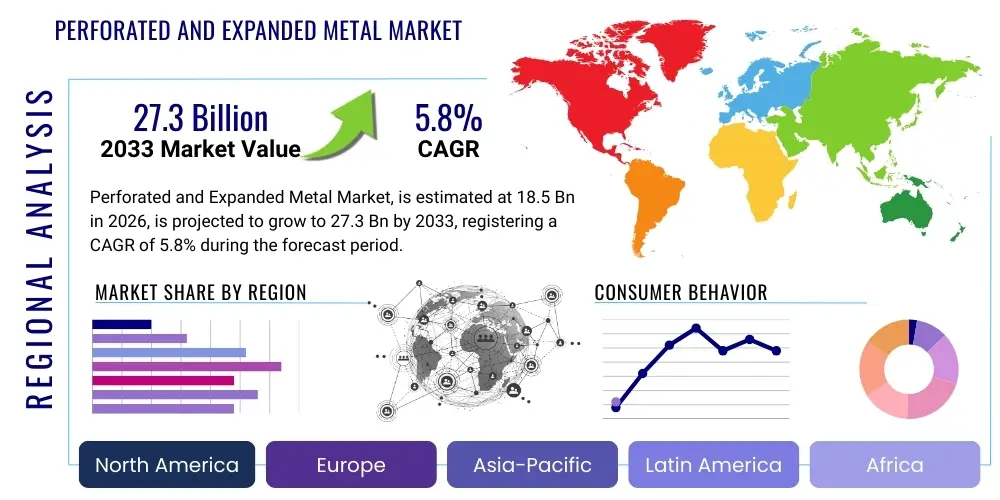

Perforated and Expanded Metal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442952 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Perforated and Expanded Metal Market Size

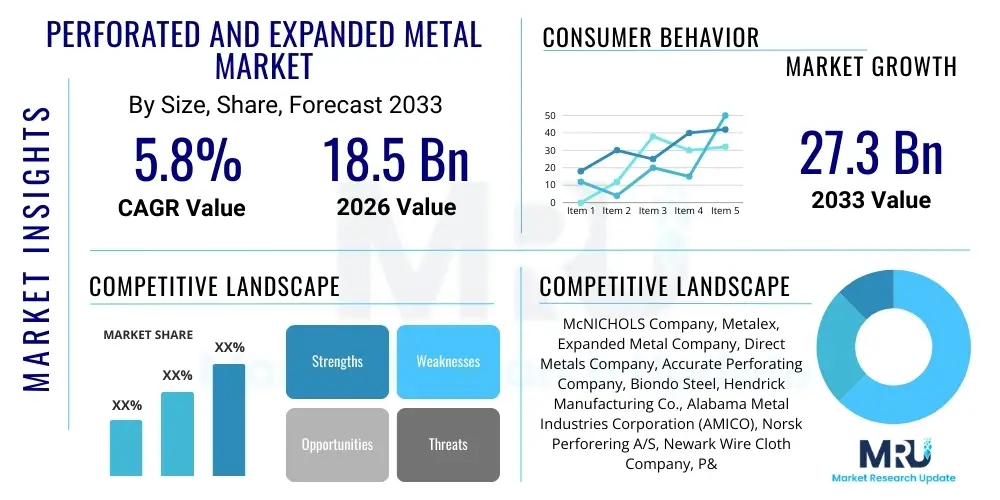

The Perforated and Expanded Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $27.3 Billion by the end of the forecast period in 2033.

Perforated and Expanded Metal Market introduction

The Perforated and Expanded Metal Market encompasses specialized materials widely utilized across industrial, architectural, and safety applications. Perforated metal refers to sheet material, typically steel, aluminum, or stainless steel, that has been mechanically punched or stamped to create a pattern of holes, slots, or decorative shapes. This process allows for specific filtration, acoustic dampening, and light transmission characteristics. Expanded metal, conversely, is manufactured by simultaneously slitting and stretching a solid sheet, creating a mesh-like pattern without any waste of raw material, making it inherently cost-efficient and structurally rigid. These metals are crucial components in industries requiring high strength-to-weight ratios, excellent ventilation, and controlled fluid dynamics.

Major applications for these materials span across the construction sector, where they are used for facades, sunscreens, and railings; the automotive industry for grille components, protective guards, and filtration screens; and the Heating, Ventilation, and Air Conditioning (HVAC) sector for air filters and acoustic panels. The inherent benefits, such as durability, fire resistance, aesthetic versatility, and customizable open area percentages, drive their widespread adoption. Perforated metals are particularly favored in architectural design for aesthetic purposes and noise control, while expanded metals are essential in security barriers, walkways, and protective enclosures due to their robust, one-piece construction and high load-bearing capacity.

Driving factors for market growth include accelerating global urbanization and the subsequent surge in infrastructure development, particularly in emerging economies of the Asia Pacific region. Furthermore, stringent environmental regulations necessitating enhanced filtration systems in industrial processes boost the demand for precise perforation patterns. The rising adoption of lightweight materials in the automotive and aerospace industries to improve fuel efficiency and structural integrity also acts as a significant market catalyst. Innovations in material science, leading to the use of advanced alloys and specialized coatings for corrosion resistance, continue to broaden the application scope, ensuring steady market expansion throughout the forecast period.

Perforated and Expanded Metal Market Executive Summary

The Perforated and Expanded Metal Market is undergoing a strategic shift characterized by evolving regulatory landscapes and a heightened focus on material efficiency and sustainability. Business trends indicate a movement towards greater customization, driven by architectural projects demanding unique aesthetic and functional properties, necessitating advanced computer-aided design (CAD) and manufacturing capabilities among key players. Furthermore, manufacturers are increasingly integrating recycled content into production processes to meet corporate sustainability goals and consumer demand for green building materials. Strategic mergers, acquisitions, and partnerships aimed at vertical integration and geographical expansion are prevalent, allowing firms to consolidate supply chains and gain access to specialized fabrication techniques.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily fueled by massive infrastructure investments in China, India, and Southeast Asian nations, alongside rapid expansion in manufacturing capacity across various end-use sectors. North America and Europe, characterized by mature construction industries and strict safety and environmental standards, prioritize high-quality, corrosion-resistant stainless steel and aluminum products, particularly within the energy and chemical processing segments. These established regions focus heavily on modernization projects, retrofitting existing structures, and implementing advanced security solutions, sustaining demand for complex expanded metal geometries and highly engineered perforated panels.

Segment trends reveal that the Application segment of Construction and Infrastructure holds the largest market share due to continuous urban development and large-scale public works. However, the Filtration segment is projected to exhibit the fastest Compound Annual Growth Rate, driven by increasing regulatory requirements for air and liquid purification in industrial, HVAC, and pharmaceutical settings. By Material Type, the Aluminum segment is gaining prominence owing to its lightweight characteristics and excellent corrosion resistance, making it ideal for transportation and architectural facades. Conversely, galvanized steel remains fundamental in basic structural and safety applications due to its cost-effectiveness and mechanical strength, ensuring its enduring importance across diverse market sectors.

AI Impact Analysis on Perforated and Expanded Metal Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the perforated and expanded metal sector primarily revolve around efficiency gains, predictive maintenance, and quality control automation. Key concerns center on how AI can optimize complex production parameters—such as material feed rates, stamping pressures, and mesh tensioning—to minimize waste and maximize output speed while maintaining strict dimensional tolerances. Users are keen to understand AI's capability in predicting material defects or wear in tooling before failure occurs, moving production facilities from reactive to proactive maintenance models. Expectations also focus on AI-driven supply chain transparency, allowing manufacturers to better forecast fluctuating raw material costs (like steel or aluminum) and manage inventory levels effectively to hedge against market volatility. Furthermore, AI is expected to revolutionize customized design processes, allowing architects and engineers to quickly generate optimal perforation patterns or mesh geometries based on desired functional outcomes (e.g., specific acoustic absorption levels or airflow rates).

- AI-Optimized Production: Machine learning algorithms analyze real-time operational data from punching, stamping, and expanding machinery to automatically adjust variables like speed and pressure, reducing material wastage by up to 15%.

- Predictive Maintenance: AI models analyze vibration and thermal data from fabrication equipment to predict tooling fatigue and required maintenance cycles, minimizing unplanned downtime and extending equipment lifespan.

- Automated Quality Inspection: Computer vision systems powered by deep learning identify microscopic defects, inconsistencies in hole pitch, or web size deviations in expanded metal sheets faster and more accurately than traditional manual or sensor-based methods.

- Demand Forecasting and Supply Chain Management: AI analyzes historical sales, geopolitical factors, and commodity price indices to generate highly accurate forecasts, enabling optimal raw material procurement and inventory holding strategies.

- Custom Design Generation: Generative AI tools assist architects in quickly developing complex, performance-driven perforation patterns tailored to specific client needs regarding light diffusion, solar shading, or sound attenuation.

- Energy Consumption Optimization: AI analyzes energy usage patterns across fabrication lines, identifying peak usage times and suggesting scheduling adjustments or process modifications to minimize energy costs per unit produced.

- Improved Material Utilization: Optimization algorithms determine the most efficient nesting of complex patterns on sheet metal blanks, maximizing yield from expensive raw materials like stainless steel or specialized alloys.

DRO & Impact Forces Of Perforated and Expanded Metal Market

The market is predominantly driven by sustained global infrastructure expenditure and a growing architectural preference for aesthetically pleasing and functionally optimized building enclosures. Rapid urbanization, particularly across Asian and Latin American cities, necessitates new housing, commercial complexes, and public transportation infrastructure, all of which heavily rely on perforated and expanded metals for safety, ventilation, and decorative elements. The increasing recognition of these materials in advanced safety applications, such as pedestrian walkways, industrial flooring, and machine guards, mandated by stringent workplace safety regulations globally, further fuels demand. Additionally, the inherent sustainability of expanded metal—due to its zero-waste manufacturing process—aligns well with modern green building initiatives, promoting its use over alternative materials.

However, the market faces significant restraints, primarily centered around the high volatility and unpredictable pricing of key raw materials, including steel, aluminum, and copper, which directly impacts manufacturing margins and final product costs. Furthermore, the fabrication of highly customized, complex patterns requires specialized tooling and high initial capital investment, making market entry challenging for new players and increasing the barrier to rapid technological adoption. Technical restraints also arise from the need to comply with diverse and strict international standards (e.g., ASTM, ISO) regarding load-bearing capacity, corrosion resistance, and dimensional accuracy, which can complicate multi-regional distribution and standardization efforts.

Significant opportunities exist in the development and commercialization of new lightweight, high-strength alloys specifically engineered for demanding applications in aerospace and high-speed rail, where weight reduction is critical. The integration of 3D printing and additive manufacturing techniques, particularly for rapid prototyping of complex custom patterns, offers a pathway to reduced lead times and greater design flexibility. Moreover, penetrating emerging markets in Africa and specific segments within renewable energy infrastructure, such as solar panel racking and wind turbine enclosures requiring durable, ventilated materials, represents a fertile area for sustained growth. The increasing focus on noise pollution control also opens opportunities for specialized micro-perforated acoustic panels in commercial and residential construction.

The impact forces driving the market are substantial, with technological advancements in manufacturing precision being a major force. Modern computer numerical control (CNC) perforation and slitting machinery can achieve tolerances and speeds previously unattainable, allowing for mass production of highly complex designs tailored for specific performance criteria (e.g., precise light diffusion or specific acoustic impedance). Economic impact forces include the cyclical nature of the construction industry; however, diversification into filtration, automotive, and safety sectors provides a mitigating stabilizing effect. Environmental forces strongly favor expanded metal due to its minimal waste footprint and recyclability, pushing its market acceptance globally. Regulatory forces, particularly those relating to safety standards (guarding, flooring) and structural integrity in seismic zones, ensure a continuous, baseline demand for certified, high-quality products.

Segmentation Analysis

The Perforated and Expanded Metal Market is comprehensively segmented based on material type, product type, and application, allowing for a detailed analysis of specific demand drivers and competitive landscapes within distinct end-use sectors. Material segmentation highlights the shift between traditional ferrous metals (carbon steel, stainless steel) and non-ferrous options (aluminum, copper) based on application requirements such as corrosion resistance, weight, and cost sensitivity. Product segmentation differentiates between perforated sheets, which are optimized for aesthetics and acoustic properties, and expanded meshes, valued for their structural integrity, load-bearing capability, and economic advantage due to the lack of material waste during fabrication.

Application segmentation reveals the diverse utility of these materials, ranging from large-scale construction projects (facades, ceiling panels) to highly technical filtration systems required in chemical processing and pharmaceuticals. Understanding these segment dynamics is crucial for manufacturers to tailor their production capabilities, inventory management, and marketing strategies. For instance, companies targeting the automotive segment must prioritize specialized lightweight alloys and precision stamping, while those focusing on the security segment need to emphasize material thickness and maximum shear strength specifications. The rapid growth of the HVAC and air quality management sectors is driving demand for specific hole sizes and open area percentages critical for optimal airflow and particulate capture.

- By Material Type:

- Carbon Steel

- Stainless Steel

- Aluminum

- Copper & Brass

- Other Alloys (e.g., Titanium, Nickel Alloys)

- By Product Type:

- Perforated Metal

- Standard Perforated

- Decorative Perforated

- Micro Perforated

- Expanded Metal

- Standard Expanded (Raised)

- Flattened Expanded

- Architectural Mesh

- Perforated Metal

- By Application:

- Construction and Infrastructure (Facades, Ceilings, Guardrails)

- Automotive and Transportation (Grills, Protective Screens)

- Filtration and Screening (HVAC, Industrial Strainers)

- Industrial Equipment and Machinery Guards

- HVAC and Acoustic Dampening

- Security and Fencing

- Agriculture and Food Processing

Value Chain Analysis For Perforated and Expanded Metal Market

The value chain for the Perforated and Expanded Metal Market begins with the highly concentrated upstream segment involving the sourcing and refining of base metals, primarily steel, aluminum, and nickel. Fluctuations in global commodity markets directly impact the cost structure of subsequent stages. Key suppliers include large integrated steel mills and aluminum smelters, whose production capacity and geopolitical stability dictate raw material supply. Manufacturers often enter long-term supply agreements to mitigate price volatility. Efficiency in this upstream segment is paramount, as the raw sheet metal cost often constitutes the largest percentage of the final product’s manufacturing expense, requiring rigorous supply management and strategic hedging against price increases.

The core manufacturing process constitutes the midstream, where the value addition is significant. This stage includes precision slitting, cutting, punching, and expanding using advanced CNC equipment and specialized tooling. Manufacturers differentiate themselves based on precision capabilities, speed of customization, and ability to handle diverse material types and thicknesses. The distribution channel segment is crucial for market reach and timely project delivery. This includes a mix of direct sales channels for large, custom architectural projects and indirect channels utilizing industrial distributors, metal service centers, and specialized resellers who maintain regional inventory and provide localized cutting and finishing services. Direct channels ensure better communication regarding complex specifications, while indirect channels provide immediate availability for standard products and smaller orders.

The downstream segment involves the end-user applications and final installation. Key customers include large construction firms, original equipment manufacturers (OEMs) in the automotive and machinery sectors, and specialist sub-contractors focused on HVAC installation or safety barriers. The value chain concludes with post-sales service, including material testing and technical support, especially for applications requiring specific certifications (e.g., fire rating, seismic performance). Effective coordination between midstream manufacturers and downstream installers is vital, as errors in sizing or material specification can lead to significant project delays and cost overruns. The shift towards just-in-time delivery models is increasing the pressure on distributors to maintain agile inventory and processing capabilities close to major metropolitan and industrial areas.

Perforated and Expanded Metal Market Potential Customers

Potential customers for perforated and expanded metal products are diverse, primarily concentrated within sectors where structural integrity, ventilation, filtration, and aesthetic design are critical performance criteria. The largest category of buyers is the Construction and Infrastructure sector, encompassing both commercial and residential builders, as well as municipal and governmental agencies responsible for public works. These customers utilize the materials extensively for building facades, shading elements (brise soleil), decorative ceilings, industrial walkways, safety guardrails, and acoustic barriers along highways and railways. Their purchasing decisions are driven by architectural specifications, compliance with building codes, durability, and total lifecycle cost, often requiring material certifications for corrosion resistance and load-bearing capacity.

Another major segment comprises Original Equipment Manufacturers (OEMs), particularly those in the Automotive, Machinery, and HVAC industries. Automotive manufacturers are high-volume purchasers, using these materials for vehicle grilles, heat shields, interior trim, and protective components, prioritizing lightweight aluminum variants to enhance fuel efficiency. Machinery manufacturers utilize expanded metal for protective enclosures and guards around moving parts, mandated by industrial safety standards. HVAC system integrators and filter manufacturers require highly specific, precise perforations and mesh sizes in stainless steel or aluminum for air intake screens, sound attenuation baffles, and particulate filters to ensure optimal system performance and air quality compliance in commercial buildings.

Specialized industrial segments also represent significant high-value potential customers. These include the Chemical and Pharmaceutical Processing industries, which demand materials with exceptional corrosion resistance, such as high-grade stainless steel or specialty alloys, for use in industrial strainers, conveyor guards, and separation screens. Furthermore, the burgeoning Renewable Energy sector, including solar and wind farms, uses expanded metal mesh for security fencing, ground mounts, and internal component protection against debris and weather elements. These diverse end-user requirements necessitate that manufacturers offer extensive customization capabilities regarding material composition, thickness, pattern geometry, and secondary finishing services like powder coating or anodization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McNICHOLS Company, Metalex, Expanded Metal Company, Direct Metals Company, Accurate Perforating Company, Biondo Steel, Hendrick Manufacturing Co., Alabama Metal Industries Corporation (AMICO), Norsk Perforering A/S, Newark Wire Cloth Company, P&R Specialty, Reliable Expanded Metal, Wire Cloth Manufacturers, Anping County Anrun Wire Mesh, Dongfu Wire Mesh |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perforated and Expanded Metal Market Key Technology Landscape

The manufacturing technology landscape for perforated and expanded metal is highly sophisticated, focusing on increasing production speed, precision, and material utilization efficiency. For perforated metal, the core technology revolves around high-speed CNC punching presses, which utilize multi-tool turret systems and rotary tooling to create precise patterns rapidly. Modern presses are often equipped with advanced servo-electric drives, offering faster acceleration and deceleration compared to traditional hydraulic systems, which translates directly into higher production throughput and superior hole geometry quality, particularly for complex and micro-perforated patterns. Furthermore, computer-aided manufacturing (CAM) software is integral, optimizing tool paths and nesting layouts to minimize scrap material and facilitate quick changeovers between different design specifications, which is vital in the customized architectural market segment.

In the expanded metal segment, the technology focuses on the precision of the slitting and stretching process. Advanced expanding presses utilize highly engineered knives and dies that ensure consistent mesh size (SWD and LWD) and web thickness across the entire sheet, crucial for maintaining structural integrity and meeting stringent load-bearing standards required in industrial walkways and safety guards. Recent innovations include specialized flattening and leveling processes that convert the standard "raised" mesh into a flattened sheet without compromising the material's structural strength, broadening its applicability in facades and decorative panels. Material handling automation, including robotic sheet loading and stacking, is increasingly employed to handle the large, heavy sheets of metal efficiently and safely, minimizing manual intervention and reducing the potential for surface damage.

Surface finishing and coating technologies also play a pivotal role in the market's technological landscape, enhancing the lifespan and aesthetic properties of the final product. Techniques such as electro-galvanization, hot-dip galvanizing, powder coating, and anodizing (for aluminum) provide superior resistance against corrosion, UV exposure, and wear, extending the materials' use in harsh exterior environments. Specialized acoustic engineering techniques are being developed, focusing on tailored micro-perforation patterns combined with backing materials to achieve precise sound absorption coefficients required for recording studios, concert halls, and office spaces. The synergistic deployment of these advanced manufacturing, coating, and design technologies allows manufacturers to meet the increasingly demanding and varied performance criteria specified by architects and industrial engineers globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by unparalleled levels of urbanization and massive government investments in infrastructure, including railways, airports, and smart city development across China, India, and Southeast Asia. The region’s strong manufacturing base, particularly in automotive production and electronics, creates consistent demand for filtration components and protective mesh. Lower labor costs, coupled with increasing technological adoption in automated manufacturing, enable regional players to maintain competitive pricing, further solidifying the region's market leadership. Demand is particularly high for carbon steel and aluminum perforated products used in commercial facade cladding and industrial safety applications.

- North America: North America represents a mature, high-value market characterized by strict building codes, safety regulations, and a focus on premium, aesthetically driven architectural applications. The U.S. and Canada demand high-grade stainless steel and specialized alloys for robust industrial environments, particularly in the oil & gas, chemical processing, and marine sectors where corrosion resistance is paramount. Market growth is sustained by significant public spending on infrastructure repair and modernization, along with a growing trend toward green building certifications, favoring expanded metal for its sustainable production process. Technological maturity allows for greater customization and integration of perforated panels into advanced HVAC and sound control systems.

- Europe: Europe holds a strong position, distinguished by its emphasis on sustainable construction, energy efficiency, and high design standards. Regulations related to noise pollution and workplace safety drive consistent demand for specialized acoustic panels and certified industrial flooring/walkways. Western European countries, particularly Germany and the UK, are leaders in utilizing architectural mesh for building envelopes, solar shading, and contemporary public art installations. The market is highly sensitive to the cost of raw materials and faces strict environmental directives regarding material sourcing and processing waste, pushing manufacturers toward innovative, eco-friendly production methods.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily tied to fluctuating economic stability and regional investments in mining, construction, and basic infrastructure projects. Countries like Brazil and Mexico are key markets, showing increasing adoption of perforated and expanded metals in industrial security fencing, agricultural screening, and affordable housing construction. Challenges include navigating logistical complexities and addressing currency volatility, but the long-term potential remains strong due as governmental focus shifts towards modernizing transportation networks and addressing housing shortages.

- Middle East and Africa (MEA): The MEA region exhibits significant, albeit concentrated, growth opportunities, predominantly centered around large-scale construction projects in the Gulf Cooperation Council (GCC) states (Saudi Arabia, UAE, Qatar). Major demand drivers include new airport developments, expo facilities, and luxurious residential complexes that use perforated and expanded metals extensively for decorative facades, ventilation screens, and solar control systems, where aesthetic appeal and thermal management are critical. Demand in Africa is rising steadily, primarily linked to resource extraction industries (mining, energy) requiring robust protective mesh and grating for operational safety and security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perforated and Expanded Metal Market.- McNICHOLS Company

- Metalex

- Expanded Metal Company

- Direct Metals Company

- Accurate Perforating Company

- Biondo Steel

- Hendrick Manufacturing Co.

- Alabama Metal Industries Corporation (AMICO)

- Norsk Perforering A/S

- Newark Wire Cloth Company

- P&R Specialty

- Reliable Expanded Metal

- Wire Cloth Manufacturers

- Anping County Anrun Wire Mesh

- Dongfu Wire Mesh

- Ametco Mfg. Corp.

- Dartmouth Metals Ltd.

- RMIG A/S

- Perforated Metals Inc.

Frequently Asked Questions

Analyze common user questions about the Perforated and Expanded Metal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of expanded metal over perforated metal?

Expanded metal is produced without material waste, offering cost efficiency and a higher strength-to-weight ratio compared to perforated sheet metal. Its one-piece construction provides greater structural integrity and load-bearing capacity, making it superior for walkways, safety gratings, and high-security applications, while perforated metal is often preferred for precise acoustic or aesthetic purposes.

Which application segment is driving the highest growth in the Perforated and Expanded Metal Market?

The Filtration and Screening application segment is anticipated to exhibit the fastest growth, primarily driven by increasingly stringent environmental regulations globally concerning industrial air quality and wastewater treatment. This necessitates the use of high-precision perforated and expanded metals for efficient separation and purification processes across HVAC, chemical, and pharmaceutical sectors.

How does raw material volatility affect the profitability of market manufacturers?

Raw material volatility, especially in steel and aluminum commodity markets, is a major restraint as these costs constitute a significant portion of production expenses. Manufacturers typically employ strategies such as forward contracts, long-term supply agreements, and inventory hedging to stabilize input costs, though sharp unexpected price increases can compress profit margins significantly, especially for projects with fixed-price contracts.

What is the role of CNC technology in the production of modern perforated metal sheets?

Computer Numerical Control (CNC) technology is fundamental, enabling high-speed, high-precision punching and stamping operations. CNC presses ensure exact dimensional consistency, minimize tooling changeover time, and allow for the cost-effective creation of complex, customized perforation patterns essential for architectural facades and specialized acoustic panels, dramatically improving manufacturing efficiency and design flexibility.

Why is the Asia Pacific region the leading consumer of perforated and expanded metals?

The Asia Pacific region leads consumption due to robust and continuous infrastructure development, accelerated urbanization rates, and massive public and private investments in commercial and residential construction, particularly in rapidly industrializing economies like China and India. Favorable government policies and expanding manufacturing capacities further bolster demand across transportation and industrial safety sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager