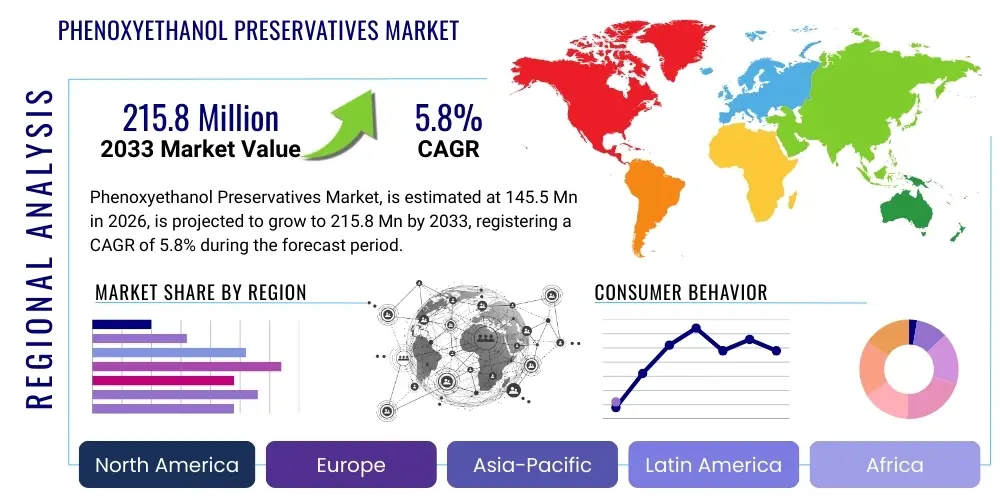

Phenoxyethanol Preservatives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443562 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Phenoxyethanol Preservatives Market Size

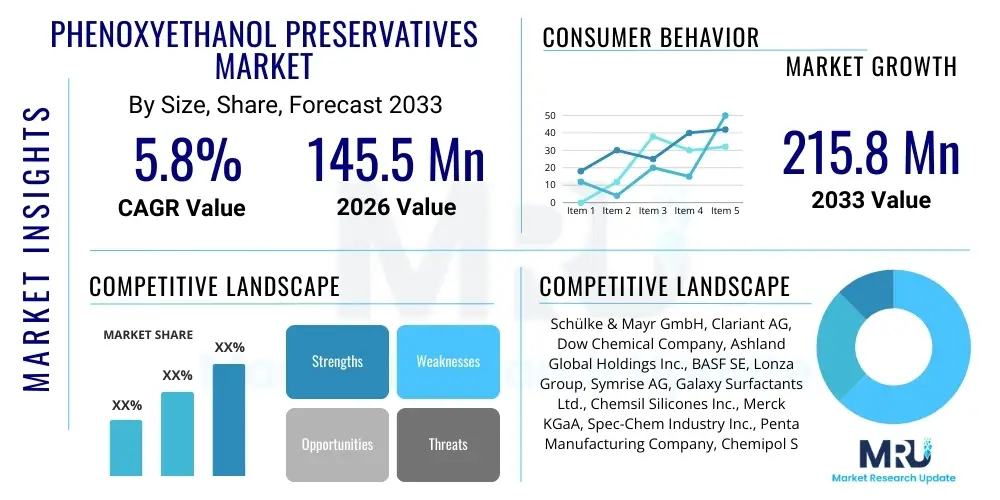

The Phenoxyethanol Preservatives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 145.5 Million in 2026 and is projected to reach USD 215.8 Million by the end of the forecast period in 2033.

Phenoxyethanol Preservatives Market introduction

The Phenoxyethanol Preservatives Market encompasses the global trade and utilization of 2-Phenoxyethanol, a crucial glycol ether compound widely employed as a preservative in diverse consumer and industrial products. Known for its broad-spectrum antimicrobial activity against bacteria, yeast, and molds, phenoxyethanol is a preferred alternative to parabens, which have faced increasing scrutiny regarding safety and long-term health effects. Its primary function is to inhibit microbial proliferation, thereby extending the shelf life and ensuring the safety and efficacy of formulation integrity in aqueous systems. The compound is valued for its stability, compatibility with various cosmetic ingredients, and effectiveness across a wide pH range, making it highly versatile for formulators worldwide.

Major applications of phenoxyethanol span the cosmetic and personal care industry, including moisturizers, sunscreens, shampoos, and makeup products. Beyond cosmetics, it finds significant usage in pharmaceutical preparations (topical creams), household cleaning products, and specialized industrial fluids. The market growth is fundamentally driven by the escalating demand for shelf-stable consumer packaged goods, stringent regulatory requirements mandating microbial safety in personal care items, and the industry’s continuous search for efficacious, globally accepted preservative solutions that satisfy modern consumer demands for perceived safety. The urbanization trends and increasing per capita spending on beauty and wellness products in developing economies further bolster the adoption rates of this preservative.

The key benefits driving its market dominance include its excellent solvency power, low odor profile, and ability to function effectively even at low concentrations (typically 0.5% to 1.0% in formulations, depending on regional regulations). While facing competitive pressures from novel natural and organic preservatives, phenoxyethanol maintains a robust position due to its proven track record of safety and efficiency, supported by major regulatory bodies like the European Union (EU) and the U.S. Food and Drug Administration (FDA) when used within defined concentration limits. This regulatory clarity provides manufacturers with the confidence required for large-scale production and global distribution.

Phenoxyethanol Preservatives Market Executive Summary

The Phenoxyethanol Preservatives Market is characterized by resilient demand driven by the robust expansion of the global cosmetics industry and the ongoing transition away from traditional preservatives like formaldehyde donors and certain parabens. Business trends highlight strategic capacity expansion by key chemical manufacturers, particularly in the Asia Pacific region, to meet the surging demand from local and multinational CPG companies. Furthermore, increased investment in research and development is focused on optimizing phenoxyethanol’s synergistic potential when combined with other mild preservatives, enhancing overall preservation efficacy while adhering to clean beauty standards. Regulatory harmonization and divergence, especially concerning concentration limits in products intended for infants, remain pivotal factors shaping business strategies and supply chain management globally.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive population bases, rising disposable incomes, and the burgeoning local cosmetic manufacturing hubs in China, India, and Southeast Asian countries. North America and Europe, while mature, maintain substantial market shares due to high consumer awareness regarding product safety and the established presence of global beauty and pharmaceutical conglomerates. These regions are also witnessing intense competitive shifts as smaller brands leverage phenoxyethanol's favorable public perception relative to more controversial synthetic alternatives, driving innovation in formulation delivery systems.

In terms of segmentation, the Cosmetic and Personal Care application segment retains the largest market share, dictated by the sheer volume of products requiring preservation, ranging from mass-market skincare to premium anti-aging formulations. The Grade segment sees significant demand for Pharmaceutical Grade phenoxyethanol due to stricter quality requirements in medical applications. The market structure remains moderately consolidated, with major chemical producers leveraging economies of scale and sophisticated distribution networks to maintain market dominance, focusing on ensuring supply consistency and regulatory compliance across diverse international markets.

AI Impact Analysis on Phenoxyethanol Preservatives Market

User inquiries regarding AI's influence on the Phenoxyethanol Preservatives Market predominantly revolve around three critical areas: enhanced safety testing, optimizing formulation efficiency, and predicting supply chain disruptions. Users frequently ask how AI can accelerate the discovery of novel, potentially milder synergistic preservative blends that maintain efficacy while minimizing required phenoxyethanol concentrations. Concerns often surface about AI-driven predictive toxicology models potentially flagging phenoxyethanol as a compound of concern based on large datasets, leading to premature phase-out decisions. Furthermore, cosmetic manufacturers are keen to understand how AI-powered demand forecasting and inventory management systems can mitigate the risks associated with volatile raw material pricing and regulatory changes impacting cross-border trade of preservative chemicals.

The consensus suggests that AI integration will primarily refine the R&D and manufacturing phases rather than fundamentally alter the chemical’s core function. AI tools, specifically machine learning algorithms, are proving instrumental in analyzing complex microbial challenge test data, allowing formulators to precisely determine the minimum inhibitory concentration (MIC) required for specific product matrices, thus improving cost-efficiency and minimizing chemical usage. This precision is particularly valuable in maintaining the delicate balance between preservation efficacy and consumer acceptance of product ingredient lists. Furthermore, predictive modeling aids in understanding the real-time degradation kinetics of formulations, leading to more accurate shelf-life predictions without lengthy, traditional accelerated aging tests.

The long-term expectation is that AI will drive transparency and sustainability. By simulating complex chemical interactions and predicting environmental impact, AI supports the development of greener production routes for phenoxyethanol and helps in identifying sustainable alternatives. However, the direct impact on phenoxyethanol demand itself is likely nuanced; while AI might promote the use of blends reducing the need for high single-ingredient concentrations, its role in ensuring product safety and quality control paradoxically solidifies the requirement for robust, proven broad-spectrum preservatives like phenoxyethanol in high-volume production cycles.

- Accelerated discovery of preservative synergy blends via machine learning modeling.

- Predictive toxicology and risk assessment of high-volume preservatives, affecting regulatory scrutiny.

- Optimization of manufacturing processes, reducing energy consumption in phenoxyethanol synthesis.

- AI-driven supply chain forecasting and logistics management for raw material stability.

- Enhanced formulation analysis to minimize concentration use while maintaining microbial stability (MIC determination).

DRO & Impact Forces Of Phenoxyethanol Preservatives Market

The market dynamics for Phenoxyethanol Preservatives are characterized by strong underlying growth drivers stemming from globalization of consumer markets and stringent regulatory requirements for product safety, balanced against significant restraints related to chemical toxicity perceptions and the relentless pursuit of natural alternatives. The core drivers include the worldwide proliferation of personal care products, particularly in emerging economies, and the continuous phase-out of legacy preservatives deemed harmful. However, the primary restraint is the mounting consumer backlash against synthetic ingredients, fueled by clean beauty trends and misinformation regarding phenoxyethanol's minor toxicological profile when used within regulated limits. This creates a challenging environment where manufacturers must constantly defend the ingredient's safety record against marketing claims of 'phenoxyethanol-free' products.

Significant opportunities lie in developing advanced, controlled-release encapsulation techniques for phenoxyethanol, which would allow for lower effective dosing, addressing consumer concerns regarding concentration. Furthermore, the pharmaceutical sector presents an untapped growth trajectory, especially in sterile topical applications where the high purity and broad-spectrum activity of phenoxyethanol are indispensable. The market is also heavily influenced by impact forces such as regulatory shifts (e.g., EU limits on concentration in specific child-care products), which necessitate continuous re-formulation efforts and drive research into synergistic preservation systems to maintain performance while complying with stricter guidelines. The competitive intensity among chemical suppliers, focusing on ensuring purity and consistent supply, also acts as a critical force shaping pricing and market access.

Ultimately, the long-term viability of the phenoxyethanol market hinges on its ability to navigate the complex public perception landscape while maintaining regulatory approval as a safe and effective preservative. The industry is strategically positioning phenoxyethanol not merely as a standalone preservative but as a cornerstone in complex preservation matrices, utilizing its potent antimicrobial base to stabilize formulations alongside emerging natural boosters. The ongoing trend towards multi-functional ingredients also provides an opportunity, as phenoxyethanol offers minor benefits beyond preservation, such as acting as a solvent and fragrance fixative, further integrating it into complex product compositions.

Segmentation Analysis

The Phenoxyethanol Preservatives Market is comprehensively segmented based on its application across various industries, the required purity grade, and its commercial form (liquid or powder). Understanding these segments is crucial for stakeholders to tailor production, distribution, and marketing strategies effectively. The dominance of the Personal Care and Cosmetics segment dictates overall market trends, including volume demand and regulatory focus, pushing manufacturers to ensure the highest quality standards for skin contact applications. Segmentation by grade is essential as it reflects the stringency of regulatory compliance and the associated premium pricing, particularly for pharmaceutical and medical-grade materials.

The market composition is further defined by geographic regions, reflecting differences in regulatory environments, consumer preferences, and manufacturing capabilities. The segmentation analysis reveals distinct growth patterns; while mature markets like North America focus on specialized, high-purity grades for anti-aging and sensitive skin products, emerging markets prioritize volume and cost-effectiveness for mass-market consumer goods. The interaction between these segments highlights the need for flexible manufacturing capable of producing different grades and forms to meet global specifications.

- By Grade:

- Pharmaceutical Grade

- Cosmetic Grade

- Industrial Grade

- By Application:

- Cosmetics and Personal Care

- Skincare (Creams, Lotions)

- Haircare (Shampoos, Conditioners)

- Makeup

- Fragrances

- Pharmaceuticals (Topical Preparations)

- Household Cleaning Products (Wipes, Detergents)

- Industrial Applications (Metalworking Fluids, Adhesives)

- Others (Paints, Textiles)

- Cosmetics and Personal Care

- By Form:

- Liquid

- Powder (Less Common, primarily for specific dry blends)

Value Chain Analysis For Phenoxyethanol Preservatives Market

The value chain for the Phenoxyethanol Preservatives Market begins with upstream activities centered on the procurement and processing of raw materials, primarily ethylene oxide and phenol, which are critical precursors in the etherification process. These steps are dominated by large petrochemical companies and specialty chemical manufacturers that leverage complex synthesis processes to produce high-purity phenoxyethanol. Significant focus at this stage is placed on quality control, ensuring minimal residual impurities, especially for pharmaceutical and cosmetic grades, which directly impacts the compound’s regulatory compliance and safety profile for downstream use.

The midstream activities involve synthesis, purification, blending, and specialized packaging. Key players invest heavily in continuous manufacturing processes to achieve economies of scale and maintain strict batch-to-batch consistency. The blending stage is particularly important, as phenoxyethanol is frequently sold in pre-mixed combinations with other mild preservatives (like caprylyl glycol or ethylhexylglycerin) to offer synergistic broad-spectrum protection, marketed as proprietary preservation systems. Distribution channels are varied, including direct sales from major manufacturers to large CPG corporations, and indirect sales through specialized chemical distributors who service smaller cosmetic laboratories and regional formulators.

Downstream activities are dominated by the end-user industries: cosmetics, pharmaceuticals, and household products manufacturing. Direct channels are utilized for high-volume supply contracts with multinational companies, ensuring seamless integration into large-scale production lines. Indirect distribution through third-party chemical suppliers and regional agents is vital for reaching SMEs and specialized niche markets. The final stage involves rigorous quality assurance by the end-users to confirm that the received preservative adheres to internal specifications and regulatory requirements, ultimately impacting the safety and commercial viability of the finished consumer product.

Phenoxyethanol Preservatives Market Potential Customers

The primary customers and end-users of phenoxyethanol preservatives are the global manufacturers of formulated consumer products who require broad-spectrum microbial protection to ensure product longevity and consumer safety. The largest consumer base resides within the Cosmetics and Personal Care industry, which includes multinational corporations producing mass-market lotions, creams, hair products, and infant care items, as well as thousands of specialized 'indie' beauty brands that utilize phenoxyethanol as a proven, paraben-free alternative. Their purchasing decisions are driven by efficacy, regulatory acceptance, and price competitiveness, with a growing emphasis on high-purity grades.

Another critical set of buyers comprises Pharmaceutical manufacturers, particularly those focusing on topical drug delivery systems such as medicated creams, gels, and ophthalmological preparations. For this segment, the requirement for Pharmaceutical Grade phenoxyethanol is non-negotiable, demanding stringent documentation and validation of purity. Furthermore, manufacturers of Household Cleaning Products, including liquid detergents, fabric softeners, and disposable wipes, represent a large volume buyer base, where cost-effectiveness and broad-spectrum efficacy are paramount to prevent spoilage during extended storage and use.

Finally, industrial sectors, including producers of paints, coatings, adhesives, and metalworking fluids, utilize phenoxyethanol for its antimicrobial properties to prevent biofilm formation and product degradation in harsh environments. These buyers typically focus on Industrial Grade phenoxyethanol, prioritizing volume and technical compatibility within complex industrial formulations, demonstrating the compound's broad utility beyond the traditional consumer sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 215.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schülke & Mayr GmbH, Clariant AG, Dow Chemical Company, Ashland Global Holdings Inc., BASF SE, Lonza Group, Symrise AG, Galaxy Surfactants Ltd., Chemsil Silicones Inc., Merck KGaA, Spec-Chem Industry Inc., Penta Manufacturing Company, Chemipol S.A., TRI-K Industries, Inc., Jiangsu Achem Technology Co., Ltd., Haihang Industry Co., Ltd., Thor Specialties, Inc., Universal Preserv-A-Chem Inc., Evonik Industries AG, Guangzhou Tinci Materials Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Phenoxyethanol Preservatives Market Key Technology Landscape

The technological landscape of the phenoxyethanol market is primarily focused on optimizing synthesis for ultra-high purity grades and integrating it into complex, multi-component preservation systems. The core manufacturing process involves the reaction of ethylene oxide with phenol, and continuous improvements are made in catalysis and reaction conditions to enhance yield and minimize the formation of undesirable by-products, crucial for meeting the stringent purity standards of pharmaceutical and high-end cosmetic applications. Advanced chromatographic techniques and spectroscopic analysis are the mainstays of quality control, ensuring compliance with global pharmacopoeias and cosmetics directives. This technological emphasis on purity is a direct response to consumer and regulatory demands for safer ingredients.

Another crucial technological development involves the encapsulation and stabilization of phenoxyethanol. Manufacturers are exploring micro- and nano-encapsulation technologies to achieve controlled release of the preservative within a formulation. This technique allows for effective preservation at lower overall concentrations, mitigating perceived toxicity concerns and enhancing the ingredient’s stability against environmental factors such as temperature variation. Furthermore, the development of synergistic booster technologies, where phenoxyethanol is combined with mild organic acids or natural compounds like botanical extracts, represents a significant technological shift. These blends are engineered to disrupt microbial cell walls more effectively than single agents, allowing formulators to reduce the reliance on higher concentrations of any single synthetic ingredient while maintaining broad-spectrum efficacy, appealing to the "natural-friendly" segment.

Digitalization and automation are also playing an increasingly important role, particularly in the bulk chemical manufacturing stage, where Continuous Flow Chemistry (CFC) is being adopted to improve process safety, energy efficiency, and overall batch consistency. In formulation development, high-throughput screening technologies are utilized to quickly test the effectiveness of phenoxyethanol in hundreds of unique matrix combinations, rapidly accelerating the time-to-market for new cosmetic and personal care products. The combination of advanced synthesis, synergistic formulation, and digital optimization defines the modern technological edge in the phenoxyethanol preservation industry.

Regional Highlights

Regional dynamics are critical in defining the growth trajectory and market maturity of phenoxyethanol preservatives, driven significantly by local manufacturing capabilities and the varying stringency of cosmetic regulations.

- Asia Pacific (APAC): Represents the fastest-growing region due to explosive growth in cosmetic manufacturing, especially in China, India, and South Korea. High population density, rising middle-class disposable income, and increasing consumer awareness regarding product shelf-life and safety drive massive volume demand. APAC acts as a key manufacturing hub for global brands, prioritizing cost-effective and compliant preservative solutions like phenoxyethanol.

- North America: A mature market characterized by high consumer spending on premium and specialized skincare. Demand is strong for high-purity, often blended phenoxyethanol systems. Regulatory compliance is robust, and the market is intensely influenced by 'clean beauty' trends, forcing manufacturers to justify the use of synthetic ingredients.

- Europe: Governed by the highly influential EU Cosmetics Regulation (Regulation (EC) No 1223/2009), which strictly defines the permissible concentration (up to 1.0%) of phenoxyethanol. This region is a leader in formulation innovation, driving the adoption of synergistic blends to maximize efficacy within strict regulatory limits. Germany and France are major consumption centers due to their large pharmaceutical and cosmetic industries.

- Latin America (LATAM): Exhibits solid growth potential, mirroring APAC's trajectory, driven by improving economic conditions and increased localized manufacturing in Brazil and Mexico. The market often seeks cost-efficient solutions and benefits from regulatory frameworks that frequently align with European or US standards, providing a stable foundation for phenoxyethanol usage.

- Middle East and Africa (MEA): A relatively smaller but expanding market, heavily dependent on imports of formulated products and raw materials. Growth is concentrated in the GCC states, spurred by infrastructure development and rising healthcare spending, increasing the demand for compliant, stable preservatives in topical pharmaceutical and personal hygiene products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Phenoxyethanol Preservatives Market.- Schülke & Mayr GmbH

- Clariant AG

- Dow Chemical Company

- Ashland Global Holdings Inc.

- BASF SE

- Lonza Group

- Symrise AG

- Galaxy Surfactants Ltd.

- Chemsil Silicones Inc.

- Merck KGaA

- Spec-Chem Industry Inc.

- Penta Manufacturing Company

- Chemipol S.A.

- TRI-K Industries, Inc.

- Jiangsu Achem Technology Co., Ltd.

- Haihang Industry Co., Ltd.

- Thor Specialties, Inc.

- Universal Preserv-A-Chem Inc.

- Evonik Industries AG

- Guangzhou Tinci Materials Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Phenoxyethanol Preservatives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the regulatory status and safe concentration limit of Phenoxyethanol in cosmetics?

Phenoxyethanol is regulated globally, notably by the European Union (EU) and FDA. The EU Cosmetics Regulation mandates a maximum concentration of 1.0% in finished cosmetic products to ensure consumer safety. Most other jurisdictions adhere closely to this limit, confirming its standing as a safe and effective broad-spectrum preservative when used within established parameters.

Why is Phenoxyethanol often used as an alternative to Parabens in personal care products?

Phenoxyethanol is widely adopted as a paraben alternative because it offers excellent broad-spectrum efficacy against bacteria, yeast, and mold, but lacks the endocrine-disrupting perception associated with some parabens. This shift is driven by strong consumer preference for paraben-free labeling, even though phenoxyethanol is a synthetic preservative itself.

Which application segment drives the highest demand for Phenoxyethanol Preservatives?

The Cosmetics and Personal Care segment constitutes the largest consumer base for phenoxyethanol. This includes high-volume products such as skin creams, lotions, sunscreens, and liquid makeup, where the ingredient's stability, efficacy, and compatibility with diverse cosmetic formulations are critically important for preventing microbial contamination and ensuring extended shelf life.

How is the rise of 'clean beauty' trends impacting the future demand for Phenoxyethanol?

The 'clean beauty' movement creates a dichotomy: while consumers increasingly reject synthetic ingredients, they still demand microbial safety and long shelf life. This pushes manufacturers to use phenoxyethanol in lower concentrations, often combined with natural boosters, or to focus on high-purity grades to appeal to skeptical consumers, maintaining its essential role despite preference shifts.

What are the key differences between Cosmetic Grade and Pharmaceutical Grade Phenoxyethanol?

The primary difference lies in the purity and documentation requirements. Pharmaceutical Grade phenoxyethanol demands significantly higher purity (minimal specified impurities) and extensive testing documentation (validation reports and compliance with pharmacopoeia standards), often commanding a premium price compared to Cosmetic Grade, which adheres to less stringent purity benchmarks required for non-sterile consumer goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager