Pharmaceutical Grade Calcium Gluconate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442564 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Pharmaceutical Grade Calcium Gluconate Market Size

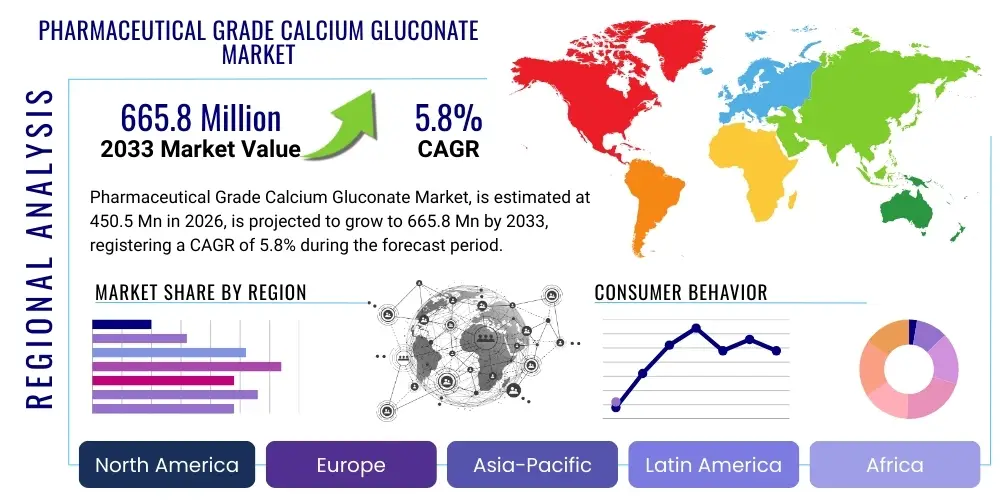

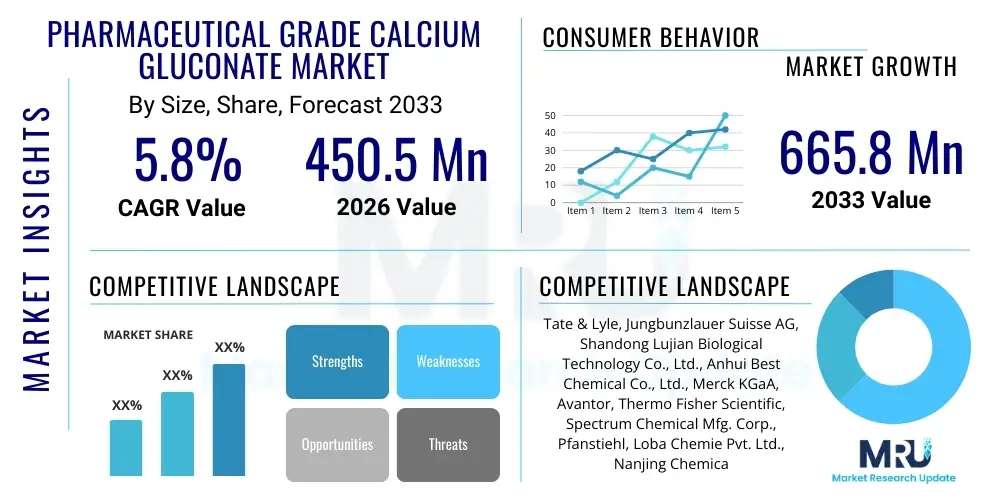

The Pharmaceutical Grade Calcium Gluconate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 665.8 Million by the end of the forecast period in 2033.

Pharmaceutical Grade Calcium Gluconate Market introduction

The Pharmaceutical Grade Calcium Gluconate Market encompasses the production, distribution, and utilization of high-purity calcium gluconate specifically manufactured to meet stringent pharmaceutical quality standards, such as USP (United States Pharmacopeia) or EP (European Pharmacopoeia). This compound, the calcium salt of gluconic acid, is essential in medical practice primarily due to its high solubility and bioavailability, making it the preferred intravenous calcium source. It is widely applied in the treatment of hypocalcemia, emergency management of cardiac arrest, counteracting hyperkalemia, and as an antidote for magnesium sulfate toxicity.

Pharmaceutical Grade Calcium Gluconate serves as a crucial electrolyte replacement in clinical settings. Its primary application lies in correcting calcium imbalances quickly and safely, especially when oral supplementation is insufficient or contraindicated. The product is manufactured under strict Good Manufacturing Practices (GMP) to ensure sterility, defined particle size distribution, and guaranteed low impurity levels, prerequisites for injectable and specialized oral pharmaceutical formulations. The benefits of using this grade include minimized risk of adverse reactions, improved efficacy in critical care scenarios, and regulatory compliance for finished drug products.

The driving factors for market growth include the rising prevalence of chronic kidney disease (which often leads to hypocalcemia), the increasing use of specialized injectable nutritional therapies (such as Total Parenteral Nutrition or TPN), and the global expansion of healthcare infrastructure, particularly in emerging economies. Furthermore, continuous advancements in drug delivery systems utilizing calcium salts, coupled with the need for high-quality, traceable raw materials in the global pharmaceutical supply chain, sustain the demand for this specialized compound.

Pharmaceutical Grade Calcium Gluconate Market Executive Summary

The Pharmaceutical Grade Calcium Gluconate Market demonstrates robust growth driven by escalating clinical demand for intravenous calcium supplementation, particularly in emergency medicine and specialized parenteral nutrition. Business trends indicate a strong emphasis on supply chain integrity, with major pharmaceutical manufacturers prioritizing long-term contracts with suppliers who can guarantee USP/EP standards and stability of supply. Regulatory scrutiny remains a dominant force, compelling manufacturers to invest heavily in quality control measures and documentation, thereby favoring larger, established players capable of meeting global regulatory requirements. Consolidation within the supply chain, focusing on backward integration to control raw material sourcing (gluconic acid), is emerging as a key strategic move.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid expansion of the pharmaceutical manufacturing sector in China and India, increased public health spending, and the growing prevalence of nutritional deficiencies. North America and Europe, characterized by established healthcare systems, represent mature but high-value markets, driven by critical care applications and strict quality mandates for drug formulation inputs. Furthermore, increased awareness regarding osteoporosis and other calcium deficiency-related disorders across Latin America and the Middle East is opening new avenues for prophylactic and therapeutic applications.

Segment trends underscore the dominance of the Injectable Formulation Application segment, given the criticality of intravenous administration in hypocalcemia treatment. In terms of purity, the demand for 99.5% purity material is increasing as pharmaceutical companies strive to meet increasingly rigorous purity specifications set by global regulatory bodies. The Powder form segment remains the largest due to its versatility in compounding and formulation, though liquid forms are gaining traction for immediate use applications in hospital settings.

AI Impact Analysis on Pharmaceutical Grade Calcium Gluconate Market

User inquiries regarding AI's influence on the Pharmaceutical Grade Calcium Gluconate market often center on optimizing the complex synthesis process, enhancing quality control and batch consistency, and streamlining regulatory documentation and compliance. Users frequently ask if AI can predict supply chain disruptions, automate impurity detection beyond traditional analytical methods, or accelerate the development of novel calcium salt formulations. The primary concerns revolve around the initial investment cost for AI integration in legacy manufacturing facilities and the data privacy implications when optimizing proprietary production processes.

The consensus themes suggest that while AI will not directly substitute the core chemical synthesis, its application in upstream and downstream process optimization is highly anticipated. Specifically, users expect AI to significantly reduce batch failure rates by analyzing real-time data from reactors and crystallization units, leading to higher yield and lower operational costs. Furthermore, AI-driven predictive maintenance in complex chemical plants is projected to minimize downtime, ensuring a more reliable supply of high-purity calcium gluconate to the critical care sector. This technological integration is expected to cement the position of advanced manufacturers capable of deploying complex algorithms for process control and quality assurance.

- AI optimizes large-scale fermentation and chemical synthesis processes, predicting optimal reaction parameters (temperature, pH) to maximize yield and purity.

- Predictive Maintenance (PdM) uses machine learning to anticipate equipment failure in crystallization and drying units, minimizing costly manufacturing downtime.

- AI-enhanced Quality Control (QC) utilizes image analysis and spectral data processing to detect minute physical and chemical impurities in final batches, surpassing human detection limits.

- Streamlined Regulatory Compliance: AI tools accelerate the compilation and cross-referencing of GMP documentation, ensuring audit readiness and faster time-to-market for derived formulations.

- Supply Chain Optimization: Machine learning algorithms forecast demand fluctuations based on disease outbreaks and seasonal trends, enabling proactive inventory management of raw materials.

DRO & Impact Forces Of Pharmaceutical Grade Calcium Gluconate Market

The Pharmaceutical Grade Calcium Gluconate market is fundamentally driven by the indispensable role of intravenous calcium in emergency medicine and critical care, coupled with the increasing global incidence of chronic diseases requiring electrolyte management. However, the market faces significant restraints, primarily stemming from the necessity of adhering to extremely stringent regulatory purity standards (USP/EP/JP), which imposes high manufacturing costs and acts as a barrier to entry for smaller players. Opportunities exist in developing advanced, ready-to-use liquid formulations with enhanced stability and shelf life, catering to hospitals seeking immediate administration solutions. Furthermore, expansion into veterinary pharmaceutical applications and specialized nutritional supplements represents untapped growth potential. These dynamics create powerful impact forces centered around regulatory pressures and clinical necessity.

The primary drivers include the expanding geriatric population globally, which is more susceptible to calcium metabolic disorders, and the rising number of patients requiring TPN (Total Parenteral Nutrition) in hospital settings, which necessitates pharmaceutical-grade calcium sources. Technological advancements in continuous manufacturing processes are also reducing energy consumption and improving batch consistency, thereby supporting market expansion. Conversely, the market is restrained by price sensitivity in developing countries, where local manufacturers might offer lower-grade alternatives, and the complex process required for regulatory approval of new manufacturing sites or formulation changes.

Impact forces are predominantly driven by globalization of regulatory standards and the non-substitutable nature of calcium gluconate in acute medical intervention. Any failure in quality or purity can have life-threatening consequences, leading regulatory bodies to intensify oversight. This regulatory environment favors established global suppliers with robust quality systems. The force of opportunity lies in emerging market penetration, where healthcare investment is surging, creating long-term demand for standardized, high-quality pharmaceutical raw materials like calcium gluconate.

Segmentation Analysis

The Pharmaceutical Grade Calcium Gluconate Market is segmented based on Purity Level, Form, Application, and End-Use Industry, providing a granular view of demand drivers and consumer preferences across different pharmaceutical value chains. This segmentation helps stakeholders understand where the most stringent requirements lie (e.g., high purity for injectable applications) and where volume demand is highest (e.g., compounding pharmacies). The analysis of these segments reveals distinct growth trajectories influenced by regulatory compliance requirements and the final route of administration for the derived medicinal products.

- By Purity Level:

- 99.0% Purity

- 99.5% Purity

- Others (e.g., 98.5%)

- By Form:

- Powder

- Granules

- Liquid/Solution

- By Application:

- Calcium Deficiency Treatment (Hypocalcemia)

- Cardiac Arrest Management

- Antidote for Magnesium Overdose (Hypermagnesemia)

- Pharmaceutical Formulations (Injectables, Oral Solutions, Tablets)

- By End-Use Industry:

- Pharmaceutical Companies

- Compounding Pharmacies

- Hospitals & Clinics

- Research Institutes

Value Chain Analysis For Pharmaceutical Grade Calcium Gluconate Market

The value chain for Pharmaceutical Grade Calcium Gluconate begins with the upstream segment, primarily involving the sourcing and production of raw materials, specifically glucose (often derived from corn starch or other agricultural sources) and subsequently, gluconic acid, which is produced through microbial fermentation or oxidation. Efficiency and cost management at this stage are critical, as the purity of the precursor materials directly influences the final pharmaceutical grade product quality. Key upstream players are chemical manufacturers specializing in fermentation and organic acid production. Backward integration by major calcium gluconate producers to secure gluconic acid supply is a notable trend, mitigating price volatility and ensuring consistent quality inputs.

The midstream segment involves the core manufacturing process: the reaction of gluconic acid with calcium carbonate or calcium hydroxide, followed by purification, crystallization, drying, and milling to achieve the required particle size distribution and high purity. This is the most regulated segment, requiring GMP certification and strict adherence to pharmacopoeial standards (USP/EP). Manufacturers must employ advanced analytical techniques to validate the absence of heavy metals and microbial contaminants. Distribution channels include both direct sales and indirect routes. Direct sales typically involve large-volume contracts between major calcium gluconate producers and global pharmaceutical companies for bulk Active Pharmaceutical Ingredient (API) supply.

The downstream segment involves the final compounding, formulation, and distribution of finished pharmaceutical products. Calcium gluconate is processed into injectable solutions, oral suspensions, or integrated into TPN solutions by pharmaceutical companies and compounding pharmacies. Hospitals, clinics, and research institutions act as the final end-users. Indirect distribution utilizes specialized pharmaceutical distributors and wholesalers who handle logistics, quality documentation, and temperature-controlled storage, ensuring the product reaches compounding pharmacies and healthcare facilities efficiently. Regulatory documentation, including Certificates of Analysis (CoA) and Material Safety Data Sheets (MSDS), is paramount at every transfer point in the value chain, ensuring full traceability from the raw material to patient administration.

Pharmaceutical Grade Calcium Gluconate Market Potential Customers

The primary customers for Pharmaceutical Grade Calcium Gluconate are entities that require high-purity calcium salts for the treatment of acute medical conditions, customized parenteral nutrition, or large-scale production of regulated injectable drugs. Hospitals and clinics represent a significant customer base, procuring the product either as a finished injectable drug or as a raw material for compounding specialized solutions needed in emergency rooms, critical care units, and dialysis centers. Their demand is inelastic and dictated by clinical necessity, often focusing on reliability and immediate availability.

Pharmaceutical manufacturing companies constitute the largest volume consumers. These companies utilize calcium gluconate as an API for mass production of pre-filled syringes, ampoules, and vials for global distribution. Their purchasing decisions are driven by strict regulatory adherence, bulk pricing, and the supplier's capacity to meet high-volume, long-term supply agreements under stringent quality controls (e.g., zero defects policy). Compounding pharmacies are also vital customers, specializing in preparing tailor-made medications, especially pediatric or complex TPN formulations, where precise, pharmaceutical-grade ingredients are non-negotiable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 665.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tate & Lyle, Jungbunzlauer Suisse AG, Shandong Lujian Biological Technology Co., Ltd., Anhui Best Chemical Co., Ltd., Merck KGaA, Avantor, Thermo Fisher Scientific, Spectrum Chemical Mfg. Corp., Pfanstiehl, Loba Chemie Pvt. Ltd., Nanjing Chemical Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., J.R. Chemicals, Dr. Paul Lohmann GmbH KG, Krishna Chemicals, American Elements, Jost Chemical Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Grade Calcium Gluconate Market Key Technology Landscape

The technology landscape in the Pharmaceutical Grade Calcium Gluconate market is predominantly focused on achieving and maintaining ultra-high purity and consistency, crucial for injectable applications. The core manufacturing process often utilizes advanced fermentation technologies for the efficient, high-yield production of gluconic acid, followed by sophisticated crystallization techniques. Key technological advancements involve continuous crystallization processes, which replace traditional batch methods, offering enhanced product uniformity, reduced energy consumption, and superior control over crystal habit and particle size distribution—factors critical for dissolution rates and filterability in final drug formulations.

Furthermore, analytical technology plays an indispensable role. Advanced High-Performance Liquid Chromatography (HPLC), Inductively Coupled Plasma Mass Spectrometry (ICP-MS), and Fourier-Transform Infrared Spectroscopy (FTIR) are standard technologies used extensively in quality control to detect and quantify minute levels of impurities, heavy metals, and residual solvents, ensuring compliance with strict global pharmacopeial guidelines. Process Analytical Technology (PAT) is increasingly being adopted, allowing manufacturers to monitor and control critical quality attributes in real-time during manufacturing, moving away from reliance solely on end-product testing.

The future technology trajectory points toward integrating automation and digitalization within production facilities. Implementation of validated, automated systems for batch tracking, environmental monitoring, and packaging reduces human error and contamination risks, aligning with stricter GMP requirements globally. Nanotechnology is also being explored cautiously, particularly concerning modifying particle morphology to improve solubility and stability, although injectable formulations currently rely on established, validated macroscopic crystal structures for predictable performance and safety profiles.

Regional Highlights

The global demand for Pharmaceutical Grade Calcium Gluconate is geographically diverse, reflecting varying levels of healthcare maturity and pharmaceutical manufacturing capabilities.

- North America: Dominates the market value due to highly advanced critical care infrastructure, high healthcare expenditure, and stringent regulatory standards (USP compliance). Demand is strong for high-purity injectable grades used in TPN, emergency cardiovascular protocols, and specialized compounding. The presence of major global pharmaceutical companies drives consistent, high-volume demand.

- Europe: Characterized by rigorous quality control (EP standards) and a mature market for specialty parenteral products. Germany, France, and the UK are key contributors, focusing heavily on R&D for stable intravenous solutions and advanced drug delivery systems incorporating calcium salts. The emphasis here is on technological integration for energy-efficient production.

- Asia Pacific (APAC): Exhibits the highest growth potential, fueled by massive investment in healthcare infrastructure, increasing prevalence of chronic diseases, and the expansion of domestic pharmaceutical manufacturing bases in China, India, and Southeast Asia. The rise in awareness regarding nutritional deficiencies and the growing elderly population accelerate the need for high-quality pharmaceutical excipients and APIs.

- Latin America (LATAM): A developing market segment showing steady growth, primarily driven by improving access to emergency medical services and gradual harmonization of regulatory standards. Brazil and Mexico are core markets, focusing on importing high-grade materials for local formulation and distribution.

- Middle East and Africa (MEA): Growth is primarily centered in the GCC countries (Saudi Arabia, UAE) due to high per capita healthcare spending and expansion of private hospital networks. The demand is heavily reliant on imports of finished dosage forms and high-purity raw materials from established international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Grade Calcium Gluconate Market.- Tate & Lyle

- Jungbunzlauer Suisse AG

- Shandong Lujian Biological Technology Co., Ltd.

- Anhui Best Chemical Co., Ltd.

- Merck KGaA

- Avantor

- Thermo Fisher Scientific

- Spectrum Chemical Mfg. Corp.

- Pfanstiehl

- Loba Chemie Pvt. Ltd.

- Nanjing Chemical Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- J.R. Chemicals

- Dr. Paul Lohmann GmbH KG

- Krishna Chemicals

- American Elements

- Jost Chemical Co.

- Gokul Refoils and Solvent Ltd.

- AET Chemicals

- Parchem fine & specialty chemicals

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Grade Calcium Gluconate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Pharmaceutical Grade Calcium Gluconate?

The increasing global prevalence of hypocalcemia, often associated with chronic kidney disease, and the essential requirement for reliable intravenous calcium supplementation in emergency medical settings and Total Parenteral Nutrition (TPN) are the primary market drivers.

How does Pharmaceutical Grade Calcium Gluconate differ from food or industrial grades?

Pharmaceutical Grade Calcium Gluconate must adhere strictly to pharmacopeial standards (USP, EP), ensuring exceptionally low levels of impurities, heavy metals, and endotoxins, making it safe for parenteral (injectable) administration, unlike lower-purity food or industrial grades.

Which geographical region exhibits the fastest growth rate in this market?

Asia Pacific (APAC) is projected to record the highest growth rate, driven by expanding pharmaceutical manufacturing capabilities in India and China, increasing healthcare spending, and improving access to critical care services across the region.

What are the key technological advancements impacting the manufacturing process?

Key advancements include the adoption of continuous crystallization techniques for improved batch consistency, implementation of Process Analytical Technology (PAT) for real-time quality monitoring, and advanced chromatographic methods for detecting trace impurities, ensuring regulatory compliance and product reliability.

What is the main restraint affecting the profitability of calcium gluconate manufacturers?

The major restraint is the high capital expenditure required to maintain Good Manufacturing Practice (GMP) standards and the continuous investment needed for quality control testing to meet global regulatory stringency, leading to higher operational costs compared to non-pharmaceutical chemical production.

The Pharmaceutical Grade Calcium Gluconate Market stands at a critical juncture, defined by the interplay between regulatory rigor and accelerating clinical demand. The indispensable nature of calcium gluconate in life-saving medical procedures ensures its sustained growth, irrespective of minor economic fluctuations. Market players are strategically focusing on vertical integration—securing the supply of high-purity gluconic acid—to insulate themselves from upstream supply risks. The imperative for suppliers to maintain impeccable quality documentation, including Certificates of Analysis that guarantee USP or EP compliance for heavy metals and residual solvents, remains the central competitive differentiator. As healthcare systems globally pivot towards complex TPN protocols and enhanced emergency preparedness, the demand for highly reliable, sterile, and readily available calcium gluconate formulations will continue its upward trajectory.

Technological refinement in the purification and crystallization steps is paramount. Manufacturers utilizing continuous flow processing, which allows for greater control over particle morphology and purity, gain a competitive edge in serving the injectable formulation segment, which commands premium pricing. Furthermore, sustainability is becoming an increasingly important factor, with pharmaceutical end-users favoring suppliers who can demonstrate energy-efficient manufacturing and responsible raw material sourcing. This pressure fosters innovation not just in product quality, but also in environmental and governance (ESG) compliance, influencing long-term supply agreements and partnerships across North America and Europe.

Future growth will be significantly impacted by regulatory changes concerning excipients and APIs originating from emerging markets. While APAC provides unparalleled growth volume, regulatory barriers remain a substantial challenge for suppliers seeking to penetrate highly controlled markets like the US and EU. Investment in localized GMP facilities within key growth regions, coupled with digital solutions for end-to-end supply chain traceability, are crucial strategic maneuvers expected over the forecast period (2026–2033). The market outlook remains positive, driven fundamentally by the non-substitutable nature of calcium gluconate in managing critical hypocalcemic events.

The segmentation analysis confirms that the Application segment of Pharmaceutical Formulations, particularly those destined for intravenous use, dominates the market share in terms of value, owing to the high specification and testing required for injectable products. The 99.5% Purity segment is growing rapidly as global standards trend towards minimal residual impurity tolerance. Key end-users, such as major pharmaceutical companies, prioritize long-term strategic partnerships to mitigate risks associated with supply disruption or quality failure, reinforcing the market dominance of well-established global chemical and pharmaceutical ingredient suppliers. The market structure, while competitive at the pricing level for standard grades, becomes highly oligopolistic for ultra-high purity, specialized injectable grades.

The continuous evolution of diagnostic capabilities, leading to earlier detection of calcium metabolic disorders and osteoporosis, further reinforces the therapeutic demand for calcium salts. The market for oral calcium gluconate preparations, while smaller than injectables, is experiencing steady growth driven by improved patient compliance strategies and non-acute management of chronic calcium deficiency. The intersection of nutrition science and pharmaceutical manufacturing is creating niche opportunities, particularly for buffered and stable oral solutions designed for sensitive patient populations, such as pediatrics and geriatrics. The market remains inherently stable due to the necessity of the product in human medicine.

In summary, while the market faces headwinds from high compliance costs and complex manufacturing requirements, the overarching drivers—clinical necessity and global healthcare expansion—ensure robust and stable expansion. Strategic players must focus on achieving operational excellence through technological integration (including AI for process optimization) and maintaining flawless regulatory credentials to capture long-term high-value contracts in the critical care and specialized pharmaceutical formulation sectors.

The stringent demands imposed by global regulatory agencies, such as the FDA and EMA, regarding the quality of APIs utilized in injectable drugs, are the primary filter for market participation. Only manufacturers demonstrating consistent adherence to GMP guidelines, supported by thorough documentation and rigorous quality testing, can successfully compete in the high-value segments. This regulatory landscape acts as a significant entry barrier, protecting the market share of established suppliers like Merck, Jungbunzlauer, and specialized Chinese manufacturers that have achieved international certification.

Furthermore, the trend towards centralized purchasing by large hospital groups and government health organizations, especially in North America and Europe, necessitates manufacturers to provide large-scale supply solutions with optimized logistics. This pushes suppliers towards greater automation and scale, further marginalizing smaller competitors unable to meet capacity demands or match the economies of scale achieved by global leaders. The market dynamic is shifting toward a reliance on fewer, highly certified, and geographically diversified manufacturing hubs to ensure resilience against regional supply shocks.

Investment in research and development is focused less on discovering new uses for the molecule itself and more on enhancing its formulation characteristics—namely, stability, compatibility with other parenteral solutions (to prevent precipitation risks), and shelf life extension. Innovations related to stabilizing calcium gluconate in complex TPN admixtures represent a high-value area of focus for pharmaceutical formulators, directly impacting market demand for specialized powder or anhydrous forms.

The impact of AI, while nascent, is most disruptive in the efficiency of the production line. By optimizing crystallization parameters, manufacturers can minimize batch variations, reduce waste, and improve energy efficiency, aligning with corporate sustainability goals. This operational advantage provided by sophisticated digital tools will likely become a prerequisite for major pharmaceutical contracts within the next five years, cementing technological prowess as a critical determinant of market leadership alongside regulatory compliance.

The regional analysis clearly indicates that future market strategy must be dual-focused: defending market share and premium pricing in mature markets (North America, Europe) through superior quality and supply chain reliability, while aggressively pursuing volume growth opportunities in the burgeoning economies of APAC. The increasing self-sufficiency of Asian pharmaceutical industries means that global suppliers must establish local production or strategic partnerships to capitalize fully on the region's vast demand potential for pharmaceutical-grade raw materials.

In conclusion, the Pharmaceutical Grade Calcium Gluconate Market is fundamentally robust, sustained by medical necessity and rigorous quality demands. The strategic agenda for companies operating in this space revolves around continuous process improvement, strict regulatory management, and strategic geographic expansion to ensure long-term stability and profitability in this critical pharmaceutical sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager