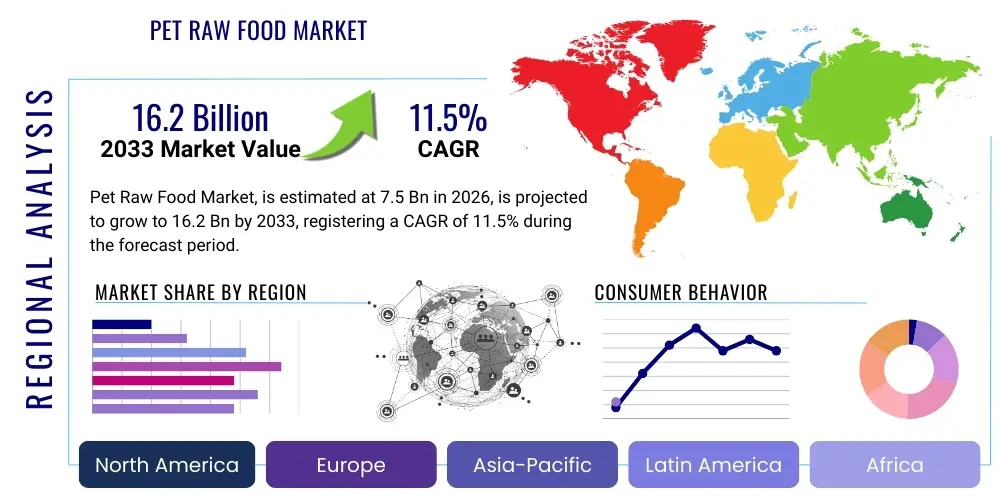

Pet Raw Food Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440931 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Pet Raw Food Market Size

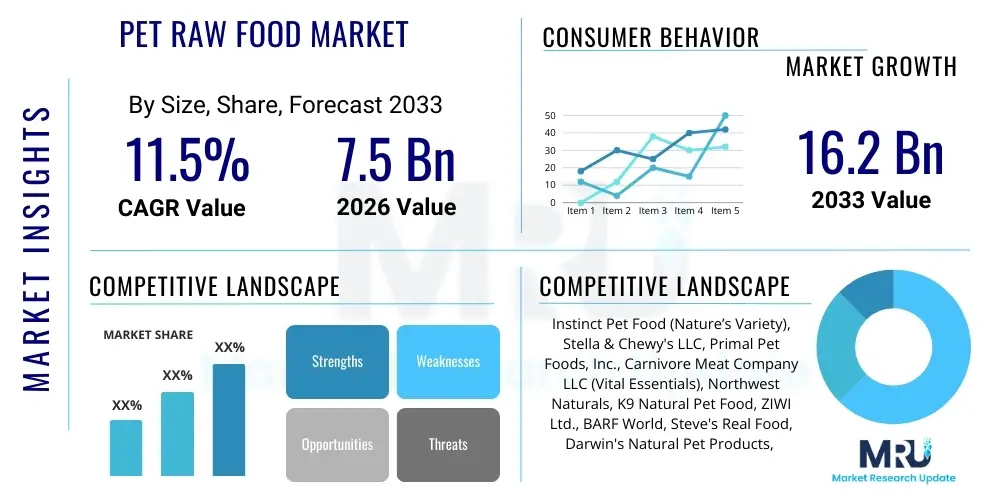

The Pet Raw Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $16.2 Billion by the end of the forecast period in 2033.

Pet Raw Food Market introduction

The Pet Raw Food Market encompasses commercially available diets for companion animals, primarily dogs and cats, formulated using uncooked, minimally processed ingredients, including muscle meat, organs, bones, high-quality fruits, and vegetables. This high-growth market segment is experiencing robust expansion driven by increasing pet humanization trends, where owners prioritize premium, species-appropriate, and nutritionally superior dietary options mirroring ancestral carnivorous diets. The foundational premise of raw feeding proponents is the enhancement of physiological functions, including superior digestive health, improved coat and skin condition, better dental hygiene, and overall vitality in pets, contrasting sharply with the reliance on heavily processed traditional kibble. The commercial products typically fall into categories such as complete and balanced frozen raw meals, highly convenient freeze-dried raw nuggets, and hybrid raw-coated kibbles, catering to varied consumer logistical requirements, convenience needs, and budget considerations.

Major applications of pet raw food extend significantly beyond general maintenance to crucial therapeutic uses, particularly for dogs and cats suffering from chronic ailments such as allergies, idiopathic chronic skin conditions, inflammatory bowel disease (IBD), and dietary sensitivities that conventional diets fail to manage effectively. Veterinarians who specialize in holistic or functional medicine, alongside certified pet nutritionists, are increasingly recognizing the positive anecdotal evidence and emerging clinical benefits associated with these nutrient-dense, highly bioavailable raw formulations. Benefits frequently cited by consumers include improved stool quality and volume reduction, natural dental cleaning effects (often attributed to recreational bones included in some specific diets), superior hydration due to the naturally high moisture content of raw meat, and measurable increases in sustained energy levels. These perceived and demonstrated benefits serve as powerful demand accelerators, especially among owners seeking dietary solutions after exhausting traditional interventions.

The driving factors underpinning this market's vigorous expansion include heightened consumer awareness regarding rigorous ingredient sourcing standards (demanding human-grade quality), a pervasive societal desire for radical transparency in pet food manufacturing processes, and highly effective digital marketing campaigns that emphasize the biological appropriateness and evolutionary alignment of raw diets. Furthermore, the market's favorable trajectory is intrinsically linked to socio-demographic shifts, notably the increasing prominence of millennial and Gen Z pet ownership, cohorts typically characterized by higher spending on premium health products and a strong affinity for ethical and sustainable sourcing narratives. The widespread adoption of seamless subscription models and direct-to-consumer (DTC) sales channels has effectively mitigated the logistical inconvenience traditionally associated with raw feeding, making daily preparation less onerous for busy pet owners. Concurrently, regulatory scrutiny, particularly from bodies like the FDA and CFIA, concerning microbial pathogen control (e.g., Salmonella and Listeria), remains a critical, non-negotiable factor shaping manufacturing standards, compelling producers to invest massively in specialized pathogen mitigation technologies such as High-Pressure Processing (HPP) and stringent quality assurance protocols.

The industry's focus on innovation is key to sustaining growth. Manufacturers are continuously investing in research and development to create new, specialized product lines, including those targeting specific breed sizes, life stages (like high-calorie puppy formulas or joint-support senior diets), and unique health conditions. This specialization allows for highly differentiated marketing and premium pricing. Moreover, packaging science is playing an increasingly important role, with developments in resealable, portion-controlled packaging for frozen raw meals and moisture-barrier materials for freeze-dried products ensuring optimum freshness and extending freezer shelf life. The transition towards utilizing sustainable protein sources, such as responsibly harvested fish or even insect-based components in supplements and mixers, also aligns with the ethical consumption priorities of the target demographic, ensuring the market remains strategically positioned for long-term, ethically conscious growth.

Pet Raw Food Market Executive Summary

The Pet Raw Food Market is currently navigating a period of intense strategic activity, characterized by dynamic business trends focusing on operational scalability, technological safety implementation, and nuanced geographic expansion. Key business trends involve significant vertical integration efforts among leading players, aimed at securing reliable, verifiable human-grade raw material supply chains to ensure consistency and meet transparency demands. This integration mitigates volatility in sourcing and provides a strong foundation for premium pricing justification. Market competition is accelerating, necessitating that specialized raw food producers invest heavily in proprietary processing technologies and scientific validation to differentiate themselves from global conglomerates entering the space, often through strategic acquisitions of established raw brands to instantly gain specialized manufacturing expertise and brand trust. A critical operational trend is the enhanced efficiency within the complex cold chain, leveraging real-time monitoring via IoT and sophisticated Enterprise Resource Planning (ERP) systems to minimize spoilage, which is essential given the extremely high input costs of raw materials.

From a regional perspective, North America and Europe retain their established positions as the revenue leaders, driven by the highest per-capita spending on pet products, cultural acceptance of premium nutrition, and highly developed, efficient frozen distribution infrastructures. However, strategic focus and future capital allocation are heavily shifting towards the Asia Pacific (APAC) region, which is anticipated to be the fastest-growing market segment throughout the forecast period. This rapid expansion in APAC, fueled by emerging middle classes in countries like China, Japan, and South Korea, is contingent upon global manufacturers successfully navigating diverse import regulations and investing in regional cold chain hubs to support the frozen segment, or strategically prioritizing the high-margin, logistically simple Freeze-Dried format. Regulatory environments significantly influence regional strategies; for example, the stringency of EU feed hygiene regulations impacts processing standards in European manufacturing more profoundly than in some developing markets.

Analysis of segment trends clearly indicates a structural preference for consumer convenience, which is driving the disproportionate growth of the Freeze-Dried Raw format. Although Frozen Raw still commands the largest overall volume share, Freeze-Dried products offer crucial benefits in terms of ease of storage, shelf stability, and portability, making them highly attractive to time-poor urban consumers and facilitating sales through traditional e-commerce platforms. Protein segmentation reveals a crucial polarization: while poultry and beef remain volume leaders, Exotic Proteins (such as rabbit, venison, and bison) are exhibiting steep growth curves, commanding premium prices by catering to the necessary niche of hypoallergenic and limited-ingredient diets. Furthermore, the distribution landscape is increasingly defined by the efficiency of Direct-to-Consumer (DTC) subscription services, which allow manufacturers unprecedented control over customer relationships, educational outreach, and recurring revenue streams, effectively bypassing traditional retail markups and inventory risks associated with perishable goods.

In summary, the raw pet food market is fundamentally shifting from a niche, grassroots movement to a professionalized, high-technology food manufacturing sector. Successful navigation of the next decade requires sophisticated risk management—specifically, flawless safety records achieved through HPP and AI-driven quality checks—coupled with effective communication strategies that validate the nutritional superiority of raw diets to both consumers and the medical community. Investment capital is being channeled not just into increasing production capacity, but critically into technology that ensures verifiable sourcing, eliminates pathogen risk, and optimizes the complex logistics of perishable product distribution. The market’s resilience and growth potential are inextricably linked to its ability to marry the emotional, natural feeding ethos with industrial-scale safety and efficiency.

AI Impact Analysis on Pet Raw Food Market

Analysis of common user questions related to the transformative impact of Artificial Intelligence (AI) on the Pet Raw Food Market reveals highly concentrated interest in enhancing safety, achieving true nutritional customization, and optimizing the notoriously complex supply chain. Users frequently ask about AI's capacity to provide a 'zero-risk' guarantee for raw diets by implementing instantaneous, non-destructive pathogen detection methods—moving beyond the time-consuming and often retrospective nature of traditional microbiological testing. This directly addresses the market's single largest hurdle: consumer anxiety regarding bacterial contamination. Expectations are high regarding the integration of machine learning to generate hyper-personalized nutritional formulations. Users anticipate AI models that can process vast datasets—including pet genomic profiles, longitudinal health records, real-time activity metrics gathered from wearables, and even environmental factors—to recommend raw diets that are precisely balanced for optimal health and disease prevention, far surpassing the efficacy of current generalized formulations. Moreover, there is significant user interest in how AI can introduce efficiency gains, such as optimizing procurement of highly perishable ingredients and predicting subtle shifts in specialized protein demand, which would ideally translate into cost savings passed on to the premium consumer.

The operational implementation of AI is revolutionizing core manufacturing competencies, particularly quality assurance and traceability. Raw food manufacturers are deploying AI-powered computer vision systems integrated into high-speed production lines. These systems are trained on extensive data sets to instantaneously identify minute quality inconsistencies—such as incorrect trim specifications, deviations in muscle/organ ratios, and the presence of foreign material—with an accuracy and speed that manual inspection cannot match. Furthermore, Machine Learning (ML) algorithms are being utilized to create predictive risk models. By analyzing historical data correlating specific raw material batches, geographical sourcing origins, seasonal variations, and subsequent testing outcomes, these models assign a real-time probability of contamination to incoming ingredients. This proactive risk scoring allows manufacturers to dynamically adjust processing parameters, prioritize HPP cycles, or immediately quarantine and reject materials deemed high-risk, thereby transitioning quality control from a reactive measurement to a continuous, predictive risk management system. This level of granular control is crucial for maintaining the stringent safety standards required for raw pet food.

In the consumer-facing sphere, AI is rapidly becoming the indispensable tool for enhancing market trust and optimizing customer lifetime value. Generative AI is being utilized not merely for rudimentary customer service, but to power sophisticated, expert-level virtual nutrition assistants. These tools can analyze complex questions regarding dietary transitions, ingredient intolerances, and safe handling procedures, providing instant, scientifically substantiated responses that build brand authority and confidence, often directly challenging traditional kibble-based veterinary advice. Simultaneously, AI-driven predictive analytics are transforming market strategy. By synthesizing transactional data, social media sentiment, and search trends, AI models accurately forecast demand for niche products—such as specialized hypoallergenic blends or seasonal protein variants. This high-precision demand forecasting is paramount for managing highly perishable frozen inventory, minimizing waste, optimizing storage allocation, and ensuring just-in-time procurement of expensive raw inputs. The strategic deployment of AI ensures scalable and resilient operational growth while deeply enhancing personalized interaction with the discerning, premium customer base.

- AI-driven Predictive Quality Control: Utilizing machine learning algorithms integrated with spectroscopic and hyperspectral imaging to perform instantaneous, non-destructive safety checks, identifying and scoring the risk of microbial contamination (e.g., E. coli, Salmonella) in raw materials before they enter the processing line.

- Personalized Nutritional Formulation: Deploying advanced AI platforms to synthesize multi-omic data (genetics, health history, microbiome analysis) to algorithmically design and recommend hyper-personalized raw food recipes optimized for the unique physiological needs and preventative health requirements of individual pets.

- Optimized Supply Chain Resilience: Implementing AI algorithms for dynamic, real-time demand forecasting and inventory management of highly perishable frozen and refrigerated ingredients, leading to minimized spoilage rates, reduced warehousing costs, and optimized capital utilization.

- Automated Regulatory Compliance Monitoring: Leveraging AI to continuously scan and interpret global regulatory changes (e.g., AAFCO, EU Novel Food status) and automatically update internal documentation, formulation specifications, and digital labeling requirements, ensuring proactive adherence and minimizing legal risk.

- Enhanced Consumer Trust and Education: Utilizing generative AI to create authoritative, highly specialized virtual nutrition consultants and content engines that provide instant, evidence-based guidance to consumers on raw feeding protocols, safe handling, and dietary transitioning strategies, building brand loyalty and addressing safety concerns.

- Robotics and Hygienic Processing: Integration of AI-guided robotic systems and computer vision in specialized clean rooms for precise, automated portioning, blending, and packaging, maximizing hygiene standards, ensuring macronutrient consistency, and minimizing human contact risk during production.

DRO & Impact Forces Of Pet Raw Food Market

The Pet Raw Food Market is primarily propelled by potent socio-cultural and health-driven factors, notably the unrelenting elevation of pets' status to cherished family members, which encourages owners to prioritize diets that are perceived as the healthiest and most natural biological fit. This emotional driver is consistently reinforced by consumer testimonials and a growing body of scientific inquiry suggesting that raw, unprocessed diets can alleviate chronic health issues, resulting in significant spending inelasticity even in economic downturns. Conversely, the market faces formidable restraining forces: the prohibitive high cost of sourcing human-grade ingredients and maintaining the extensive cold chain infrastructure, and the enduring public health mandate to strictly control microbial contamination (e.g., Campylobacter and pathogenic E. coli). The persistent skepticism within the traditional veterinary establishment regarding the nutritional balance and pathogen risk of raw diets further complicates consumer acceptance and necessary medical endorsement, requiring manufacturers to invest substantial resources into professional education.

Specific driving forces are amplified by the digital era, where social media communities and specialized online forums act as powerful conduits for advocacy, sharing success stories, and disseminating raw feeding philosophies, often overriding cautious professional advice. The increasing diagnosis rates of modern pet illnesses, such as inflammatory bowel disorders, severe dermatological issues, and metabolic syndrome, push dedicated owners towards experimental dietary interventions, often leading them directly to specialized raw or limited-ingredient raw foods as a last-resort therapeutic option. However, the regulatory restraint is significant: the raw food sector is subject to intense scrutiny, forcing mandatory, highly expensive pathogen intervention techniques like HPP. This need for advanced processing technologies acts as a high capital barrier to entry for smaller, independent manufacturers, consolidating power among well-funded, technologically advanced players capable of guaranteeing compliance and safety standards consistently.

Substantial market opportunities are derived from strategic format innovation and geographical diversification. The development and mass marketing of advanced shelf-stable options—such as sophisticated freeze-dried and air-dried products—effectively neutralize the cold chain constraint, unlocking distribution potential in emerging markets in Asia Pacific and Latin America where refrigeration logistics are rudimentary. Furthermore, opportunities exist in leveraging personalized nutrition, utilizing genomic testing and AI-driven platforms to offer tailored raw diets, thereby elevating the product from premium commodity to specialized health solution and justifying even higher price points. The resultant impact forces dictate a clear strategic priority: sustained market growth is achievable only through the marriage of ethical, natural ingredient sourcing (meeting consumer desire) with flawless execution of industrial-scale safety procedures (HPP and digital traceability), effectively bridging the gap between perceived natural benefits and verified public health safety.

- Drivers:

- Elevated Pet Humanization Leading to Premiumization of Diet Selection and High Willingness to Pay.

- Strong Consumer Belief in the Superior Biological Appropriateness and Health Outcomes of Raw Diets.

- Therapeutic Demand from Owners Dealing with Chronic Pet Allergies and Digestive Sensitivities.

- Effective Digital Community Building and Advocacy Accelerating Adoption Rates.

- Restraints:

- Prohibitive Comparative Pricing and Economic Sensitivity Among Non-Affluent Consumer Segments.

- Existential Public Health Risks Associated with Pathogen Contamination and Regulatory Requirements for Mitigation.

- High Fixed and Operating Costs for Maintaining Specialized Cold Chain Logistics and Sub-Zero Storage.

- Continued Institutional Skepticism and Cautionary Statements from Veterinary Medical Associations.

- Opportunities:

- Technological Neutralization of Cold Chain through Advanced Freeze- and Air-Drying Preservation.

- Significant Untapped Market Expansion in Rapidly Growing APAC and LATAM Urban Centers.

- Commercialization of AI-Enabled Personalized Pet Nutrition and Diagnostic Support.

- Exploitation of Sustainable, Novel Protein Sources (e.g., insect protein, cultivated meat inputs).

- Impact Forces:

- Mandatory Capital Investment in High-Pressure Processing (HPP) and State-of-the-Art Quality Assurance Facilities.

- Intense Pressure to Fund and Publish Peer-Reviewed Clinical Trials to Gain Credibility and Overcome Professional Skepticism.

- Strategic Shift Towards DTC Models and Subscription Services to Control Logistics and Customer Relationship Management.

Segmentation Analysis

Granular segmentation analysis is fundamental to dissecting the competitive landscape and identifying high-yield growth pockets within the Pet Raw Food Market, focusing on variations in technological adoption, consumer convenience demands, and nutritional specialization. The structural division based on Product Type—Frozen Raw versus Shelf-Stable Raw (Freeze-Dried/Air-Dried)—defines the logistical and financial parameters for manufacturers. The Frozen segment, while retaining the foundational credibility of raw feeding and holding the largest current volume, requires high-cost, specialized infrastructure and limits distribution scope. Conversely, the Freeze-Dried segment serves as the key engine for market value growth, offering a high-margin, shelf-stable product that caters directly to the consumer's need for maximum convenience and the industry's need for scalable, non-refrigerated distribution, making it the strategic priority for global market penetration and e-commerce dominance.

Segmentation by Pet Type reveals critical differences in growth momentum and nutritional complexity. Although the Dog segment represents the overwhelming majority of current sales volume, the Cat segment is demonstrating an accelerated growth trajectory. This is driven by heightened awareness of the severe consequences of processed diets (e.g., low moisture kibble) on feline renal and urinary tract health, propelling owners toward high-protein, high-moisture raw solutions. Catering to the feline segment demands extreme precision in formulation, specifically mandatory taurine supplementation and strict adherence to low carbohydrate profiles, requiring distinct manufacturing and R&D strategies separate from canine-focused operations to ensure both palatability and nutritional adequacy for obligate carnivores.

Furthermore, segmentation by Protein Source provides essential insight into pricing power and therapeutic market targeting. While ubiquitous proteins like chicken and beef secure high sales volume, providing entry-level raw options, the fastest revenue growth resides within the Novel/Exotic Proteins segment (e.g., kangaroo, rabbit, bison). These proteins command premium pricing and are strategically vital for capturing the highly loyal, therapeutic market niche comprising pets with severe, confirmed allergies where ingredient elimination is critical. Distribution Channel analysis underscores the irreversible shift towards digital platforms. The Direct-to-Consumer (DTC) subscription model offers the maximum strategic advantage, allowing for predictive revenue streams, personalized customer engagement via integrated AI tools, and superior control over the cold chain logistics (for frozen delivery), ultimately enabling higher profit margins by eliminating multiple intermediary markups.

- Product Type:

- Frozen Raw Pet Food (Complete & Balanced Patties, Ground Meals, Bulk Components)

- Freeze-Dried Raw Pet Food (Nuggets, Meal Toppers, Portable Treats)

- Air-Dried Raw Pet Food (Chewier Texture, Shelf-Stable, Intermediate Moisture)

- Hybrid/Raw Coated Kibble (Kibble blended with Freeze-Dried Raw for Transitioning Feeders)

- HPP-Treated Raw Diets (Products explicitly marketed with High-Pressure Processing safety assurance)

- Pet Type:

- Dogs (Specialized formulas for Giant, Large, Medium, and Small breeds)

- Cats (High-Taurine, Moisture-Rich, Ultra-Low Carbohydrate Formulations)

- Other Pets (Niche raw diets for Ferrets, Hedgehogs, etc.)

- Protein Source:

- Conventional Poultry (Chicken, Turkey – Cost Leadership and Volume)

- Conventional Red Meat (Beef, Lamb – Rich in Iron and Essential Fatty Acids)

- Aquatic Sources (Salmon, Mackerel, Shellfish – Targeted Omega-3 Benefits)

- Novel/Exotic Proteins (Venison, Rabbit, Duck, Quail – Hypoallergenic and Therapeutic Use)

- Distribution Channel:

- Specialty Pet Food Stores (High-touch, expert consultation sales environment)

- Veterinary/Holistic Clinics (Sales driven by professional therapeutic recommendations)

- Online Retail (Chewy, Amazon, General E-commerce – High Volume, Low Margin)

- Direct-to-Consumer (DTC)/Subscription Services (Highest Growth Potential and Customer Loyalty)

- Mass Merchandisers (Focus on Freeze-Dried and Hybrid formats due to infrastructure constraints)

- Formulation:

- Complete and Balanced Meals (Meeting AAFCO/FEDIAF Nutritional Profiles)

- Supplemental Raw Products (Bone Broths, Single-Ingredient Chews, Organ Mixers)

Value Chain Analysis For Pet Raw Food Market

The integrity of the Pet Raw Food value chain is fundamentally dictated by the rigor of upstream sourcing and the inviolability of the cold chain, creating a profile distinct from processed food manufacturing. Upstream analysis focuses intensely on highly selective, verified procurement of human-grade raw ingredients, which typically include certified cuts of muscle meat, highly regulated organ meat procurement, and nutritionally appropriate bone components. Manufacturers frequently bypass traditional commodity brokers, favoring direct, contract-based relationships with certified abattoirs and farms to ensure transparency, ethical handling, and verifiable quality documentation, often demanding certifications like USDA inspection or equivalent international standards. This commitment to premium sourcing necessitates significant operational costs and continuous auditing, but it is essential for substantiating the 'human-grade' claims crucial to the raw food category's premium pricing structure.

The manufacturing stage is defined by high technological dependency and obsessive hygiene control. Following raw material receipt, rapid processing occurs within stringent, dedicated clean room environments to minimize microbial load prior to intervention. Key technological investments include specialized cryogenic grinders (to prevent heat generation during mincing), high-precision volumetric blending machinery to ensure exact nutritional uniformity across batches, and, most critically, dedicated High-Pressure Processing (HPP) units used for final pathogen mitigation before packaging. After packaging and immediate flash-freezing, the product must be rigorously tracked. Integration of IoT sensors within storage freezers and shipping vehicles provides continuous, verifiable data regarding temperature and humidity compliance, offering an auditable guarantee of product integrity from the processing floor to the distribution center, mitigating the existential risk of temperature-related spoilage.

Downstream analysis covers distribution, marketing, and the final point of sale, where channels are strategically segregated. Direct-to-Consumer (DTC) models represent the highest margin strategy; they utilize proprietary refrigerated fleets or specialized third-party logistics (3PL) providers focused on "last-mile" frozen delivery, allowing manufacturers to maintain maximum control over product integrity until it reaches the customer's freezer. Indirect channels leverage specialty retailers and mass merchandisers, but require the manufacturer to enforce strict retail compliance regarding dedicated, functioning freezer space for raw products. Marketing strategies in the downstream are heavily centered on transparent education, utilizing certified nutritionists and scientific content to address safety concerns and justify premium pricing, positioning the raw diet as an unparalleled investment in pet wellness. The efficiency of this complex value chain is wholly dependent on seamless digital integration (Blockchain/ERP) linking initial ingredient certification (upstream) with verifiable cold chain delivery (downstream).

Pet Raw Food Market Potential Customers

The primary demographic of the Pet Raw Food Market potential customers comprises affluent, highly educated pet owners—predominantly Gen X and Millennial populations—who inhabit urban and densely populated suburban areas of developed Western economies. This core segment, frequently identified as 'Pet Parents,' demonstrates deep psychological attachment and high emotional empathy toward their companion animals, viewing them as beneficiaries of the same wellness and preventative health principles they apply to themselves (e.g., preference for organic, minimally processed foods). These consumers are characterized by high levels of digital literacy, performing extensive online research into pet nutrition, and are often highly engaged with brand narratives surrounding ethical sourcing, sustainability, and human-grade quality assurance. They exhibit significant price inelasticity, accepting the premium cost as a necessary investment for superior long-term health outcomes, often preferring the convenience and consistency provided by managed DTC subscription services.

A secondary, but rapidly expanding, highly valuable customer segment is constituted by owners whose pets are currently afflicted with diagnosed chronic conditions, such as severe auto-immune responses, persistent gastrointestinal disorders, or debilitating skin allergies. This therapeutic market often seeks out raw food as an intervention after traditional veterinarian-prescribed processed diets have failed to resolve the issue. These buyers are extremely specialized, seeking limited-ingredient diets (LIDs) and novel protein sources (e.g., rabbit or bison) and are highly responsive to recommendations from holistic or functional veterinarians, bypassing general practitioners who may express skepticism. Their brand loyalty is exceptional once a successful formulation is found, and they require absolute transparency and rigorous documentation regarding ingredient sourcing and processing to ensure compliance with elimination diets, making them critical targets for specialized product lines.

The emerging potential customer base includes younger Gen Z consumers and transitional raw feeders who are seeking entry points into the premium nutrition space without committing immediately to the full financial and logistical burden of frozen raw diets. This segment is highly receptive to hybrid formats, such as raw-coated kibble, or cost-effective supplements like freeze-dried meal toppers and bone broths, which they use to enhance the nutritional profile of a more affordable base diet. Manufacturers strategically engage this group by offering flexible starter packs, smaller, accessible freeze-dried formats, and targeted social media content emphasizing the gradual health benefits and comparative value proposition. Successfully converting this transitional base into committed frozen or freeze-dried raw buyers represents a core strategy for maintaining long-term volume growth and expanding the total addressable market beyond the most affluent consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $16.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instinct Pet Food (Nature’s Variety), Stella & Chewy's LLC, Primal Pet Foods, Inc., Carnivore Meat Company LLC (Vital Essentials), Northwest Naturals, K9 Natural Pet Food, ZIWI Ltd., BARF World, Steve's Real Food, Darwin's Natural Pet Products, Champion Petfoods (Orijen/Acana Raw), Small Batch Pet Food, Tucker's Raw Frozen, OC Raw Dog Food, Dr. Marty Pets, Furchild, Nutriment, We Feed Raw, Answers Pet Food, The Honest Kitchen (Hybrid/Dehydrated Focus) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pet Raw Food Market Key Technology Landscape

The technological architecture of the Pet Raw Food Market is focused on balancing the preservation of the raw, biologically active state of ingredients with the absolute necessity for verifiable safety and extended shelf life, addressing the primary consumer and regulatory mandates. The cornerstone technology for safety compliance is the wide adoption of High-Pressure Processing (HPP). HPP is a non-thermal, hydrostatic pressure application (typically 400–600 MPa) used post-packaging to effectively inactivate vegetative bacteria, molds, and parasites, ensuring the elimination of pathogens like Listeria monocytogenes and Salmonella without compromising the integrity of heat-sensitive proteins, vitamins, and enzymes. This process is instrumental in allowing raw food manufacturers to comply with stringent government food safety standards while confidently marketing a ‘raw’ product, fundamentally mitigating the market’s single largest perception risk.

Secondly, advancements in food preservation are crucial for enabling global market expansion and achieving mass-market convenience. Industrial-scale Vacuum Freeze-Drying technology is the dominant innovation here. This process, involving freezing the raw food and then subjecting it to a deep vacuum to sublimate the ice directly into vapor, removes up to 99% of moisture content. The resulting lightweight, shelf-stable product retains superior nutritional integrity, high palatability, and significantly extends the product's shelf life (often exceeding 18 months), crucially eliminating the need for cold chain logistics and making e-commerce and global export economically viable. Continuous technological refinement in this area focuses on optimizing energy efficiency within the sublimation process to lower operational costs and improve throughput, thereby increasing the affordability of the final premium product.

Furthermore, digital technologies are playing an essential governance role in quality control and traceability. Advanced rapid molecular diagnostic techniques, such as Quantitative PCR (qPCR) testing, allow manufacturers to screen large batches of raw materials for specific pathogens in mere hours, providing near real-time safety verification necessary for highly perishable inputs. Simultaneously, the deployment of Distributed Ledger Technology (Blockchain) provides an auditable, immutable system of record for every stage of the value chain. This digital documentation tracks the raw material origin (e.g., specific farm), processing parameters (HPP cycle duration and pressure), and distribution pathway (verified temperature logs via IoT integration). This level of technological transparency provides stakeholders with irrefutable proof of sourcing claims and safety compliance, enhancing brand credibility and acting as a powerful competitive edge against less transparent suppliers.

Regional Highlights

- North America (U.S. and Canada): The dominant market segment globally, characterized by high consumer spending on premium pet products, a culture of aggressive pet humanization, and comprehensive cold chain infrastructure. The U.S. is the primary innovation hub, demonstrating the highest penetration of sophisticated formats like HPP-treated frozen raw and widely available freeze-dried options through robust DTC networks. Regulatory compliance is highly structured, guided by FDA and AAFCO nutritional standards.

- Europe (Germany, UK, France, Scandinavia): The second largest and a mature market, strongly influenced by the BARF feeding philosophy (Biologically Appropriate Raw Food) and stringent EU regulatory guidelines (FEDIAF feed hygiene). The UK and Germany are leading consumers, showing a preference for locally sourced, highly sustainable, and ethically produced raw meats. The region is seeing rapid growth in specialized therapeutic and novel protein raw diets.

- Asia Pacific (APAC, specifically China, Japan, Australia, South Korea): The fastest-growing regional market, driven by rapidly increasing urbanization, rising middle-class disposable incomes, and the adoption of Western-style premium pet care philosophies. Australia and New Zealand are crucial production centers due to high-quality meat exports. Expansion relies heavily on the introduction of shelf-stable formats (freeze-dried) to overcome significant infrastructural challenges associated with cold chain establishment in mainland Asia.

- Latin America (LATAM, especially Brazil, Mexico, Argentina): An emerging market showing substantial potential, particularly in urban, high-income centers. Growth is accelerating as local pet owners seek higher quality alternatives to conventional diets. The market remains highly price-sensitive compared to North America, focusing primarily on frozen raw options produced regionally to manage import costs. Distribution challenges related to consistent electricity supply and cold storage are a limiting factor.

- Middle East and Africa (MEA): Represents the smallest market share, with demand concentrated in affluent urban clusters within the GCC nations. Consumption is almost entirely based on imported, high-end products, primarily in the shelf-stable freeze-dried format due to extreme climate conditions and limited specialized local manufacturing or cold chain support for imported frozen goods. Market growth is slow but consistent within the luxury pet segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pet Raw Food Market.- Instinct Pet Food (Nature’s Variety)

- Stella & Chewy's LLC

- Primal Pet Foods, Inc.

- Carnivore Meat Company LLC (Vital Essentials)

- Northwest Naturals

- K9 Natural Pet Food

- ZIWI Ltd. (Air-Dried Raw Specialist)

- BARF World

- Steve's Real Food

- Darwin's Natural Pet Products

- Champion Petfoods (Orijen/Acana Raw Formulations)

- Small Batch Pet Food

- Tucker's Raw Frozen

- OC Raw Dog Food

- Dr. Marty Pets

- Furchild Pet Nutrition

- Nutriment

- We Feed Raw

- Answers Pet Food

- MegaDog Raw

- Raw Bistro

- Hare Today Gone Tomorrow

- TruDog

- A Place for Paws

- Honest Kitchen (Hybrid and Dehydrated Focus)

- Blue Ridge Beef

- Savage Cat Food

- My Pet Carnivore

- Raw Paws Pet Food

- Paleo Ridge Raw

- Only Natural Pet (Raw Focus)

- Syd Hill's Pet Foods

- Vital Pet Health

- Raw Feeding Miami

- Big Dog Pet Foods

Frequently Asked Questions

What is the primary factor driving the high growth rate of the Pet Raw Food Market?

The primary factor driving the substantial market growth (CAGR 11.5%) is the profound trend of pet humanization. This elevates pets' status to family members, compelling high-discretionary-spending owners to prioritize investing in premium, biologically appropriate raw diets perceived to maximize pet longevity and proactively address chronic health issues better than conventional processed foods.

What are the key technological advancements mitigating safety concerns in raw pet food?

The central technological solution for ensuring safety is High-Pressure Processing (HPP). HPP utilizes extreme hydrostatic pressure to non-thermally inactivate harmful pathogens (like Salmonella and E. coli) without compromising the nutritional integrity or raw state of the ingredients. Complementary advancements include rapid molecular testing (qPCR) and robust blockchain integration for verifiable traceability.

How is the Freeze-Dried Raw segment impacting market accessibility and logistics?

The Freeze-Dried Raw segment fundamentally transforms market accessibility by creating a lightweight, shelf-stable product that requires no refrigerated storage or specialized cold chain during transport. This significantly lowers logistical costs, overcomes infrastructural barriers in emerging markets, and facilitates aggressive global expansion through e-commerce platforms and mass-market retail placement.

Which geographical region is projected to exhibit the fastest growth in the raw pet food sector?

The Asia Pacific (APAC) region, spearheaded by rapid economic development and increasing discretionary spending in major economies like China and South Korea, is projected to register the fastest growth rate. This acceleration is due to the nascent adoption of premium Western pet care standards and the willingness of the growing middle class to invest in high-quality, imported nutrition.

What role does AI play in customizing pet raw food formulations and supply chain management?

AI plays a dual critical role: first, in customization, by analyzing multi-dimensional pet health data (genomic markers, activity) to formulate highly precise, personalized raw diets; and second, in supply chain management, by using machine learning for predictive quality control (pathogen risk scoring) and optimizing perishable inventory forecasting, minimizing waste, and ensuring timely, compliant ingredient procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager