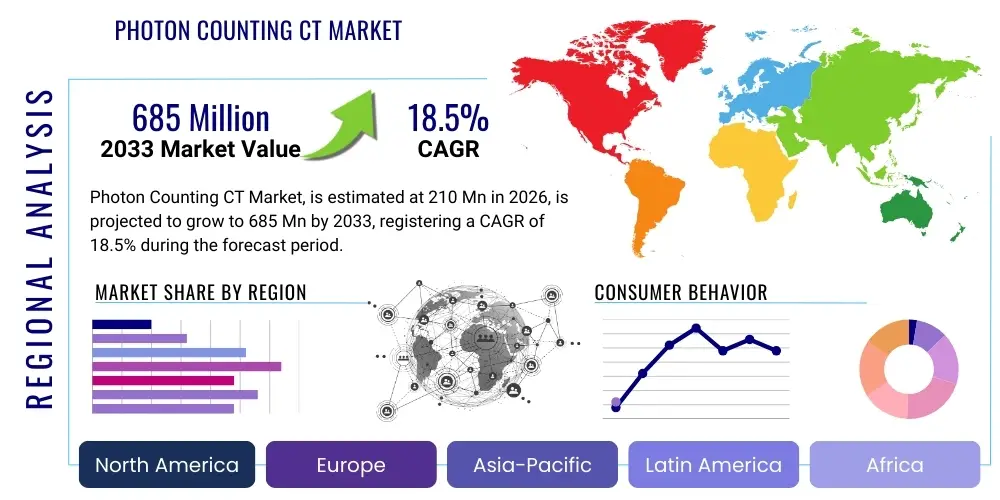

Photon Counting CT Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442234 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Photon Counting CT Market Size

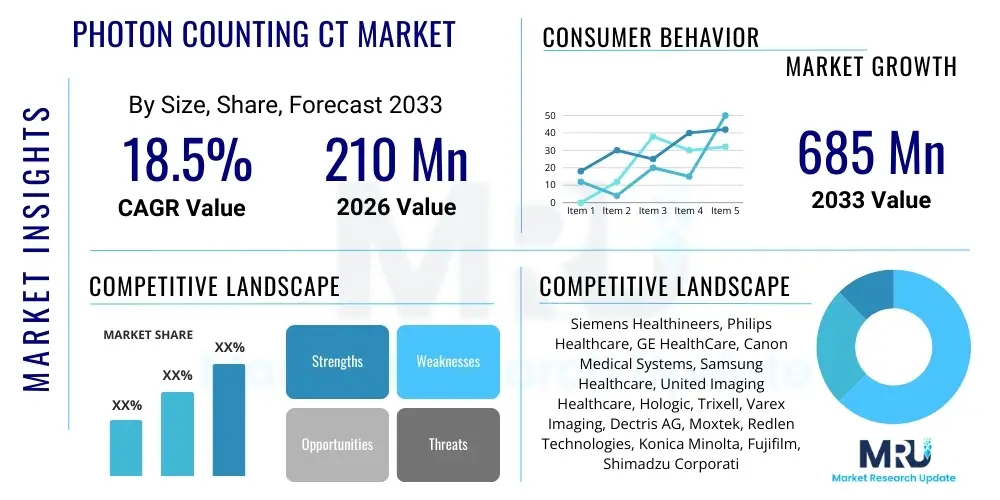

The Photon Counting CT Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $210 Million USD in 2026 and is projected to reach $685 Million USD by the end of the forecast period in 2033.

Photon Counting CT Market introduction

Photon Counting Computed Tomography (PCCT) represents a paradigm shift from conventional Energy Integrating Detectors (EIDs) by measuring the energy of individual X-ray photons directly. This revolutionary approach allows for the elimination of electronic noise, significantly enhancing spatial resolution, and crucially, enabling spectral imaging capabilities where specific materials can be differentiated based on their K-edge absorption characteristics. This technology is rapidly evolving from academic research into mainstream clinical deployment, primarily driven by its unparalleled potential in improving diagnostic accuracy across complex conditions such as oncology, cardiovascular disease, and musculoskeletal imaging. The enhanced contrast-to-noise ratio and inherent multi-energy data acquisition position PCCT as the next generation standard for diagnostic imaging, promising personalized medicine through precise quantification of tissue composition.

Photon Counting CT Market Executive Summary

The Photon Counting CT market is characterized by intense technological innovation, focusing on optimizing detector materials such as Cadmium Telluride (CdTe) and Cadmium Zinc Telluride (CZT) to improve count rate performance and energy resolution. Key business trends include strategic collaborations between academic research institutions and major medical imaging manufacturers, coupled with aggressive investment in clinical trials to establish definitive clinical utility and reimbursement pathways. Geographically, North America currently dominates the market due to robust healthcare infrastructure, high adoption rates of advanced imaging technologies, and significant R&D spending, while the Asia Pacific region is anticipated to exhibit the fastest growth driven by increasing patient volumes and government initiatives promoting technological upgrades in diagnostic facilities. Segment trends show a strong emphasis on high-throughput, high-resolution systems catering specifically to cardiovascular and oncological applications, where spectral imaging offers unique advantages in characterizing plaques, lesions, and tracking therapeutic response. The shift towards non-invasive quantitative biomarkers ensures sustained market expansion and competitive differentiation among key players.

AI Impact Analysis on Photon Counting CT Market

User inquiries regarding AI's impact on PCCT frequently revolve around three core themes: improving image reconstruction speed, automating the analysis of complex spectral data, and leveraging machine learning for dose optimization. Users are keen to understand how AI algorithms can handle the massive data volumes generated by PCCT detectors, expecting AI to drastically reduce reconstruction times necessary for clinical workflow integration. Furthermore, there is significant interest in AI's role in performing automated material decomposition and quantitative analysis, moving beyond visual interpretation to provide precise, reproducible biomarkers, especially in complex multi-material environments like those found in oncological staging or vascular health assessment. The overarching expectation is that AI will be the crucial enabling technology that transforms raw photon count data into clinically actionable insights efficiently.

Artificial intelligence is fundamentally reshaping the operational and diagnostic capabilities of Photon Counting CT systems, moving the technology beyond mere hardware advancement into an integrated intelligent platform. AI-driven iterative reconstruction algorithms are essential for efficiently processing the terabytes of spectral data generated per scan, significantly reducing computational load and achieving superior image quality in clinically relevant timeframes. These algorithms utilize deep learning models trained on vast datasets to differentiate true signals from noise patterns, allowing for ultra-low dose scanning protocols while maintaining diagnostic image fidelity. This synergy between advanced detectors and intelligent processing enhances both patient safety and clinical throughput, addressing previous concerns regarding the complexity and speed of data analysis inherent to spectral CT.

Moreover, AI is pivotal in maximizing the diagnostic value derived from spectral PCCT data. Machine learning models are being developed to automatically perform material decomposition (e.g., quantifying iodine, calcium, fat, and water content) and classify subtle tissue characteristics that are imperceptible to the human eye. This capability facilitates automated plaque characterization in coronary arteries, precise tumor delineation, and functional assessment of organs based on iodine uptake kinetics. By automating quantitative biomarker generation, AI ensures consistency and reproducibility, accelerating the translation of PCCT's advanced spectral information into routine clinical decision support systems, thereby solidifying its indispensable role in the future of personalized imaging diagnostics.

- AI-Enhanced Iterative Reconstruction: Accelerates complex spectral image formation, crucial for maintaining clinical workflow speed.

- Automated Spectral Decomposition: Utilizes machine learning to quantify material concentrations (e.g., calcium, iodine, blood) based on energy bins, providing precise biomarkers.

- Dose Optimization Algorithms: Dynamically adjusts scanning parameters based on patient size and desired image quality, ensuring minimal radiation exposure.

- Noise Reduction and Artifact Suppression: Deep learning models effectively distinguish true signal from electronic noise and scatter, enhancing image clarity at low doses.

- Quantitative Biomarker Generation: Facilitates automated measurement and reporting of tissue characteristics for oncology and cardiology, supporting predictive modeling.

DRO & Impact Forces Of Photon Counting CT Market

The Photon Counting CT market is primarily driven by the escalating demand for superior diagnostic image quality capable of detailed material differentiation, coupled with the imperative for reduced patient radiation exposure. Technological maturation, particularly in detector fabrication (CZT/CdTe), has overcome initial limitations in count rate and energy resolution, enabling high-performance clinical applications. However, significant restraints impede faster adoption, notably the exceptionally high capital expenditure required for acquiring PCCT systems compared to conventional CT, which creates budgetary pressures on smaller hospitals and diagnostic centers. Furthermore, regulatory complexity and the time required to establish sufficient clinical evidence for broad reimbursement coverage act as barriers to market entry and rapid expansion. Opportunities abound in expanding the clinical utility of PCCT into novel domains, such as molecular imaging via targeted contrast agents and integration into hybrid imaging platforms like PET/PCCT, offering highly sensitive quantitative capabilities.

Impact forces on the PCCT market are strong and multifaceted, primarily centered on technological pull and regulatory push for higher clinical standards. The demand side is fueled by specialists in cardiology and oncology who require the unambiguous material identification provided by spectral data, particularly for early disease detection and accurate treatment monitoring. Competitive forces are intensifying as major OEMs invest heavily, resulting in continuous improvement in system specifications, including gantry rotation speed and field of view. Regulatory bodies, while ensuring safety and efficacy, are gradually streamlining the approval process for these novel devices, recognizing their potential for significantly improved patient outcomes. Economic impact forces are characterized by the premium pricing strategy associated with cutting-edge technology, necessitating strong economic justification models to demonstrate superior cost-effectiveness over the system's lifecycle through improved diagnostic accuracy and reduced subsequent procedures.

The core innovation inherent in photon counting technology—the ability to simultaneously capture spatial and spectral information—is the fundamental driver propelling this market forward. This capability enables applications such as K-edge imaging, which is impossible with conventional detectors, opening lucrative avenues in material science and pharmaceutical research focused on targeted contrast agents. Conversely, the market faces headwinds from the need for specialized physicist and technologist training, as operating and maintaining these advanced systems requires specialized expertise that is not yet widely available, posing a challenge to clinical implementation, especially in developing healthcare markets. The long-term success of the market is contingent upon decreasing manufacturing costs, standardizing data analysis protocols, and achieving widespread favorable reimbursement policies globally.

Segmentation Analysis

The Photon Counting CT Market is rigorously segmented based on application, end-user, and component type, reflecting the diverse utilization landscape of this advanced imaging modality. The component segmentation, differentiating between detector types (Cadmium Telluride vs. Cadmium Zinc Telluride) and gantry designs (single-source vs. dual-source), highlights the core technological differences influencing performance metrics like spectral resolution and count rate. Application segmentation reveals critical areas of high growth, particularly Cardiology and Oncology, where the unique spectral capabilities offer definitive diagnostic advantages over standard CT. The End-User analysis focuses on consumption patterns across major healthcare institutions, differentiating between the high-volume adoption in large academic hospitals versus the targeted deployment in specialized diagnostic imaging centers, illustrating where the primary capital investments are being directed.

- By Component:

- Detector Type (Cadmium Telluride, Cadmium Zinc Telluride, Others)

- Gantry Design (Single-Source PCCT, Dual-Source PCCT)

- Data Acquisition and Processing Systems

- By Application:

- Cardiology (Coronary Artery Plaque Characterization, Myocardial Perfusion)

- Oncology (Tumor Staging, Treatment Monitoring, Material Decomposition)

- Neurology (Vascular Imaging, Stroke Assessment)

- Musculoskeletal Imaging (Bone Mineral Density Quantification, Joint Assessment)

- Angiography and Vascular Studies

- By End-User:

- Hospitals (Academic Medical Centers, General Hospitals)

- Diagnostic Imaging Centers

- Research and Academic Institutions

Value Chain Analysis For Photon Counting CT Market

The value chain for the Photon Counting CT market begins significantly upstream with highly specialized raw material suppliers and component manufacturers. This upstream segment is dominated by companies providing ultra-high-purity semiconductor materials, specifically CZT and CdTe crystals, which are vital for the detector arrays. The manufacturing of Application-Specific Integrated Circuits (ASICs) designed to handle the extremely high photon counting rates is another critical upstream activity, requiring specialized microelectronics expertise. The integration phase involves Original Equipment Manufacturers (OEMs) who assemble these detectors and ASICs into sophisticated gantry systems, developing proprietary reconstruction software, and obtaining necessary regulatory approvals.

Midstream activities involve the distribution channel, which is typically a mix of direct sales teams employed by the major OEMs and specialized medical device distributors, particularly for accessing smaller, regional markets. Due to the high complexity and capital cost of PCCT systems, direct sales and extensive service contracts are often preferred, ensuring dedicated technical support and clinical application training. Downstream, the value chain focuses on the end-users—primarily large academic medical centers and specialized cardiology/oncology clinics—where the systems are installed, maintained, and utilized for patient diagnostics and research. The feedback loop from these end-users is crucial for guiding future product iterations and clinical workflow improvements.

The unique aspect of the PCCT value chain is the immense reliance on intellectual property and highly proprietary software for spectral data processing, meaning that technological expertise acts as a significant bottleneck. Direct distribution channels are often necessary to effectively communicate the complex clinical advantages of spectral CT to potential buyers and provide mandatory post-installation training. Indirect channels, while used, require partners with deep technical knowledge to manage the installation and maintenance lifecycle. Ensuring high standards of quality and traceability for the detector components is paramount, as defects at this stage can significantly impact system performance and necessitate costly field replacements.

Photon Counting CT Market Potential Customers

The primary customers for Photon Counting CT systems are large, tertiary healthcare facilities and academic medical centers that possess the clinical throughput, financial resources, and dedicated research mandates necessary to justify the high investment. These institutions are driven by the need for state-of-the-art diagnostic capabilities to support complex medical programs, particularly in transplant surgery, advanced oncology, and interventional cardiology, where precise material differentiation is critical for planning and outcome assessment. The research component is also a significant driver, as academic centers leverage PCCT's spectral capabilities for developing novel quantitative biomarkers and pushing the boundaries of non-invasive diagnosis.

Specialized diagnostic imaging centers, particularly those focusing on preventive health screening and cardiac risk assessment, represent a growing segment of potential customers. These centers prioritize advanced technologies that offer reduced radiation doses and highly specific diagnostic information (e.g., differentiating stable vs. vulnerable coronary plaque). They seek systems that enhance their competitive edge by offering superior patient outcomes and reduced need for subsequent invasive procedures. Furthermore, dedicated cancer treatment centers are keen adopters, using PCCT for highly accurate tumor boundary detection and monitoring response to chemoradiation, leveraging the system's ability to precisely map contrast agent uptake.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $210 Million USD |

| Market Forecast in 2033 | $685 Million USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, Philips Healthcare, GE HealthCare, Canon Medical Systems, Samsung Healthcare, United Imaging Healthcare, Hologic, Trixell, Varex Imaging, Dectris AG, Moxtek, Redlen Technologies, Konica Minolta, Fujifilm, Shimadzu Corporation, Carestream Health, Analogic Corporation, Medtronic, Hitachi Medical Corporation, Neusoft Medical Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photon Counting CT Market Key Technology Landscape

The technological landscape of the Photon Counting CT market is defined by continuous innovation in detector physics and signal processing. Unlike traditional CT detectors, which use scintillators to convert X-rays into light before measuring the total energy deposited, PCCT detectors directly measure the X-ray photons and sort them into multiple energy bins. This direct conversion requires highly sensitive and stable semiconductor materials. Cadmium Zinc Telluride (CZT) is the leading material, offering high efficiency, good spectral resolution, and room-temperature operation, overcoming many of the limitations associated with earlier detector prototypes. The key technological focus is on enhancing the uniformity and thickness of these CZT wafers to handle the extremely high count rates necessary for clinical CT scanning, which can involve billions of photons per second.

Alongside the detector material science, the development of ultra-fast Application-Specific Integrated Circuits (ASICs) is paramount. These customized microchips are responsible for reading out the signal from each detector element (pixel) almost instantaneously, assigning an energy value, and binning the photon counts without spectral overlap or "pulse pile-up." Advancements in ASIC design are directly correlated with the achievable gantry rotation speed and spatial resolution of the PCCT system. Manufacturers are pushing the limits of integration density, placing processing capabilities closer to the detector plane to minimize electronic noise and maximize count rate linearity, ensuring accurate spectral information even in high-flux areas of the body.

Furthermore, proprietary reconstruction algorithms form a crucial part of the technological landscape. Since PCCT produces highly complex, multi-dimensional spectral data, sophisticated iterative and deep learning-based reconstruction techniques are essential to generate diagnostically relevant images while managing data complexity. These algorithms not only aim for fast image creation but also focus on accurately separating material components (e.g., bone from iodine) using the spectral data. The ability to perform K-edge imaging—exploiting the sharp absorption increase of specific elements at characteristic energy levels—requires highly tuned software that can precisely handle the spectral fingerprints of various contrast agents, ultimately expanding the utility of PCCT in functional and molecular imaging.

Regional Highlights

North America currently holds the largest share of the Photon Counting CT market, driven by several favorable factors. The United States, in particular, benefits from high healthcare expenditure, rapid adoption of advanced medical technologies, and the presence of numerous leading academic research institutions that serve as early adopters and validation centers for PCCT systems. Furthermore, favorable regulatory pathways and strong reimbursement policies for high-end diagnostic imaging procedures contribute significantly to market dominance. The region is characterized by intensive competitive activity among major OEMs and a substantial installed base of conventional CT scanners ready for technological upgrade.

Europe represents the second-largest market, exhibiting strong growth potential, particularly in Western European nations such as Germany, the UK, and France. These countries are characterized by mature, government-funded healthcare systems that prioritize dose reduction technologies and clinically proven innovations. European adoption is often accelerated by robust clinical evidence generated through pan-European research consortia and a regulatory environment (such as MDR) that supports the introduction of devices demonstrating superior patient safety and diagnostic accuracy. Focus areas include integrating PCCT into comprehensive cancer screening and cardiac centers of excellence.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapidly expanding healthcare infrastructure, increasing disposable incomes, and significant government investments in modernizing diagnostic facilities, particularly in China, Japan, and South Korea. While the initial penetration of PCCT has been concentrated in elite metropolitan hospitals, the vast patient population, coupled with the rising incidence of chronic diseases like cardiovascular ailments and cancer, creates immense demand for high-resolution, low-dose imaging solutions. Localization of manufacturing and increased efforts by multinational companies to enter these high-growth markets will further fuel regional expansion.

- North America: Market leader due to high R&D spending, established reimbursement structures, and early clinical integration of PCCT technology, particularly in academic centers in the US and Canada.

- Europe: Significant market share, driven by a strong emphasis on reducing radiation dose (ALARA principle) and integrating spectral data into routine clinical protocols across major diagnostic centers in Germany and the UK.

- Asia Pacific (APAC): Highest expected growth rate, fueled by massive infrastructure investment, growing public and private sector healthcare spending, and increasing demand for precision diagnostics in rapidly urbanizing countries like China and India.

- Latin America (LATAM): Emerging market characterized by selective adoption in major private hospital chains in Brazil and Mexico, focusing on systems that offer cost-effective, high-quality alternatives to older imaging modalities.

- Middle East & Africa (MEA): Growth concentrated in affluent Gulf Cooperation Council (GCC) countries, driven by government initiatives to establish world-class medical tourism and diagnostic capabilities requiring cutting-edge technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photon Counting CT Market.- Siemens Healthineers

- Philips Healthcare

- GE HealthCare

- Canon Medical Systems

- Samsung Healthcare

- United Imaging Healthcare

- Hologic

- Trixell

- Varex Imaging

- Dectris AG

- Moxtek

- Redlen Technologies

- Konica Minolta

- Fujifilm

- Shimadzu Corporation

- Carestream Health

- Analogic Corporation

- Medtronic

- Hitachi Medical Corporation

- Neusoft Medical Systems

Frequently Asked Questions

Analyze common user questions about the Photon Counting CT market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Photon Counting CT over conventional CT?

The primary technical advantage is the ability to measure the energy of individual X-ray photons directly and sort them into distinct energy bins, enabling spectral imaging and precise material decomposition. This contrasts with conventional CT, which measures only the total energy deposited.

How does PCCT improve diagnostic accuracy in complex diseases?

PCCT significantly improves diagnostic accuracy by providing quantitative spectral information, allowing clinicians to differentiate materials like calcium, iodine, and water, which is crucial for characterizing cardiac plaques, identifying subtle tumor boundaries, and monitoring targeted contrast agent uptake.

What are the main financial barriers impacting the widespread adoption of PCCT?

The primary financial barriers are the high initial capital expenditure associated with manufacturing advanced detector materials (like CZT/CdTe) and complex ASIC technology, leading to a significantly higher purchase price compared to established conventional CT systems.

In which clinical application is Photon Counting CT expected to show the greatest near-term impact?

Cardiology and Oncology are expected to see the greatest near-term impact. PCCT's ability to characterize coronary artery plaques and perform highly accurate tumor staging and monitoring using spectral analysis provides diagnostic advantages unmatched by previous CT generations.

How does AI contribute to the practical clinical use of Photon Counting CT?

AI is essential for the clinical viability of PCCT by accelerating complex spectral image reconstruction, automating material decomposition for quantitative analysis, and optimizing radiation dose protocols to maintain high image quality while ensuring patient safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager