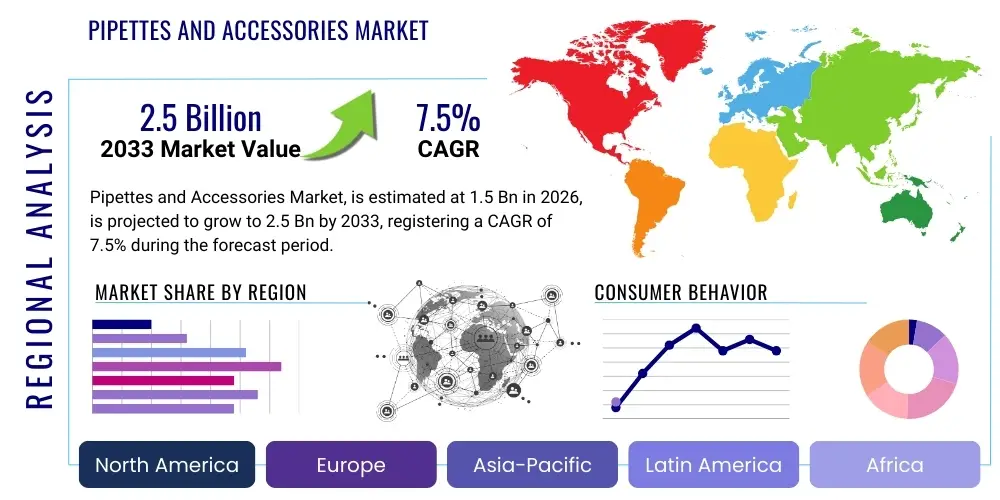

Pipettes and Accessories Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443218 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pipettes and Accessories Market Size

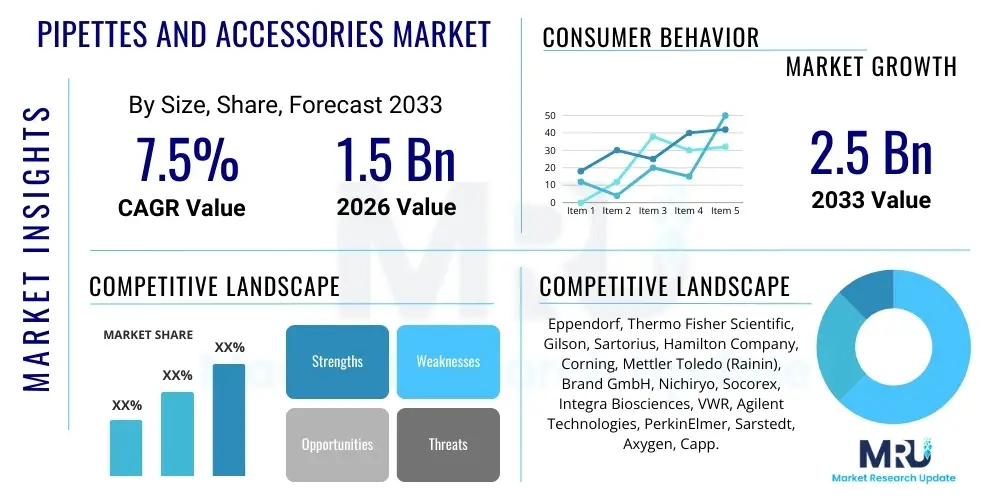

The Pipettes and Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Pipettes and Accessories Market introduction

The Pipettes and Accessories Market encompasses the sale of laboratory instruments utilized for accurately measuring and transferring precise volumes of liquid, ranging from microliters to milliliters. Pipettes are fundamental tools in modern scientific laboratories, essential for tasks across molecular biology, chemistry, and clinical diagnostics. The market includes various types of pipettes, such as manual (mechanical), electronic, and robotic systems, alongside necessary accessories like pipette tips, stands, and calibration services. Key product offerings span single-channel, multi-channel, and specialty pipettes designed for high-throughput screening and complex liquid handling applications. The increasing volume of research and development activities in the life sciences sector, particularly in genomics, proteomics, and drug discovery, directly contributes to sustained demand for high-precision liquid handling tools.

Major applications of pipettes and accessories are concentrated in clinical diagnostic labs, pharmaceutical and biotechnology companies, academic research institutions, and forensic laboratories. The core benefit derived from advanced pipetting technology is the assurance of accuracy and repeatability in experiments, which is paramount for generating reliable scientific data and complying with strict regulatory standards such as Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP). Furthermore, ergonomic design and the integration of electronic features in modern pipettes help mitigate repetitive strain injuries (RSIs) among laboratory personnel, enhancing overall workflow efficiency and user comfort. The necessity for strict contamination control in sensitive assays, like PCR and sequencing, drives the demand for certified, high-quality pipette tips and robust sterilization protocols.

Driving factors for market expansion include escalating global investments in biological research, especially concerning chronic and infectious diseases, necessitating efficient sample preparation and handling. The automation trend in laboratories, shifting from manual processing to fully integrated robotic liquid handlers, significantly boosts the consumption of advanced electronic pipettes and compatible accessories optimized for automation platforms. Additionally, the rapid expansion of emerging economies, characterized by improving healthcare infrastructure and growing biotechnology industries in regions like Asia Pacific, presents substantial opportunities for market penetration. Regulatory requirements mandating precise measurement in quality control testing further solidify the consistent demand for calibrated and high-performance pipetting systems.

Pipettes and Accessories Market Executive Summary

The Pipettes and Accessories Market is experiencing robust growth driven by accelerating pharmaceutical research and development expenditure and the widespread adoption of automation technologies in life science laboratories globally. Current business trends indicate a strong shift toward electronic and automated pipetting systems over traditional manual devices, particularly in high-throughput screening environments where speed and consistency are critical. Manufacturers are focusing on developing ergonomic designs, integrating smart features like data logging and connectivity (IoT), and ensuring compliance with stringent regulatory standards, thereby enhancing product differentiation and value proposition. The competitive landscape is characterized by innovation in tip technology, focusing on low retention surfaces and contamination barriers, addressing critical needs in sensitive molecular assays.

Regionally, North America maintains its dominance due to substantial R&D funding, the presence of major biopharmaceutical companies, and advanced clinical research infrastructure. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by increasing government investments in biotechnology, expansion of contract research organizations (CROs), and rising healthcare awareness, leading to greater deployment of advanced laboratory tools. European markets demonstrate stable growth, supported by strong academic research output and consistent adherence to high quality standards in clinical diagnostics. Regulatory harmonization efforts across major markets are also influencing product design and calibration service requirements.

Segmentation trends highlight the Electronic Pipettes segment as the most dynamic, attributed to their ease of use, superior precision, and suitability for complex, repetitive tasks. Multi-channel pipettes are gaining traction, especially in genomics and cell culture applications, maximizing efficiency in handling multiple samples simultaneously. The End-User segment shows pharmaceutical and biotechnology companies as the largest consumers, driven by continuous drug discovery pipelines and quality control requirements. Furthermore, specialized accessories, such as filtered pipette tips, are seeing heightened demand due to the global focus on minimizing cross-contamination, particularly post-pandemic, ensuring market resilience across various application fields.

AI Impact Analysis on Pipettes and Accessories Market

Common user questions regarding AI's impact on the Pipettes and Accessories Market often center on how automation and smart integration will fundamentally change manual pipetting tasks, whether AI can improve calibration accuracy and maintenance scheduling, and if data generated by smart pipettes will feed directly into AI-driven laboratory information management systems (LIMS). Users frequently inquire about the potential for AI algorithms to optimize liquid handling protocols autonomously, minimizing human error and maximizing resource efficiency in complex assays. Key themes include the fear of job displacement for laboratory technicians performing repetitive tasks, the expectation of hyper-accurate, predictive maintenance for instruments, and the demand for AI-enhanced data integrity and traceability in highly regulated environments. The consensus expectation is that AI will transform pipetting from a purely mechanical action into an intelligent, integrated data generation step.

The implementation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to significantly enhance the operational efficiency and reliability of advanced pipetting systems, particularly robotic liquid handlers. AI can analyze vast datasets generated during automated pipetting cycles to detect anomalies, predict potential equipment failures before they occur (predictive maintenance), and optimize dispense speeds and volumes based on real-time environmental conditions or liquid properties. This level of optimization minimizes waste of expensive reagents and ensures tighter control over experimental variability, crucial in complex assays like quantitative PCR (qPCR) or compound screening. Moreover, AI integration facilitates better compliance management by automating detailed record-keeping and traceability logs for every liquid transfer event.

In the context of accessories, AI plays a role in quality control and inventory management. ML algorithms are being used to analyze visual data captured during the manufacturing process of pipette tips, ensuring precise geometric consistency that is vital for accurate liquid transfer. On the user side, smart inventory systems, often powered by AI, can track the usage rates of specific pipette tips and reagents, automatically predict future consumption, and trigger timely procurement requests, thereby preventing workflow interruptions due to stock depletion. This integration moves the market toward a fully connected, self-optimizing laboratory ecosystem, where pipetting processes are continuously refined based on intelligent feedback loops.

- AI optimizes automated liquid handling protocols, reducing execution time and error rates.

- Predictive maintenance driven by AI enhances instrument uptime and calibration stability.

- Machine learning improves quality control checks during the manufacturing of pipette tips.

- AI-enabled data logging ensures enhanced traceability and compliance documentation.

- Smart laboratory systems use AI to manage and optimize inventory of pipettes and accessories.

DRO & Impact Forces Of Pipettes and Accessories Market

The Pipettes and Accessories Market is primarily driven by the massive expansion of the biotechnology and pharmaceutical sectors, coupled with increasing investments in genomic and personalized medicine research, demanding highly precise and reliable liquid handling tools. Restraints include the high initial capital expenditure associated with sophisticated electronic and automated pipetting systems, which can be prohibitive for smaller academic labs or labs in developing regions. Furthermore, the persistent challenge of ensuring regular and accurate calibration services poses a maintenance restraint. Opportunities arise from the transition towards disposable and sterilized products due to heightened contamination concerns, particularly in sensitive clinical applications, and the untapped potential of full laboratory automation integration facilitated by advanced robotic systems. The core impact force driving market dynamics is technological innovation focused on improving accuracy, ergonomics, and automation compatibility, directly influencing purchasing decisions across all end-user segments.

Segmentation Analysis

The Pipettes and Accessories Market is broadly segmented based on product type, technology, volume range, channel count, application, and end-user, allowing for a detailed analysis of specific market drivers and consumer preferences within diverse laboratory settings. Product segmentation includes pipettes, which can be further categorized into manual, electronic, and automated systems, and essential accessories, such as tips, reservoirs, and specialized maintenance equipment. Segmentation by channel count—single-channel versus multi-channel—reflects the laboratory's throughput requirements, with multi-channel options dominating high-volume environments like genomics screening centers. This granular segmentation is crucial for manufacturers targeting specific niches, ensuring product specifications align precisely with user needs in areas ranging from basic academic research to complex clinical diagnostics.

Analysis reveals that the dominance of accessories, particularly certified pipette tips, in terms of market share by volume, underscores the consumable nature of the business model. Tips must be continually replaced, driven by the sheer volume of experiments conducted globally. Conversely, the growth rate is often highest in the electronic and automated pipette segments, reflecting the broader industry move towards efficiency and reduced variability. End-user segmentation indicates robust demand from commercial entities (Biopharma and CROs) due to intensive drug discovery activities, while academic and research institutes provide a stable, foundational demand base for manual and standardized electronic pipettes. Geographic segmentation further highlights disparities in adoption rates of automated systems, correlated with R&D spending per region.

Strategic positioning within the competitive landscape heavily relies on excelling in key segments, such as providing low-retention tips for proteomics applications or developing ergonomic manual pipettes for general laboratory use. Manufacturers who successfully integrate connectivity and data logging features into their electronic pipettes are better positioned to capitalize on the increasing trend towards centralized laboratory data management. This layered segmentation strategy enables stakeholders to accurately forecast demand shifts, optimize inventory, and tailor marketing efforts to address the unique pain points of specific customer groups, such as the need for sterile, pre-racked tips in cell culture facilities or highly accurate calibration services for GLP environments.

- Product Type: Manual Pipettes, Electronic Pipettes, Automated Pipetting Systems, Accessories (Tips, Reservoirs, Stands, Calibrators).

- Volume Range: Micropipettes, Macropipettes.

- Channel Count: Single-Channel Pipettes, Multi-Channel Pipettes (8-channel, 12-channel, 96-channel).

- Application: Drug Discovery, Clinical Diagnostics, Genomics and Proteomics, Cell Culture, Academic Research, Others.

- End-User: Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Diagnostic Laboratories, Contract Research Organizations (CROs) & CMOs.

Value Chain Analysis For Pipettes and Accessories Market

The value chain for the Pipettes and Accessories Market commences with the upstream analysis, involving the sourcing and processing of high-grade raw materials such as specialized polymers (polypropylene, polyethylene) for tips and advanced plastics, metals, and electronic components (microprocessors, motors) for the pipette bodies. Key upstream activities include material purification, precision molding, and component manufacturing, often requiring specialized third-party suppliers to meet the strict quality and dimensional tolerances necessary for accurate liquid handling. Maintaining a secure and quality-controlled supply of these components is critical, as any variance in material composition or manufacturing precision directly impacts the reliability and accuracy of the final product, especially concerning the fit between pipette barrel and tip.

The core of the value chain lies in the manufacturing and assembly phase, where companies leverage precision engineering, advanced robotics, and stringent quality assurance protocols to produce pipettes and accessories. This midstream activity involves sophisticated tooling for injection molding high-quality, sterile pipette tips and complex assembly lines for electronic and manual pipettes. Distribution channels, forming the downstream segment, are typically multifaceted, involving direct sales forces for large institutional clients (pharmaceutical companies) and indirect channels through specialized scientific distributors (e.g., VWR, Fisher Scientific). These distributors play a vital role in inventory management, localized technical support, and rapid delivery of consumables, ensuring quick turnaround for labs that require constant replenishment of tips.

Direct sales channels are preferred for high-value automated systems and complex instrumentation requiring intensive installation and training, allowing manufacturers to maintain direct control over customer relationships and service quality. Conversely, the vast majority of consumables, such as pipette tips, are efficiently moved through indirect channels due to the geographic reach and established logistical networks of third-party distributors. After-sales services, including calibration, maintenance contracts, and technical support, represent a crucial value-added component in the downstream chain, providing ongoing revenue and ensuring instrument longevity and regulatory compliance. The effective management of this distribution and service network is paramount for market penetration and customer loyalty in the highly competitive life sciences tools sector.

Pipettes and Accessories Market Potential Customers

The primary customers for the Pipettes and Accessories Market are entities within the life sciences ecosystem that engage in quantitative liquid handling operations, demanding high precision, repeatability, and sterility. Pharmaceutical and biotechnology companies constitute the largest segment of potential buyers, utilizing pipetting systems extensively throughout their research, development, and quality control pipelines—from initial drug screening and synthesis to formulation testing and regulatory batch release. These commercial end-users often require high-throughput automated systems and large volumes of certified, sterile tips to maintain operational efficiency and compliance with GLP and GMP standards, driving demand for advanced electronic and robotic solutions.

Academic and governmental research institutions represent another crucial customer base, relying heavily on pipettes for foundational biological and chemical research, including molecular cloning, cell culture, and assay development. While academic settings frequently opt for a mix of robust manual and multi-channel electronic pipettes due to budgetary constraints, they prioritize long-term durability and ergonomic design for frequent daily use. Hospitals and independent diagnostic laboratories are significant consumers, particularly of single-channel and fixed-volume pipettes, essential for clinical chemistry, hematology, and infectious disease testing, where regulatory compliance and fast, accurate results are non-negotiable requirements for patient care.

Furthermore, the rapidly growing sector of Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) globally presents substantial opportunity. These organizations, often serving as outsourced research arms for pharmaceutical majors, require cutting-edge automated liquid handling infrastructure to manage multiple projects efficiently, demanding bulk orders of specific tips compatible with their varied instrument platforms. Food and beverage testing laboratories, environmental testing agencies, and forensic labs also contribute to the customer pool, requiring specialized pipettes for quality assurance and analytical chemistry applications, ensuring the market's diversity across specialized analytical fields.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eppendorf, Thermo Fisher Scientific, Gilson, Sartorius, Hamilton Company, Corning, Mettler Toledo (Rainin), Brand GmbH, Nichiryo, Socorex, Integra Biosciences, VWR, Agilent Technologies, PerkinElmer, Sarstedt, Axygen, Capp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipettes and Accessories Market Key Technology Landscape

The technological landscape of the Pipettes and Accessories Market is dominated by advancements in electronic and automated liquid handling systems, moving beyond basic mechanical piston mechanisms toward sophisticated, motor-driven precision. Key technologies include advanced stepping motors in electronic pipettes that ensure extremely fine volume resolution and high repeatability, significantly reducing the inter-operator variability seen with manual devices. Furthermore, the integration of microprocessors and associated software allows for complex programming of pipetting protocols, enabling features such as multi-dispensing, sequential dilution, and variable speed settings, which are crucial for complex biological assays like ELISA and genomic library preparation. This shift towards smart instrumentation includes onboard data storage and display capabilities, providing real-time feedback and simplifying compliance documentation.

Another pivotal technological advancement involves the development of specialized tip technologies, which are essential consumables impacting the performance of the entire system. Low-retention surfaces, achieved through innovative polymer treatments or specialized mold designs, minimize the residual liquid film clinging to the tip walls, thereby ensuring maximum accuracy, especially when handling viscous or high-value reagents. Filtered pipette tips, incorporating hydrophobic barrier filters, prevent aerosol contamination and sample carryover into the pipette body, protecting both the instrument and subsequent samples, which is paramount in sensitive applications such as PCR. Manufacturers are continuously investing in materials science to create tips that are chemically resistant, certified DNase/RNase/pyrogen-free, and guaranteed for automation platform compatibility.

The most significant technological trajectory is the convergence of pipetting systems with the Internet of Things (IoT) and laboratory automation. Modern electronic pipettes are increasingly featuring Bluetooth or Wi-Fi connectivity, allowing them to communicate calibration status, usage data, and protocol parameters directly to centralized laboratory informatics management systems (LIMS) or dedicated cloud platforms. This connectivity facilitates automated calibration tracking and regulatory audit trails, streamlining compliance processes. Robotic liquid handlers utilize sophisticated vision systems and proprietary algorithms for precise tip placement and volume verification, pushing the limits of throughput and reliability, fundamentally transforming high-throughput screening and genomics workflows into fully automated, self-monitoring processes that require minimal manual intervention.

Regional Highlights

- North America (NA): North America, particularly the United States, represents the largest and most mature market for pipettes and accessories, driven by the substantial concentration of leading pharmaceutical and biotechnology companies, extensive academic research infrastructure, and high levels of government and private funding directed toward life sciences R&D. The region exhibits high adoption rates of advanced automated liquid handling systems due to the emphasis on high-throughput screening, personalized medicine initiatives, and stringent regulatory requirements that necessitate precise and traceable measurements. The market is characterized by intense competition and a strong focus on innovative products featuring connectivity and enhanced ergonomics.

- Europe: The European market maintains a significant share, supported by robust research activity in countries like Germany, the UK, and Switzerland, especially in areas of drug discovery, vaccine development, and academic biology. European laboratories are strong adopters of high-quality manual and electronic pipettes, valuing precision, calibration integrity, and certified accessories due to strict adherence to ISO standards and centralized regulatory bodies. Economic stability and established healthcare systems ensure consistent demand, though the growth rate is often slightly lower than in the Asia Pacific due to market saturation in key developed economies.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rising government investments in establishing domestic biotechnology sectors, expanding clinical trial activities, and improving healthcare infrastructure across populous countries like China, India, and South Korea. The increasing number of academic research collaborations and the expansion of global pharmaceutical companies establishing manufacturing and R&D bases in the region are driving the rapid uptake of both standard pipettes and modern automated solutions, creating immense market opportunity.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, driven by increasing access to modern medical technologies and gradual improvements in laboratory standards. Market expansion is often reliant on economic stability and governmental healthcare spending. While manual pipettes remain dominant in many smaller labs, large clinical diagnostic centers and established research institutions in countries like Brazil and Mexico are increasingly investing in electronic and multi-channel systems to modernize their operations and improve testing throughput.

- Middle East and Africa (MEA): The MEA market is currently the smallest but shows potential, especially within the Gulf Cooperation Council (GCC) countries, driven by ambitious diversification plans, significant investments in healthcare infrastructure, and the establishment of advanced biomedical research hubs. The adoption of high-quality pipetting systems is crucial for developing sophisticated diagnostic capabilities and ensuring quality control in emerging pharmaceutical manufacturing facilities. Challenges include varied regulatory environments and reliance on imports for advanced equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipettes and Accessories Market.- Eppendorf AG

- Thermo Fisher Scientific Inc.

- Mettler Toledo International Inc. (Rainin)

- Sartorius AG

- Gilson, Inc.

- Hamilton Company

- Corning Incorporated

- BRAND GMBH + CO KG

- Nichiryo Co., Ltd.

- Socorex Isba SA

- Integra Biosciences AG

- VWR International (Avantor)

- Agilent Technologies, Inc.

- PerkinElmer Inc.

- Sarstedt AG & Co. KG

- Axygen Scientific (Corning Subsidiary)

- Capp P/S

- Greiner Bio-One International GmbH

- Hirschmann Laborgeräte GmbH & Co. KG

- Eppendorf AG

Frequently Asked Questions

Analyze common user questions about the Pipettes and Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the shift from manual to electronic pipettes?

The primary drivers include the need for increased accuracy and repeatability, especially in high-volume assays, coupled with demands for enhanced ergonomics to minimize repetitive strain injuries (RSI). Electronic pipettes also offer programmable functions and better integration with laboratory automation systems, optimizing workflow efficiency.

How does the quality of pipette tips impact overall liquid handling accuracy?

Pipette tip quality is critical; poorly manufactured or incompatible tips can lead to significant volume errors, poor sealing, and increased retention of liquid, resulting in experimental variability and wastage of reagents. High-quality tips ensure an airtight seal, low retention, and certified sterility.

Which application segment accounts for the highest demand for advanced pipetting systems?

The Drug Discovery and Development segment, particularly within pharmaceutical and biotechnology companies, generates the highest demand for advanced and automated pipetting systems. This is driven by high-throughput screening, compound management, and rigorous quality control protocols requiring fast, precise, and consistent liquid handling.

What is the significance of integrating IoT technology in modern pipettes?

IoT integration allows smart pipettes to wirelessly connect with LIMS and cloud platforms, automating data logging, tracking usage statistics, and enabling automated calibration reminders and status reports. This significantly enhances regulatory compliance, data traceability, and overall laboratory efficiency by minimizing manual documentation errors.

Which geographical region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, primarily fueled by substantial governmental investments in life science research, the rapid expansion of the biopharmaceutical and contract research industries, and the continuous improvement and modernization of clinical diagnostic capabilities across key economies.

The robust expansion of the Pipettes and Accessories Market is intrinsically linked to global advancements in biological sciences and healthcare diagnostics, where precision and efficiency are non-negotiable standards. The transition toward high-throughput methodologies and personalized medicine protocols necessitates continuous technological upgrades in liquid handling equipment. The integration of electronic features, ergonomic designs, and increasingly, AI-driven optimization algorithms, defines the leading edge of market innovation. This technological evolution ensures that pipetting tools remain central to achieving reliable and reproducible results in both fundamental research and highly regulated clinical environments. Market leaders are competing fiercely on the basis of product accuracy, automation compatibility, and the provision of comprehensive after-sales calibration and maintenance services.

Future growth will be heavily concentrated in specialized accessories, particularly filter and low-retention tips, as laboratories worldwide intensify efforts to prevent cross-contamination in sensitive assays like NGS (Next-Generation Sequencing) and qPCR. Furthermore, the burgeoning demand from Contract Research Organizations (CROs), especially in Asia Pacific, for scalable and validated automated solutions will continue to accelerate market velocity. Regulatory pressure for greater data integrity and traceable workflows, particularly in the pharmaceutical quality control sector, further reinforces the adoption of smart, connected pipetting systems that streamline compliance reporting. Strategic partnerships between instrument manufacturers and laboratory software providers will be key to unlocking the full potential of integrated laboratory automation.

The segmentation by end-user illustrates the resilient nature of demand across diverse sectors. While academic funding provides a foundational baseline, commercial spending from large biopharma corporations dictates the trends in high-end automation and specialized consumables. The increasing complexity of biological samples, requiring nanoliter-scale precision, forces manufacturers to continually refine mechanical tolerances and material sciences in both the pipettes themselves and their compatible tips. This sustained focus on improving metrology and user experience ensures the pipettes and accessories market remains a cornerstone of the global scientific technology infrastructure, poised for sustained growth through the forecast period, driven by unparalleled global health research needs.

The competitive dynamics within the Pipettes and Accessories Market are largely defined by patent portfolios related to liquid transfer mechanisms, ergonomic designs, and material composition for specialized tips. Established market players, such as Eppendorf, Thermo Fisher Scientific, and Mettler Toledo (Rainin), leverage their global distribution networks, established brand recognition, and extensive product breadth—ranging from entry-level manual pipettes to sophisticated robotic systems—to maintain market dominance. Smaller, specialized firms often focus on niche segments, such as unique ergonomic features or highly specialized tips for specific applications (e.g., highly viscous fluids or radioactive handling), challenging the large incumbents through focused innovation. Mergers and acquisitions remain a common strategy for larger companies seeking to integrate specialized technology or expand regional market access, especially in high-growth APAC countries.

Customer purchasing decisions are heavily influenced by several critical factors beyond price, including instrument accuracy certifications, the cost and availability of compatible tips (the recurring consumable expense), and the quality of local technical support and calibration services. Laboratories operating under strict regulatory frameworks (CLIA, GLP) prioritize systems that offer documented calibration traceability and features facilitating audit compliance. Consequently, manufacturers are increasingly bundling service and calibration contracts with instrument purchases, creating sticky customer relationships and recurring revenue streams. The ecological impact of disposable plastic tips is an emerging consideration, driving research into biodegradable materials and more efficient plastic use, though sterility requirements present significant challenges to full sustainability adoption.

To succeed in this evolving landscape, companies must prioritize interoperability, ensuring their instruments and accessories are compatible with a wide array of existing laboratory automation equipment and LIMS platforms. Investing in user training and educational outreach programs is also vital to facilitate the smooth adoption of complex electronic and robotic systems, ensuring users maximize the precision benefits offered by advanced technology. The globalization of research and manufacturing mandates robust supply chain management, capable of quickly responding to surges in demand, such as those experienced during recent public health crises, solidifying the market's role as an essential service provider to the global biomedical community.

The emphasis on minimizing manual error has led to significant advancements in user interface design for electronic pipettes, often featuring intuitive touch screens and guided protocols to simplify complex dilutions and serial transfers. This focus on human factors engineering (HFE) not only improves efficiency but critically reduces the risk of incorrect volume settings, which can compromise entire experimental batches. Furthermore, the technology surrounding pipette calibration has matured, with specialized calibration tools and software now offering highly accurate, gravimetric, or photometric methods performed either in-house or through certified service centers, providing verifiable results necessary for regulatory documentation. These technical innovations are collectively driving the market toward near-zero error liquid handling.

Looking forward, the proliferation of miniaturized assays and microfluidics technology presents both a challenge and an opportunity. While microfluidic chips can sometimes replace traditional pipetting steps for small volumes, they simultaneously create a niche requirement for ultra-low volume, high-precision pipetting systems used to load or transfer samples into these devices. Manufacturers are responding by developing specialized fixed-volume and semi-automated micro-pipettors capable of handling sub-microliter quantities with reliability. This adaptation ensures that the core technology of pipetting remains relevant even as assay formats become increasingly complex and miniature, securing the market's long-term viability across the spectrum of scientific innovation.

The continued consolidation of clinical diagnostic laboratories into larger networks increases the buying power and standardization requirements of end-users. These large organizations seek enterprise-wide solutions, including standardized pipette fleets, centralized calibration management, and consolidated contracts for bulk consumables, favoring manufacturers capable of offering integrated solutions and global support. This shift favors major market players who can manage extensive product portfolios and sophisticated logistical operations required to supply multi-site laboratory systems efficiently. Consequently, maintaining robust intellectual property protection over proprietary features and specialized tip designs is paramount for securing competitive advantage and defending market share against aggressive pricing strategies.

The growing field of personalized medicine, which relies heavily on highly sensitive molecular diagnostics and genomics, places an unprecedented demand on the accuracy and contamination control offered by pipetting systems. The preparation of samples for Next-Generation Sequencing (NGS) libraries, for example, involves numerous critical, low-volume transfer steps where even minimal error or cross-contamination can invalidate expensive runs. This necessity translates directly into a market pull for certified automated liquid handlers equipped with filtered, low-retention tips and validated protocols designed specifically for genomics applications, ensuring that the critical early stages of sample preparation meet the quality thresholds required for advanced molecular analysis.

Finally, sustainability is emerging as a long-term strategic consideration. The sheer volume of disposable plastic tips used globally poses an environmental challenge, prompting manufacturers to explore strategies for reducing material usage, developing lighter tips, and investing in recycling programs for both tips and pipette packaging. While sterility requirements currently limit the feasibility of reusable tips in many sensitive applications, innovative approaches, such as highly efficient sterilization cycles for robotic tips or the use of sustainable bio-based polymers, are gradually entering the R&D pipeline, indicating a future market trajectory that balances precision with environmental responsibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager