Phase Noise Analyzers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441836 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Phase Noise Analyzers Market Size

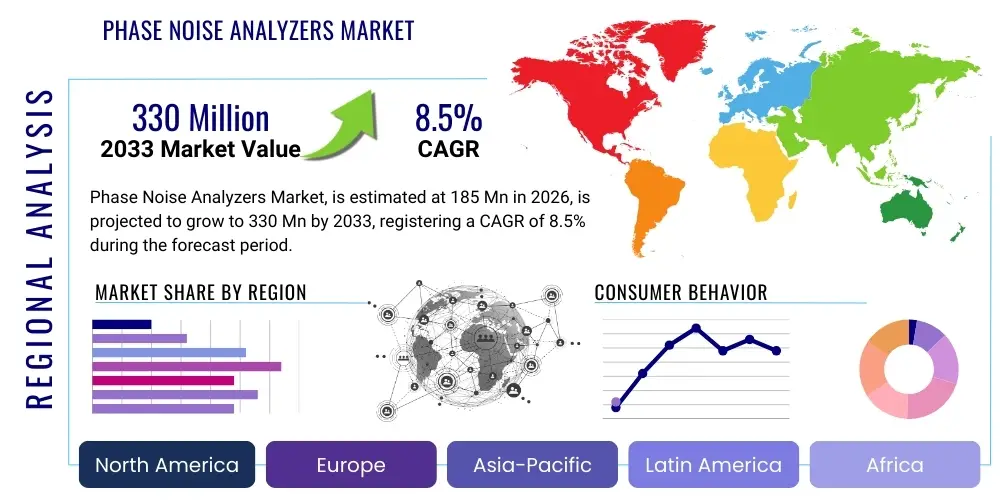

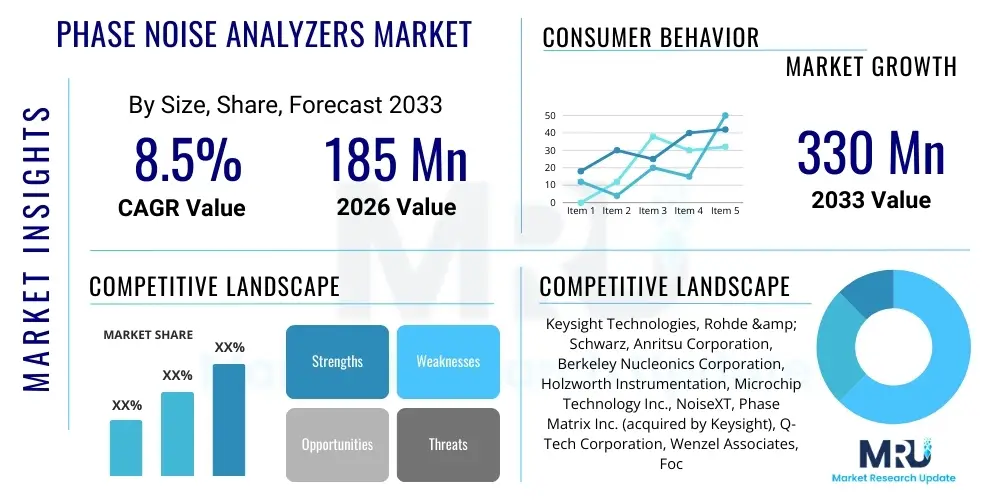

The Phase Noise Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $185 Million in 2026 and is projected to reach $330 Million by the end of the forecast period in 2033.

Phase Noise Analyzers Market introduction

The Phase Noise Analyzers Market encompasses specialized electronic test and measurement (T&M) equipment designed to quantify the spectral purity and short-term frequency stability of oscillators, synthesizers, and other critical RF/microwave components. Phase noise, essentially random frequency fluctuations, is a crucial metric in high-performance communication systems, radar, and satellite navigation, as it directly impacts signal quality, system bit error rates, and overall receiver sensitivity. Modern analyzers utilize sophisticated techniques, such as cross-correlation and dual-channel measurement architectures, to achieve extremely low noise floors, enabling accurate characterization of increasingly stable frequency sources required for 5G, 6G, and advanced aerospace applications. The demand for these highly precise instruments is intrinsically linked to the escalating complexity and frequency requirements of wireless and defense technologies.

These sophisticated instruments are indispensable in the design validation and manufacturing quality assurance processes across various high-technology sectors. Major applications include characterizing voltage-controlled oscillators (VCOs), dielectric resonator oscillators (DROs), and frequency synthesizers used in base stations, electronic warfare systems, and high-speed data links. The primary benefit derived from utilizing dedicated phase noise analyzers is the capability to perform highly sensitive, accurate, and repeatable measurements far exceeding the limitations of traditional spectrum analyzers, which often struggle with dynamic range and inherent noise limitations when measuring ultra-low phase noise levels. This precision is vital for minimizing reciprocal mixing and improving system stability in demanding environments.

The market is primarily driven by the global deployment of advanced telecommunication standards, particularly the widespread rollout of 5G infrastructure requiring highly stable reference clocks for synchronization. Furthermore, the relentless pursuit of enhanced resolution in military radar and electronic warfare systems mandates continuous improvements in the spectral purity of frequency sources, thereby fueling the necessity for more advanced analysis tools. The proliferation of satellite communication systems (LEO/MEO constellations) and the growth in autonomous vehicle technology, which relies on high-accuracy positioning derived from stable reference signals, further contribute to the expanding application base for phase noise analyzers across diverse vertical markets.

Phase Noise Analyzers Market Executive Summary

The Phase Noise Analyzers Market is characterized by robust growth, driven primarily by technological advancements in wireless communication and defense sectors demanding superior spectral purity. Business trends indicate a strong move toward integrating cross-correlation techniques and increasing measurement automation to meet the requirements of mass production testing and complex R&D environments. Key vendors are focusing on developing hybrid solutions that combine traditional phase noise measurement capabilities with features like jitter analysis and amplitude noise characterization within a single platform, enhancing efficiency and reducing the cost of ownership for end-users. Strategic partnerships and mergers among technology providers are also prevalent, aimed at expanding geographic reach and integrating complementary signal generation capabilities with measurement platforms.

Regionally, North America and Asia Pacific dominate the market landscape. North America maintains its leadership due to substantial defense spending, extensive presence of leading telecommunication R&D firms, and early adoption of cutting-edge technologies like 6G research initiatives. The Asia Pacific region, however, is witnessing the fastest expansion, fueled by massive investments in 5G infrastructure deployment, burgeoning electronics manufacturing industries in China, South Korea, and Taiwan, and increasing domestic military modernization efforts. Europe follows closely, driven by sophisticated aerospace programs and stringent regulatory requirements for high-performance communication standards, particularly within the automotive and industrial sectors.

In terms of segmentation trends, the market for stand-alone phase noise analyzers, while premium, is experiencing strong demand for ultra-low noise measurements crucial in fundamental physics and high-end defense applications. Simultaneously, the segment involving systems utilizing the phase detector method remains significant due to its cost-effectiveness and applicability in manufacturing environments. By application, the demand from the telecommunications sector remains paramount, but the aerospace and defense segment is anticipated to exhibit accelerated growth, given the stringent requirements for stable frequency sources in new generation radar, satellite navigation, and electronic countermeasures (ECM) systems being deployed globally.

AI Impact Analysis on Phase Noise Analyzers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Phase Noise Analyzers Market frequently revolve around how AI can enhance measurement speed, automate calibration processes, and improve the accuracy of interpreting complex noise spectra. Users are interested in understanding if machine learning algorithms can predict component failure based on subtle changes in phase noise characteristics over time or optimize test sequences in high-volume production lines. Key themes summarized from user concerns include the transition from manual, expertise-driven analysis to automated diagnostics, the potential for AI-driven noise floor reduction techniques, and the integration of AI for smarter anomaly detection in measured data, thereby reducing test time and improving the overall efficiency of frequency source characterization.

AI algorithms are beginning to be integrated into advanced Phase Noise Analyzers primarily for predictive maintenance and enhanced data processing capabilities. By analyzing vast datasets generated during component testing, machine learning models can identify patterns indicative of manufacturing defects or degradation that might be missed by traditional statistical analysis. This leads to significantly improved quality control in high-volume production environments, such as those manufacturing RF filters or oscillators for 5G infrastructure. Furthermore, AI facilitates the development of automated calibration routines, drastically reducing the time required to set up complex measurements, especially those involving multiple signal sources and intricate environmental compensations.

The implementation of AI also extends to optimizing the measurement parameters themselves. For instance, in cross-correlation measurements where the test time is a critical factor, AI can dynamically adjust the correlation factor or the number of averages required based on the input signal characteristics and desired uncertainty level. This optimization ensures that the required measurement accuracy is achieved in the shortest possible time, maximizing throughput in R&D and production testing. As connectivity increases, the use of cloud-based AI platforms for benchmarking and comparative analysis of frequency sources across different manufacturing batches and vendors is expected to gain traction.

- AI enables automated anomaly detection in complex noise spectra.

- Machine learning optimizes cross-correlation measurement parameters, reducing test time.

- Predictive maintenance based on phase noise degradation patterns is facilitated by AI.

- AI-driven automated calibration and self-correction enhance instrument accuracy and efficiency.

- Improved data correlation capabilities using neural networks for root cause analysis of noise sources.

DRO & Impact Forces Of Phase Noise Analyzers Market

The Phase Noise Analyzers Market is significantly shaped by a confluence of driving factors, technological restraints, and emerging market opportunities, all moderated by strong impact forces stemming from global telecommunications and defense spending cycles. The primary driver is the pervasive demand for higher data rates and greater spectral efficiency in communication systems (5G/6G), which necessitates extremely low-jitter clocking and reference oscillators. Simultaneously, the escalating complexity and cost associated with achieving ultra-low noise floor measurements, particularly below -180 dBc/Hz, act as a key restraint, limiting widespread adoption outside high-end research and defense applications. However, opportunities abound in developing integrated, lower-cost PNA solutions tailored for mass-market manufacturing and specialized IoT synchronization requirements, promising market expansion.

Drivers: The explosive growth of satellite constellations, especially LEO systems, requires robust phase noise analysis for onboard frequency sources crucial for high-speed data links and precise orbital tracking. Furthermore, the global military sector's relentless drive for advanced radar (AESA systems), electronic warfare (EW), and secure communications places continuous pressure on manufacturers to improve the stability and spectral purity of signal generators, directly translating into demand for high-performance analyzers. These drivers create a compelling environment where stability and precision are prioritized over instrument cost, sustaining the premium segment of the market.

Restraints: The most prominent restraints include the high initial capital expenditure required for purchasing and maintaining cutting-edge cross-correlation phase noise measurement systems. Additionally, the inherent complexity in interpreting measurement results and the need for highly specialized technical expertise to operate these instruments restrict market penetration in smaller R&D labs or less mature markets. Furthermore, the competitive threat posed by high-end spectrum analyzers, which, although less precise, offer sufficient performance for mid-range applications, slightly dampens the growth potential of entry-level PNA dedicated solutions.

Opportunities: Significant opportunities lie in the miniaturization and integration of phase noise measurement capabilities into existing multi-function T&M platforms, reducing footprint and improving workflow. The transition towards photonic microwave sources and the increasing requirement for characterizing optical phase noise presents a novel, high-growth niche. Moreover, developing software-defined measurement solutions that leverage standardized hardware platforms and advanced signal processing algorithms offers a pathway to reduce hardware costs while maintaining high performance, democratizing access to precision phase noise characterization.

Impact Forces: The overarching impact force is the accelerating pace of the semiconductor industry, which requires ever-lower noise components (VCOs, PLLs) manufactured in volume. Geopolitical shifts influencing defense budgets and the regulatory environment governing spectral allocation and 5G deployment strongly affect procurement cycles. The rapid obsolescence cycle of RF technology mandates continuous investment in the newest analyzer technology capable of characterizing next-generation frequency sources, making instrument refresh rates a key determinant of market stability and growth.

Segmentation Analysis

The Phase Noise Analyzers Market is comprehensively segmented based on the critical differentiation points inherent in measurement technology, instrument type, operating frequency range, and end-user application. Segmentation by measurement technique, encompassing techniques like Phase Detector (PD), Cross-Correlation, and Digital Signal Processing (DSP) methods, directly reflects the level of precision and the noise floor achievable, which dictates the instrument’s suitability for R&D or manufacturing environments. Furthermore, classifying instruments into benchtop/stand-alone units versus modular/PXI-based systems addresses the end-user preference for mobility, integration, and scalability within existing test racks.

The segmentation based on the frequency range is crucial as phase noise characteristics often vary significantly between the low-frequency RF domain and the high-frequency microwave and millimeter-wave domains. Analyzers specialized for millimeter-wave measurements (e.g., above 50 GHz) command a premium due to the complexity of integrating high-frequency downconverters and minimizing internal instrument noise at these ranges. Application-based segmentation provides insight into the primary market drivers, distinguishing between high-volume commercial telecommunications testing and highly specialized defense, aerospace, and metrology requirements, each having distinct measurement needs and budget allocations.

Analyzing these segments allows stakeholders to understand the most profitable niches and technological inflection points. For instance, the Cross-Correlation technique segment is expected to show the highest growth rate due to its unparalleled sensitivity, essential for characterizing emerging quantum computing clocks and ultra-stable defense oscillators. Simultaneously, the telecommunications sector remains the largest volume consumer, driving the demand for highly automated, high-throughput measurement systems optimized for production line efficiency rather than absolute lowest noise performance, highlighting a significant divergence in demand characteristics across market segments.

- By Measurement Technique:

- Phase Detector Method

- Cross-Correlation Method

- Digital Signal Processing (DSP) Method

- By Instrument Type:

- Stand-alone/Benchtop Analyzers

- Modular/PXI Analyzers

- Integrated Signal Analyzers (with PNA Option)

- By Operating Frequency Range:

- Below 10 GHz (RF)

- 10 GHz to 50 GHz (Microwave)

- Above 50 GHz (Millimeter-Wave)

- By Application:

- Telecommunications

- Aerospace and Defense

- Metrology and Research

- Automotive and IoT

Value Chain Analysis For Phase Noise Analyzers Market

The value chain for the Phase Noise Analyzers Market begins with sophisticated upstream activities focused on component sourcing, particularly the acquisition of highly stable reference oscillators, low-noise amplifiers, high-speed Analog-to-Digital Converters (ADCs), and precision frequency synthesizers, which form the core of the measurement instrument. The performance of these upstream components directly dictates the instrument's noise floor and dynamic range, making component quality and stability paramount. Leading manufacturers invest heavily in vertical integration or secure long-term contracts with specialized component suppliers to maintain control over the instrument’s fundamental performance characteristics, ensuring market differentiation based on measurement sensitivity.

Midstream activities involve the complex processes of instrument design, software development (including proprietary noise reduction algorithms and user interface design), assembly, calibration, and rigorous quality assurance. Calibration is a particularly critical step, often requiring specialized metrology labs to trace the instrument’s performance back to international standards, guaranteeing measurement integrity. Downstream activities focus on distribution, which is predominantly executed through a mix of direct sales channels, especially for large defense and government contracts, and indirect channels relying on specialized technical distributors and representatives who possess the expertise to provide local support, pre-sales consultancy, and post-sales calibration services.

The distribution channel is heavily skewed towards highly specialized indirect partners due to the technical nature of phase noise analysis. These channel partners play a crucial role in providing local training and application support, which is essential for maximizing the utilization of high-cost, complex instruments by end-users in diverse geographical locations. Direct sales are usually reserved for major accounts or strategic regions where the manufacturer maintains a significant service and support infrastructure. The effectiveness of the value chain is measured by its ability to deliver ultra-precise, reliable, and well-supported measurement solutions quickly to demanding R&D and mission-critical production facilities globally.

Phase Noise Analyzers Market Potential Customers

The primary customers for Phase Noise Analyzers are organizations that develop, manufacture, or integrate high-frequency signal sources where spectral purity is a critical performance parameter impacting system efficacy. This includes major telecommunication equipment manufacturers (TEMs) who require PNA for qualifying oscillators and PLLs used in 5G and future base stations, ensuring compliance with stringent synchronization standards and minimizing adjacent channel interference. Furthermore, government defense contractors and military research organizations are crucial buyers, utilizing these analyzers for designing advanced radar systems, secure satellite communication uplinks, and electronic warfare countermeasures, where frequency stability is a mission-critical requirement.

Beyond telecom and defense, significant demand originates from research institutions and university metrology labs focused on fundamental physics, time-keeping standards (atomic clocks), and high-precision scientific instrumentation, necessitating the absolute lowest noise measurements available. The expanding satellite communication sector, particularly companies building LEO/MEO constellations, represent a rapidly growing customer base, requiring rugged analyzers for satellite payload component testing. Additionally, companies involved in high-speed data transmission (e.g., fiber optics testing) and semiconductor firms designing RF integrated circuits (RFICs) and low-jitter clocking solutions for digital electronics are key end-users driving demand for automated, integrated PNA solutions for characterization and quality control during fabrication.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million |

| Market Forecast in 2033 | $330 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Berkeley Nucleonics Corporation, Holzworth Instrumentation, Microchip Technology Inc., NoiseXT, Phase Matrix Inc. (acquired by Keysight), Q-Tech Corporation, Wenzel Associates, Focus Microwaves, Spectracom (Orolia), Tektronix (Fortive), Aeroflex (Cobham), Stanford Research Systems (SRS), Synergy Microwave Corporation, EM Research, Valon Technology, Teseq (Ametek), Rigol Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phase Noise Analyzers Market Key Technology Landscape

The technological backbone of the Phase Noise Analyzers Market is dominated by two primary methodologies: the Phase Detector (PD) method, favored for its simplicity and speed in near-carrier measurements, and the Cross-Correlation technique, which is the current industry standard for achieving the lowest possible instrument noise floor. The Cross-Correlation method operates by simultaneously measuring the noise of the source using two independent measurement channels and then mathematically correlating and averaging the results. This averaging process effectively cancels out the instrument's inherent noise components, allowing the measurement sensitivity to be limited almost entirely by the source under test, a capability essential for qualifying ultra-stable frequency references used in deep space communication and atomic clocks.

A significant technological trend involves the transition from traditional analog components to advanced Digital Signal Processing (DSP) and high-speed FPGAs. Modern analyzers increasingly employ DSP techniques to process digitized IF signals, allowing for sophisticated noise reduction algorithms, improved frequency stability, and flexibility in adapting to different modulation types. This shift enables manufacturers to integrate functions like amplitude noise (AM noise) measurement and transient analysis alongside phase noise characterization, offering a multi-domain analysis capability within a single instrument. The use of synthesized signal sources within the analyzer also enhances operational flexibility, allowing precise setting of reference frequencies.

Furthermore, the high-frequency measurement landscape is evolving with the proliferation of millimeter-wave applications (30 GHz and above). To address this, high-performance Phase Noise Analyzers utilize external frequency extenders or high-quality phase-locked loops (PLLs) and mixers to down-convert the high-frequency signals into the instrument's operational baseband. This ensures that the extremely low noise performance achieved at lower frequencies is maintained even when characterizing high-frequency 5G/6G components. Future innovations are expected to heavily rely on integrating photonic technology, particularly for characterizing ultra-low phase noise optical carriers, pushing the boundaries of spectral purity measurement into terahertz frequencies and enabling new generations of precision timing and radar systems.

Regional Highlights

Regional dynamics within the Phase Noise Analyzers Market are heavily influenced by the concentration of technology manufacturers, defense investment, and the pace of advanced communication infrastructure deployment. North America stands out as the most dominant region, driven by the presence of major aerospace and defense prime contractors (e.g., in the US) and the leading global T&M equipment manufacturers. Substantial R&D expenditure in advanced radar systems, next-generation satellite technology, and burgeoning 6G research ensures sustained, high-value demand for premium, ultra-low noise analysis instruments. The region also benefits from stringent regulatory standards requiring high-precision test protocols in high-frequency applications.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is directly attributable to massive government and private sector investments in rolling out comprehensive 5G networks across China, Japan, South Korea, and India, necessitating bulk procurement of testing equipment for network component manufacturing and validation. Furthermore, increased focus on domestic defense production capabilities and the expansion of the indigenous electronics manufacturing base, particularly in Taiwan and South Korea for advanced semiconductor components, are key factors stimulating high demand for automated phase noise analysis solutions required for production lines.

Europe represents a mature market, demonstrating steady growth driven by strong academic and industrial research in physics, metrology, and high-reliability aerospace programs, notably those under the European Space Agency (ESA). Countries such as Germany, the UK, and France maintain a significant footprint in precision engineering and automotive radar development, requiring highly accurate phase noise characterization. The Middle East and Africa (MEA) and Latin America currently hold smaller market shares but are expected to see moderate growth, primarily tied to modernization of military communication systems and nascent expansion of advanced cellular network infrastructure, increasing the need for basic to mid-range PNA capabilities for network deployment and maintenance.

- North America: Market leader due to high defense spending, 6G R&D focus, and presence of major T&M industry players.

- Asia Pacific (APAC): Fastest-growing region driven by extensive 5G rollout, massive electronics manufacturing expansion, and increasing domestic defense modernization efforts.

- Europe: Stable demand fueled by aerospace programs, precision engineering, and metrology institutions requiring high-accuracy testing.

- Latin America & MEA: Moderate growth driven by infrastructure upgrades in telecom and foundational military communications investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phase Noise Analyzers Market.- Keysight Technologies

- Rohde & Schwarz

- Anritsu Corporation

- Berkeley Nucleonics Corporation

- Holzworth Instrumentation

- Microchip Technology Inc.

- NoiseXT

- Phase Matrix Inc. (Keysight Subsidiary)

- Q-Tech Corporation

- Wenzel Associates

- Focus Microwaves

- Spectracom (Orolia)

- Tektronix (Fortive)

- Aeroflex (Cobham)

- Stanford Research Systems (SRS)

- Synergy Microwave Corporation

- EM Research

- Valon Technology

- Teseq (Ametek)

- Rigol Technologies

Frequently Asked Questions

Analyze common user questions about the Phase Noise Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Phase Noise Analyzer (PNA) and a high-end Spectrum Analyzer?

A PNA is optimized specifically for measuring the spectral purity and short-term stability of frequency sources, often utilizing cross-correlation techniques to achieve noise floors far below those attainable by general-purpose spectrum analyzers, which are typically limited by their own internal noise and dynamic range. PNAs provide significantly higher sensitivity crucial for modern, ultra-low jitter applications.

Which application segment drives the highest demand in the Phase Noise Analyzers Market?

The Telecommunications sector, particularly the deployment and testing of 5G and ongoing development of 6G infrastructure, drives the highest volume demand. However, the Aerospace and Defense segment remains the key driver for high-performance, ultra-low noise cross-correlation systems due to stringent requirements in radar and electronic warfare systems.

How does the Cross-Correlation technique improve measurement accuracy?

The Cross-Correlation technique uses two independent measurement channels to measure the same source. By mathematically averaging the correlation results over time, the uncorrelated noise from the two instrument channels is effectively cancelled out, isolating only the noise originating from the Source Under Test (SUT), thus drastically lowering the instrument's effective noise floor.

What are the expected impacts of AI integration on the future of Phase Noise Analyzers?

AI is expected to significantly enhance efficiency by automating complex calibration routines, optimizing measurement time through adaptive algorithms, and improving quality control via machine learning for predictive maintenance and early detection of subtle component defects in high-volume testing environments.

What are the biggest challenges restricting the wider adoption of dedicated Phase Noise Analyzers?

The primary restraints include the high acquisition cost of sophisticated cross-correlation analyzers, the operational complexity requiring specialized expertise for accurate interpretation, and the competition posed by integrated signal analyzers that offer sufficient performance for mid-range general R&D tasks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager