Physical Security Information Management (PSIM) Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442921 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Physical Security Information Management (PSIM) Software Market Size

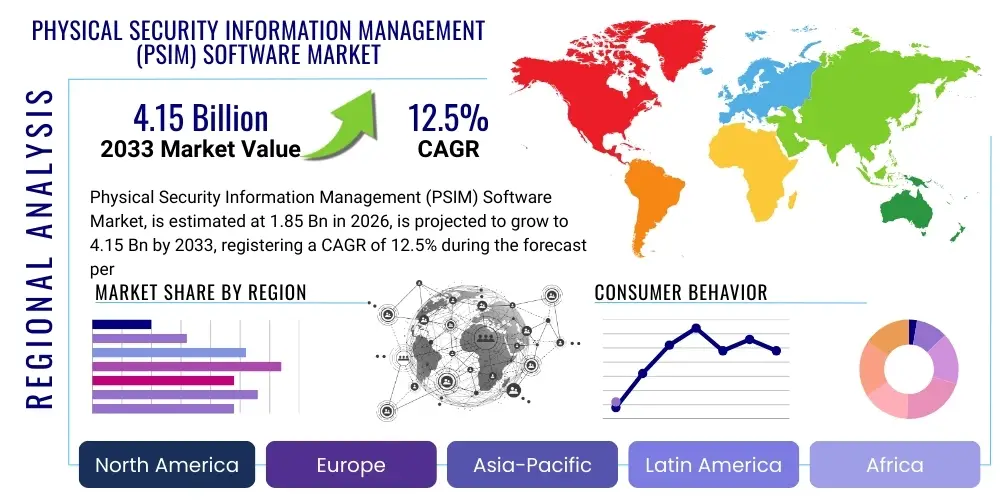

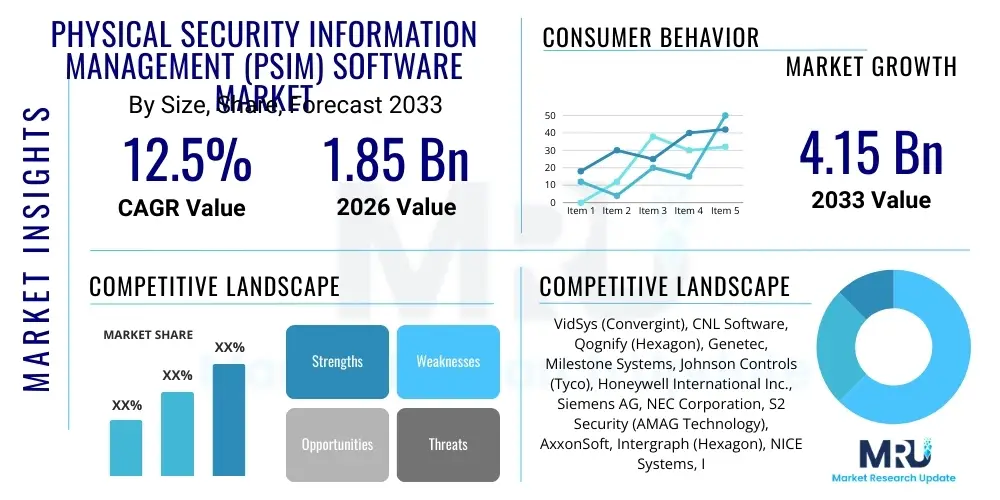

The Physical Security Information Management (PSIM) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 4.15 Billion by the end of the forecast period in 2033.

Physical Security Information Management (PSIM) Software Market introduction

The Physical Security Information Management (PSIM) Software Market encompasses advanced solutions designed to integrate and manage various disparate physical security systems, such as video surveillance, access control, alarms, sensors, and situational awareness tools, into a unified platform. This integration enables organizations to achieve holistic situational awareness, streamline operational workflows, and automate response protocols to security incidents. PSIM software acts as a centralized command and control system, enhancing decision-making speed and efficiency during critical events, thereby transforming reactive security processes into proactive, intelligence-driven strategies. Key driving factors include the escalating complexity of security threats, stringent regulatory compliance mandates, and the widespread adoption of smart city initiatives demanding integrated surveillance infrastructure.

The core product description of PSIM software revolves around its ability to correlate data from multiple subsystems into a single, intuitive interface, often featuring geospatial mapping and standard operating procedure (SOP) guidance. Major applications span high-security environments, including critical infrastructure (power plants, utilities), governmental institutions, large-scale commercial facilities, and transportation hubs. The primary benefits realized by end-users include reduced operational costs, improved incident response times, minimized human error, and enhanced regulatory adherence through comprehensive auditing and reporting capabilities. As organizations shift towards comprehensive risk management frameworks, PSIM solutions are becoming indispensable tools for managing converged IT and OT security landscapes.

Key market drivers fueling this growth include the rapid expansion of the Internet of Things (IoT) in security environments, necessitating a platform capable of managing millions of sensor data points, alongside the increasing demand for real-time risk visualization. Furthermore, the global rise in sophisticated physical threats, ranging from corporate espionage to active shooter scenarios, pushes large enterprises and government entities to invest heavily in integrated security platforms that offer automated incident mitigation. The transition from legacy, siloed security systems to unified, intelligent management platforms represents a fundamental shift that underpins the market's robust growth trajectory, further boosted by governmental initiatives promoting resilience and critical asset protection.

Physical Security Information Management (PSIM) Software Market Executive Summary

The PSIM market demonstrates strong momentum, driven primarily by evolving regulatory environments and technological advancements in sensor fusion and data analytics. Business trends highlight a significant shift towards cloud-based and hybrid deployment models, offering scalability and reduced initial investment costs, particularly appealing to small and medium-sized enterprises (SMEs) previously deterred by the high upfront costs of traditional on-premise PSIM solutions. Additionally, strategic mergers and acquisitions among key market players are consolidating expertise in niche areas like video analytics and cybersecurity integration, aiming to offer more comprehensive security orchestration capabilities. The market is increasingly characterized by platform standardization, ensuring interoperability between diverse security products and third-party systems, which is crucial for maximizing the utility of complex deployments.

Regionally, North America maintains its dominance due to early adoption of advanced security technologies, robust government spending on national security infrastructure, and stringent compliance requirements in sectors like finance and healthcare. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive investments in smart city projects, rapid industrialization, and heightened security concerns in emerging economies such as China and India. European growth is steady, driven by regulatory mandates like the NIS Directive and GDPR, which emphasize data protection and resilient operational continuity, pushing organizations to adopt robust, centralized management systems that minimize incident downtime and comply with data sovereignty laws.

Segment trends indicate that the services component—including implementation, maintenance, and consulting—is growing faster than the software segment itself, reflecting the complexity of integrating highly customized security ecosystems and the need for specialized expertise in migrating legacy systems. Application-wise, the critical infrastructure sector remains the largest consumer of PSIM software, given the high consequences of security breaches in power grids, oil and gas facilities, and water treatment plants. Meanwhile, the transportation segment, particularly international airports and major metropolitan rail networks, shows accelerated adoption driven by the need for seamless, multi-agency coordination and real-time threat neutralization across vast, dispersed operational environments.

AI Impact Analysis on Physical Security Information Management (PSIM) Software Market

Common user inquiries concerning AI in PSIM solutions primarily focus on the transition from reactive incident management to predictive threat identification, the scalability of deep learning algorithms across massive sensor networks, and the integration costs associated with retrofitting existing systems with AI capabilities. Users are highly interested in how AI, particularly machine learning (ML) and computer vision, can automate complex decision-making processes, reduce reliance on human operators for repetitive tasks, and drastically minimize false alarm rates—a notorious challenge in traditional PSIM deployments. Key concerns revolve around data privacy, algorithmic bias in facial recognition and behavior analysis, and the computational resources required to run sophisticated AI models at the edge, ensuring low latency in mission-critical applications.

The integration of Artificial Intelligence (AI) fundamentally transforms the value proposition of PSIM, moving it beyond mere integration and visualization toward true intelligence and automation. AI algorithms enhance situational awareness by analyzing massive datasets from CCTV feeds, access logs, and environmental sensors in real-time, identifying subtle anomalies and patterns indicative of imminent threats long before they escalate. This predictive capability significantly shifts the security paradigm from detecting events after they occur to proactive intervention, optimizing resource allocation by intelligently prioritizing alerts based on contextual severity and historical risk profiles. Furthermore, AI facilitates the automated generation of dynamic standard operating procedures (SOPs) tailored to specific emerging threat scenarios, ensuring rapid and standardized responses across large organizations.

AI also plays a critical role in optimizing the operational efficiency of PSIM systems through intelligent resource management and system health monitoring. Machine learning models can predict equipment failure or system degradation within the security network, enabling preemptive maintenance that ensures maximum system uptime and reliability. This predictive maintenance, coupled with AI-enhanced video and behavioral analytics, dramatically improves the accuracy of threat detection, drastically reducing the labor hours traditionally spent sifting through voluminous log data and false alarms. This enhancement of operational reliability and reduction of human intervention positions AI as the primary evolutionary catalyst for the next generation of PSIM platforms, making them essential components of autonomous security operations centers (SOCs).

- AI enables predictive threat identification through pattern recognition and anomaly detection.

- Reduces false alarms by filtering and prioritizing alerts based on contextual data and severity.

- Automates real-time incident response using machine learning to trigger dynamic SOPs.

- Enhances video surveillance and access control through advanced computer vision capabilities (e.g., facial and object recognition).

- Optimizes system performance and reliability via predictive maintenance of integrated security components.

- Facilitates intelligent data correlation across previously siloed security subsystems.

DRO & Impact Forces Of Physical Security Information Management (PSIM) Software Market

The Physical Security Information Management (PSIM) market is profoundly shaped by a confluence of driving forces, inherent constraints, and emerging opportunities, collectively defining its trajectory and impact. Key drivers include the escalating global threat landscape encompassing terrorism, vandalism, and sophisticated corporate malfeasance, compelling organizations to adopt unified security platforms capable of coordinating responses across multiple domains. Furthermore, the proliferation of IoT devices and the resulting data deluge necessitate a centralized management system like PSIM to process and make sense of massive, diverse data streams. Conversely, the high initial implementation cost, the complexity of integrating heterogeneous legacy systems, and ongoing challenges related to data privacy and regulatory fragmentation across geographies serve as significant restraints impeding broader market adoption, especially among smaller entities or those with limited IT budgets.

Opportunities in the market are primarily centered around the convergence of physical and cybersecurity (P-SOCs), allowing PSIM platforms to incorporate IT security alerts and vulnerabilities into their risk assessment matrices, offering a truly holistic enterprise security overview. The growing demand for cloud-based PSIM solutions, offering subscription models and greater scalability, presents a vast untapped market, particularly for service providers capable of delivering Security-as-a-Service (SaaS). Impact forces are primarily driven by rapid technological evolution; the increasing sophistication of AI and ML integration is enhancing predictive capabilities, while the necessity for open standards and robust API frameworks is pressuring vendors to abandon proprietary protocols in favor of greater interoperability and ease of customization, impacting vendor dominance and market access.

The impact forces determine the competitive landscape and technological investment priorities. Regulatory mandates, such as critical infrastructure protection standards (CIPS) and industry-specific regulations (e.g., in finance or pharmaceuticals), act as external catalysts mandating the adoption of audited, comprehensive security management systems. The shift towards mobile and remote monitoring capabilities, facilitated by robust network infrastructure, also acts as a profound impact force, requiring PSIM solutions to be accessible and fully functional on diverse devices and across geographically dispersed operational sites. Successful vendors must navigate these forces by emphasizing seamless integration, flexible deployment, and clear demonstrable return on investment (ROI) derived from efficiency gains and minimized liability risk.

Segmentation Analysis

The Physical Security Information Management (PSIM) Software Market is segmented comprehensively based on component, deployment type, application, and end-user, providing a granular view of market dynamics and adoption patterns across diverse operational environments. Analyzing these segments is crucial for understanding specific consumer needs, technology preferences, and regional investment hot spots. The component segmentation clearly illustrates the growing reliance on professional services, highlighting the complexity and customization required for successful PSIM implementation, contrasting with the fundamental software licensing revenue. Deployment type segmentation reveals a critical migration trend from traditional on-premise solutions towards flexible cloud and hybrid models, reflecting broader enterprise IT strategies focused on agility and cost optimization.

Application segmentation demonstrates where the critical security priorities lie globally, with critical infrastructure consistently demanding the highest level of integration and redundancy due to the catastrophic potential of system failure or security breach. This segment’s requirements often dictate the technological standards for the entire market, pushing for higher reliability and advanced analytical capabilities. The end-user segmentation, differentiating between Large Enterprises and SMEs, shows that while large organizations currently dominate market revenue due to extensive infrastructure and higher security budgets, SMEs represent a high-growth opportunity for vendors offering affordable, scalable, and easy-to-deploy cloud solutions tailored to simpler organizational structures and decentralized security needs.

Overall market segmentation highlights the increasing complexity required from PSIM platforms, necessitating modules specifically focused on compliance, audit trails, and multi-agency coordination. As the scope of physical security broadens to include environmental monitoring and cybersecurity threat correlation, the software component is evolving rapidly to handle multi-domain integration. The future growth of the market is intrinsically linked to the successful penetration of flexible deployment models into the SME sector and the continuous technological refinement of AI-powered analytics to serve the demanding, high-stakes requirements of critical infrastructure and government applications.

- By Component:

- Software

- Services (Consulting, Integration & Installation, Maintenance & Support)

- By Deployment Type:

- On-Premise

- Cloud (SaaS)

- Hybrid

- By Application:

- Critical Infrastructure (Energy, Utilities, Water)

- Government and Defense

- Transportation (Aviation, Maritime, Rail)

- Commercial (Retail, Real Estate, Banking, Financial Services, and Insurance (BFSI))

- Industrial and Manufacturing

- Healthcare and Education

- By End-User Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Physical Security Information Management (PSIM) Software Market

The value chain of the Physical Security Information Management (PSIM) software market begins with upstream component providers, primarily focused on hardware manufacturing (sensors, cameras, access control readers) and foundational software providers (database management, operating systems, and core analytical engines). This upstream stage is characterized by intense R&D investment focused on miniaturization, enhanced sensor fidelity, and improved data throughput capabilities, driven by the increasing demands of high-definition video and massive IoT deployments. Key PSIM software vendors then take these foundational technologies, developing proprietary integration platforms and sophisticated correlation engines that define the core intelligence and functionality of the PSIM solution. Success in this stage depends on achieving maximum interoperability and building robust, scalable software architectures capable of real-time processing.

Midstream activities primarily involve System Integrators (SIs) and Value-Added Resellers (VARs), who play the most crucial role in the deployment phase. Given the highly customized nature of PSIM implementations—which must interface with legacy systems, unique facility layouts, and specific organizational SOPs—SIs are essential for tailoring the software, performing complex installation, configuration, and integration services. The distribution channel is complex, featuring a mix of direct sales to large governmental and critical infrastructure clients, and indirect channels relying on certified partners and distributors for smaller commercial projects and regional market penetration. The profitability of the midstream segment is heavily influenced by the availability of specialized, certified technical expertise necessary to handle multi-vendor security ecosystems effectively.

The downstream segment focuses on the end-user adoption and ongoing support. This phase includes the physical security departments, IT teams, and executive management who utilize the system for operational security, risk management, and compliance auditing. Post-sales services, including continuous technical support, software updates, maintenance contracts, and periodic system audits, constitute a significant and growing revenue stream. Customer retention hinges on the vendor's ability to provide proactive system health monitoring and seamless integration of new security technologies as they emerge. Direct channels are preferred for high-value strategic accounts to ensure quality control, while indirect channels leverage regional partners for wider geographical reach and localized support capabilities.

Physical Security Information Management (PSIM) Software Market Potential Customers

The primary customers and end-users of Physical Security Information Management (PSIM) software are organizations that possess extensive physical infrastructure, handle critical operational processes, and face high regulatory scrutiny or elevated security threats. This includes governmental agencies at federal, state, and local levels, particularly those responsible for national defense, law enforcement, and emergency management. Their need stems from the requirement for seamless inter-agency communication, rapid mobilization, and holistic command and control over complex and widely distributed assets during crises. Furthermore, the critical infrastructure sector—encompassing energy generation, oil and gas pipelines, transportation networks (airports, ports), and utilities—represents a foundational customer base due to the high stakes involved in protecting these essential services from physical and cyber threats.

In the commercial sector, large enterprises, particularly those in BFSI (Banking, Financial Services, and Insurance), high-tech manufacturing, and global retail chains, are significant consumers. BFSI institutions utilize PSIM to manage branch security, centralize alarm monitoring across diverse geographic locations, and ensure compliance with strict financial regulations regarding physical asset protection and data center security. Multinational corporations leverage PSIM to standardize security protocols across their global real estate portfolios, enabling centralized monitoring and consistent incident handling regardless of local operational variations. The increasing interconnectedness of corporate operations mandates a single pane of glass view, which PSIM inherently provides, making it attractive for Chief Security Officers (CSOs) aiming for operational uniformity and efficiency.

Emerging customer segments include large university campuses and major healthcare systems, which face unique challenges related to public safety, access control management for high-value research assets, and emergency response coordination within sprawling, multi-building environments. While SMEs traditionally lagged in adoption due to cost barriers, the rise of cloud-based PSIM solutions is transforming this segment into a viable and accelerating market opportunity. These smaller organizations, though possessing fewer assets, still require centralized visibility and standardized procedures to manage increasingly sophisticated threats and comply with localized safety regulations efficiently and affordably, thereby broadening the customer base significantly beyond traditional high-security applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.15 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VidSys (Convergint), CNL Software, Qognify (Hexagon), Genetec, Milestone Systems, Johnson Controls (Tyco), Honeywell International Inc., Siemens AG, NEC Corporation, S2 Security (AMAG Technology), AxxonSoft, Intergraph (Hexagon), NICE Systems, ISM Security, Vidsys, SureView Systems, LENSEC, Verint Systems, Bosch Security and Safety Systems, and Cisco Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Physical Security Information Management (PSIM) Software Market Key Technology Landscape

The Physical Security Information Management (PSIM) software market is defined by several converging technology stacks that enhance its functionality and effectiveness. Foremost among these is the integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which are crucial for moving beyond simple data aggregation to sophisticated threat analysis and predictive modeling. Specifically, deep learning models are applied to video analytics for highly accurate object detection, behavioral anomaly identification, and minimizing false positives, thereby vastly improving the efficiency of surveillance operations. The use of open Application Programming Interfaces (APIs) and standardized protocols (like ONVIF) is paramount, ensuring seamless integration with thousands of third-party hardware devices and legacy security systems, a foundational requirement for any modern PSIM platform aiming for market acceptance.

Another significant technological focus is the adoption of robust cloud and hybrid architectures. Vendors are increasingly offering PSIM functionalities through Software-as-a-Service (SaaS) models, leveraging the scalability and reduced infrastructure requirements of the cloud environment. This shift allows for faster deployment, easier updates, and better support for geographically dispersed facilities, crucial for multinational corporations and wide-area monitoring projects like smart cities. Furthermore, mobile command capabilities, utilizing secure wireless networks and hardened mobile applications, are essential, enabling security personnel and first responders to access real-time situational data, SOPs, and system controls remotely, dramatically reducing incident response times outside the traditional command center.

The convergence of IT and Operational Technology (OT) security is also a critical technological trend, requiring PSIM platforms to incorporate sophisticated data management tools and cybersecurity risk assessment modules. Technologies such as blockchain are beginning to be explored for enhancing the integrity and trustworthiness of audit trails and security logs, ensuring that incident data remains immutable for forensic purposes. Moreover, the user interface (UI) and user experience (UX) are being significantly redesigned, incorporating geospatial information systems (GIS) for accurate mapping, real-time 3D visualization, and intuitive dashboards to simplify the complexity of managing multi-layered security protocols, ensuring operators can make informed decisions under high-stress conditions with minimal cognitive load.

Regional Highlights

The Physical Security Information Management (PSIM) Software Market exhibits distinct adoption patterns and growth drivers across major geographic regions, reflecting varied economic maturity, regulatory landscapes, and security spending priorities. North America, encompassing the United States and Canada, currently holds the largest market share, characterized by high spending on sophisticated security infrastructure, particularly within the government (Homeland Security, defense) and highly regulated commercial sectors (BFSI, technology). The region benefits from early and widespread technological adoption, strict compliance mandates (e.g., NERC CIP standards for utilities), and the presence of numerous key industry vendors and innovators. Investment here is driven by modernization projects aimed at integrating aging infrastructure with AI-driven predictive capabilities.

Europe demonstrates steady, mature growth, strongly influenced by pan-European regulations such as the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive, which necessitate robust, auditable security management solutions. Western European nations, including Germany, the UK, and France, are key adopters, focusing heavily on critical infrastructure protection and smart city developments that require centralized, integrated command solutions. The market here is focused on ensuring data sovereignty and integrating security platforms with broader organizational resilience strategies, often prioritizing solutions that offer high levels of customization and compliance reporting specific to national standards, alongside cross-border operational coordination requirements.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is primarily attributed to massive urbanization trends, ambitious smart city initiatives in countries like China, India, and Singapore, and heavy governmental investment in security modernization and public safety systems. Rapid industrialization and the establishment of new manufacturing hubs, ports, and commercial zones necessitate integrated security management from the ground up. While China and South Korea lead in terms of technological deployment volume, emerging economies are increasingly adopting scalable, cloud-based PSIM solutions to quickly address rapidly evolving infrastructure security needs, often leveraging governmental partnerships and national security mandates to drive adoption.

Latin America and the Middle East & Africa (MEA) represent significant growth potential, although they currently hold smaller market shares. In MEA, particularly the GCC countries (UAE, Saudi Arabia), high levels of security spending are mandated by governmental focus on critical national infrastructure, large-scale event security (like World Expos or sporting events), and protecting vast oil and gas operations. The focus is on integrating physical security with advanced cyber defenses and implementing centralized monitoring centers. Latin American growth is driven by increasing concerns over crime and infrastructure security, pushing sectors like transportation, mining, and energy to invest in PSIM for improved operational visibility and standardized incident response protocols, despite facing challenges related to economic volatility and budget constraints, making flexible, scalable solutions highly attractive.

- North America: Market leader; driven by stringent regulations (NERC CIP), high government spending on defense/homeland security, and early adoption of AI-enhanced PSIM solutions.

- Europe: Stable growth fueled by compliance requirements (GDPR, NIS Directive), focus on critical infrastructure protection, and sophisticated smart city deployments prioritizing data integrity.

- Asia Pacific (APAC): Highest CAGR; propelled by massive investments in smart city projects, rapid urbanization, and security modernization in high-growth economies like China and India.

- Middle East & Africa (MEA): Strong investment in high-security environments, particularly in the oil & gas sector and protecting key national assets, coupled with large-scale security projects for major international events.

- Latin America: Emerging market driven by increasing crime rates and security concerns in high-value sectors such as mining, energy, and key transportation hubs, favoring cost-effective and scalable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Physical Security Information Management (PSIM) Software Market.- VidSys (Convergent)

- CNL Software

- Qognify (Hexagon)

- Genetec

- Milestone Systems

- Johnson Controls (Tyco)

- Honeywell International Inc.

- Siemens AG

- NEC Corporation

- S2 Security (AMAG Technology)

- AxxonSoft

- Intergraph (Hexagon)

- NICE Systems

- ISM Security

- SureView Systems

- LENSEC

- Verint Systems

- Bosch Security and Safety Systems

- Cisco Systems

- IBM Corporation

Frequently Asked Questions

Analyze common user questions about the Physical Security Information Management (PSIM) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between PSIM software and standard Video Management Systems (VMS)?

PSIM software provides a centralized, holistic platform designed to integrate, correlate, and manage data from all disparate security systems (VMS, access control, fire alarms, sensors) into a unified interface, automating incident response based on Standard Operating Procedures (SOPs). VMS focuses primarily on the management, recording, and retrieval of video data only.

How is cloud computing influencing the future deployment of PSIM solutions?

Cloud computing enables PSIM providers to offer scalable, flexible Software-as-a-Service (SaaS) models, drastically reducing the high upfront costs associated with on-premise solutions. This shift lowers the barrier to entry for Small and Medium-sized Enterprises (SMEs) and facilitates rapid deployment across geographically dispersed sites, while ensuring automatic software updates and enhanced disaster recovery capabilities.

What is the role of Artificial Intelligence (AI) within modern PSIM platforms?

AI, specifically machine learning and computer vision, transforms PSIM from a reactive system to a predictive one. It analyzes complex security data in real-time to identify anomalous behaviors, minimize false alarms, automatically prioritize critical incidents, and suggest optimal, context-aware response protocols, significantly enhancing overall operational intelligence.

Which end-user segment is currently driving the largest adoption of PSIM software?

The Critical Infrastructure segment, encompassing energy, utilities, oil & gas, and transportation, currently represents the largest market share due to the severe consequences of security breaches in these sectors. These highly regulated environments require integrated, redundant, and auditable systems capable of managing complex, large-scale security ecosystems effectively.

What are the primary challenges limiting the widespread adoption of PSIM solutions?

The main challenges include the substantial initial capital investment required for implementation, the inherent complexity involved in integrating new PSIM platforms with various heterogeneous legacy security hardware systems, and ongoing concerns related to compliance with evolving data privacy regulations (e.g., GDPR) concerning the collection and processing of sensitive video and access data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager