Photochromic Snow Goggle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441153 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Photochromic Snow Goggle Market Size

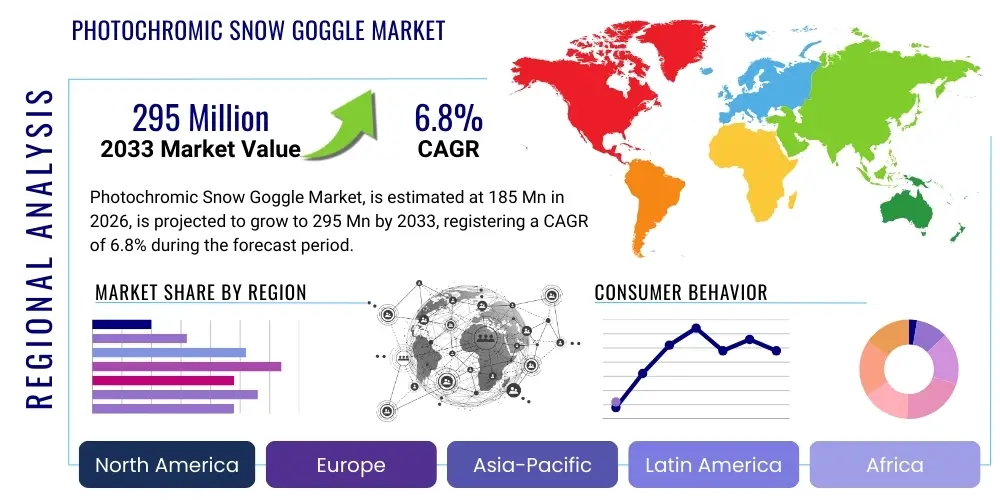

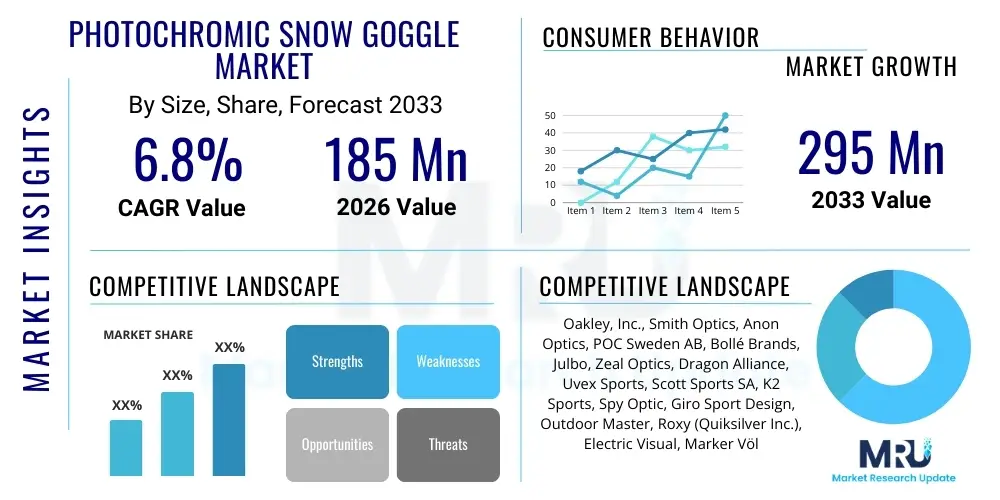

The Photochromic Snow Goggle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $295 Million USD by the end of the forecast period in 2033.

Photochromic Snow Goggle Market introduction

The Photochromic Snow Goggle Market encompasses specialized eyewear designed for snow sports, featuring lenses that automatically adjust their tint level in response to changing ultraviolet (UV) light intensity. This adaptive technology enhances visibility and eye protection across various lighting conditions, ranging from bright, sunny high-altitude environments to overcast days and deep shade. The core product incorporates advanced lens materials treated with photochromic molecules (such as naphthopyrans or spirooxazines) that rapidly react to UV radiation, transitioning from a lighter state to a darker state, thereby eliminating the need for skiers and snowboarders to carry multiple sets of lenses or goggles for different weather conditions. This convenience and functional superiority position photochromic goggles as a premium segment within the broader winter sports equipment market. Their primary applications include competitive and recreational skiing, snowboarding, and other high-altitude winter activities where rapid weather changes are common.

Major applications of these high-performance goggles span professional winter sports competitions, demanding backcountry touring, and general resort skiing/snowboarding, catering to serious enthusiasts who prioritize safety, optical clarity, and performance consistency. The benefit derived from using photochromic lenses is primarily enhanced safety due to uninterrupted vision and reduced eye strain, coupled with superior convenience and versatility compared to traditional fixed-tint or interchangeable lens systems. Photochromic technology optimizes contrast and depth perception, critical factors for navigating varied snow textures and terrain obstacles safely. Furthermore, they offer 100% UV protection regardless of the tint state, protecting the delicate structures of the eye from long-term sun damage encountered at higher elevations.

The market growth is fundamentally driven by several key factors, including the increasing global participation in winter sports, driven by improved resort infrastructure and rising disposable incomes in emerging economies. Technological advancements in lens manufacturing, leading to faster transition times and wider usable VLT (Visible Light Transmission) ranges, make the products more appealing. Moreover, a heightened consumer awareness regarding the risks associated with UV exposure and blue light damage, especially in high-glare environments like snow, is bolstering demand for premium protective eyewear solutions. Marketing efforts by leading brands focusing on performance advantages and the seamless integration of technology into aesthetically pleasing designs further accelerate market adoption.

Photochromic Snow Goggle Market Executive Summary

The global Photochromic Snow Goggle Market is characterized by robust growth, primarily fueled by the premiumization trend in snow sports equipment and continuous technological innovations. Key business trends indicate a strong focus on direct-to-consumer (DTC) sales channels, enhanced customization options, and the integration of auxiliary technologies like anti-fog coatings and advanced ventilation systems. Companies are investing heavily in material science research to improve photochromic reactivity speed, range of tint adjustment, and durability under extreme cold conditions, shifting consumer focus from basic protection to high-fidelity optical performance. Strategic collaborations between lens manufacturers and major goggle brands are common, aiming to secure proprietary technology and maintain competitive edge. Sustainability initiatives, focusing on recycled frame materials and eco-friendly packaging, are emerging as significant differentiating factors, particularly in European and North American markets where environmentally conscious consumers hold strong purchasing power.

Regionally, North America and Europe dominate the market due to their established snow sports cultures, high consumer purchasing power, and the presence of numerous major ski resorts. These regions exhibit high adoption rates for premium, technologically advanced products, including cylindrical and toric lens shapes that offer superior peripheral vision. The Asia Pacific (APAC) region, led by countries like China, Japan, and South Korea, is rapidly expanding, driven by massive government investment in winter sports infrastructure ahead of major international events, and a burgeoning middle class eager to adopt Western recreational activities. Latin America and the Middle East & Africa (MEA) represent nascent markets with high potential, although currently restricted by limited suitable snow infrastructure and lower consumer awareness regarding specialized high-performance eyewear. Market penetration strategies in APAC often focus on online distribution and localized marketing campaigns featuring regional athletes.

Segmentation analysis highlights that the adult segment remains the largest revenue contributor, reflecting the demographic most engaged in high-end winter sports. Based on lens type, the polyurethane-based lens material segment holds significant market share due to its flexibility, impact resistance, and suitability for complex photochromic application techniques. In terms of application, recreational activities account for the majority of sales volume, although the professional segment generates higher average selling prices (ASP) due to stringent performance requirements. The growth rate is notably high within the online retail segment, leveraging e-commerce efficiency and detailed product information to reach geographically dispersed consumer bases, though specialized sports retailers maintain importance for fitting and expert advice. The trend toward integration of prescription inserts or over-the-glasses (OTG) designs is also a noticeable growth vector within the product segment.

AI Impact Analysis on Photochromic Snow Goggle Market

User inquiries regarding AI's influence on the Photochromic Snow Goggle market frequently center on three main themes: the potential for AI-driven lens optimization, improvements in the design and fitting process, and the role of AI in supply chain and predictive inventory management. Consumers are keenly interested in whether AI can monitor ambient light conditions and user physiological data in real-time, allowing lenses to anticipate and instantly adjust tint levels with predictive accuracy, going beyond mere reactive UV measurement. There is also significant curiosity about AI-powered design tools that could optimize goggle curvature, frame ventilation, and fit based on complex 3D scans of the user's face, addressing issues like pressure points and fogging before manufacturing. Furthermore, businesses are exploring how AI can forecast demand spikes related to weather patterns or social media trends, minimizing stockouts of popular models and managing the highly seasonal nature of the snow sports market efficiently.

The direct integration of AI into the goggle itself, moving towards "smart goggles," involves computational elements that interpret complex environmental data faster than traditional chemical reactions. While fully AI-controlled photochromic lenses are still futuristic, current R&D efforts utilize machine learning to refine the chemical composition of photochromic dyes, optimizing their sensitivity and transition speed across diverse temperature and humidity ranges, which are crucial variables in snow environments. This refinement leads to more reliable, high-performance products that better meet consumer expectations under challenging conditions. Beyond the product, AI is transformative in customer relationship management (CRM) and personalization, analyzing purchase histories and regional weather data to recommend the most suitable photochromic products (e.g., lenses optimized for low light versus high altitude).

In manufacturing, AI-driven quality control systems use computer vision to inspect lens coatings and photochromic consistency during production, ensuring defect rates remain minimal, which is critical for precision optical equipment. These systems analyze vast datasets to identify patterns that lead to manufacturing inconsistencies, allowing for real-time process adjustments. This level of precision is vital for photochromic lenses where uneven tinting can compromise safety and user experience. Consequently, AI acts less as a direct lens control mechanism and more as an underlying optimization layer across design, materials science, manufacturing quality, and market forecasting, ultimately enhancing the final product's performance and accessibility.

- AI optimizes photochromic material formulations, leading to faster tint transition speeds and broader operational temperature ranges.

- Predictive analytics driven by AI enhance supply chain responsiveness, accurately forecasting seasonal demand fluctuations and optimizing inventory.

- Machine learning algorithms analyze consumer feedback and biomechanical data to improve goggle frame ergonomics and fit personalization.

- AI-enabled computer vision systems increase manufacturing quality control precision for anti-fog and photochromic coatings.

- Advanced algorithms analyze real-time light and environmental data for potential future integration into 'smart' adaptive lens control systems.

DRO & Impact Forces Of Photochromic Snow Goggle Market

The dynamics of the Photochromic Snow Goggle Market are governed by powerful drivers (D) stemming from consumer desire for convenience and performance, significant restraints (R) related to cost and technological complexity, and substantial opportunities (O) presented by emerging markets and material science breakthroughs. The major impact forces relate to macroeconomic factors like climate change affecting snowfall patterns and geopolitical stability influencing global tourism. Drivers are heavily concentrated on the superior utility of a single lens solution, which addresses variable mountain weather without interruption. Restraints often include the higher initial purchase price compared to standard fixed-tint goggles, placing them in a niche luxury segment, alongside the inherent trade-off in photochromic technology, where transition times, though improving, are not instantaneous. Opportunities lie in expanding into non-traditional snow sports locales and perfecting low-temperature performance reactivity.

Key drivers include the global expansion of high-end snow tourism and the increasing emphasis among amateur and professional athletes on maximizing performance through superior vision technology. Consumers are willing to pay a premium for features that significantly reduce eye fatigue and maximize clarity, thereby enhancing safety on complex terrains. The rising number of heli-skiing and backcountry participants, who face highly unpredictable and rapidly changing environments, particularly rely on the adaptability of photochromic lenses. Restraints are primarily technological, specifically the challenge of maintaining optimal photochromic efficiency in extremely cold conditions, which can slow down the tinting reaction, and the higher susceptibility of complex coatings to scratching compared to simpler lens materials. Furthermore, market saturation in established regions forces companies to continuously innovate to justify the premium price point, creating high R&D pressure.

Opportunities are vast, centering on product diversification into specialized segments like junior sizing or dedicated racing goggles that integrate these adaptive features. Geographical expansion, particularly in Eastern Europe and parts of Asia where snow sports are growing rapidly, offers significant untapped revenue potential. The impact forces compelling market change include shifting climate patterns, which necessitate products that perform effectively under marginal snow conditions (e.g., slush and mixed light), and strong marketing campaigns by industry leaders that successfully educate consumers about the long-term cost-benefit of investing in high-quality photochromic gear versus managing multiple fixed-tint lenses. Regulatory changes concerning UV protection standards for sports equipment also act as an influential force, pushing manufacturers towards higher quality optical standards, which photochromic technology inherently supports.

Segmentation Analysis

The Photochromic Snow Goggle Market is intricately segmented across various dimensions, including lens type, end-user, distribution channel, and application, reflecting the diverse needs and preferences of the global snow sports community. This comprehensive segmentation allows market players to tailor their product offerings, pricing strategies, and marketing campaigns to specific high-value demographics. Understanding these segments is critical for identifying primary revenue streams, emerging niche markets, and potential competitive gaps. The analysis reveals a pronounced shift toward technologically advanced lens coatings and materials, prioritizing optical clarity, wide fields of view, and durability, especially within the adult and professional end-user segments. Polycarbonate and Trivex materials dominate the lens material landscape due to their superior impact resistance and clarity, crucial safety features in high-speed environments. Furthermore, the market differentiates sharply between consumer-focused recreational products and professional-grade models demanding rigorous optical standards.

From an end-user perspective, the adult segment commands the overwhelming majority of market revenue due to higher participation rates, greater disposable income for premium equipment, and strong brand loyalty. However, the youth/junior segment is experiencing healthy growth, fueled by increased parental investment in quality protective gear as children participate in organized snow sports at younger ages. The distribution segmentation underscores the importance of a hybrid strategy: traditional brick-and-mortar sports retailers remain vital for product fitting and expert consultation, while the e-commerce channel offers wider geographical reach, competitive pricing, and the convenience sought by technologically adept millennials and Gen Z consumers. Application segmentation confirms that recreational activities are the volume driver, contrasting with the smaller, high-ASP (Average Selling Price) professional/competitive segment which demands bespoke features like quick-release mechanisms and highly specific VLT ranges.

Detailed analysis of the lens technology segment shows a growing preference for Toric lenses (which offer curvature in two different planes, optimizing peripheral vision while minimizing distortion) over traditional Cylindrical lenses, particularly among high-performance users. Spherical lenses also maintain relevance, striking a balance between cost and vision quality. Crucially, the differentiation based on Visible Light Transmission (VLT) range is increasingly important; some photochromic lenses are specifically marketed for "low light to overcast" conditions, while others focus on the transition between "partly cloudy and full sun," catering to specific regional light environments. The segmentation strategy must therefore address both the functional superiority of the photochromic aspect and the ergonomic and optical requirements of the underlying lens and frame architecture, ensuring that the premium price is justified by multi-faceted performance benefits.

- Lens Type:

- Cylindrical Lenses

- Spherical Lenses

- Toric Lenses

- End-User:

- Adults

- Youth/Junior

- Application:

- Recreational Skiing and Snowboarding

- Professional/Competitive Sports

- Backcountry Touring

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Sports Stores, Department Stores, Resort Pro Shops)

- Material Type (Lens):

- Polycarbonate

- Polyurethane

- Trivex

- VLT Range Optimization:

- High VLT Range (Low Light Focus)

- Medium VLT Range (All-Weather/General Purpose)

Value Chain Analysis For Photochromic Snow Goggle Market

The value chain for the Photochromic Snow Goggle Market is complex, beginning with highly specialized upstream suppliers and concluding with diverse downstream distribution channels reaching the end consumer. Upstream analysis focuses on the procurement of specialized raw materials, primarily high-grade optical polymers (Polycarbonate, Polyurethane) and the critical photochromic dyes or molecules, which are often proprietary and sourced from a limited number of chemical companies globally. These molecules dictate the speed and range of the tint transition. Specialized lens manufacturers then integrate these materials through sophisticated injection molding and coating processes, including the application of anti-fog, anti-scratch, and mirror finishes, demanding high capital expenditure and stringent quality control. This early stage is characterized by intense intellectual property protection and high entry barriers due to the precision engineering required for optical quality.

The midstream involves the core goggle assembly, where frame materials (often TPU for flexibility and durability in cold) are molded, ventilation systems are integrated, and the photochromic lenses are fitted. Major goggle brands either operate their own assembly facilities or outsource manufacturing to specialized contractors, typically in Asia. Brand differentiation at this stage relies heavily on design aesthetics, ergonomic frame fit (including compatibility with helmets), and the effectiveness of the ventilation/anti-fog system. Quality assurance checks for structural integrity and optical consistency are vital before the product moves to market. Strong relationships with suppliers ensuring consistent quality of specialized components, such as high-density foam padding and adjustable straps, are crucial for maintaining brand reputation for comfort and longevity.

Downstream analysis details the path to the consumer. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves brand-owned websites and flagship stores, offering higher margin control and direct customer data collection, often targeting niche groups like professional athletes or early adopters. Indirect distribution, which still accounts for the majority of sales volume, utilizes specialized sports retailers (providing personalized fitting and expert advice), large department stores, and increasingly, major third-party e-commerce platforms. The choice of channel depends heavily on the target region and consumer demographic, with resort pro shops being particularly important for impulse purchases. Effective logistics and inventory management are critical in this highly seasonal market to ensure stock availability during peak winter months and minimize obsolete inventory during off-season periods.

Photochromic Snow Goggle Market Potential Customers

The primary customer base for the Photochromic Snow Goggle Market consists of dedicated snow sports enthusiasts and professionals who demand uncompromising optical performance and safety across varying environmental conditions. The core segment comprises experienced recreational skiers and snowboarders (aged 25-55) who frequent resorts multiple times per season, possess higher disposable income, and prioritize convenience and technological superiority over cost. These consumers often participate in high-speed or challenging terrain, making consistent visibility a safety prerequisite. They are typically well-informed about lens technologies and actively seek products that minimize visual fatigue and maximize depth perception, justifying the investment through enhanced performance and protection.

A significant secondary customer segment includes backcountry and touring enthusiasts. These users operate in environments where weather and light can shift dramatically within minutes, often far from shelter. For this segment, a single, highly reliable photochromic lens is indispensable, as carrying multiple lenses is impractical due to weight and storage constraints. Their purchasing decisions are heavily influenced by durability, wide VLT range, and anti-fog reliability, placing them among the highest-value customers for premium, ruggedized photochromic models. Furthermore, professional athletes and instructors constitute a smaller but highly influential segment. Their use of the product serves as a powerful endorsement, driving consumer confidence in the technology's effectiveness under extreme duress.

Emerging customer groups include affluent beginners and intermediate skiers from rapidly growing Asian markets, such as China and South Korea, where the uptake of advanced snow gear is increasing rapidly in parallel with the expansion of local winter sports facilities. These new entrants often purchase high-end gear initially, viewing advanced technology as essential for both safety and status. Also, the segment of goggle wearers who utilize prescription eyewear (OTG users) represents substantial potential, as photochromic solutions simplify their vision needs by eliminating the need to swap prescription glasses for specialized fixed-tint versions, offering unmatched flexibility and comfort.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $295 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oakley, Inc., Smith Optics, Anon Optics, POC Sweden AB, Bollé Brands, Julbo, Zeal Optics, Dragon Alliance, Uvex Sports, Scott Sports SA, K2 Sports, Spy Optic, Giro Sport Design, Outdoor Master, Roxy (Quiksilver Inc.), Electric Visual, Marker Völkl, Revo Eyewear, 100 Percent, Zipline Ski. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photochromic Snow Goggle Market Key Technology Landscape

The technological landscape of the Photochromic Snow Goggle Market is defined by the continual refinement of adaptive lens chemistry, coupled with advancements in frame ergonomics and optical coatings designed to enhance performance in harsh environments. The core technology centers on proprietary photochromic molecular compounds—often naphthopyrans or spirooxazines—embedded within or laminated onto the lens material. Recent innovations focus on increasing the density and efficiency of these molecules to achieve significantly faster activation and fade-back times, minimizing the user's perception of the transition and ensuring seamless adjustment. Furthermore, research is heavily invested in creating photochromic solutions that operate effectively across a wider thermal spectrum, counteracting the historical challenge where cold temperatures tend to slow down the photochromic reaction, a critical necessity for alpine environments.

Beyond the photochromic chemistry itself, the market benefits greatly from advanced ancillary technologies. Anti-fog solutions are paramount, employing hydrophilic inner lens coatings (such as those based on cellulose derivatives or proprietary polymeric compounds) that absorb moisture, preventing condensation. This is often coupled with sophisticated active and passive ventilation systems integrated into the frame structure, designed to manage temperature differentials without compromising protection from snow and wind. Optical perfection is pursued through high-definition injection molding processes that eliminate distortion and precise application of polarization filters, which, when integrated with photochromic technology, dramatically reduce glare from snow and ice surfaces, enhancing safety and visual comfort.

Current technological trends highlight the adoption of Trivex and certain polyurethane formulations as superior base lens materials due to their exceptional optical clarity, impact resistance (exceeding polycarbonate standards), and lightweight nature. Another crucial area of focus is the development of advanced mirror coatings that work synergistically with the photochromic layer. These flash coatings are applied selectively to reflect intense light while the photochromic molecules manage overall tint, improving aesthetic appeal and high-sun performance. Connectivity is also emerging, with high-end models exploring integration points for smart components, such as micro-LED indicators or seamless integration with helmet audio systems, moving the goggle from a passive protective device to an active piece of wearable technology.

Regional Highlights

Regional dynamics play a crucial role in shaping the Photochromic Snow Goggle Market, with established markets driving innovation and emerging regions fueling volume growth. North America (primarily the United States and Canada) holds the largest market share, driven by a deep-rooted snow sports culture, high consumer awareness regarding premium protective gear, and robust infrastructure supporting recreational and professional skiing. The region exhibits high acceptance of premium pricing for technologically advanced products, prioritizing features like wide peripheral vision (Toric lenses) and seamless helmet compatibility. Marketing efforts here often center around performance, durability, and brand association with competitive athletes. The demand is stable and focuses on replacement cycles and upgrades to the latest photochromic advancements, particularly in states like Colorado, Utah, and regions of British Columbia.

Europe constitutes the second-largest market, characterized by strong consumer demand in the Alpine countries (Switzerland, Austria, France, Italy). This region demonstrates a significant inclination towards eco-friendly and sustainably sourced products, alongside an appreciation for high-end European optics and design. European consumers often engage in multi-day tours and glacier skiing, necessitating reliable photochromic performance across extreme altitude changes and fluctuating weather. Regulations and safety standards related to eye protection in snow sports are highly emphasized here, further boosting the demand for certified, high-quality adaptive lenses. Germany and the Nordic countries also contribute substantially, driven by strong outdoor recreation participation rates and high disposable income.

The Asia Pacific (APAC) region is projected to register the fastest growth, primarily propelled by market maturation in Japan and South Korea, coupled with exponential growth in China. Significant governmental investment in winter sports infrastructure, spurred by the hosting of international events, is rapidly popularizing skiing and snowboarding among the burgeoning middle class. While price sensitivity remains higher than in Western markets, demand for high-quality protective gear is accelerating as safety standards rise. Local manufacturing capabilities are improving, but international brands still dominate the premium photochromic segment, often adapting frame sizes and fits to better suit regional anatomical requirements. Distribution is heavily reliant on modern e-commerce channels in urban centers.

Latin America (LATAM) and the Middle East & Africa (MEA) represent niche or emerging markets. LATAM, specifically countries like Chile and Argentina with significant Andean skiing opportunities, shows seasonal demand for high-quality gear among domestic affluent skiers and international tourists. The MEA region's market is highly fragmented and dependent mainly on expatriate communities, high-net-worth individuals traveling abroad for snow holidays, and indoor snow resorts. Growth in these regions is contingent upon expanding winter tourism investment and increased awareness of specialized equipment benefits, currently relying heavily on imported goods and lacking significant local manufacturing or research presence.

- North America: Dominant market share; driven by high disposable income and established snow sports culture; focus on high-performance Toric lenses and brand loyalty (US, Canada).

- Europe (Alpine Region): Strong preference for high optical quality and sustainable materials; high participation in high-altitude and touring activities (Switzerland, Austria, France, Germany).

- Asia Pacific: Fastest growing region; massive infrastructure investment and increasing participation rates in China, Japan, and South Korea; e-commerce penetration is critical.

- Latin America: Seasonal, localized demand centered around Andean resorts; purchases driven by affluent domestic users and international visitors (Chile, Argentina).

- Middle East and Africa: Nascent market dependent on luxury tourism and indoor snow facilities; high reliance on imported premium brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photochromic Snow Goggle Market.- Oakley, Inc. (Luxottica Group S.p.A.)

- Smith Optics (Safilo Group S.p.A.)

- Anon Optics (Burton Snowboards)

- POC Sweden AB

- Bollé Brands (A&M Production)

- Julbo

- Zeal Optics (Maui Jim)

- Dragon Alliance (Marchon Eyewear)

- Uvex Sports

- Scott Sports SA

- K2 Sports

- Spy Optic

- Giro Sport Design (Vista Outdoor)

- Outdoor Master

- Roxy (Quiksilver Inc.)

- Electric Visual

- Marker Völkl

- Revo Eyewear

- 100 Percent

- Zipline Ski

Frequently Asked Questions

Analyze common user questions about the Photochromic Snow Goggle market and generate a concise list of summarized FAQs reflecting key topics and concerns.How quickly do photochromic snow goggle lenses adjust their tint?

The adjustment speed depends on the quality of the photochromic molecules and ambient temperature. High-end photochromic snow goggles typically transition significantly (darken or lighten) within 10 to 30 seconds of light exposure change, though full stabilization can take longer. Cold temperatures generally slow down the chemical reaction, a crucial factor for snow sports.

Are photochromic goggles effective in low light or fog conditions?

Yes, photochromic goggles are highly effective in low light because they revert to a lighter tint state (higher Visible Light Transmission or VLT), maximizing the light reaching the eye. Paired with advanced anti-fog coatings and ventilation, they maintain clarity better than fixed-tint lenses under rapidly changing or overcast conditions.

What is the difference between photochromic and polarized snow goggle lenses?

Photochromic lenses automatically change tint based on UV light intensity to manage brightness. Polarized lenses have a fixed filter that specifically blocks horizontal glare reflected off snow or water surfaces. While they serve different functions, many premium snow goggle models now successfully integrate both photochromic adaptability and polarization technology for maximum visual comfort and safety.

Are photochromic lenses worth the higher cost for recreational skiers?

For recreational skiers, the higher cost is often justified by the convenience and safety benefits. Photochromic technology eliminates the need to carry and swap multiple lenses, ensuring optimal visibility instantly when weather shifts unexpectedly, significantly reducing eye strain and improving overall performance regardless of the time of day or light conditions.

Do photochromic snow goggles work well with helmets and prescription glasses (OTG)?

Yes, most leading manufacturers design their photochromic goggle frames to be compatible with standard snow sport helmets, ensuring a seamless fit without gaps. Many lines also feature specific Over-The-Glasses (OTG) designs with deeper frames and specialized side cuts to comfortably accommodate prescription spectacles underneath the photochromic lens.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager