Personalized Hydration Solutions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442077 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Personalized Hydration Solutions Market Size

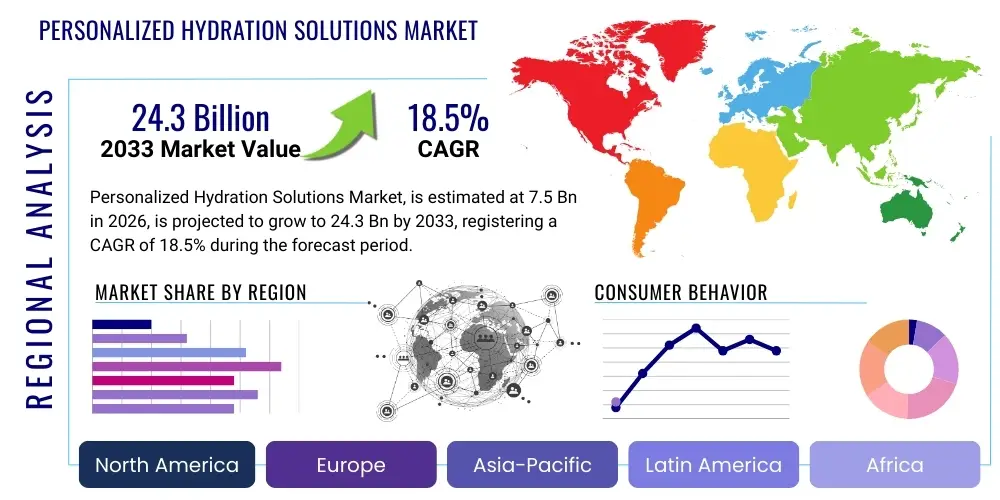

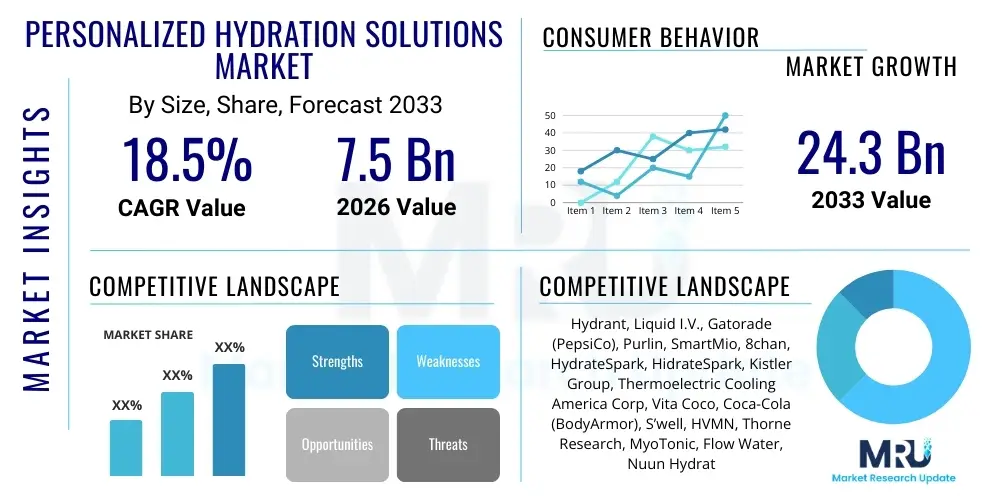

The Personalized Hydration Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 24.3 Billion by the end of the forecast period in 2033.

Personalized Hydration Solutions Market introduction

The Personalized Hydration Solutions Market encompasses innovative technologies and services designed to monitor, analyze, and optimize individual fluid intake and electrolyte balance based on unique physiological needs, activity levels, and environmental conditions. This rapidly evolving sector integrates cutting-edge Internet of Things (IoT) devices, such as smart water bottles and wearable sensors, with sophisticated analytical platforms driven by artificial intelligence (AI). The primary offering revolves around providing real-time recommendations for the type, timing, and quantity of fluid intake, often incorporating customized nutrient or electrolyte supplements to address deficiencies or optimize specific health outcomes, ranging from peak athletic performance to managing chronic health conditions such as diabetes or hypertension. The necessity for precision in health and wellness management, coupled with the increasing accessibility of biometric data capture, drives the core value proposition of these solutions, positioning them as essential tools in proactive health maintenance.

Product descriptions within this market span a broad spectrum, including smart beverage dispensers that mix customized flavor or nutrient pods, hydration-tracking patches, advanced urinalysis sensors, and mobile applications that correlate biometric inputs (like heart rate, sweat rate, and ambient temperature) with personalized hydration goals. Major applications are prominently featured in three domains: sports and fitness, clinical health monitoring, and general consumer wellness. In sports, these solutions prevent performance degradation due due to suboptimal hydration status and accelerate recovery protocols. Clinically, they assist patients in maintaining electrolyte equilibrium, particularly post-surgery or during intensive medical treatments, offering a level of continuous monitoring previously unattainable outside hospital settings. For the general populace, the solutions aim to combat widespread mild chronic dehydration, which can impact cognitive function and overall energy levels, thereby democratizing access to scientifically backed hydration strategies.

The immediate benefits derived from adopting personalized hydration solutions include significant improvements in physical and cognitive performance, a marked reduction in the incidence of dehydration-related ailments such as headaches and fatigue, and enhanced nutrient absorption through optimal fluid regulation. Key driving factors propelling this market forward are the escalating global focus on preventative health and wellness, the pervasive integration of IoT and wearable technology into daily life, and the development of advanced algorithms capable of translating complex physiological data into actionable, user-friendly recommendations. Furthermore, strategic partnerships between technology providers and major beverage or pharmaceutical companies are expanding distribution channels and accelerating consumer acceptance, cementing the market’s trajectory toward substantial growth over the forecast period, especially as sensor technology becomes cheaper and more accurate, facilitating wider adoption across diverse demographic groups and use cases globally.

Personalized Hydration Solutions Market Executive Summary

The Personalized Hydration Solutions Market is poised for exponential growth, fueled primarily by a confluence of technological advancements in biosensors and predictive analytics, coupled with a fundamental shift in consumer behavior toward proactive and data-driven wellness management. Business trends indicate a strong move away from generic, one-size-fits-all hydration advice toward highly customized nutritional and fluid intake plans. This involves significant investment in direct-to-consumer (DTC) subscription models for customized nutrient pods and refillable smart consumables, creating robust recurring revenue streams for market leaders. Furthermore, large technology firms and healthcare providers are actively seeking strategic acquisitions and partnerships with niche solution providers to integrate real-time hydration metrics into broader digital health platforms, establishing comprehensive ecosystems that track exercise, sleep, nutrition, and fluid balance simultaneously. This convergence of services accelerates market penetration across various socioeconomic brackets and healthcare settings, emphasizing preventative care over reactive treatment methodologies, which is highly appealing to both insurers and consumers.

Regional trends highlight North America and Europe as the dominant markets in terms of technology adoption and revenue generation, primarily due to high disposable incomes, mature digital health infrastructures, and high consumer acceptance of wearable technology and data-sharing for health benefits. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by rapidly improving internet penetration, growing urbanization leading to greater health consciousness, and massive government investments in digital healthcare infrastructure, particularly in countries like China, India, and Japan. APAC is becoming a crucial manufacturing hub and an increasingly important consumer base, especially for affordable, scalable smart bottle technologies. Meanwhile, regions in Latin America and the Middle East & Africa (MEA) are still in nascent stages, with growth concentrated among affluent populations and specialized segments like professional sports organizations, though increasing mobile penetration promises future expansion as product costs decrease and accessibility improves.

Segment trends reveal that the Technology segment, particularly AI and machine learning platforms responsible for data interpretation and recommendation generation, holds significant promise and is attracting the largest venture capital investments. Within the End-User segment, the Sports & Fitness category remains the primary revenue driver, given the immediate and quantifiable performance benefits hydration optimization offers to athletes. Crucially, the Clinical segment is expected to show accelerated growth as personalized hydration solutions become integrated into the standard care protocols for managing renal issues, chronic dehydration in the elderly, and post-operative recovery, validating the technology's efficacy through rigorous medical studies. The continued miniaturization of sensors and enhanced battery life are also key trends shaping the Product Type segment, making devices less intrusive and more user-friendly, thereby increasing sustained consumer adherence and long-term data capture capabilities for more accurate personalization over time.

AI Impact Analysis on Personalized Hydration Solutions Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Personalized Hydration Solutions Market generally coalesce around themes of accuracy, privacy, and clinical efficacy. Consumers frequently ask how AI ensures the recommendations are truly personalized, distinguishing basic tracking from predictive modeling based on physiological stressors and genetic predispositions. A significant concern revolves around the security and ethical use of highly sensitive biometric data, querying who owns the data and how it is protected against breaches or unauthorized commercial use. Furthermore, users often question the clinical validation of AI-driven hydration recommendations, seeking evidence that these personalized plans yield better health outcomes than traditional, standardized advice, particularly in managing chronic conditions. These inquiries underscore a collective expectation that AI must deliver tangible, medically sound benefits while maintaining the highest standards of data integrity and user autonomy.

The fundamental contribution of AI in this domain lies in transforming raw, often noisy, sensor data—such as sweat composition, ambient temperature, heart rate variability, and historical intake logs—into clinically relevant and actionable insights. Traditional algorithms often fail to account for the complex, non-linear relationships between these factors; however, machine learning models, specifically deep learning neural networks, excel at identifying subtle physiological patterns indicative of impending dehydration or electrolyte imbalance well before symptoms manifest. This predictive capability allows personalized solutions to shift from merely reactive tracking (e.g., "you haven't drunk water today") to proactive intervention (e.g., "based on your sleep quality, ambient temperature rise, and scheduled workout intensity, you require an electrolyte boost 30 minutes before training to maintain peak cognitive function"), thereby drastically improving the utility and perceived value of the system for end-users.

Moreover, AI platforms facilitate the dynamic adjustment of hydration protocols in real-time, adapting to unexpected physiological shifts or environmental changes. This ability to continuously learn from vast datasets—aggregating data across millions of users while maintaining individual anonymity—enables the refinement of personalization algorithms, making the solutions more robust and universally applicable. As AI integration deepens, it will also enable advanced integration with electronic health records (EHRs) and telehealth services, allowing clinicians to remotely monitor patient hydration status, reducing hospital readmission rates related to fluid management issues. This synergy elevates personalized hydration solutions from consumer gadgetry to integral components of the digital health ecosystem, driving future innovation in sensor fusion and predictive health modeling, while simultaneously increasing the regulatory scrutiny required to ensure algorithm transparency and bias mitigation across diverse user populations.

- Real-time Predictive Analytics: AI analyzes multimodal biometric data (heart rate, skin conductivity, activity levels) to predict future hydration needs 1–2 hours in advance, ensuring proactive intervention.

- Customized Supplement Formulation: Machine learning algorithms recommend specific concentrations of electrolytes, vitamins, or minerals tailored to individual sweat losses and metabolic rates.

- Biometric Data Fusion: AI integrates data from multiple sources (wearables, smart bottles, external environment sensors) to create a holistic, unified view of physiological status.

- Enhanced Data Security: AI-powered anomaly detection identifies unauthorized access patterns and potential breaches of sensitive physiological data, bolstering user trust.

- Behavioral Nudging and Optimization: AI models determine the optimal timing and personalized messaging strategy to encourage consistent user adherence to hydration goals.

DRO & Impact Forces Of Personalized Hydration Solutions Market

The Personalized Hydration Solutions Market is propelled by a robust set of drivers, simultaneously constrained by significant hurdles, and presents substantial future opportunities, all shaped by overarching impact forces. The core driver is the globally escalating consumer awareness regarding the critical link between optimal hydration and physical, cognitive, and mental health outcomes. This heightened health consciousness translates directly into willingness to invest in preventative wellness technologies. Complementing this is the pervasive adoption of the Internet of Things (IoT) ecosystem, characterized by cheaper, smaller, and more accurate biosensors and high-speed data connectivity (5G), which collectively enable seamless, continuous, and non-invasive data collection crucial for personalized recommendations. These drivers are further strengthened by the increasing prevalence of lifestyle diseases, such as obesity and kidney stones, where fluid management plays a vital role in therapeutic and preventative protocols, urging healthcare systems toward digital monitoring solutions.

However, the market faces significant restraints that could temper its projected growth rate. Primary among these is the pervasive concern regarding data privacy and security. Personalized hydration requires the continuous collection of extremely sensitive biometric and location data, making consumers apprehensive about potential misuse or data breaches, which is amplified by evolving global data regulations like GDPR and CCPA. Furthermore, the high initial cost associated with premium smart hydration devices, coupled with the recurring expense of customized nutrient pods or subscription services, presents a substantial barrier to entry for lower-income demographics, limiting mass market adoption. Establishing clinical credibility remains another restraint; many consumer-grade devices lack formal medical certification or validation, leading to skepticism among healthcare professionals who prefer evidence-based interventions, thus hindering uptake in clinical settings.

The opportunities within this sector are vast, particularly in expanding personalized hydration protocols into specialized clinical applications, such as managing geriatric dehydration, monitoring athletes during extreme endurance events, and integrating solutions into corporate wellness programs focused on enhancing employee productivity and reducing healthcare costs. Technological advancements offer specific opportunities, including the development of non-invasive, disposable sensors embedded in clothing or skin patches that eliminate the need for traditional device charging, thus enhancing user convenience and compliance. Impact forces, which shape the market's trajectory, include rapid technological obsolescence, where newer, more accurate sensing technologies quickly displace older ones, demanding constant innovation and investment. Regulatory environments are also critical impact forces; as governing bodies finalize standards for digital health devices and data privacy, compliance will become a significant determinant of market success, favoring established, secure platforms over less regulated entrants.

Segmentation Analysis

The Personalized Hydration Solutions Market is meticulously segmented based on key criteria, offering a granulated view of market dynamics, competitive intensity, and potential growth vectors across different product types, technologies employed, and end-user applications. Understanding these segments is crucial for strategic business planning, allowing stakeholders to target specific niches—such as high-performance athletes requiring real-time electrolyte monitoring versus general consumers focused on daily water intake goals. The segmentation reveals a market structure where technological innovation drives product evolution, and end-user requirements dictate application focus. The market is primarily divided by the type of device utilized (wearable vs. non-wearable), the technology enabling personalization (AI/ML vs. simple sensors), and the primary consumers adopting the solutions (Sports, Clinical, or General Wellness). Analyzing these segments helps in identifying underserved sub-markets and tailoring marketing efforts to resonate with distinct consumer needs, such as durability and accuracy for athletes versus simplicity and affordability for the elderly population.

The segmentation structure also highlights the growing importance of software and data services over mere hardware sales. While smart bottles and wearables capture initial market share and generate revenue, the long-term profitability resides in the subscription services attached to the data analytics and customized supplement delivery. This trend is reflected in the segmentation by Component, which typically distinguishes between Hardware (devices and sensors), Software (mobile apps and cloud platforms), and Services (consultation and personalized subscription refills). The fastest-growing component segment is generally the Software and Services category, owing to its scalability and the recurring nature of revenue, positioning data analytics firms and subscription providers as key investment targets. Furthermore, geographical segmentation is pivotal, reflecting diverse rates of adoption and differing regulatory environments, with North America leading in value generation and Asia Pacific poised for volume-driven growth due to massive consumer bases and increasing affordability.

Ultimately, comprehensive segmentation analysis enables market participants to assess their competitive standing and identify white-space opportunities. For instance, focusing on clinical applications requires navigating stricter regulatory pathways but promises higher revenue per user and greater stability, whereas targeting the general consumer segment necessitates aggressive pricing strategies and broad distribution networks. The complexity inherent in personalization requires continuous innovation across all segments, ensuring that devices remain accurate, data analysis remains insightful, and the user experience is sufficiently engaging to maintain long-term adoption. This strategic framework based on detailed segmentation is foundational to navigating the complex landscape of personalized health technology and ensuring sustainable market presence across the rapidly diversifying consumer base.

- By Product Type:

- Smart Bottles

- Wearable Sensors (Patches, Smartwatches, Clothing)

- Smart Hydration Dispensers and Systems

- Personalized Nutrient/Electrolyte Pods and Supplements

- By Technology:

- Sensor Technology (Biometric, Environmental)

- Artificial Intelligence (AI) and Machine Learning (ML) Platforms

- Cloud Computing and Data Analytics

- IoT Connectivity

- By End-User:

- Sports and Fitness Professionals

- General Wellness Consumers

- Clinical and Healthcare Settings (Hospitals, Clinics, Long-Term Care)

- Corporate Wellness Programs

- By Component:

- Hardware (Devices and Sensors)

- Software (Applications and Cloud Services)

- Services (Subscription and Consultation)

Value Chain Analysis For Personalized Hydration Solutions Market

The value chain for the Personalized Hydration Solutions Market begins with upstream activities focused heavily on specialized raw material sourcing and precision component manufacturing, particularly for advanced sensor technology. This phase involves sourcing highly pure materials for biosensors (e.g., microfluidic chips, conductive polymers) and securing microchip supply for processing units within smart devices. Key upstream players include specialized semiconductor manufacturers, advanced sensor developers, and high-quality plastics/material providers that ensure devices are durable, safe, and biocompatible. Optimization in the upstream segment focuses on reducing the size and cost of sensors while increasing accuracy and battery efficiency, necessitating strong R&D collaboration between device makers and material science companies. Efficient procurement and supply chain management at this stage are crucial, as delays or quality issues in sensor components can severely impact the reliability and launch timelines of the final product, directly affecting consumer trust and market reputation.

Midstream activities encompass the core transformation processes, including device assembly, software development, data platform establishment, and the formulation and manufacturing of customized nutrient or electrolyte pods. This stage involves sophisticated manufacturing operations to integrate sensors, batteries, and connectivity modules into ergonomic, user-friendly consumer products like smart bottles or wearable patches. Simultaneously, intense effort is dedicated to software development, which includes creating user interfaces, developing proprietary AI/ML algorithms for personalization, and ensuring robust cloud infrastructure for data storage and processing. This stage is highly proprietary, representing the core intellectual property of market competitors. Downstream focus shifts to reaching the consumer and ensuring continuous service delivery. The primary distribution channels are varied, including direct-to-consumer (DTC) online sales, specialized retail partnerships (e.g., sporting goods stores, pharmacies), and institutional sales channels targeting hospitals or corporate clients.

Direct channels offer higher margins and allow for immediate feedback and personalized customer service, which is critical for subscription-based models involving customized pods. Indirect channels, such as partnerships with major retailers or healthcare distributors, offer broader market reach and scalability. Post-sale services, including customer support, software updates, and managing recurring subscription refills for customized supplements, complete the value chain, ensuring high customer lifetime value (CLV). The continuous feedback loop from the downstream market back to R&D (upstream) through data analytics allows for rapid product iteration and improvement, which is a hallmark of highly technological markets. Efficient management of the entire chain, particularly minimizing data latency between the sensor (upstream) and the personalized recommendation (software), is the primary competitive advantage sought by industry leaders aiming for market dominance.

Personalized Hydration Solutions Market Potential Customers

The target audience for Personalized Hydration Solutions is broadly segmented into three high-value groups: performance athletes and fitness enthusiasts, individuals managing chronic health conditions, and the general population focused on holistic wellness and professional productivity. Performance athletes represent an immediate and high-engagement segment, as they require precise fluid and electrolyte management to sustain peak performance, prevent injury, and optimize recovery during rigorous training cycles and competitive events. For this group, the value proposition centers around quantifiable performance gains and physiological data accuracy. Solutions marketed here often emphasize sweat rate analysis, specific electrolyte replacement formulations, and real-time coaching based on immediate physiological strain, justifying a premium price point for specialized monitoring systems and integrated ecosystems designed for demanding environments.

The second major cohort comprises patients and elderly individuals under clinical supervision, who are essential buyers through institutional channels. This group includes individuals managing conditions like diabetes (where hydration status affects blood sugar levels), kidney disease, and geriatric care where maintaining optimal fluid balance is challenging due to reduced thirst perception and medication interference. Hospitals, long-term care facilities, and insurance providers are the key decision-makers here, valuing solutions that offer reliable, remote monitoring capabilities to reduce hospitalization risks associated with dehydration and electrolyte imbalance. These clinical customers prioritize medical-grade accuracy, seamless integration with existing Electronic Health Records (EHRs), and robust data security compliance, making the sales cycle longer but offering high volume potential once regulatory approval and clinical validation are secured for the device's application.

Finally, the largest volume segment includes general wellness consumers, particularly professionals seeking to enhance cognitive function, reduce fatigue, and support weight management through better daily hydration habits. These buyers are motivated by ease of use, aesthetic design, and integration with popular lifestyle applications (e.g., Fitbit, Apple Health). Corporate wellness programs are increasingly adopting these solutions as a benefit to improve employee health and productivity, purchasing in bulk for organizational deployment. For this segment, affordability, user-friendly mobile interfaces, and compelling behavioral insights are key purchasing criteria. These varied end-users ensure a resilient and diversified demand base for the market, requiring providers to customize their product features and pricing models to effectively capture market share across these distinct purchasing profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 24.3 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hydrant, Liquid I.V., Gatorade (PepsiCo), Purlin, SmartMio, 8chan, HydrateSpark, HidrateSpark, Kistler Group, Thermoelectric Cooling America Corp, Vita Coco, Coca-Cola (BodyArmor), S’well, HVMN, Thorne Research, MyoTonic, Flow Water, Nuun Hydration, The Coca-Cola Company (smartwater), Fitbit (Google) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Personalized Hydration Solutions Market Key Technology Landscape

The personalized hydration market is fundamentally driven by a dynamic technology stack that integrates advanced sensing capabilities with complex data processing and personalized delivery mechanisms. Central to this landscape are IoT-enabled devices, which include sophisticated smart bottles equipped with conductive materials and ultrasonic sensors to measure fluid intake volume and temperature, and wearable devices, such as patches and smart apparel, capable of monitoring biometric data. The critical innovation lies in miniaturized, non-invasive biosensors, particularly those designed to analyze sweat composition. These sensors can accurately measure electrolyte levels (sodium, potassium), pH, and lactate in real-time, providing the precise data necessary for true personalization. The advancement of flexible electronics and biocompatible materials is crucial here, enabling comfortable, continuous monitoring without impacting the user's daily activities, thus maximizing data collection quality and user compliance.

Beyond the hardware, the core intelligence is rooted in advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms residing in cloud platforms. These algorithms are designed to perform multivariate analysis, correlating real-time biometric readings, activity logs, environmental factors (humidity, altitude), and historical consumption patterns. The ML models utilize predictive analytics to forecast hydration deficits and recommend proactive interventions, far surpassing the capabilities of simple rule-based software. This involves deep learning models that optimize fluid type (water vs. electrolyte solution), volume, and timing, often incorporating complex genetic or metabolic profiles provided by the user. The efficiency and accuracy of these AI platforms are a major competitive differentiator, requiring massive computational resources and continuous data ingestion for model refinement and robust performance across heterogeneous user demographics and physiological conditions.

Furthermore, the market relies heavily on innovative delivery technologies to translate personalized recommendations into tangible products. This primarily involves smart dispensers and modular beverage systems that automatically mix custom concentrations of flavorings, vitamins, or electrolyte supplements using pre-packaged pods or cartridge systems. These dispensing systems ensure dosage accuracy and cater to the specific, micro-adjusted nutritional profile recommended by the AI platform, thus closing the loop between data analysis and tailored consumption. Connectivity is standardized through Bluetooth Low Energy (BLE) and Wi-Fi, ensuring seamless data transmission to the user’s mobile application and the cloud platform. As the ecosystem matures, integration with existing digital health platforms (e.g., electronic health records, fitness trackers) using standardized APIs will become essential, establishing personalized hydration solutions as an interconnected node within the broader digital health infrastructure, thereby increasing clinical utility and mass market appeal.

Regional Highlights

- North America: North America currently dominates the Personalized Hydration Solutions Market, both in terms of market size and technological innovation, primarily due to the high purchasing power of consumers, early adoption of advanced wearable technology, and a well-established digital health infrastructure. The United States leads regional revenue generation, driven by significant consumer expenditure on premium wellness products and high rates of participation in structured sports and fitness activities. Furthermore, substantial venture capital investment in personalized nutrition startups and strong partnerships between technology firms and major beverage companies accelerate product commercialization and market penetration. The regulatory environment, particularly in areas concerning health claims and data privacy (like HIPAA compliance for clinical data), is mature, which encourages development but also requires rigorous compliance from market players. Demand is high across all three segments: professional sports, corporate wellness initiatives, and specialized clinical monitoring, especially among the affluent and tech-savvy population.

- Europe: The European market is characterized by a strong emphasis on preventative healthcare and strict data protection regulations (GDPR), influencing how solutions are designed and implemented. Western European nations, notably Germany, the UK, and France, exhibit robust market growth, fueled by government initiatives promoting digital health integration and a cultural focus on longevity and wellness. The adoption rate is substantial in the general wellness category, though integration into clinical settings is slower due to complex national healthcare systems and approval processes compared to the US. European consumers often prioritize sustainable and transparent sourcing, influencing the packaging and components of personalized supplement pods. The market is highly competitive, with a focus on aesthetically pleasing, high-quality hardware and reliable, secure data management platforms, appealing to the discerning European consumer base.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing disposable incomes, and explosive growth in smartphone and internet penetration across key economies such as China, India, and Southeast Asia. The demand is escalating due to rising awareness of lifestyle diseases and the adoption of modern fitness trends. While North America leads in value, APAC is expected to dominate in volume, spurred by the introduction of more affordable smart devices and scalable software solutions tailored to large, dense populations. Government support for digital health innovation, particularly in China and India, provides a significant tailwind. Localized personalization is critical here, adapting recommendations for regional climates (extreme heat and humidity) and diverse dietary habits. Investment in local manufacturing capabilities also drives down costs, making personalized hydration solutions accessible to a broader consumer base in the coming years.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. In LATAM, market growth is concentrated in economically stable countries like Brazil and Mexico, driven by high interest in sports nutrition and fitness. Challenges include fluctuating economic conditions and infrastructure limitations in some areas. The MEA market, while nascent, shows promising growth in urban centers of the GCC countries (UAE, Saudi Arabia), propelled by government efforts to diversify economies into healthcare technology and a high prevalence of sports and luxury wellness consumption. Adoption in both regions tends to initially focus on the high-end consumer and specialized sectors, gradually expanding as international players establish local distribution networks and tailor pricing models to regional economic realities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Personalized Hydration Solutions Market.- Gatorade (PepsiCo)

- HidrateSpark (Acquired by mylife)

- Theraflu (GlaxoSmithKline)

- Purlin Inc.

- Hydrant

- Liquid I.V. (Unilever)

- Vita Coco

- The Coca-Cola Company (smartwater)

- HVMN

- Thorne Research

- Nuun Hydration (Nestle Health Science)

- Flow Water Inc.

- Kistler Group

- Nix Biosensors

- 8chan (Placeholder for an emerging tech startup)

- MyoTonic

- S’well

- Fitbit (Google)

- Xiaomi Corporation

- AQUAHydrate

Frequently Asked Questions

Analyze common user questions about the Personalized Hydration Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Personalized Hydration and how does it differ from standard advice?

Personalized Hydration is a data-driven approach using IoT sensors and AI to calculate fluid and electrolyte needs based on individual biometrics, activity levels, and environmental conditions. It differs from standard advice by offering real-time, dynamic recommendations for precise timing, volume, and composition of fluid intake, moving beyond the generic 'eight glasses a day' guidance.

Are personalized hydration solutions clinically validated or are they only for athletes?

While initially popular among athletes, these solutions are increasingly utilized in clinical settings, particularly for managing chronic conditions, geriatric dehydration, and post-operative care. Although many consumer devices lack full medical certification, the underlying principles are based on validated physiological models, and regulatory efforts are accelerating to integrate medical-grade versions into standard clinical protocols for reliable patient monitoring.

What are the primary concerns regarding the security of biometric data collected by smart hydration devices?

The primary concern is the potential for data breaches and misuse of highly sensitive physiological data (like sweat metrics, heart rate, and location). Users seek assurance that providers adhere to stringent global data protection laws (e.g., GDPR) and employ advanced encryption and AI-powered anomaly detection to safeguard personal health information against unauthorized access or commercial exploitation by third parties.

How expensive are personalized hydration systems, and are the costs sustainable for long-term use?

Initial setup costs can be high due to specialized smart bottles, wearables, or dispensing hardware. Sustainability depends largely on the business model; devices often require recurring costs for customized nutrient or electrolyte pods and subscription fees for premium data analytics services, making total cost of ownership a key consideration for consumers assessing long-term affordability.

Which technologies are crucial for making hydration truly personalized?

Key technologies include advanced non-invasive biosensors (e.g., sweat patches) for accurate electrolyte measurement, low-latency IoT connectivity for real-time data transmission, and sophisticated Machine Learning (ML) algorithms that interpret complex biometric and environmental inputs to generate predictive, individualized fluid management strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager