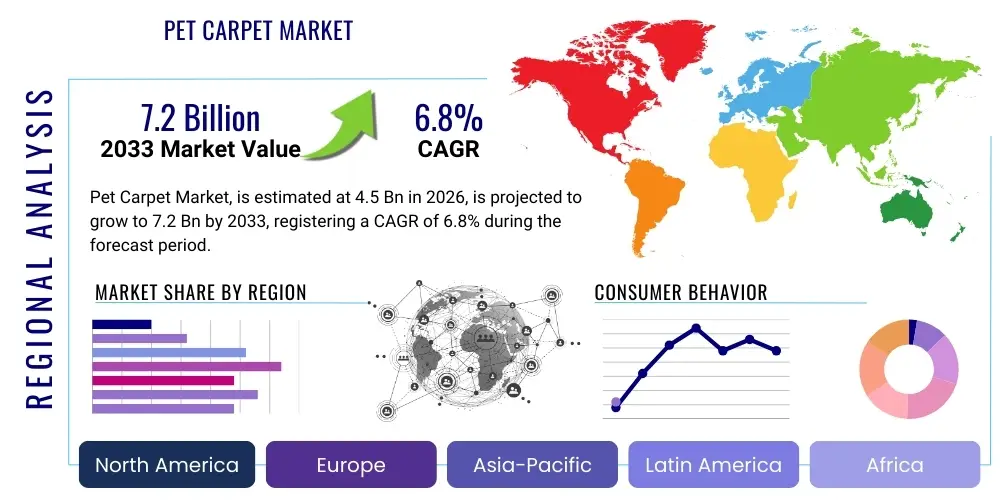

Pet Carpet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441046 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pet Carpet Market Size

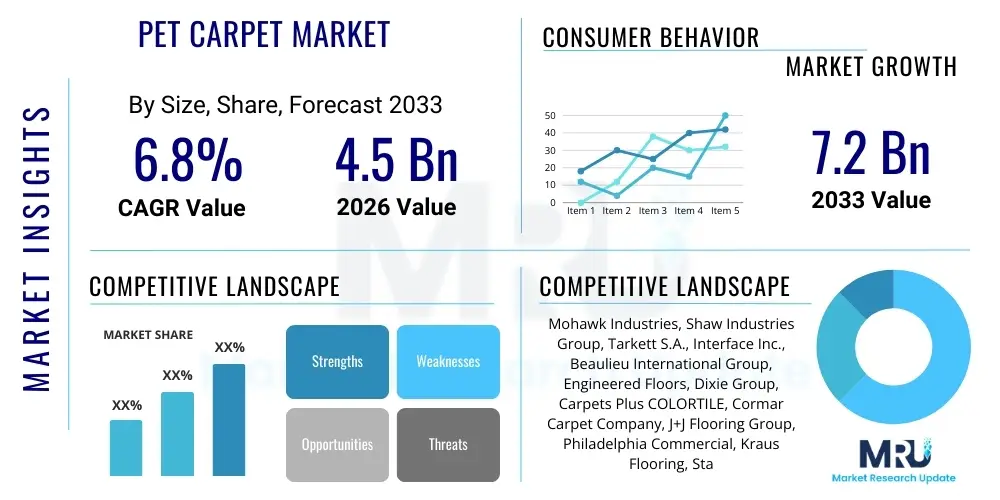

The Pet Carpet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Pet Carpet Market introduction

The Pet Carpet Market encompasses floor covering solutions specifically designed and engineered to withstand the unique challenges presented by household pets, primarily focusing on durability, stain resistance, odor mitigation, and comfort. These specialized products cater to the growing demand from pet owners seeking flooring options that blend aesthetic appeal with practical functionality necessary for a multi-pet household. Key product attributes include enhanced moisture barriers, proprietary fiber treatments that repel common pet stains like urine and mud, and superior abrasion resistance to handle repeated paw traffic and scratching. Furthermore, modern pet carpets often incorporate antimicrobial agents to inhibit bacterial growth and odor absorption, improving indoor air quality and maintenance ease for consumers.

Major applications of pet carpets span both residential and commercial settings. In the residential sector, they are predominantly used in high-traffic areas such as living rooms, hallways, and pet designated zones, providing a softer landing and better traction for aging or active animals. Commercial applications include veterinary clinics, pet grooming facilities, boarding kennels, and pet-friendly retail spaces, where stringent hygiene standards and extreme wear resistance are critical requirements. The market’s rapid expansion is significantly driven by the humanization of pets trend, whereby pets are increasingly viewed as family members, leading to greater consumer willingness to invest in premium, specialized home furnishings that enhance the pet's quality of life while protecting property value.

The core benefits driving consumer adoption include superior stain warranty coverage, reduced cleaning time, enhanced thermal and acoustic insulation, and improved slip resistance compared to hard surfaces. Key driving factors include the substantial global increase in pet ownership rates, particularly post-pandemic, innovation in material science leading to truly durable and sustainable carpet fibers (like recycled polyester or specific nylon blends), and aggressive marketing by manufacturers highlighting health benefits for pets, such as cushioning for joints and paws. The synergy between interior design trends favoring soft surfaces and the necessity for highly practical, cleanable solutions creates a robust environment for market growth.

Pet Carpet Market Executive Summary

The Pet Carpet Market is characterized by vigorous innovation focused on material technology and sustainability, reflecting significant business trends. Manufacturers are increasingly integrating advanced polymer treatments, such as per- and poly-fluoroalkyl substances (PFAS) alternatives or bio-based stain repellents, to meet rising consumer expectations for non-toxic yet highly effective protection against pet-related damage. The market exhibits a clear segmentation shift, with premium, high-density synthetic fiber carpets (Nylon 6,6 and high-grade polyester) dominating the value share due to their superior performance metrics regarding resilience and cleanability. Furthermore, direct-to-consumer (D2C) channels, particularly e-commerce platforms, are gaining prominence, allowing niche brands to bypass traditional flooring retail intermediaries and offer customized solutions, thereby streamlining the supply chain and potentially increasing profit margins.

Regionally, North America and Europe maintain the largest market shares, primarily fueled by high disposable income, established pet culture, and advanced housing infrastructure that supports premium flooring investment. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapidly expanding urbanization, rising middle-class income, and a corresponding surge in pet ownership in countries like China and India. Regional trends also show varying preferences in material; while synthetic materials are globally popular, regions like Europe show a higher acceptance of natural or blended fiber carpets treated with eco-friendly coatings, reflecting stringent regulatory environments and strong consumer inclination towards sustainable products.

Segment trends highlight the critical role of distribution channel optimization and pet type specialization. The Residential Application segment remains the largest end-user group, demanding aesthetically pleasing carpets that integrate seamlessly into home decor while offering robust protection. Within the material segment, the shift towards solution-dyed fibers is notable, as this coloring process embeds color deep within the fiber, making it highly resistant to harsh cleaning chemicals often necessary for sanitizing pet areas. Finally, the strategic focus is increasingly moving towards developing specific product lines tailored for different animal types—such as ultra-short, dense loops for cats prone to scratching, versus thick, cushioned piles suitable for large breed dogs requiring joint support.

AI Impact Analysis on Pet Carpet Market

User inquiries regarding the impact of Artificial Intelligence on the Pet Carpet Market frequently revolve around three core themes: personalized purchasing experiences, optimization of manufacturing processes, and predictive maintenance. Consumers often question how AI can help them select the 'perfect' carpet, considering specific pet breeds, activity levels, and interior lighting conditions. Manufacturers, conversely, focus on AI's ability to refine material compounding, predict machinery failures, and optimize inventory management based on real-time consumer trend analysis. The central expectation is that AI will deliver hyper-efficiency across the value chain—from simulating material performance under various pet-related stresses (e.g., concentrated urine exposure or claw shearing force) to automating customer service inquiries regarding installation, warranty, and complex cleaning protocols.

A significant area of concern analyzed through user data is related to supply chain resilience and demand forecasting. Users expect AI tools to minimize out-of-stock situations for popular styles and specialized treatments. This necessitates implementing sophisticated machine learning algorithms that analyze vast datasets, including seasonal pet health trends, regional housing starts, and social media sentiment towards specific carpet features (e.g., texture, color, and performance guarantees). By leveraging predictive analytics, companies can substantially reduce waste in production and ensure optimal stock levels at various distribution points, leading to a more environmentally sound and financially efficient operation. This data-driven approach shifts production from reactive to proactive, securing better market positioning.

Ultimately, the impact of AI is expected to revolutionize customer engagement and product development. AI-powered virtual try-on tools, utilizing augmented reality (AR) technology, allow consumers to visualize carpet options in their own homes, drastically reducing returns and improving purchase confidence. Furthermore, AI assists in analyzing performance data from installed carpets, fed back via smart home ecosystems or customer reviews, generating critical insights that inform the next generation of fiber technology and protective treatments. This closed-loop feedback system enables faster iteration cycles for durable, pet-friendly products, setting new industry standards for performance guarantees.

- AI-driven personalized recommendation engines enhance customer fit-to-product matching based on pet profiles and home environments.

- Machine learning algorithms optimize manufacturing processes, reducing material waste and energy consumption during fiber production and weaving.

- Predictive maintenance schedules for weaving looms and tufting machines minimize downtime and operational costs.

- Natural Language Processing (NLP) improves customer service responsiveness and efficiency for complex pet stain removal and warranty claims.

- Computer vision systems enable automated quality control checks for weaving defects and consistency in protective treatment application.

- AI models forecast regional demand fluctuations, improving inventory management and logistics planning across the global supply chain.

DRO & Impact Forces Of Pet Carpet Market

The Pet Carpet Market is subject to a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces shaping its trajectory. The primary Driver is the aforementioned humanization of pets trend, translating into increased willingness to spend on premium, specialized products that prioritize pet welfare and owner convenience. Coupled with this is continuous innovation in fiber technology, particularly the development of sustainable, stain-proof, and odor-resistant materials that overcome traditional carpet limitations. Opportunities are abundant in emerging economies with rapid increases in pet ownership and urbanization, alongside the potential for integrating smart home technologies for maintenance and monitoring. Restraints primarily involve the high initial cost of specialized pet carpets compared to standard flooring options, and ongoing regulatory pressures regarding the use of certain chemicals (like specific flame retardants or stain protectors) in consumer goods.

Key impact forces stem from consumer demand for verifiable sustainability and toxicity information. Environmental, Social, and Governance (ESG) criteria are becoming non-negotiable, pressuring manufacturers to adopt eco-friendly production methods, utilize recycled content, and achieve third-party certifications (e.g., CRI Green Label Plus). This force drives research into bio-based polymers and solvent-free finishing processes. Another major force is the competition from hard surface flooring alternatives (LVT, tile, laminate), which often market themselves based on superior water resistance and cleanability; pet carpet manufacturers must continuously advance their protective coatings to retain market share against these competitive threats. Furthermore, the fragmented nature of the distribution network, particularly in developing regions, influences pricing strategies and market penetration success.

Ultimately, the successful navigation of this market depends on balancing performance attributes with accessibility and sustainability. Companies that invest heavily in transparent reporting on chemical usage, offer robust lifetime stain warranties, and strategically utilize digital distribution channels to reach the specialized pet owner demographic are positioned for long-term growth. The cyclical nature of housing starts and renovation activity also acts as a macroeconomic impact force; during periods of high home improvement spending, demand for premium flooring, including pet carpets, typically surges, while economic downturns tend to favor lower-cost alternatives, demanding strategic inventory and pricing flexibility from market participants.

Segmentation Analysis

The Pet Carpet Market is intricately segmented across various dimensions, including the type of material used, the specific end-user application, the distribution channel utilized for sales, and the type of pet targeted. This detailed segmentation allows manufacturers to tailor product attributes, marketing messages, and pricing strategies to specific consumer cohorts, ensuring maximum market penetration and addressable market optimization. Understanding these segments is crucial for strategic planning, as distinct needs exist across different geographic regions and consumer demographics, necessitating specialized product offerings, such as solution-dyed Nylon 6,6 carpets for commercial veterinary settings, contrasted with softer, aesthetically focused blended fibers for high-end residential use.

The segmentation by material type remains paramount, differentiating products based on resilience, cost, and maintenance requirements. Synthetic fibers, predominantly nylon and polyester, dominate due to their inherent durability and exceptional responsiveness to stain and odor treatments. However, the rise of conscious consumerism is fueling the niche growth of natural fibers (like wool, treated heavily for protection) and blended materials that aim to marry the aesthetic warmth of natural fibers with the performance of synthetics. Distribution channels are undergoing rapid change, reflecting global retail shifts; while traditional brick-and-mortar stores still facilitate large, complex purchases requiring professional installation, the online segment offers convenience, comparative shopping, and often better pricing for self-installation or smaller room applications, thereby attracting digitally native consumers and widening geographical reach.

Furthermore, segmentation by application—Residential versus Commercial—dictates the required performance specifications. Commercial carpets require heavy-duty performance ratings (e.g., Class II or III traffic ratings) and must comply with institutional hygiene standards, often necessitating waterproof backings and industrial-grade microbial protection. Conversely, the Residential segment is highly sensitive to color palettes, texture, and softness, demanding features that enhance the home environment while offering protective functions. Finally, recognizing the unique needs of different pet types, such as the destructive chewing habits of puppies or the delicate balance and orthopedic needs of senior dogs, allows companies to design specialized products, increasing perceived value and justifying premium price points.

- Material Type:

- Synthetic Fiber (Nylon 6,6, Polyester/PET, Polypropylene)

- Natural Fiber (Wool, Sisal, Jute)

- Blended Fiber (Mix of natural and synthetic for enhanced durability)

- Application:

- Residential (Single-family homes, Multi-unit housing)

- Commercial (Veterinary clinics, Grooming salons, Pet hotels, Retail stores)

- Distribution Channel:

- Offline (Specialty Flooring Stores, Home Improvement Centers, Professional Installers)

- Online (E-commerce Platforms, Brand Websites, Subscription Services)

- Pet Type:

- Dogs (Small Breed, Large Breed, Senior/Orthopedic Focus)

- Cats (Scratch-resistant options, Hair shedding mitigation)

- Other Small Household Pets (Rabbits, Ferrets)

Value Chain Analysis For Pet Carpet Market

The Pet Carpet Market value chain begins intensely in the upstream segment with the sourcing and manufacturing of raw materials, primarily focusing on synthetic polymers (nylon pellets, PET resins) and specialized chemical treatments (stain repellents, antimicrobial agents). Key upstream activities involve polymerization, spinning of fibers, and complex dyeing processes, particularly solution dyeing which ensures colorfastness crucial for pet applications requiring harsh cleaning agents. The cost and quality of these raw inputs significantly dictate the final product's performance and profitability. Suppliers capable of providing sustainable, recycled, or bio-based polymers at scale gain a competitive advantage, responding to the rising pressure for eco-friendly products within the market.

Midstream activities center on manufacturing, which includes tufting, weaving, bonding, and applying specialized backing and protective coatings. This stage is highly capital-intensive, requiring advanced machinery and strict quality control, especially concerning the uniform application of proprietary stain-and-odor treatments. Distribution channels then connect manufacturers to the end consumer. Direct channels involve manufacturers selling directly via e-commerce or specialized brand showrooms, offering greater control over branding and pricing. Indirect channels involve wholesalers, large big-box retailers (Home Depot, Lowe’s), and independent specialty flooring dealers who provide installation and consultation services. The latter remains critical for large-scale residential and commercial projects requiring expert measurement and fitting.

The downstream segment encompasses professional installation, maintenance services, and consumer engagement. Post-purchase support, including robust warranty execution and detailed cleaning instructions (often product-specific), enhances consumer satisfaction and brand loyalty. The shift towards online retail has amplified the importance of strong digital marketing and customer review management in the downstream segment. Effective value chain management, specifically optimizing the logistics between fiber production and final installation, minimizes costs, reduces lead times, and ensures the product's protective features remain intact until they reach the user’s floor. Manufacturers are increasingly integrating forward by offering affiliated installation services to maintain quality control across the entire product lifecycle.

Pet Carpet Market Potential Customers

The primary end-users and potential buyers in the Pet Carpet Market are bifurcated into two major categories: Residential Consumers and Commercial Entities. Residential consumers represent the largest segment and include current pet owners, prospective pet owners, and renters or homeowners undergoing renovations who prioritize the aesthetic and protective qualities of their living spaces. These customers are typically motivated by the need to prevent damage caused by pet accidents, reduce cleaning efforts, and improve the comfort and safety of their pets, especially older animals requiring orthopedic support or improved traction on slick surfaces. The demographic skew often favors middle to high-income households in urban and suburban areas where pet ownership is high and where investments in home quality are commonplace.

The Commercial sector encompasses a diverse range of buyers requiring specialized, institutional-grade flooring solutions. This includes veterinary hospitals and clinics that need easily sanitized, non-slip, and fluid-impermeable carpets to maintain strict health and safety protocols. Pet boarding facilities and hotels require extremely durable, high-traffic-rated carpets that can withstand intensive cleaning and constant wear from numerous animals. Additionally, pet-friendly offices and retail establishments represent a growing customer base, seeking carpets that communicate a welcoming environment while adhering to commercial maintenance standards. For commercial buyers, total cost of ownership (TCO), longevity, fire safety ratings, and rigorous cleanability are the paramount purchasing criteria.

A rapidly emerging customer demographic consists of Property Management Companies and developers of multi-family housing (apartments and condominiums). As pet ownership becomes a standard amenity, developers are seeking bulk purchasing options for durable, standardized pet carpet solutions that minimize turnover costs associated with pet damage between tenancies. These professional buyers prioritize warrantied performance against specific pet stains and ease of replacement. The segmentation of potential customers relies heavily on tailored messaging: focusing on emotional connection and aesthetics for residential users, and emphasizing hygiene, durability, and low TCO for commercial and property management clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mohawk Industries, Shaw Industries Group, Tarkett S.A., Interface Inc., Beaulieu International Group, Engineered Floors, Dixie Group, Carpets Plus COLORTILE, Cormar Carpet Company, J+J Flooring Group, Philadelphia Commercial, Kraus Flooring, Stanton Carpet Corporation, Milliken & Company, Dream Weaver, Queen Carpet, The Carpet and Rug Institute (CRI) members. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Carpet Market Key Technology Landscape

The technological landscape of the Pet Carpet Market is heavily dominated by advancements in fiber chemistry and specialized finishing treatments designed to enhance durability, stain resistance, and microbial defense. A critical innovation is the widespread adoption of solution-dyed fibers, primarily nylon (Nylon 6 and Nylon 6,6) and polyester (PET), where color is added to the polymer before the fiber is extruded. This process creates a colorfast fiber that resists fading from strong cleaning agents, including bleach, which is often required to sanitize pet accidents. Furthermore, high-performance synthetic fibers are increasingly engineered with advanced molecular structures that resist crushing and matting, maintaining the carpet's aesthetic appearance despite heavy traffic and furniture displacement, a common issue in pet households.

Another major technological pillar is the development of advanced liquid barriers and backing systems. Traditional carpets often allow liquids to penetrate the backing and reach the subfloor, leading to permanent odors, mold growth, and costly structural damage. Modern pet carpets utilize impervious, non-porous backings (such as high-density polyurethane or specialized latex compounds) that completely block moisture migration. This technology is essential for commercial applications like veterinary clinics, where hygiene failure is unacceptable. Concurrent developments in proprietary stain repellent technologies involve surface treatments that create a molecular shield, preventing liquids from adhering to the fiber surface, allowing pet owners to blot up spills effectively before permanent staining occurs.

The market also benefits significantly from antimicrobial and anti-odor technologies. These include specialized chemical compounds integrated into the fiber or backing that actively inhibit the growth of bacteria, mildew, and fungi, which are the primary sources of lingering pet odors. Innovations in odor neutralization extend beyond simple masking; some technologies utilize zeolite minerals or carbon-based absorbents embedded within the carpet structure to capture and neutralize odor-causing molecules over time. Looking forward, the application of smart textiles and sensors, while nascent, holds potential for carpets that can signal excessive moisture or temperature changes, aiding in preventative maintenance and health monitoring for pets, driving the market toward a more integrated, high-tech home solution.

Regional Highlights

Regional dynamics within the Pet Carpet Market exhibit substantial variation driven by economic maturity, climate, housing types, and the density of pet ownership. North America, encompassing the United States and Canada, represents the largest market share globally. This dominance is attributed to high disposable incomes, deeply ingrained pet ownership culture (pet spending often exceeds discretionary spending), and a strong propensity for large-scale home renovations involving premium, specialized flooring. The US market is characterized by robust demand for high-performance nylon and polyester carpets with lifetime stain and odor warranties, reflecting a consumer base that values convenience and long-term investment protection. Furthermore, established distribution networks and the presence of major global manufacturers underpin the region's maturity.

Europe holds the second-largest share, exhibiting mature demand concentrated in Western European nations like Germany, the UK, and France. Unlike North America, the European market often shows a stronger preference for environmentally certified and sustainable products, driving the demand for carpets using recycled content or non-toxic, bio-based stain treatments. Regulatory frameworks (such as REACH compliance) significantly influence product formulation, pushing manufacturers towards advanced material science solutions that maintain performance without relying on restricted chemicals. Urbanization trends in Europe, leading to smaller, high-density living spaces, also fuel demand for products that manage noise and improve air quality, features often enhanced in premium pet carpet offerings.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fundamentally driven by accelerating urbanization, rising middle-class disposable income, and a demographic shift favoring small, companion pets in major economies such as China, Japan, and South Korea. While the overall market size remains smaller than the West, the growth potential is immense. Demand here is often bifurcated, with a premium segment seeking globally recognized brands and a massive, price-sensitive segment requiring functional, yet affordable, solutions. Cultural preferences in APAC often lean towards modular solutions or specialized rugs rather than full wall-to-wall carpeting, offering a unique opportunity for product innovation tailored to local housing structures and cleaning practices.

Latin America (LATAM) and the Middle East & Africa (MEA) collectively represent nascent but expanding markets. In LATAM, growth is driven by improving economic conditions and a noticeable increase in household pet ownership, particularly in metropolitan centers like São Paulo and Mexico City. Challenges include economic volatility and less sophisticated distribution infrastructure compared to developed markets, leading to higher reliance on imported goods. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows increasing interest in luxury and high-specification pet carpets as residential interior design standards rise. However, climatic factors (extreme heat and reliance on cooling systems) necessitate specialized materials that resist degradation from high temperatures and humidity, influencing material choices and application feasibility.

- North America (US, Canada): Largest market share; high willingness to pay for premium, warrantied performance products; focus on Nylon and Polyester durability.

- Europe (Germany, UK, France): Strong demand for sustainable, eco-friendly, and non-toxic materials; rigorous regulatory compliance (e.g., REACH); growing trend towards localized, specialized product offerings.

- Asia Pacific (China, India, Japan): Highest growth rate globally; driven by rapid urbanization and rising income; market opportunities in modular carpets and culturally specific designs; price sensitivity remains a key factor.

- Latin America (Brazil, Mexico): Emerging market driven by economic improvement and increased pet adoption; challenges related to distribution and reliance on imported high-end products.

- Middle East and Africa (MEA): Growth concentrated in GCC nations; focus on high-end luxury specifications; technological requirements for heat and humidity resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Carpet Market.- Mohawk Industries

- Shaw Industries Group

- Tarkett S.A.

- Interface Inc.

- Beaulieu International Group

- Engineered Floors

- The Dixie Group

- Cormar Carpet Company

- J+J Flooring Group

- Stanton Carpet Corporation

- Milliken & Company

- Dream Weaver

- Kraus Flooring

- Queen Carpet

- Godfrey Hirst

- Victoria PLC

- Balta Group

- Gerflor Group

- Karastan

- Tandus Centiva

Frequently Asked Questions

Analyze common user questions about the Pet Carpet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the best type of carpet material for extreme pet wear?

Solution-dyed Nylon 6,6 is generally considered the best material for extreme pet wear. It offers superior durability, exceptional resilience against crushing, and is permanently stain-resistant due to the color being embedded within the fiber structure, allowing the use of strong cleaning agents without color loss.

Are specialized pet carpets truly odor and urine proof?

High-quality pet carpets are engineered to be highly resistant to odor and urine damage through two primary technologies: impervious backings that prevent liquid seepage to the subfloor, and integrated antimicrobial agents that neutralize odor-causing bacteria growth within the carpet fibers.

How do pet carpets differ from standard residential carpets?

Pet carpets differ by incorporating advanced protective features such as lifetime stain warranties for pet accidents, enhanced moisture barriers in the backing, superior tuft bind to resist claw damage, and specialized fiber treatments focused on microbial and odor resistance, features not standard in conventional carpeting.

Is investment in high-end pet carpet cost-effective compared to cheaper alternatives?

Yes, investment in a high-end pet carpet is often more cost-effective over its lifecycle. While initial costs are higher, the robust warranty, resistance to premature degradation, reduced need for professional cleaning, and prevention of expensive subfloor damage result in a significantly lower total cost of ownership (TCO).

What sustainability certifications should I look for when purchasing pet carpets?

Consumers should look for certifications such as CRI Green Label Plus for low volatile organic compounds (VOCs) emissions, ensuring better indoor air quality, and certifications related to recycled content use or third-party verification of non-toxic stain protection treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager