Pharmaceutical Aseptic Filling Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441100 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pharmaceutical Aseptic Filling Machine Market Size

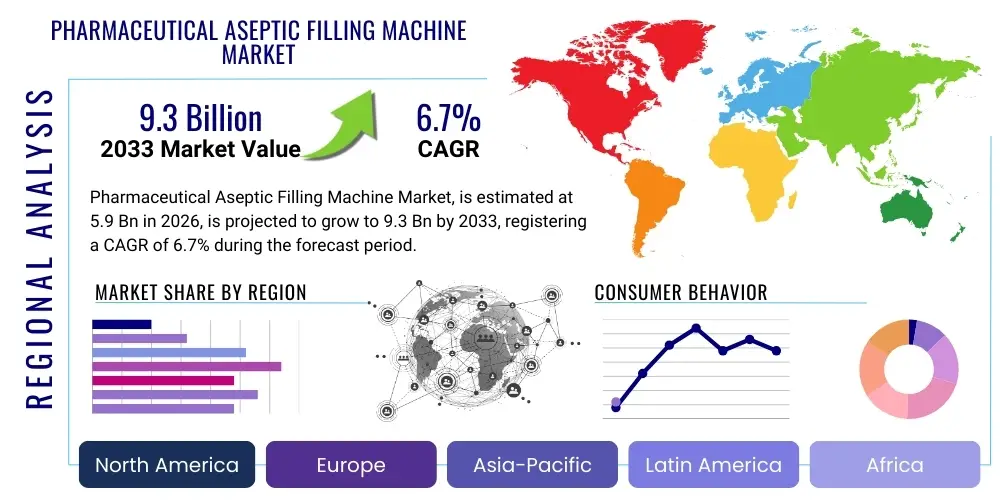

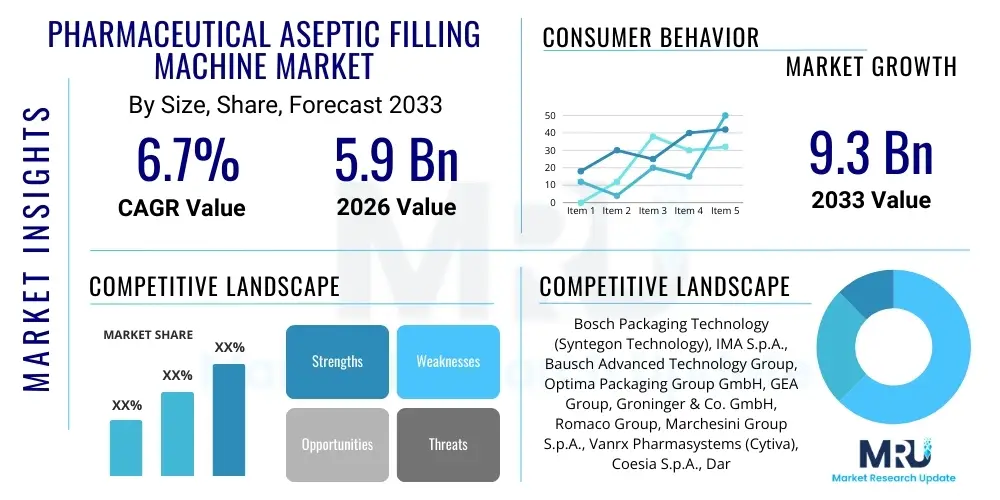

The Pharmaceutical Aseptic Filling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 5.9 Billion in 2026 and is projected to reach USD 9.3 Billion by the end of the forecast period in 2033.

Pharmaceutical Aseptic Filling Machine Market introduction

The Pharmaceutical Aseptic Filling Machine Market encompasses sophisticated automated equipment essential for packaging sterile drug products, vaccines, and biologics into primary containers such as vials, ampoules, syringes, and cartridges. These machines operate under highly controlled environmental conditions, typically utilizing Restricted Access Barrier Systems (RABS) or isolators, to prevent microbial contamination during the filling and closing process. The stringent regulatory requirements set forth by global bodies like the FDA and EMA for sterile manufacturing necessitate the use of high-precision, validated aseptic filling technology, positioning these machines as indispensable assets in modern pharmaceutical production lines. The fundamental principle revolves around minimizing human intervention and ensuring the highest level of product safety.

Aseptic filling machines are critical components in the overall drug production lifecycle, particularly for parenteral medications that bypass the body's natural defenses. Product description highlights include high speed, volumetric or gravimetric dosing accuracy, integration capabilities with upstream sterilization and downstream lyophilization equipment, and suitability for various container types and drug viscosities. Major applications span injectables, ophthalmic solutions, respiratory aerosols, and specialized biological therapeutics. The demand is intrinsically linked to the burgeoning biotech sector and the increasing prevalence of chronic diseases requiring advanced parenteral treatments, ensuring sustained market expansion.

The core benefits derived from utilizing advanced aseptic filling equipment include enhanced product sterility assurance, significant reduction in batch contamination risks, compliance with rigorous Good Manufacturing Practices (GMP), and improved operational efficiency through high throughput and minimal downtime. Key driving factors propelling this market include the global expansion of vaccine manufacturing, the increasing pipeline of complex biologic drugs requiring specialized handling, and pharmaceutical companies’ continuous efforts to modernize aging production facilities to meet current regulatory standards and capacity needs. Furthermore, technological advancements, such as the implementation of robotics and single-use technologies within the aseptic environment, are reshaping market dynamics.

Pharmaceutical Aseptic Filling Machine Market Executive Summary

The global Pharmaceutical Aseptic Filling Machine Market is characterized by robust growth, driven primarily by escalating demand for injectable drugs and the continuous regulatory pressure for heightened product safety standards in sterile manufacturing. Business trends highlight a strong shift toward highly flexible, multi-format filling lines capable of handling diverse container types, notably pre-filled syringes and ready-to-use (RTU) components, addressing the industry's need for efficiency and reduced changeover times. Furthermore, suppliers are focusing intensely on developing integrated solutions incorporating advanced isolation technologies (Isolators and RABS) to minimize environmental bioburden, fostering higher adoption rates in both established and emerging pharmaceutical clusters worldwide.

Regional trends indicate that North America and Europe currently dominate the market, attributed to the presence of major biopharmaceutical companies, rigorous quality control mandates, and substantial investment in R&D infrastructure. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment. This accelerated growth is fueled by increasing domestic pharmaceutical production, governmental initiatives promoting local manufacturing capabilities, and the rising availability of advanced clinical trials and contract manufacturing organizations (CMOs) focusing on sterile products. Capacity expansion projects in APAC are significantly boosting the deployment of new, high-speed aseptic filling lines.

Segment trends reveal that the Vials segment maintains the largest market share due to its traditional use in high-volume injectable drug and vaccine packaging. Nevertheless, the Pre-filled Syringes segment is experiencing the fastest growth rate, reflecting the preference for convenient and patient-friendly drug delivery systems, especially for chronic disease management and self-administration therapies. Technology-wise, fully automated machines coupled with advanced robotics are becoming the industry standard, offering unparalleled precision and sterility assurance compared to semi-automated systems, thereby driving the premium segment of the market. Single-use components are also increasingly influencing equipment design, simplifying cleaning and validation processes.

AI Impact Analysis on Pharmaceutical Aseptic Filling Machine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pharmaceutical Aseptic Filling Machine Market frequently center on themes of enhanced quality assurance, predictive maintenance, and optimized batch processing. Users are keen to understand how AI algorithms can improve the critical, high-stakes environment of aseptic processing, specifically addressing common concerns related to particle contamination, microbial excursion identification, and minimizing costly batch losses. The primary expectations revolve around leveraging machine learning to automate complex decision-making processes, reduce human error associated with monitoring and control, and provide real-time regulatory compliance documentation. Key concerns often address the integration difficulty of sophisticated AI systems with existing legacy filling infrastructure and the validation requirements imposed by regulatory bodies for AI-driven processes.

AI's role in the aseptic filling domain is transformative, moving beyond basic automation toward intelligent operational control. Machine learning models are being deployed to analyze massive streams of sensor data—from environmental parameters (temperature, humidity, differential pressure) to visual inspection systems—to detect subtle anomalies indicative of potential contamination events or equipment malfunction long before they escalate into critical issues. This predictive capability translates directly into higher yield rates and significantly reduced downtime, optimizing the capital utilization of expensive high-speed filling lines. Furthermore, AI contributes to enhanced process validation by ensuring continuous monitoring of critical process parameters (CPPs), making compliance reporting more robust and auditable.

The implementation of AI also facilitates advanced robotics and vision systems used for inspecting primary containers and filled products. Deep learning algorithms are proving superior to traditional rule-based systems in identifying minute cosmetic defects, labeling errors, or particulate matter within the injectable solutions, boosting the reliability of final product release. Expectations are high that AI will eventually enable truly autonomous filling operations, where the machine itself can self-diagnose and adjust parameters in real-time based on fluctuating environmental or material conditions, further solidifying sterility assurance and efficiency across various manufacturing scales.

- AI-driven predictive maintenance forecasts equipment failure, minimizing unplanned downtime of sterile lines.

- Machine vision systems powered by deep learning enhance automated particulate and cosmetic inspection accuracy.

- Real-time anomaly detection in environmental monitoring systems (EMS) prevents potential microbial contamination risks.

- Optimized batch scheduling and parameter adjustment based on AI analysis maximizes yield and minimizes waste.

- Improved data integrity and automated compliance reporting leveraging AI for continuous process verification.

- Development of autonomous robotic handling within isolators, reducing the need for human intervention.

DRO & Impact Forces Of Pharmaceutical Aseptic Filling Machine Market

The Pharmaceutical Aseptic Filling Machine Market is propelled by several robust drivers, anchored by the massive expansion of the global biopharmaceuticals and vaccine markets, which demand strict sterile processing. Regulatory mandates for enhanced product safety and quality assurance, particularly following global health crises, force pharmaceutical manufacturers to upgrade to advanced filling technologies like isolators and RABS. Opportunities are predominantly found in the rapid shift toward high-value, high-precision products such as pre-filled syringes and cartridges, which require highly specialized, flexible filling platforms. However, the market faces significant restraints, including the high initial capital investment required for these complex machines and the challenging regulatory hurdles associated with validating new, highly integrated technologies, especially concerning software validation and data integrity.

Drivers for market growth include the increasing global geriatric population, which correlates directly with a higher incidence of chronic diseases requiring parenteral treatments, alongside the continuous innovation in drug delivery systems favoring ready-to-administer formats. Furthermore, the growth of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) specializing in sterile fill-finish operations provides substantial impetus, as these entities require flexible and scalable filling solutions to serve a diverse client base. The need for faster time-to-market for novel drugs, combined with automation trends to address labor shortages and ensure consistent quality, further cements demand for fully automated aseptic systems.

Restraints are often operational and economic; the complexity of maintaining cGMP compliance across multi-site operations and the significant training required for personnel operating highly sensitive aseptic equipment pose continuous challenges. The opportunity landscape is broad, focusing on technological advancements such as the integration of single-use components to simplify sterilization protocols, the adoption of advanced robotics for enhanced precision and reduced contamination risk, and market penetration in emerging economies where healthcare infrastructure investment is accelerating. Impact forces such as rapid regulatory changes (e.g., Annex 1 revisions in Europe) and intense competition among key technology providers necessitate constant innovation and adaptation to maintain market relevance and compliance.

Segmentation Analysis

The Pharmaceutical Aseptic Filling Machine Market is highly segmented based on crucial operational and technological parameters, providing a detailed view of current industry preferences and future investment trajectories. Key segmentation includes classification by machine type (e.g., fully automated, semi-automated), product type (vials, ampoules, syringes, cartridges), capacity (low, medium, high speed), and application (injectables, biologics, vaccines). This structure reflects the diverse needs of pharmaceutical manufacturers, ranging from small-batch specialized drug producers to large-scale vaccine manufacturers. The analysis of these segments is vital for understanding competitive landscapes and allocating R&D efforts towards high-growth areas, particularly those demanding high precision and flexibility like pre-filled syringe manufacturing.

- By Product Type:

- Vials

- Ampoules

- Syringes (Pre-filled Syringes)

- Cartridges

- By Machine Type:

- Fully Automated

- Semi-Automated

- By Application:

- Vaccines and Biologics

- Antibiotics and General Injectables

- Ophthalmic Solutions

- Others (e.g., Diagnostic Kits)

- By Capacity:

- Low Speed (Up to 6,000 units/hour)

- Medium Speed (6,000 to 15,000 units/hour)

- High Speed (Above 15,000 units/hour)

- By End User:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Academic & Research Institutes

Value Chain Analysis For Pharmaceutical Aseptic Filling Machine Market

The value chain for the Pharmaceutical Aseptic Filling Machine Market begins with upstream analysis involving critical component suppliers, focusing primarily on high-precision mechanical parts, advanced robotics, sophisticated sensor technology, and isolation system materials (e.g., specialized stainless steel and validated glove ports). These suppliers must adhere to stringent quality standards, as the performance and longevity of the filling machine are dependent on the reliability and sterility compatibility of these base materials. Innovation in the upstream segment is centered around modular design and the development of components suitable for vaporized hydrogen peroxide (VHP) sterilization, which is essential for maintaining the aseptic environment. Strong supplier relationships and component traceability are paramount in this phase.

The mid-chain activity involves the Original Equipment Manufacturers (OEMs), who design, assemble, integrate, and rigorously test the aseptic filling lines. This stage includes complex integration of subsystems such as sterilization tunnels, filling pumps (peristaltic, rotary piston), stopper/capping machines, and isolation technology (RABS/Isolators). High value is added here through specialized engineering expertise, regulatory know-how, and software validation (21 CFR Part 11 compliance). OEMs compete based on customization capabilities, machine throughput, accuracy, and lifecycle support services, necessitating heavy investment in R&D to meet evolving biopharma container standards (e.g., RTU tubs and nests).

The downstream analysis focuses on the installation, qualification (IQ/OQ/PQ), and continuous maintenance and service provided to end-users (pharmaceutical companies and CMOs). Distribution channels are primarily direct, given the high capital cost, complexity, and customization required for these machines. However, indirect channels, involving authorized sales agents or specialized regional distributors, are sometimes utilized for after-sales support and spare parts logistics. The service aspect, including validation support, maintenance contracts, and operational training, constitutes a significant portion of the total value proposition, ensuring sustained high performance and regulatory compliance throughout the machine's operational life. The relationship between the OEM and the end-user often extends over the machine’s lifetime, emphasizing robust technical support.

Pharmaceutical Aseptic Filling Machine Market Potential Customers

The primary potential customers and end-users of Pharmaceutical Aseptic Filling Machines are global pharmaceutical and biopharmaceutical companies. These organizations require sophisticated equipment for the in-house manufacturing of their proprietary sterile drug products, ranging from small molecule injectables to complex monoclonal antibodies and gene therapies. Companies involved in vaccine production constitute a particularly critical customer base, especially given the global focus on pandemic preparedness and the necessity for high-volume, highly consistent sterile filling capacity. These customers often require high-speed, fully automated lines integrated with advanced barrier technology to ensure zero contamination risk, demanding strict adherence to global regulatory guidelines like GMP and Annex 1.

The second major category comprises Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As drug development increasingly relies on outsourcing specialized manufacturing tasks, CMOs/CDMOs focusing on sterile fill-finish operations represent a rapidly expanding customer segment. Their purchasing decisions are driven by the need for maximum flexibility, requiring machines that can quickly switch between various container formats (vials, syringes, cartridges) and accommodate small, medium, and large batch sizes efficiently. The ability of a filling machine to offer quick changeover and rapid cleaning cycles is highly valued by CMOs servicing diverse clients.

Furthermore, academic institutions, specialized research laboratories, and government-run public health organizations, particularly those involved in early-stage clinical trial material production or strategic national stockpile development (like vaccine production), also constitute a valuable customer base. While these groups typically require lower-speed or semi-automated, highly flexible machines for clinical batches, their demand for aseptic technology is critical for ensuring the safety and sterility of materials used in research and development. The requirement for precision and regulatory adherence remains paramount across all end-user categories, solidifying the market focus on quality and validation services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 9.3 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Packaging Technology (Syntegon Technology), IMA S.p.A., Bausch Advanced Technology Group, Optima Packaging Group GmbH, GEA Group, Groninger & Co. GmbH, Romaco Group, Marchesini Group S.p.A., Vanrx Pharmasystems (Cytiva), Coesia S.p.A., Dara Pharmaceutical Packaging, IWK Verpackungstechnik GmbH, Watson-Marlow Fluid Technology Solutions, Tofflon Science and Technology Co., Ltd., Shanghai Truking Technology Co., Ltd., ACIC Pharmaceutical Machinery, JCM VALLS, NIPRO PharmaPackaging. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Aseptic Filling Machine Market Key Technology Landscape

The technology landscape of the Pharmaceutical Aseptic Filling Machine Market is defined by the critical need to achieve and maintain sterility throughout the filling process, leading to the dominance of advanced barrier technologies. Key technologies utilized include Restricted Access Barrier Systems (RABS) and Isolators. Isolators represent the gold standard, providing a completely sealed environment where all materials are transferred in and out via validated rapid transfer ports (RTPs) or continuous decontamination mechanisms, typically using vaporized hydrogen peroxide (VHP). RABS offer a less costly, though still highly controlled, solution, utilizing positive pressure air flow and glove ports for intervention. The ongoing trend is toward modular and compact isolator designs, facilitating easier integration into existing facility layouts and reducing the required cleanroom footprint.

Filling technology itself utilizes high-precision dosing systems, primarily rotary piston pumps, peristaltic pumps, or, increasingly, single-use volumetric pump systems. Single-use technology (SUT) is a major disruptor, offering pre-sterilized fluid paths and components that eliminate the need for complex, costly, and time-consuming Cleaning-in-Place (CIP) and Sterilization-in-Place (SIP) procedures. This significantly reduces cross-contamination risks and minimizes machine downtime, making it highly attractive to CMOs and specialized biologic manufacturers. The shift towards SUT aligns with the industry's drive for flexibility and faster product changeovers, particularly for personalized medicines and small-batch production.

Robotics and advanced automation are central to modern aseptic filling lines. Robotic systems are employed extensively within isolators for tasks like container handling, loading, and unloading, drastically reducing potential human interaction which is the primary source of microbial contamination. Furthermore, integrating Artificial Intelligence (AI) and sophisticated sensor arrays (as discussed previously) provides enhanced Process Analytical Technology (PAT) capabilities, allowing for continuous, real-time monitoring of critical quality attributes (CQAs) and critical process parameters (CPPs). This technological amalgamation ensures precise dosing, minimal product loss, high throughput, and robust adherence to data integrity requirements (ALCOA principles), setting the stage for fully autonomous sterile manufacturing.

Regional Highlights

The regional analysis of the Pharmaceutical Aseptic Filling Machine Market reveals distinct growth trajectories and maturity levels across key geographical areas. North America, driven by the United States, commands a significant market share due to its established biopharmaceutical industry, leading research and development capabilities, and early adoption of advanced sterile processing technologies like isolators and robotics. The presence of major global pharmaceutical headquarters and stringent regulatory enforcement by the FDA continuously necessitate investment in state-of-the-art filling equipment, particularly for complex biologics and rapidly developed vaccines.

Europe represents another mature and substantial market segment, fueled by comprehensive regulatory frameworks, especially the EU GMP Annex 1, which mandates the highest standards for sterile manufacturing. Countries like Germany, Switzerland, and Italy host numerous leading machinery manufacturers and large pharmaceutical companies, driving demand for high-speed, fully automated filling lines. The market here is characterized by continuous modernization projects aimed at compliance and efficiency, with strong emphasis on minimizing risk through barrier technologies and integrating advanced vision systems.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is predominantly supported by massive pharmaceutical sector expansion in China, India, and South Korea, coupled with government initiatives promoting domestic drug manufacturing capabilities and increasing investment in healthcare infrastructure. The rapid expansion of local CMOs and the focus on generic injectable production, alongside increasing demand for advanced therapeutics, are spurring the adoption of both semi-automated and high-speed fully automated lines. Market penetration for highly sophisticated machinery, previously lagging, is now accelerating in this region.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, showing steady growth driven by efforts to improve domestic healthcare infrastructure and reduce reliance on imported pharmaceuticals. Brazil and Mexico in LATAM, and countries like Saudi Arabia and the UAE in MEA, are witnessing increasing investments in pharmaceutical manufacturing facilities. While often starting with smaller capacity or semi-automated machines, the push for local vaccine production and injectable manufacturing is gradually increasing the demand for compliant aseptic filling equipment, primarily sourced from established global OEMs.

- North America: Dominant market share; driven by robust biopharma R&D, stringent FDA regulations, and high adoption rate of robotics and isolator technology.

- Europe: High adoption due to strict Annex 1 compliance; strong manufacturing base for complex biologics; focused on continuous modernization and high-quality European OEMs.

- Asia Pacific (APAC): Fastest growing region; propelled by expansion in China and India, increased capacity of local CMOs, and rising healthcare investment.

- Latin America (LATAM): Steady growth fueled by local drug manufacturing initiatives and increasing demand for generic injectables; focus on cost-effective automation solutions.

- Middle East & Africa (MEA): Emerging market segment; driven by governmental efforts to localize pharmaceutical production and strategic investments in vaccine capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Aseptic Filling Machine Market.- Bosch Packaging Technology (Syntegon Technology)

- IMA S.p.A.

- Bausch Advanced Technology Group

- Optima Packaging Group GmbH

- GEA Group

- Groninger & Co. GmbH

- Romaco Group

- Marchesini Group S.p.A.

- Vanrx Pharmasystems (Cytiva)

- Coesia S.p.A.

- Dara Pharmaceutical Packaging

- IWK Verpackungstechnik GmbH

- Watson-Marlow Fluid Technology Solutions

- Tofflon Science and Technology Co., Ltd.

- Shanghai Truking Technology Co., Ltd.

- ACIC Pharmaceutical Machinery

- JCM VALLS

- NIPRO PharmaPackaging

- F. Hoffmann-La Roche Ltd. (Specialized Equipment Division)

- Steriline S.r.l.

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Aseptic Filling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automated aseptic filling machines?

The primary driver is the stringent global regulatory requirement (e.g., FDA, EMA Annex 1) to minimize human intervention in the sterile filling process, coupled with the rising volume of complex biologic drugs and vaccines that require ultra-precise dosing and zero contamination risk. Automation, especially integrating robotics within isolators, directly addresses these needs by improving sterility assurance and increasing throughput efficiently.

How are pre-filled syringes impacting the design of new aseptic filling equipment?

The growing market preference for pre-filled syringes (PFS) demands higher machine flexibility and gentler handling systems. New aseptic filling equipment is designed to process Ready-to-Use (RTU) components, often nested in trays, minimizing washing and sterilization steps for the end-user. OEMs focus on modular systems with rapid changeover capabilities to accommodate various PFS formats and materials, optimizing operations for CMOs.

What is the main difference between RABS and Isolator technology in aseptic filling?

The main difference lies in the level of environmental separation and decontamination. Isolators provide a gas-tight, sealed environment with internal decontamination cycles (usually VHP), offering the highest sterility assurance level and classifying the surrounding room as lower grade. RABS (Restricted Access Barrier Systems) utilize an open barrier system with high air velocity but rely on the surrounding cleanroom environment (Grade A air over B background) for overall control, offering less stringent but more flexible protection.

Which geographical region is expected to show the highest growth rate and why?

The Asia Pacific (APAC) region, led by China and India, is forecast to exhibit the highest CAGR. This accelerated growth is attributed to massive ongoing investments in domestic pharmaceutical manufacturing capabilities, expansion of Contract Manufacturing Organizations (CMOs) catering to global markets, and increased government focus on establishing local vaccine production infrastructure and modernizing facilities.

How does the integration of Artificial Intelligence (AI) benefit aseptic filling operations?

AI significantly benefits aseptic filling by enabling advanced predictive maintenance, thereby reducing costly unplanned downtime. Furthermore, AI-powered deep learning vision systems enhance quality control by accurately detecting minute particles and container defects in real-time. This increases batch yield and strengthens regulatory compliance through continuous, data-driven process monitoring and verification.

The Pharmaceutical Aseptic Filling Machine Market continues its trajectory of innovation driven by regulatory stringency and therapeutic advances. The imperative for absolute sterility, particularly for high-value biological products, dictates that manufacturers must continually adopt cutting-edge barrier and automation technologies. Key players are aggressively developing highly flexible, scalable platforms that efficiently handle multiple container formats, addressing the complex demands of personalized medicine and high-speed vaccine production simultaneously. The transition towards fully integrated, smart filling lines utilizing AI for process optimization and fault prediction is not just a trend but a requirement for maintaining competitiveness and compliance in the modern sterile manufacturing landscape. This sustained technological evolution ensures that the market remains a high-growth sector within the broader pharmaceutical machinery industry.

Regional dynamics play a crucial role in market development. While North America and Europe set the benchmark for quality and technological adoption, serving as crucial markets for high-end isolator and robotic systems, APAC is rapidly closing the gap by prioritizing volume and domestic capability building. The increasing demand from CMOs across all regions for quick-changeover lines underscores the industry's focus on operational agility. As the pharmaceutical pipeline continues to swell with sensitive biological entities and advanced therapy medicinal products (ATMPs), the specifications for aseptic filling equipment will only become more rigorous, demanding tighter tolerances, enhanced sterility assurance, and superior integration capabilities, thereby driving further innovation among OEMs globally.

In terms of technology adoption, the widespread implementation of single-use components is fundamentally simplifying fluid handling and sterilization protocols, reducing the validation burden for end-users and accelerating product launch timelines. This shift, coupled with the sophisticated use of Vaporized Hydrogen Peroxide (VHP) decontamination cycles within barrier systems, standardizes the approach to environmental control. The future market success hinges on providers offering holistic solutions—combining robust machinery, validated software integration for data integrity, and comprehensive lifecycle support—to manage the complex regulatory and operational challenges inherent in sterile fill-finish operations. These factors collectively solidify the positive growth outlook for the Pharmaceutical Aseptic Filling Machine Market through 2033.

The segmentation analysis highlights a decisive shift in investment away from traditional bulk vial filling towards patient-centric formats like pre-filled syringes and cartridges. This is particularly evident in developed markets where self-administration and convenience are highly valued. Consequently, equipment manufacturers are allocating significant R&D resources to developing specialized handling systems that minimize component damage and ensure accurate dosing in these delicate container types. Capacity expansion, particularly in high-speed, fully automated lines, is most prevalent among large pharmaceutical giants and top-tier CMOs seeking maximum economic efficiency and throughput consistency for global supply chains. The ongoing consolidation and specialization within the sterile fill-finish sector ensure a continuous, high-volume demand stream for state-of-the-art aseptic technology.

Regulatory harmonization efforts, while challenging, are pushing manufacturers globally toward common high standards. The implementation of concepts such as Quality by Design (QbD) and Process Analytical Technology (PAT) requires filling machines that can generate, collect, and analyze massive amounts of operational data seamlessly. This data management capability is becoming a core competitive differentiator, surpassing mere mechanical performance. The emphasis on minimizing contamination risk through superior barrier technology (Isolators over RABS for many new facilities) reflects the industry's zero-tolerance approach to microbial excursion. The convergence of hardware innovation (robotics, modular design) and software intelligence (AI, real-time analytics) defines the current technological frontier in this highly specialized manufacturing segment.

The market faces external pressures, including supply chain volatility for key components and the need for highly skilled labor to manage and maintain these complex systems. However, these restraints are mitigated by the overwhelming opportunities presented by new drug therapies and the global priority placed on public health resilience, epitomized by vaccine production capabilities. Strategic collaborations between technology OEMs and biopharmaceutical end-users—often resulting in highly customized and validated turnkey solutions—are a characteristic feature of this market. This collaborative approach ensures that the design and performance of aseptic filling machines directly evolve in response to the pharmaceutical industry’s most demanding product requirements, sustaining long-term market vitality and technological leadership.

Further analysis of the value chain reveals that intellectual property related to aseptic processing techniques, such as specific nozzle designs for viscous products or specialized VHP distribution systems within isolators, holds immense value for OEMs. The service segment, encompassing mandatory qualification, calibration, and validation services (IQ, OQ, PQ), represents a crucial, high-margin revenue stream, ensuring the machine maintains regulatory compliance throughout its operational lifespan. End-users prioritize total cost of ownership (TCO) over initial capital expenditure, driving demand for reliable, energy-efficient machines with high Mean Time Between Failures (MTBF) and robust remote diagnostics capabilities. The direct distribution model ensures OEMs retain control over validation and specialized installation, critical for such high-stakes equipment.

The competitive landscape is dominated by a few major integrated players who offer complete sterile lines, from washing and sterilization to filling, capping, and inspection. These key companies leverage their comprehensive portfolios and global service networks to secure large-scale contracts with multinational pharmaceutical corporations and global CMOs. However, specialized niche players focusing exclusively on advanced technologies like robotic filling or specific container types (e.g., small-batch personalized medicine vials) maintain strong positions by offering superior technical specifications in their specific areas. Merger and acquisition activities remain vibrant, reflecting the strategy of large OEMs to rapidly integrate niche technological expertise, such as specialized robotic handling or novel single-use dosing systems, thereby strengthening their overall aseptic offering and technological moat against competitors. This continuous striving for technological superiority is fundamentally shaping the market structure.

Considering the regional market variances, APAC’s acceleration mandates that OEMs develop more scalable and slightly lower-cost, yet fully compliant, solutions to meet the growing mid-tier manufacturing requirements there. Conversely, in mature markets like North America and Europe, the focus is on ultra-high-speed machines for blockbuster drugs and specialized, highly flexible lines for personalized treatments. The future trajectory involves a greater degree of smart factory integration, where aseptic filling lines are seamlessly connected to Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES), enabling real-time performance monitoring and fully auditable electronic batch record generation. This trend toward "Pharma 4.0" is heavily reliant on advanced aseptic filling technology capable of generating reliable, high-quality data throughout the entire manufacturing cycle, reinforcing the machine's role as a data generator, not just a physical production asset.

The evolution of container materials, such as cyclic olefin copolymer (COC) and other advanced plastics, also influences machine design, requiring lighter-touch, precision handling capabilities to prevent damage and ensure container integrity during high-speed processing. The long-term stability and compatibility of drugs stored in these advanced containers also place high demands on the closing and sealing mechanisms of the aseptic filling line. Continuous technical refinement in every module—from vial neck sterilization to stopper insertion and crimping—is mandatory to uphold the regulatory promise of product safety and shelf-life stability. The market environment thus mandates constant vigilance and investment in R&D to stay ahead of both regulatory mandates and the complex needs of modern biopharmaceutical products.

Furthermore, sustainability and operational efficiency are emerging as secondary, yet increasingly critical, decision factors for purchasing aseptic filling equipment. Manufacturers are demanding solutions that minimize energy consumption (e.g., advanced air handling units and recirculation systems in isolators) and reduce waste (e.g., highly accurate dosing to minimize product loss). OEMs who successfully integrate sustainable practices and demonstrate substantial reductions in operational costs, alongside superior performance, gain a competitive edge. This confluence of regulatory compliance, technological sophistication (AI, robotics), and operational efficiency is driving the market towards highly optimized, state-of-the-art aseptic filling solutions globally.

The geopolitical landscape also subtly influences the market, particularly regarding critical component sourcing and the establishment of redundant supply chains. The need for localized manufacturing capabilities, accelerated by recent global events, has stimulated demand for new fill-finish sites in previously undersupplied regions. This geographically dispersed demand creates new opportunities for specialized regional OEMs while also placing pressure on global leaders to expand their service and support networks worldwide. The complexity of commissioning and validating new aseptic facilities remains a major barrier to entry, ensuring that market leadership remains concentrated among experienced technology providers with proven regulatory compliance records and extensive validation expertise.

In conclusion, the Pharmaceutical Aseptic Filling Machine Market is defined by its strategic importance in public health, high technological barriers to entry, and relentless pursuit of sterility and precision. The market’s resilience is guaranteed by the continuous pipeline of injectable drugs and the unwavering regulatory focus on patient safety. The intersection of advanced isolation technology, high-speed robotics, and data-driven intelligence is transforming aseptic filling from a high-risk operational process into a highly controlled, sophisticated, and predictable element of the pharmaceutical manufacturing ecosystem, paving the way for further market growth and innovation throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager