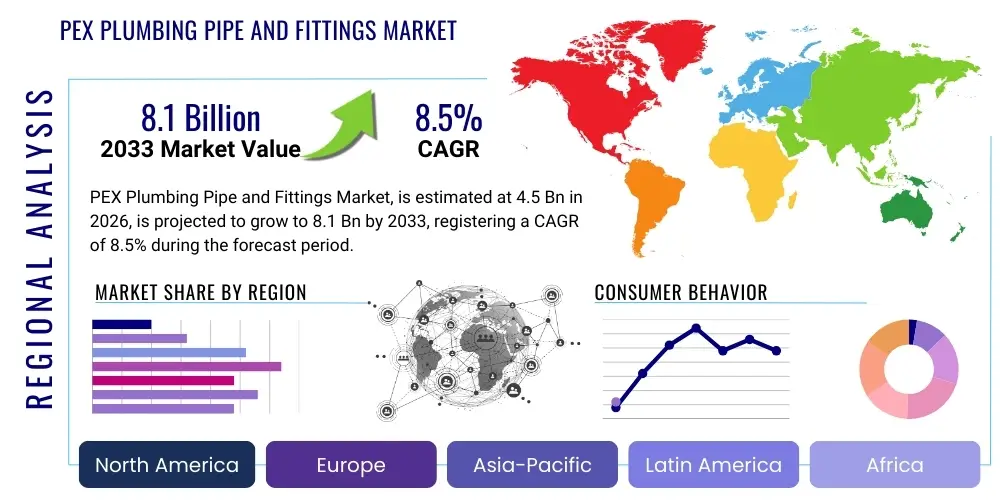

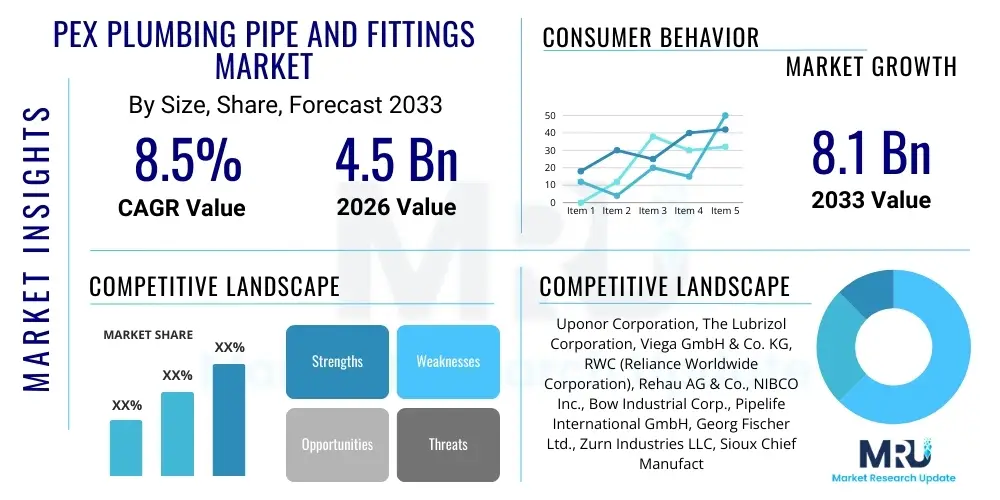

PEX Plumbing Pipe and Fittings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441546 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

PEX Plumbing Pipe and Fittings Market Size

The PEX Plumbing Pipe and Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing adoption of PEX (Cross-linked polyethylene) piping systems in residential and commercial construction due to their superior flexibility, chemical resistance, and ease of installation compared to traditional metallic piping materials like copper.

The acceleration in market valuation reflects a fundamental shift in global plumbing practices, prioritizing long-term durability and cost-effectiveness. Developing regions are experiencing rapid urbanization and subsequent expansion of modern infrastructure, leading to high demand for efficient and reliable plumbing solutions. Furthermore, stringent environmental regulations in mature economies, favoring materials that require less energy for production and transportation, bolster the market position of PEX products.

PEX Plumbing Pipe and Fittings Market introduction

The PEX Plumbing Pipe and Fittings Market encompasses the manufacturing, distribution, and utilization of plumbing systems made from cross-linked polyethylene. PEX material is thermoset, meaning it retains its shape and integrity even at high temperatures, offering excellent resistance to scaling, chlorine, and freeze damage. The product range includes PEX-A, PEX-B, and PEX-C pipes, categorized by their respective cross-linking methods, alongside a variety of brass, plastic, and poly-alloy fittings (such as crimp, compression, and expansion fittings) necessary for connection and installation. Major applications span hot and cold potable water delivery systems, hydronic radiant heating, and cooling systems in both new construction and renovation projects. The primary benefits driving adoption are reduced installation time due to flexibility, corrosion resistance, superior thermal efficiency, and lower overall material costs compared to traditional piping. Key driving factors include increasing government mandates for energy-efficient building codes, robust residential construction activity globally, and growing awareness among plumbers regarding the long-term performance advantages of polymer-based systems.

PEX Plumbing Pipe and Fittings Market Executive Summary

The PEX Plumbing Pipe and Fittings Market is characterized by robust growth, propelled by strong business trends focusing on sustainable and resource-efficient construction practices. Manufacturers are heavily investing in developing multi-layered PEX pipe structures, such as PEX-AL-PEX (barrier pipe), to enhance oxygen resistance for closed-loop hydronic heating systems, thus expanding the application scope beyond traditional potable water transport. The consolidation among key market players, coupled with advancements in fitting technology (like push-to-connect fittings), is streamlining installation processes, offering significant competitive advantages. Regional trends indicate that North America and Europe currently dominate the market due to established construction standards favoring PEX and significant replacement cycles of aging infrastructure. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate, fueled by massive housing projects and commercial developments, particularly in China and India. Segmentation trends show that the residential sector remains the largest consumer base, although the shift toward radiant floor heating systems is boosting the hydronic segment significantly. Furthermore, the rising prices of copper coupled with supply chain volatility are creating a sustained financial incentive for adopting stable, cost-effective PEX alternatives across all major end-use segments.

AI Impact Analysis on PEX Plumbing Pipe and Fittings Market

Common user inquiries concerning AI in the PEX market often revolve around optimizing manufacturing processes, predictive maintenance of large-scale commercial installations, and enhancing supply chain resilience. Users are keen to understand how AI algorithms can improve the efficiency and quality control during the extrusion and cross-linking phases of PEX production, minimizing material waste and ensuring compliance with stringent performance standards. Furthermore, the integration of smart building management systems (BMS), often leveraging AI for optimizing heating and cooling cycles, directly impacts the performance specifications required for PEX pipes used in radiant systems. Key expectations include using AI for demand forecasting to manage fluctuating raw material prices (polyethylene resin), optimizing inventory management across complex distribution networks, and implementing machine vision systems for defect detection in pipe manufacturing lines, thereby elevating overall product reliability and reducing operational costs for manufacturers and installers alike.

- AI optimizes PEX manufacturing through predictive quality control and machine vision systems for defect detection.

- Generative AI models assist in designing complex plumbing layouts, optimizing material usage and installation paths.

- AI-driven supply chain management improves raw material procurement (polyethylene resin) and minimizes inventory risks amidst price volatility.

- Predictive maintenance analytics, often AI-enabled, enhance the longevity and efficiency of PEX systems in large commercial buildings by identifying potential wear points.

- Integration with Smart Home/Building Management Systems (BMS) allows AI to optimize flow rates and temperatures in PEX radiant heating systems, improving energy efficiency.

DRO & Impact Forces Of PEX Plumbing Pipe and Fittings Market

The dynamics of the PEX market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, leading to significant impact forces across the construction ecosystem. Major drivers include the inherent cost advantages and faster installation times of PEX over traditional piping, alongside its proven long-term resistance to corrosion and scaling, which significantly reduces maintenance expenses for end-users. However, restraints such as lower resistance to UV radiation, requiring careful storage and installation, and the existing regulatory preference for metallic pipes in certain historical or high-pressure applications present challenges. The primary opportunity lies in the expanding adoption of PEX in sustainable building projects and its synergistic application in integrated renewable energy systems, such as solar thermal transfer. The convergence of these factors results in impact forces that favor innovation in connection technology, driving manufacturers toward developing fittings that require minimal specialized tooling and enhancing the thermal and pressure ratings of the pipes themselves to address specific commercial demands.

Specifically addressing the constraints, market players are actively investing in R&D to improve the cross-linking process and introduce exterior protective coatings that mitigate UV degradation, expanding the suitability of PEX for outdoor or semi-exposed installations. Furthermore, educational initiatives aimed at plumbers and building engineers are crucial to overcome the initial resistance associated with adopting new materials, ensuring correct installation techniques are standardized globally. The opportunity to replace aging, corrosive copper and galvanized steel infrastructure, particularly in mature economies like the U.S. and parts of Western Europe, provides a sustained demand trajectory for PEX systems that offer a longer operational lifespan and reduced infrastructure investment risk. The impact forces are thus heavily tilted towards technology transfer and regulatory harmonization.

The long-term success of the PEX market hinges on its ability to continually innovate in the fittings segment, specifically reducing reliance on expensive metallic fittings where possible, and improving the overall system pressure capabilities. The competitive landscape forces manufacturers to maintain highly efficient production scales to keep pricing competitive against legacy materials and emerging alternatives like PP-R (polypropylene random copolymer). Successfully navigating the constraints related to system compatibility and installer training will unlock vast market potential in both residential retrofitting and large-scale commercial ventures, firmly establishing PEX as the dominant flexible piping material worldwide.

Segmentation Analysis

The PEX Plumbing Pipe and Fittings Market is extensively segmented based on pipe type, fitting type, application, and end-user, providing a granular view of market dynamics and consumer preferences. The segmentation by pipe type (PEX-A, PEX-B, PEX-C) is crucial as it reflects varying manufacturing costs, flexibility levels, and suitability for different regulatory environments. PEX-A, produced using the Engel method, generally commands a premium due to its highest flexibility and suitability for expansion fittings, while PEX-B remains the dominant choice globally due to its balance of cost-effectiveness and performance. Fitting type segmentation is highly dynamic, witnessing a strong shift towards tool-less and push-to-connect mechanisms that accelerate installation time, moving away from traditional crimp and clamp methods. End-user segmentation clearly indicates the residential sector as the primary revenue generator, though the non-residential segment, driven by large commercial HVAC and mechanical systems, is experiencing faster growth rates due to stringent energy efficiency standards.

Analyzing the application segments reveals the increasing penetration of PEX in radiant heating and cooling systems, outpacing its use in standard plumbing. This expansion is largely attributed to PEX’s superior thermal characteristics, making it ideal for distributing heated or chilled water efficiently across large floor areas. Manufacturers are tailoring specific products, such as oxygen-barrier PEX pipes, to meet the requirements of closed-loop hydronic applications, further cementing this specialization. The differentiation between various cross-linking methods dictates raw material inputs and subsequently influences regional market adoption rates, where PEX-B is highly favored in North America and PEX-A has strong traction in Europe due to historical regulatory precedents and plumbing traditions.

The strategic importance of segmentation analysis lies in identifying high-growth niches. For example, the fittings segment is currently undergoing significant innovation, with companies focusing on lead-free brass and poly-alloy materials to comply with revised health and safety regulations concerning potable water. Furthermore, the repair and maintenance application segment offers considerable resilience to economic downturns, as property owners consistently require durable solutions for system repairs. Understanding these segment dynamics is paramount for stakeholders aiming to optimize their product portfolios and geographically targeted expansion strategies within the competitive PEX landscape.

- By Pipe Type:

- PEX-A (Engel Method)

- PEX-B (Silane Method)

- PEX-C (Electron Beam/Irradiation Method)

- By Fitting Type:

- Brass Fittings (Crimp, Compression, Expansion)

- Plastic Fittings (Poly-Alloy, Push-to-Connect)

- Copper Fittings

- By Application:

- Potable Water Plumbing (Hot and Cold)

- Radiant Heating and Cooling Systems

- Hydronic Distribution Systems

- Snow Melting Systems

- By End-User:

- Residential Construction (Single-family, Multi-family)

- Non-Residential Construction (Commercial, Institutional, Industrial)

- Repair and Renovation

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For PEX Plumbing Pipe and Fittings Market

The PEX plumbing value chain begins with upstream activities dominated by petrochemical companies that supply high-density polyethylene (HDPE) resin, the primary raw material, often sourced from large chemical producers. This segment is highly sensitive to crude oil price fluctuations and involves complex polymerization processes. Midstream activities involve the specialized cross-linking process (A, B, or C methods) performed by PEX pipe manufacturers, which requires substantial capital investment in extrusion and specialized irradiation equipment. Fitting manufacturers, often specialized, work in parallel, sourcing brass, poly-alloy, or other metals to produce connection components. Downstream logistics involve sophisticated distribution channels, moving product from factory to end-user. Direct channels include manufacturers supplying large construction firms or OEM integrators directly, ensuring bulk pricing and standardized supply. Indirect channels, which form the majority of sales, rely heavily on wholesale distributors, large retail home improvement stores, and local plumbing supply houses, offering inventory management and localized technical support to contractors and professional plumbers. The efficiency of the indirect channel is crucial for market penetration due to the highly fragmented nature of the contractor base.

Upstream analysis reveals that the dependence on specific grades of high-density polyethylene necessitates strong relationships with petrochemical suppliers, where supply contracts often dictate pricing stability for PEX producers. Any disruptions in the global oil and gas supply chain immediately translate into volatility in PEX pipe costs, impacting market competitiveness against metallic options. Furthermore, the specialized nature of the cross-linking technology often involves licensing agreements or proprietary knowledge, creating high barriers to entry for new pipe manufacturers. The quality control at the upstream level, ensuring uniform resin characteristics, is critical for achieving the required durability and pressure ratings of the final PEX product.

Downstream analysis highlights the crucial role of professional training and certification provided through distribution channels. Since correct installation is paramount to system longevity, distributors often serve as training hubs for plumbers, ensuring adherence to specific fitting and joining techniques (e.g., expansion versus crimp). The selection of the distribution channel is heavily influenced by the project scale: large commercial projects typically utilize direct manufacturer relationships or major wholesalers, while residential and repair markets rely on the accessibility and inventory depth provided by local supply retailers. Efficient inventory management within these channels is vital, particularly for ensuring the immediate availability of diverse pipe diameters and fitting configurations needed for time-sensitive construction projects.

PEX Plumbing Pipe and Fittings Market Potential Customers

The primary customers for PEX Plumbing Pipe and Fittings fall into three major categories: Residential Builders and Developers, Non-Residential Construction Contractors, and the specialized Renovation and Maintenance sector. Residential builders constitute the largest volume buyer, relying on PEX for new single-family and multi-family housing projects, valuing its speed of installation and cost efficiency, which directly impacts their project timelines and overall profitability. Non-residential customers, including contractors specializing in commercial offices, hospitals, schools, and institutional facilities, purchase PEX not only for potable water but extensively for large-scale hydronic heating and cooling systems, prioritizing the material’s resistance to corrosion and its robust performance under high operational pressures. Furthermore, facilities managers and maintenance companies represent a consistent customer segment, utilizing PEX for repair and replacement projects due to its compatibility with existing plumbing systems and relative ease of handling in confined spaces during retrofitting operations.

Within the renovation sector, DIY enthusiasts and smaller independent plumbing contractors also form a significant customer base, attracted by modern push-to-connect fittings that minimize the need for complex tools and specialized training, making PEX accessible for smaller-scale projects. Institutional buyers, such as government agencies and military housing authorities, are increasingly mandating PEX systems due to their long projected lifespan and reduced risk of costly leaks associated with metallic pipe corrosion over time. This diversification of the customer base across construction sectors ensures resilient demand, driven both by new project initiation and ongoing infrastructural maintenance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uponor Corporation, The Lubrizol Corporation, Viega GmbH & Co. KG, RWC (Reliance Worldwide Corporation), Rehau AG & Co., NIBCO Inc., Bow Industrial Corp., Pipelife International GmbH, Georg Fischer Ltd., Zurn Industries LLC, Sioux Chief Manufacturing, Mueller Industries, SharkBite Plumbing Solutions, Apollo Flow Controls, KWH Group (Pipelife), Plastic Components, Inc., Bluefin, Hebei Litong Pipe Industry Manufacturing Co., Ltd., MrPEX Systems, Roth Industries GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PEX Plumbing Pipe and Fittings Market Key Technology Landscape

The technology landscape of the PEX market is defined by continuous innovation across material science, manufacturing techniques, and connection systems aimed at enhancing performance, simplifying installation, and improving environmental sustainability. A primary technological focus remains on improving the three main cross-linking methods (Engel, Silane, and Irradiation), optimizing efficiency and ensuring uniform cross-linking density throughout the pipe wall, which directly correlates with pressure rating and resistance to high temperatures. The advent of multi-layer barrier pipes, such as PEX-AL-PEX, which integrate an aluminum layer between two PEX layers, represents a significant technological leap, providing superior oxygen barrier capabilities essential for protecting metallic boiler components in hydronic systems, and also offering shape retention beneficial for long, straight runs. Furthermore, manufacturers are exploring bio-based polyethylene resins to reduce the environmental footprint associated with traditional petrochemical derivatives, aligning with global sustainable development goals.

In the fittings segment, the technological evolution is equally rapid, moving decisively toward innovative coupling mechanisms. Push-to-connect technology, allowing secure, leak-proof connections without specialized crimping tools or soldering, has revolutionized the repair and DIY market, significantly reducing required labor time and minimizing the risk of installer error. Advanced material engineering is also focusing on developing robust, lead-free poly-alloy fittings that match the performance characteristics of traditional brass while offering cost advantages and strict adherence to NSF/ANSI health standards regarding potable water. The sophistication of these fitting technologies is critical, as the fittings often represent the highest risk point in a PEX system; hence, manufacturers utilize advanced simulation and testing procedures to guarantee long-term joint integrity.

Technological advancement is also evident in the manufacturing process optimization. The implementation of sophisticated sensors and automated control systems in extrusion lines ensures precise dimensional stability and wall thickness, which are vital for system reliability. Furthermore, the integration of digital tools, including Building Information Modeling (BIM) libraries and mobile apps, allows plumbers and engineers to efficiently design PEX systems, calculate flow rates, and generate precise bills of materials, significantly enhancing the professional delivery of PEX projects. This digital integration, combined with material science improvements, positions PEX technology as a forward-looking solution capable of addressing the complex demands of modern infrastructure.

Regional Highlights

Regional dynamics heavily influence the adoption and growth rate of the PEX Plumbing Pipe and Fittings Market, largely driven by local construction standards, climate requirements, and regulatory frameworks. North America, particularly the United States, holds a significant market share due to its established infrastructure replacement cycle and the widespread acceptance of PEX-B piping for residential and commercial potable water systems. The region benefits from stringent energy codes promoting radiant heating solutions, where PEX is the material of choice. Europe is another mature market, characterized by high utilization of PEX-A for hydronic and underfloor heating systems, fueled by strong governmental emphasis on energy efficiency and low-carbon heating technologies. Countries like Germany and Scandinavia have been pioneers in the comprehensive adoption of PEX technology, establishing long-standing regulatory support.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion is primarily attributed to unprecedented urbanization, massive government investments in smart city projects, and the explosive growth in residential construction in populous nations like China and India. While traditional metal piping still dominates certain segments, increasing awareness regarding the superior performance and health benefits (non-corrosion) of PEX is accelerating its market penetration, particularly in high-rise residential buildings and institutional projects. However, challenges related to standardization and competition from lower-cost polymer alternatives require focused market penetration strategies in this region.

Latin America and the Middle East and Africa (MEA) represent emerging opportunities. In Latin America, infrastructure improvements and shifting regulatory landscapes are slowly paving the way for PEX adoption, moving away from older PVC and metallic systems. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, presents unique demands due to extreme climate conditions. PEX’s resilience to high temperatures and its suitability for pressurized water systems make it an increasingly attractive option for new luxury developments and public works, provided manufacturers address issues related to potential thermal degradation in severe heat through specialized coatings or installation methods.

- North America: Dominant market share; driven by residential construction boom and extensive replacement of aging copper infrastructure; high penetration of PEX-B and push-to-connect fittings.

- Europe: High adoption in hydronic heating systems; strong regulatory backing for PEX-A use in energy-efficient buildings; mature market focused on system optimization and sustainability.

- Asia Pacific (APAC): Fastest growing region; fueled by rapid urbanization and infrastructure development in China and India; increasing awareness of PEX benefits overcoming reliance on traditional materials.

- Latin America: Emerging market; growing adoption driven by infrastructure modernization and efforts to reduce water leakage and corrosion issues prevalent in older systems.

- Middle East and Africa (MEA): Niche applications in high-end construction and commercial facilities; material specification driven by extreme temperature resilience requirements; significant growth potential in non-residential sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PEX Plumbing Pipe and Fittings Market.- Uponor Corporation

- The Lubrizol Corporation

- Viega GmbH & Co. KG

- RWC (Reliance Worldwide Corporation)

- Rehau AG & Co.

- NIBCO Inc.

- Bow Industrial Corp.

- Pipelife International GmbH (KWH Group)

- Georg Fischer Ltd.

- Zurn Industries LLC

- Sioux Chief Manufacturing

- Mueller Industries

- SharkBite Plumbing Solutions

- Apollo Flow Controls

- Hebei Litong Pipe Industry Manufacturing Co., Ltd.

- MrPEX Systems

- Roth Industries GmbH & Co. KG

- Bluefin

Frequently Asked Questions

Analyze common user questions about the PEX Plumbing Pipe and Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key advantages of PEX plumbing pipes over traditional copper or PVC?

PEX pipes offer superior flexibility, allowing for easier installation and fewer joints, which reduces leak risk. They are corrosion-resistant, do not scale, and possess excellent freeze-damage resistance, often translating into lower material and long-term maintenance costs compared to metallic systems.

Which type of PEX pipe (A, B, or C) is preferred for radiant floor heating systems?

PEX-A is often preferred due to its highest flexibility and suitability for expansion fittings, making it easier to maneuver during complex radiant heating installations. However, oxygen-barrier versions of PEX-B are widely used due to their better cost-to-performance ratio and superior ability to protect metal boiler components.

Are PEX pipes safe for use in potable water applications, and do they comply with regulatory standards?

Yes, PEX pipes and fittings used in potable water systems must comply with stringent health standards such as NSF/ANSI 61 and are certified lead-free. They are non-toxic, chemically inert, and highly resistant to chlorine degradation commonly found in municipal water supplies.

What is the current market trend regarding PEX fittings technology?

The predominant market trend is the rapid growth of tool-less connection systems, particularly push-to-connect fittings. These fittings dramatically reduce installation time, minimize installer error, and make PEX systems highly attractive for renovation and repair projects by reducing the need for specialized crimping tools.

How is the volatility of raw material prices affecting the PEX market?

Since PEX is derived from polyethylene resin, which is a petrochemical derivative, its manufacturing cost is sensitive to fluctuations in crude oil and natural gas prices. This volatility forces manufacturers to implement robust supply chain risk management and can occasionally challenge PEX’s cost competitiveness against stable alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager