Pharmaceutical Blister Packaging Tooling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441768 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Pharmaceutical Blister Packaging Tooling Market Size

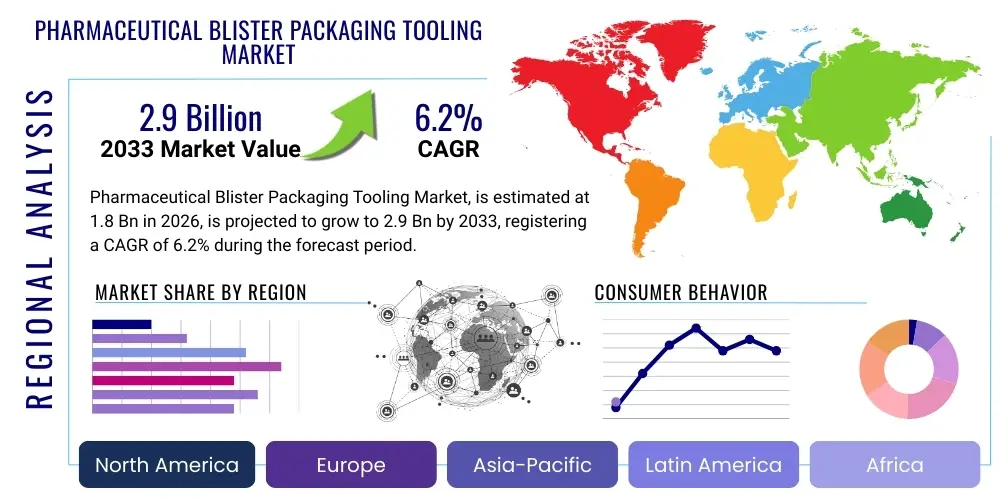

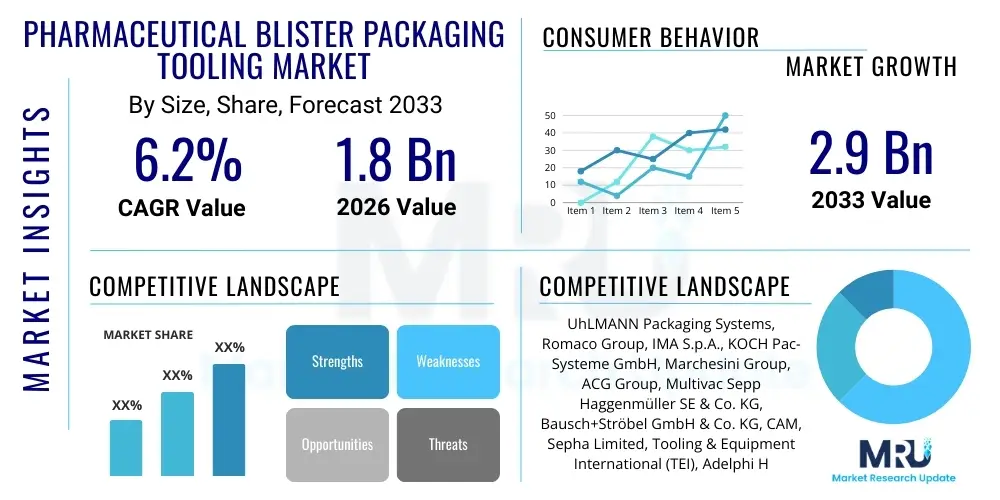

The Pharmaceutical Blister Packaging Tooling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Pharmaceutical Blister Packaging Tooling Market introduction

The Pharmaceutical Blister Packaging Tooling Market encompasses the specialized dies, punches, guide rails, and sealing plates essential for shaping and sealing blister packs used in the pharmaceutical industry. Blister packaging remains the dominant primary packaging format for oral solid dose medications (OSD) due to its superior barrier protection against moisture, light, and contaminants, coupled with high tamper evidence and dose compliance features. The increasing global demand for precise drug dosage delivery, driven by an aging population and rising prevalence of chronic diseases, directly fuels the need for high-quality, durable, and highly precise tooling systems that minimize production downtime and maintain strict regulatory adherence (cGMP).

Tooling components are designed to interact seamlessly with high-speed blister packaging machinery, ensuring consistent pocket formation, product loading, and secure lidding application. Key attributes of modern tooling include high wear resistance, optimal heat transfer properties, and easy cleanability, usually achieved through specialized coatings and advanced materials like hardened stainless steel or aerospace-grade aluminum. The product scope spans a variety of systems, including deep-draw tooling for complex shapes, dedicated forming tools for unique pharmaceutical products such as injectables or medical devices packaged in blisters, and sealing tooling optimized for different lidding materials (e.g., aluminum foil, paper-backed foil).

Major applications of these tooling solutions are concentrated within contract manufacturing organizations (CMOs), pharmaceutical giants, and generics producers. The primary benefit derived from advanced tooling lies in operational efficiency; precise tooling reduces material waste, increases machine throughput, and extends the Mean Time Between Failures (MTBF) for packaging lines. Driving factors for market growth include increasing regulatory scrutiny requiring traceable and unit-dose packaging, the rapid expansion of the biosimilars and biologics sector demanding specialized packaging formats, and technological advancements in 3D printing and surface treatments that enhance tooling longevity and customization capabilities.

Pharmaceutical Blister Packaging Tooling Market Executive Summary

The Pharmaceutical Blister Packaging Tooling Market is characterized by robust growth, propelled primarily by the stringent quality demands of the global pharmaceutical industry and the shift toward automated, high-speed packaging lines. Key business trends include the consolidation among tooling suppliers offering integrated packaging solutions, and a pronounced focus on modular and quick-changeover tooling sets that significantly reduce setup times in multi-product facilities. Geographically, the market expansion is most vigorous in emerging economies, particularly the Asia Pacific region, driven by massive investments in local pharmaceutical manufacturing capabilities spurred by government initiatives and the localization of drug production following global supply chain vulnerabilities experienced during recent health crises. Developed markets, such as North America and Europe, continue to emphasize specialized, high-precision tooling catering to high-value drugs and demanding regulatory environments.

Regional trends indicate that while North America maintains its dominance due to early adoption of advanced machinery and focus on customized tooling for specialized drug formats (e.g., unit dose and clinical trial packaging), the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by expanding generics production and increasing healthcare expenditure in countries like China and India. European manufacturers prioritize sustainability in tooling materials and processes, seeking environmentally friendly coatings and optimized tool geometry to reduce energy consumption during forming and sealing processes. Latin America and the Middle East & Africa (MEA) are developing steadily, driven by increased domestic production capacities aimed at achieving self-sufficiency in medicine supply.

Segmentation trends highlight the increasing demand for high-speed rotary tooling systems over traditional flatbed systems, owing to superior output rates and continuous operation capabilities. Furthermore, the material segment is witnessing a transition towards advanced stainless steel alloys and specialized surface coatings, such as ceramic or hard chromium, to significantly enhance wear resistance and chemical compatibility, especially when packaging corrosive or moisture-sensitive drugs. End-users, particularly large pharmaceutical companies and CMOs, are increasingly investing in proprietary tooling designs that offer unique branding opportunities while ensuring maximum product protection, reflecting a greater integration between packaging design and tooling technology.

AI Impact Analysis on Pharmaceutical Blister Packaging Tooling Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pharmaceutical Blister Packaging Tooling Market frequently revolve around two core themes: predictive maintenance for minimizing line downtime and optimizing tooling design for performance and lifespan. Users are highly concerned with how AI-driven analytics can transition tooling maintenance from reactive or time-based schedules to condition-based monitoring, anticipating tool wear or failure before it occurs. Furthermore, there is significant user interest in leveraging AI algorithms, specifically Generative Design and Machine Learning (ML), to optimize the geometry of punches, forming dies, and sealing tools, accounting for complex variables such as material flow, heat distribution, and deformation under high-speed operation, thereby ensuring higher precision and extending the operational life of expensive components.

AI's influence extends deeply into enhancing quality control and reducing manufacturing defects associated with tooling inconsistencies. Through the integration of high-resolution vision systems and ML-based defect detection algorithms, packaging lines can instantaneously analyze blister quality, seal integrity, and pocket uniformity. This capability allows for real-time adjustments to tooling temperature, pressure settings, and dwell times, dynamically compensating for minor material variations or ambient environmental changes. Consequently, the reliance on human inspection diminishes, leading to substantially lower scrap rates, higher yields, and strict compliance with global quality standards (e.g., FDA and EMA requirements).

Moreover, AI is transforming the supply chain and procurement process for tooling. Predictive models analyze historical usage patterns, lead times, and required stock levels for replacement parts, optimizing inventory management and ensuring just-in-time delivery of complex, custom-machined tooling. This predictive capability is particularly vital for specialized or proprietary tooling, where lead times can be extensive. The adoption of AI in tooling manufacturing itself, particularly in CNC machining optimization and robotic quality verification, promises to accelerate prototyping cycles and enhance the consistency and dimensional accuracy of the final tooling product, facilitating rapid scale-up for new drug launches.

- AI enables predictive maintenance, forecasting tool wear and scheduling proactive replacement, maximizing Overall Equipment Effectiveness (OEE).

- Machine Learning algorithms optimize blister tooling designs (punches, dies) for enhanced thermal management and stress distribution, increasing longevity.

- Vision systems powered by AI perform real-time, high-speed quality control on blister formation and sealing integrity, significantly reducing defect rates.

- Generative Design assists in creating lightweight, high-performance tooling structures, potentially utilizing advanced manufacturing techniques like 3D printing.

- AI-driven supply chain management optimizes inventory levels for highly customized and expensive replacement tooling parts, reducing capital tie-up.

- Automated root cause analysis identifies tooling-related packaging defects, accelerating the correction process and improving process validation.

- Integration of AI feedback loops allows packaging machines to dynamically adjust tooling parameters (heat, pressure) based on real-time material properties.

- Advanced robotics, guided by AI, can automate tooling changeovers, drastically cutting setup time and mitigating human error in complex adjustments.

- AI facilitates the creation of digital twins of packaging lines, allowing virtual testing of new tooling designs and operational parameters before physical implementation.

- Data analytics derived from AI helps manufacturers comply with regulatory requirements by providing highly granular, verifiable data on packaging consistency and process control.

DRO & Impact Forces Of Pharmaceutical Blister Packaging Tooling Market

The Pharmaceutical Blister Packaging Tooling Market is fundamentally shaped by a confluence of accelerating drivers (D), significant restraining factors (R), strategic growth opportunities (O), and potent external impact forces (I). The primary driver is the pervasive and non-negotiable requirement for high-precision, tamper-evident unit-dose packaging mandated by global regulatory bodies, coupled with continuous growth in global pharmaceutical production, particularly in chronic disease medications and specialized high-value drugs. However, this growth is moderated by key restraints, most notably the high initial capital investment required for state-of-the-art tooling and packaging machinery, and the complex challenge of ensuring material compatibility between the tooling, the packaging substrate (e.g., PVC/PVDC, Aclar), and the drug product itself, which can lead to costly validation cycles and specialized material requirements.

Opportunities for market expansion are substantial, driven by the emergence of novel drug delivery systems, such as oral dissolvable films and injectables requiring specialized, often deep-drawn, blister formats, offering manufacturers avenues to develop proprietary and high-margin tooling solutions. Furthermore, the industry-wide focus on sustainability presents opportunities for tooling manufacturers to innovate with lightweight, recyclable materials and optimized geometries that reduce energy consumption during the thermoforming process. Strategic impact forces include rapid technological obsolescence, where advances in 3D printing and nanotechnology coatings necessitate constant R&D investment, and geopolitical instability, which affects raw material pricing (e.g., specialized steel alloys) and global supply chain reliability for tooling components.

The imperative to minimize cross-contamination and ensure patient safety globally necessitates sophisticated, easily cleanable tooling, pushing demand towards specialized non-corrosive materials and modular designs suitable for quick cleaning validation in multi-product facilities. This demand acts as a strong driver. Conversely, the market faces restraints related to the highly customized nature of tooling; since tooling is specific to the packaging machine model and the desired blister geometry, manufacturers face limited standardization, which increases production costs and lead times. The impact forces of globalization in pharmaceutical manufacturing compel tooling suppliers to establish robust service and calibration networks worldwide, ensuring consistent performance and rapid maintenance support for international clients operating under harmonized quality standards.

Segmentation Analysis

The Pharmaceutical Blister Packaging Tooling Market is comprehensively segmented based on several key dimensions, including the type of packaging machine utilized, the material used in the tooling construction, the specific application or drug format being packaged, and the type of tooling component itself. This granular segmentation is crucial for understanding specific technological niches and addressing the highly varied needs of pharmaceutical manufacturers, which range from high-volume generic producers requiring maximum throughput and durability to specialized biotechnology companies demanding custom tooling for sensitive, high-value products. The primary goal of segmentation is to reflect the diverse operational requirements concerning speed, precision, longevity, and regulatory compliance across the global packaging landscape.

Segmentation by Machine Type, distinguishing between rotary, flatbed, and semi-automatic systems, reveals shifts towards continuous operation models where rotary tooling dominates due to its efficiency in high-volume production environments. Similarly, segmentation by Material is highly relevant, differentiating between standard stainless steel, aluminum alloys, and specialized coated tooling; the shift is favoring sophisticated coatings (like ceramic or PVD coatings) that enhance hardness, reduce friction, and extend the lifespan of components while preventing sticking or contamination. These material advancements are particularly critical for packaging hygroscopic or sticky pharmaceutical formulations, ensuring clean release and maintaining precise blister cavity dimensions.

Further analysis of the market segments focuses on Application, differentiating tooling used for tablets, capsules, vials, ampoules, and medical devices. The tablet and capsule segment holds the largest market share, but tooling for specialized parenteral packaging and controlled substances is experiencing rapid growth due to complexity and the need for enhanced barrier properties. Understanding these segment dynamics allows tooling manufacturers to strategically allocate R&D resources towards next-generation materials and precision machining techniques necessary to meet the escalating demands for customized, high-precision, and validated tooling solutions that integrate seamlessly with increasingly automated packaging lines across different facility scales.

- By Type of Machine:

- Rotary Blister Machines Tooling

- Flatbed Blister Machines Tooling

- Semi-Automatic/Manual Blister Machines Tooling

- By Material Type:

- Stainless Steel Tooling (HSS, Martensitic)

- Aluminum Alloy Tooling

- Coated Tooling (Ceramic, PVD, PTFE)

- Specialty Materials (e.g., Titanium)

- By Component:

- Forming Tools (Dies, Mold Plates)

- Sealing Tools (Platens, Heating Plates)

- Punching Tools (Die Sets, Cutters)

- Guide Rails and Change Parts

- By Application/Drug Format:

- Tablets and Capsules (Solid Dosage)

- Vials and Ampoules

- Syringes and Injectables

- Medical Devices and Diagnostics

- Unit Dose and Clinical Trial Packaging

- By End-User:

- Pharmaceutical Manufacturing Companies (Branded and Generic)

- Contract Manufacturing Organizations (CMOs) and Contract Packaging Organizations (CPOs)

- Biotechnology Firms

Value Chain Analysis For Pharmaceutical Blister Packaging Tooling Market

The value chain for the Pharmaceutical Blister Packaging Tooling Market is complex and highly specialized, beginning with the upstream supply of specialized raw materials, primarily high-grade tool steels, aluminum, and advanced coating precursors. Upstream analysis focuses heavily on the procurement of materials that meet stringent industry standards for hardness, thermal conductivity, and purity, often sourced from specialized metal processors and alloy manufacturers. The quality and stability of this upstream supply directly impact the precision and longevity of the final tooling product. Fluctuations in global raw material prices, particularly for exotic alloys used in high-performance tooling, can introduce significant cost volatility throughout the value chain, requiring sophisticated risk management and long-term procurement contracts by tooling manufacturers.

Midstream activities involve the highly precise manufacturing processes, including CNC machining, surface finishing, heat treatment, and specialized coating applications. This stage requires significant investment in advanced machinery, metrology equipment, and skilled labor capable of maintaining micron-level tolerances, which are critical for cGMP compliance and high-speed operation. Tooling manufacturers often collaborate closely with pharmaceutical machine builders to ensure seamless integration and validation of the tooling with the specific packaging line (OEM collaboration). After manufacturing, rigorous quality control and certification processes are essential, validating dimensional accuracy and material composition before distribution.

The downstream segment primarily involves distribution channels, which can be categorized as direct and indirect. Direct distribution involves tooling manufacturers supplying custom components directly to large pharmaceutical companies or CMOs, often including installation, qualification, and ongoing maintenance contracts. Indirect channels involve machine manufacturers (OEMs) who sell the tooling as part of a complete packaging line package, or specialized local distributors who provide faster replacement and service support in regional markets. Potential customers, the pharmaceutical end-users, place immense value on reliability, rapid availability of replacement parts (change parts), and validated performance, making after-sales service and technical support a crucial differentiating factor in the overall value proposition.

Pharmaceutical Blister Packaging Tooling Market Potential Customers

The primary potential customers and end-users of Pharmaceutical Blister Packaging Tooling are organizations heavily involved in the mass production, distribution, and clinical preparation of regulated drug products. Foremost among these are multinational pharmaceutical corporations, both those producing branded, proprietary medicines and those specializing in high-volume generic drugs. These large companies typically operate highly automated, high-speed packaging lines and require vast quantities of highly durable, standardized tooling that guarantees consistent output and minimal deviation, often customized to their specific proprietary machine specifications and global packaging standards. Their purchasing decisions are driven by total cost of ownership (TCO), operational efficiency (OEE), and global service reliability.

Contract Manufacturing Organizations (CMOs) and Contract Packaging Organizations (CPOs) represent a rapidly expanding and critical customer segment. CMOs manage production for multiple clients, necessitating frequent tooling changeovers and highly flexible, modular tooling systems that can accommodate a wide variety of drug sizes, shapes, and packaging materials quickly and accurately. Their need for versatile, quick-change tooling that meets diverse client specifications and regulatory requirements (often across multiple jurisdictions) makes them high-value customers who prioritize tooling lead times, validation documentation, and reliability under varied operational demands. As outsourcing trends accelerate globally, the reliance of the pharmaceutical sector on CMOs further solidifies their position as key consumers of specialized tooling.

Furthermore, smaller biotechnology firms and academic research institutions involved in clinical trials constitute niche but important customer segments, particularly requiring small-batch, highly specialized, and often rapidly produced tooling for investigational new drugs (INDs) or unique dosage forms. While their volume is lower, their demand for precision, rapid prototyping (often utilizing 3D printing technologies), and specialized material compatibility for highly sensitive drug substances drives significant innovation in custom tooling solutions. Additionally, veterinary pharmaceutical companies, and manufacturers of regulated medical devices and diagnostic kits (which often use blister packaging for sterility) also represent significant customer bases requiring robust and certified tooling solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UhLMANN Packaging Systems, Romaco Group, IMA S.p.A., KOCH Pac-Systeme GmbH, Marchesini Group, ACG Group, Multivac Sepp Haggenmüller SE & Co. KG, Bausch+Ströbel GmbH & Co. KG, CAM, Sepha Limited, Tooling & Equipment International (TEI), Adelphi Healthcare Packaging, STARLANCER PACKAGING MACHINERY, Custom Tooling, Inc., Pharma Tooling Solutions, Blister Tooling Solutions, SaintyCo, Körber Pharma, Fabrima Maquinas Automaticas Ltda., Jicon Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Blister Packaging Tooling Market Key Technology Landscape

The technological landscape of pharmaceutical blister packaging tooling is highly dynamic, driven by the twin imperatives of increasing operational speed and ensuring absolute product integrity under increasingly stringent regulatory frameworks. A fundamental shift involves the widespread adoption of specialized surface treatments, moving beyond traditional hard chromium plating to advanced Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings, such as diamond-like carbon (DLC) or specific ceramics. These coatings dramatically improve the tooling's surface hardness, reduce friction, prevent product sticking (especially crucial for hygroscopic or difficult-to-handle APIs), and enhance chemical resistance, thereby extending the tool's lifecycle and reducing the frequency of costly cleaning and replacement cycles, directly impacting the OEE of high-speed lines.

Another pivotal technological advancement is the integration of Additive Manufacturing (AM), or 3D printing, into the tooling design and production workflow. While high-volume production tooling still predominantly relies on traditional CNC machining for ultimate precision and surface finish, AM is rapidly becoming indispensable for creating rapid prototypes, complex cooling channels within sealing platens (enhancing temperature uniformity and sealing quality), and specialized, small-batch tooling required for clinical trials or highly customized product shapes. This technology significantly reduces lead times for new designs and facilitates faster iterative optimization, allowing pharmaceutical companies to bring novel packaging concepts to market more quickly while maintaining dimensional accuracy.

Furthermore, the incorporation of smart tooling and digital integration is gaining momentum. This involves embedding sensors within the tooling components—particularly in sealing platens and forming pockets—to monitor crucial operational parameters such as temperature, pressure, and vibration in real-time. This real-time data is then fed into the machine's control system, often leveraging AI/ML models, to facilitate predictive maintenance and instantaneous process adjustments, ensuring continuous quality assurance. Tooling manufacturers are also focusing on modular, quick-change designs with RFID or barcode tracking systems to simplify tooling changeover processes, automatically loading necessary parameters (recipes) into the packaging machine, thus minimizing human error and maximizing flexibility in facilities handling a diverse product portfolio.

Regional Highlights

The Pharmaceutical Blister Packaging Tooling Market exhibits distinct regional dynamics driven by varying levels of pharmaceutical manufacturing maturity, regulatory environments, and investment in automated packaging technology. North America, encompassing the United States and Canada, remains a dominant force, characterized by substantial R&D investment in high-value, specialized pharmaceuticals, leading to a strong demand for custom, highly complex tooling optimized for specialized delivery systems and clinical trial packaging. Strict FDA regulations necessitate robust tooling validation and documentation, favoring established suppliers known for quality and traceability. Tooling innovation here is often focused on high-barrier materials and unit-dose compliance features.

Europe holds a significant market share, driven by major manufacturing hubs in Germany, Switzerland, and Italy. The region emphasizes high-speed production for both branded drugs and generics, coupled with a strong focus on sustainable manufacturing practices, leading to demand for tooling made from recyclable materials or optimized geometries that reduce energy consumption during thermoforming. Regulatory adherence to EMA guidelines and the serialization mandate further fuel the need for precision tooling compatible with integrated track-and-trace systems. The consolidation of packaging machinery OEMs in Europe often dictates the tooling standards adopted across the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region, powered by rapid expansion in generics manufacturing, increasing healthcare infrastructure spending, and government initiatives promoting domestic drug production in markets like China, India, and Southeast Asia. While cost-effectiveness remains a key factor, the demand for high-speed, reliable, and durable tooling is surging as local manufacturers upgrade their facilities to meet international export standards. Latin America and the Middle East & Africa (MEA) are emerging regions showing steady growth, driven by increasing pharmaceutical accessibility and the development of local manufacturing capabilities aiming for self-sufficiency, often prioritizing standardized, robust tooling solutions that offer ease of maintenance and long operational lifecycles.

- North America: Focus on high-precision tooling for biologics and specialized therapies, driven by stringent FDA compliance and high investment in complex automation.

- Europe: High demand for modular, quick-changeover tooling systems and sustainable material solutions, underpinned by EMA regulations and serialization requirements.

- Asia Pacific (APAC): Leading growth region, fueled by expansion in high-volume generics production in India and China, increasing adoption of high-speed rotary tooling technology.

- Latin America: Growing domestic manufacturing base demanding cost-effective, durable tooling, often sourcing from global suppliers for machine compatibility.

- Middle East and Africa (MEA): Emerging market with nascent manufacturing capabilities, emphasizing tooling solutions that guarantee product stability in challenging climatic conditions (high heat/humidity).

- Germany: Key innovation hub for high-speed blister machinery, driving demand for technologically advanced, integrated tooling solutions.

- China and India: Massive domestic drug consumption leading to immense scale in tooling demand for standard oral solid dosage forms.

- Switzerland: Focus on high-end, customized tooling for specialized pharmaceutical and biotechnology products.

- Japan: Strong market for advanced materials and ultra-high precision tooling reflecting rigorous domestic quality standards.

- Brazil: Largest market in Latin America, focusing on local production and increasing the adoption of automated packaging systems requiring matched tooling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Blister Packaging Tooling Market.- UhLMANN Packaging Systems

- Romaco Group

- IMA S.p.A.

- KOCH Pac-Systeme GmbH

- Marchesini Group

- ACG Group

- Multivac Sepp Haggenmüller SE & Co. KG

- Bausch+Ströbel GmbH & Co. KG

- CAM

- Sepha Limited

- Tooling & Equipment International (TEI)

- Adelphi Healthcare Packaging

- STARLANCER PACKAGING MACHINERY

- Custom Tooling, Inc.

- Pharma Tooling Solutions

- Blister Tooling Solutions

- SaintyCo

- Körber Pharma

- Fabrima Maquinas Automaticas Ltda.

- Jicon Industries

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Blister Packaging Tooling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key technological advancements driving innovation in pharmaceutical blister tooling materials?

Key technological advancements are centered on specialized surface engineering and advanced material science to maximize durability and reduce friction. The shift is moving towards high-performance coatings such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings, including Diamond-Like Carbon (DLC) and various ceramic composites, applied to tool steels. These coatings significantly enhance wear resistance, corrosion protection, and improve non-stick properties, which is crucial for handling sticky or abrasive pharmaceutical powders and granules. Furthermore, novel stainless steel alloys with improved thermal properties are being adopted for sealing tools to ensure highly consistent heat distribution and seal integrity at elevated packaging line speeds, directly contributing to superior Overall Equipment Effectiveness (OEE) and compliance with cGMP standards.

How does 3D printing impact the production and lead times for customized blister tooling components?

3D printing, or Additive Manufacturing (AM), fundamentally transforms the lead time for customized tooling by enabling rapid prototyping and the production of complex geometries that are difficult or impossible to achieve through traditional subtractive manufacturing (CNC machining). For pharmaceutical companies requiring unique blister shapes for new drug launches or clinical trials, AM can reduce design-to-delivery cycles from several weeks to just a few days. While high-volume, precision production tooling typically still relies on CNC machining for ultra-tight tolerances and optimal surface finish, 3D printing excels in creating specialized auxiliary components, small inserts, testing fixtures, and tooling parts with internal conformal cooling channels, optimizing thermal control in sealing tools and drastically speeding up the validation phase for new packaging formats.

What are the primary regulatory challenges affecting the design and validation of blister packaging tooling?

The primary regulatory challenge is ensuring that the tooling consistently produces packaging that adheres to strict global standards for moisture barrier protection, oxygen barrier integrity, child resistance (where applicable), and tamper evidence, as mandated by bodies like the FDA and EMA. Tooling materials must be certified as non-reactive, non-leaching, and suitable for pharmaceutical contact, requiring extensive Material Safety Data Sheet (MSDS) documentation and compatibility testing. Furthermore, tooling validation requires detailed documentation demonstrating that the components maintain dimensional stability and performance throughout their operational lifespan, contributing to Process Validation (PV) and ensuring that the packaging process is continuously in a state of control (cGMP compliance). Tooling suppliers must provide comprehensive qualification documentation (IQ/OQ/PQ) to facilitate the pharmaceutical manufacturer's regulatory submissions.

In the context of tooling, what is the significance of quick-changeover features and modular design?

Quick-changeover features and modular design are paramount in modern pharmaceutical packaging, particularly for Contract Manufacturing Organizations (CMOs) that handle numerous different Stock Keeping Units (SKUs) on the same production line. Modular tooling systems allow operators to exchange specific components (e.g., forming dies or sealing platens) rapidly and accurately, drastically reducing downtime associated with product changeovers. This capability directly enhances line efficiency and profitability, optimizing the Overall Equipment Effectiveness (OEE). Advanced systems incorporate standardized interfaces and sometimes use automated systems or RFID tagging to ensure the correct tooling set is installed and the machine automatically loads the corresponding operational parameters (the 'recipe'), minimizing setup errors and ensuring compliance across different batch runs.

How is the lifespan and maintenance of blister packaging tooling quantified, and what technologies extend it?

The lifespan of blister packaging tooling is typically quantified by the number of cycles or production batches achieved before performance degradation necessitates replacement or extensive refurbishment, with key metrics being dimensional stability and surface finish integrity. Technologies that extend this lifespan include specialized abrasion-resistant coatings (DLC, ceramics) which shield the base metal from wear, advanced heat treatment processes (e.g., vacuum hardening) to maximize core hardness and resistance to deformation, and integrated cooling channels that prevent thermal stresses, which often lead to premature failure in sealing platens. Furthermore, the implementation of AI-driven predictive maintenance utilizes embedded sensors to monitor tooling condition, allowing manufacturers to schedule precise, condition-based maintenance interventions, thereby avoiding catastrophic failures and maximizing the tool’s useful operational life far beyond traditional scheduled replacement intervals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager