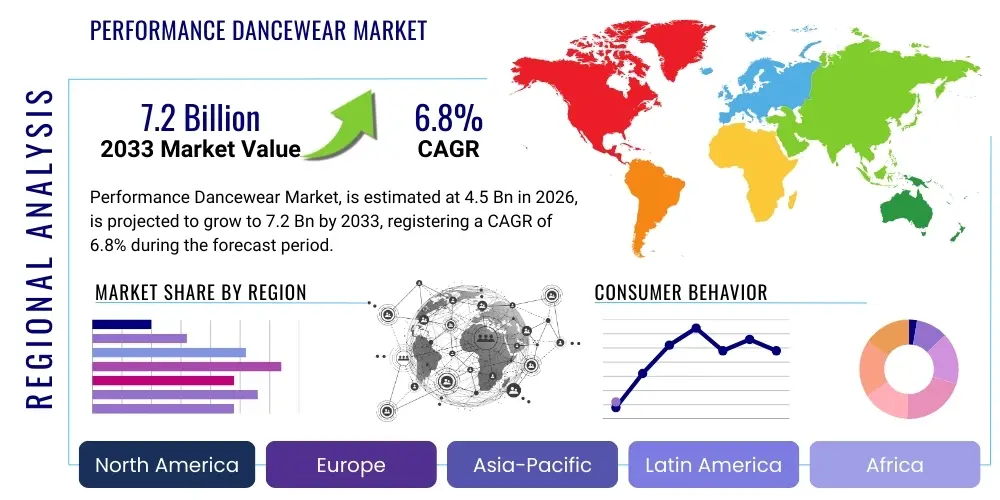

Performance Dancewear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443187 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Performance Dancewear Market Size

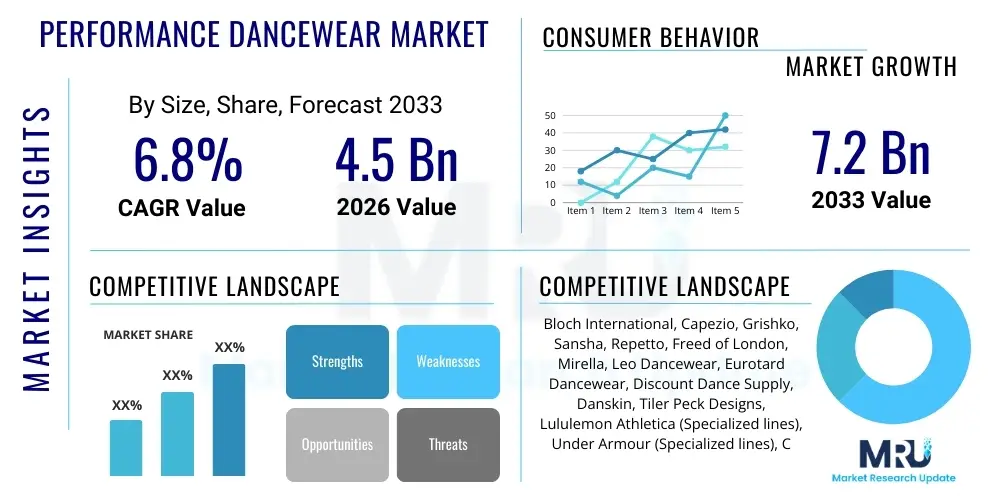

The Performance Dancewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global popularity of organized dance forms, particularly competitive genres and specialized fitness routines, coupled with significant advancements in textile technology that enhance product comfort, durability, and functional performance across various disciplines.

Performance Dancewear Market introduction

The Performance Dancewear Market encompasses specialized apparel, footwear, and accessories meticulously designed for various professional and amateur dance disciplines, including classical ballet, contemporary dance, jazz, tap, and specialized fitness activities like Barre and Zumba. Key products include leotards, tights, tutus, specialized unitards, pointe shoes, jazz shoes, and related warm-up attire, all engineered to maximize the dancer's range of motion, optimize physical performance, and ensure adherence to aesthetic requirements of specific dance styles. These garments differ significantly from general athletic wear due to their stringent requirements for precise fit, moisture management, compression support, and aesthetic integrity, demanding the use of high-stretch synthetic blends such as Lycra, spandex, and specialized microfiber textiles. The fundamental objective of performance dancewear manufacturers is to integrate high-level functionality with traditional design elements required for stage performance and rigorous training environments.

Major applications for performance dancewear span professional dance companies, academic institutions offering dance curricula, competitive dance studios, and individual amateur dancers participating in recreational classes. The benefits derived from using specialized performance attire are multifaceted, encompassing injury prevention through targeted muscle support, improved kinetic feedback, and enhanced longevity of the garments under continuous strenuous use. Furthermore, modern performance dancewear often integrates thermal regulation properties and superior breathability, critically important during extended rehearsal sessions or high-intensity competitive events. This market is highly sensitive to fashion cycles within the dance community while also being governed by the practical necessity of durable, fit-optimized products required for demanding physical activities.

The market's robust growth trajectory is underpinned by several powerful driving factors, including the increasing globalization and commercialization of dance through reality television shows, international competitions, and social media platforms that elevate the visibility of the art form. The concurrent surge in health and wellness awareness globally has positioned dance as a desirable form of physical fitness, expanding the consumer base beyond traditional professional circles. Innovation in material science, particularly the introduction of sustainable, lightweight, and antimicrobial fabrics, also serves as a critical growth accelerator, encouraging dancers to frequently update their wardrobes for enhanced performance and hygiene. Moreover, rising disposable incomes in emerging economies allow for greater investment in specialized training equipment and apparel, further solidifying the market’s positive outlook throughout the forecast period.

Performance Dancewear Market Executive Summary

The global Performance Dancewear Market is characterized by intense competition and rapid product innovation, driven primarily by the confluence of technical textile advancements and evolving consumer demand for style integrated with high functionality. A significant business trend observed across the market landscape is the shift toward Direct-to-Consumer (DTC) models, leveraging e-commerce platforms to offer customized sizing options and foster deeper brand engagement with specialized consumer segments, circumventing traditional, often fragmented, retail distribution networks. Furthermore, sustainability and ethical sourcing have emerged as pivotal purchasing criteria, compelling leading manufacturers to invest heavily in eco-friendly material research, such as recycled polyesters and organic cotton blends, to appeal to a socially conscious customer base, particularly in North America and Western Europe. Customization, facilitated by digital design tools and on-demand manufacturing, is rapidly transforming the supply chain, allowing for quick response to niche demands and personal preferences, thereby minimizing inventory risk and enhancing customer loyalty.

Regionally, the market exhibits divergent growth profiles. North America and Europe currently represent the largest market shares, characterized by a mature infrastructure supporting professional ballet, extensive competitive dance circuits, and established consumer brand loyalty. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is fueled by the burgeoning middle class in countries like China and India, increasing penetration of Western dance forms, and significant governmental investment in cultural and sports education, leading to a proliferation of dance schools and academies. Latin America and the Middle East & Africa (MEA) are also showing promising, albeit slower, growth, often tied to localized cultural dances and the gradual adoption of global competitive dance standards, presenting opportunities for strategic market entry by international brands focused on localized product adaptations.

Segment-wise, the Apparel segment, comprising leotards, tights, and specialized warm-ups, retains the dominant market share, benefiting from high replacement frequency and seasonal style changes. Within Apparel, technical fabrics offering superior compression, moisture-wicking, and seamless construction are driving premiumization. The Footwear segment, although smaller by volume, is crucial for market value and innovation, particularly in specialized footwear such as pointe shoes and jazz sneakers. Innovations in 3D-printed sole structures, lightweight material utilization, and advanced fitting systems are paramount in this segment to address critical issues of comfort, support, and longevity for serious dancers. Distribution channel trends indicate a continued acceleration of online sales, capitalizing on the niche nature of the products, which benefits from specialized online fitting guides and global delivery capabilities, while traditional specialty retail stores maintain importance for personalized fitting services, especially for sensitive products like pointe shoes.

AI Impact Analysis on Performance Dancewear Market

Analysis of common user questions regarding AI's influence in the Performance Dancewear Market reveals primary concerns centered on personalized fit accuracy, supply chain agility, and the potential for AI-driven design innovation. Users frequently inquire whether AI can resolve the long-standing challenge of finding perfectly fitting specialized apparel and footwear, particularly in custom sizing for rapidly growing competitive dancers. There is high expectation concerning AI's ability to forecast micro-trends in specific dance disciplines, enabling manufacturers to rapidly prototype and launch relevant collections, thus minimizing waste and maximizing responsiveness. Furthermore, users are keen to understand how AI-powered visualization and virtual fitting tools will enhance the online purchasing experience, which is currently hindered by the necessity of physical try-ons for critical items like pointe shoes and supportive leotards. The overarching theme is the integration of AI to move the market beyond standardized sizing toward hyper-personalized performance solutions.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is poised to fundamentally revolutionize the design, manufacturing, and retail aspects of performance dancewear. In the design phase, AI tools analyze vast datasets of anatomical measurements, movement patterns captured via motion sensors, and performance feedback to create generative designs that optimize fabric stress points and ergonomic contours, leading to significantly enhanced garment functionality and reduced design cycles. This shift allows manufacturers to design highly customized patterns instantaneously, addressing the diverse body types and specific movement requirements inherent in different dance styles (e.g., the high-flex demands of contemporary dance versus the structural requirements of classical ballet costumes). This analytical capability supports the creation of true performance-enhancing apparel rather than merely aesthetic costuming.

In the supply chain and consumer experience domains, AI is deployed to manage demand forecasting with unprecedented accuracy, correlating real-time consumer purchasing data with competitive dance schedules, academy enrollment rates, and social media trends to predict material requirements and production volumes precisely. For consumers, AI-powered 3D body scanning and virtual fitting technologies, accessible via mobile devices, are transforming e-commerce. These tools allow dancers to submit accurate body measurements and receive personalized size recommendations, significantly lowering return rates and increasing consumer confidence in purchasing specialized items online. This technological leap addresses a core restraint of the niche dancewear market—the difficulty in ensuring proper fit without extensive in-store consultation—thereby accelerating global digital adoption.

- AI-driven predictive analytics optimize inventory levels for seasonal and competitive demand fluctuations.

- Generative Design algorithms create anatomically optimized dancewear patterns based on biomechanical data input.

- Virtual reality and augmented reality fitting tools, powered by machine vision, enhance online sizing accuracy for specialized footwear and apparel.

- Machine Learning analyzes historical sales and trend data to accelerate product development cycles, ensuring responsiveness to niche market aesthetics.

- Automated quality control systems use computer vision to inspect seams and fabric integrity during the manufacturing process, reducing defects.

- Personalized marketing and recommendation engines tailor product offerings based on the dancer's specific style, skill level, and training intensity.

DRO & Impact Forces Of Performance Dancewear Market

The dynamics of the Performance Dancewear Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces guiding industry growth and evolution. Key market drivers include the pervasive influence of media, such as global dance-themed reality television shows and cinematic productions, which significantly boost public interest and participation rates, creating an expanding pool of potential consumers requiring specialized attire. Furthermore, the increasing global emphasis on competitive dance, which necessitates frequent wardrobe updates for different routines and high-quality, durable garments for intensive training, provides a continuous revenue stream. The technological advancements in textile manufacturing, delivering superior functional properties like enhanced elasticity, compression, and thermal regulation, also act as a crucial driver, encouraging professional and serious amateur dancers to upgrade to the latest performance fabrics for marginal competitive advantages.

Conversely, the market faces significant restraints that dampen overall growth potential. One primary restraint is the relatively high cost of advanced, technical fabrics, coupled with specialized manufacturing techniques required for items like professional pointe shoes or seamless performance leotards, leading to high retail prices that can restrict purchases, particularly in budget-sensitive amateur segments or developing regions. Additionally, the market suffers from the widespread issue of counterfeiting and low-quality imitation products, especially those sold through unauthorized online channels, which erodes the brand equity of established manufacturers and can pose safety risks to dancers relying on specific structural support. The inherently fragmented nature of the distribution channel, particularly the reliance on specialized local dance boutiques for personalized fitting, presents logistical challenges for large-scale international expansion and standardization.

Opportunities for exponential growth are concentrated primarily in two areas: geographic expansion into emerging markets and technological innovation in product offerings. The growing affluence and cultural globalization across Asian markets represent vast untapped consumer bases for professional-grade dancewear. Technologically, the integration of smart textiles that incorporate sensors to monitor biomechanical data, track injury risk, or assess posture offers a lucrative avenue for premium product development, transforming dancewear from passive attire into active training equipment. Furthermore, addressing the demand for environmentally sustainable products through certified supply chains and recyclable materials presents a powerful opportunity for market differentiation and capturing the loyalty of younger, environmentally aware demographics, mitigating existing restraints related to high material costs through value-added product positioning. These impact forces necessitate strategic investment in R&D and targeted regional marketing strategies for sustained market leadership.

Segmentation Analysis

The Performance Dancewear Market is meticulously segmented across dimensions including product type, application, end-user, and distribution channel, reflecting the specialized and nuanced nature of the dance industry. Product segmentation typically includes Apparel (e.g., leotards, tights, skirts, unitards, warm-up wear), Footwear (e.g., ballet slippers, pointe shoes, jazz shoes, tap shoes, contemporary shoes), and Accessories (e.g., knee pads, hair nets, bags, injury support items). The Apparel segment dominates the market due to its high volume and necessity for varied training and performance contexts, while the Footwear segment, although smaller, commands higher average selling prices and drives technical innovation. Understanding these segments is crucial as design complexity, material science requirements, and average price points vary drastically between a technical leotard and a handcrafted professional pointe shoe.

Further segmentation by end-user differentiates between professional dancers (those earning income from performing or teaching, requiring the highest quality and durability), amateur dancers (those participating recreationally or in low-level competitive settings), and dance academies/institutions (bulk buyers prioritizing value and consistent supply). This delineation influences marketing strategies and pricing tiers, with professional dancers often prioritizing brand reputation, specific material composition, and ergonomic precision, while amateur segments may be more responsive to style, color trends, and affordability. Additionally, application-based segmentation (Ballet, Jazz/Tap, Modern/Contemporary, Specialized Fitness) dictates specific design features; for example, ballet wear focuses on classical lines and structural support, whereas contemporary wear emphasizes fluid movement and seamless construction.

The distribution channel analysis is critical for market access, dividing sales between Offline channels (specialty retail stores, dedicated dance boutiques, department stores) and Online channels (e-commerce platforms, brand-specific websites). Offline channels remain indispensable for products requiring precise, specialized fitting, such as pointe shoes, where expert assistance is mandatory to prevent injury. Conversely, online channels are rapidly gaining traction for standardized apparel and general warm-up gear, offering global reach, extensive inventory, and competitive pricing, particularly appealing to the younger, digitally native consumer base. Strategic brands utilize an omnichannel approach, integrating online presence for visibility and ease of replenishment with specialized brick-and-mortar locations for critical fitting services and community engagement.

- Product Type:

- Apparel (Leotards, Tights, Skirts, Warm-ups)

- Footwear (Ballet Slippers, Pointe Shoes, Jazz Shoes, Tap Shoes)

- Accessories (Bags, Hair Accessories, Support/Injury Gear)

- End-User:

- Professional Dancers

- Amateur/Recreational Dancers

- Dance Schools & Institutions

- Application:

- Ballet

- Jazz & Tap

- Modern & Contemporary

- Specialized Fitness & Other Disciplines

- Distribution Channel:

- Online (E-commerce, Brand Websites)

- Offline (Specialty Retail Stores, Department Stores)

Value Chain Analysis For Performance Dancewear Market

The value chain for the Performance Dancewear Market is characterized by a complex structure, starting with high-tech raw material sourcing and culminating in highly specialized retail distribution. The upstream segment involves the procurement and processing of specialized raw materials, primarily focusing on synthetic fibers such as high-grade spandex, Lycra, Tactel, and moisture-wicking microfibers, alongside natural fibers like specialized cotton blends used for comfort and breathability. Innovation at this stage is crucial, as the performance characteristics—elasticity retention, compression level, durability, and hand feel—are determined by these inputs. Key suppliers often include specialized textile manufacturers who possess the technological expertise to produce fabrics meeting stringent performance standards required for active wear, necessitating strong, collaborative relationships between fabric producers and performance wear manufacturers to co-develop proprietary materials that offer a competitive edge in flexibility and longevity.

The midstream phase, encompassing design, manufacturing, and quality control, is labor-intensive and highly specialized. Design requires input from professional dancers, biomechanical experts, and fashion specialists to ensure garments are both aesthetically appropriate for various dance forms and functionally optimized for movement. Manufacturing processes often involve seamless knitting technology, specialized stitching to prevent chafing, and sophisticated cutting patterns to achieve the required fit and support without restricting motion. This stage is where intellectual property, such as proprietary shoe construction methods or patented fabric finishing, contributes significantly to product value. Quality control is particularly rigorous for items like pointe shoes, which are often handcrafted or utilize hybrid manufacturing techniques, demanding meticulous inspection to ensure structural integrity and consistent sizing crucial for dancer safety.

Downstream activities focus on marketing and distribution, where the distinction between direct and indirect channels is pronounced. Direct distribution, via brand-owned physical stores and dedicated e-commerce platforms, allows manufacturers to maintain higher margins, control brand image, and gather direct consumer feedback, which is vital for quick product iteration. Indirect distribution relies heavily on specialty dance retail boutiques, which act as essential intermediaries, especially for fitting services for footwear and complex sizing apparel. These boutiques provide expert knowledge and personalized consultation, a non-negotiable service for novice and professional dancers alike, cementing their role as a critical component of the distribution channel. The marketing efforts are often targeted through dance academies, sponsorships of professional troupes, and digital campaigns emphasizing performance benefits and specialized design features to reach the highly engaged, niche consumer base effectively.

Performance Dancewear Market Potential Customers

The primary customer base for the Performance Dancewear Market is diverse yet highly segmented, comprising individuals and institutions dedicated to formal dance and related physical activities. Professional dancers, including members of international ballet companies, modern dance troupes, and theatrical performers, constitute a premium segment, prioritizing products offering maximum durability, performance enhancement, and specific aesthetic adherence required for high-stakes performances and continuous daily training. This segment demands the highest quality materials, precise sizing, and specialized support features, leading to repeat purchases based on stringent replacement cycles dictated by usage intensity. Brands catering to professionals often establish close relationships with companies to prototype and test new products, leveraging these endorsements for broader market visibility.

A significantly larger volume segment is composed of amateur and recreational dancers, ranging from children participating in local studio classes to adults engaging in dance for fitness or hobby. This segment is highly sensitive to trends, color palettes, and accessible pricing, but still requires adequate functional quality for training purposes. Parents of young dancers often represent a key purchasing demographic, focusing on comfort, ease of care, and value for money, driving demand for durable, multi-purpose apparel and introductory footwear. Furthermore, competitive dancers, regardless of age, represent a rapidly growing, high-spending sub-segment, necessitating frequent purchases of specialized costumes and attire for various routines, making them prime targets for rapid fashion cycles and trend-driven sales strategies.

Institutional buyers, such as private dance academies, public school programs, universities offering dance degrees, and specialized fitness centers (e.g., Barre, Pilates), form another critical customer category. These entities often make bulk purchasing decisions for uniforms, mandated training attire, and rehearsal supplies, valuing long-term supply contracts, consistent quality, reliable inventory availability, and institutional discounts. The expansion of these educational and training institutions globally, particularly in emerging markets where dance education is becoming formalized, directly fuels demand across all product categories, from basic practice wear to advanced performance gear. Catering to institutional needs requires specialized B2B sales and logistics capabilities, distinct from direct consumer sales strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bloch International, Capezio, Grishko, Sansha, Repetto, Freed of London, Mirella, Leo Dancewear, Eurotard Dancewear, Discount Dance Supply, Danskin, Tiler Peck Designs, Lululemon Athletica (Specialized lines), Under Armour (Specialized lines), Chacott, Wear Moi, Zarely, Intermezzo, Bal Togs, Attitude Dancewear |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Performance Dancewear Market Key Technology Landscape

The technological landscape of the Performance Dancewear Market is rapidly evolving, driven primarily by innovations in material science and digital customization tools aimed at maximizing dancer comfort, safety, and performance longevity. Central to this evolution is the utilization of advanced technical textiles, which move far beyond traditional cotton and standard nylon/spandex blends. Modern performance fabrics incorporate seamless knitting technologies that eliminate chafing points, highly efficient moisture management systems (wicking and quick-dry finishes) for thermal regulation during intense activity, and specialized compression zoning. Compression wear, in particular, is engineered with variable tension to support muscle groups, reduce fatigue, and aid in post-performance recovery, appealing strongly to professional and competitive dancers seeking marginal performance gains. Furthermore, antimicrobial treatments are increasingly integrated into fabric finishes to ensure hygiene and extend the usable life of high-investment garments, addressing a significant consumer concern within the niche market.

Another transformative technology is the integration of digital manufacturing and body measurement systems, vital for addressing the inherent difficulty of specialized fitting. Three-dimensional (3D) body scanning technology allows retailers and manufacturers to capture precise anatomical data of the dancer, ensuring that customized garments and, crucially, specialized footwear like pointe shoes, are manufactured or selected with unprecedented accuracy. This move towards data-driven sizing minimizes the risk of injury caused by poorly fitting gear and allows manufacturers to utilize 3D printing for rapid prototyping of shoe components (e.g., shanks, boxes) to cater to individual foot shapes and strength levels. This level of customization, once manual and time-consuming, is now being streamlined through digital workflows, significantly reducing the lead time for highly specialized products and allowing mass customization to become a viable business model for premium brands.

The future technology landscape is centered on the adoption of smart textiles and wearable technology. While still nascent, the integration of micro-sensors into performance wear allows for the real-time monitoring of biomechanical data, including posture, alignment, muscle exertion, and even impact forces. This data can provide immediate feedback to dancers and instructors, optimizing training techniques and potentially preventing chronic injuries. For example, pressure-sensing elements within shoe soles or specific garment zones could wirelessly transmit data on weight distribution and movement efficiency. Although regulatory and cost hurdles remain, the potential application of these technologies to create "active performance wear" that provides quantifiable feedback represents the next major technological leap, positioning dancewear as a high-tech athletic equipment sector rather than just an apparel category, further justifying premium price points and attracting investment in research and development.

Regional Highlights

- North America: North America holds the largest market share, characterized by mature consumer markets, high participation rates in competitive dance, and strong brand presence from major international and domestic players. The region drives global trends in technical textile adoption and athleisure integration within dancewear. The United States, in particular, benefits from extensive professional circuits and a highly commercialized dance education system, leading to high annual expenditure per dancer. Innovation often focuses on sustainability, diverse sizing options, and advanced e-commerce experiences utilizing virtual fitting technologies to serve a geographically dispersed clientele.

- Europe: Europe is a highly significant market, particularly due to its deep historical roots in classical ballet (e.g., France, UK, Russia) and its strong institutional framework of professional companies and academies. The market emphasizes heritage brands, artisanal quality, and specialized, handcrafted products, especially in footwear manufacturing (like Freed of London or Repetto). Western Europe exhibits high adoption of premium, durable apparel, while Eastern Europe is seeing accelerating growth driven by rising disposable incomes and increased commercial investment in dance education and performance venues, fueling demand for both classical and contemporary attire.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, projected to exhibit the highest CAGR during the forecast period. This rapid growth is propelled by increasing Western cultural influence, governmental promotion of physical activity, and soaring middle-class income levels in countries such as China, South Korea, and Japan. While traditional dance forms remain strong, the acceptance and proliferation of competitive ballet, jazz, and hip-hop are creating massive demand for specialized performance gear. Market players often focus on establishing strong local distribution partnerships and offering culturally adapted designs and sizing to penetrate this diverse region effectively.

- Latin America (LATAM): The LATAM region presents significant growth potential, albeit from a smaller base. Brazil and Mexico are leading the regional growth, driven by both traditional dance forms and a rising interest in international competitive dance styles and dance fitness programs. Market expansion is dependent on improving economic stability and reducing barriers to entry for specialized international brands. Pricing strategies are critical here, often requiring regional manufacturers to focus on balancing quality with affordability to cater to a price-sensitive yet growing consumer base.

- Middle East & Africa (MEA): The MEA market is highly varied. The Middle East shows growing demand linked to expatriate communities, luxury retail presence, and new investment in large-scale cultural and sports infrastructure. Africa’s growth is nascent but promising, primarily focused around major urban centers and educational institutions, requiring highly localized distribution models. Growth drivers often include investments in organized sports and performing arts, leading to a gradual but steady requirement for formalized dance apparel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Performance Dancewear Market.- Bloch International

- Capezio

- Grishko

- Sansha

- Repetto

- Freed of London

- Mirella

- Leo Dancewear

- Eurotard Dancewear

- Discount Dance Supply

- Danskin

- Tiler Peck Designs

- Lululemon Athletica (Specialized lines)

- Under Armour (Specialized lines)

- Chacott

- Wear Moi

- Zarely

- Intermezzo

- Bal Togs

- Attitude Dancewear

Frequently Asked Questions

Analyze common user questions about the Performance Dancewear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Performance Dancewear Market globally?

The primary drivers are the increasing global participation in competitive and specialized dance activities, the widespread influence of media showcasing dance, and continuous technological advancements in textiles that improve garment comfort, flexibility, and durability, thus encouraging frequent product replacement and upgrades.

How is technological innovation impacting the design and fit of dance footwear, especially pointe shoes?

Technology is crucial, particularly through the adoption of 3D body scanning for precise anatomical measurement and 3D printing for customized shoe components (shanks and boxes). This customization ensures an optimal fit, which is vital for dancer safety and performance, significantly reducing injury risk associated with improperly fitted specialized footwear.

Which geographic region is expected to show the fastest growth rate in the market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by rising middle-class incomes, rapid globalization of Western dance forms, and increasing formal education in dance across key economies like China and India.

What role does sustainability play in current performance dancewear purchasing decisions?

Sustainability has become a key purchasing criterion, especially in mature markets like North America and Western Europe. Consumers increasingly favor brands that use eco-friendly materials, recycled fibers, and ethical manufacturing practices, leading manufacturers to prioritize sustainable sourcing and transparency in their supply chains.

What are the main distribution channels for specialized dance apparel and footwear?

The market utilizes an omnichannel approach, consisting of offline specialty retail boutiques (essential for customized fitting and professional consultation, particularly for pointe shoes) and rapidly expanding online e-commerce platforms (used for standard apparel, convenience, and global reach).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager