Perfume Bottle Crimping Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443184 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Perfume Bottle Crimping Machine Market Size

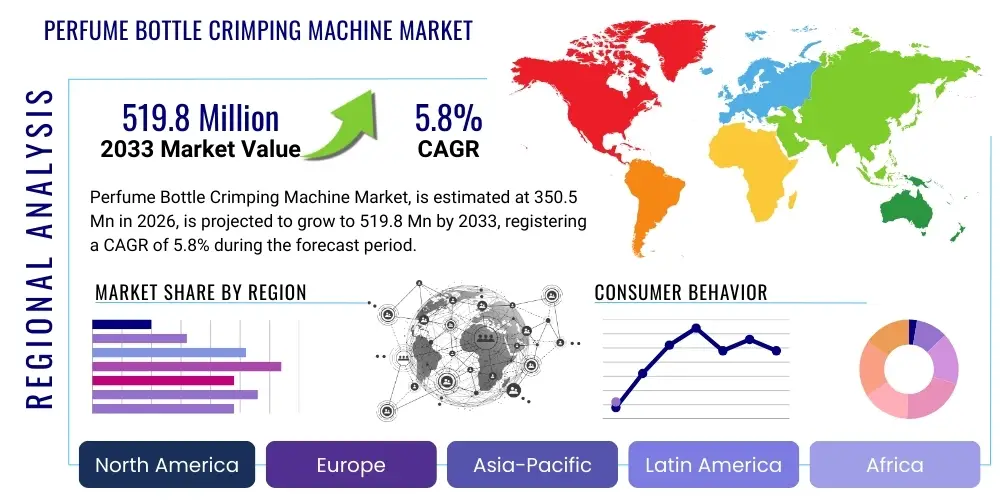

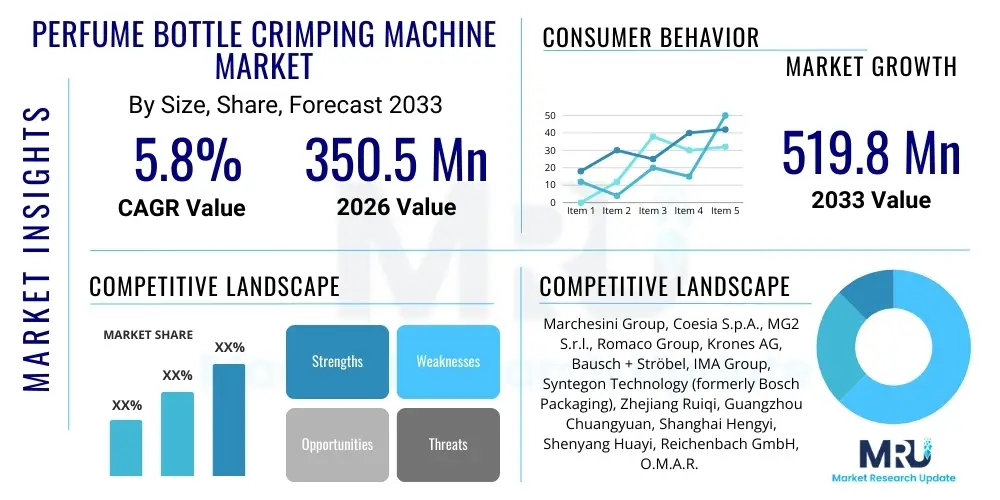

The Perfume Bottle Crimping Machine Market is projected to grow at a Compound Annual Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 519.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the sustained expansion of the global fragrance industry, which increasingly prioritizes high-speed, precision, and reliable sealing solutions for complex and aesthetically demanding perfume packaging.

Perfume Bottle Crimping Machine Market introduction

The Perfume Bottle Crimping Machine Market encompasses specialized industrial equipment designed to hermetically seal perfume bottles, primarily those utilizing glass containers and aluminum or plastic ferrule components, to ensure product integrity and prevent volatile ingredient evaporation. These sophisticated machines execute the crucial final step in the perfume manufacturing process, involving the precise compression and sealing of the atomizer pump onto the neck of the glass bottle. Product descriptions vary from compact, semi-automatic benchtop models catering to small-batch artisanal producers to fully integrated, high-throughput automatic rotary systems suitable for large multinational cosmetic and fragrance conglomerates. Major applications span high-end luxury fragrances, mass-market Eau de Toilette production, and specialized contract packaging services where versatility and quick changeovers are paramount. The principal benefits derived from utilizing advanced crimping technology include superior seal quality, minimization of leakage and contamination risks, enhanced production line efficiency, and maintenance of aesthetic uniformity across large production runs. Key driving factors propelling market expansion include the surging global demand for personal care and luxury goods, stringent quality control standards necessitating highly precise sealing mechanisms, and the continuous push towards greater automation in packaging operations to reduce labor costs and improve throughput capacity.

The technical evolution within this market centers on improving crimping head precision and adaptability to diverse bottle neck diameters and heights, which are often customized for brand differentiation. Modern crimping machines incorporate advanced features such as servo-driven mechanisms for repeatable force application, integrated vision systems for real-time quality assurance checks, and modular designs that facilitate rapid format changes between product lines. The complexity of handling delicate glass bottles at high speeds requires specialized indexing and handling systems, further defining the technological sophistication of leading market offerings. Moreover, the shift in consumer preference toward premium packaging materials and intricate bottle designs necessitates crimping machinery capable of managing these specialized requirements without compromising the structural integrity or visual appeal of the final product. The integration capabilities of these machines with upstream filling and downstream labeling and cartoning equipment are increasingly vital, establishing them as critical components in fully automated fragrance production lines.

Geographically, market growth is particularly pronounced in regions with rapidly expanding luxury consumer bases, such as the Asia Pacific, and in established manufacturing hubs like Western Europe and North America, where investments in advanced automation technology are high. The need for precise dosage and non-returnable closures in high-value perfume products mandates the use of reliable crimping technology, making these machines indispensable assets for manufacturers aiming to comply with international regulatory standards regarding packaging safety and consumer protection. Furthermore, the rising popularity of small-volume, travel-sized, and sample perfume formats, requiring equally precise miniature crimping capabilities, introduces new niche demands that specialized machine manufacturers are actively addressing, thereby diversifying the application scope of this essential packaging technology.

Perfume Bottle Crimping Machine Market Executive Summary

The Perfume Bottle Crimping Machine Market is experiencing robust expansion driven by fundamental shifts in consumer purchasing behavior favoring premium and differentiated fragrance products, coupled with pervasive industrial modernization trends globally. Key business trends include a pronounced move towards fully automatic, high-speed rotary crimpers equipped with sophisticated quality control sensors and predictive maintenance functionalities, optimizing uptime and reducing reliance on manual inspection. Manufacturers are focusing on developing highly flexible machines that can accommodate the wide variety of neck sizes and bottle shapes demanded by boutique and luxury brands, necessitating rapid changeover mechanisms and adaptive tooling. Regionally, the Asia Pacific market is poised for the fastest growth, underpinned by increasing disposable incomes, burgeoning domestic fragrance industries, and significant foreign investment in local manufacturing infrastructure, contrasting with the established, but mature, markets of North America and Europe, which are focusing primarily on replacing older machinery with technologically advanced, IoT-enabled units. Segment trends highlight the dominance of automatic machinery due to scalability and efficiency requirements, while specialized applications, such as small-diameter crimping for samples and miniatures, are creating profitable niche segments, further distinguishing the market by machine capacity and intended production volume.

AI Impact Analysis on Perfume Bottle Crimping Machine Market

Common user inquiries concerning AI integration in the Perfume Bottle Crimping Machine Market revolve around achieving zero-defect production through enhanced quality checks, optimizing maintenance schedules to minimize costly downtime, and adapting machine parameters dynamically based on real-time sensory input from the production environment. Users frequently ask: "How can AI vision systems differentiate between acceptable and faulty crimps at high speeds?" and "Will machine learning enable the crimper to self-adjust pressure settings based on minute variations in glass quality?" The key themes center on concerns regarding initial implementation costs versus long-term ROI, the reliability of predictive algorithms in complex mechanical systems, and the need for simplified human-machine interfaces (HMI) to manage the increased computational complexity. Expectations are high regarding AI's potential to dramatically elevate the consistency and traceability of the crimping process, moving beyond simple automation to genuine intelligent process control, ensuring brand protection and regulatory compliance globally. This drive is rooted in the recognition that even microscopic defects in the seal can compromise the high value of the encapsulated fragrance, making perfect crimping a critical operational mandate that AI is expected to address.

The application of Artificial Intelligence within the specialized domain of perfume bottle crimping machines primarily focuses on leveraging machine learning algorithms to interpret vast streams of operational data, transforming raw sensor readings into actionable insights. This includes predictive quality assurance, where sophisticated neural networks are trained on datasets representing successful and failed crimps, enabling the system to identify potential failure points before they manifest visually or mechanically. AI-driven systems monitor subtle variances in crimping force, rotational torque, and vibration patterns, correlating these metrics with the dimensional characteristics of the bottle neck and the ferrule material. Furthermore, the integration of deep learning-based vision systems allows for non-contact, high-speed inspection of the finished crimp, verifying proper seal geometry, ensuring the absence of glass chips, and confirming alignment, thereby drastically reducing the risk of product recall due to packaging failure. This level of real-time cognitive quality control far surpasses the capabilities of traditional deterministic automation, pushing manufacturing standards toward true six sigma quality levels in packaging.

Beyond quality control, AI fundamentally alters the maintenance paradigm within the perfume crimping sector. By analyzing operational history, component wear rates, and environmental factors, AI algorithms enable genuine predictive maintenance (PdM). These systems can forecast the remaining useful life (RUL) of critical components, such as the crimping jaws, bearings, and servo motors, scheduling maintenance interventions precisely when they are needed, rather than relying on fixed time intervals or reactive failure response. This minimizes unplanned downtime, which is particularly costly in high-volume fragrance production environments. Additionally, AI optimizes batch changeover procedures; by learning the optimal settings for specific bottle and ferrule combinations, the machine can automatically adjust pressure profiles and cycle times, accelerating setup and reducing material waste during the transition period. This capability significantly improves overall equipment effectiveness (OEE) and is a primary driver for investment among large-scale fragrance manufacturers seeking operational excellence and enhanced sustainability through minimized waste.

- AI-enabled Predictive Maintenance (PdM) reduces unplanned downtime by forecasting component failure in crimping mechanisms.

- Machine Vision Systems powered by deep learning detect microscopic crimp defects and misalignments in real-time at high throughput rates.

- Optimization of Crimping Parameters utilizes algorithms to dynamically adjust pressure and cycle time for material variances and format changes.

- Enhanced Traceability and Data Analytics provide detailed, timestamped crimp performance data for regulatory compliance and auditing.

- Automated Anomaly Detection identifies operational inefficiencies or material flaws not observable by human operators or traditional sensors.

DRO & Impact Forces Of Perfume Bottle Crimping Machine Market

The market dynamics for Perfume Bottle Crimping Machines are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate investment decisions and technological innovation. Key drivers include the exponential growth in global demand for luxury and specialty fragrances, which mandates precision, high-speed, and aesthetically consistent sealing technology to protect brand integrity. The sustained trend toward miniaturization and diversification of bottle formats necessitates increasingly versatile and adaptive machinery capable of handling a wide array of specifications efficiently. Furthermore, regulatory pressures related to product safety and anti-counterfeiting measures push manufacturers toward sophisticated, tamper-evident sealing solutions provided by modern crimpers. These forces collectively incentivize capital investment in next-generation automated systems that promise superior output quality and operational efficiency compared to legacy equipment, particularly in emerging economies where production capacity is rapidly scaling up.

Conversely, significant restraints hinder market growth and adoption. The primary restraint is the substantial initial capital expenditure required for purchasing fully automatic, high-precision crimping machines, which can be prohibitive for small and medium-sized enterprises (SMEs) or start-up fragrance houses. The operational complexity associated with integrating these machines into existing production lines, coupled with the necessity for highly specialized technical expertise for maintenance and troubleshooting, poses another critical barrier, especially in regions lacking a robust skilled labor force. Additionally, the increasing variety and complexity of innovative bottle and pump designs require frequent and expensive re-tooling and format part fabrication, adding to the total cost of ownership and sometimes slowing down the deployment of new product lines. These cost and complexity factors necessitate careful strategic planning by potential purchasers to ensure a favorable return on investment.

Opportunities for market stakeholders primarily lie in the integration of Industry 4.0 capabilities, allowing machines to communicate seamlessly with broader manufacturing execution systems (MES) and enterprise resource planning (ERP) platforms, thereby enabling real-time production monitoring and optimized resource allocation. There is also a significant untapped opportunity in developing specialized, cost-effective modular crimping solutions specifically tailored for high-growth artisanal and niche fragrance producers, offering scalable automation solutions that bridge the gap between manual and high-volume automatic machinery. The pursuit of sustainable packaging solutions, such as recyclable materials or novel closure methods, necessitates the development of compatible crimping technologies, offering manufacturers a competitive edge through innovation and compliance with circular economy principles. The impact forces thus strongly favor manufacturers who can deliver integrated, flexible, and intelligent crimping solutions that address both the efficiency needs of mass producers and the flexibility demands of luxury and custom packaging markets.

Segmentation Analysis

The Perfume Bottle Crimping Machine Market is rigorously segmented based on crucial operational and structural characteristics, allowing for targeted analysis of consumer needs and technological specialization within the packaging industry. The primary axes of segmentation typically include the degree of automation (manual, semi-automatic, automatic), the size and capacity of the machine (low-speed, medium-speed, high-speed), the specific diameter of the capping required (a critical parameter directly related to bottle neck size), and the end-user industry (differentiating between mass-market fragrance producers and specialized luxury brand manufacturers). This granular segmentation provides a clear framework for understanding market dynamics, allowing equipment suppliers to tailor their offerings—from compact, versatile benchtop units to massive, integrated rotary systems—to specific application requirements, ensuring optimal throughput and quality control based on the intended production scale. The evolution of segmentation reflects the increased demand for customized solutions, particularly in the high-end luxury segment where unique bottle designs necessitate bespoke crimping heads and specialized handling mechanisms.

- By Type:

- Manual Crimping Machines

- Semi-Automatic Crimping Machines

- Automatic Crimping Machines

- By Capacity/Speed:

- Low Speed (Under 1,000 bottles/hour)

- Medium Speed (1,000 - 5,000 bottles/hour)

- High Speed (Above 5,000 bottles/hour)

- By Capping Diameter:

- Under 15mm (Miniatures and samples)

- 15mm - 20mm (Standard fragrance sizes)

- Above 20mm (Large flacons and customized designs)

- By End-User Industry:

- High-Volume Production (Mass Market/Contract Manufacturing)

- Small & Medium Enterprises (SMEs) / Private Label

- Luxury & Boutique Manufacturing

- By Technology:

- Pneumatic Crimping

- Hydraulic Crimping

- Servo-Electric Crimping

Value Chain Analysis For Perfume Bottle Crimping Machine Market

The value chain for the Perfume Bottle Crimping Machine Market commences with upstream activities involving the sourcing of high-quality industrial components, raw materials such as specialized stainless steel, high-tolerance mechanical components, advanced servo motors, precision sensors, and programmable logic controllers (PLCs). Key upstream suppliers include manufacturers of high-performance bearings, hydraulic and pneumatic systems, and increasingly, specialized software developers providing integrated control and diagnostic platforms. The core value addition occurs during the manufacturing and assembly phase, where machine builders design, fabricate, and rigorously test the complex mechanical and electrical systems, ensuring the necessary precision and repeatability for high-speed operation. This manufacturing stage demands significant investment in R&D to develop proprietary crimping head technologies that minimize stress on delicate glass containers while achieving a perfect seal. Downstream analysis focuses on the distribution and installation phases, primarily through direct sales channels for major machinery providers who offer comprehensive after-sales service, technical training, and spare parts management. Indirect distribution, leveraging local agents and integrators, is more common for standard or semi-automatic benchtop models targeting smaller businesses. The efficiency of the distribution channel is critical, as machine uptime and rapid technical support are paramount concerns for high-volume end-users in the fragrance industry.

The intricate nature of the product mandates a strong emphasis on service and intellectual property protection within the value chain. Machine manufacturers not only sell hardware but also a portfolio of specialized tools, format parts, and software licenses critical for operational flexibility. The profitability of the value chain is highly sensitive to fluctuations in the cost of high-precision components and the availability of specialized engineering talent required for custom machine design and field service. Successful companies manage their value chain by securing robust relationships with key technology suppliers (e.g., specialized motion control providers) and establishing decentralized service networks to provide immediate support to global fragrance production facilities. The final, critical stage of the value chain involves the end-user operations, where the machine's reliability and integration with surrounding equipment (fillers, labelers) directly translate into the cost efficiency and output quality of the finished perfume product, ultimately impacting the brand's market standing.

In terms of distribution, large, customized automatic lines are predominantly sold via direct sales forces due to the complexity of specification, installation, and factory acceptance testing (FAT) required by large multinational corporations. This ensures maximum control over the commissioning process and facilitates long-term service agreements. In contrast, smaller, lower-cost manual or semi-automatic machines often utilize indirect channels, relying on regional distributors who handle sales, basic support, and localized logistics. The rise of sophisticated contract packagers (co-packers) has introduced an intermediate value chain participant, as these entities invest heavily in versatile machinery to serve multiple clients, thus influencing the purchasing patterns of both machine manufacturers and small to mid-sized fragrance brands that outsource their production needs.

Perfume Bottle Crimping Machine Market Potential Customers

The primary potential customers for Perfume Bottle Crimping Machines are entities operating within the global fragrance and cosmetic packaging ecosystem that require reliable, high-integrity sealing for their liquid products. These customers segment broadly into three main groups: multinational fragrance conglomerates, which demand high-throughput, fully automated, and highly reliable machinery capable of producing millions of units annually; medium to large-scale contract packagers, who require versatile, quick-changeover machines to service diverse clients and bottle formats; and specialized artisanal or boutique perfume houses and private label manufacturers, who typically invest in semi-automatic or low-volume benchtop crimpers to maintain strict quality control over smaller, high-value production batches. The purchasing drivers for these groups differ significantly: conglomerates prioritize speed, OEE, and integration capabilities, while boutiques prioritize precision, gentleness on specialized packaging, and cost-effectiveness for smaller runs. Contract packagers focus heavily on flexibility and ease of format adjustment to maximize machine utilization across different client projects.

In addition to traditional fragrance houses, adjacent industries such as pharmaceutical packaging (for spray solutions and nasal sprays) and high-end essential oil distillers also represent potential customer bases, particularly those utilizing similar glass vial and pump dispensing systems that require equivalent hermetic sealing technology. These customers often prioritize machines compliant with stringent regulatory standards (like cGMP), which necessitates higher levels of machine validation and data logging capabilities, positioning them as prime targets for high-specification, automated servo-driven crimpers. The continuous emergence of new niche fragrance brands, often utilizing crowdfunding and e-commerce platforms, fuels consistent demand for entry-level and mid-range semi-automatic machinery, ensuring a constant flow of new customers into the market who are graduating from completely manual processes to mechanized packaging solutions.

Customer acquisition strategies deployed by machine manufacturers must therefore be highly tailored. Targeting multinational corporations involves complex, long sales cycles focused on demonstrating superior operational metrics (efficiency, precision, maintenance costs), often requiring customized machine builds. Conversely, targeting SMEs and artisanal producers relies more heavily on localized sales, rapid delivery, ease of use, and competitive pricing for standardized, reliable equipment. The growing trend of brands focusing on sustainability also positions manufacturers who offer machines compatible with new materials (such as recycled glass or bio-based ferrules) as preferred suppliers, reflecting an evolving customer requirement set that extends beyond mere throughput capacity to encompass environmental responsibility and material adaptability in the sealing process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 519.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marchesini Group, Coesia S.p.A., MG2 S.r.l., Romaco Group, Krones AG, Bausch + Ströbel, IMA Group, Syntegon Technology (formerly Bosch Packaging), Zhejiang Ruiqi, Guangzhou Chuangyuan, Shanghai Hengyi, Shenyang Huayi, Reichenbach GmbH, O.M.A.R. S.r.l., G.R. Packaging Equipment, FOGG Filler, Accutek Packaging, Norden Machinery, GEA Group, CFT Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfume Bottle Crimping Machine Market Key Technology Landscape

The technological landscape of the Perfume Bottle Crimping Machine Market is defined by a shift towards highly precise, controlled, and data-driven sealing processes, moving away from purely mechanical or pneumatic operations. Central to this evolution is the adoption of advanced servo motor technology, replacing traditional cam-driven or purely pneumatic systems. Servo systems provide exceptional control over the crimping force and vertical movement profile of the crimping heads, allowing manufacturers to define and replicate exact sealing parameters for every bottle, regardless of minor material inconsistencies. This precise control minimizes the risk of glass breakage—a critical concern when handling high-value perfume bottles—while ensuring optimal seal integrity to prevent product leakage and evaporation. Furthermore, servo-driven machines facilitate significantly faster and more accurate format changes, as new parameters can be digitally loaded rather than requiring physical adjustments, drastically reducing changeover time and increasing overall equipment effectiveness (OEE) in multi-product facilities.

Another crucial technological advancement involves the integration of sophisticated machine vision systems (MVS) utilizing high-resolution cameras and advanced image processing algorithms, often supported by AI or deep learning frameworks. These vision systems perform non-contact, high-speed inspection checks both before and after the crimping process. Pre-crimping inspection verifies the correct placement of the pump components and the integrity of the bottle neck, acting as a Poka-Yoke (mistake-proofing) mechanism. Post-crimping inspection scrutinizes the sealed aluminum or plastic ferrule for dimensional accuracy, flatness, absence of wrinkles or tears, and confirms the precise distance from the bottle shoulder, ensuring compliance with stringent aesthetic and functional quality standards. This continuous, automated quality feedback loop is vital for maintaining the premium image associated with luxury fragrances and ensuring batch consistency across global manufacturing sites, offering data traceability that is increasingly required by regulatory bodies and brand owners.

Beyond motion control and vision, connectivity and data management form the backbone of modern crimping technology. Contemporary machines are equipped with Industrial Internet of Things (IIoT) sensors and robust communication protocols (e.g., OPC UA, Ethernet/IP) that allow them to interface seamlessly with Manufacturing Execution Systems (MES) and Cloud-based analytical platforms. This connectivity enables real-time performance monitoring, remote diagnostics, and the collection of vast amounts of operational data critical for predictive maintenance applications. Furthermore, modular design principles are being applied to crimping head architecture, allowing manufacturers to quickly swap out specialized tools for different bottle geometries or closure types (e.g., snap-on versus standard crimp), maximizing machine flexibility and lifespan. Advanced Human-Machine Interfaces (HMIs) with intuitive touchscreens and graphical diagnostics are also integral, simplifying complex operation and maintenance tasks and reducing the reliance on highly specialized external technicians, contributing significantly to improved operational throughput and reliability across diverse global production environments.

Materials science also plays a subtle yet important role, particularly in the development of the actual crimping jaws and tooling. Manufacturers are utilizing specialized alloys and surface coatings (like ceramic or high-hardness chrome plating) to increase the durability and wear resistance of these contact parts, extending tool life and minimizing the risk of metal particles contaminating the final product. The move towards highly sterilized and hygienic designs, particularly for machines that might also handle sensitive cosmetic or pharmaceutical products, necessitates stainless steel construction and design features that facilitate easy cleanability and validation protocols, adhering to cGMP standards. Finally, there is ongoing research into non-traditional sealing methods, such as ultrasonic welding or laser sealing for plastic-based closures, which, while not dominant yet, represent future technological vectors that could potentially challenge the traditional mechanical crimping methods in certain specialized application niches, particularly those driven by novel sustainable packaging material innovations.

Regional Highlights

- North America (USA, Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

North America represents a highly sophisticated and technologically mature market for perfume bottle crimping machines, characterized by intense demand for high-speed automation and integration with digital manufacturing platforms. The United States, in particular, is a global leader in both luxury fragrance consumption and advanced contract packaging services. Market growth here is less focused on expanding production capacity through sheer volume, but rather on upgrading existing infrastructure with Industry 4.0 compliant machinery, such as servo-driven systems with integrated AI quality control. Manufacturers prioritize total cost of ownership (TCO) and operational excellence, meaning investments lean heavily toward premium, high-efficiency equipment offering superior diagnostic capabilities and minimal downtime. Regulatory compliance, particularly concerning safety and highly accurate sealing necessary for high-value products, drives the adoption of the most precise available technology. The presence of numerous international pharmaceutical and cosmetic firms further elevates the demand for machines that adhere to stringent validation protocols and cGMP requirements. The trend towards personalized and small-batch customization, often handled by specialized contract packagers, also ensures steady demand for flexible machines capable of quick format changes and handling diverse closure types, supporting both high-end boutique brands and large-scale mass-market producers simultaneously, necessitating robust and versatile machinery investments.

The Canadian and Mexican markets, while smaller, mirror these trends but often serve as key manufacturing hubs for North American distribution. Mexico, leveraging its strategic geographic location and improving manufacturing base, is increasingly attracting foreign direct investment (FDI) in high-volume production facilities, driving demand for new, large-scale automatic crimping lines. Innovation in the U.S. market often focuses on reducing the ecological footprint of packaging processes, leading to the adoption of machines capable of handling novel, sustainable materials, often requiring adjustments in crimping pressure profiles and tooling design. This region is a primary early adopter of new technologies, setting global benchmarks for speed, accuracy, and process traceability, ensuring sustained, though moderated, growth through technological replacement cycles rather than purely capacity addition.

Europe holds a dominant position in the global fragrance industry, being home to the majority of the world's most renowned luxury fashion houses and perfume manufacturers, particularly concentrated in France and Italy. This region is characterized by an uncompromising demand for aesthetic quality and sealing precision, driven by the prestige of 'Made in Europe' luxury goods. Consequently, the European market for crimping machines emphasizes high-precision engineering, customization capabilities, and aesthetic consistency over pure production speed. German and Italian manufacturers lead globally in supplying these high-end, customized automatic lines, often incorporating sophisticated robotics for handling delicate and custom-designed glass bottles. The market is mature, but the continuous introduction of new product lines, seasonal variations, and complex, proprietary packaging designs ensures perpetual demand for new tooling and highly adaptive machinery.

Sustainability regulations and consumer pressure are particularly strong forces in Europe. The market is rapidly moving toward machines designed for energy efficiency, reduced material waste during changeovers, and compatibility with non-standard packaging materials aimed at recyclability. The implementation of strict EU regulations regarding product integrity necessitates the use of crimpers that offer detailed validation logs and process data, aligning closely with Industry 4.0 and Smart Factory initiatives promoted across the continent. France, as the epicenter of luxury fragrance, exhibits consistent demand for state-of-the-art machinery that minimizes any potential aesthetic defect on the final product, while Italy and Germany serve as key technology suppliers for the specialized machinery needed to meet these stringent quality benchmarks. Eastern Europe, while smaller, offers growth potential as manufacturing relocates or expands into these regions seeking optimized labor and operational costs, driving localized demand for efficient crimping solutions.

The Asia Pacific region is the engine of current and future market growth for perfume bottle crimping machines, characterized by significant industrial investment and a rapidly expanding consumer base for personal care and luxury goods. China dominates regional demand, driven by its dual role as a massive manufacturing hub (serving both global exports and a colossal domestic market) and its rapid technological modernization. Investment in APAC is heavily skewed towards high-volume, fully automatic production lines to meet the scaling requirements of both domestic brands and multinational corporations establishing local production facilities to serve regional consumers efficiently. The growth rate in this region is substantially higher than in Europe or North America, reflecting the accelerating transition from manual or semi-automatic processes to integrated automation across various consumer product sectors.

While China focuses on scaling and speed, Japan maintains a market demand characterized by extremely high-quality expectations, precision, and zero-defect manufacturing standards, similar to Western Europe. South Korea is rapidly emerging as a center for innovative cosmetic and fragrance packaging, driving demand for versatile crimping machines that can handle complex and unique bottle designs popular among K-Beauty trends. India, undergoing significant economic development, presents enormous untapped potential, with local manufacturers increasingly investing in quality automated machinery to compete effectively with established global brands. Southeast Asian nations, including Thailand and Indonesia, are developing their manufacturing bases, translating into increasing localized demand for reliable medium-capacity automatic crimpers. A major regional trend involves domestic machinery manufacturers in countries like China and India rapidly improving the technological sophistication of their offerings, posing competitive pressure on established European and North American suppliers by offering more cost-effective automation solutions, although precision requirements often still favor global leaders in the luxury segment.

The Latin American market is characterized by moderate but consistent growth, influenced by economic volatility and varying levels of industrial maturity across countries. Brazil is the key market in this region, possessing a substantial domestic cosmetics and personal care industry that drives demand for both imported and domestically manufactured crimping equipment. Investment decisions in Latin America are often sensitive to pricing and currency fluctuations, leading to a strong preference for robust, easy-to-maintain machinery with favorable local service infrastructure. While high-end automatic machines are utilized by international firms operating in the region, there is also significant, sustained demand for reliable semi-automatic machines among smaller local producers and specialized regional distributors seeking cost-efficient solutions. The need for precise and secure sealing remains critical due to the high retail value of fragrances and the often challenging climatic conditions that necessitate excellent product integrity.

Market expansion in countries like Argentina and Colombia is highly dependent on overall macroeconomic stability, but the long-term trend favors increased automation to improve competitiveness against global imports. The region is seeing increased investment in local manufacturing to reduce logistics costs and import tariffs, creating new opportunities for machinery suppliers. Service and local technical support are paramount competitive differentiators, as complex repairs or the procurement of specialized spare parts can be challenging due to logistical hurdles and customs complexities. Therefore, customers often prefer suppliers who can guarantee reliable local support and comprehensive training for their technical personnel, ensuring maximum operational uptime in environments where unplanned downtime can severely impact production targets and profitability margins.

The Middle East and Africa represent a polarized market segment. The Gulf Cooperation Council (GCC) countries are highly lucrative for luxury fragrance producers, supporting sophisticated bottling operations driven by high consumer spending power and a deep cultural appreciation for perfumes (attar, oud). The GCC market, particularly the UAE and Saudi Arabia, demands the highest quality crimping machines, often prioritizing European-made equipment for reliability and prestige, utilizing these machines to produce both internationally branded products and high-end local luxury lines. Investments here are characterized by a focus on cutting-edge automation, often integrated with large, temperature-controlled manufacturing facilities and requiring customization for unique, opulent bottle designs and materials. The growth is fueled by expanding local manufacturing capabilities aimed at serving regional markets efficiently and reducing reliance on imports, mirroring global localization trends.

In contrast, the broader African market, while representing a vast long-term growth opportunity, currently shows scattered demand, concentrated primarily in South Africa and emerging industrial centers like Nigeria and Egypt. Demand in these areas focuses more on robust, easily operable, and medium-capacity semi-automatic or moderate-speed automatic machines that offer a compelling balance between initial cost and long-term durability. Challenges such as infrastructure limitations and currency risks often necessitate cautious investment. However, as local consumer goods manufacturing matures, particularly in the personal care sector, the demand for reliable automated crimping solutions is projected to increase substantially over the forecast period, driven by the urbanization trend and the rising aspiration for packaged consumer products bearing consistent quality, making MEA a region defined by high-value niche segments (GCC) and significant future scaling potential (Africa).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfume Bottle Crimping Machine Market.- Marchesini Group

- Coesia S.p.A.

- MG2 S.r.l.

- Romaco Group

- Krones AG

- Bausch + Ströbel

- IMA Group

- Syntegon Technology (formerly Bosch Packaging)

- Zhejiang Ruiqi

- Guangzhou Chuangyuan

- Shanghai Hengyi

- Shenyang Huayi

- Reichenbach GmbH

- O.M.A.R. S.r.l.

- G.R. Packaging Equipment

- FOGG Filler

- Accutek Packaging

- Norden Machinery

- GEA Group

- CFT Group

Frequently Asked Questions

Analyze common user questions about the Perfume Bottle Crimping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for fully automatic crimping machines?

The primary driver is the necessity for high-volume fragrance manufacturers to achieve superior operational efficiency (OEE), consistent sealing quality, and precise control over complex bottle handling at high production speeds, minimizing labor dependency and product loss.

How is Industry 4.0 impacting the Perfume Bottle Crimper Market?

Industry 4.0 integration enables real-time data collection, remote diagnostics, and predictive maintenance (PdM) through IIoT sensors and cloud connectivity, allowing manufacturers to optimize machine performance, reduce unplanned downtime, and improve process transparency for validation.

What is the significance of servo motor technology in modern crimping equipment?

Servo motor technology provides highly precise and repeatable control over the crimping force and motion profile, crucial for preventing delicate glass bottle breakage while ensuring a consistent, hermetic seal across diverse bottle formats and materials, leading to higher product quality and reduced waste.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region, particularly driven by scaling manufacturing in China and rapidly growing consumer markets in India and Southeast Asia, exhibits the highest growth potential due to increasing urbanization, rising disposable incomes, and widespread investment in new automation capabilities.

What are the key differences between pneumatic and servo-electric crimping machines?

Pneumatic machines are generally lower cost and simpler, suitable for lower speeds, but offer less precise control over force. Servo-electric machines provide superior force precision, faster cycle times, digital control for quick format changes, and higher energy efficiency, making them ideal for high-speed, high-precision operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager