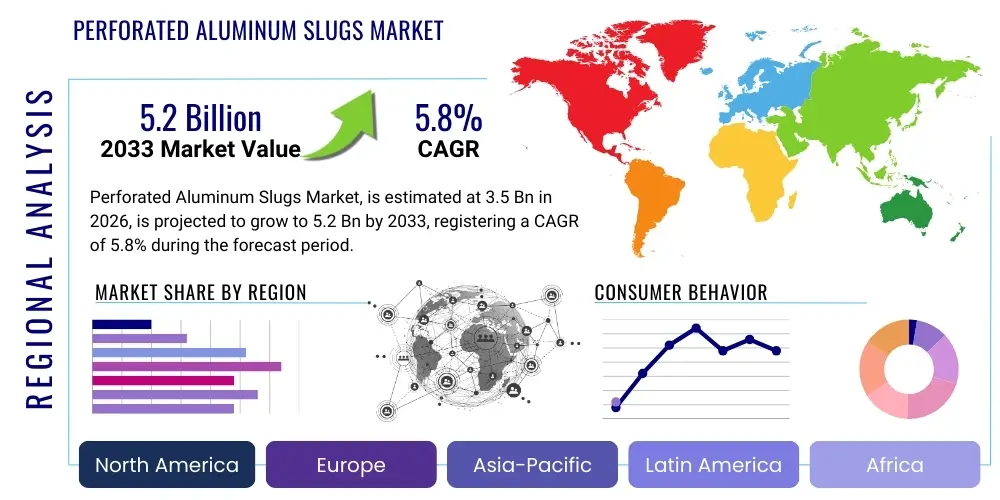

Perforated Aluminum Slugs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442199 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Perforated Aluminum Slugs Market Size

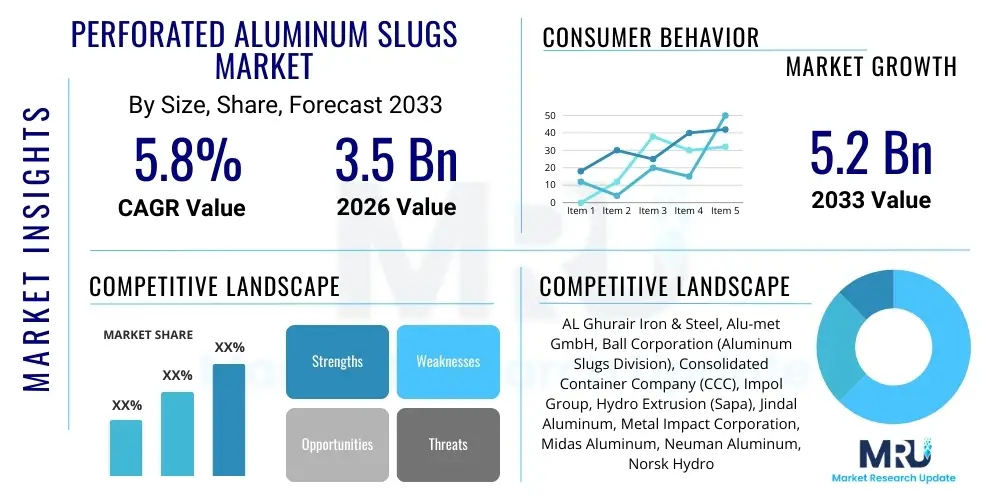

The Perforated Aluminum Slugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating demand for sustainable, lightweight packaging solutions across fast-moving consumer goods (FMCG), pharmaceutical, and cosmetic industries globally. The intrinsic properties of aluminum, combined with the precision engineering of perforation, make these slugs essential components in the production of high-quality aerosol cans and collapsible tubes, maintaining the integrity and shelf life of various sensitive products.

Perforated Aluminum Slugs Market introduction

The Perforated Aluminum Slugs Market centers around small, cylindrical discs of aluminum, which are meticulously perforated during the manufacturing process. These specialized semi-finished products serve as the foundational raw material, primarily utilized in the impact extrusion process to manufacture seamless aluminum containers, particularly aerosol cans, bottles, and collapsible tubes. Aluminum slugs offer unparalleled benefits including excellent barrier properties, corrosion resistance, and high recyclability rates, positioning them as a critical component in achieving corporate sustainability goals across global manufacturing chains. The perforation is engineered to optimize material flow and metal deformation during the extrusion process, reducing internal stress and ensuring the homogeneity and structural integrity of the final container, which is paramount for pressurized applications like aerosol cans.

Major applications of perforated aluminum slugs span the entire consumer packaged goods landscape. They are heavily used in the production of containers for personal care items (deodorants, hairsprays), household products (air fresheners, cleaning sprays), pharmaceuticals (metered dose inhalers, specialized creams), and increasingly in premium beverage packaging. The superior performance of aluminum over alternative materials in maintaining product stability and ensuring safe dispensing drives its widespread adoption. Furthermore, aluminum's lightweight nature reduces transportation costs and carbon footprints, aligning with contemporary environmental regulations and consumer preferences for eco-friendly packaging solutions, thereby solidifying the product’s essential status in modern industrial applications.

Driving factors for this market include stringent regulatory standards mandating sustainable packaging, especially in Europe and North America, necessitating materials with high recyclability like aluminum. The continuous innovation in aerosol technology and the expanding use of pressurized containers in emerging economies further bolster demand. Technological advancements in slug manufacturing, leading to improved material utilization, higher throughput, and reduced defect rates, contribute significantly to market growth. Additionally, the shift away from heavier, less sustainable materials, coupled with the rapid expansion of the cosmetics and personal care sectors in the Asia Pacific region, are pivotal factors ensuring sustained market expansion throughout the forecast period.

Perforated Aluminum Slugs Market Executive Summary

The global Perforated Aluminum Slugs Market exhibits robust growth, underpinned by significant shifts toward lightweighting and circular economy principles within the packaging industry. Key business trends indicate increasing consolidation among primary aluminum producers and slug converters to ensure supply chain stability and quality control. There is a noticeable investment trend in high-speed, automated production lines capable of producing precision slugs with specialized surface treatments to cater to demanding applications, such as pharmaceutical aerosols. Furthermore, manufacturers are increasingly focusing on slugs derived from recycled or secondary aluminum sources to meet aggressive corporate sustainability targets and regulatory requirements, driving innovation in material sourcing and purification technologies.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by rapid industrialization, expanding middle-class consumption, and burgeoning personal care and pharmaceutical markets, particularly in China and India. North America and Europe, while mature, remain dominant in terms of technology adoption and premium product manufacturing, characterized by a strong emphasis on regulatory compliance related to material safety and environmental impact. These established regions are focusing on maximizing the use of post-consumer recycled (PCR) aluminum content in slugs, leading the global transition towards truly circular packaging supply chains and pushing the boundaries of material engineering and purity standards.

Segment trends highlight the dominance of slugs used for aerosol applications due to the widespread consumer acceptance and versatility of aerosol dispensing systems. Within end-use segments, the personal care category holds the largest market share, though pharmaceutical and cosmetic applications are projected to witness the highest growth CAGR, driven by stricter quality requirements necessitating ultra-pure aluminum and precise perforation geometry. Additionally, there is an emerging trend towards customized slug sizes and alloys to meet specific container performance requirements, optimizing tensile strength and reducing the weight of the final extruded product without compromising pressure containment capabilities, reflecting an ongoing industry push for material efficiency.

AI Impact Analysis on Perforated Aluminum Slugs Market

User questions regarding AI's influence typically revolve around how AI can enhance manufacturing precision, optimize raw material usage, predict quality defects, and improve supply chain resilience for highly standardized components like perforated aluminum slugs. Key themes emphasize AI’s role in predictive maintenance for high-speed extrusion presses, optimizing punch-and-die geometry based on real-time material feedback, and creating 'digital twins' of the slug production process to minimize scrap rates. Users are seeking quantifiable improvements in operational efficiency, specifically focusing on AI-driven vision systems for microscopic defect detection and machine learning models that can dynamically adjust temperature and pressure parameters during hot forging and perforation to ensure consistent quality and purity, mitigating risks associated with material variability in secondary aluminum feedstocks.

- AI-driven optimization of manufacturing parameters (e.g., billet heating, lubrication, stamping force) to maximize throughput and reduce material waste.

- Predictive maintenance analytics for punch presses and extrusion equipment, minimizing unplanned downtime and extending tooling lifespan.

- Advanced AI vision systems for high-speed, 100% inspection of perforation geometry, diameter, thickness, and surface integrity, ensuring zero-defect output.

- Optimization of supply chain logistics and inventory management, using machine learning to forecast demand fluctuations from major aerosol fillers and packaging converters.

- Development of digital twins of the slug production process to simulate different alloy compositions and perforation patterns, accelerating R&D for new product applications.

DRO & Impact Forces Of Perforated Aluminum Slugs Market

The Perforated Aluminum Slugs Market is driven primarily by the global impetus toward sustainable packaging, capitalizing on aluminum's infinite recyclability, coupled with the expanding consumer demand for aerosol and tube packaging in emerging economies. The high demand for personal care products, particularly deodorants and specialized cosmetic sprays, dictates steady volume growth for the slugs. Conversely, the market faces significant restraints, chiefly concerning the high volatility of primary aluminum prices, which impacts the cost of raw materials, creating financial uncertainty for manufacturers and converters. Furthermore, the energy-intensive nature of aluminum production and the stringent quality control required for precision products like slugs pose operational challenges, necessitating continuous investment in advanced, energy-efficient manufacturing technologies.

Opportunities for growth are vast, particularly in developing slugs with higher recycled content (PCR) while maintaining stringent purity standards required for pharmaceutical and food contact materials. Innovation in surface treatment and pre-lubrication techniques that enhance the impact extrusion process and reduce wear on machinery presents a key avenue for competitive differentiation. Moreover, the increasing substitution of traditional plastic or steel components with lightweight aluminum in new applications, such as specialized beverage bottles and industrial containers, opens up entirely new customer segments and geographical markets, necessitating diversification in product sizing and alloy specifications to meet performance metrics.

Impact forces are predominantly shaped by regulatory actions emphasizing environmental protection and material safety. Government initiatives promoting circular economies and penalizing the use of single-use plastics directly increase the attractiveness and mandated usage of aluminum slugs. Competitive intensity remains moderate to high, concentrated among a few large, specialized global suppliers who control proprietary manufacturing techniques and scale efficiencies. Buyer power is strong, as packaging converters often negotiate large volume contracts, pressuring slug manufacturers on price and consistency, driving the need for operational excellence and sophisticated quality assurance programs to maintain long-term relationships and secure profitable contracts.

Segmentation Analysis

The Perforated Aluminum Slugs Market is meticulously segmented based on key differentiators including the Alloy Type used, the final Application of the extruded container, and the End-Use Industry served. Segmentation by alloy is crucial, separating standard purity alloys (e.g., 1050, 1070) suitable for general-purpose aerosols and tubes, from ultra-high purity alloys required for critical pharmaceutical or specialized food contact applications where material migration must be strictly controlled. This distinction influences both the manufacturing process complexity and the resulting price point of the slug, ensuring material properties meet the functional demands of the final product and its regulatory environment.

The segmentation by Application focuses on the primary product type manufactured, with key segments including Slugs for Aerosol Cans, Slugs for Collapsible Tubes, and Slugs for Rigid Bottles and Containers. Aerosol cans currently dominate the market volume due to the massive global consumption of personal care and household aerosol products, demanding high-volume production of slugs optimized for high-pressure performance. Conversely, the collapsible tube segment, widely used for ointments, adhesives, and cosmetics, requires slugs tailored for superior ductility and seamless wall formation during extrusion, reflecting different technical specifications and quality checks.

Finally, the End-Use Industry segmentation highlights where the market value is generated, categorizing demand across Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, and Industrial Applications. The Personal Care sector remains the largest consumer, valuing the aesthetic appeal and barrier protection of aluminum packaging. However, the Pharmaceutical segment, despite smaller volumes, commands premium pricing due to stringent quality control, traceability requirements, and the need for zero-defect production, presenting a lucrative high-margin opportunity for specialized slug manufacturers capable of meeting Good Manufacturing Practice (GMP) standards and associated material purity certifications globally.

- By Alloy Type:

- Standard Purity Aluminum (e.g., 1050, 1070)

- High Purity Aluminum (e.g., >99.7% Al)

- Recycled Aluminum Content Slugs (PCR)

- By Application:

- Aerosol Cans

- Collapsible Tubes

- Rigid Bottles and Containers

- By End-Use Industry:

- Personal Care and Cosmetics

- Pharmaceutical

- Food and Beverage

- Industrial and Technical Applications

Value Chain Analysis For Perforated Aluminum Slugs Market

The value chain for perforated aluminum slugs begins with upstream activities centered on the procurement and processing of primary or secondary aluminum metal. Primary aluminum smelters or secondary aluminum recyclers supply aluminum billets, which form the base raw material. Given the high-purity requirements for packaging applications, particularly for pharmaceuticals, control over the raw material source and alloying process is critical. Upstream efficiency significantly dictates the final slug quality and cost structure, with price volatility of LME-traded aluminum being the single largest external cost factor influencing the entire value chain and requiring sophisticated hedging strategies by large slug manufacturers to stabilize pricing models and ensure supply continuity to downstream users.

The midstream involves specialized aluminum slug manufacturers who receive the billets, perform hot forging, blanking, punching, and the crucial perforation process. This stage is capital-intensive, requiring high-precision stamping and lubrication systems. Quality assurance is paramount here, utilizing sophisticated machine vision and dimensional measurement tools to inspect every slug. The distribution channel, which bridges the gap between the slug manufacturer and the packaging converter (downstream), typically involves direct sales for high-volume, strategic partnerships, and specialized logistics providers handling bulk, damage-sensitive materials. Indirect channels, involving regional metal traders or specialized distributors, cater primarily to smaller converters or those requiring specialized, non-standard material specifications, facilitating market access to niche applications and geographically dispersed manufacturing sites.

Downstream activities include the impact extrusion and finishing processes carried out by packaging converters, where the slug is transformed into the final container (aerosol can or tube). These converters then supply the finished containers to the brand owners (end-users) in the Personal Care, Pharma, or Food sectors. Direct distribution channels are prevalent when slug manufacturers are vertically integrated with the packaging converters or have long-standing, strategic supply contracts with major multinational brand owners. Indirect channels are used when the manufacturer relies on third-party logistics and regional stocking hubs to service smaller, geographically diverse packaging producers, requiring robust inventory management and standardized packaging protocols to minimize physical damage during transit and storage, ensuring the precision integrity of the perforated slugs upon arrival.

Perforated Aluminum Slugs Market Potential Customers

The primary potential customers and end-users of perforated aluminum slugs are the packaging converters and manufacturers specializing in the production of seamless aluminum containers via impact extrusion. This cohort includes global giants and specialized regional players who supply containers to major Fast-Moving Consumer Goods (FMCG) corporations. These converters require consistent, high-quality slug feedstock that ensures optimal flow characteristics during the demanding extrusion process, minimizing tooling wear and maximizing production speeds. Key decision-makers at these converter companies focus intensely on material consistency, dimensional accuracy (diameter, thickness, concentricity of the perforation), and certifications related to alloy purity and environmental stewardship (e.g., ISO 14001, high PCR content validation).

Within the converter base, the largest consumer segment comprises manufacturers dedicated to aerosol can production. These customers service the expansive personal care market (deodorants, shaving foams), demanding millions of standard-sized slugs annually. Another crucial segment includes manufacturers of aluminum collapsible tubes, serving the cosmetic and pharmaceutical sectors, requiring slugs with enhanced ductility and specialized alloy compositions to withstand frequent handling and dispensing cycles without stress cracking. Growth in the premium cosmetic and niche pharmaceutical packaging segments is driving demand for highly customized, small-batch slug orders that often necessitate complex logistics and stringent quality documentation.

Indirectly, the brand owners—such as multinational cosmetic firms, global pharmaceutical companies, and major food processors—are the ultimate drivers of demand. While they do not purchase slugs directly, their packaging specifications (e.g., container size, internal pressure rating, required shelf life) dictate the technical requirements passed down to the converters, who then source the appropriate slugs. Potential customers therefore highly value suppliers that can provide detailed material traceability and actively support their efforts to integrate recycled content into their supply chain, thereby enhancing their corporate sustainability profile and meeting evolving consumer expectations for environmentally responsible packaging materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AL Ghurair Iron & Steel, Alu-met GmbH, Ball Corporation (Aluminum Slugs Division), Consolidated Container Company (CCC), Impol Group, Hydro Extrusion (Sapa), Jindal Aluminum, Metal Impact Corporation, Midas Aluminum, Neuman Aluminum, Norsk Hydro ASA, PEC Aluminum, Qingdao Ruide Metal Co., Ltd., Rio Tinto Aluminum, UACJ Corporation, Zhongfu Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perforated Aluminum Slugs Market Key Technology Landscape

The technological landscape of the perforated aluminum slugs market is defined by precision engineering, advanced material science, and automation aimed at achieving zero-defect production at high volumes. The primary manufacturing technology involves specialized hot forging or cold punching processes applied to extruded or cast aluminum billets. Recent technological advancements focus heavily on optimizing the pre-treatment stage, specifically the heating profile of the billets and the application of specialized lubricants. State-of-the-art slug manufacturing lines utilize closed-loop feedback systems and high-resolution sensors to monitor temperature uniformity and stamping force in real-time. This sophisticated control minimizes internal stresses and structural heterogeneity in the slug, which are critical factors that could lead to flaws during the subsequent high-pressure impact extrusion process performed by the converter, thereby protecting the integrity of the final container under pressure.

A major focus is placed on enhancing the perforation accuracy and consistency. Modern slug presses use precision-engineered tooling and advanced computer numerical control (CNC) systems to ensure the concentricity, diameter, and sharpness of the perforation are within extremely tight tolerances. The function of the perforation is not merely material saving; it primarily serves to optimize the material flow during the impact extrusion, ensuring uniform wall thickness and reduced friction. To ensure product quality at high production speeds (often thousands of slugs per minute), manufacturers are integrating sophisticated machine vision inspection systems powered by AI. These systems can instantaneously detect microscopic surface defects, dimensional deviations, and incomplete perforations that are invisible to the human eye, ensuring that only certified, high-quality feedstock reaches the packaging converters.

Furthermore, technology related to sustainability is rapidly gaining traction. Innovations in secondary aluminum processing, including advanced sorting, purification, and alloying techniques, allow manufacturers to incorporate higher percentages of Post-Consumer Recycled (PCR) aluminum into slugs without compromising the metallurgical purity required for sensitive applications (e.g., food or pharma contact). This necessitates specialized furnace technology and refined alloying processes to remove trace elements and impurities effectively. Simultaneously, efforts are being made in process optimization to reduce energy consumption per ton of slug produced, aligning with global decarbonization goals and addressing the high energy costs associated with aluminum manufacturing, ensuring the long-term environmental and economic viability of the slug supply chain within the context of a globally competitive market.

Regional Highlights

The market dynamics of perforated aluminum slugs vary significantly across major geographical regions, influenced by industrial maturity, regulatory frameworks, and consumer trends. North America represents a mature, high-value market characterized by stringent quality standards and a significant emphasis on sustainable sourcing. The U.S. and Canada are major consumers, primarily driven by the personal care (premium cosmetics and deodorants) and pharmaceutical sectors. Market players in this region prioritize efficiency and traceability, often demanding slugs with verifiable recycled content to align with corporate social responsibility (CSR) goals of major brand owners. The demand here focuses less on high volume expansion and more on specialized, high-specification products tailored for unique packaging designs and regulatory compliance, ensuring product integrity and consumer safety.

Europe stands as a regulatory and innovation hub, particularly due to the European Union’s robust focus on circular economy initiatives and waste reduction targets. European manufacturers are leading the charge in implementing high percentages of PCR content in their aluminum slugs, driven by environmental legislation and high consumer awareness regarding packaging sustainability. Germany, France, and the UK are key markets, dominating the pharmaceutical and high-end cosmetic aerosol segments. The European market demands exceptional quality control and material documentation, often setting the global benchmark for slug purity and performance. This competitive environment fosters continuous investment in advanced manufacturing technology and process optimization to meet strict environmental and technical specifications efficiently.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is spurred by rapid urbanization, expanding disposable incomes, and the resulting surge in demand for personal care, household, and food products in packaged formats, especially in populous nations like China, India, and Southeast Asian countries. While cost competitiveness is a major factor in APAC, there is a swift transition toward quality and sustainability, particularly as multinational corporations expand their presence and introduce international packaging standards. The sheer volume of manufacturing activity, coupled with significant governmental investment in infrastructure and industrial capacity, positions APAC as the dominant region for future market expansion, requiring massive capital investment in new slug manufacturing plants to meet the escalating localized demand efficiently.

- Asia Pacific (APAC): Highest projected growth rate fueled by rapid consumption growth in personal care, cosmetics, and household sectors across China and India.

- Europe: Leading region for sustainability, demanding high Post-Consumer Recycled (PCR) content slugs, driven by stringent EU circular economy policies and premium pharmaceutical packaging needs.

- North America: Mature market focused on high-specification, premium applications (aerosols for specialty products) with a strong emphasis on supply chain reliability and regulatory compliance.

- Latin America & MEA: Emerging markets showing increasing adoption of aluminum packaging, particularly in local FMCG sectors, offering long-term volume growth opportunities as local manufacturing capacity matures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perforated Aluminum Slugs Market, providing competitive positioning, key strategic developments, product portfolios, and financial overviews. These companies are critical to the global supply chain, influencing technological standards, pricing dynamics, and sustainable material adoption across the packaging industry.- Neuman Aluminum

- Impol Group

- Hydro Extrusion (Sapa)

- Ball Corporation (Aluminum Slugs Division)

- Pechiney Aluminium

- Alu-met GmbH

- Metal Impact Corporation

- Jindal Aluminum Limited

- UACJ Corporation

- Norsk Hydro ASA

- PEC Aluminum

- Consolidated Container Company (CCC)

- Rio Tinto Aluminum (Material Supply)

- Qingdao Ruide Metal Co., Ltd.

- Midas Aluminum

- AL Ghurair Iron & Steel

- Zhongfu Industry Co., Ltd.

- Aleris International (now part of Novelis)

- G.S.P. Aluminium S.p.A.

- Alumasc Group Plc

Frequently Asked Questions

Analyze common user questions about the Perforated Aluminum Slugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of perforation in aluminum slugs?

The perforation in aluminum slugs primarily optimizes the flow of material during the high-speed impact extrusion process. It ensures uniform material distribution, reduces friction and tooling wear, and minimizes internal stresses, resulting in a seamless container with consistent wall thickness and superior structural integrity, critical for pressurized aerosol applications.

Which end-use industry drives the highest demand for perforated aluminum slugs?

The Personal Care and Cosmetics industry drives the highest volume demand for perforated aluminum slugs globally, largely due to the massive scale of manufacturing required for aerosol products such as deodorants, hairsprays, and shaving foams, leveraging aluminum’s excellent barrier properties and aesthetic finish.

How is sustainability impacting the sourcing of aluminum slugs?

Sustainability is profoundly impacting sourcing, leading to a strong demand for slugs made from Post-Consumer Recycled (PCR) aluminum content. Regulatory pressure and brand owner commitments require suppliers to demonstrate verifiable traceability and increase the use of secondary aluminum to reduce the environmental footprint associated with primary metal production.

What is the projected CAGR for the Perforated Aluminum Slugs Market between 2026 and 2033?

The Perforated Aluminum Slugs Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, driven by expanding packaging applications in Asia Pacific and the continued global shift towards lightweight, infinitely recyclable aluminum solutions over traditional materials.

What technological advancements are most crucial for quality control in slug manufacturing?

The most crucial technological advancements for quality control involve high-speed, AI-powered machine vision inspection systems. These systems perform instantaneous, non-contact inspection of dimensional accuracy, surface finish, and perforation geometry, ensuring zero-defect material feedstock is supplied to downstream packaging converters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager