Pharmaceutical Membrane Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442482 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Pharmaceutical Membrane Technology Market Size

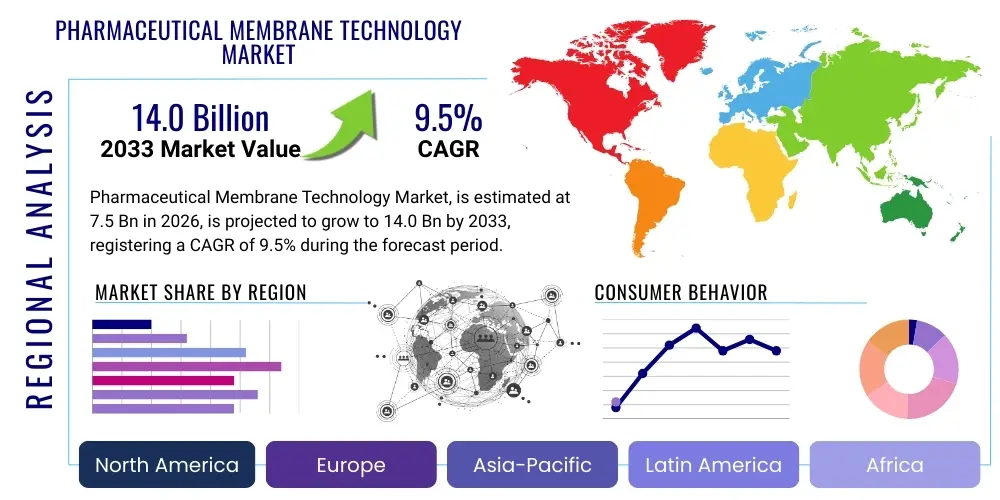

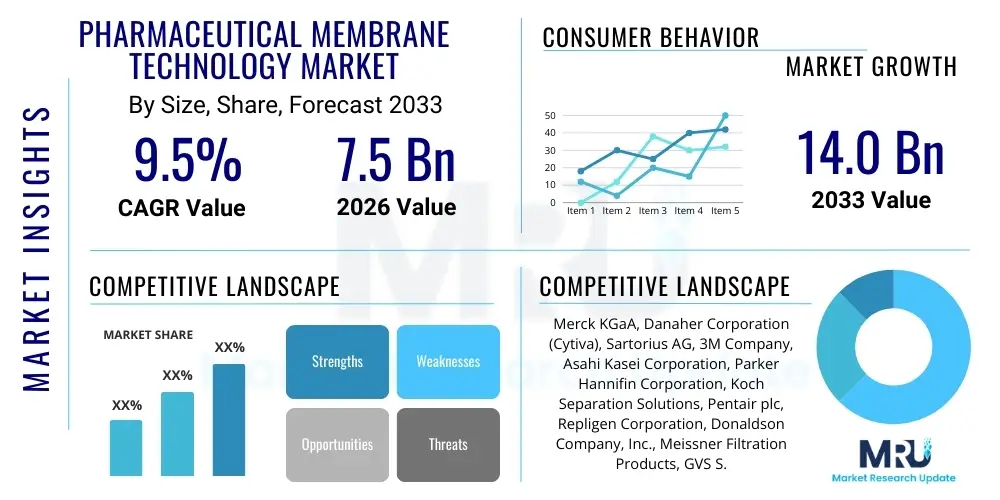

The Pharmaceutical Membrane Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $14.0 Billion by the end of the forecast period in 2033. This robust expansion is fueled primarily by the increasing necessity for stringent regulatory compliance in drug manufacturing, particularly concerning purity and sterility. Membrane technologies, integral to separation, filtration, and purification processes, are witnessing heightened adoption across both biopharmaceutical and small-molecule drug production lines, driven by the shift towards continuous manufacturing models and the escalating demand for high-value biologics.

The valuation reflects significant investments in research and development aimed at improving membrane materials, such as ceramic and PTFE membranes, which offer enhanced chemical resistance and thermal stability compared to traditional polymer membranes. Furthermore, the rising complexity of drug formulations, including gene therapies and monoclonal antibodies, mandates highly efficient and scalable purification methods that only advanced membrane systems, like those utilizing tangential flow filtration (TFF) and chromatography, can adequately provide. Market dynamics are also influenced by global health crises, which underscore the criticality of rapid, sterile vaccine and therapeutic production, cementing the essential role of specialized membrane filtration units.

Pharmaceutical Membrane Technology Market introduction

The Pharmaceutical Membrane Technology Market encompasses specialized filtration and separation systems essential for achieving high levels of purity, sterility, and concentration required during various stages of pharmaceutical and biotechnological manufacturing. These technologies utilize semipermeable membranes to selectively separate components based on molecular weight, size, or chemical properties. Key products include microfiltration (MF), ultrafiltration (UF), nanofiltration (NF), reverse osmosis (RO), and chromatography membranes. These systems are critical for applications ranging from solvent recovery and sterile filtration of final drug products to complex protein purification in biologics manufacturing and water purification systems necessary for Good Manufacturing Practices (GMP).

The major applications of pharmaceutical membrane technology are deeply integrated into the bioprocessing workflow, encompassing cell harvesting, virus filtration, buffer preparation, and sterile venting. The inherent benefits of utilizing these technologies include significantly improved product yield, reduced processing time compared to conventional separation methods like centrifugation or precipitation, lower energy consumption, and high scalability necessary for industrial production volumes. Furthermore, membrane systems minimize the use of harsh chemicals, aligning with increasing environmental and safety mandates within the industry.

Driving factors for the market expansion are multifaceted, anchored by the rapid expansion of the global biopharmaceuticals sector, particularly the pipeline development for monoclonal antibodies (mAbs) and recombinant proteins, which are highly dependent on TFF and depth filtration for purification. Regulatory pressure from agencies like the FDA and EMA demanding absolute sterile environments and high-purity drug substances acts as a powerful catalyst. Additionally, technological advancements resulting in durable, high-flux membranes with customized pore sizes and surface chemistries are continuously enhancing the efficiency and applicability of these systems across novel therapeutic modalities, solidifying membrane technology's position as a fundamental component of modern drug production.

Pharmaceutical Membrane Technology Market Executive Summary

The Pharmaceutical Membrane Technology Market is experiencing a pivotal period of growth driven by robust business trends emphasizing single-use systems and process intensification. Leading pharmaceutical and biotech companies are increasingly adopting modular and continuous manufacturing frameworks, where membrane filtration units are indispensable for maintaining continuous flow and quality control. Strategic mergers, acquisitions, and partnerships aimed at integrating complementary technologies, such as advanced sensor systems with membrane units for real-time monitoring, are accelerating market penetration. Furthermore, sustained venture capital interest in specialized membrane material startups is indicative of the innovation focus on developing high-performance polymer and ceramic composite membranes capable of resisting aggressive cleaning agents and extreme operational conditions.

Regionally, North America maintains its dominance due to a highly developed biopharmaceutical industry, massive R&D spending, and stringent regulatory environment demanding superior filtration standards. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market. This exponential growth is spurred by government initiatives supporting local pharmaceutical production, increasing foreign direct investment in contract manufacturing organizations (CMOs), and rapidly expanding access to advanced healthcare technologies. European growth remains steady, primarily fueled by mature regulatory frameworks and a concentration of key membrane technology providers driving innovation in sustainable and energy-efficient separation processes.

Segment trends highlight the significant lead held by the Ultrafiltration segment, essential for concentrating proteins and removing small molecular weight impurities in biologics production. However, the rapidly expanding Virus Filtration segment is projected to exhibit the highest growth rate, necessitated by rigorous viral safety requirements for blood plasma derivatives and biotherapeutics. By material, polymeric membranes retain the largest market share due to cost-effectiveness and versatility, but ceramic membranes are gaining traction, particularly in applications requiring harsh chemical cleaning or high-temperature operations, capitalizing on their superior durability and longevity. The end-user segment is dominated by Pharmaceutical and Biotechnology companies, though CMOs and academic research institutes are increasingly becoming pivotal consumers due to the outsourcing trends in drug development.

AI Impact Analysis on Pharmaceutical Membrane Technology Market

Common user questions regarding AI's impact on Pharmaceutical Membrane Technology revolve around process optimization, predictive maintenance, and novel material discovery. Users frequently inquire about how AI algorithms can predict membrane fouling rates, thereby optimizing cleaning schedules and extending operational lifespan (a key concern for cost control). There is also significant interest in the application of machine learning for rapidly screening and identifying novel membrane polymers and composite structures with tailored porosity and surface charges for highly specific separation challenges in complex drug matrices. Furthermore, users seek clarity on integrating AI-driven real-time data analysis systems with Continuous Tangential Flow Filtration (CTFF) setups to ensure consistent product quality and process yield without human intervention, effectively leading to fully autonomous purification lines.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational efficiency and R&D landscape of pharmaceutical membrane technology. AI algorithms are proving instrumental in modeling complex fluid dynamics and solute transport mechanisms within membrane modules, allowing manufacturers to simulate various operating conditions and optimize flux rates, thereby significantly reducing energy consumption and increasing throughput. By analyzing vast datasets generated from high-volume bioprocessing runs, AI can precisely identify subtle anomalies or deteriorating membrane performance indicators far before traditional monitoring systems, shifting maintenance from reactive to predictive paradigms.

Furthermore, AI is accelerating the discovery phase for new membrane materials. ML models can analyze structural characteristics, hydrophobicity, pore distribution, and chemical stability of thousands of potential compounds, predicting their efficacy for specific separation tasks, such as selective removal of trace contaminants or highly efficient fractionation of complex protein mixtures. This algorithmic approach dramatically shortens the development cycle for next-generation membranes required for advanced therapies like mRNA vaccines and personalized medicines, driving innovation in separation science and expanding the technological capacity of the pharmaceutical industry to handle increasingly challenging purification demands.

- AI-driven Predictive Maintenance: Utilizing machine learning to forecast membrane fouling and degradation, optimizing backwash and cleaning-in-place (CIP) schedules, thereby maximizing membrane lifespan and reducing unscheduled downtime.

- Process Optimization: Implementation of AI control systems to dynamically adjust flow rates, pressure differentials, and temperature in real-time within Tangential Flow Filtration (TFF) and chromatography systems to maintain optimal separation efficiency and yield.

- Material Informatics: Applying ML algorithms to analyze material properties and simulation data for the accelerated discovery and synthesis of novel, high-selectivity polymer and ceramic membranes tailored for specific pharmaceutical separations.

- Quality Assurance Automation: Integrating vision systems and AI analytics to monitor membrane integrity and filtrate quality continuously, automating validation processes and ensuring compliance with strict GMP guidelines.

- Enhanced Data Analysis: Leveraging AI to process high-throughput screening data from membrane performance trials, facilitating faster identification of optimal operating parameters for new biotherapeutic products.

- Continuous Manufacturing Enablement: Using predictive models to stabilize continuous bioprocessing streams, ensuring uniform product consistency across long operational cycles in integrated membrane separation trains.

- Virtual Prototyping: Employing digital twins and AI simulations to test the performance of new module designs and configurations before physical fabrication, drastically reducing R&D costs and time-to-market.

DRO & Impact Forces Of Pharmaceutical Membrane Technology Market

The market is primarily propelled by significant Drivers stemming from the explosive growth in the biopharmaceuticals sector, which relies heavily on membrane filtration for complex protein purification and sterile manufacturing. This is coupled with rigorous global regulatory standards demanding high-purity drug substances and strict viral clearance validation. However, expansion faces substantial Restraints, chief among them being the high initial capital expenditure required for installing advanced membrane systems and the persistent challenge of membrane fouling, which necessitates frequent cleaning and replacement, contributing to operational costs. Opportunities lie in developing cost-effective, durable, and self-cleaning membrane materials, particularly those compatible with single-use bioprocessing workflows, alongside capitalizing on the burgeoning market for specialized viral filtration units and continuous manufacturing solutions.

The Impact Forces shaping this market are dynamic and pervasive. Technological innovation serves as a major influencing force, with ongoing advancements in material science leading to membranes with higher flux rates, improved selectivity, and extended chemical tolerance. Regulatory stringency acts as an external push, compelling pharmaceutical manufacturers to adopt state-of-the-art filtration technologies to meet ever-increasing safety and quality benchmarks, particularly in cell and gene therapy production. Competitive pressure among major manufacturers to offer integrated, end-to-end purification platforms, including hardware, software, and consumables, dictates pricing strategies and market share distribution. Finally, macroeconomic factors, such as increasing global healthcare expenditure and the outsourcing trend to CMOs, amplify the overall demand for robust and reliable separation technologies.

Overall, while the inherent technological challenges associated with membrane stability and fouling present friction, the critical and irreplaceable role of membrane technology in meeting the safety and purity requirements of high-value biopharmaceuticals ensures strong sustained demand. The convergence of drivers—biotech expansion and regulatory necessity—outweighs the restraints, fostering an environment where innovation in materials science (Opportunity) is key to solving persistent operational issues, ultimately leading to market acceleration and consolidation among technology leaders.

Segmentation Analysis

The Pharmaceutical Membrane Technology market is highly segmented based on the critical parameters necessary for different stages of drug manufacturing, including membrane type, material, application, and process flow. Analyzing these segments provides strategic insights into areas experiencing the most intense technological investment and commercial growth. The microfiltration segment holds a strong historical share, essential for pre-filtration and clarification, while advanced segments like ultrafiltration and virus filtration are projected to grow faster due to their indispensability in high-value bioprocessing steps, particularly protein concentration and viral safety assurance. Understanding the split between polymeric and ceramic membranes based on required operational durability and cleaning regiment is crucial for market participants.

The primary classifications reveal a market that is mature yet highly adaptive, constantly incorporating new materials and configurations to meet evolving purity requirements in biopharma. Segmentation by flow configuration, distinguishing between dead-end filtration (typically for batch processes like sterile venting) and tangential flow filtration (essential for continuous concentration and diafiltration), illustrates the industry’s ongoing transition towards efficiency and continuous operation. Furthermore, the segmentation by end-user clearly delineates the massive purchasing power of large pharmaceutical and biotechnology firms versus the specific, often custom, needs of academic research institutions and emerging start-up biotechs.

- By Type:

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

- Chromatography Membranes

- Virus Filtration (VF)

- By Material:

- Polymer Membranes

- Polyethersulfone (PES)

- Polyvinylidene Fluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Cellulose Acetate (CA)

- Nylon

- Ceramic Membranes

- Metallic Membranes

- By Application:

- API Purification and Concentration

- Sterile Filtration

- Cell Separation and Harvesting

- Water and Wastewater Treatment (WFI production)

- Virus Removal and Clearance

- Buffer and Media Preparation

- Solvent Filtration and Recovery

- By Flow Configuration:

- Dead-End Filtration (Normal Flow Filtration - NFF)

- Tangential Flow Filtration (TFF)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Academic and Research Institutions

Value Chain Analysis For Pharmaceutical Membrane Technology Market

The value chain for Pharmaceutical Membrane Technology begins with the Upstream Analysis, which is highly focused on the sourcing and preparation of specialized raw materials, primarily high-grade polymers (e.g., PES, PVDF) and specialized ceramic precursors. This segment is characterized by intense R&D investment in material science to develop membranes with enhanced selectivity, chemical resistance, and flux. Key activities here include polymer synthesis, ceramic formulation, and the meticulous casting or sintering processes required to achieve precise pore size distribution. The quality and purity of these raw materials directly determine the final performance and regulatory compliance of the membrane products, creating a bottleneck requiring highly specialized suppliers.

The central manufacturing stage involves designing and fabricating the membrane modules, including hollow fibers, spiral wounds, and plate-and-frame configurations. Technology providers then assemble these membranes into complete filtration systems (hardware) that often integrate sophisticated automation and monitoring software. The Distribution Channel is critical, often relying on a hybrid model involving Direct Sales for large, complex, and customized bioprocessing systems, ensuring deep technical support and validation services for pharmaceutical clients. Indirect distribution, leveraging specialized regional distributors and value-added resellers, handles standardized consumable membrane cartridges and smaller laboratory-scale units, ensuring broad market reach and inventory management.

The Downstream Analysis involves the application, installation, validation, and ongoing technical support provided to end-users. After initial procurement, the focus shifts to post-sales services, including system validation (crucial for regulatory submissions), training on cleaning and maintenance protocols, and supplying replacement cartridges. The effectiveness of the supply chain in delivering specialized single-use assemblies rapidly and reliably is increasingly a competitive differentiator, especially for high-volume biopharma producers who cannot tolerate supply disruptions. The complexity of regulatory requirements further strengthens the relationship between manufacturers and end-users, requiring collaborative validation studies.

Pharmaceutical Membrane Technology Market Potential Customers

The primary End-Users and Buyers of Pharmaceutical Membrane Technology are large-scale Pharmaceutical and Biotechnology Companies, particularly those involved in developing and manufacturing biologics such as monoclonal antibodies, vaccines, and recombinant proteins. These entities require high-volume, reliable, and rigorously validated membrane systems for purification, concentration, and final sterile filtration of their high-value therapeutic products. Their purchasing decisions are heavily influenced by regulatory compliance (FDA, EMA), validated performance data, scalability, and the total cost of ownership, including consumable replacement frequency and cleaning efficiency. The trend toward continuous manufacturing means these customers are shifting demand towards integrated TFF systems.

A rapidly expanding segment of potential customers includes Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource production and specialized process steps, CMOs become significant purchasers of membrane technology. CMOs prioritize flexibility, rapid changeover capabilities (often achieved through single-use membrane systems), and systems that can handle a diverse portfolio of products with minimal cross-contamination risk. Their growth directly correlates with the overall market expansion, often acting as early adopters of advanced membrane materials and standardized modular filtration units to maximize facility utilization.

Furthermore, Academic Research Institutions and University Laboratories constitute a niche but crucial customer base, typically requiring bench-scale and pilot-scale membrane units for drug discovery, process development, and small-volume experimental purification steps. These buyers prioritize affordability, ease of use, and the ability to customize membrane parameters for specialized research needs. Government research agencies and blood processing centers also represent important end-users, utilizing membrane technology extensively for plasma fractionation, viral clearance, and ensuring the safety of therapeutic blood products, demanding exceptionally high standards of validation and sterility assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $14.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Danaher Corporation (Cytiva), Sartorius AG, 3M Company, Asahi Kasei Corporation, Parker Hannifin Corporation, Koch Separation Solutions, Pentair plc, Repligen Corporation, Donaldson Company, Inc., Meissner Filtration Products, GVS S.p.A., Saint-Gobain, Alfa Laval, Microdyn-Nadir GmbH, Thermo Fisher Scientific Inc., Pall Corporation (a Danaher subsidiary), Graver Technologies, Synder Filtration, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pharmaceutical Membrane Technology Market Key Technology Landscape

The technology landscape of the Pharmaceutical Membrane Market is defined by a relentless pursuit of higher selectivity and flux, coupled with enhanced integration into automated bioprocessing workflows. Key technologies center on the development of composite membranes, such such as surface-modified polymeric membranes using nanotechnology to minimize protein binding and fouling while maintaining high throughput. The advancement of ceramic membranes, particularly those based on zirconia and alumina, is crucial for applications demanding extreme pH or temperature tolerance, offering superior durability over traditional polymer variants in harsh environments like solvent filtration and sterilization cycles. Furthermore, high-performance hollow fiber modules are displacing older cassette formats in certain large-scale applications due to their high packing density and ease of scaling.

Tangential Flow Filtration (TFF) remains the foundational process technology, but innovation focuses heavily on continuous TFF (CTFF) systems, which integrate advanced sensors and control logic to maintain steady-state concentration and diafiltration, crucial for continuous biomanufacturing. Alongside TFF, the area of Virus Filtration (VF) is seeing exponential growth and technological refinement, with specialized asymmetric membranes designed to offer robust, validated removal of viruses down to 20 nanometers, essential for ensuring the safety of biotherapeutics and blood plasma derivatives. Novel functionalized membranes, including affinity chromatography membranes, are also gaining traction, enabling rapid, single-pass capture steps that traditionally required slow resin-based columns.

A significant ongoing technological shift involves the transition toward disposable, Single-Use Systems (SUS) membranes, encompassing pre-validated capsules and cartridges. These systems eliminate the need for costly and time-consuming cleaning validation and sterilization procedures (SIP/CIP), significantly reducing facility downtime and mitigating the risk of cross-contamination, a critical requirement for CMOs handling multiple products. The continuous evolution of membrane materials, including the incorporation of charge-modified layers and precise pore engineering via track-etching techniques, is expanding the separation capabilities, allowing for unprecedented purity levels necessary for cutting-edge modalities like cell and gene therapies where product quality is paramount.

Regional Highlights

- North America: This region holds the largest market share, characterized by high investment in R&D, a strong presence of major biopharmaceutical companies, and a well-established regulatory framework (FDA) that mandates high-purity standards. The US is the epicenter for novel drug approvals, driving consistent demand for advanced membrane systems, particularly TFF for complex biologics purification and robust virus filtration technologies.

- Europe: Holding the second-largest share, Europe benefits from significant academic research collaboration and the presence of global leaders in filtration technology (e.g., Merck, Sartorius). The region is characterized by early adoption of continuous bioprocessing and a focus on sustainable manufacturing, driving demand for energy-efficient filtration and high-performance, reusable ceramic membranes. Germany, Ireland, and Switzerland are key manufacturing hubs.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the rapid expansion of pharmaceutical manufacturing capabilities in China and India. Government initiatives supporting local drug production, increasing healthcare expenditure, and the rise of local CMOs outsourcing services are fueling intense demand for cost-effective microfiltration and ultrafiltration solutions, as well as significant uptake of Water for Injection (WFI) generation membrane systems.

- Latin America: This region shows moderate growth, primarily focused on generics production and vaccine manufacturing. Market expansion is concentrated in Brazil and Mexico, driven by efforts to modernize local drug production facilities and improve water purification infrastructure within the pharmaceutical sector. Demand is primarily for robust, standardized filtration consumables.

- Middle East and Africa (MEA): Growth is nascent but steady, stimulated by increasing investments in pharmaceutical manufacturing infrastructure in key countries like Saudi Arabia and the UAE. The market here is highly reliant on imported advanced membrane systems, with significant demand for reverse osmosis and nanofiltration technologies for high-purity water requirements and essential sterile filtration applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pharmaceutical Membrane Technology Market.- Merck KGaA (including MilliporeSigma)

- Danaher Corporation (including Cytiva and Pall Corporation)

- Sartorius AG

- 3M Company

- Asahi Kasei Corporation

- Parker Hannifin Corporation

- Koch Separation Solutions (KSS)

- Pentair plc

- Repligen Corporation

- Donaldson Company, Inc.

- Meissner Filtration Products

- GVS S.p.A.

- Saint-Gobain

- Alfa Laval

- Microdyn-Nadir GmbH

- Thermo Fisher Scientific Inc.

- Graver Technologies

- Synder Filtration, Inc.

- Cobetter Filtration Equipment Co., Ltd.

- Purolite (an Ecolab Company)

Frequently Asked Questions

Analyze common user questions about the Pharmaceutical Membrane Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical application driving the growth of pharmaceutical membrane technology?

The most critical application driving market growth is the purification and concentration of biopharmaceuticals, particularly monoclonal antibodies (mAbs) and vaccines, utilizing advanced Tangential Flow Filtration (TFF) and specialized Virus Filtration (VF) systems to meet strict regulatory viral safety and purity standards.

How are single-use membrane systems influencing the pharmaceutical manufacturing landscape?

Single-use systems (SUS) are significantly influencing the market by eliminating the need for complex, time-consuming, and costly cleaning-in-place (CIP) and sterilization-in-place (SIP) validation steps, thereby reducing contamination risk, minimizing downtime, and enabling greater flexibility for Contract Manufacturing Organizations (CMOs).

What challenges does membrane fouling pose in large-scale pharmaceutical processing?

Membrane fouling is a major challenge as it reduces the flux rate, necessitates frequent cleaning, increases operational costs, and shortens the membrane lifespan. Industry efforts are focused on developing anti-fouling surface chemistries and integrating AI for predictive maintenance to mitigate this issue effectively.

Which membrane type is predicted to exhibit the fastest growth rate?

The Virus Filtration (VF) segment is projected to show the highest Compound Annual Growth Rate (CAGR). This is due to increasing global regulatory focus on viral clearance across all biotherapeutic modalities, including cutting-edge cell and gene therapies, requiring absolute validation of pathogen removal.

How does the shift to continuous manufacturing affect demand for membrane technology?

The industry shift to continuous manufacturing strongly increases demand for robust, highly automated, and scalable membrane technologies, specifically continuous TFF (CTFF) and integrated filtration trains, which are essential for maintaining stable, steady-state processing and real-time quality control over extended periods.

What role do ceramic membranes play compared to traditional polymeric membranes?

Ceramic membranes are gaining importance in specific niche applications requiring superior chemical and thermal resistance, such as solvent filtration, high-temperature operations, and processes involving aggressive cleaning agents, offering greater durability and longer operational life span compared to more widely used polymeric options.

In which regional market is outsourcing driving the most significant growth?

The Asia Pacific (APAC) region is experiencing the most significant growth driven by outsourcing, particularly in China and India. The rapid establishment and expansion of local Contract Manufacturing Organizations (CMOs) are creating massive demand for reliable, validated, and scalable membrane filtration units.

How is Nanofiltration (NF) technology utilized within the pharmaceutical value chain?

Nanofiltration (NF) is primarily utilized for the separation of small molecules, such as antibiotics, hormones, and peptides, from solvents. It is also increasingly used in upstream water purification processes (pre-RO) and for precise fractionation steps in drug synthesis where separation size falls between Ultrafiltration and Reverse Osmosis.

What is the primary difference between Dead-End Filtration (NFF) and Tangential Flow Filtration (TFF) in pharmaceutical use?

Dead-End Filtration (NFF) is generally used for clarification or sterile filtration where the fluid flows perpendicular to the membrane (e.g., small volume sterile final fill). TFF, conversely, flows parallel to the membrane, minimizing fouling and allowing continuous removal of concentrated material, making it ideal for high-volume concentration and diafiltration of high-value biologics.

What are the key polymeric materials used in pharmaceutical membrane manufacturing?

Key polymeric materials include Polyethersulfone (PES), prized for its high flux and low protein binding; Polyvinylidene Fluoride (PVDF), known for its excellent chemical resistance; and Polytetrafluoroethylene (PTFE), widely used in sterile gas venting and solvent compatibility applications due to its hydrophobicity and chemical inertia.

Beyond purification, where else is membrane technology essential in pharma production?

Beyond direct drug purification, membrane technology is essential in producing Water for Injection (WFI) through Reverse Osmosis (RO) systems, sterile gas venting (using hydrophobic PTFE membranes), buffer preparation, and environmental compliance related to pharmaceutical wastewater treatment before discharge.

How do regulatory bodies like the FDA influence membrane technology procurement?

Regulatory bodies significantly influence procurement by requiring extensive validation documentation, proof of viral clearance (for VF membranes), and compliance with cGMP standards. This forces manufacturers to choose validated, high-quality, and robust systems that can withstand rigorous sterilization and cleaning protocols.

What opportunities exist in the membrane technology market related to cell and gene therapy?

Opportunities are vast in cell and gene therapy purification, which requires specialized, low-shear TFF systems for processing sensitive cell preparations and highly efficient nanofiltration or ultrafiltration for viral vector purification. The focus is on minimizing product loss and preserving cell viability during filtration and concentration steps.

What recent technological advances have improved membrane selectivity?

Recent advances include the development of tailored composite membranes, utilizing nanotechnology to engineer precise surface charge and pore size distribution at the molecular level. This enhancement facilitates highly selective separation of molecules with similar sizes, drastically improving purification efficiency over standard size exclusion filtration.

Why is the upstream analysis of the value chain so critical for membrane manufacturers?

The upstream analysis is critical because the quality, purity, and consistency of the base polymer or ceramic precursors directly dictate the final membrane performance characteristics, such as pore homogeneity and fouling resistance. Ensuring control over raw material sourcing is paramount for product reliability and batch-to-batch consistency required by the regulated pharmaceutical industry.

How is the adoption of Industry 4.0 concepts impacting membrane systems?

Industry 4.0 adoption is leading to the integration of advanced sensors (e.g., pH, conductivity, turbidity) directly into membrane modules, providing real-time data flow. This data, analyzed by AI/ML algorithms, enables precise process control, remote monitoring, and autonomous optimization of filtration parameters in continuous manufacturing settings.

What is the significance of the shift from batch processing to continuous biomanufacturing for TFF market growth?

Continuous biomanufacturing demands continuous separation methods. TFF systems, particularly CTFF configurations, are perfectly suited for this, allowing steady, sustained concentration and purification steps integrated directly with upstream bioreactors and downstream chromatography, thereby minimizing tank sizes and maximizing throughput efficiency.

Which end-user segment is most focused on flexibility and rapid changeover capability?

Contract Manufacturing Organizations (CMOs) are the end-user segment most focused on flexibility and rapid changeover, as they handle multiple client products in the same facility. This need strongly drives their adoption of validated, pre-sterilized, single-use membrane capsules and assemblies.

What role does chromatography membrane technology play in modern bioprocessing?

Chromatography membranes (membrane adsorbers) are used for highly efficient capture and purification steps, often replacing slow, resin-based columns. They provide high binding capacities at high flow rates, significantly accelerating the purification of complex biotherapeutics like plasma derivatives and viral vectors in a highly scalable manner.

How does membrane technology contribute to environmental sustainability in pharma?

Membrane technology contributes to sustainability by enabling water recycling and wastewater treatment (minimizing fresh water intake for WFI production) and by reducing the reliance on large volumes of toxic solvents and harsh chemicals often used in traditional separation and purification methods, resulting in a smaller environmental footprint.

What impact does the increasing complexity of drug molecules have on membrane requirements?

The increasing complexity of drug molecules, such as gene therapies and complex proteins, mandates membranes with ultra-high selectivity, precise pore distribution, and specific surface modifications to prevent non-specific binding and protein denaturation, pushing R&D towards customized and advanced material engineering.

Why is validation a key concern in the procurement of pharmaceutical membrane systems?

Validation is critical because pharmaceutical products must demonstrate absolute purity and safety. Membrane system validation involves rigorous testing to prove sterile filtration efficacy, viral clearance capabilities, and leachables/extractables testing, ensuring regulatory compliance and product quality assurance before commercial use.

How are metallic membranes utilized in the pharmaceutical industry?

Metallic membranes, often made of stainless steel or titanium, are utilized in niche pharmaceutical applications requiring extreme robustness, particularly in harsh chemical environments, high-pressure filtration, or high-temperature steam sterilization cycles where polymer or ceramic materials might degrade or fail.

What is the significance of Polyethersulfone (PES) in the polymer membrane segment?

PES is significant because it offers a favorable combination of high mechanical strength, good chemical resistance, and excellent inherent hydrophilicity, making it ideal for high-flow rate applications like sterile filtration and ultrafiltration where minimal protein adsorption is required to maximize product yield.

How does the global rise in chronic diseases influence the membrane technology market?

The global rise in chronic diseases necessitates increased production of therapeutic drugs, particularly complex biologics like mAbs. This surge in biopharmaceutical manufacturing capacity directly translates to higher demand for reliable, high-throughput membrane purification and sterile filtration systems globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager