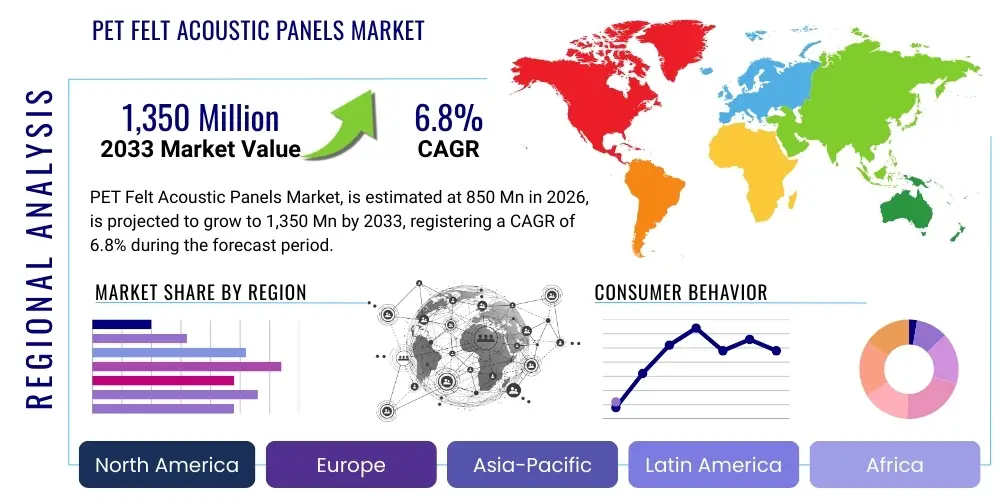

PET Felt Acoustic Panels Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441684 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

PET Felt Acoustic Panels Market Size

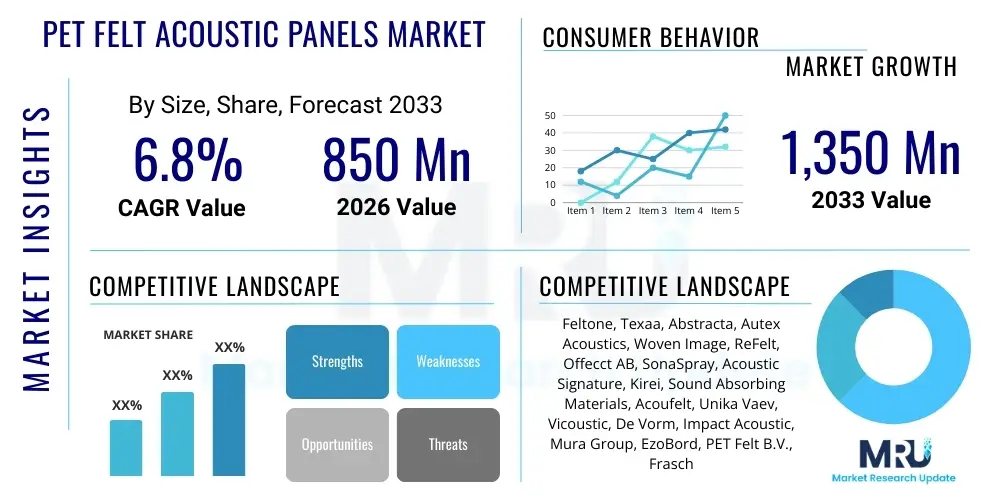

The PET Felt Acoustic Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

PET Felt Acoustic Panels Market introduction

The PET Felt Acoustic Panels Market encompasses the production, distribution, and application of sound-absorbing materials manufactured primarily from recycled Polyethylene Terephthalate (PET) plastic bottles. These panels are renowned for their exceptional acoustic performance, aesthetic versatility, and significant environmental sustainability credentials. The increasing focus on creating comfortable, noise-controlled indoor environments across commercial, institutional, and residential sectors is the primary driver propelling market expansion. Furthermore, stringent building codes and design standards requiring specific Noise Reduction Coefficient (NRC) values in modern construction projects necessitate the adoption of high-performance, eco-friendly acoustic solutions like PET felt panels.

Key applications of PET felt acoustic panels span a diverse range of environments, including corporate offices, educational institutions, healthcare facilities, hospitality venues, and recording studios. The inherent benefits of these panels—such as their lightweight nature, ease of installation, fire retardancy, and customizable coloration and sizing—make them a superior alternative to traditional acoustic materials like fiberglass or mineral wool. Product descriptions typically emphasize the non-toxic, non-irritating nature of the material, along with its ability to contribute positively to LEED and other green building certifications, appealing directly to sustainability-conscious developers and architects.

The market is predominantly driven by the global shift towards circular economy principles, where the utilization of recycled content is highly prioritized. Major driving factors include heightened awareness regarding the psychological and physiological impacts of noise pollution (Sick Building Syndrome), rapid urbanization leading to increased construction activity, and technological advancements in manufacturing processes that allow for greater design complexity and improved durability of the finished panels. The versatility in form factors, ranging from flat panels and baffles to three-dimensional tiles and custom art pieces, ensures sustained market relevance across sophisticated interior design projects worldwide.

PET Felt Acoustic Panels Market Executive Summary

The PET Felt Acoustic Panels Market is characterized by robust growth stemming from the dual pressures of enhanced acoustic performance requirements and rising environmental sustainability mandates. Business trends indicate a strong move toward vertical integration among key manufacturers, aiming to control the supply chain from PET bottle collection and recycling to final panel fabrication and installation services. There is also a notable surge in strategic partnerships between panel manufacturers and architectural firms, facilitating earlier integration of acoustic design elements into project planning, thereby accelerating market penetration. Furthermore, product diversification focusing on bespoke designs, antimicrobial treatments, and integrated lighting solutions is opening up premium market segments and enhancing average selling prices.

Regionally, North America and Europe maintain leading positions, primarily due to established green building standards and substantial renovation activities in commercial spaces. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid infrastructure development, particularly in China and India, alongside increasing adoption of modern office design aesthetics and international workplace standards. Regulatory frameworks supporting the use of sustainable building materials are contributing significantly to this geographical shift. Conversely, regions like Latin America and the Middle East and Africa (MEA) are emerging markets, expected to show steady growth as awareness regarding acoustic quality and sustainable construction practices improves.

Segment trends reveal that the commercial application segment, which includes corporate offices and co-working spaces, continues to dominate the market share due to high demand for sound dampening in open-plan environments. The thickness segment analysis indicates that 9mm and 12mm panels remain the standard, offering optimal balance between acoustic efficacy and material cost. However, the demand for thicker, high-performance panels (15mm and above) is growing rapidly, particularly for specialized applications such as auditoriums and performance venues. The growth in the DIY and residential renovation sectors, although smaller, represents a developing opportunity for simplified, easily installable panel solutions sold through e-commerce channels.

AI Impact Analysis on PET Felt Acoustic Panels Market

Users frequently inquire about how Artificial Intelligence can optimize material sourcing, enhance product customization, and streamline installation processes within the PET felt acoustic panel sector. Key themes revolve around predictive modeling for recycled PET availability and pricing volatility, automated design generation tailored to specific room acoustics, and AI-driven quality control during manufacturing. Concerns often center on the initial investment required for AI integration and the necessity for specialized personnel to manage advanced automation systems. Expectations focus on AI reducing material waste, accelerating complex design iterations, and potentially creating entirely new, performance-optimized panel geometries that current traditional design methods overlook. The overarching sentiment is that AI will transform the industry from a materials-focused sector into a sophisticated, data-driven acoustic engineering domain.

AI's primary influence will be felt in optimizing the complex supply chain of recycled materials. Algorithms can predict regional supply fluctuations of high-quality PET bottles, enabling manufacturers to secure raw materials at optimal costs and ensure consistent production cycles. Furthermore, Generative Design AI is being explored to create panels with complex, non-linear geometries that maximize sound diffusion and absorption for unique architectural spaces, surpassing limitations imposed by conventional square or rectangular panel designs. This integration promises enhanced performance metrics and reduced time-to-market for specialized, bespoke acoustic solutions.

In the end-user phase, AI applications include smart acoustic planning software. These tools utilize machine learning to analyze architectural blueprints and room usage patterns, instantly recommending the optimal type, placement, and quantity of PET felt panels required to achieve desired NRC levels, significantly simplifying the specification process for architects and interior designers. This not only improves efficiency but also provides data-backed justification for material choices, addressing user needs for demonstrable acoustic performance metrics and reinforcing the panel's value proposition against competing materials.

- Optimization of Recycled PET Sourcing: AI predictive modeling ensures stable material supply and cost efficiency.

- Generative Design: AI creates complex panel geometries maximizing sound absorption and diffusion.

- Automated Quality Control: Machine vision systems monitor panel density and consistency during manufacturing.

- Smart Acoustic Simulation: AI tools recommend optimal panel placement based on room geometry and usage data.

- Enhanced Customization: Algorithms rapidly generate unique panel patterns and color palettes based on client aesthetic preferences.

- Predictive Maintenance: AI monitors production machinery, minimizing downtime and increasing manufacturing throughput.

DRO & Impact Forces Of PET Felt Acoustic Panels Market

The PET Felt Acoustic Panels Market is propelled by strong environmental drivers and constrained by raw material volatility, while substantial opportunities exist in emerging markets and high-end customization. The most significant Driver is the overwhelming demand for sustainable and recycled content in modern construction, coupled with tightening governmental regulations worldwide concerning indoor air quality and noise control in public buildings. However, the primary Restraint involves the fluctuating global price and inconsistent quality of post-consumer PET bottle feedstock, which directly impacts manufacturing costs and profit margins. A crucial Opportunity lies in the residential market's growing recognition of acoustic comfort and the expansion into niche applications such as automotive interiors and noise barriers for industrial machinery, requiring tailored product development and sophisticated fire rating compliance.

The core Impact Forces shaping the market landscape are centered around environmental sustainability and competitive pricing. The threat of substitutes from bio-based acoustic materials or advanced composites exerts continuous downward pressure on pricing, forcing manufacturers to differentiate through superior design and value-added services like expert acoustic consultation. The bargaining power of buyers, particularly large corporate clients and major architectural firms, is high due to the standardization of base PET felt materials, requiring suppliers to invest heavily in brand reputation, certification, and customization capabilities to maintain competitive advantage.

Furthermore, technological advancements in fiber felting and printing techniques serve as key driving forces, allowing for the creation of aesthetically pleasing and durable panels that seamlessly integrate into high-end architectural designs. Conversely, geopolitical instability affecting global shipping routes and energy costs acts as a major external restraint, increasing logistical challenges for international distribution networks. Successfully navigating these forces requires strategic sourcing, diversification of manufacturing locations, and continuous innovation in product aesthetic and acoustic performance metrics, ensuring the PET felt solution remains the preferred material for sustainable acoustic management.

Segmentation Analysis

The PET Felt Acoustic Panels Market is comprehensively segmented based on product type, thickness, end-use application, and distribution channel, allowing for granular market targeting and strategic development. The product type segmentation distinguishes between flat panels, 3D molded panels, ceiling baffles, and ceiling clouds, reflecting the diverse installation methods and acoustic requirements across different environments. Thickness segmentation is critical as it directly correlates with acoustic performance (NRC value), with 9mm and 12mm being prevalent for general commercial use, while thicker panels (up to 25mm) are reserved for spaces requiring higher levels of sound absorption or structural integrity.

The end-use application is arguably the most dynamic segmentation axis, capturing demand from commercial, institutional, residential, and industrial sectors. Commercial applications, including offices, hotels, and retail spaces, remain the revenue cornerstone due to large volume procurement and high standards for employee wellness and guest experience. The institutional segment, encompassing schools, universities, and hospitals, is characterized by stringent regulatory requirements for fire safety and indoor air quality, favoring certified, low-VOC PET felt panels. Understanding these segment differences allows manufacturers to tailor product specifications, certification processes, and marketing messaging effectively to address specific buyer needs.

Distribution analysis highlights the importance of both direct sales channels to large construction projects and indirect channels, such as partnerships with interior design distributors, material wholesalers, and specialized acoustic contractors. E-commerce platforms are also gaining traction, particularly for standard, easily installable panels targeting small businesses and the growing residential DIY market. This segmentation framework provides a roadmap for market participants to identify lucrative niches and align production capabilities with evolving demand patterns globally.

- By Product Type:

- Flat Panels

- 3D Molded Panels (Tiles, Blocks)

- Ceiling Baffles

- Ceiling Clouds (Suspended Panels)

- Custom Art Panels

- By Thickness:

- < 9 mm

- 9 mm to 12 mm

- 13 mm to 25 mm

- > 25 mm

- By End-Use Application:

- Commercial (Offices, Retail, Hospitality)

- Institutional (Education, Healthcare)

- Residential (Homes, Multi-family Units)

- Industrial/Specialized (Studios, Automotive, Machinery Enclosures)

- By Distribution Channel:

- Direct Sales

- Indirect Sales (Distributors, Wholesalers)

- E-commerce

Value Chain Analysis For PET Felt Acoustic Panels Market

The value chain for the PET Felt Acoustic Panels Market commences with upstream analysis focused on the procurement of raw materials, primarily post-consumer PET bottles and occasionally virgin PET flakes for specific structural integrity requirements. Key activities in this stage include collection, sorting, washing, flaking, and polymerization to convert recycled PET into usable staple fibers or pellets suitable for felting. Fluctuations in the global price of recycled plastics and the efficiency of local recycling infrastructure significantly influence the input costs for manufacturers. Securing stable, high-quality feedstock is a critical competitive differentiator in the upstream segment, prompting many large players to invest in or partner with dedicated recycling facilities to guarantee supply quality and volume.

Midstream activities involve the specialized manufacturing process, which converts PET fibers into dense felt boards using needle punching or thermal bonding techniques. This stage is capital-intensive, requiring advanced machinery for precise density control, material lamination, and the application of surface treatments like printing or lamination for aesthetic finishes. Value addition is maximized through efficient production scales and the implementation of waste minimization protocols. Manufacturers must also comply with rigorous international certifications (e.g., ISO, fire ratings, VOC standards) during this stage to facilitate global market access. Downstream analysis focuses on logistics, distribution, and installation services.

The distribution channel involves both direct and indirect routes. Direct sales are often utilized for large-scale commercial or institutional projects, involving specialized sales teams and acoustic consultants working closely with architects and general contractors. Indirect channels leverage networks of regional distributors, building material suppliers, and specialized interior fit-out firms who handle smaller, more decentralized projects and residential sales. Effective downstream management requires robust inventory systems, efficient warehousing, and strong after-sales support, including tailored installation guidance. The final stage involves the professional installation of the panels, where skilled labor ensures optimal acoustic performance and aesthetic alignment with the project design, often requiring specialized cutting and mounting techniques.

PET Felt Acoustic Panels Market Potential Customers

Potential customers for PET felt acoustic panels span a broad spectrum of commercial enterprises, public institutions, and private consumers prioritizing enhanced indoor acoustic environments and sustainable building materials. The largest segment of end-users includes architects, interior designers, and general contractors working on large commercial fit-outs, specifically those involved in designing open-plan offices, co-working spaces, and corporate headquarters seeking LEED or WELL Building Standard certification. These professional buyers require detailed technical specifications, certifications, and aesthetic versatility to meet high-design and acoustic performance targets, focusing heavily on NRC ratings and fire safety compliance.

Another significant customer base comprises facility managers and procurement officers within the institutional sector, specifically schools, universities, libraries, and hospitals. In these environments, noise reduction is critical for concentration, healing, and privacy. Customers in this segment are highly sensitive to durability, maintenance requirements, and the panels' contribution to improving indoor air quality (low VOC emissions). Their buying decisions are often driven by public sector budgeting cycles and strict regulatory adherence, favoring suppliers with proven track records and comprehensive product warranties, often leading to large, standardized contract awards.

The rapidly growing segment of potential customers includes boutique hospitality developers (hotels, restaurants, bars) focused on premium guest experiences, as well as the emerging residential market. Residential customers, increasingly aware of noise pollution from home offices, media rooms, and neighboring units, seek aesthetically pleasing, easy-to-install solutions, often purchasing through specialized e-commerce platforms or local home improvement centers. Furthermore, specialized industries like sound recording studios and automotive manufacturers represent niche buyers requiring highly customized, technically superior, fire-rated acoustic solutions for specific noise mitigation challenges, valuing material density, absorption curves, and thermal properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Feltone, Texaa, Abstracta, Autex Acoustics, Woven Image, ReFelt, Offecct AB, SonaSpray, Acoustic Signature, Kirei, Sound Absorbing Materials, Acoufelt, Unika Vaev, Vicoustic, De Vorm, Impact Acoustic, Mura Group, EzoBord, PET Felt B.V., Frasch |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PET Felt Acoustic Panels Market Key Technology Landscape

The technology landscape of the PET Felt Acoustic Panels market is dominated by advancements in fiber processing, material bonding, and surface customization techniques. The foundation of the technology lies in the efficient conversion of post-consumer PET bottles into high-quality staple fibers suitable for acoustic material production. Key technologies include optimized shredding and washing lines that ensure minimal contamination, followed by extrusion systems engineered to produce consistent fiber diameter and length, crucial for achieving uniform panel density and acoustic performance. Thermal bonding and needle-punching are the core manufacturing processes, which create the dense, porous structure necessary for sound absorption without the use of chemical binders, aligning with sustainable material goals and improving indoor air quality.

A significant technological focus is on enhancing the aesthetic appeal and structural integrity of the panels. This includes advanced 3D molding technologies, utilizing heat and pressure to create complex, geometric panel shapes (e.g., tessellations, waves, and organic forms) that offer superior sound diffusion alongside absorption. Digital printing technology, particularly UV printing, allows manufacturers to apply high-resolution custom graphics, textures, or wood grain finishes directly onto the felt surface without compromising acoustic integrity, transforming the panels from functional elements into integrated architectural features. This customization capability is a major competitive advantage, driving demand in high-end design sectors.

Furthermore, technology is improving the functional properties of the panels beyond standard acoustics. Manufacturers are integrating advanced fire-retardant treatments during the felting process to meet stringent regulatory standards (e.g., Class A fire ratings) without using halogenated chemicals. Research is also ongoing into incorporating phase change materials (PCMs) within the PET felt structure to enhance thermal insulation properties, transforming the acoustic panels into dual-function climate control and noise reduction systems. This technological fusion drives innovation, offering multi-performance benefits that differentiate PET felt from conventional acoustic solutions.

Regional Highlights

The global PET Felt Acoustic Panels Market exhibits distinct regional consumption patterns and growth drivers, heavily influenced by local construction standards and environmental mandates.

- North America: This region holds a substantial market share, driven by a high concentration of green building projects (LEED, WELL standards) and a strong corporate emphasis on employee wellness and office acoustics. The market benefits from significant renovation activities in the US and Canada aimed at converting traditional office layouts to open-plan designs, necessitating widespread acoustic mitigation. Demand is high for high-end, custom-printed, and architecturally integrated 3D panel solutions.

- Europe: Europe is a leader in adopting strict environmental and recycling policies, making PET felt panels a preferred material due to their high recycled content. Countries like Germany, the UK, and the Scandinavian nations show mature markets for acoustic solutions across institutional and commercial sectors. European manufacturers often focus on sophisticated design, minimalist aesthetics, and rigorous testing for VOC emissions and fire safety, driving technological innovation in material compliance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive urbanization, burgeoning commercial real estate sectors, and increasing foreign direct investment in manufacturing and corporate offices, particularly in rapidly developing economies like China, India, and Southeast Asia. While price sensitivity remains a factor, awareness of acoustic comfort and international construction standards is quickly rising, leading to high adoption rates in new building construction projects.

- Latin America (LATAM): The LATAM market is characterized by emerging opportunities, particularly in Brazil and Mexico, driven by infrastructure upgrades and the expansion of the hospitality and retail sectors. Market growth is gradually accelerating as sustainable construction practices gain traction, though supply chain maturity and product awareness are still developing compared to North America and Europe.

- Middle East and Africa (MEA): Growth in the MEA region is driven primarily by large-scale commercial and governmental construction projects in the GCC nations (e.g., UAE, Saudi Arabia). The focus is often on prestigious projects requiring high fire ratings and aesthetically superior acoustic management for luxury hotels, major exhibition centers, and new smart city developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PET Felt Acoustic Panels Market.- Feltone

- Texaa

- Abstracta

- Autex Acoustics

- Woven Image

- ReFelt

- Offecct AB

- SonaSpray

- Acoustic Signature

- Kirei

- Sound Absorbing Materials

- Acoufelt

- Unika Vaev

- Vicoustic

- De Vorm

- Impact Acoustic

- Mura Group

- EzoBord

- PET Felt B.V.

- Frasch

Frequently Asked Questions

Analyze common user questions about the PET Felt Acoustic Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary environmental benefit of choosing PET Felt Acoustic Panels?

The primary benefit is sustainability, as PET felt panels are typically manufactured using a high percentage (often over 50% and sometimes 100%) of post-consumer recycled Polyethylene Terephthalate plastic bottles, significantly reducing landfill waste and minimizing reliance on virgin resources. This contributes directly to circular economy goals and helps projects achieve green building certifications like LEED.

How does the thickness of a PET felt panel affect its acoustic performance?

Panel thickness is directly correlated with the Noise Reduction Coefficient (NRC). Thicker panels (15mm and above) generally offer higher NRC values, meaning they absorb a greater percentage of sound waves, especially lower frequencies. Standard 9mm and 12mm panels are effective for mid to high-frequency noise typical of human speech, suitable for general office spaces.

Are PET felt acoustic panels safe for indoor air quality and fire safety?

Yes, modern PET felt panels are highly regarded for safety. They are typically low-VOC (Volatile Organic Compound) and non-toxic, contributing to better indoor air quality compared to some traditional materials. Furthermore, reputable panels are manufactured to achieve high fire ratings, such as Class A (ASTM E84), making them suitable for commercial and institutional applications requiring strict safety compliance.

What are the key application areas driving current market demand?

The largest driver of current market demand is the Commercial sector, specifically open-plan corporate offices, co-working spaces, and retail environments, where acoustic comfort is essential for productivity and customer experience. Rapid growth is also observed in the Institutional sector (schools and hospitals) due to mandates for regulated noise levels and sustainable material use.

What is the competitive advantage of 3D molded PET felt panels over flat panels?

3D molded panels offer superior aesthetic complexity and enhanced acoustic diffusion capabilities in addition to absorption. Their geometric shapes help scatter sound waves across a broader frequency range, minimizing echo and standing waves more effectively than simple flat panels. This makes them ideal for architecturally significant spaces and specialized acoustic environments.

This comprehensive market insight report confirms the robust trajectory of the PET Felt Acoustic Panels Market, driven primarily by sustainability mandates and the increasing prioritization of acoustic quality in modern architectural design globally. The integration of advanced manufacturing technologies, coupled with sophisticated customization capabilities, positions PET felt as a leading solution in the global acoustic materials sector.

The market's resilience against economic fluctuations is underpinned by its foundation in recycled materials, offering a clear environmental advantage that resonates with corporate ESG goals and public policy. Strategic market participation requires continuous investment in R&D to enhance fire safety, integrate smart acoustic features, and streamline supply chains for recycled feedstock. Future success hinges on balancing material cost stability with the rapidly evolving demands for aesthetic complexity and multifunctional performance in both established and emerging regional markets.

Addressing the challenges related to feedstock volatility and increasing market fragmentation through strategic partnerships and vertical integration will be crucial for sustained competitive leadership. The long-term outlook remains highly positive, supported by global urbanization trends and an unwavering commitment across all construction sectors toward achieving healthier, quieter, and more environmentally responsible built environments. The PET Felt Acoustic Panels market is set to transition from a niche sustainable product to a mainstream requirement in high-performance building design.

The penetration of this material is heavily correlated with the proliferation of performance-based building standards rather than prescriptive regulations, necessitating that manufacturers provide transparent and verifiable acoustic performance data (NRC, SAA) for every product line. This data transparency is essential for gaining the confidence of professional specifiers. The movement towards modular construction and prefabricated building components also presents a lucrative pathway for PET felt panels, allowing for factory-installed acoustic solutions that improve construction efficiency and quality control on site, further enhancing the material's market appeal and reducing overall installation costs, which is a major factor in large-scale project budgeting and execution efficiency.

In addition to standard aesthetic customization, the market is beginning to witness the development of PET felt panels integrated with connectivity solutions, such as wireless charging pads or embedded sensor technology for monitoring room occupancy and acoustic quality in real-time. These innovations transform the panel from a passive sound absorber into an active component of the smart building ecosystem. Such technological differentiation will command premium pricing and expand the total addressable market by offering unparalleled value proposition to technology-forward corporate clients and high-security institutional environments.

The segmentation by distribution channel is becoming increasingly blurred as e-commerce platforms begin to service commercial clients directly with specialized logistics, challenging the traditional reliance on large material distributors. Success in this evolving environment requires a hybrid strategy: maintaining strong personal relationships with architectural specifiers for large custom projects while simultaneously optimizing digital channels for efficient, high-volume sales of standardized products targeting the small-to-medium enterprise (SME) market and residential consumers, ensuring maximum market reach and channel efficiency across the value chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager