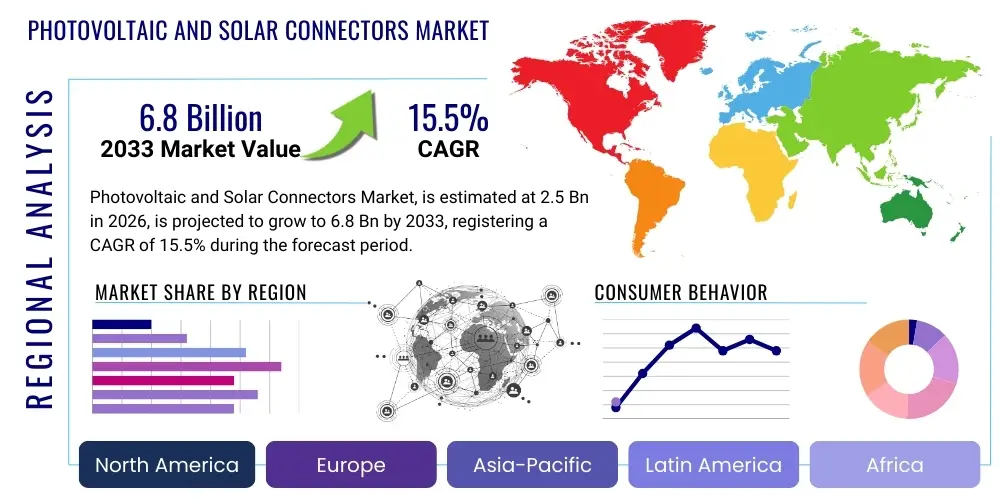

Photovoltaic and Solar Connectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441207 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Photovoltaic and Solar Connectors Market Size

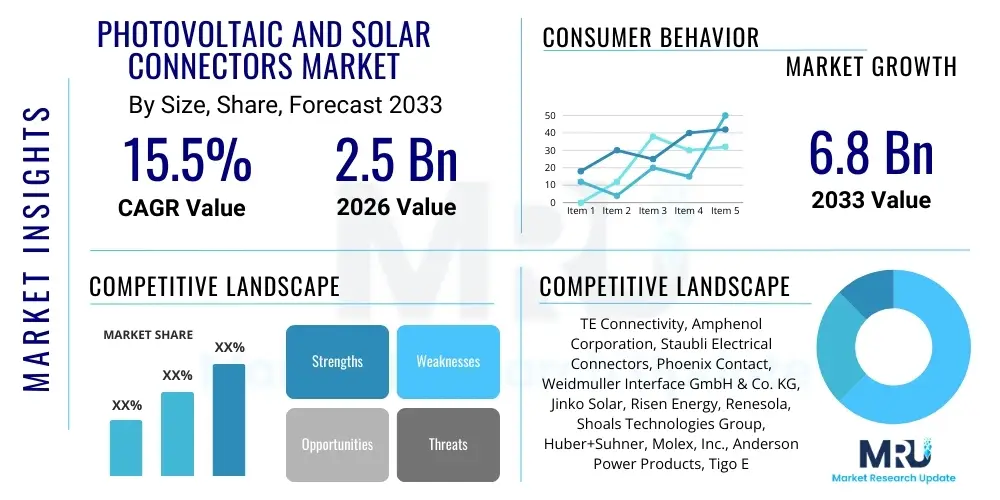

The Photovoltaic and Solar Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033.

Photovoltaic and Solar Connectors Market introduction

The Photovoltaic (PV) and Solar Connectors Market is integral to the global renewable energy infrastructure, providing the necessary electrical linkages within solar power systems, ranging from small residential installations to massive utility-scale solar farms. These connectors are specialized components designed to withstand harsh environmental conditions, including extreme temperature fluctuations, high UV exposure, moisture, and potential mechanical stress, ensuring the reliable and safe transmission of power generated by solar modules. The primary function of these connectors, predominantly standardized as MC4 or H4 types, is to allow quick, safe, and durable connections between solar panels, junction boxes, and inverters, thereby minimizing power loss and ensuring system efficiency over a minimum expected lifespan of 25 years. The market growth is inextricably linked to global governmental mandates and incentives aimed at accelerating the transition towards clean energy sources, driven by urgent climate change mitigation strategies and the decreasing levelized cost of solar electricity generation.

Product sophistication in the connector market is continuously advancing, focusing on enhancing current ratings, improving ingress protection (IP) standards—typically requiring IP67 or IP68—and implementing robust locking mechanisms that prevent accidental disconnection under load. Major applications span residential rooftop PV systems, commercial and industrial (C&I) installations, and utility-scale ground-mounted projects, each demanding different specifications regarding voltage and current handling capabilities. The critical benefits of employing high-quality PV connectors include enhanced system safety, simplified installation and maintenance procedures, reduced overall balance of system (BOS) costs through labor savings, and maximized power yield by reducing resistive losses at connection points. Furthermore, the adoption of higher voltage standards (e.g., 1500V DC) in utility-scale projects necessitates connectors capable of meeting stringent safety and performance criteria under elevated electrical stress, driving innovation in insulation materials and contact technologies.

Driving factors for the sustained market expansion include the significant reduction in photovoltaic panel manufacturing costs, making solar power highly competitive with traditional fossil fuels, and aggressive capacity expansion targets set by major economies like China, India, the United States, and the European Union. Furthermore, technological advancements such as the deployment of bifacial solar modules and floating PV systems (FPV) introduce new environmental challenges, requiring specialized, highly durable connectors resistant to humidity and potential water submersion. The increasing emphasis on grid stability and microgrids also necessitates reliable, fail-safe connection technologies that minimize downtime and maintenance requirements, cementing the critical role of solar connectors as non-negotiable components in the photovoltaic ecosystem. Supply chain resilience, material sustainability, and adherence to international safety certifications (such as UL and TUV) remain central themes defining competitive advantage in this specialized market segment.

Photovoltaic and Solar Connectors Market Executive Summary

The Photovoltaic and Solar Connectors Market is undergoing rapid expansion, primarily fueled by supportive regulatory frameworks, significant investments in utility-scale solar projects, and the accelerating global drive for decarbonization. Key business trends indicate a shift towards higher voltage (1500V DC) systems to optimize power transmission efficiency, necessitating the development of next-generation connectors with superior dielectric strength and thermal management properties. Consolidation within the connector manufacturing sector is also observable, as leading players invest heavily in automation and standardization to manage increasing volume demands and stringent quality control. Furthermore, the push for local manufacturing and diversification of supply chains, particularly in North America and Europe, is influencing market dynamics, moving away from sole reliance on Asia Pacific sources, though APAC retains dominant production and consumption shares due to large-scale deployment projects in countries like China and India.

Regionally, the Asia Pacific continues to lead the market, driven by governmental targets for renewable energy capacity addition and massive deployment of solar infrastructure, particularly in utility and large commercial segments. North America, propelled by policy mechanisms such as the Inflation Reduction Act (IRA) in the US, is experiencing robust growth, with a strong emphasis on domestic content requirements, spurring investments in local connector assembly and innovation tailored for high-performance modules. Europe demonstrates stable demand, focusing heavily on integrating solar PV into the existing power grid structure and promoting aesthetic, durable connectors for the dense residential rooftop segment. These regional dynamics reflect varied regulatory environments and solar installation preferences, influencing connector specifications, material selection, and pricing strategies across continents.

Segmentation trends highlight the dominance of standard multi-contact (MC4-compatible) connectors due to their industry ubiquity and ease of installation, but specialized connectors for emerging technologies, such as hybrid systems and microinverter applications, are showing the highest growth momentum. By application, the utility-scale segment commands the largest market share owing to the sheer volume of connectors required for gigawatt-scale projects. However, the residential and C&I segments are demonstrating faster proportional growth, driven by increasing consumer awareness and supportive net-metering policies. Material innovation is also critical, with manufacturers exploring alternatives to standard copper contacts to manage commodity price volatility while maintaining or enhancing conductivity and corrosion resistance necessary for long-term system reliability. The evolution towards smart connectors capable of integrating monitoring features represents a critical future growth vector.

AI Impact Analysis on Photovoltaic and Solar Connectors Market

User inquiries regarding AI's influence on the Photovoltaic and Solar Connectors Market frequently revolve around three core themes: How AI can enhance connector reliability and fault prediction; whether AI will optimize manufacturing processes, reducing costs and lead times; and the potential for AI-driven design optimization for next-generation solar farms. Users are primarily concerned about minimizing system downtime and extending the lifespan of solar assets, viewing AI as a tool for predictive maintenance rather than simple monitoring. The analysis confirms that AI is not directly used in the material composition or basic function of the connector itself, but profoundly impacts the ecosystem surrounding its deployment and long-term performance. Specifically, users anticipate AI algorithms analyzing large datasets of thermal and electrical performance across thousands of connection points to preemptively identify potential hot spots or degradation issues before they lead to complete failure, thereby shifting maintenance strategies from reactive to predictive and significantly improving system safety and return on investment.

The application of Artificial Intelligence (AI) and machine learning (ML) is fundamentally changing how solar power plants are designed, operated, and maintained, indirectly benefiting the performance and selection criteria of PV connectors. In the design phase, ML algorithms can analyze complex system layouts, environmental data, and material properties to simulate the optimal placement and specification of components, including connectors, to minimize electrical losses and maximize energy yield under specific site conditions. This sophisticated simulation allows manufacturers to stress-test connector designs virtually, ensuring they meet the durability requirements of optimized, high-density solar arrays. During the manufacturing process, AI-powered quality control systems utilize computer vision to inspect connector assembly and detect micro-defects at a much higher precision and speed than manual inspection, significantly improving the consistency and quality of mass-produced connectors, which is vital for long-term reliability in the field.

Operationally, AI integrated within solar monitoring systems uses algorithms to analyze vast streams of operational data—including current, voltage, and temperature data transmitted via adjacent sensors—to predict potential connector failures due to thermal cycling, poor installation, or material fatigue. By identifying anomalies indicative of poor contact resistance or arcing issues at the connection level, AI allows asset managers to schedule targeted maintenance actions. This capability not only prevents catastrophic failures, such as fires caused by sustained arcing, but also preserves the warranty of the solar modules and associated balance-of-system components. Thus, while AI does not change the physical structure of the connector, it elevates the importance of high-fidelity, data-ready PV systems, encouraging the adoption of premium, reliable connectors whose predictable performance can be modeled effectively by intelligent systems.

- AI-driven Predictive Maintenance: Utilizing thermal imaging and electrical data analysis to anticipate connector degradation and arcing faults before operational failure.

- Optimized Solar Farm Layout: ML algorithms determining optimal string configurations, reducing the total length of cable and number of connection points needed, influencing connector demand.

- Enhanced Quality Control in Manufacturing: Employing computer vision and automated inspection to ensure zero-defect production of high-volume PV connectors.

- Supply Chain Optimization: AI forecasting demand for specific connector types (e.g., 1500V vs. 1000V) based on projected project pipelines and regional policy shifts.

- Simulation and Design Testing: Accelerating the development of new connector prototypes by simulating electrical and environmental stresses accurately, reducing physical prototyping time.

DRO & Impact Forces Of Photovoltaic and Solar Connectors Market

The dynamics of the Photovoltaic and Solar Connectors Market are governed by a robust combination of drivers, significant restraints, compelling opportunities, and powerful external impact forces that collectively shape strategic planning and investment decisions. The primary drivers are undoubtedly the ambitious global renewable energy targets and the substantial governmental subsidies and tax credits, such as the Investment Tax Credit (ITC) extension in the US and equivalent Feed-in Tariff (FiT) schemes globally, which make solar energy economically viable and highly scalable. These policies ensure a continuous pipeline of large-scale solar projects, which demand vast quantities of reliable, certified connectors. Furthermore, the global commitment to phasing out coal and transitioning to decentralized energy generation systems significantly enhances the market for connectors used in small-scale distributed generation and microgrid applications, expanding the market beyond traditional utility projects.

Conversely, the market faces several critical restraints. Standardization challenges remain a persistent issue; although MC4 connectors dominate, minor variations among manufacturers and the proliferation of non-certified counterfeit products pose significant risks to system integrity and safety. Supply chain volatility, particularly concerning critical materials like specialized polymers, copper, and silver used in contacts, leads to unpredictable pricing and potential lead time delays, pressuring manufacturers' profit margins. Moreover, the initial high cost associated with premium, highly durable connectors, necessary for a 25-year lifespan, can sometimes lead installers in highly price-sensitive markets to opt for lower-quality, non-certified alternatives, which compromises long-term reliability and market reputation. Addressing these standardization and quality control issues is paramount for sustainable market growth.

Opportunities for expansion are abundant, particularly in emerging market segments such as floating PV (FPV), which require highly specialized, water-resistant connectors, and integrated Building-Integrated Photovoltaics (BIPV), where aesthetic and highly customized connection solutions are needed. The ongoing technological migration towards high-voltage (1500V DC) systems for improved efficiency in utility-scale deployments presents a substantial opportunity for manufacturers investing in advanced material science and testing capabilities required for enhanced safety standards. Finally, the increasing demand for energy storage solutions (Battery Energy Storage Systems, BESS) creates a synergistic market, as these systems rely on similar, high-reliability connectors for system integration, offering manufacturers a pathway for product diversification and cross-selling capabilities. Impact forces include stringent environmental regulations requiring halogen-free and recyclable materials, which necessitate immediate R&D investment, and geopolitical tensions that impact global trade flows and raw material sourcing, demanding increased regional manufacturing capacity.

Segmentation Analysis

The Photovoltaic and Solar Connectors Market is comprehensively segmented based on product type, application, material, and voltage rating, allowing for precise market analysis and strategic targeting. The segmentation by product type typically differentiates between standard multi-contact connectors (e.g., MC4), which form the foundational component of most installations, specialized branch connectors (Y-connectors) used for parallel wiring of modules, and highly customized connectors for microinverter and power optimizer integration. Analyzing these segments helps in understanding the maturity and growth dynamics of various connection methods in the field. The overarching trend points towards innovation in quick-fit and tool-less installation designs, minimizing manual labor costs on site.

From an application perspective, the segmentation reveals the diverse end-use spectrum, primarily categorized into Utility-Scale (large ground-mounted solar farms), Commercial and Industrial (C&I, often rooftop or carport installations), and Residential (small rooftop systems). The utility-scale segment dominates in volume due to the massive capacity additions in countries like China and India, but the residential and C&I sectors are demonstrating faster growth rates due to decentralized energy adoption and attractive net-metering policies globally. This application diversity means connector requirements vary significantly; utility projects prioritize high voltage and current capacity with extreme durability, while residential applications may emphasize aesthetic design and ease of installation.

Furthermore, critical segmentation factors include voltage rating (1000V and 1500V DC) and material composition. The transition to 1500V systems is a major market driver, increasing the market share for connectors certified for this higher safety standard. Material segmentation often focuses on the contact element (copper alloys or specialized treated metals for corrosion resistance) and insulation jacket material (UV-resistant, flame-retardant polymers). Understanding these segments is crucial for manufacturers to align their product portfolios with evolving industry standards, particularly those concerning fire safety, environmental resilience, and long-term performance guarantees.

- By Product Type:

- Standard Single-Pole Connectors (MC4, H4 compatible)

- Branch Connectors (Y-Connectors, T-Connectors)

- Panel-Mount Connectors

- In-line Fuses and Protective Connectors

- By Voltage Rating:

- 1000V DC

- 1500V DC

- By Material:

- Contact Material (Copper, Tin-Plated Copper, Silver-Plated Copper)

- Insulation Material (PPO, PC/ABS, UV-Stabilized Polymers)

- By Application:

- Utility-Scale

- Commercial & Industrial (C&I)

- Residential

- Floating PV (FPV) and Specialized Systems

Value Chain Analysis For Photovoltaic and Solar Connectors Market

The value chain of the Photovoltaic and Solar Connectors Market is characterized by a high degree of integration between raw material procurement and final system integration, highlighting the necessity for robust supply chain management. The chain begins with the upstream segment, dominated by suppliers of specialized raw materials, including high-pgrade copper and copper alloys for conductive contacts, and engineering thermoplastics like PPO (Polyphenylene Oxide) or specialized polyamides for the insulator bodies, which must offer excellent UV resistance and flame retardancy. The quality and stable pricing of these raw materials directly influence the manufacturing cost and, critically, the long-term reliability of the final connector product. Fluctuations in global commodity markets, particularly copper, pose a constant challenge to upstream planning, compelling manufacturers to lock in long-term procurement contracts or explore lightweight and cost-effective alternatives while maintaining electrical performance standards.

The core segment involves the specialized manufacturing and assembly of the connectors, typically performed by established electrical component manufacturers or dedicated PV connector specialists. This stage includes precision stamping, plating of contacts (e.g., silver or tin), injection molding of the insulator housing, and final automated assembly. Distribution channels play a critical role in bridging the gap between manufacturers and the highly fragmented downstream segment. Direct distribution is common for large-volume orders placed by major Engineering, Procurement, and Construction (EPC) companies executing utility-scale projects, allowing for tailored technical specifications and volume pricing. Indirect channels, involving authorized distributors and wholesalers specialized in electrical and solar components, cater to the smaller, diverse residential and C&I installers, providing localized inventory and technical support necessary for quick deployment.

The downstream segment encompasses the final end-users and integrators: solar module manufacturers (who sometimes integrate proprietary connectors), EPC contractors, and independent solar installation companies. EPCs are the primary purchasers of solar connectors for utility projects, integrating them into the overall balance of system (BOS) architecture. The successful performance of the connector relies heavily on proper installation practices; therefore, manufacturers often provide extensive training and certification programs to ensure correct crimping and mating procedures are followed in the field. The entire value chain is heavily regulated by certification bodies like UL, TUV, and IEC, ensuring that all components, from raw materials to final assembly, meet global safety and performance benchmarks, thereby impacting material sourcing, manufacturing protocols, and market access strategies for both direct and indirect suppliers.

Photovoltaic and Solar Connectors Market Potential Customers

The potential customer base for Photovoltaic and Solar Connectors is diverse yet concentrated around key entities responsible for the design, construction, and maintenance of solar power generation assets. Engineering, Procurement, and Construction (EPC) firms represent the largest volume buyers, as they manage the execution of utility-scale and large commercial solar projects globally. These firms prioritize connectors that offer extreme durability, high current and voltage ratings (especially 1500V), easy installation features to reduce labor time, and verifiable international certifications, ensuring project financiers and owners long-term asset security and warranty adherence. Their purchasing decisions are highly influenced by total system costs (BOS), requiring a balance between premium quality and competitive pricing for bulk orders.

Solar Module Manufacturers constitute a secondary but equally critical customer segment. While some module manufacturers produce their own proprietary connectors, the majority rely on established connector specialists for high-quality, standardized components to integrate into their junction boxes and pre-wired systems. The trend towards higher-efficiency panels, such as bifacial and half-cut cell modules, demands specialized junction boxes and corresponding connectors that can manage increased thermal loads and maintain reliability over the extended system life. Furthermore, independent solar installers, serving the residential and small commercial sectors, form a highly fragmented yet high-growth customer base. These installers rely heavily on local distributors for standardized, readily available, and user-friendly connectors that minimize installation time and potential wiring errors on residential rooftops.

Finally, utility companies and Independent Power Producers (IPPs) are the ultimate asset owners, and while they may not purchase connectors directly, their stringent specifications and long-term maintenance requirements dictate the connector quality standards enforced upon the EPCs and module manufacturers. These end-users demand fail-safe components because connector failure is a major source of system downtime and fire risk. Consequently, maintenance and retrofit markets also represent a growing customer base, wherein asset management firms purchase replacement connectors to upgrade aging solar farms or replace failed proprietary components with standardized, high-reliability alternatives to enhance system performance and safety margins.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, Staubli Electrical Connectors, Phoenix Contact, Weidmuller Interface GmbH & Co. KG, Jinko Solar, Risen Energy, Renesola, Shoals Technologies Group, Huber+Suhner, Molex, Inc., Anderson Power Products, Tigo Energy, LAPP Group, Chint Group, Zhejiang Yuankai Electrical Co. Ltd., BizLink Technology, Heyco Products Inc., Santon (Schaltanlagen-technik), Tonglin Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Photovoltaic and Solar Connectors Market Key Technology Landscape

The technological landscape of the Photovoltaic and Solar Connectors Market is primarily driven by the need for enhanced safety, reduced installation time, and superior long-term performance under extreme environmental conditions. A fundamental technological advancement involves the increasing adoption of higher voltage capacity, moving predominantly from 1000V DC to 1500V DC systems, particularly in utility-scale projects. This transition requires connectors to employ advanced insulation materials with higher dielectric strength and robust internal designs to prevent corona discharge and arcing, ensuring operational safety and efficiency over the system's lifespan. Manufacturers are investing heavily in specialized sealing technologies, often achieving IP68 ratings, which are mandatory for resilience against moisture ingress, a common cause of connector failure and potential fire hazards in PV arrays. Innovations also focus on the contact technology itself, favoring highly reliable, low-resistance contact systems, often utilizing spring-loaded or multi-point contacts with silver plating, to maintain consistent electrical connection despite thermal expansion and contraction cycles.

Another significant technological shift is the introduction of simplified and labor-saving connection mechanisms. Push-in technology, for instance, is gaining traction over traditional crimp contacts, offering quicker, tool-less field installation while maintaining connection integrity. This innovation addresses the rising cost of skilled labor and accelerates project deployment schedules, particularly crucial in fast-paced commercial and residential installations. Furthermore, in response to growing concerns over system safety and arc faults, there is increasing integration of intelligence into connection points. Although full smart connectors are nascent, advanced solutions include integrated diagnostics or the capability to interface with monitoring systems to report critical data like temperature anomalies or voltage drops directly at the string level. This technological evolution transforms the connector from a passive component into a critical data node.

Material science remains at the forefront of connector innovation. Manufacturers are continually researching and implementing new polymers for the housing that offer superior UV stability, extreme temperature tolerance (both high and low), and enhanced fire resistance (meeting UL 94 V-0 standards). The demand for halogen-free and environmentally sustainable materials is also driving polymer reformulation efforts. For the metallic contacts, advancements focus on proprietary coatings and highly conductive copper alloys that resist galvanic corrosion, a common issue when different metals are used in close proximity or exposed to moisture. The ability to guarantee performance longevity and maintain low contact resistance (typically less than 0.3 mOhm) for two decades or more is the ultimate measure of technological success in this market, requiring rigorous adherence to IEC 62852 and UL 6703 standards throughout the design and manufacturing lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for PV connectors, primarily driven by massive utility-scale deployment programs in China, which leads the world in solar capacity additions, and India, with ambitious national targets. Government support, coupled with the rapid expansion of solar manufacturing capabilities across the region, ensures sustained high demand. Connector standardization and managing component supply chain stability are key market characteristics in this region.

- North America (NA): Driven by robust legislative support, notably the U.S. Inflation Reduction Act (IRA), North America is witnessing significant market growth, particularly in the utility and C&I segments. The regional focus is heavily on high-quality, certified connectors (UL standards are paramount) and 1500V systems. There is an increasing trend toward localized manufacturing and high-performance products tailored for extreme weather conditions and specific safety codes.

- Europe: Europe offers a mature, stable market characterized by high standards for quality and safety, driven by the EU Green Deal mandates. Demand is strong in the residential and commercial sectors, where aesthetic considerations and compliance with strict fire safety regulations (e.g., VDE, TUV) are critical. The proliferation of BIPV and BESS systems requires specialized, highly reliable connection solutions.

- Latin America (LATAM): Growth in LATAM is strong, spearheaded by Brazil, Chile, and Mexico, focusing predominantly on large-scale utility projects leveraging high solar irradiation levels. Connector adoption here is sensitive to price, but increasing regulatory enforcement is gradually pushing demand toward certified, quality products to mitigate long-term maintenance costs and project risks.

- Middle East and Africa (MEA): This region is emerging as a significant market due to immense solar resource potential and large, planned giga-projects (like those in Saudi Arabia and the UAE). The demand focuses on connectors that can withstand extreme heat, dust, and high UV radiation, requiring specialized, highly durable insulation materials and IP68 protection, making product resilience a primary purchasing criterion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Photovoltaic and Solar Connectors Market.- TE Connectivity

- Amphenol Corporation

- Staubli Electrical Connectors

- Phoenix Contact

- Weidmuller Interface GmbH & Co. KG

- Shoals Technologies Group

- Huber+Suhner

- Molex, Inc.

- Anderson Power Products

- LAPP Group

- Chint Group

- Zhejiang Yuankai Electrical Co. Ltd.

- BizLink Technology

- Heyco Products Inc.

- Santon (Schaltanlagen-technik)

- Tonglin Technology

- Jinko Solar (Integrated Solutions)

- Risen Energy (Integrated Solutions)

- Renesola (Integrated Solutions)

- Tigo Energy (Module-Level Power Electronics Interface)

Frequently Asked Questions

Analyze common user questions about the Photovoltaic and Solar Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial performance factor for PV solar connectors?

The most crucial performance factor is sustained low contact resistance over the system's 25-year lifespan, ensuring minimal power loss and preventing overheating (hot spots) that could lead to system failure or arc faults. Reliability under extreme environmental stress (UV, thermal cycling, moisture) is paramount for longevity and safety.

Why are 1500V DC connectors increasingly replacing 1000V connectors in new solar projects?

The transition to 1500V DC systems allows for longer strings of solar panels, reducing the number of strings, trenching, wiring, and balance of system (BOS) components like combiner boxes. This significantly enhances system efficiency, reduces electrical losses, and lowers the overall Levelized Cost of Energy (LCOE) for utility-scale installations.

How does the quality of solar connectors affect fire safety in a photovoltaic system?

Poor quality or incorrectly installed connectors are a leading cause of arc faults in PV systems. Connectors must maintain a tight, low-resistance seal and connection. Certified connectors are designed with fire-retardant, UV-stable materials and specific locking mechanisms to meet stringent international standards (e.g., IEC, UL) to mitigate fire risk effectively.

Which geographic region dominates the demand and production of PV solar connectors?

The Asia Pacific (APAC) region currently dominates both the production and consumption of PV solar connectors, driven primarily by massive solar capacity additions and robust manufacturing ecosystems in China and India. However, North America and Europe are rapidly increasing localized manufacturing capacity due to policy incentives.

What is the role of AI in improving the long-term reliability of solar connector installations?

AI is utilized in predictive maintenance systems that analyze thermal and electrical data from solar arrays to identify subtle anomalies, such as rising temperatures at connection points, indicating potential connector degradation or installation flaws. This allows asset managers to proactively replace or repair faulty connectors before catastrophic failure occurs, maximizing asset uptime and safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager