PFA Tubing and Pipe Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443285 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

PFA Tubing and Pipe Market Size

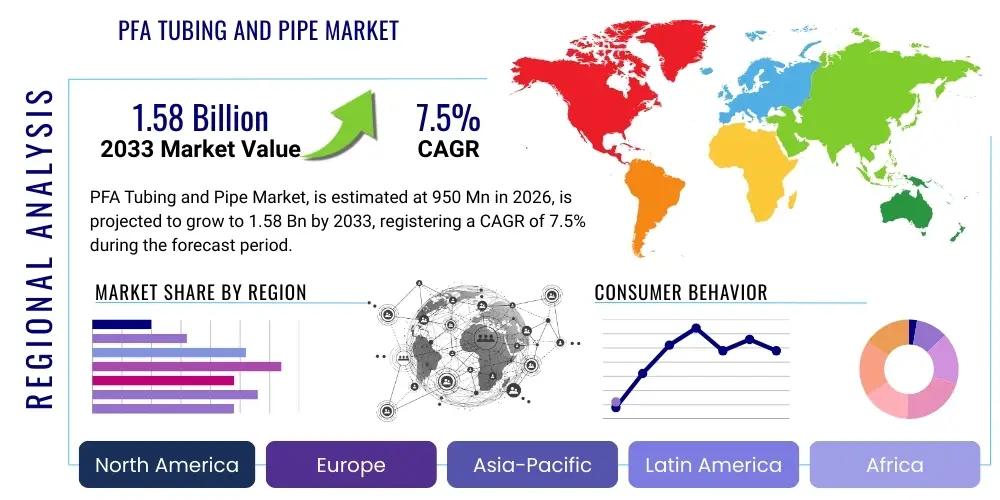

The PFA Tubing and Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 980 Million in 2026 and is projected to reach USD 1,530 Million by the end of the forecast period in 2033. This consistent expansion is underpinned by the increasing demand for high-performance fluid handling solutions across specialized industrial sectors, particularly those requiring extreme chemical resistance, thermal stability, and low extractability profiles.

PFA Tubing and Pipe Market introduction

The PFA (Perfluoroalkoxy Alkane) Tubing and Pipe Market encompasses the manufacturing, distribution, and utilization of fluid transfer components made from this high-performance fluoropolymer. PFA is a copolymer of tetrafluoroethylene (TFE) and perfluoropropyl vinyl ether (PPVE), offering similar properties to PTFE (Polytetrafluoroethylene) but with the crucial advantage of being melt-processable, allowing for conventional thermoplastic molding and extrusion techniques to produce seamless tubing and pipe with high dimensional stability and superior surface finishes. The inherent benefits of PFA, such as its exceptional chemical inertness to nearly all industrial solvents, acids, and bases, coupled with an operational temperature range extending up to 260°C (500°F), position it as the material of choice for critical applications.

Major applications driving market growth include the transport of ultra-high-purity (UHP) chemicals in semiconductor manufacturing, aggressive chemical handling in the chemical processing industry (CPI), sterile fluid transfer in pharmaceuticals and biotechnology, and demanding hydraulic and pneumatic systems in aerospace and automotive sectors. The semiconductor industry, specifically, relies heavily on PFA components for wet processing stations and chemical distribution systems, where zero contamination and integrity are paramount to maintaining wafer yields. The ability of PFA tubing to resist degradation from highly corrosive chemicals like hydrofluoric acid and nitric acid ensures system longevity and purity.

Driving factors for this market include the global expansion of microelectronics manufacturing, stringent regulatory requirements mandating high-purity materials in life sciences, and increasing industrial investment in corrosive environment mitigation. Furthermore, the longevity and low maintenance requirements of PFA systems provide a compelling total cost of ownership (TCO) advantage over traditional metallic or non-fluoropolymer alternatives, solidifying its adoption in mission-critical infrastructure across developed and rapidly industrializing economies.

PFA Tubing and Pipe Market Executive Summary

The PFA Tubing and Pipe Market is characterized by robust growth fueled primarily by technological advancements in microelectronics and stringent quality standards in healthcare and chemical sectors. Key business trends include the shift towards larger diameter PFA piping systems in bulk chemical delivery infrastructure, driven by economies of scale in high-volume manufacturing facilities, particularly in Asia Pacific. Additionally, innovation in material compounding and extrusion techniques focuses on achieving even higher internal surface smoothness (low Ra values) to minimize particle entrapment and microbial adhesion, catering specifically to the UHP and biopharmaceutical segments. Manufacturers are also increasingly focusing on vertically integrated supply chains to ensure raw material quality and traceability, essential for highly regulated end-user markets. Strategic mergers, acquisitions, and partnerships aimed at expanding regional manufacturing footprints and specialized product portfolios are defining the competitive landscape.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market due to massive capital investments in semiconductor foundries (fabs) in countries like China, Taiwan, South Korea, and Japan, which require extensive installations of high-purity PFA fluid handling systems. North America and Europe maintain significant market shares, characterized by established chemical processing industries and advanced pharmaceutical and aerospace manufacturing, driving demand for specialized, high-pressure PFA pipes and complex PFA fittings. These developed regions emphasize regulatory compliance and customized solutions for extreme operational conditions. Latin America and MEA are emerging markets, showing gradual adoption driven by localized expansion of chemical manufacturing and oil and gas sector requirements for corrosion-resistant materials.

Segment trends reveal that the PFA tubing segment, categorized by smaller diameters typically used for instrumentation and localized fluid paths, holds a larger volume share, whereas PFA piping (larger diameter, often rigid) commands higher value per unit, primarily dictated by large-scale infrastructural projects. In terms of end-use, the Semiconductor and Electronics segment remains the largest consumer, highly sensitive to geopolitical factors affecting electronics supply chains. The Chemical Processing Industry (CPI) follows closely, driven by the need to safely handle aggressive reagents under high temperature and pressure, ensuring operational safety and environmental protection.

AI Impact Analysis on PFA Tubing and Pipe Market

Analysis of common user questions regarding the interaction between Artificial Intelligence (AI) and the PFA Tubing and Pipe Market reveals a focus on optimizing manufacturing efficiency, predictive maintenance, and quality control. Users are keen to understand how AI can improve extrusion process precision, minimize material waste, and ensure the consistent internal surface quality critical for UHP applications. Key themes center around leveraging machine learning algorithms to analyze real-time sensor data from extrusion lines to predict defects, optimize curing cycles, and reduce variations in wall thickness. Furthermore, users inquire about AI's role in supply chain resilience, forecasting demand fluctuations for specialized PFA compounds, and automating quality inspections using vision systems to rapidly identify microscopic imperfections. The expectation is that AI integration will lead to higher yield rates and reduced production costs for complex PFA components, thereby indirectly lowering the TCO for end-users in sectors like semiconductor fabrication.

The integration of AI into the manufacturing lifecycle of PFA products promises transformative benefits extending beyond simple automation. Advanced algorithms can monitor parameters such as melt flow rate, die temperature gradients, and cooling rates in real time, making micro-adjustments that human operators cannot perceive, thereby achieving previously unattainable levels of precision. This is particularly vital for highly regulated industries where specifications for low particle generation and surface roughness are extremely tight. The predictive capabilities of AI also enable proactive maintenance scheduling for extrusion equipment, minimizing unexpected downtime and maximizing operational output, which is crucial given the high cost of PFA resins.

Moreover, AI is beginning to influence product design and material science within the PFA domain. Machine learning models are being used to simulate how different PFA grades and compound additives affect long-term performance under specific chemical and thermal stresses, accelerating the development cycle for new PFA formulations tailored for novel applications, such as extreme heat exchangers or advanced medical devices. This rapid iterative design process ensures that PFA materials continue to meet the evolving demands of advanced technology sectors, securing the market's future growth trajectory.

- AI-driven optimization of extrusion parameters to achieve superior internal surface finish and consistent wall thickness.

- Predictive maintenance analytics for PFA manufacturing equipment, maximizing uptime and reducing unplanned production halts.

- Automated, high-speed visual inspection using machine vision and deep learning to ensure zero-defect compliance for UHP tubing.

- Enhanced supply chain forecasting and inventory management of expensive PFA raw materials based on projected industry demand signals.

- Accelerated R&D through simulation of PFA material performance under specific chemical and thermal conditions.

- Improved energy efficiency in PFA processing by optimizing heating and cooling cycles using smart control systems.

DRO & Impact Forces Of PFA Tubing and Pipe Market

The PFA Tubing and Pipe Market is propelled by several significant drivers, primarily the escalating global demand from the semiconductor industry, which relies intrinsically on PFA for its unmatched purity and chemical resistance in highly aggressive wet processes. This demand is further amplified by the continuous miniaturization of semiconductor chips, necessitating even stricter material purity standards. Simultaneously, the inherent restraints include the high initial cost of PFA resin relative to conventional polymers and metallic alloys, posing an adoption barrier in cost-sensitive applications. Furthermore, the complex processing requirements of PFA, demanding specialized, high-tolerance extrusion equipment and expertise, limit the number of qualified manufacturers, impacting supply responsiveness during peak demand cycles. These market forces collectively shape the competitive dynamics and future strategic direction of the PFA industry, emphasizing quality over cost where performance is mission-critical.

Opportunities for market expansion are significant, particularly in emerging applications such as advanced medical devices, including implantable components and specialized laboratory analytical equipment, where biocompatibility and chemical inertness are non-negotiable. The development of flexible PFA tubing designed for continuous flexing applications in robotic systems and highly automated production lines represents another major growth avenue. Additionally, the increasing global focus on environmental regulations and industrial safety mandates the replacement of less inert materials (like certain metals or commodity plastics) with PFA in chemical transfer lines, especially in chemical manufacturing and wastewater treatment facilities handling harsh effluents. The trend toward developing reinforced or composite PFA structures to handle ultra-high pressures offers premium market opportunities in niche aerospace and high-performance industrial fluidics.

The impact forces influencing this market include the macro-level impact of geopolitical stability affecting global semiconductor supply chains, which directly translates to fluctuations in demand for PFA components. Technological impact forces center on innovations in fluoropolymer synthesis and compounding, which may yield new PFA grades with enhanced abrasion resistance or improved electrical properties. Regulatory impact is profound; strict mandates from organizations like the FDA (for pharma/biotech) and local environmental agencies drive demand for high-integrity, non-leaching PFA systems. The confluence of these drivers, restraints, and opportunities dictates strategic investments in capacity expansion and technological innovation across the value chain, ensuring that PFA remains the benchmark material for high-purity fluid handling.

- Drivers: Rapid expansion of semiconductor fabrication (especially 300mm and 450mm wafer production); increasing use of aggressive chemicals and solvents requiring superior corrosion resistance; stringent regulatory demands for material purity in pharmaceutical and biotech manufacturing; high-temperature operation requirements across industrial sectors.

- Restraints: High initial cost of PFA raw materials and specialized manufacturing equipment; intense competition from substitute fluoropolymers (e.g., PTFE, FEP) in less demanding applications; complexity and time required for high-purity PFA certification processes.

- Opportunity: Growth in advanced medical device manufacturing and laboratory diagnostics; potential for PFA integration in green energy technologies (e.g., fuel cells, battery cooling systems); development of composite PFA products for high-pressure/high-abrasion environments.

- Impact Forces: Geopolitical tensions affecting global electronics supply chains; stricter global environmental health and safety (EHS) standards; technological advances in fluoropolymer processing methods.

Segmentation Analysis

The PFA Tubing and Pipe Market is meticulously segmented based on product type, diameter, end-use industry, and region, allowing for a precise understanding of market dynamics and targeted strategic investment. The primary distinction lies between tubing and piping, where tubing typically refers to smaller, more flexible conduits (often up to 1 inch OD) used for localized fluid transport, instrumentation, and laboratory use, while piping constitutes larger, often rigid systems utilized for infrastructural bulk fluid delivery and structural chemical handling. Further segmentation by diameter is critical, as smaller diameters dominate unit volume, but larger diameters drive significant value due to material volume and complex installation requirements. Analysis across these segments reveals distinct growth patterns influenced by the specific purity, pressure, and temperature needs of the dominant end-use sectors, especially semiconductors and CPI.

Within the critical end-use segment, the semiconductor sector demands tubing and pipe with the absolute highest purity specifications, necessitating proprietary manufacturing techniques to minimize leachables and extractables. This segment requires tubing designed for dynamic flex life in robotic chemical delivery arms, and piping for vast networks distributing high-purity water (UPW) and process chemicals throughout the fab. Conversely, the Chemical Processing Industry (CPI) often prioritizes mechanical strength, pressure rating, and thermal stability in larger piping systems, where corrosion protection and safety over long distances are the primary concerns. The segmentation highlights the market’s duality: a high-value, high-specification segment driven by purity (electronics/pharma) and a high-volume, durability-focused segment driven by corrosion resistance (CPI).

The ongoing trend towards customization is leading to further sub-segmentation based on performance characteristics, such as anti-static PFA tubing required in volatile environments, or reinforced PFA pipes capable of operating at higher burst pressures than standard grades. Manufacturers are increasingly catering to these niche requirements by offering specialized interior treatments, color coding for safety, and custom co-extrusion capabilities. Understanding these detailed segment performances is paramount for stakeholders aiming to capture specific high-growth areas, particularly where technological mandates (like those in advanced biotech processing) align perfectly with PFA’s superior material characteristics.

- By Product Type:

- PFA Tubing (Standard Wall, Thin Wall, Heavy Wall)

- PFA Pipe (Schedule 40/80/120)

- PFA Liners and Coatings

- By Diameter:

- Up to 0.5 inch (Instrumentation and analytical)

- 0.5 inch to 1.5 inches (Process lines and localized delivery)

- Above 1.5 inches (Bulk chemical delivery and infrastructure)

- By End-Use Industry:

- Semiconductor & Electronics (UHP Applications)

- Chemical Processing Industry (CPI)

- Pharmaceutical & Biotechnology

- Medical Devices

- Aerospace & Automotive

- Food & Beverage

Value Chain Analysis For PFA Tubing and Pipe Market

The value chain for the PFA Tubing and Pipe Market begins with the upstream sourcing and production of fluoropolymer resins, a highly concentrated market dominated by a few global chemical giants. These companies synthesize the specialized PFA pellets that serve as the primary raw material. The cost and quality of these proprietary resins significantly influence the downstream manufacturing costs and the final performance characteristics of the tubing or pipe. Upstream dynamics are heavily focused on chemical process optimization to achieve the desired melt-flow indices and purity levels required for subsequent high-tolerance extrusion processes, which constitute the core manufacturing stage.

The midstream involves specialized processors who extrude the PFA resin into finished tubing and pipe components. This stage demands substantial capital investment in highly precise extrusion machinery, stringent cleanroom environments (especially for UHP products), and specialized quality control protocols, such as surface roughness measurement and dimensional analysis. Direct manufacturing and customization, including flaring, welding, and assembly of complex manifolds or hose assemblies, add significant value here. Due to the high-stakes nature of end-use applications (e.g., semiconductor fabs), manufacturers must maintain ISO 9001 certification and often specialized material cleanliness certifications, reinforcing the barrier to entry.

The downstream distribution channel involves a mix of direct sales to large end-users (like major semiconductor corporations or large CPI facilities) and indirect sales through specialized industrial distributors and fluid handling system integrators. System integrators play a crucial role by providing design consultation, installation services, and managing the overall implementation of fluid transfer systems, requiring deep application expertise. Direct sales ensure tight quality control and customization feedback, whereas indirect channels provide broader market reach and localized inventory management, particularly important for maintenance, repair, and operations (MRO) demand. The efficiency and technical competency of the distribution network are essential for delivering customized solutions globally and maintaining product integrity during transport.

PFA Tubing and Pipe Market Potential Customers

The primary customers for PFA tubing and pipe are entities operating processes where chemical purity, resistance to high temperatures and corrosive media, and non-leaching characteristics are absolutely essential for operational success and product integrity. The semiconductor industry represents the most critical segment, with major integrated device manufacturers (IDMs), foundry operators, and specialized equipment suppliers requiring PFA components for every stage of wafer processing, particularly chemical mechanical planarization (CMP) and etching stations. These customers procure high volumes of ultra-high-purity (UHP) PFA tubing and piping systems specifically designed to handle extreme levels of purity demanded in modern microchip fabrication.

Another major customer base resides within the Chemical Processing Industry (CPI), including manufacturers of specialty chemicals, petrochemicals, and fertilizers. These end-users demand robust PFA piping for handling highly corrosive mineral acids (sulfuric, hydrochloric, hydrofluoric acid) and strong oxidizers under high-pressure conditions, prioritizing system longevity and worker safety. In the pharmaceutical and biotechnology sector, customers include drug manufacturers, research laboratories, and bioreactor operators who utilize PFA for sterile fluid transfer, fermentation lines, and sampling systems due to its excellent non-stick properties and ability to withstand aggressive cleaning agents and sterilization cycles (CIP/SIP), ensuring compliance with Good Manufacturing Practices (GMP).

Additional significant buyers include aerospace and defense contractors, who use PFA tubing for hydraulic and fuel lines requiring resistance to extreme temperatures and corrosive hydraulic fluids, and the food and beverage industry, which utilizes PFA for hot liquid dispensing and equipment lining due to its FDA compliance and inertness. The common denominator among all these potential customers is the inability to tolerate material failure or chemical contamination, placing PFA in a premium, non-negotiable material category where performance dictates procurement decisions over upfront cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980 Million |

| Market Forecast in 2033 | USD 1,530 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain S.A., Zeus Industrial Products, Inc., Swagelok Company, Parker Hannifin Corporation, Sumitomo Electric Industries, Ltd., Optinova Group, Fluorotherm Polymers, Inc., Holscot Fluoroplastics Ltd., Furon (A part of Saint-Gobain), NewAge Industries, Inc., Teleflex Incorporated, Tef-Cap Industries, Inc., Junkosha Inc., Entegris, Inc., DIC Corporation, DuPont de Nemours, Inc., Asahi/America, Inc., Trelleborg AB, Dongyue Group, Zhejiang Juhua Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PFA Tubing and Pipe Market Key Technology Landscape

The manufacturing technology for PFA tubing and pipe relies heavily on advanced fluoropolymer extrusion techniques, which must operate under extremely tight tolerance controls due to the material's complex rheology and the high demands of end-use applications. Key technologies center around melt-processing, specifically utilizing high-precision screw extruders equipped with specialized heating and cooling zones to manage the narrow processing temperature window of PFA without causing thermal degradation or generating voids. The design of the die head is critical, ensuring seamless, uniform flow and preventing stagnation points which could lead to material discoloration or particle contamination. Furthermore, post-extrusion processes, such as precise cutting, annealing (stress relief), and surface conditioning, are essential to achieve the final product specifications, especially for products requiring minimal stress or memory effect.

A crucial technological differentiator, particularly in the UHP sector, is the development and implementation of proprietary cleanroom extrusion techniques. This involves conducting the entire manufacturing process—from resin feed to packaging—within an ISO Class 5 or better environment. Technologies for achieving ultra-smooth internal surfaces, often measured in terms of sub-micron surface roughness (Ra), include specialized mandrel polishing and controlled cooling systems that minimize crystalline structure variability at the surface level. These advancements ensure low particle generation and minimal bacterial adhesion, critical factors for semiconductor and pharmaceutical compliance. Quality assurance technology involves highly sensitive non-destructive testing (NDT), such as ultrasonic thickness gauging and advanced vision systems capable of detecting microscopic surface flaws and internal defects.

Innovation is also focused on enhancing joining and assembly technologies, moving beyond conventional flaring and heat fusion. The rise of PFA fittings designed for quick disconnect, high-pressure sealing, and zero dead space facilitates easier installation and maintenance in complex fluid manifolds. Furthermore, manufacturers are exploring co-extrusion technologies to create multi-layer PFA tubing that may integrate an anti-static layer, color-coded identification layer, or enhanced barrier properties, catering to specialized industrial safety and performance needs. The continuous evolution in material processing and quality control remains the core technological landscape driving the PFA tubing and pipe market forward, enabling its use in increasingly sophisticated and demanding environments.

Regional Highlights

The global PFA Tubing and Pipe Market exhibits significant regional disparities, driven by the concentration of high-tech manufacturing, regulatory frameworks, and industrial capital expenditure. Asia Pacific (APAC) commands the largest market share and simultaneously registers the highest growth rate globally. This dominance is intrinsically linked to the monumental investments in semiconductor fabrication plants (Fabs), particularly in East Asian economies such as China, Taiwan, South Korea, and Japan. These countries are the epicenter of global electronics production, requiring vast networks of UHP PFA piping for clean chemical delivery systems. Additionally, rapid industrialization across Southeast Asia drives demand in the chemical processing and automotive sectors, solidifying APAC’s pivotal role in the market structure.

North America holds a mature and technologically advanced market share, driven primarily by the strong presence of the pharmaceutical and biotechnology industries, particularly in the United States, alongside significant investment in specialty chemical manufacturing and aerospace. Demand here is characterized by high-specification requirements, emphasizing compliance with FDA regulations and custom-engineered solutions for high-pressure and critical aerospace fluid systems. The regional focus on R&D and sophisticated medical device manufacturing ensures a consistent, albeit slower, growth trajectory compared to the expansive industrial scale-up seen in APAC.

Europe represents a crucial market, particularly led by Germany, France, and Ireland, which host major pharmaceutical manufacturing hubs and sophisticated chemical production sites. European demand is heavily influenced by stringent environmental and safety regulations (REACH), favoring the use of inert, long-lasting PFA materials to mitigate corrosion risks and environmental leakage. The European market demands highly documented, traceable PFA products, aligning with stringent quality management systems and pushing manufacturers towards superior quality control technologies. Latin America and the Middle East & Africa (MEA) currently constitute smaller segments, primarily driven by localized growth in chemical refining, petrochemicals, and emerging pharmaceutical production, offering long-term opportunities as industrial infrastructure matures.

- Asia Pacific (APAC): Market leader and fastest-growing region, driven by massive capital expenditure in semiconductor fabrication (Fabs) and robust expansion of the chemical industry in China, Taiwan, and South Korea. Dominant consumer of UHP PFA products.

- North America: Mature market characterized by high demand from the advanced pharmaceutical, biotechnology, and aerospace sectors. Focus on high-pressure, custom-engineered PFA solutions and strict regulatory compliance (FDA).

- Europe: Strong market driven by stringent environmental regulations (REACH) and established chemical and pharmaceutical industries, particularly in Western Europe. Demand emphasizes product traceability and high-integrity systems.

- Latin America (LATAM): Emerging market growth linked to localized chemical and mining infrastructure development, increasingly replacing conventional materials with PFA for corrosion mitigation.

- Middle East & Africa (MEA): Growth driven by diversification of industrial bases, specifically in petrochemicals and specialty chemical production, requiring durable, high-temperature PFA pipe systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PFA Tubing and Pipe Market.- Saint-Gobain S.A.

- Zeus Industrial Products, Inc.

- Swagelok Company

- Parker Hannifin Corporation

- Sumitomo Electric Industries, Ltd.

- Optinova Group

- Fluorotherm Polymers, Inc.

- Holscot Fluoroplastics Ltd.

- Furon (A part of Saint-Gobain)

- NewAge Industries, Inc.

- Teleflex Incorporated

- Tef-Cap Industries, Inc.

- Junkosha Inc.

- Entegris, Inc.

- DIC Corporation

- DuPont de Nemours, Inc.

- Asahi/America, Inc.

- Trelleborg AB

- Dongyue Group

- Zhejiang Juhua Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the PFA Tubing and Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for PFA tubing in the global market?

The primary driver is the exponential growth of the global semiconductor industry, particularly the construction and expansion of fabrication plants (Fabs). PFA's unmatched purity, chemical inertness, and ability to handle ultra-high-purity (UHP) chemicals under high temperatures make it indispensable for critical fluid handling systems within these facilities, ensuring zero contamination crucial for advanced wafer production yields.

How does PFA compare to PTFE and FEP in terms of performance and application?

PFA (Perfluoroalkoxy) shares the exceptional chemical resistance of PTFE (Polytetrafluoroethylene) but offers a crucial advantage: it is melt-processable, allowing for conventional extrusion into seamless, longer lengths with superior surface finishes. While PTFE has a higher maximum operating temperature, PFA provides better flexibility and clarity than PTFE, and a higher continuous use temperature (up to 260°C) than FEP (Fluorinated Ethylene Propylene), positioning it optimally for high-purity, high-temperature fluid handling systems.

What are the key technological advancements in PFA tubing manufacturing?

Key technological advancements focus on achieving ultra-low surface roughness (sub-micron Ra values) through proprietary cleanroom extrusion techniques to minimize particle generation. Other critical innovations include high-precision dimensional control for tight tolerance applications, development of specialized joining methods (zero dead space fittings), and co-extrusion to integrate anti-static or barrier layers for enhanced safety and performance.

Which end-use industry holds the largest market share for PFA piping and tubing?

The Semiconductor and Electronics industry segment holds the largest market share. This sector requires PFA for ultra-high-purity (UHP) chemical delivery, deionized water systems, and corrosive acid transport, demanding the highest specifications in terms of material purity and resistance to leachables and extractables to prevent damage to sensitive microelectronic components.

What is the main restraining factor limiting broader adoption of PFA components?

The main restraining factor is the high initial cost of PFA resin compared to standard engineering plastics and common metallic alloys. PFA is a premium fluoropolymer, and its complex, high-tolerance manufacturing process further contributes to the high final product cost, making substitution an economic consideration in applications where purity and temperature resistance requirements are slightly less stringent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager