organic farming markets. Their purchasing decisions are driven by efficacy, regulatory approvals (e.g., OMRI listing for organic use), and large-volume consistency. These companies require technical-grade purity and reliable, scaled supply chains capable of meeting seasonal agricultural demand spikes across multiple geographies.

Another significant customer segment comprises Synthetic Lubricant Manufacturers and Blenders, particularly those serving the aerospace, automotive (especially EV fluids), and industrial machinery sectors. These customers require Pelargonic acid to synthesize high-performance polyol esters, demanding high purity and stringent quality control. Their purchasing criteria prioritize thermal stability, viscosity index, and oxidation resistance, as the end-product is used in critical applications where failure can be catastrophic or extremely costly. The relationship here is often highly technical, involving co-development of specialized ester compounds to meet specific OEM (Original Equipment Manufacturer) specifications for new engine or machinery designs.

Furthermore, major manufacturers of polymer additives, specifically Plasticizer Producers, constitute a key customer group. As global regulation increasingly restricts phthalates, these companies seek high-performance, non-toxic alternatives like Pelargonic acid-derived nonanoates (DON) for use in flexible PVC products, including medical devices, automotive interiors, and children's toys. For this segment, compliance with consumer safety standards (e.g., absence of endocrine disruptors) and assurance of low volatility and migration are paramount purchasing factors. Lastly, companies in the Flavor and Fragrance industry and Cosmetics Manufacturers utilize high-purity Pelargonic acid derivatives for specialized emollients, flavor bases, and fragrance carriers, emphasizing purity, consistency, and compliance with cosmetic ingredient databases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 180 million |

| Market Forecast in 2033 | USD 280 million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Azelis, Emery Oleochemicals, Eastman Chemical Company, TCI Chemicals (India) Pvt. Ltd., Kao Corporation, Tokyo Chemical Industry Co., Ltd., Merck KGaA, Santa Cruz Biotechnology, Inc., Sigma-Aldrich (MilliporeSigma), Parchem Fine & Specialty Chemicals, Toronto Research Chemicals, Croda International Plc, Godrej Industries Limited, P&G Chemicals, Arkema S.A., BASF SE, Evonik Industries AG, Oleon NV, KLK Oleo, Mosselman s.a. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pelargonic Acid Market Key Technology Landscape

The technology landscape for Pelargonic Acid production is undergoing a significant transition, driven by the imperative for cost efficiency, environmental sustainability, and enhanced product purity. Historically, the primary method involved the ozonolysis of high-oleic vegetable oils, a process that is effective but requires specialized equipment and careful handling of intermediates. Modern technological advancements focus heavily on optimizing this process through advanced catalysis and reaction engineering. Specifically, continuous flow reactors are replacing batch processes, enabling greater control over reaction temperature and pressure, which in turn maximizes yield, reduces side-product formation, and ensures consistent quality, particularly for the high-purity grades demanded by the pharmaceutical and cosmetic industries. Furthermore, highly selective catalysts are being developed to improve the efficiency of the oxidation of unsaturated fatty acids, thereby minimizing energy inputs and reducing the overall environmental footprint of the manufacturing process.

A burgeoning technological area is the development and commercialization of bio-catalytic or fermentation-based routes for Pelargonic acid synthesis. This involves utilizing genetically modified microorganisms to convert renewable carbohydrate sources or specialized fatty acid precursors directly into nonanoic acid. This bio-based approach offers the long-term strategic advantage of decoupling production from volatile agricultural commodity prices (oleic acid) and petrochemical sources, aligning perfectly with global green chemistry initiatives. While still maturing, this technology promises significantly lower energy intensity and inherent sustainability benefits, positioning early adopters for premium market access. Key research efforts are directed towards improving the titer and yield of the fermentative processes and simplifying the downstream separation and purification of the bio-derived acid from the fermentation broth, which remains a technical challenge due to complexity.

Beyond synthesis, advancements in separation and purification technologies are crucial. Techniques such as fractional distillation under high vacuum, supercritical fluid extraction, and membrane separation are being continuously refined to enhance the separation of Pelargonic acid from co-produced fatty acids and impurities. The push for High Purity Grade Pelargonic Acid—necessary for use in advanced plasticizers that meet strict health standards (e.g., non-migration requirements for medical PVC) and high-specification lubricants—requires these advanced purification methods. The integration of spectroscopic analysis and real-time process monitoring, often facilitated by AI, ensures that the final product adheres strictly to exacting quality specifications, reinforcing the technology landscape's focus on high-performance output and compliance.

Regional Highlights

Regional dynamics play a crucial role in shaping the Pelargonic Acid Market, with distinct growth drivers and end-use focuses characterizing each major geographical area. North America is a mature market exhibiting robust, sustained growth, driven primarily by the strong regulatory push for sustainable agriculture and the transition toward high-performance synthetic lubricants. The United States leads in the adoption of Pelargonic acid-based herbicides due to widespread consumer demand for organic and non-toxic weed control solutions. Additionally, the region's advanced automotive and aerospace industries require high volumes of specialized polyol ester lubricants, underpinning high demand for high-purity grades of the acid.

Europe stands out as the most stringent regulatory environment, which heavily dictates market movement. Regulations such as REACH have effectively restricted or banned many conventional plasticizers and chemical herbicides, directly creating a lucrative opportunity for Pelargonic acid derivatives, particularly non-phthalate plasticizers and bio-herbicides. Countries like Germany and the Netherlands, with their strong chemical manufacturing and environmental policies, are central hubs for production and consumption. The European market places a premium on certified bio-based origins, compelling manufacturers to invest heavily in sustainable sourcing and production technologies.

Asia Pacific (APAC), spearheaded by China and India, is the fastest-growing region both in terms of consumption volume and new manufacturing capacity investment. While environmental regulations are less uniform than in the West, rapid industrialization, expansion in construction (driving plasticizer demand), and the booming automotive sector (increasing demand for industrial lubricants and engine oils) are the primary growth engines. APAC manufacturers are rapidly scaling up production to serve the regional industrial base, sometimes relying on both petrochemical and increasingly bio-based routes. The market in APAC is characterized by intense price competition but also massive scale opportunities.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets. LATAM shows strong potential in the agricultural sector, where large-scale farming operations are beginning to integrate bio-herbicides as a pest resistance management strategy. MEA, particularly the GCC countries, shows growing demand related to the oil and gas industry and infrastructural development, requiring specialized lubricants and performance chemicals, though reliance on imports remains high.

- North America: Focus on bio-herbicides and high-specification synthetic lubricants for automotive and aerospace sectors; driven by stringent environmental standards.

- Europe: High adoption rates due to strict regulatory compliance (REACH); primary market for non-phthalate plasticizers and bio-certified chemical intermediates.

- Asia Pacific (APAC): Highest growth rate, fueled by industrial expansion, automotive manufacturing, and construction; emerging production hub for bulk and specialty Pelargonic acid.

- Latin America (LATAM): Growth concentrated in agriculture, particularly the adoption of non-selective bio-herbicides in major agricultural economies (Brazil, Argentina).

- Middle East and Africa (MEA): Emerging demand from infrastructural projects and specialized industrial applications, particularly in the lubrication and chemical sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pelargonic Acid Market.- Azelis

- Emery Oleochemicals

- Eastman Chemical Company

- TCI Chemicals (India) Pvt. Ltd.

- Kao Corporation

- Tokyo Chemical Industry Co., Ltd.

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Sigma-Aldrich (MilliporeSigma)

- Parchem Fine & Specialty Chemicals

- Toronto Research Chemicals

- Croda International Plc

- Godrej Industries Limited

- P&G Chemicals

- Arkema S.A.

- BASF SE

- Evonik Industries AG

- Oleon NV

- KLK Oleo

- Mosselman s.a.

Frequently Asked Questions

Analyze common user questions about the Pelargonic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Pelargonic Acid and its primary use in sustainable applications?

Pelargonic Acid, or nonanoic acid (C9 fatty acid), is a versatile chemical intermediate known for its low toxicity and high biodegradability. Its primary sustainable application is as the active ingredient in non-selective, fast-acting, contact bio-herbicides, providing an environmentally safer alternative to conventional pesticides in agricultural and organic settings.

How is the global shift toward electric vehicles (EVs) impacting the demand for Pelargonic Acid?

The transition to EVs is significantly boosting demand. EVs require specialized synthetic lubricants and thermal management fluids that can handle unique operating temperatures and electrical conductivity requirements. Pelargonic acid is a key precursor for synthesizing high-performance polyol esters (POEs), which are highly favored base oils for these demanding EV applications due to their thermal and oxidative stability.

What are the key differences between Technical Grade and High Purity Grade Pelargonic Acid?

Technical Grade is used in high-volume industrial applications like general-purpose plasticizers and industrial lubricants, where strict purity levels are less critical. High Purity Grade undergoes further extensive purification and is essential for sensitive applications such as cosmetics, specialized high-performance synthetic esters (e.g., aerospace lubricants), and food-contact plasticizers, where minimal impurities are required for safety and optimal performance.

Which geographical region exhibits the strongest growth potential for Pelargonic Acid?

Asia Pacific (APAC) is projected to show the strongest growth potential, driven by rapid industrialization, particularly in the automotive and construction sectors in China and India. This regional growth is fueled by increasing localized manufacturing of high-performance lubricants and polymer additives to meet domestic infrastructural expansion needs.

What are the main alternatives Pelargonic Acid competes with, particularly in the plasticizer segment?

In the plasticizer segment, Pelargonic acid-derived nonanoates (e.g., DON) primarily compete with cheaper, conventional phthalate plasticizers (like DOP/DEHP) and other non-phthalate alternatives (e.g., cyclohexanoates or trimellitates). However, regulatory pressures restricting phthalate use in Europe and North America give Pelargonic acid derivatives a significant competitive edge due to their superior environmental and safety profiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager