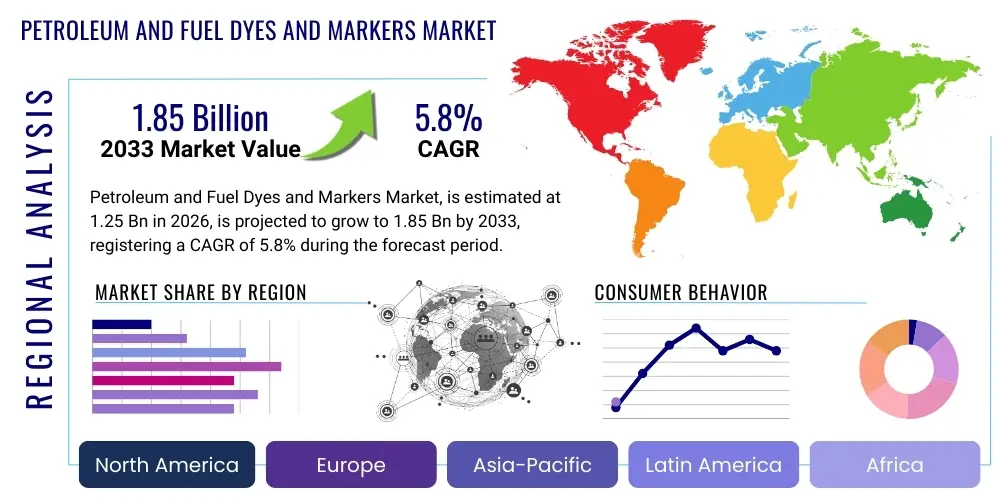

Petroleum and Fuel Dyes and Markers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443162 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Petroleum and Fuel Dyes and Markers Market Size

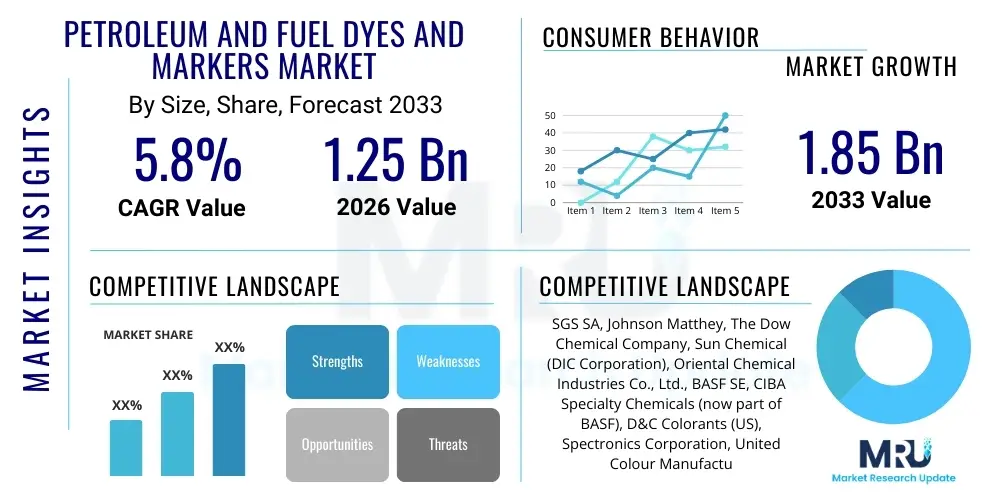

The Petroleum and Fuel Dyes and Markers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Petroleum and Fuel Dyes and Markers Market introduction

The Petroleum and Fuel Dyes and Markers Market encompasses specialized chemical additives utilized primarily for the identification, differentiation, and tracing of various fuel types, crucial for tax collection, regulation enforcement, and quality control. These chemicals serve a critical function in supply chain integrity, preventing fuel adulteration and ensuring that subsidized or tax-exempt fuels, such as heating oil or agricultural diesel, are not illicitly diverted for use in on-road vehicles. The product spectrum includes solvent dyes, fluorescent markers, and complex chemical tracers, all designed to be highly stable in hydrocarbon environments and undetectable without specialized forensic equipment, depending on the enforcement requirements.

The primary applications of these dyes and markers are centered around maintaining regulatory compliance mandated by governmental agencies globally. For instance, high-sulfur diesel or specific grades of gasoline are often colored differently to indicate adherence to environmental standards or regulatory classification. Beyond mandatory taxation and regulatory requirements, these products are increasingly employed by major oil companies for brand identification and proprietary anti-counterfeiting measures. The inherent need for complex chemical signaling to distinguish between legitimate and illegal fuels, coupled with rising instances of fuel fraud, underscores the foundational importance of this niche chemical sector within the broader energy landscape.

Driving factors for sustained market growth include escalating global concerns over tax evasion through illicit fuel mixing, coupled with tightening international environmental standards that necessitate clearer differentiation between compliant and non-compliant fuels. The rising adoption of electronic marking technologies, which use invisible chemical identifiers traceable through forensic analysis rather than simple visual color, further propels market innovation. The stability and efficacy of these additives in harsh petroleum environments—withstanding extreme temperatures and blending processes—remain key criteria for their adoption, ensuring long-term utility in complex downstream operations worldwide.

Petroleum and Fuel Dyes and Markers Market Executive Summary

The global Petroleum and Fuel Dyes and Markers Market is characterized by stringent regulatory oversight and a persistent demand for anti-adulteration solutions, driving steady business trends focused on high-security marking systems. Business activity is increasingly concentrated on the development of highly stable, solvent-soluble dyes and next-generation covert markers (such as spectroscopic tracers) that offer enhanced detection capabilities and resistance to chemical removal. Key industry players are focusing on vertical integration and strategic partnerships with government customs agencies and regulatory bodies to secure long-term marking contracts. The underlying trend highlights a shift from basic visible coloration towards sophisticated forensic marking protocols, demanding greater precision in chemical formulation and application technology.

Regionally, market dynamics are heavily influenced by the regulatory landscape and the prevalence of fuel fraud. North America and Europe, characterized by established tax differentiation programs (e.g., dyed diesel for off-road use), represent mature markets focused on efficiency and technological upgrades. Conversely, the Asia Pacific (APAC) region, particularly emerging economies with vast fuel consumption growth and nascent regulatory frameworks, is poised for explosive growth as governments implement large-scale, mandatory marking programs to formalize tax collection and reduce infrastructure losses. The Middle East and Africa (MEA) region shows unique trends driven by governmental efforts to monitor subsidized fuel distribution, often requiring specialized, locally adapted marking programs to combat smuggling across borders.

Segment trends reveal that the Solvent Dyes segment continues to dominate due to their cost-effectiveness and broad regulatory acceptance for visual marking, primarily in low-tax heating oil and agricultural diesel sectors. However, the Markers segment, comprising fluorescent and chemical tracers, is registering the highest CAGR. This accelerated growth is attributed to the superior security and tamper-proof nature of covert markers, which are critical for high-value fuels like marine diesel and aviation kerosene, where non-visible, quantitative tracking is essential. The application segments remain dominated by the automotive and off-road transportation sectors, though the marine and aviation industries are seeing intensified marking efforts due to global sustainability and anti-smuggling initiatives.

AI Impact Analysis on Petroleum and Fuel Dyes and Markers Market

Common user questions regarding AI's influence on the Petroleum and Fuel Dyes and Markers Market often revolve around predictive analytics for tracking marked fuel flows, optimizing dye injection processes, and enhancing the forensic analysis of marker presence. Users frequently ask how AI can improve the efficiency of regulatory enforcement, automate the detection of anomalies in fuel distribution data, and potentially create "smarter" markers that interact with digital monitoring systems. Key themes summarize to concerns about AI's ability to counter increasingly sophisticated fuel fraud techniques and whether machine learning algorithms can rapidly identify emerging adulteration patterns that current static testing methods miss, thereby accelerating the response time of enforcement agencies and optimizing marker deployment strategies across complex supply chains.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and security aspects of fuel marking programs. AI is not directly involved in the chemical synthesis of the dyes themselves, but rather in the entire ecosystem surrounding their deployment and detection. For example, ML models can analyze historical data regarding fuel consumption, market pricing discrepancies, and border activity to predict high-risk areas for fuel diversion, allowing regulatory bodies to strategically concentrate sampling and testing resources. This shift from reactive testing to proactive, risk-based enforcement significantly improves the cost-effectiveness and deterrent effect of fuel marking.

Furthermore, AI algorithms are becoming integral in the analysis of data generated by advanced marker detection technologies, such as spectroscopy and chromatography. When forensic analysis yields complex spectral signatures from trace markers, AI can swiftly compare these against massive databases of known adulterants and marker degradation profiles, providing near real-time identification of illicit blending or attempts to "wash out" the markers. This data-intensive analysis capability shortens investigation cycles, providing crucial evidence for prosecution and elevating the overall sophistication of fuel security protocols beyond manual oversight and conventional statistical process control.

- AI optimizes marker injection dosage, minimizing chemical wastage while ensuring regulatory compliance.

- Machine Learning predicts hot spots for fuel fraud based on geospatial and economic data, enhancing enforcement targeting.

- AI accelerates the interpretation of spectroscopic data from chemical markers, enabling rapid forensic identification of adulterated fuels.

- Natural Language Processing (NLP) aids in analyzing regulatory updates globally, ensuring marker formulations remain compliant across multiple jurisdictions.

- Predictive maintenance using AI ensures the reliability of automated fuel dyeing and marking equipment at refineries and terminals.

DRO & Impact Forces Of Petroleum and Fuel Dyes and Markers Market

The Petroleum and Fuel Dyes and Markers Market is fundamentally shaped by stringent government regulations (Driver) aimed at curbing massive fiscal losses from fuel tax evasion, which necessitates the mandatory use of specialized markers. However, the high initial cost and complex infrastructure required for widespread marker implementation, particularly in developing nations (Restraint), pose significant barriers to rapid market penetration. An enduring Opportunity lies in the growing demand for highly secure, covert markers that resist conventional stripping techniques, driven by increasing sophistication in fuel fraud attempts. These elements collectively generate strong Impact Forces, where regulatory mandates constantly challenge the cost-effectiveness and technological stability of the marker products, forcing continuous innovation in chemical security.

Drivers: The primary driver is the financial imperative for governments worldwide to protect tax revenues. Fuels, especially diesel and gasoline, are subject to high excise duties. When low-tax or tax-exempt fuels (like heating oil or marine bunker fuel) are illegally diverted to the high-tax market (road transport), the government incurs substantial revenue losses. Mandatory marking programs, reinforced by evolving international standards and governmental bodies such as the European Union and the U.S. Environmental Protection Agency (EPA), create a captive demand for reliable, government-approved dyes and markers. Furthermore, the global push towards cleaner fuels necessitates clear distinction between mandated lower-sulfur or bio-blended fuels and traditional grades, requiring specific coloration or marking for quality assurance.

Restraints: Significant restraints include the volatility of raw material prices, as many dyes and markers are synthesized from petroleum-derived intermediates, tying production costs directly to crude oil price fluctuations. A more critical restraint is the technical challenge associated with finding markers that are stable, non-corrosive, highly soluble in diverse fuel matrices (including modern bio-blends), and yet highly detectable at trace concentrations. Furthermore, the perception that markers can be "stripped" or chemically neutralized by sophisticated fraudsters requires continuous research and development, which carries a high cost. Finally, the logistical complexity and capital expenditure involved in equipping thousands of distribution points (refineries, terminals, and pipelines) with precise, automated dosing systems also slow down widespread adoption, especially in resource-constrained markets.

Opportunity: The market opportunity lies squarely in the development and implementation of forensic, covert marking technologies that offer superior traceability and are resistant to countermeasures. This includes multi-layered marking systems combining visual dyes with spectral tracers and DNA-based security markers. The shift towards renewable fuels and increasing blend ratios (e.g., higher ethanol or biodiesel content) also creates a unique opportunity for specialized markers that maintain stability and detection efficacy in these newer fuel chemistries, where traditional solvent dyes may degrade or precipitate. Emerging economies implementing new fuel quality and anti-adulteration standards present lucrative, untapped markets for comprehensive marking infrastructure solutions.

Impact Forces: The interplay between regulatory pressure and technological countermeasures dictates the market’s evolution. Regulatory mandates drive demand for higher security features (Impact Force 1). However, the complexity of synthesis and high cost of advanced covert markers often limits their deployment to the highest-risk applications (Impact Force 2). The continuous cycle of sophisticated fraud attempts followed by innovative counter-marking technology (Impact Force 3) ensures persistent R&D spending. Geopolitical stability and international trade agreements also impose significant impact, as cross-border fuel smuggling directly necessitates internationally standardized marking protocols, impacting product formulation requirements.

Segmentation Analysis

The Petroleum and Fuel Dyes and Markers Market is comprehensively segmented based on product type, application, and chemical composition, reflecting the diverse regulatory and commercial requirements across the energy sector. The segregation by product type differentiates between traditional visible dyes, which primarily serve large-volume, low-security applications like tax-exempt heating oil, and highly specialized markers, which cater to anti-counterfeiting and high-security tracking needs in gasoline and premium diesel. Segmentation by application allows market participants to tailor their offerings—such as thermal stability and solubility profiles—to the specific requirements of different fuels, ranging from high-octane gasoline to heavy bunker fuel for marine transport. This structured approach helps stakeholders analyze market penetration and future growth vectors based on evolving regulatory mandates for specific fuel grades.

Chemical composition segmentation is particularly critical as it dictates the functional properties, cost, and regulatory approval of the final product. Solvent dyes, which are widely used for visual differentiation, typically include azo, anthraquinone, and methine chemistries. Conversely, the marker segment involves more complex chemistries, often fluorescent compounds or unique chemical taggants, designed to be invisible under normal conditions but easily detectable using proprietary laboratory or field equipment. The choice of chemistry is determined by environmental impact considerations, potential fuel compatibility issues (especially with engine components), and the level of security required by the end-user or government mandate.

The market’s complexity is further highlighted by the geographic differences in fuel standards and marking requirements. While mature markets in Europe prioritize highly detailed forensic markers for carbon emission tracking and tax integrity, burgeoning markets often focus on implementing foundational, visually distinctive dyes to establish basic regulatory control over widespread bulk fuel diversion. Effective market strategy therefore necessitates a thorough understanding of how these segmentations intersect with regional regulatory frameworks, ensuring compliance and maximizing the security and commercial value proposition of the marking solution provided.

- By Product Type:

- Dyes (Solvent Dyes, Oil Soluble Dyes)

- Markers (Fluorescent Markers, Chemical Tracers, DNA Markers)

- By Chemical Composition:

- Azo Dyes

- Anthraquinone Dyes

- Methine Dyes

- Fluorescent Compounds

- Other Chemical Markers

- By Application:

- Gasoline

- Diesel/Gas Oil (On-road, Off-road, Agricultural)

- Jet Fuel/Aviation Turbine Fuel (ATF)

- Kerosene and Heating Oil

- Lubricants and Specialty Oils

- By End-Use Industry:

- Government Agencies and Regulatory Bodies

- Refineries and Petroleum Companies

- Chemical and Petrochemical Industries

Value Chain Analysis For Petroleum and Fuel Dyes and Markers Market

The value chain for Petroleum and Fuel Dyes and Markers begins with the Upstream Analysis, which involves the specialized synthesis of intermediate chemical precursors, often requiring complex, multi-stage organic chemistry processes. Raw material inputs typically include various naphthalene, benzene, or anthraquinone derivatives, highly reliant on the petrochemical industry. Suppliers in this stage require high regulatory compliance, stringent quality control, and scalable production capabilities, as the purity of the intermediates directly impacts the efficacy and stability of the final dye or marker product. Due to the proprietary nature of many advanced markers, R&D in this upstream segment is intense, focusing on developing new chemistries resistant to increasingly sophisticated countermeasures.

Moving through the midstream, the synthesized precursors are formulated into specific, market-ready dye concentrates or liquid marker solutions. This stage involves blending, standardization, and quality assurance testing to meet specific customer requirements regarding color index, solubility, and thermal stability in diverse fuel matrices. Distribution channels play a critical role, requiring specialized logistics for handling hazardous chemical materials. Direct distribution models are often favored for high-security markers contracted directly with national governments or major oil companies, ensuring supply chain integrity and confidentiality. Indirect distribution, leveraging chemical distributors, is more common for standard visual dyes used across smaller distribution networks.

The Downstream Analysis focuses on the end-use application: the physical injection of the dye or marker into the petroleum product, typically at refinery terminals, pipeline injection points, or bulk storage facilities. Precision dosing equipment is mandatory to ensure the correct concentration is achieved, as regulatory requirements often mandate minimum and maximum marker levels. End-users, ranging from large multinational oil corporations (MNCs) implementing brand protection to customs agencies enforcing tax laws, drive the demand for reliable service and technical support related to marker detection and analytical testing services. The value chain concludes with post-application monitoring and forensic testing, where specialized detection services often represent a profitable service revenue stream, completing the cycle of security and compliance.

Petroleum and Fuel Dyes and Markers Market Potential Customers

Potential customers and end-users of Petroleum and Fuel Dyes and Markers are primarily entities responsible for the production, distribution, taxation, and quality control of refined petroleum products. The most significant customer segment comprises governmental bodies and regulatory agencies, such as customs departments, revenue authorities, and environmental protection agencies, who mandate the use of markers to enforce tax parity, identify subsidized fuels, and ensure compliance with environmental standards (e.g., distinguishing high-sulfur from low-sulfur fuels). These government entities often issue large, multi-year contracts for high-security, covert marker technologies that require complex forensic analysis for detection, providing stable and substantial revenue streams for suppliers.

Another major segment includes large national and multinational oil and gas companies (NOCs and IOCs) that utilize these products for commercial purposes, including brand protection and quality assurance. In competitive markets, color additives are sometimes used to differentiate proprietary fuel blends, discouraging dilution or counterfeiting by unauthorized parties. These commercial customers prioritize cost-effectiveness, compatibility with engine systems, and ease of handling within their existing pipeline and storage infrastructure. Specific downstream customers also include bulk fuel distributors, independent blenders, and large consumers of off-road diesel (such as agriculture, mining, and construction companies) who must adhere to regulations regarding the use of tax-exempt fuels, requiring the consistent presence of visible dyes.

Finally, specific niche end-users include the aviation and marine bunker industries, which require specialized markers for critical safety and environmental compliance. For instance, jet fuel requires a marker to prevent accidental mixing with gasoline, and certain international maritime regulations necessitate specific marking protocols for bunker fuels to track emissions compliance. These segments demand extremely high purity, non-corrosive markers that do not impact engine performance or stability, representing a premium market for specialized chemical formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Johnson Matthey, The Dow Chemical Company, Sun Chemical (DIC Corporation), Oriental Chemical Industries Co., Ltd., BASF SE, CIBA Specialty Chemicals (now part of BASF), D&C Colorants (US), Spectronics Corporation, United Colour Manufacturing, Inc., Pylam Products Company, Inc., Vivimed Labs Limited, Chromatech Incorporated, Mid Continent Chemical Co. Inc., Keystone Aniline Corporation, Global Fuel Marking Solutions (GFMS), Authentix, Inc., Tracerco (Johnson Matthey), Vilasara Chemical, Rohm and Haas (now part of Dow). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Petroleum and Fuel Dyes and Markers Market Key Technology Landscape

The technological landscape of the Petroleum and Fuel Dyes and Markers market is defined by continuous innovation aimed at increasing the security, stability, and detectability of marking agents under harsh conditions. A critical technology involves the synthesis of high-performance solvent dyes, specifically engineered to withstand extreme temperatures, prolonged exposure to sunlight (photostability), and complex chemical environments found in pipelines and storage tanks. Modern dye chemistry focuses on creating non-metal-containing dyes (to avoid catalyst poisoning in refining processes) and environmentally benign compositions, moving away from older, potentially hazardous chemistries. Furthermore, the development of dyes with high tinctorial strength allows for lower dosing concentrations, reducing overall chemical costs while maintaining visual distinctiveness, which is paramount for high-volume applications.

The most advanced technological shifts are occurring within the markers segment, driven by the need for covert security. This includes the proliferation of spectroscopic markers, which are chemical taggants detectable only through specialized analytical techniques such as fluorescence spectroscopy or Fourier-Transform Infrared (FTIR) spectroscopy. These markers are dosed at parts-per-billion concentrations, making them virtually impossible to detect or remove using conventional methods. The core innovation here is the development of unique, proprietary chemical signatures that are difficult to replicate by counterfeiters, ensuring high levels of product authentication and security for government programs. Companies invest heavily in patented formulations to protect the uniqueness of these forensic signatures, which are often used in conjunction with centralized databases for instantaneous verification.

In terms of application technology, there is a major focus on precision dosing and monitoring systems. Automated injection equipment uses real-time flow meters and high-precision pumps to ensure accurate and traceable injection of markers directly into the fuel stream at the loading rack or terminal. This digital integration is crucial for compliance reporting. Moreover, the development of robust, portable field test kits—utilizing technologies like rapid colorimetric reactions or handheld spectrometers—enables customs officials and inspectors to quickly verify the presence and concentration of markers outside of a traditional laboratory setting. This decentralization of detection capabilities enhances enforcement agility and effectiveness, reinforcing the deterrent effect of the marking program.

Regional Highlights

Regional variations in the Petroleum and Fuel Dyes and Markers Market are primarily dictated by the maturity of fuel taxation systems, the severity of fuel fraud, and specific environmental mandates across different continents. Each region presents a unique demand profile, influencing the preferred type of marking technology and the volume of consumption.

- North America (NA): The region is characterized by established regulatory programs, especially concerning off-road diesel (dyed red for tax exemption in the US and Canada). The market here is mature, driven by continuous maintenance and occasional upgrades to existing marking programs. Demand is stable, focusing on highly efficient, environmentally compliant solvent dyes and advanced anti-adulteration markers for premium fuels. Technological adoption is high, favoring automated dosing and digital tracking systems.

- Europe: Europe is a highly regulated market, with the EU mandating complex marking standards for gas oil (heating oil) and low-sulfur fuels. The emphasis is heavily on covert, forensic markers due to sophisticated cross-border smuggling and tax evasion attempts. Regulatory consistency across member states drives demand for internationally harmonized dye and marker chemistries, making this region a leader in high-security marking technology adoption and consumption.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid industrialization, massive infrastructure projects, and the implementation of new, comprehensive fuel marking schemes in emerging economies like India, China, and Indonesia. These nations are fighting widespread fuel subsidy fraud and quality dilution, leading to significant government investment in both high-volume visual dyes and initial installations of covert marking infrastructure. Volume growth is exponential, though regulatory fragmentation remains a challenge.

- Latin America (LATAM): The LATAM market is defined by intense government efforts to combat fuel theft and illegal cross-border diversion, particularly in countries with heavily subsidized fuels (e.g., Mexico, Brazil). Demand is strong for secure, traceable markers to protect national interests and tax revenue. The complexity of smuggling operations drives the need for multi-layered security solutions, often incorporating unique national marking protocols.

- Middle East and Africa (MEA): This region is crucial due to high volumes of crude oil production and significant disparities in subsidized fuel prices, leading to rampant smuggling. MEA governments utilize markers extensively to monitor subsidized kerosene and diesel distribution domestically and prevent the illegal export of subsidized products. Demand centers on large-scale governmental contracts requiring robust, high-concentration dyes and specialized markers that withstand extreme climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Petroleum and Fuel Dyes and Markers Market.- SGS SA (Providing Verification and Testing Services for Markers)

- Johnson Matthey (Specialized Markers and Catalysts)

- The Dow Chemical Company (Chemical Intermediates and Solutions)

- Sun Chemical (DIC Corporation) (Leading Supplier of Colorants)

- Oriental Chemical Industries Co., Ltd.

- BASF SE (Diverse Chemical Portfolio, including Dyes)

- D&C Colorants (US)

- Spectronics Corporation (Marker Detection Equipment and Chemicals)

- United Colour Manufacturing, Inc.

- Pylam Products Company, Inc.

- Vivimed Labs Limited (Specialty Chemicals and Dyes)

- Chromatech Incorporated

- Mid Continent Chemical Co. Inc.

- Keystone Aniline Corporation

- Global Fuel Marking Solutions (GFMS)

- Authentix, Inc. (Global Leader in Covert Marking Solutions)

- Tracerco (Johnson Matthey Subsidiary specializing in Tracers)

- Vilasara Chemical

- Rohm and Haas (now part of Dow)

- Chemtura Corporation (Part of Lanxess)

Frequently Asked Questions

Analyze common user questions about the Petroleum and Fuel Dyes and Markers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of fuel markers in the petroleum industry?

The primary function of fuel markers is regulatory compliance and revenue protection. They are used to differentiate tax-exempt, subsidized, or specific grades of fuel, ensuring proper taxation, preventing illegal diversion (fuel fraud), and guaranteeing adherence to quality or environmental standards.

What is the difference between fuel dyes and fuel markers?

Fuel dyes provide visible coloration (e.g., red diesel) for immediate visual identification in high-volume, low-security applications. Fuel markers are invisible, complex chemical taggants (covert markers) detectable only through specialized forensic analysis, offering a higher level of security against sophisticated counterfeiting.

Which geographical region exhibits the highest growth potential for fuel markers?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, driven by governments in developing economies implementing new, mandatory national marking programs to combat extensive fuel subsidy fraud and secure substantial tax revenue.

How does the increasing adoption of bio-fuels affect the marker market?

The increasing adoption of bio-fuels (e.g., ethanol, biodiesel blends) necessitates the development of specialized dyes and markers that maintain chemical stability and detection accuracy within these altered fuel matrices, driving innovation in new, compatible chemistries.

What are the key technological advancements driving market security?

Key technological advancements include the deployment of forensic spectroscopic markers (chemical taggants resistant to stripping) and the integration of AI-powered analysis systems for predictive fraud detection and rapid, accurate identification of adulterated fuels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Petroleum and Fuel Dyes and Markers Market Statistics 2025 Analysis By Application (Low Tax Fuel, High Sulfur Fuel), By Type (Solvent Red 26, Solvent Red 164), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Petroleum and Fuel Dyes and Markers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fluorescent Dyes, Ethyl Dyes, Azo Dyes, Others), By Application (Gasoline, Diesel, Jet Fuel, Fuel Oil, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager