Picture Hanging System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443612 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Picture Hanging System Market Size

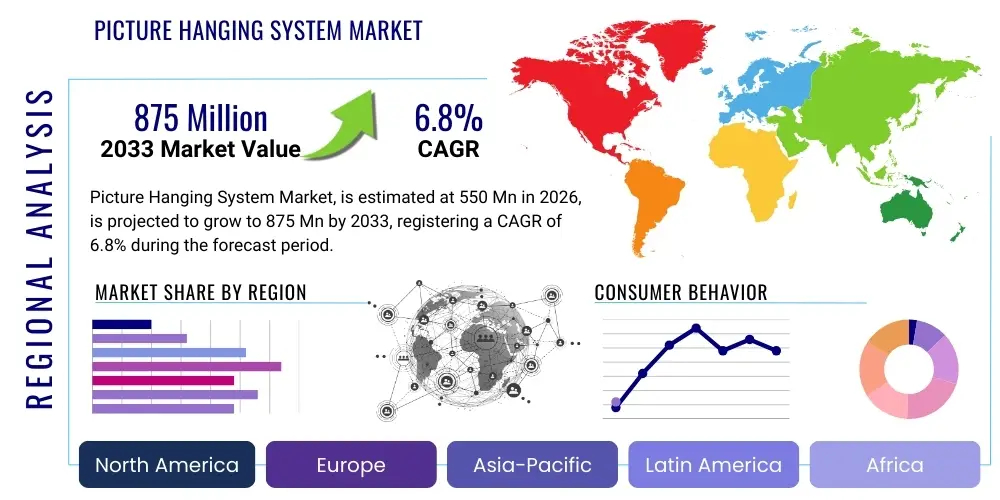

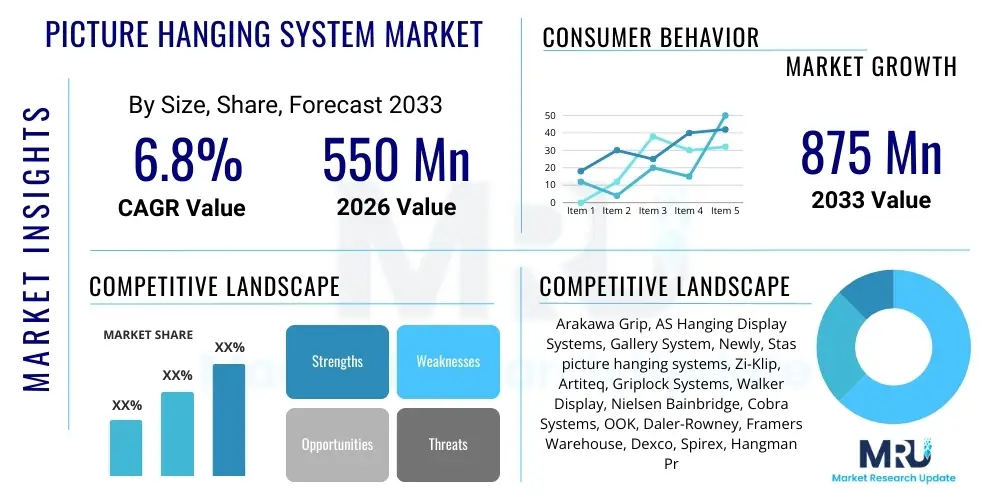

The Picture Hanging System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 875 Million by the end of the forecast period in 2033.

Picture Hanging System Market introduction

The Picture Hanging System Market encompasses the sale and distribution of integrated hardware solutions designed for securely and flexibly displaying art, photographs, and other wall decor without causing damage to the underlying structure. These systems typically include rails, tracks, cables, wires, rods, and adjustable hooks that allow users to easily modify the height and position of hung items. The primary applications span high-end residential spaces, commercial environments like corporate offices and retail establishments, and specialized cultural institutions such as art galleries and museums where flexibility and preservation are paramount. The sophisticated nature of these systems ensures precise alignment, high load-bearing capacity, and aesthetic integration, moving beyond traditional nail and wire methods.

Product descriptions within this market segment highlight attributes such as material quality (often aluminum or stainless steel), discreet design profiles, and ease of installation. Modern systems prioritize adjustability and versatility, catering to dynamic display needs, particularly in professional settings where exhibits change frequently. Key benefits include the elimination of repetitive wall damage (reducing long-term maintenance costs), enhanced safety due to robust load distribution, and superior aesthetic presentation. The market offers products tailored for both heavy-duty institutional use and lightweight residential decor, driving widespread adoption across various end-user segments seeking sophisticated wall decor solutions.

Driving factors for market expansion include the increasing global focus on interior design and aesthetics, a rising disposable income leading to greater investment in artwork and home decor, and the robust growth in the commercial construction sector, particularly the development of museums, corporate headquarters, and luxury residential complexes that require professional-grade display infrastructure. Furthermore, growing urbanization and the concurrent rise in remodeling and renovation activities, where damage minimization is a key priority, further propel the demand for non-destructive, high-quality picture hanging solutions. Technological advancements, such as magnetic and LED-integrated systems, also contribute significantly to market growth.

Picture Hanging System Market Executive Summary

The Picture Hanging System Market is characterized by steady growth driven fundamentally by global construction booms in the commercial and institutional sectors, coupled with strong residential demand for damage-free, flexible decor solutions. Business trends indicate a strong move toward modular and integrated systems that minimize visual intrusion while maximizing load-bearing capacity and ease of adjustment. Manufacturers are concentrating on material innovation, favoring lightweight, high-strength aluminum and stainless steel alloys, and expanding distribution channels to target the burgeoning DIY segment through readily available, easy-to-install kits. Strategic partnerships with interior designers and architects are becoming crucial for early product integration into new projects. The competitive landscape remains moderately fragmented, with specialized manufacturers holding significant shares through superior patent portfolios and quality standards compliance.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing region, fueled by rapid urbanization, significant government investment in cultural infrastructure (museums and galleries), and rising consumer spending on interior aesthetics in countries like China and India. North America and Europe maintain dominance in terms of market value due to established infrastructure, high penetration rates of professional-grade systems, and mature markets in residential renovation. Europe, in particular, leads in adopting concealed and architecturally integrated systems, reflecting strong adherence to minimalist design principles. Geopolitical stability and local economic conditions in these regions significantly influence commercial project timelines, which directly impact high-value system procurement.

Segmentation trends reveal that the rail-based systems segment dominates the market due to their unparalleled flexibility and professional appeal, particularly in gallery and museum applications. Material segmentation indicates aluminum systems hold the largest share, balancing cost-effectiveness with durability and load capacity. The commercial application segment, encompassing galleries, museums, and corporate spaces, represents the largest revenue generator, demanding robust, high-specification products. However, the residential segment is projected to exhibit the highest CAGR, driven by the increasing popularity of renting and the resulting need for decor solutions that preserve wall integrity, alongside the expansion of e-commerce platforms simplifying DIY kit procurement and installation.

AI Impact Analysis on Picture Hanging System Market

User inquiries regarding AI's impact on the Picture Hanging System Market primarily revolve around three key themes: how AI can optimize product selection and customization for complex wall displays, the role of machine learning in inventory and supply chain efficiency for manufacturers and large retailers, and the potential integration of AI-powered tools for precise, autonomous installation and maintenance. Users are concerned about whether AI integration will raise the complexity or cost of systems, contrasting the traditional simplicity of physical hardware with the high-tech requirements of smart systems. Expectations center on AI streamlining the process of decorating, offering predictive analytics for visual placement based on room dimensions, lighting, and aesthetic trends, thereby bridging the gap between sophisticated design planning and physical installation execution.

- AI-driven personalized recommendation engines enhance customer experience by suggesting optimal hanging systems based on specific wall material, artwork weight, room size, and desired aesthetic outcome, improving conversion rates for online retailers.

- Predictive maintenance analytics, utilizing computer vision data from smart installations, allows institutions to monitor the stability and integrity of hanging systems over time, preempting hardware fatigue or failure.

- Machine learning algorithms optimize inventory levels and production scheduling for manufacturers by accurately forecasting demand shifts based on seasonal consumer trends and architectural project pipelines across different regions.

- AI integration supports augmented reality (AR) visualization tools, enabling users to digitally preview how different hanging systems and artwork layouts will appear in their actual physical space before purchase or installation.

- Robotics and AI are being explored for automating large-scale, precision installation of complex rail systems in new commercial builds, significantly reducing labor time and ensuring millimeter-level accuracy across extensive wall spaces.

DRO & Impact Forces Of Picture Hanging System Market

The market dynamics of Picture Hanging Systems are heavily influenced by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and external impact forces. The primary drivers are the accelerating demand for flexible and modular interior design solutions, particularly in commercial spaces where displays must change frequently, coupled with a consumer preference shift toward non-destructive installation methods to preserve property value and minimize upkeep expenses. Global growth in both new construction (especially museums, offices, and galleries) and extensive renovation projects provides a consistent demand floor for high-quality, professional hanging systems. Additionally, advancements in material science offering lighter yet stronger load-bearing components further enhance product appeal and expand application potential.

Restraints largely center on the relatively higher initial investment required for professional rail and cable systems compared to traditional hooks and nails, which can deter cost-sensitive residential or small office buyers. A lack of comprehensive awareness and standardization in some emerging markets also presents a challenge, making product differentiation and consumer education critical. Furthermore, the competitive threat posed by simple, low-cost DIY mounting alternatives, such as adhesive strips and temporary hooks, often satisfies the basic needs of a significant portion of the residential market, acting as a ceiling to the premium system segment's growth potential. Overcoming these restraints necessitates demonstrating the long-term value and aesthetic superiority of specialized hanging systems.

Opportunities for market players are abundant, notably through the integration of smart technology components, such as LED lighting systems directly incorporated into tracks or sensors providing real-time load monitoring, catering to the growing smart building trend. Geographic expansion into untapped markets, particularly in rapidly developing parts of Southeast Asia and Africa where infrastructure investment is increasing, offers substantial growth potential. Developing sustainable and recyclable material options for system components also presents a strong opportunity, aligning with global green building standards and appealing to environmentally conscious consumers and institutions. Impact forces, driven by evolving architectural trends prioritizing minimalist aesthetics and concealed infrastructure, continuously push manufacturers toward highly refined, low-profile product designs. Economic volatility impacts commercial construction budgets, while regulatory standards for public safety and load testing influence product specifications and compliance costs across major regions.

Segmentation Analysis

The Picture Hanging System market is comprehensively segmented based on product type, material composition, primary application, and end-use segment, providing a detailed view of market penetration and growth trajectories across various consumer and professional demands. Understanding these segments is crucial for manufacturers to tailor their product offerings, distribution strategies, and marketing efforts effectively. The segmentation reflects the diverse requirements of end-users, ranging from highly technical, heavy-duty systems required by major art institutions to aesthetically discreet, user-friendly kits favored by residential homeowners. The dominance of specific product types or materials often correlates directly with regional construction standards and prevalent interior design philosophies, emphasizing the need for targeted segmentation analysis in market entry strategies.

- By Product Type

- Rail-Based Systems (J-Rail, Click Rail, Classic Rail)

- Cable/Wire Systems (Perlon Wire, Steel Cable)

- Rod-Based Systems (Traditional Rods, Heavy Duty Rods)

- Hook and Clip Systems (Adjustable Hooks, Security Hooks)

- By Material

- Aluminum

- Stainless Steel

- Brass

- Plastic & Composites

- By Application

- Residential (Homes, Apartments, Rental Properties)

- Commercial

- Art Galleries and Museums

- Corporate Offices and Lobbies

- Educational Institutions

- Retail and Showrooms

- By End-Use

- Professional Installers and Contractors

- Do-It-Yourself (DIY) Consumers

Value Chain Analysis For Picture Hanging System Market

The value chain for the Picture Hanging System Market begins with upstream activities focused on raw material procurement, primarily aluminum, stainless steel, high-strength plastics, and specialized cables (Perlon and steel). Upstream suppliers must maintain strict quality control to ensure materials meet the necessary load-bearing and durability specifications essential for product safety. Key activities at this stage include sourcing high-grade alloys, precision extrusion and casting processes for rail manufacturing, and rigorous material testing. Manufacturers often seek long-term contracts with specialized metal suppliers to ensure stable pricing and consistent quality, mitigating risks associated with commodity price volatility. Innovations in material science that reduce weight while maintaining strength are crucial here.

The core manufacturing and assembly stage involves high-precision machining, surface finishing (e.g., anodizing, powder coating), and the assembly of complex mechanical components like adjustable hooks and rail connectors. Efficiency in manufacturing processes, including automated assembly lines, is vital for maintaining competitive pricing. Distribution channels play a decisive role in reaching the diverse end-user base. Direct channels include sales to large architectural firms, interior designers, and major institutional clients (museums), facilitating customized solutions and large-volume orders. Indirect channels utilize established networks of specialized hardware distributors, building supply stores, and increasingly, large e-commerce platforms and mass retailers, which cater more effectively to the DIY and smaller professional contractor segments.

Downstream activities center on installation, post-sales support, and customer education. Professional installers (direct channel beneficiaries) often manage large, complex commercial projects requiring expert structural knowledge. For the DIY consumer (indirect channel), clear, instructional content and simple installation designs are essential for product adoption. The market’s overall performance relies heavily on the quality and robustness of the distribution network to ensure product availability and timely delivery across global markets. The distinction between specialized distributors focusing on art display solutions and general hardware retailers dictates the level of technical support and premium positioning of the product line within the channel structure.

Picture Hanging System Market Potential Customers

The potential customers for Picture Hanging Systems are broadly categorized into two major groups: high-volume, institutional, and commercial buyers, and individual residential end-users. Commercial buyers, comprising art galleries, major metropolitan museums, corporate offices, healthcare facilities, and retail chains, represent the highest value segment due to their requirement for expansive, robust, and often customized multi-track systems capable of supporting heavy weights and facilitating frequent display changes. These customers prioritize long-term durability, professional aesthetic integration, and security features like anti-theft hooks, viewing the system as a critical piece of operational infrastructure. They often purchase directly from manufacturers or through specialized professional contractors and interior design firms.

The residential sector constitutes a vast and rapidly growing end-user base, driven by homeowners, apartment renters, and interior design enthusiasts seeking flexible solutions that prevent wall damage. This segment typically purchases easy-to-install, lighter-duty rail or cable kits via indirect channels, such as home improvement stores, specialized online retailers, and dedicated e-commerce platforms. Residential customers prioritize ease of use, aesthetic discretion, and affordability. A crucial emerging sub-segment within residential buyers is the rental market tenant, who requires solutions that adhere to lease terms prohibiting permanent alterations to walls, making non-destructive systems highly appealing.

Furthermore, educational institutions (universities, schools) and government buildings represent significant, recurring buyers, needing durable solutions for displaying instructional material, historical documents, and student artwork. These entities often focus on systems that offer high security and compliance with public safety standards. Understanding the procurement cycles and budget limitations of these institutional customers is vital for successful engagement. The diverse needs of these end-users, ranging from high security and load capacity for institutional buyers to user-friendliness and aesthetic appeal for residential users, necessitate a product portfolio that addresses both extremes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 875 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arakawa Grip, AS Hanging Display Systems, Gallery System, Newly, Stas picture hanging systems, Zi-Klip, Artiteq, Griplock Systems, Walker Display, Nielsen Bainbridge, Cobra Systems, OOK, Daler-Rowney, Framers Warehouse, Dexco, Spirex, Hangman Products, J-Rail, Picture Rail Systems, E-Rail |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Picture Hanging System Market Key Technology Landscape

The technology landscape of the Picture Hanging System Market is evolving beyond simple mechanical hardware toward integrated, smart, and architecturally sensitive solutions. Key technological advances focus on improving load capacity, minimizing visual impact, and integrating display functionalities. Precision engineering in components like self-locking hooks and micro-adjusters ensures secure locking mechanisms and fine-tuned vertical adjustment, allowing for unparalleled accuracy in exhibit placement. Furthermore, the use of advanced materials, such as aerospace-grade aluminum and high-tensile steel cables (Perlon and PTFE-coated), allows systems to manage significantly higher loads while maintaining ultra-thin profiles, catering to large-format and heavy artworks increasingly favored in modern architecture. These material innovations are critical for safety compliance in institutional settings.

A significant trend involves the integration of electrical and digital infrastructure directly into the hanging rails. LED track lighting systems that are seamlessly incorporated into the top rail profile offer flexible and energy-efficient illumination for displayed pieces, controlled often via low-voltage wiring hidden within the track. This integration eliminates the need for separate lighting fixtures and wiring clutter, satisfying the minimalist aesthetic demands of contemporary interior design. Beyond lighting, some advanced systems incorporate magnetic levitation principles or smart sensors for load monitoring and stability assurance, particularly beneficial for priceless or extremely sensitive exhibits where even minor vibrations are a concern, though these remain niche and high-cost applications.

The role of supporting technologies, especially in the digital domain, is increasingly important. Manufacturers are leveraging digital tools for product visualization and installation planning, including CAD/BIM models of their systems for architects and AR applications for residential users. Furthermore, advancements in tamper-proof and security-focused hook mechanisms, utilizing patented locking technologies, address the growing need for enhanced security in public and institutional display environments, acting as a crucial selling point for high-value applications. The future trajectory leans towards fully concealed systems that become an integral, invisible component of the building envelope, requiring close collaboration between system manufacturers and construction technology firms early in the design process.

Regional Highlights

- North America: North America holds a significant share of the market, characterized by high adoption rates in commercial real estate, corporate offices, and a robust museum and gallery sector, especially in metropolitan areas like New York and Los Angeles. The US market drives demand for both professional heavy-duty systems and premium residential DIY kits. The renovation and remodeling market here is highly active, often incorporating advanced, integrated hanging solutions. This region benefits from established distribution channels and high consumer awareness regarding the aesthetic and structural benefits of these systems.

- Europe: Europe is a mature and highly influential market, particularly excelling in design and architectural integration. Countries such as Germany, the Netherlands, and the UK demonstrate strong preference for concealed rail systems and highly aesthetic solutions that complement European modernist and minimalist interior design trends. The presence of numerous historical and contemporary art institutions ensures steady demand for archival-safe and high-security systems. Stringent building codes and quality standards drive innovation toward durable, certified products.

- Asia Pacific (APAC): APAC is projected to register the highest growth CAGR over the forecast period, driven by rapid urbanization and massive investment in commercial infrastructure, including state-of-the-art museums, luxury hotels, and large corporate headquarters in China, India, and Southeast Asia. Rising affluence and increasing cultural exchange fuel demand for high-quality art display infrastructure. While the price sensitivity remains a factor, the rapid expansion of professional contracting services and increasing awareness of premium solutions are strong market accelerators.

- Latin America: This region presents a market in nascent stages, with demand concentrated primarily in major urban centers (e.g., São Paulo, Mexico City) and high-end residential developments. Market growth is closely linked to economic stability and investment in cultural projects. Distribution relies heavily on specialized importers, and consumer awareness is gradually increasing as international interior design trends gain traction.

- Middle East and Africa (MEA): The MEA market is largely driven by substantial government investments in cultural infrastructure, exemplified by major museum projects in the Gulf Cooperation Council (GCC) countries. High-value, luxurious commercial and residential construction projects demand top-tier, imported hanging systems. Africa remains a developing market, with demand localized primarily around commercial hubs and expatriate communities, but institutional investment in art infrastructure shows emerging potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Picture Hanging System Market.- Arakawa Grip

- AS Hanging Display Systems

- Gallery System

- Newly

- Stas picture hanging systems

- Zi-Klip

- Artiteq

- Griplock Systems

- Walker Display

- Nielsen Bainbridge

- Cobra Systems

- OOK

- Daler-Rowney

- Framers Warehouse

- Dexco

- Spirex

- Hangman Products

- J-Rail

- Picture Rail Systems

- E-Rail

Frequently Asked Questions

Analyze common user questions about the Picture Hanging System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using a professional picture hanging system over traditional methods?

Professional picture hanging systems offer superior flexibility, allowing artworks to be repositioned easily without damaging walls. They provide robust security for valuable pieces and ensure consistent aesthetic presentation, significantly reducing long-term maintenance costs associated with plaster and paint repair.

Which material segment holds the largest market share and why is it preferred?

Aluminum systems currently dominate the market share. Aluminum is favored for its optimal balance of light weight, high tensile strength, resistance to corrosion, and ease of fabrication, making it suitable for both professional (heavy-duty) and residential (aesthetically discreet) applications while remaining cost-effective.

How does the integration of smart technology impact the Picture Hanging System Market?

Smart technology integration is driving innovation by embedding features like adjustable LED lighting, remote control capabilities, and sensor-based load monitoring directly into the rail systems. This enhances the functionality, security, and energy efficiency of the displays, particularly in modern commercial and museum settings.

Which geographical region is expected to show the fastest growth rate, and what are the drivers?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to rapid urbanization, immense investment in new commercial and cultural infrastructure (museums and corporate centers), and rising disposable incomes leading to increased consumer spending on high-quality interior decor solutions.

What is the main distinction between rail-based and cable/wire-based hanging systems?

Rail-based systems utilize a fixed track mounted high on the wall or ceiling from which cables or rods drop, offering maximum flexibility and high load capacity suitable for institutional use. Cable/wire systems are often simpler, focusing on light to medium loads and are popular in DIY and residential settings for their minimal visual intrusion.

Are Picture Hanging Systems suitable for rental properties?

Yes, picture hanging systems, especially those designed for simple installation and removal (e.g., adhesive or tension-mounted rails), are highly suitable for rental properties as they minimize or eliminate wall damage, complying with strict lease agreements regarding alterations to the structure.

What role do security hooks play in the commercial application segment?

Security hooks are crucial in commercial applications like museums and retail spaces. They feature patented locking mechanisms that prevent unauthorized removal or accidental displacement of valuable artwork or displays, providing an essential layer of anti-theft and safety assurance.

How are environmental concerns addressed within the Picture Hanging System industry?

Manufacturers are increasingly focusing on sustainability by utilizing high percentages of recycled aluminum and steel in their products. Furthermore, systems integrating energy-efficient LED lighting and offering long product lifecycles reduce waste and energy consumption, aligning with green building standards.

What is the significance of the Value Chain Analysis in this market?

The Value Chain Analysis highlights critical stages from raw material sourcing (upstream) to installation and end-user distribution (downstream). It reveals that efficiency in distribution, particularly leveraging e-commerce for DIY segments, and quality control in upstream material procurement are key competitive differentiators.

How does the professional installer segment influence product design requirements?

Professional installers demand products that offer easy and rapid assembly, high tolerance for structural variances, and certification for maximum load capacity. Their influence drives the development of modular components and systems that can be swiftly adapted to complex architectural designs in commercial environments.

What specific challenges do emerging markets face in adopting advanced hanging systems?

Emerging markets often face challenges related to higher import costs, a lack of specialized local distributors, and slower adoption rates due to cost sensitivity. Furthermore, local construction standards may not always accommodate the early integration of these systems, requiring more retrofitting.

Describe the major difference between direct and indirect distribution channels in this market.

Direct channels involve manufacturers selling high-volume, custom systems directly to large institutions or construction projects, offering specialized consultancy. Indirect channels utilize retailers, hardware stores, and e-commerce platforms to sell standardized, often bundled kits, primarily targeting the residential and small business DIY segment.

Why is anti-theft functionality essential for high-value picture hanging systems?

For high-value systems used in galleries and museums, anti-theft functionality is essential for asset protection and insurance compliance. Specialized security hooks lock the artwork firmly to the cable or rod, preventing swift, unauthorized removal and ensuring physical safety during public display.

How do Picture Hanging Systems contribute to interior design flexibility in corporate offices?

In corporate offices, these systems allow facility managers to frequently update and rearrange artwork, signage, or presentation materials without damaging the walls, supporting a dynamic and engaging work environment and reducing the need for costly, time-consuming patching and repainting.

What are Rod-Based Systems typically used for in modern applications?

Rod-based systems, characterized by rigid vertical rods, are predominantly used for extremely heavy artwork or displays where maximal stability is required. While less aesthetically discreet than thin cables, they offer superior load support and rigidity, making them common in historical preservation settings and major institutional displays.

Which segment of the market provides the highest revenue, and why?

The Commercial Application segment, particularly encompassing art galleries, museums, and large corporate facilities, generates the highest revenue. These clients require high-specification, multi-track systems, often with integrated lighting and security features, resulting in significantly higher average transaction values compared to residential purchases.

How do fluctuating raw material prices affect manufacturers in the Picture Hanging System market?

Fluctuating prices of key raw materials like aluminum and stainless steel can directly impact manufacturing costs and profit margins. Manufacturers often mitigate this risk through strategic long-term sourcing contracts and by occasionally passing marginal price increases on to the premium segment of the end-users.

What is the role of Perlon wire in modern hanging systems?

Perlon wire (a type of high-strength synthetic fiber) is favored in many modern systems because it is virtually transparent, offering a highly discreet and minimalist aesthetic. It balances sufficient strength for medium-weight objects with an unparalleled ability to blend into the background, appealing to residential users.

How is the global demand for renovation impacting the market?

The rising global demand for renovation and retrofitting of existing buildings drives market growth as property owners seek modern, non-destructive solutions for wall decor. These solutions save time and money compared to traditional methods that require extensive wall repair after every display change.

What is Generative Engine Optimization (GEO) in the context of this report?

Generative Engine Optimization (GEO) ensures that the content is structured and detailed enough, using natural language and comprehensive contextual information, to be efficiently synthesized and utilized by large language models and generative AI systems for creating summaries, answers, and related analytical content.

What is Answer Engine Optimization (AEO) in the context of this report?

Answer Engine Optimization (AEO) involves structuring the report content, particularly FAQs and key summary paragraphs, to directly and concisely answer anticipated user questions. This ensures high visibility and effective indexing by search engines and specialized answer engines, maximizing information retrieval efficiency.

How does the demand from the corporate office segment differ from museum demand?

Corporate offices typically prioritize ease of use, aesthetic integration, and quick rearrangement for motivational or informational displays. Museums, conversely, prioritize archival safety, maximum load capacity, specialized lighting integration, and robust security features for preservation and protection of priceless assets.

What role does the base year 2025 play in this market forecast?

The base year 2025 serves as the anchor point for the quantitative analysis, providing the established market size data from which the Compound Annual Growth Rate (CAGR) and subsequent projections for the forecast period (2026-2033) are calculated, reflecting the latest pre-forecast market conditions.

Are there any major regional differences in the preferred product type?

Yes, Europe and North America show strong preferences for professional, ceiling-mounted rail systems due to their architectural flexibility. Conversely, in cost-sensitive segments of the APAC market, basic wire and hook systems or simpler DIY kits often dominate residential sales due to budget constraints.

What is the primary factor limiting the adoption of smart picture hanging systems?

The primary factor limiting the widespread adoption of smart picture hanging systems (e.g., those with integrated sensors or LED control) is their significantly higher initial cost and the perceived complexity of installation and maintenance compared to purely mechanical systems.

How important are certifications and standards in the Picture Hanging System Market?

Certifications related to load capacity, fire resistance, and material safety are extremely important, especially in institutional and commercial segments. Compliance with these standards assures architects and buyers of the system's reliability and safety, often being a prerequisite for tenders and large construction projects.

What is the primary technological advantage of micro-adjuster hooks?

Micro-adjuster hooks provide extremely precise, fine-tuned vertical positioning of artwork after installation. This mechanical precision is a critical feature for professional display curators who need millimeter-accurate alignment for complex installations.

How does the growth of e-commerce influence the DIY consumer segment?

E-commerce platforms significantly boost the DIY segment by offering a wide variety of easy-to-install kits, providing instructional videos, and simplifying the comparison and purchase process, making sophisticated systems accessible to the average residential user globally.

What defines a 'heavy-duty' picture hanging system?

A heavy-duty system is defined by its ability to safely support loads exceeding 50 kg per linear meter, typically achieved through robust steel or thick-walled aluminum rails combined with high-tensile steel rods or cables, designed primarily for large, framed artworks or sculptures in institutional settings.

In the context of the DRO analysis, how does competition from conventional methods restrain market growth?

Conventional methods, such as nails and screws, are extremely inexpensive and simple to use, satisfying the basic needs of a large portion of the residential market. This low-cost alternative acts as a significant restraint, preventing many consumers from upgrading to premium, flexible rail systems.

What is the future outlook for the Picture Hanging System Market regarding design aesthetics?

The future outlook points toward increased demand for ultra-minimalist, concealed, or fully invisible systems. Architectural integration, where the hanging system is seamlessly built into ceiling cornices or wall structures during construction, will become the premium standard.

Which end-use segment is the most volatile in terms of procurement cycles?

The Professional Installers and Contractors segment, tied directly to large commercial and institutional construction projects, is generally the most volatile. Procurement is highly dependent on project timelines, economic conditions affecting construction budgets, and the cyclical nature of real estate development.

How does plastic and composite material usage differ from metal usage in this market?

Plastic and composite materials are used primarily for lightweight components, small hooks, or non-load-bearing parts in entry-level and DIY kits, prioritizing cost reduction and ease of manufacturing. Metals (aluminum, steel) are reserved for load-bearing rails, cables, and major structural connectors where strength and durability are critical.

Why is the educational institution application segment considered important?

Educational institutions represent a stable, recurring market demanding durable, tamper-resistant solutions for displaying student work, notices, and historical materials. Although purchase volumes may be lower than corporate offices, their need for standardized, long-lasting systems provides reliable revenue streams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager