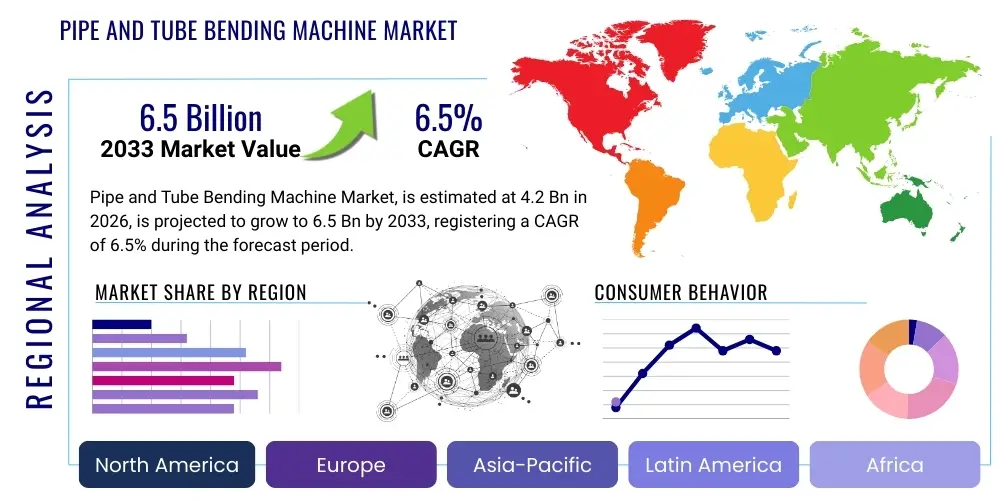

Pipe and Tube Bending Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441612 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Pipe and Tube Bending Machine Market Size

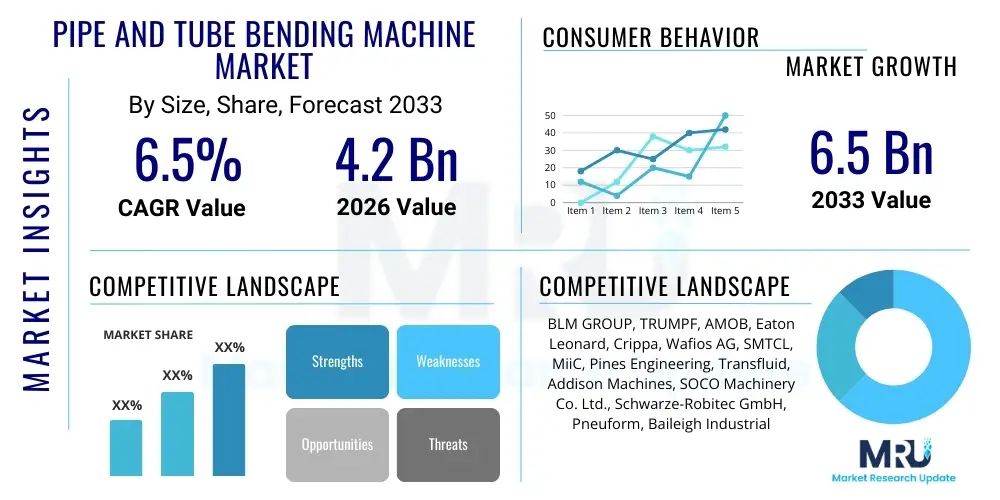

The Pipe and Tube Bending Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Pipe and Tube Bending Machine Market introduction

The Pipe and Tube Bending Machine Market encompasses specialized industrial equipment designed to form, shape, and manipulate metallic and non-metallic tubes and pipes into precise angles and configurations without damaging the material integrity. These machines are crucial across heavy industries, transforming straight stock material into components required for fluid conveyance, structural support, or thermal exchange systems. Product descriptions range from simple manual benders used in low-volume applications to sophisticated Computer Numerical Control (CNC) multi-axis electric benders capable of high-speed, complex, three-dimensional bends with exceptional repeatability and minimal material wastage. The precision offered by modern bending machines is essential for maintaining geometric tolerances demanded by critical applications like aerospace hydraulics and automotive exhaust systems, where minor deviations can compromise safety and performance.

Major applications of pipe and tube bending machines span diverse industrial verticals, including the automotive sector for chassis, exhaust systems, and fuel lines; construction and HVAC for piping networks and structural elements; aerospace for critical hydraulic and engine components; and shipbuilding for complex marine piping. The primary benefit derived from employing high-precision bending technology is the significant reduction in welding and assembly time, which improves overall manufacturing efficiency and component strength, as bent parts inherently possess fewer stress concentration points than welded joints. Furthermore, advanced machines enable manufacturers to handle specialized alloys and materials, such as stainless steel, titanium, and high-strength aluminum, which are increasingly utilized for lightweighting and enhanced durability across various end-use sectors.

The primary driving factors sustaining the growth of this market involve the accelerating global demand for infrastructure development, particularly in emerging economies, coupled with stringent regulatory requirements emphasizing lightweight vehicle design and improved fuel efficiency, necessitating precise tube manipulation for complex component integration. Furthermore, the pervasive trend toward automation and the adoption of Industry 4.0 standards in manufacturing facilities globally are pushing manufacturers to replace older, less efficient hydraulic systems with faster, fully electric, and highly integrated CNC bending machines. This shift allows for seamless integration into automated production lines, enabling manufacturers to manage tighter tolerances and complex geometries required for new generation products, thereby underpinning steady market expansion throughout the forecast period.

Pipe and Tube Bending Machine Market Executive Summary

The global Pipe and Tube Bending Machine Market is currently shaped by pivotal business trends focused on digitalization and sustainability. Manufacturers are heavily investing in integrating advanced sensor technology, real-time monitoring capabilities, and sophisticated software interfaces to enhance operational efficiency and reduce energy consumption, moving away from conventional hydraulic systems toward electric and hybrid models. Geographically, the Asia Pacific region, led by China and India, maintains market dominance, driven by robust activity in automotive production and massive government investments in energy infrastructure and construction projects. Conversely, North America and Europe emphasize the adoption of high-end automation, focusing on machines capable of handling specialty materials crucial for aerospace and electric vehicle (EV) manufacturing. Segment-wise, the CNC bending machine category commands the largest revenue share due to its unparalleled precision, speed, and versatility, while the automotive and HVAC sectors continue to represent the most significant application segments, bolstered by renewed global production cycles and continuous innovation in vehicle architecture and building efficiency standards.

AI Impact Analysis on Pipe and Tube Bending Machine Market

Common user questions regarding AI's influence on the Pipe and Tube Bending Machine Market frequently revolve around how artificial intelligence can enhance machine accuracy, reduce material waste, and streamline setup times—critical concerns for high-volume manufacturers. Users are particularly interested in the application of predictive maintenance using machine learning algorithms to forecast potential component failures, thereby minimizing unplanned downtime. Furthermore, there is significant inquiry into AI's role in optimizing complex, multi-bend sequences and compensating for material spring-back variations in real-time, processes traditionally requiring extensive manual calibration. The synthesis of these user queries confirms a strong market expectation that AI will transition bending operations from prescriptive methods to adaptive, self-optimizing manufacturing systems, fundamentally improving yield rates and operational efficiency across the entire production lifecycle, validating investments in advanced, intelligent machinery.

- Implementation of predictive maintenance protocols utilizing machine learning models to analyze sensor data, reducing unexpected equipment failures and optimizing maintenance schedules.

- Real-time spring-back compensation mechanisms powered by AI, allowing machines to instantly adjust bending angles based on material property variations and environmental factors, ensuring precise geometry on the first attempt.

- Automated quality control (AQC) through computer vision and deep learning, rapidly inspecting complex bent parts for dimensional accuracy and surface defects, accelerating throughput and enhancing conformity to stringent quality standards.

- Optimization of complex bending programs and sequencing algorithms, minimizing cycle times and energy consumption by intelligently planning the most efficient path for the bending head and material feed.

- Enhanced operator assistance and training through AI-driven simulation and augmented reality interfaces, simplifying the complexity associated with setting up intricate bending jobs for novel materials.

DRO & Impact Forces Of Pipe and Tube Bending Machine Market

The dynamics of the Pipe and Tube Bending Machine Market are governed by a complex interplay of facilitating drivers, market limitations, emerging opportunities, and competitive impact forces. A primary driver is the accelerating global adoption of lightweighting strategies in transportation sectors, particularly in electric vehicles (EVs) and aerospace, which mandates the use of highly precise, mandrel bending techniques for complex, thin-walled tubing made from specialized alloys, necessitating investment in advanced CNC equipment. Conversely, a significant restraint is the high initial capital expenditure required for acquiring sophisticated multi-axis CNC bending machines and their associated automation peripherals, which often deters small and medium-sized enterprises (SMEs) from rapid adoption. This high barrier to entry slows down the market penetration rate in developing regions, impacting overall growth potential, particularly given the specialized nature of the equipment and the requirement for dedicated infrastructural support, such as pneumatic or hydraulic supplies, depending on the machine type.

Opportunities for expansion are fundamentally rooted in the integration of Industry 4.0 principles, allowing bending machines to become nodes within smart factory ecosystems. The shift toward custom fabrication and small-batch production, particularly in areas like architectural design and custom vehicle modification, presents significant niche market potential for highly adaptable, quick-change tooling machines. Furthermore, the convergence of bending technology with additive manufacturing processes—where tubes produced via 3D printing require secondary bending or manipulation—opens new avenues for hybrid manufacturing solutions. The rapid urbanization in densely populated regions further fuels demand for efficient HVAC systems and reliable fluid management infrastructure, requiring large volumes of custom-bent pipework for effective installation, which sustains demand for large-scale, automated bending solutions capable of high throughput and consistency across varied pipe diameters.

The impact forces influencing the competitive landscape are dominated by technological innovation and strategic mergers and acquisitions among key players aiming to consolidate market share and intellectual property related to proprietary bending software and control systems. The availability and pricing of raw materials, such as steel and aluminum, directly affect the cost structures of end-user industries, creating cyclical demand volatility for bending equipment manufacturers. Furthermore, strict environmental regulations governing energy efficiency and noise reduction compel machine builders to continually refine their designs, favoring energy-efficient electric benders over older hydraulic models. The requirement for highly skilled technicians to program, operate, and maintain these complex, high-precision machines acts as a subtle but powerful force, influencing purchasing decisions towards manufacturers that offer comprehensive training and robust service support, thereby increasing the value proposition associated with advanced machinery procurement.

Segmentation Analysis

The Pipe and Tube Bending Machine Market is meticulously segmented based on key functional and application parameters, providing a detailed view of market structure and growth avenues. Primary segmentation includes Type (CNC, Hydraulic, Electric, Manual), wherein CNC machines dominate due to superior accuracy and integration potential in automated lines, while Electric machines are gaining rapid traction due to their energy efficiency and faster cycle times compared to traditional hydraulic counterparts. Further analysis is conducted based on End-User Industry, recognizing the diverse demands of the automotive, HVAC and Refrigeration, Oil and Gas, Construction, and Aerospace sectors. Each segment exhibits distinct requirements concerning tube diameter, material type (mild steel, stainless steel, specialty alloys), and required bending complexity, influencing the type of machinery procured.

Geographical segmentation remains critical, identifying Asia Pacific as the largest and fastest-growing market, driven by expanding manufacturing bases and large infrastructure projects. North America and Europe focus on replacing legacy equipment with high-end, automated, and intelligent systems, targeting precision-intensive applications like medical device manufacturing and high-performance vehicle components. The granular segmentation allows stakeholders to tailor product development and marketing strategies to specific regional and industrial needs. For instance, the demand in the Oil and Gas sector focuses predominantly on heavy-duty hydraulic benders capable of handling large-diameter, high-pressure pipes, contrasting sharply with the automotive sector's need for high-speed, multi-stack CNC electric benders for intricate small-diameter tubing.

- Type:

- CNC Pipe and Tube Bending Machines

- Hydraulic Pipe and Tube Bending Machines

- Electric Pipe and Tube Bending Machines

- Manual/Semi-Automatic Pipe and Tube Bending Machines

- Operation:

- Automatic

- Semi-Automatic

- Manual

- Bending Technology:

- Rotary Draw Bending

- Roll Bending

- Compression Bending

- Press Bending

- End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- Construction and Infrastructure

- HVAC and Refrigeration

- Oil and Gas

- Shipbuilding

- Furniture and Consumer Goods

- Others (Medical, Agriculture)

- Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Pipe and Tube Bending Machine Market

The value chain for the Pipe and Tube Bending Machine Market starts with upstream activities focused on the sourcing and processing of core components, particularly high-quality steel, specialty alloys, advanced electronic controls, and hydraulic systems. Key upstream suppliers include component manufacturers specializing in high-precision servo motors, sensors, and robust castings necessary for machine frames, ensuring the structural rigidity and operational accuracy required for industrial applications. The complexity of CNC controls often necessitates partnerships with leading industrial automation and software developers. Efficient management of the upstream segment is crucial as component quality directly impacts machine performance and longevity, which are critical metrics for end-users operating in demanding environments such as aerospace or energy infrastructure. Procurement strategies heavily focus on reliability and standardization to maintain high manufacturing throughput.

The midstream of the value chain involves the design, manufacturing, assembly, and testing of the bending machines themselves. Manufacturers invest heavily in Research and Development to integrate advanced features like multi-axis control, automated material handling systems, and proprietary software interfaces that manage complex geometries and material spring-back compensation. Downstream activities involve distribution, sales, installation, and comprehensive aftermarket support. Due to the high investment nature of the product, distribution channels typically involve a mix of direct sales teams for key accounts (large automotive OEMs or Tier 1 suppliers) and specialized, technically proficient distributors or agents who handle regional sales, installation, commissioning, and localized training for a wider client base, ensuring machines meet specific regional regulatory and operational standards.

The distribution channel structure is bifurcated into direct and indirect channels. Direct channels facilitate deep manufacturer-client relationships, especially for custom-engineered or large-scale automated lines, providing maximum control over pricing and service quality. Indirect channels, involving authorized dealers and system integrators, are vital for market penetration into geographically diverse locations and for serving SMEs that require localized sales support, financing options, and immediate technical assistance. The effectiveness of the indirect network is highly dependent on the training and technical capability of the local representatives to handle complex setup procedures and software integration, making post-sale service and support a critical differentiator within the highly competitive downstream segment of the market.

Pipe and Tube Bending Machine Market Potential Customers

Potential customers for Pipe and Tube Bending Machines are predominantly manufacturing organizations requiring precise formation of fluid and structural components across capital-intensive sectors. The primary target market consists of automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers, who need high-speed, high-volume CNC bending capabilities for chassis, exhaust systems, catalytic converters, and fuel lines, driven by the global shift towards electric and hybrid vehicles requiring lighter, more complex battery cooling and thermal management systems. Another substantial customer base lies within the heating, ventilation, and air conditioning (HVAC) and refrigeration industries, requiring consistent, high-quality bends for heat exchangers and large-scale facility piping systems, where consistency is paramount for energy efficiency and leak prevention.

Furthermore, the aerospace and defense sector represents a highly lucrative, albeit smaller-volume, segment. These customers demand the highest level of precision and traceability for critical components like fuel conduits, hydraulic lines, and engine tubes made from exotic materials such as Inconel and titanium. The machinery supplied to this sector must adhere to extremely stringent regulatory standards, often requiring specialized tooling and ultra-precise measuring systems. Lastly, general fabrication shops and construction firms involved in complex architectural elements, heavy machinery production (e.g., agricultural equipment, construction vehicles), and process piping for oil refineries and power plants represent persistent demand for robust hydraulic and roll bending equipment capable of handling large diameters and thick wall tubing reliably.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BLM GROUP, TRUMPF, AMOB, Eaton Leonard, Crippa, Wafios AG, SMTCL, MiiC, Pines Engineering, Transfluid, Addison Machines, SOCO Machinery Co. Ltd., Schwarze-Robitec GmbH, Pneuform, Baileigh Industrial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipe and Tube Bending Machine Market Key Technology Landscape

The technological landscape of the Pipe and Tube Bending Machine Market is undergoing a rapid evolution, primarily driven by the transition from less precise, energy-intensive hydraulic systems to advanced, all-electric CNC servo technology. Electric benders offer superior speed, positional accuracy across all axes (typically 8 to 11 axes), and significantly lower operating costs due to reduced power consumption and minimal maintenance requirements compared to hydraulic circuits. A critical technological focus is the development of proprietary control software that manages complex interpolation and tool collision avoidance, particularly vital for multi-stack tooling setups that allow manufacturers to complete highly intricate bends in a single cycle. Furthermore, integrated laser scanning and probing systems are increasingly employed, enabling in-line measurement of parts and closed-loop feedback systems to automatically correct geometric deviations and material spring-back instantly, ensuring zero-defect production runs, which is particularly crucial in the medical device and aerospace industries.

Another area of profound technological advancement involves tooling materials and design. The increasing use of difficult-to-bend materials, such as high-strength steel (HSS) and titanium alloys required for lightweighting initiatives, demands robust tooling with optimized friction coefficients and enhanced wear resistance. Machine manufacturers are collaborating with tooling specialists to develop specialized mandrels, wipers, and clamping dies that prevent wrinkling, flattening, or ovality during the bending of thin-walled or exotic tubes. The implementation of sensor fusion technology—integrating pressure sensors, displacement encoders, and temperature monitoring—is becoming standard practice to provide operators with comprehensive, real-time data on the bending process, moving the technology closer to fully autonomous operation by providing the necessary data foundation for advanced predictive analytics and process optimization.

The integration of digital twin technology stands out as a pioneering trend, allowing manufacturers to simulate the entire bending process virtually before committing to physical production. This simulation capability drastically reduces setup time and material waste by identifying and rectifying potential programming or tooling issues offline, leading to significant cost savings. Furthermore, the connectivity provided by Industrial Internet of Things (IIoT) frameworks is enabling remote diagnostics and preventative service operations, allowing machine builders to monitor the health and performance of installed machines globally. This level of technological sophistication ensures that modern pipe and tube bending machines are not merely tools for shaping metal, but rather integrated, data-generating assets that contribute strategically to overall factory efficiency and productivity metrics.

Regional Highlights

The market dynamics of the Pipe and Tube Bending Machine Market are highly segmented geographically, reflecting regional variations in industrial output, technological maturity, and infrastructural investment cycles.

- Asia Pacific (APAC): APAC is the global leader in both market size and growth rate, primarily driven by massive manufacturing output in China, India, and South Korea. Robust demand stems from rapid urbanization, extensive infrastructure development (high-speed rail, smart cities), and the establishment of global supply chain hubs for the automotive and electronics industries. The region represents high growth potential due to continued government investment in local production capacities and the gradual replacement of older, manually operated equipment with modern, cost-effective CNC solutions.

- North America: This region is characterized by high adoption of sophisticated, high-precision, multi-axis electric benders, particularly in the aerospace, defense, and high-end automotive sectors (including EV manufacturing). Market growth is stable, driven less by volume and more by the necessity for highly customized, high-tolerance tube forming required for critical applications. The focus here is on automation, integration with robotic loading/unloading systems, and implementation of Industry 4.0 standards.

- Europe: Europe, particularly Germany and Italy, holds a historical prominence in advanced machinery manufacturing. The market is mature but highly innovative, focusing intensely on energy efficiency, precision engineering, and sustainable manufacturing practices (ESG compliance). Key drivers include the stringent requirements of the region's premium automotive brands and strong activity in the fluid control and heavy construction machinery sectors. European demand favors highly specialized, low-volume, high-value bending solutions.

- Latin America and MEA (Middle East and Africa): These regions exhibit emerging market dynamics, where growth is highly correlated with commodity cycles (Oil and Gas) and large-scale government infrastructure projects. Demand is primarily centered on heavy-duty hydraulic benders for large diameter pipes in the energy and construction sectors. While adoption rates for high-end CNC technology are slower, increasing foreign direct investment in localized manufacturing facilities suggests strong potential for gradual transition towards automated bending solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipe and Tube Bending Machine Market.- BLM GROUP

- TRUMPF

- AMOB

- Eaton Leonard

- Crippa

- Wafios AG

- SMTCL

- MiiC

- Pines Engineering

- Transfluid

- Addison Machines

- SOCO Machinery Co. Ltd.

- Schwarze-Robitec GmbH

- Pneuform

- Baileigh Industrial

- CML USA Inc. (Ercolina)

- Horn Machine Tools

- Teledyne Hanson

- S&S Machine Tool Company

- Precision Tube Bending Systems

Frequently Asked Questions

Analyze common user questions about the Pipe and Tube Bending Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydraulic and all-electric (CNC) pipe bending machines?

Hydraulic machines use fluid power, offering high force for large, thick-walled pipes but typically operate slower and require more maintenance. All-electric CNC machines use servo motors for faster, more precise, multi-axis bending, superior repeatability, and significantly greater energy efficiency, dominating high-volume, precision applications.

Which end-user industry drives the highest demand for advanced bending technology?

The Automotive and Transportation industry drives the highest demand for advanced technology, specifically high-speed CNC and multi-stack electric bending machines. This is due to stringent requirements for lightweight components, complex exhaust systems, and precision cooling lines required by modern internal combustion and electric vehicles (EVs).

How does the integration of Industry 4.0 affect bending machine operations?

Industry 4.0 integration enhances operational efficiency by enabling real-time data collection, predictive maintenance scheduling, remote diagnostics, and seamless connection to overall factory management systems (MES/ERP). This allows for rapid tool changes, reduced downtime, and optimized production scheduling.

What is 'spring-back compensation' and why is it important in tube bending?

Spring-back is the tendency of a metal tube to partially revert to its original shape after the bending force is removed. Compensation involves calculating and over-bending the material to achieve the desired angle. Modern CNC machines use sensors and AI algorithms for real-time automatic compensation, crucial for ensuring the geometric precision of the final component.

Which region shows the highest projected growth rate for pipe bending machine adoption?

The Asia Pacific (APAC) region, driven by countries like China and India, exhibits the highest projected growth rate due to escalating investments in infrastructure, robust expansion of the local automotive manufacturing base, and increasing adoption of automation technologies across manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager