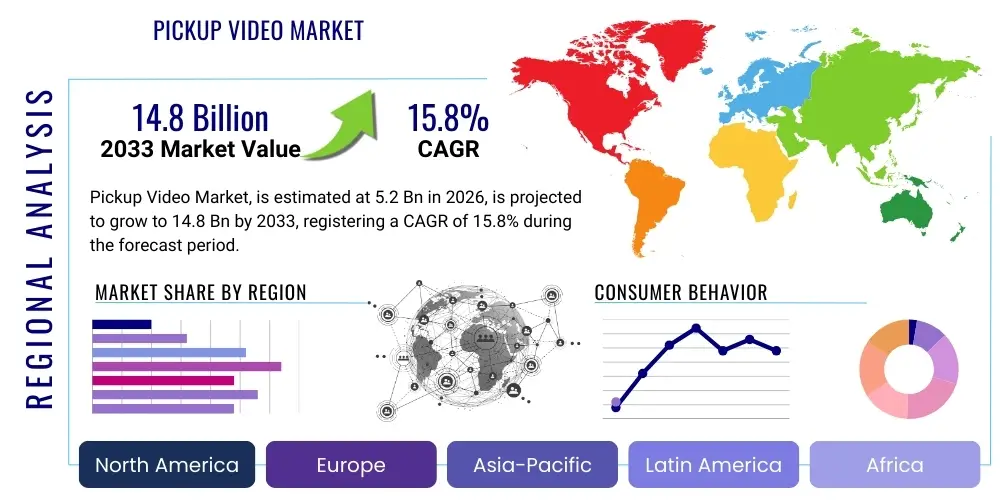

Pickup Video Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443099 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Pickup Video Market Size

The Pickup Video Market, a specialized segment focusing on the visual documentation and verification of physical goods handover, especially in e-commerce, logistics, and retail click-and-collect services, is poised for robust expansion. This growth is fundamentally driven by the escalating demand for transparency, loss prevention, and enhanced customer dispute resolution in the final mile of delivery and pickup processes. The increasing sophistication of AI-powered video analytics, coupled with the proliferation of high-resolution camera systems integrated into smart lockers, fulfillment centers, and vehicle fleets, ensures comprehensive coverage and actionable data extraction. This market’s rapid scaling reflects the essential shift towards verifiable digital records for every transaction involving physical merchandise, mitigating liability and optimizing operational workflows across diverse industry verticals.

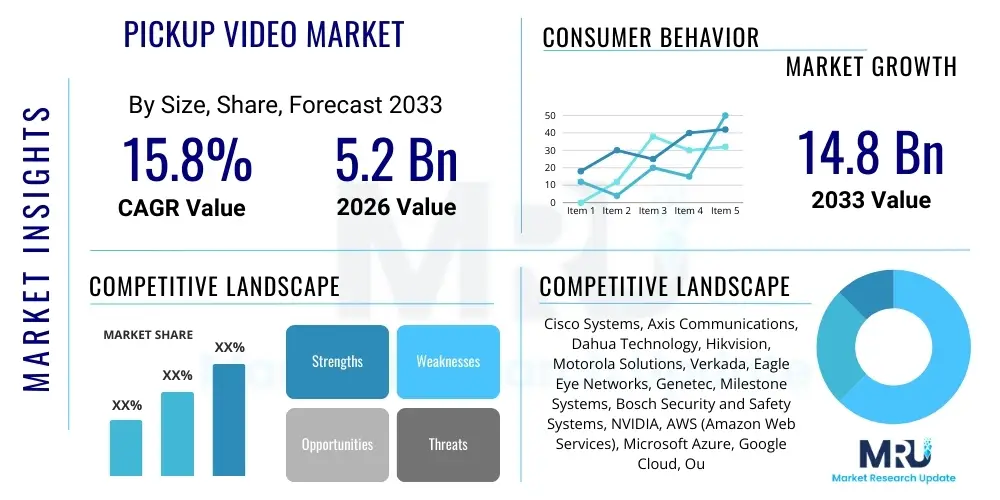

The global Pickup Video Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 14.8 Billion by the end of the forecast period in 2033. This substantial financial trajectory is indicative of the critical infrastructure investment being made by major e-commerce giants and third-party logistics (3PL) providers globally. The convergence of IoT sensors, cloud storage solutions, and advanced video processing capabilities is making verifiable pickup documentation accessible and economically feasible, further stimulating market adoption across both developed and emerging economies. Regulatory pressures regarding consumer protection and supply chain integrity also serve as underlying growth catalysts, mandating better tracking mechanisms than traditional paper-based systems.

Pickup Video Market introduction

The Pickup Video Market encompasses the technologies, hardware, software, and services dedicated to capturing, processing, storing, and analyzing video evidence during the critical moment a product is transferred from a seller, facility, or delivery agent to the final recipient or customer. These systems are designed to provide irrefutable proof of condition, quantity, and successful handoff, serving as a vital tool for preventing fraud, resolving claims, and establishing comprehensive audit trails. Key products within this domain include high-definition cameras integrated into smart lockers, point-of-sale (POS) systems, warehouse loading docks, and specialized vehicle-mounted systems optimized for capturing interactions outside the vehicle or facility. The core value proposition lies in replacing subjective verbal accounts or vulnerable photographic evidence with objective, timestamped video data.

Major applications of pickup video technology span the entire spectrum of consumer-facing and B2B logistics operations. E-commerce platforms utilize these systems extensively for documenting package integrity upon collection from designated lockers or counters, safeguarding against "empty box" claims. Food and grocery delivery services employ pickup video to confirm accurate order fulfillment before dispatch and successful handover to the customer, particularly crucial for temperature-sensitive or high-value goods. Furthermore, the retail sector leverages this technology in click-and-collect environments to ensure seamless and accurate order fulfillment, significantly enhancing customer experience and operational efficiency by minimizing retrieval errors. The utility extends to specialized logistics, such as pharmaceuticals and high-value electronics, where stringent chain-of-custody documentation is legally required.

The primary benefits driving market penetration include significant reductions in shrinkage and operational losses, faster resolution of customer disputes, and improved liability management. By integrating advanced analytics, these systems can automatically flag potential irregularities or failed protocols during the pickup process, allowing for real-time intervention and process improvement. The driving factors behind market expansion are multifaceted: the exponential growth of omnichannel retail, necessitating seamless integration between physical and digital fulfillment channels; the increasing expectation of speed and reliability in delivery services; and the corresponding surge in returns and disputes requiring objective evidence. The decreasing cost of high-quality surveillance hardware and the scalability offered by cloud-based video management systems further propel widespread adoption across businesses of all sizes seeking verifiable logistical accountability.

Pickup Video Market Executive Summary

The Pickup Video Market is undergoing rapid transformation, propelled by macro business trends emphasizing supply chain visibility and immutable transaction records. Key business trends indicate a strong movement toward integrating video capture solutions directly into existing warehouse management systems (WMS) and enterprise resource planning (ERP) platforms, moving beyond simple surveillance to embedded operational intelligence. This shift is characterized by the increased adoption of Video Management Software (VMS) capable of metadata tagging, allowing for quick retrieval of specific pickup events based on transaction IDs, employee IDs, or timestamps. Furthermore, the market is witnessing robust merger and acquisition activity as major security and logistics technology providers look to consolidate capabilities in AI-driven video analytics, aiming to offer end-to-end verifiable fulfillment solutions that cater to the exacting demands of modern e-commerce logistics, prioritizing loss prevention and customer trust.

Regionally, North America maintains market leadership due to the early and extensive penetration of e-commerce, the presence of major technological innovators, and stringent regulatory environments demanding high accountability in retail and pharmaceutical distribution. However, the Asia Pacific (APAC) region, driven by burgeoning e-commerce markets in China, India, and Southeast Asia, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). The logistical complexities and vast geographic scale of APAC necessitate scalable and reliable proof-of-pickup solutions, particularly in last-mile delivery and decentralized pickup points like convenience stores and automated parcel machines. Europe, supported by strong data protection regulations (GDPR) which necessitate careful implementation but also standardized operational processes, focuses heavily on secure, encrypted video storage and privacy-compliant data handling protocols, leading to advanced solutions for biometric and anonymized verification.

Segmentation trends highlight the ascendancy of Cloud-based deployment models, favored for their scalability, cost efficiency, and ease of integration with diverse fulfillment networks, especially vital for 3PLs managing multiple client environments. While hardware remains essential, the market value is increasingly derived from the Services and Software segments—specifically, advanced analytics and custom integration services. By application, the E-commerce and Logistics sectors dominate, representing the foundational demand base. However, niche applications in Food & Beverage delivery and specialized High-Value Goods logistics are exhibiting accelerated growth, requiring tailored pickup video systems that account for specific variables like temperature monitoring and multi-signature verification, indicating market diversification and specialization driven by distinct industry compliance needs.

AI Impact Analysis on Pickup Video Market

User inquiries regarding AI's influence on the Pickup Video Market predominantly revolve around automation capabilities, reliability in fraud detection, and the ethical implications of continuous surveillance. Common questions include: "How accurately can AI identify damaged goods during pickup?", "Can AI systems automate the claim verification process completely?", and "What are the privacy risks associated with using facial recognition or anomaly detection in pickup videos?" Users are highly concerned with moving beyond simple recording to achieving proactive operational intelligence. They expect AI to reduce human review time substantially and provide conclusive evidence faster, transforming video data from passive storage into an active forensic asset. The overarching expectation is that AI will democratize sophisticated logistical accountability, making automated loss prevention accessible even to mid-sized retailers and logistics operators.

The integration of Artificial Intelligence, particularly Machine Learning (ML) and Computer Vision, represents the most significant disruptive force within the Pickup Video Market. AI engines are now capable of performing real-time object recognition and anomaly detection, immediately flagging events such as missing items, improper packaging, or unauthorized access during the pickup phase. This capability drastically reduces the dependency on manual video review, transforming incident investigation from a post-event reactive task into a real-time preventative mechanism. For example, ML models can be trained to recognize acceptable package conditions, alerting staff if a box is crushed or tampered with immediately before the customer takes possession. This proactive verification is crucial for reducing chargebacks and improving supply chain integrity, moving the market from simple documentation to intelligent verification.

Furthermore, AI facilitates advanced metadata generation and structured data extraction from unstructured video streams. By analyzing video content, AI can automatically log key transaction details, including the exact time of handoff, the identity of the recipient (via license plate recognition, QR code scanning, or facial analysis, subject to privacy regulations), and the duration of the interaction. This indexed data is invaluable for forensic analysis and compliance reporting. The ongoing evolution of Deep Learning algorithms promises even greater contextual understanding, enabling systems to differentiate between accidental drops versus intentional damage, thereby providing nuanced evidence crucial for complex dispute resolution. This technological leap solidifies AI's role not just as a tool for surveillance, but as the foundational layer for automated supply chain accountability.

- AI-Powered Anomaly Detection: Automatically flags unusual activities or deviations from standard operating procedures during the pickup process, such as excessive dwell time or unauthorized persons accessing the item.

- Automated Damage Assessment: Computer Vision algorithms analyze video frames to identify pre-existing damage, scratches, or compromised packaging integrity before handover.

- Enhanced Data Indexing: ML models extract relevant metadata (timestamps, item identification, personnel involved) directly from video streams, allowing for rapid, search-based retrieval of specific pickup events.

- Predictive Loss Prevention: Analyzing patterns of fraudulent or high-risk pickups across multiple locations to proactively adjust security protocols and operational warnings.

- Real-Time Compliance Monitoring: Verifying that all safety and regulatory steps (e.g., identity checks, signature confirmation) were followed precisely as documented in the video feed.

- Efficiency in Dispute Resolution: Providing immediate, conclusive video evidence that accelerates the process of verifying or denying customer claims, drastically reducing administrative overhead.

- Resource Optimization: Reducing the need for human operators to continuously monitor feeds or manually search through hours of footage, redirecting labor to higher-value tasks.

- Improved Biometric Verification: Utilizing advanced facial recognition or gait analysis (where permissible by law) to confirm the identity of the authorized recipient with high precision.

DRO & Impact Forces Of Pickup Video Market

The trajectory of the Pickup Video Market is defined by a dynamic interplay of powerful market drivers, inherent operational restraints, and substantial opportunities created by technological advancements and shifting consumer behavior. The fundamental market drivers center on the unrelenting growth of global e-commerce, which introduces high volume and complexity into last-mile logistics, necessitating automated verification solutions. Simultaneously, the persistent threat of package theft (porch piracy) and fraudulent claims for non-delivery or damaged goods acts as a critical external force pushing businesses toward mandatory video documentation. These factors combine with the increasing affordability and sophistication of camera and storage technology, making enterprise-grade video verification an economically viable solution for a broader range of businesses, solidifying accountability as a core industry requirement.

Despite strong drivers, the market faces notable restraints, primarily concerning data privacy and the complexity of regulatory compliance. The capture and storage of video footage involving individuals raise significant concerns, particularly in jurisdictions with strict data protection laws like GDPR and CCPA. Ensuring that video systems comply with regulations regarding data retention, consent, and identity masking adds substantial complexity and cost to deployment, potentially slowing adoption among risk-averse organizations. Technical restraints also persist, including the massive bandwidth requirements for transmitting high-definition video from thousands of dispersed pickup points, and the challenge of integrating proprietary video systems with legacy logistics software infrastructure, demanding considerable upfront investment in network upgrades and customized APIs.

Opportunities for exponential market growth lie in the development of highly integrated, standardized platforms utilizing edge computing and 5G connectivity. Edge computing allows for real-time video processing and analysis at the pickup point itself, significantly reducing latency and data transfer costs, making the systems far more responsive and scalable for massive fulfillment networks. Furthermore, the expansion into specialized verticals such as automotive parts pickup, construction material logistics, and pharmaceutical distribution presents lucrative avenues. These sectors have high-value items and rigorous regulatory compliance needs, making the verifiable documentation provided by pickup video systems an essential operational mandate, rather than just a loss-prevention measure. The continued refinement of AI algorithms for contextual understanding represents the key impact force shaping the future competitive landscape, prioritizing intelligent systems over mere recording tools.

Segmentation Analysis

The Pickup Video Market is systematically segmented across multiple critical dimensions to reflect the diverse technological components, deployment models, operational contexts, and geographic dispersion that characterize its current structure. Understanding these segmentations is paramount for market participants to tailor offerings effectively and for businesses to identify solutions that precisely meet their operational scale and compliance requirements. The primary segmentation categories—Component, Application, and Deployment—reveal differing growth trajectories and underlying value concentration. While the market initially focused heavily on Hardware (cameras and peripherals), the accelerating growth in the Software and Services segments indicates a maturing market where value creation shifts toward intelligent processing, integration, and managed operational support, reflecting a trend towards Verifiable Logistics-as-a-Service (VLaaS).

Analyzing the segmentation by Application underscores the market’s responsiveness to high-volume logistical needs. E-commerce and dedicated Logistics providers remain the largest consuming segments, driven by intense competitive pressure to minimize fulfillment errors and dispute costs. However, the rapidly expanding Food & Beverage Delivery segment, propelled by the ubiquity of food delivery apps and the high sensitivity of product quality, is demonstrating impressive CAGR. These segments require highly specialized solutions; for instance, food delivery systems often need ruggedized, weather-resistant cameras on vehicles and time-stamping accurate to the second, distinguishing them from traditional warehouse-based systems, thus creating distinct sub-markets within the larger framework.

The deployment model segmentation—Cloud vs. On-premise—reflects the ongoing digital transformation within the logistics sector. Cloud-based solutions are increasingly dominating due to their inherent scalability, lower upfront capital expenditure, and seamless integration with distributed networks of smart lockers and delivery vans. This model is particularly appealing to 3PLs and large e-commerce platforms operating across wide geographical areas. Conversely, On-premise solutions persist primarily in highly secure environments, such as pharmaceutical warehouses or high-value manufacturing facilities, where strict control over data governance and physical security protocols necessitates localized storage and processing, ensuring that market offerings must remain flexible enough to accommodate both security and scalability requirements.

- By Component:

- Hardware (Cameras, Sensors, Storage Devices, Integrated Lockers)

- Software (Video Management Systems - VMS, AI Analytics Software, Integration Modules)

- Services (Installation, Maintenance, Managed Services, Data Consultancy)

- By Application:

- E-commerce & Retail (Click-and-Collect, Smart Lockers)

- Logistics & Transportation (Last-Mile Delivery Verification, Warehouse Loading/Unloading)

- Food & Beverage Delivery (Restaurant Pickup Confirmation, Customer Handoff Proof)

- Postal & Courier Services

- High-Value Goods Logistics (Pharmaceuticals, Electronics)

- By Deployment:

- Cloud-based

- On-premise

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Pickup Video Market

The value chain of the Pickup Video Market begins with the Upstream activities, dominated by hardware manufacturing and sensor technology innovation. This stage involves the production of ruggedized high-resolution cameras, specialized IoT sensors, and high-capacity secure storage solutions. Key players at this stage include sensor component manufacturers (e.g., CMOS producers) and specialized surveillance hardware developers (e.g., manufacturers of IP cameras and AI-enabled edge devices). Innovation here is crucial, focusing on developing cameras with better low-light performance, wide dynamic range, and the ability to withstand harsh environmental conditions common in logistics and outdoor pickup points. Success in the upstream market dictates the technical quality and data fidelity available for subsequent analytical stages.

Midstream activities primarily encompass the development of sophisticated Software and Services. This segment focuses on creating Video Management Systems (VMS), proprietary AI/ML algorithms for anomaly detection and verification, and middleware for seamless integration with enterprise logistics platforms (WMS, ERP). System integrators and dedicated software vendors transform raw video data into actionable evidence by applying computer vision to identify critical events—such as package scanning, time of handoff, and identity verification. The value added at this stage is the intelligence and forensic capability derived from the video stream, moving the offering beyond simple security to operational intelligence and automated dispute resolution.

The Downstream phase centers on implementation, distribution channels, and end-user support. Distribution channels are typically a mix of direct sales to large enterprise clients (e-commerce platforms, major 3PLs) and indirect channels utilizing certified system integrators and value-added resellers (VARs) who customize and install solutions for SMBs and regional logistics operators. Direct channels offer deep customization and high-touch support essential for complex, multi-site deployments. Indirect channels provide local expertise and scalability across diverse geographical markets. The end-user value is realized through reduced operational losses, faster claim processing, and improved customer satisfaction stemming from verified, transparent fulfillment processes, making post-installation services and system maintenance a high-margin component of the downstream value chain.

Pickup Video Market Potential Customers

The primary consumers and end-users of Pickup Video solutions are organizations deeply embedded in e-commerce fulfillment, logistics, and retail operations where the verifiable transfer of goods is a critical business function. Foremost among these are Tier 1 and Tier 2 E-commerce Giants and large Omnichannel Retailers, such as Amazon, Walmart, and Target, who require scalable solutions for millions of daily transactions occurring across dedicated fulfillment centers, retail stores offering curbside pickup, and dense networks of smart lockers. For these entities, the investment in pickup video technology is justified by the immense cost savings realized from mitigating fraudulent claims, minimizing inventory shrinkage, and improving the operational efficiency of returns and exchanges, making accountability an absolute prerequisite for maintaining consumer trust and financial integrity.

Third-Party Logistics (3PL) providers and specialized last-mile delivery companies represent another significant customer segment. Companies like FedEx, UPS, and various regional courier services face chronic challenges related to proof-of-delivery (PoD) and proof-of-pickup (PoP), especially in densely populated urban areas where misdelivery and theft rates are higher. Pickup video systems are essential for 3PLs to maintain service level agreements (SLAs) with their clients (the retailers) and to protect their own drivers and company assets. These customers prioritize solutions that integrate seamlessly with route optimization software and can operate reliably within vehicle fleets, demanding ruggedized, mobile-first video capture capabilities and highly efficient cloud-based data transfer protocols optimized for intermittent connectivity.

Furthermore, specialized industry verticals constitute rapidly growing niche customer bases. This includes Pharmacy and Healthcare Logistics, where high-value, regulated, and temperature-sensitive goods necessitate documented chain of custody from pharmacy pickup to patient handoff, often driven by legal compliance requirements. Similarly, the growing Meal Kit and Grocery Delivery sector requires verification systems that confirm the integrity and completeness of perishable orders at the point of customer retrieval, minimizing spoilage claims. These segments often require specialized hardware, such as thermal imaging integration or synchronized data capture with specialized scanners, demonstrating a market shift toward customized solutions addressing distinct vertical operational challenges beyond general parcel delivery accountability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Axis Communications, Dahua Technology, Hikvision, Motorola Solutions, Verkada, Eagle Eye Networks, Genetec, Milestone Systems, Bosch Security and Safety Systems, NVIDIA, AWS (Amazon Web Services), Microsoft Azure, Google Cloud, Ouster, Velodyne Lidar, FLIR Systems, Vivotek, Hanwha Techwin, Ava Security. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pickup Video Market Key Technology Landscape

The technological landscape of the Pickup Video Market is characterized by the confluence of advanced imaging, high-speed networking, and intelligent software processing. At the core are High-Resolution IP Cameras, often ruggedized and equipped with Wide Dynamic Range (WDR) technology to ensure clear image capture regardless of challenging lighting conditions, such as extreme shadows or direct sunlight encountered at outdoor pickup points or vehicle bays. These cameras often feature embedded edge computing capabilities, allowing them to preprocess video data, compress footage, and run rudimentary AI models directly on the device, minimizing the computational load on central servers and reducing bandwidth consumption. Furthermore, specialized sensors, including Lidar and thermal imaging, are increasingly used in conjunction with standard video to provide comprehensive contextual data, particularly valuable for confirming package volume or identifying temperature breaches during transport to the pickup location.

The shift towards intelligent, scalable data management is heavily reliant on Cloud and Hybrid Storage Architectures. Cloud-based video management systems (VMS) offer unparalleled scalability for handling the massive volume of video generated by expansive logistics networks, providing secure, compliant storage and immediate accessibility for dispute resolution teams located globally. Hybrid models utilize edge storage for short-term retention and immediate analytics, only transferring critical or flagged footage to the cloud, thus optimizing network efficiency and ensuring redundancy. The integration of 5G connectivity is fundamentally transforming this landscape, providing the high bandwidth and ultra-low latency necessary for the real-time transmission and analysis of high-definition video feeds from mobile assets like delivery vehicles and remote, smart locker locations, which previously suffered from connectivity constraints.

Perhaps the most transformative technological aspect is the reliance on Advanced Video Analytics and Machine Learning (ML). These software solutions are responsible for transforming raw video footage into verifiable business intelligence. Key technologies include Object Recognition (identifying packages, labels, hands, and human faces), Behavior Analysis (detecting unusual movements or unauthorized access), and Forensic Search Capabilities (allowing users to search for video clips based on specific criteria like time, location, or transaction ID). The continual advancement in ML models, particularly Deep Learning networks, allows systems to become increasingly adept at subtle anomaly detection and accurate verification, thereby maximizing the forensic value of the captured video and cementing the crucial role of software intelligence in the market's evolution.

Regional Highlights

Geographic analysis reveals distinct patterns of adoption and technological maturity across global markets, shaped by regulatory climates, e-commerce penetration rates, and logistical infrastructure sophistication. North America (NA) stands as the dominant market, characterized by mature e-commerce ecosystems and a high prevalence of high-value goods logistics. The US and Canada are early adopters, investing heavily in AI-driven verification systems to combat significant issues related to porch piracy and rampant package fraud. The region’s advanced integration capabilities, coupled with substantial private investment in logistical innovation, drive the demand for sophisticated, cloud-based VMS platforms that offer seamless integration with large-scale fulfillment operations. Regulatory emphasis on consumer rights often translates into a strong corporate mandate for irrefutable pickup evidence.

The Asia Pacific (APAC) region is projected to experience the fastest growth, primarily fueled by the exponential expansion of e-commerce in countries like China, India, and Southeast Asia. The logistical challenges inherent in serving massive populations across diverse geographies necessitate innovative pickup video solutions, particularly the widespread deployment of smart lockers and decentralized pickup points (e.g., convenience stores). Cost-effectiveness and scalability are paramount in APAC, leading to high demand for affordable, yet reliable, hardware solutions and mobile-optimized video verification apps. While data privacy regulations are less uniformly stringent than in Europe, the sheer volume of transactions drives the need for automated systems capable of managing petabytes of daily video data efficiently, positioning APAC as a major consumer of cutting-edge AI and cloud storage solutions.

Europe exhibits steady growth, primarily driven by strict regulatory requirements, especially the General Data Protection Regulation (GDPR). This regulatory environment mandates that European vendors prioritize privacy-by-design, focusing on anonymization techniques, secure encryption protocols, and clear data retention policies for all video footage captured during pickup. Consequently, the European market leads in developing specialized software for blurring personally identifiable information (PII) while preserving forensic evidence, ensuring compliance without sacrificing verification capability. Countries such as Germany and the UK, with highly advanced logistics infrastructures, show strong adoption in integrating pickup video systems directly into automated warehouse environments and fleet management systems, prioritizing system reliability and deep operational integration.

- North America (NA): Market leader driven by high e-commerce maturity, necessity for fraud prevention, and extensive investment in cloud and AI analytics. Focus on high-value chain-of-custody documentation.

- Asia Pacific (APAC): Highest projected growth rate, driven by massive consumer base expansion and the need for scalable, decentralized verification systems across dense urban and remote areas. Cost-efficiency is a key purchasing factor.

- Europe (EU): Growth governed by GDPR compliance, focusing heavily on privacy-compliant technology, sophisticated data anonymization, and highly secure, integrated VMS for supply chain integrity.

- Latin America (LATAM): Emerging market characterized by increasing e-commerce penetration and strong demand for solutions addressing security concerns and theft prevention in last-mile delivery.

- Middle East and Africa (MEA): Growth concentrated in logistics hubs (e.g., UAE, Saudi Arabia) driven by strategic governmental investment in smart city and trade infrastructure, emphasizing verifiable proof-of-delivery for cross-border trade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pickup Video Market.- Cisco Systems

- Axis Communications

- Dahua Technology

- Hikvision

- Motorola Solutions

- Verkada

- Eagle Eye Networks

- Genetec

- Milestone Systems

- Bosch Security and Safety Systems

- NVIDIA

- AWS (Amazon Web Services)

- Microsoft Azure

- Google Cloud

- Ouster

- Velodyne Lidar

- FLIR Systems

- Vivotek

- Hanwha Techwin

- Ava Security

Frequently Asked Questions

Analyze common user questions about the Pickup Video market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Pickup Video technology in modern logistics?

The primary function is to provide irrefutable, timestamped video evidence confirming the condition and successful transfer of goods from the logistics provider to the end recipient or designated pickup point. This evidence is crucial for automated claim resolution, fraud prevention, and maintaining an accurate, auditable chain of custody.

How does AI improve the effectiveness of Pickup Video systems?

AI, specifically Computer Vision and Machine Learning, enhances these systems by automating key tasks such as real-time damage detection, identifying anomalies during the handoff process, indexing video footage with transaction metadata, and significantly reducing the human resources needed for manual video review and claim verification.

Are Cloud-based or On-premise solutions better for the Pickup Video Market?

Cloud-based solutions are generally preferred due to their superior scalability, lower infrastructure investment, and ease of integration with distributed networks like smart lockers and delivery fleets. On-premise solutions remain relevant for highly regulated environments (e.g., pharmaceuticals) prioritizing strict, localized data governance and security control.

What are the key privacy challenges facing the implementation of pickup video systems?

The main challenges involve complying with global data protection regulations (like GDPR) regarding the capture and retention of personally identifiable information (PII) of customers and drivers. Solutions must employ privacy-by-design principles, including data anonymization, strict access controls, and transparent data retention policies, to mitigate legal and ethical risks.

Which geographical region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth. This is attributed to the monumental growth of its regional e-commerce sector, the necessity for robust last-mile verification across vast and diverse populations, and aggressive adoption of technology in rapidly expanding logistics infrastructures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager