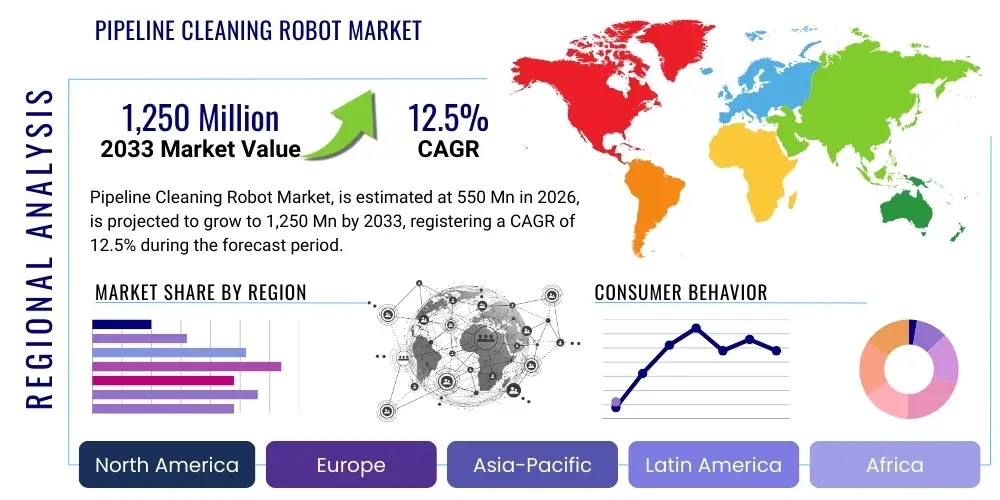

Pipeline Cleaning Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442072 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Pipeline Cleaning Robot Market Size

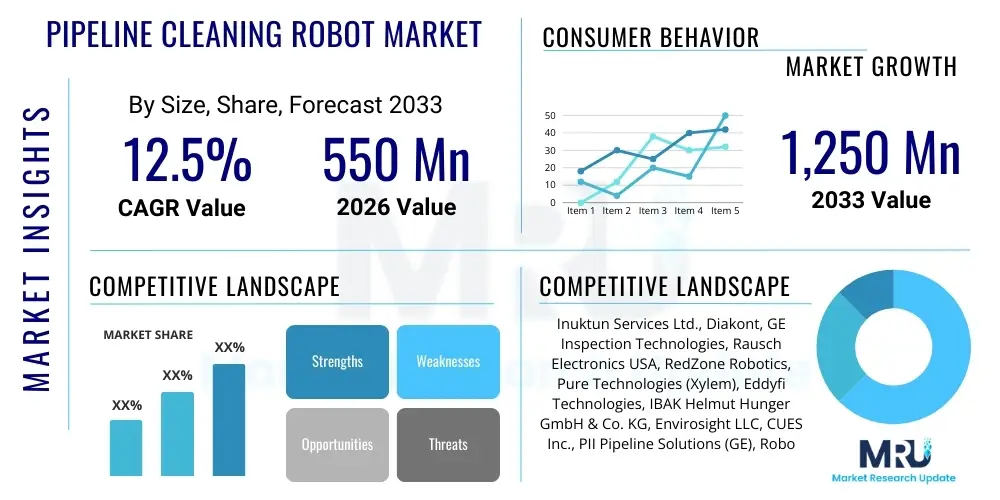

The Pipeline Cleaning Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,250 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global need for infrastructure maintenance, coupled with stringent environmental and safety regulations mandating regular inspection and cleaning of critical pipeline networks across the oil and gas, municipal water, and chemical sectors. The adoption of autonomous and semi-autonomous systems offers significant operational efficiency improvements compared to traditional manual methods, reducing downtime and operational risks, thus solidifying its financial viability for large asset owners.

Pipeline Cleaning Robot Market introduction

The Pipeline Cleaning Robot Market encompasses specialized, often autonomous, robotic systems designed for internal maintenance, inspection, and cleaning of complex pipe infrastructure without human entry. These sophisticated devices navigate varying pipe diameters and materials, utilizing advanced sensors, propulsion systems, and debris removal tools to address scaling, corrosion buildup, blockages, and foreign material accumulation. The primary product goal is to maintain pipeline integrity, ensuring optimal flow rates, preventing leaks, and extending the lifespan of valuable infrastructure assets, which are critical components in global energy distribution and municipal utility services.

Major applications of pipeline cleaning robots span several vital industries, including oil and gas transmission pipelines (both onshore and offshore), municipal sewage and stormwater systems, potable water distribution networks, and industrial processing pipelines carrying chemicals or slurries. These robots offer substantial benefits, such as enhanced worker safety by minimizing hazardous confined-space entries, increased cleaning efficacy through precise, repeatable operations, and significant cost reductions associated with proactive maintenance versus reactive repairs. Furthermore, their ability to integrate inspection capabilities (PIGging alternatives) provides comprehensive data on structural health, enabling predictive maintenance scheduling.

Key driving factors accelerating the adoption of this technology include the global crisis of aging infrastructure, particularly in mature economies like North America and Europe, which necessitates frequent rehabilitation and preventative cleaning. Regulatory compliance, specifically pertaining to environmental protection and leakage prevention, further compels operators to implement reliable and high-frequency cleaning protocols. Technological advancements, such as improved battery life, miniaturization of components, advanced non-destructive testing (NDT) capabilities, and the integration of Artificial Intelligence for autonomous navigation and defect identification, are making these robots more versatile and cost-effective across diverse operational environments.

Pipeline Cleaning Robot Market Executive Summary

The Pipeline Cleaning Robot Market is poised for substantial growth, characterized by significant technological shifts favoring highly autonomous, tetherless systems capable of navigating complex geometries and long distances. Business trends indicate a strong move towards ‘Robotics-as-a-Service’ (RaaS) models, particularly among small and medium-sized operators who require advanced capabilities without the burden of large capital expenditure for purchasing and maintaining specialized equipment. Strategic partnerships between robotics manufacturers and traditional engineering, procurement, and construction (EPC) firms are becoming common, aiming to provide integrated inspection and cleaning solutions that encompass both internal pipe maintenance and holistic asset management strategies, thereby capturing a wider end-user base.

Regional trends highlight North America and Europe as current market leaders, primarily due to the extensive network of aging oil and gas and municipal water infrastructure, coupled with stringent safety standards and high investment capacity. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, fueled by rapid industrialization, massive investments in new urban water and sewage infrastructure, and increasing energy transmission needs, particularly in China and India. The Middle East and Africa (MEA) represent significant opportunities, driven by large-scale oil and gas pipeline projects and the necessity to maintain flow efficiency in extreme desert environments.

Segment trends reveal that the untethered/autonomous robot segment is expected to gain significant traction, offering greater flexibility and reach compared to traditional tethered systems, especially for long-distance pipelines and complex networks. By application, the Oil & Gas sector remains the dominant segment due to the high value and critical nature of petroleum product transport, while the Municipal Water & Wastewater segment shows accelerating demand driven by regulatory mandates to improve urban sanitation and reduce non-revenue water (NRW) losses. The integration of advanced sensor payloads, particularly those using advanced ultrasonic and phased array technologies, is a key product trend enhancing the robot’s dual functionality of cleaning and high-resolution inspection.

AI Impact Analysis on Pipeline Cleaning Robot Market

User inquiries regarding AI's impact on pipeline cleaning robots frequently center on three critical themes: achieving true autonomy, enhancing data interpretation for predictive maintenance, and optimizing operational efficiency in real-time. Users are keen to understand how AI algorithms can enable robots to navigate complex, previously unmapped pipeline segments autonomously, overcoming obstacles and adapting to changing flow conditions without constant human input. There is also significant interest in the transition from raw data collection to actionable insights; specifically, how machine learning can automatically classify, localize, and predict the severity of defects (corrosion, cracks, scale buildup) far more accurately and rapidly than manual review processes, reducing inspection time and false positives.

The core expectation is that AI will move these systems beyond simple mechanized cleaning tasks toward sophisticated, intelligent asset management platforms. End-users in the oil and gas industry, for instance, are seeking AI solutions that correlate cleaning efficacy with flow rate improvements and use reinforcement learning to determine the optimal cleaning trajectory and intensity based on historical pipeline degradation patterns. The integration of neural networks into on-board sensor processing units allows for immediate decision-making, such as optimizing brush pressure or switching cleaning modules when encountering different types of fouling, significantly improving mission success rates.

Furthermore, concerns often revolve around the security and reliability of AI systems operating in highly critical infrastructure. Users expect robust fault detection, secure communication protocols, and explainable AI models (XAI) to ensure trust in autonomous decisions. The market anticipates that AI will drive down operational expenditure by minimizing repeat inspection runs and optimizing scheduling across entire pipeline networks, transitioning maintenance from time-based to condition-based paradigms, ultimately transforming the robots from mere tools into integral components of the smart infrastructure ecosystem.

- Enhanced Autonomous Navigation and Path Planning through Deep Learning algorithms.

- Real-time Defect Recognition and Classification using Computer Vision and Neural Networks.

- Predictive Maintenance Scheduling based on ML analysis of degradation patterns and sensor fusion data.

- Optimized Resource Allocation and Energy Management for prolonged operation cycles in untethered robots.

- Automated Reporting Generation and Data Correlation, significantly reducing post-mission analysis time.

DRO & Impact Forces Of Pipeline Cleaning Robot Market

The Pipeline Cleaning Robot Market is influenced by a dynamic interplay of propelling and restricting forces. Drivers primarily include the critical need for infrastructure longevity maintenance, driven by the global aging of utility and energy pipelines, which often suffer from internal degradation that compromises efficiency and safety. Secondly, environmental regulations, especially those targeting prevention of catastrophic failures (like oil spills or contamination of potable water), compel mandatory and frequent internal cleaning and inspection, thereby institutionalizing the demand for automated solutions. Opportunities are emerging primarily through the miniaturization of robotic systems, allowing access to smaller diameter pipes previously inaccessible to mechanized PIGs, and the geographical expansion into developing economies that are rapidly constructing new energy and utility networks.

Conversely, significant restraints hinder wider market adoption, predominantly the substantial initial capital investment required for high-end, complex robotic systems, which can be prohibitive for smaller utility companies. Technical complexities related to long-distance navigation in highly viscous fluids, overcoming significant obstacles like valves and varied pipe fittings, and ensuring reliable wireless communication through solid materials also present major operational challenges. Impact forces, which shape the market structure, emphasize technological leapfrogging—where manufacturers are pressured to continuously integrate superior sensing capabilities (e.g., advanced NDT methods) and enhanced autonomy (AI-driven decision-making) to justify the high equipment cost and displace existing, albeit less effective, conventional cleaning methods.

The market also faces inherent risks related to robot retrieval failure (becoming stuck), which can lead to significant pipeline downtime and costly recovery operations, necessitating high reliability and redundancy in design. However, opportunities in niche markets, such as nuclear facility pipe cleaning or specialized chemical plant maintenance, offer high-margin potential. The prevailing impact forces are driving the convergence of cleaning and inspection functions into unified robotic platforms, positioning these tools not just as cleaning devices, but as comprehensive digital mapping and asset integrity management systems, fundamentally redefining pipeline maintenance paradigms globally.

Segmentation Analysis

The Pipeline Cleaning Robot Market is comprehensively segmented based on technology, propulsion mechanism, application, and pipe diameter, reflecting the diverse operational requirements across various end-user industries. This segmentation is crucial for understanding specific market trends, enabling manufacturers to tailor solutions precisely to the unique challenges of, for example, high-pressure oil transmission lines versus low-pressure municipal wastewater systems. The dominance of the tethered segment historically is being challenged by the growing demand for highly maneuverable, untethered robots, particularly in applications where pipeline access points are sparse or highly restrictive, driving innovation in onboard power and advanced communication technologies. Understanding these granular segments allows for targeted investment and strategic market entry.

By application, the segmentation clearly delineates the massive market share held by the Energy and Infrastructure sectors, where regulatory compliance and asset protection drive constant demand, compared to the nascent but rapidly growing use in niche industrial settings such as pharmaceutical or food and beverage manufacturing. Propulsion methods, whether magnetic, wheeled, tracked, or swimming/crawler, define the robot’s suitability for different pipeline materials and fluid environments (e.g., dry gas lines versus liquid slurry lines). These differentiated segments underscore the necessity for modular design and customization, as a one-size-fits-all approach is highly impractical given the extreme variation in global pipeline infrastructure specifications and operational constraints.

- By Type:

- Untethered (Autonomous) Robots

- Tethered Robots

- By Propulsion Mechanism:

- Wheeled/Tracked Systems

- Magnetic Flux Systems

- Pneumatic/Hydraulic Systems

- Swimming/Crawler Robots

- By Application:

- Oil and Gas Pipelines

- Water and Wastewater Pipelines (Municipal)

- Chemical and Process Pipelines

- Mining and Metallurgy Slurry Pipelines

- Other Industrial Applications (e.g., HVAC, Nuclear)

- By Pipe Diameter:

- Less than 12 Inches

- 12 to 36 Inches

- Greater than 36 Inches

Value Chain Analysis For Pipeline Cleaning Robot Market

The value chain for the Pipeline Cleaning Robot Market begins upstream with critical component suppliers, focusing on specialized, high-reliability sensor technology, microprocessors optimized for real-time data processing, and advanced material manufacturers providing lightweight, corrosion-resistant chassis and propulsion components. Key upstream activities include the sourcing of high-density battery systems for untethered robots and high-flexibility, durable fiber optic cables for tethered solutions. The reliance on advanced NDT sensor manufacturers (ultrasonic transducers, Eddy current sensors, laser scanners) emphasizes the highly technical nature of the inputs, making supplier relationships critical for ensuring system performance and differentiation in the competitive landscape.

Midstream activities involve the core design, assembly, and integration by robot manufacturers. This stage requires significant investment in Research and Development (R&D) to integrate complex AI navigation algorithms, modular cleaning tools (brushes, cutters, water jets), and secure communication systems capable of penetrating steel and concrete. Direct and indirect distribution channels play a pivotal role downstream. Direct channels involve manufacturers selling high-value, bespoke robotic fleets directly to major oil and gas companies or national utility services, often including extensive training and long-term maintenance contracts. Indirect channels utilize specialized engineering consultants, inspection service providers, or regional robotics distributors who integrate the cleaning robots into broader maintenance service packages offered to smaller municipal or industrial clients.

The downstream success is dictated by service delivery and maintenance, encompassing field deployment, operational support, and post-mission data analysis. This is where the distinction between selling a physical product and offering a comprehensive RaaS solution becomes pronounced. End-users prioritize reliability and the speed of data turnaround. Therefore, the value chain is increasingly shifting towards robust service provision and data analytics platforms (often cloud-based) that integrate the robotic output directly into enterprise asset management (EAM) systems, cementing the robot's role as a tool for data generation rather than just physical cleaning. Profitability often resides heavily in the recurring service contracts and specialized intellectual property related to autonomous operation and advanced defect identification.

Pipeline Cleaning Robot Market Potential Customers

The primary consumers and buyers in the Pipeline Cleaning Robot Market are large asset owners who manage extensive pipeline infrastructure where operational integrity is paramount to business continuity and regulatory compliance. The most dominant segment remains the Oil and Gas industry, encompassing international and national oil companies (IOCs and NOCs), pipeline transmission operators, and petrochemical refineries. These entities require frequent, highly effective cleaning services to prevent paraffin, asphaltene, and hydrate buildup, which severely restrict flow, increase pumping costs, and pose risks of catastrophic failure. Their purchasing decisions are heavily influenced by the robot's ability to cover long distances, navigate high-pressure environments, and simultaneously collect high-fidelity inspection data, often preferring robust, large-diameter PIG-like or advanced tethered systems.

The second major cohort comprises Municipal Water and Wastewater Authorities and Public Utility Departments. For these customers, the emphasis is on minimizing non-revenue water (NRW) loss due to leaks, combating biological fouling (biofilm), and clearing heavy debris (fats, oils, grease - FOG) from sewage lines to prevent overflows and environmental damage. Municipal buyers tend to favor smaller, highly maneuverable, often wheeled or tracked robots that can operate effectively in diverse, often older, and structurally deteriorated pipe networks. Cost-effectiveness and ease of deployment are critical factors, leading to high adoption rates of RaaS models or simpler, modular systems suitable for urban infrastructure maintenance budgets.

A third, high-value segment includes specialized industrial customers such as chemical processing plants, power generation facilities (including nuclear), and mining operations that handle abrasive slurries or corrosive materials. These end-users demand customized robots capable of resisting extreme chemical environments or high-wear conditions. The procurement in this sector is driven by the necessity of minimizing human exposure to hazardous materials and maintaining extremely high product purity standards. Purchasing in this segment is characterized by highly specialized, low-volume orders where customization and adherence to specific operational safety protocols outweigh general market pricing considerations, creating a niche for specialized robotic solution providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,250 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inuktun Services Ltd., Diakont, GE Inspection Technologies, Rausch Electronics USA, RedZone Robotics, Pure Technologies (Xylem), Eddyfi Technologies, IBAK Helmut Hunger GmbH & Co. KG, Envirosight LLC, CUES Inc., PII Pipeline Solutions (GE), Robotics Design Inc., NDT Global, Robotics Inc., Intertek Group plc, Smart Pipe Technologies, Halfwave AS, Madewell Products Corporation, Subsea 7, CISBOT (Columbia Utilities) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipeline Cleaning Robot Market Key Technology Landscape

The technological evolution of pipeline cleaning robots is centered on enhancing maneuverability, extending operational range, and integrating sophisticated sensing and data acquisition capabilities. Core technologies currently driving market growth include advanced magnetic flux leakage (MFL) and ultrasonic testing (UT) sensors, which are increasingly miniaturized and integrated into the robotic chassis to perform simultaneous cleaning and non-destructive inspection. Navigation technology relies heavily on inertial measurement units (IMUs) combined with advanced odometry, often supported by proprietary mapping algorithms to accurately track the robot's position within complex and winding pipe networks where GPS signals are unavailable. Propulsion systems are shifting towards modular designs, allowing operators to quickly interchange wheeled, tracked, or magnetic units based on the specific pipe material (ferrous vs. non-ferrous) and internal conditions (dry vs. fluid-filled), optimizing deployment flexibility.

Communication protocols represent a significant technical challenge, especially for untethered robots operating over long distances. Solutions include through-wall electromagnetic wave propagation for high-bandwidth data transfer over short spans, and low-frequency, long-range acoustic or magnetic signals for command and control signaling in extended pipelines. Power management technology is crucial, with substantial R&D focused on developing high-density, fast-charging battery chemistries and energy harvesting techniques (e.g., utilizing flow differential) to extend mission endurance and reduce the reliance on cumbersome tethers. Furthermore, cleaning mechanisms are advancing beyond simple mechanical brushes to include high-pressure water jetting (hydro-jetting) and specialized chemical dispensing modules, offering enhanced efficacy against hard scaling and complex chemical residues.

The most transformative technology is the integration of Artificial Intelligence and Machine Learning (ML) for enhanced situational awareness. AI enables robots to interpret sensory data in real-time, autonomously identify and classify defects, and make optimal decisions regarding navigation (avoiding obstacles, finding bypass routes) and cleaning intensity (adjusting brush speed or jet pressure based on fouling level). The focus on modularity extends to software architecture, allowing for quick updates and specialized mission programming, turning the physical robot into a dynamic, adaptable platform for comprehensive pipeline integrity management. This technological trajectory confirms the shift from simple machinery toward highly specialized, intelligent robotic inspection platforms.

Regional Highlights

The global Pipeline Cleaning Robot Market exhibits distinct regional demands and adoption rates shaped by infrastructure maturity, regulatory environments, and investment capacity.

- North America: Market leader due to the vast, aging network of oil, gas, and municipal water pipelines. Stringent federal regulations (e.g., PHMSA requirements in the U.S.) mandate frequent integrity assessments, driving high demand for advanced, large-diameter inspection and cleaning robots. High R&D investment and presence of key technological players further solidify its dominance.

- Europe: A mature market characterized by robust environmental protection laws and a strong focus on municipal water infrastructure rehabilitation and leakage reduction. High adoption rates for specialized, small-diameter robots are evident, particularly in Western European countries focused on urban utility maintenance and smart water initiatives.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive infrastructure development in energy transmission and urbanization, particularly in China, India, and Southeast Asia. Growth is driven both by the construction of new pipelines requiring initial cleaning/inspection and the need to efficiently maintain newly built mega-cities' utility networks.

- Middle East and Africa (MEA): Growth highly concentrated in the oil and gas sector, driven by the need to maintain long-distance crude oil and natural gas pipelines under extreme thermal conditions. Investment in technology is strong, often favoring advanced autonomous PIG-like robots and specialized solutions to combat sand ingress and high-paraffin crude buildup.

- Latin America (LATAM): A developing market with increasing investment in pipeline infrastructure, particularly in countries like Brazil and Mexico. Adoption is currently focused on essential maintenance and efficiency improvements within existing state-owned oil companies, with potential for RaaS models to overcome capital constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipeline Cleaning Robot Market.- Inuktun Services Ltd.

- Diakont

- GE Inspection Technologies

- Rausch Electronics USA

- RedZone Robotics

- Pure Technologies (Xylem)

- Eddyfi Technologies

- IBAK Helmut Hunger GmbH & Co. KG

- Envirosight LLC

- CUES Inc.

- PII Pipeline Solutions (GE)

- Robotics Design Inc.

- NDT Global

- Robotics Inc.

- Intertek Group plc

- Smart Pipe Technologies

- Halfwave AS

- Madewell Products Corporation

- Subsea 7

- CISBOT (Columbia Utilities)

Frequently Asked Questions

Analyze common user questions about the Pipeline Cleaning Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between tethered and untethered pipeline cleaning robots?

Tethered robots receive continuous power and data transmission via a cable, enabling high bandwidth and unlimited mission duration, but limiting range and maneuverability. Untethered (autonomous) robots use on-board batteries and internal storage, offering superior range and flexibility, making them ideal for long-distance or complex pipes, although mission duration is constrained by battery life and data transmission capacity.

How is Artificial Intelligence enhancing the performance of pipeline cleaning robots?

AI is crucial for enabling true robot autonomy, allowing for real-time decision-making, obstacle avoidance, and optimal path planning in unpredictable pipe conditions. Furthermore, AI-driven machine learning algorithms significantly improve the accuracy and speed of defect identification (e.g., corrosion classification) from sensor data, transforming raw inspection data into actionable predictive maintenance insights.

Which industry segment currently holds the largest share in the pipeline cleaning robot market?

The Oil and Gas segment currently holds the largest market share. This dominance stems from the critical nature and immense asset value of energy pipelines, requiring frequent, high-stakes cleaning and inspection activities to maintain flow efficiency, prevent product contamination, and comply with stringent safety and environmental regulations globally.

What are the major technological challenges facing untethered pipeline cleaning robots?

Key challenges include ensuring reliable long-range communication through steel and viscous liquids, maximizing battery life for extended mission endurance without increasing robot size excessively, and developing high-fidelity autonomous navigation systems capable of accurately mapping and tracking position in complex, unknown pipe geometries without external reference points.

How do stringent environmental regulations influence the adoption of pipeline cleaning robots?

Environmental regulations are a primary market driver, compelling pipeline operators to adopt advanced cleaning and inspection technologies to proactively prevent leaks and ruptures that could lead to environmental disasters. Robots offer a highly precise, documented, and repeatable cleaning process that supports regulatory compliance and minimizes ecological risk, making them essential tools for responsible asset management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager