Pipettes and Pipettors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442125 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Pipettes and Pipettors Market Size

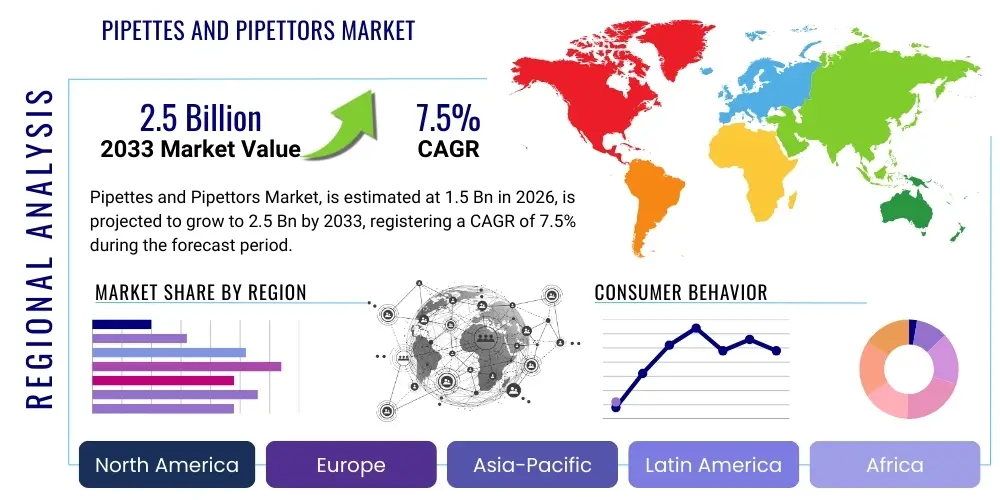

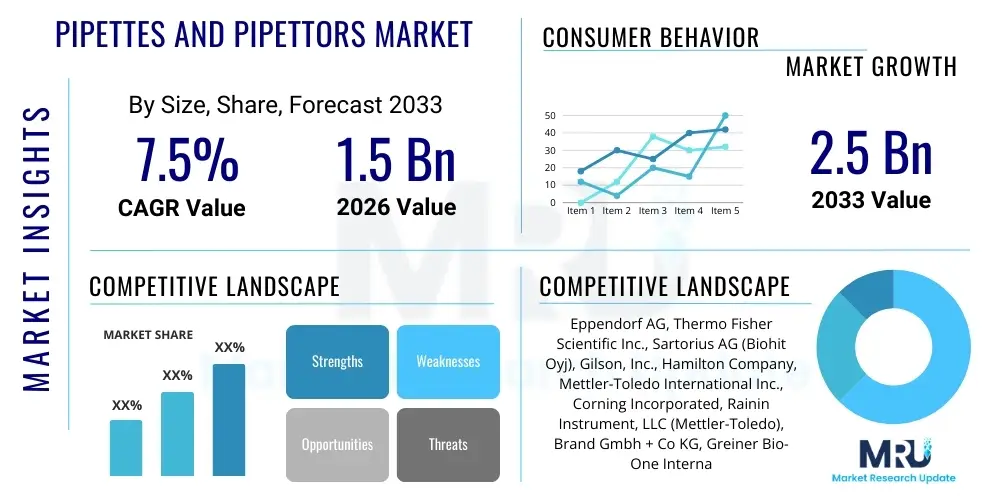

The Pipettes and Pipettors Market is projected to grow at a Compound Annual Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-precision liquid handling solutions across various life science applications, coupled with increasing investments in pharmaceutical and biotechnology research and development globally. The transition towards automated laboratory workflows and the necessity for accurate sample preparation in complex diagnostic processes are primary factors contributing to this robust market trajectory. Furthermore, the continuous introduction of advanced ergonomic and electronic pipettes that minimize user variability and enhance throughput capacity ensures sustained market growth.

The calculation of the market size and the forecasted growth trajectory takes into account several macro-environmental factors, including the expanding clinical diagnostics sector, the surge in genomic and proteomic research activities, and the imperative for standardized laboratory protocols worldwide. The inherent need for reliable, minute-volume liquid transfer in molecular biology, chemistry, and clinical analysis positions pipettes and pipettors as essential, non-substitutable tools in modern laboratories. The increasing complexity of assays, requiring ultra-low volume dispensing with guaranteed accuracy, further compels laboratories to adopt advanced electronic and automated pipetting systems, thereby boosting the average selling price and overall market valuation. Market dynamics are also influenced by replacement cycles, as older manual equipment is phased out for modern, calibrated electronic versions that offer better data logging and compliance features.

Pipettes and Pipettors Market introduction

The Pipettes and Pipettors Market encompasses specialized laboratory instruments used for accurately measuring and transferring precise volumes of liquid, ranging from microliters to milliliters. These instruments are categorized primarily into manual (mechanical) pipettes, electronic pipettes, and automated liquid handling systems, available in single-channel and multi-channel configurations. Electronic pipettes, which offer motorized volume control and enhanced ergonomic features, are increasingly preferred over traditional manual variants due to their superior reproducibility, reduced operator strain, and ability to integrate seamlessly with sophisticated laboratory information management systems (LIMS). Key applications span critical scientific disciplines including drug discovery and development, academic research, clinical diagnostics, and environmental testing, where precision in sample preparation is paramount for reliable outcomes.

The primary benefit offered by modern pipetting technology is the assurance of highly reproducible results, essential for minimizing experimental errors and ensuring regulatory compliance, particularly in regulated environments like Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) facilities. Driving factors fueling market expansion include significant increases in global healthcare expenditure, intensified focus on personalized medicine initiatives, and the rapid globalization of pharmaceutical and biotechnology industries. Furthermore, the necessity for high-throughput screening (HTS) in drug development pipelines necessitates the adoption of multi-channel and robotic liquid handling solutions, which rely heavily on advanced pipetting technologies to process thousands of samples efficiently. The integration of ergonomic designs addressing common laboratory injuries, such as Repetitive Strain Injuries (RSI), also serves as a strong driver for the adoption of newer, well-designed electronic pipettors.

Products within this market range from volumetric glass pipettes used for basic chemistry to complex positive displacement pipettes designed for highly viscous or volatile liquids. The shift in product preference is notably moving toward systems that offer integrated calibration tracking and connectivity, facilitating compliance documentation and data integrity. The ongoing battle against infectious diseases, including rapid response needs during pandemics, continually emphasizes the demand for highly reliable, quickly deployable diagnostic tools that necessitate precise liquid handling components. Consequently, manufacturers are innovating through materials science, focusing on chemical resistance, enhanced autoclavability, and sustainable manufacturing practices to meet evolving user needs and environmental standards, maintaining the market's dynamic and essential nature within the broader life science ecosystem.

Pipettes and Pipettors Market Executive Summary

The Pipettes and Pipettors Market demonstrates robust growth driven primarily by technological advancements facilitating automation and improving accuracy in critical laboratory procedures. Business trends indicate a marked shift towards electronic and automated liquid handling systems (ALHS) to mitigate human error and improve throughput, particularly in high-volume settings like contract research organizations (CROs) and large pharmaceutical companies. Key market players are intensely focused on developing ergonomic designs and software integration capabilities to provide seamless data logging and calibration verification, aligning with stringent regulatory requirements such as FDA 21 CFR Part 11. Strategic collaborations between instrument manufacturers and laboratory robotics firms are becoming common, aiming to create integrated, end-to-end automated solutions for complex assays, which further accelerates market premiumization and demand for advanced pipette tips engineered for consistency.

Regionally, North America maintains its dominance due to high concentration of leading biotechnology and pharmaceutical companies, coupled with significant government and private investment into life sciences research infrastructure. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding clinical trial activities, increasing governmental focus on healthcare modernization in countries like China and India, and the establishment of new manufacturing hubs for biopharmaceuticals. European nations continue to represent a stable and mature market, characterized by strict quality standards and a strong emphasis on sustainability and precision in research outputs. Emerging markets in Latin America and the Middle East are also contributing to growth as they upgrade their laboratory infrastructure to meet international standards for diagnostics and research capabilities.

Segmentation trends highlight the Electronic Pipettes segment as the fastest-growing product category, attributed to their ease of use, superior precision, and minimal intra-operator variability compared to traditional manual devices. Among applications, Drug Discovery and Development remains the largest revenue generator, demanding constant innovation in dispensing technologies for tasks such as compound screening and cell culture preparation. The end-user analysis reveals that Academic and Research Institutes constitute a significant and consistently growing segment, driven by governmental funding for basic research and the widespread adoption of molecular biology techniques that require precise pipetting tools. The consumables segment, particularly high-quality sterilized filter tips, is also seeing accelerated growth due to stringent requirements for contamination control and the necessity of specialized tips for automated systems, ensuring a lucrative recurring revenue stream for market participants.

AI Impact Analysis on Pipettes and Pipettors Market

User queries regarding AI's impact on the Pipettes and Pipettors Market frequently center around two major themes: the potential for AI to optimize and automate liquid handling workflows, and the role of machine learning in improving quality control and calibration procedures. Users are concerned about how AI-driven predictive maintenance can reduce instrument downtime and ensure the integrity of dispensing accuracy over long periods. There is significant interest in understanding how AI algorithms, when integrated into automated liquid handlers (ALH), can dynamically adjust pipetting parameters—such as speed, height, and aspiration/dispense cycles—based on fluid properties, thus optimizing complex protocols and minimizing errors common in manual or rigid automated programming. Furthermore, researchers are exploring AI applications for analyzing real-time sensor data from smart pipettes to detect anomalies, flag potential calibration drift, and provide predictive failure warnings, fundamentally transforming instrument management and validation practices in highly regulated laboratories.

The core expectation from AI integration is the realization of 'intelligent liquid handling.' This involves utilizing machine learning models trained on millions of dispensing cycles to predict and compensate for environmental variations (temperature, humidity) and liquid viscosity differences that traditionally impact volumetric accuracy. AI-enhanced systems are positioned to significantly reduce the need for extensive manual optimization of complex protocols, allowing researchers to input desired outcomes, upon which the AI suggests the optimal pipetting sequence and parameters. This level of sophistication is particularly critical in emerging fields like single-cell genomics, where extremely low volumes of precious samples require uncompromising precision and minimal loss, which rigid automation struggles to achieve consistently without constant manual intervention and monitoring.

The adoption of AI is not intended to replace the physical pipette, but rather to enhance the intelligence layer controlling its function, moving the market beyond simple robotic execution toward adaptive and self-optimizing laboratory operations. This focus elevates the value proposition of high-end electronic and automated systems, transforming them from mere tools into integrated smart laboratory devices. The resulting data generated by these smart systems, when processed by AI, creates a valuable feedback loop, improving the overall reliability and standardization of laboratory processes globally and setting a new benchmark for quality assurance in molecular diagnostics and drug screening. This shift ensures that the physical component (the pipette/pipettor) remains essential, but its operational efficiency and reliability are radically improved by AI algorithms.

- AI drives predictive maintenance schedules, minimizing instrument downtime and ensuring continuous operational readiness.

- Machine Learning algorithms optimize dynamic pipetting parameters (speed, height, volume adjustments) based on real-time fluid dynamics and environmental conditions.

- Integration of AI facilitates intelligent error detection and anomaly flagging during high-throughput screening (HTS) operations, drastically improving data quality.

- AI supports enhanced calibration verification and automated logging, ensuring stringent regulatory compliance (e.g., GLP/GMP).

- Smart pipettes connected to AI platforms enable remote diagnostics and troubleshooting, enhancing service efficiency.

DRO & Impact Forces Of Pipettes and Pipettors Market

The Pipettes and Pipettors Market is fundamentally influenced by a confluence of accelerating drivers and persistent restraints, managed within a dynamic framework of opportunistic advancements and strong impact forces. Key drivers include the global expansion of pharmaceutical R&D activities, particularly the intense focus on developing biological drugs, personalized medicine, and advanced diagnostics, all requiring meticulous and accurate liquid handling. The increasing prevalence of chronic and infectious diseases necessitates heightened clinical testing and research, thereby amplifying the demand for precision pipetting tools in diagnostic labs and research institutions. Furthermore, the persistent need to reduce operator variability and enhance laboratory efficiency pushes the adoption of electronic and automated pipettors, offering consistent performance across diverse experimental settings, thereby minimizing costly reruns and improving overall operational throughput.

Conversely, significant restraints impede exponential market growth. The high initial capital investment required for sophisticated automated liquid handling systems (ALHS) and high-end electronic pipettes remains a barrier for smaller academic labs and clinical facilities, particularly in developing economies. Additionally, the stringent regulatory environment governing medical devices and consumables, while ensuring quality, imposes complexity and delays in product commercialization and adoption. Another critical restraint is the need for specialized training and maintenance expertise to operate and calibrate advanced electronic pipettes and ALHS effectively; the learning curve associated with these high-tech instruments can deter widespread implementation, particularly in environments with high staff turnover. These restraints often force users to rely on older, less efficient manual pipettes despite the known limitations in accuracy and ergonomics.

Opportunities for expansion are primarily concentrated in emerging markets, such as the Asia Pacific and Latin America, where rapid modernization of healthcare infrastructure and increasing foreign direct investment in biotechnology present lucrative avenues for market penetration. Technological advancements in microfluidics and miniaturization of assays offer a significant growth opportunity, demanding new generations of highly precise, low-volume dispensing equipment compatible with microplates and chips. Impact forces, which shape the market landscape, include rigorous standardization requirements, driven by international bodies aiming to establish unified protocols for laboratory measurements, thereby increasing demand for certified and traceable instruments. The sustained momentum of technological innovation, particularly the integration of Internet of Things (IoT) capabilities into pipetting systems for remote monitoring and data exchange, acts as a continuous and powerful force accelerating the market’s evolution towards fully connected, smart laboratories.

Segmentation Analysis

The Pipettes and Pipettors Market is comprehensively segmented based on product type, technology, application, and end-user, providing a granular view of market dynamics and adoption patterns across the life science ecosystem. The product segmentation is crucial, differentiating between the core mechanism of liquid handling—Manual Pipettes, Electronic Pipettes, and Automated Liquid Handling Systems—each catering to distinct needs concerning throughput, budget, and required precision level. Manual pipettes, while lower in cost, dominate in basic research and educational settings, whereas the electronic and automated segments command higher revenue shares in high-throughput environments like pharmaceutical R&D and large-scale diagnostics. This diversification ensures that manufacturers tailor their R&D efforts and marketing strategies to specific customer segments, focusing on ergonomics and reliability for manual users, and connectivity and software integration for electronic and automated users.

Technology segmentation often distinguishes between air displacement and positive displacement pipettes. Air displacement is standard for aqueous solutions, representing the vast majority of the market, while positive displacement is specialized for challenging liquids like volatile, viscous, or high-density samples where air displacement inaccuracy is magnified. Application segments underscore the end utility of these instruments, with Drug Discovery, Clinical Diagnostics, and Genomics Research being the most significant revenue contributors, reflecting global healthcare priorities and research funding trends. The end-user classification identifies the primary purchasers, recognizing the substantial purchasing power and technical demands originating from Academic & Research Institutes, Biotechnology & Pharmaceutical Companies, and Hospitals & Clinical Diagnostic Labs, which informs distribution strategies and technical support requirements across the market.

- By Product Type:

- Manual Pipettes (Fixed Volume, Adjustable Volume)

- Electronic Pipettes (Single-Channel, Multi-Channel)

- Automated Liquid Handling Systems (Robotic Workstations, Benchtop Automation)

- Pipette Controllers and Dispensers

- By Technology:

- Air Displacement Pipettes

- Positive Displacement Pipettes

- By Application:

- Drug Discovery and Development

- Genomics and Proteomics

- Clinical Diagnostics

- Cell Culture

- Environmental Testing

- Food & Beverage Testing

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospitals and Clinical Diagnostic Laboratories

- Contract Research Organizations (CROs)

Value Chain Analysis For Pipettes and Pipettors Market

The value chain for the Pipettes and Pipettors Market begins with upstream analysis, focusing on the procurement of specialized raw materials. This includes high-grade polymers (e.g., polypropylene, polyethylene) crucial for manufacturing tips and pipette bodies, precision metals (stainless steel, specialized alloys) for mechanical components and springs, and increasingly, complex microelectronics and sensors for electronic and automated systems. Quality and purity are paramount in the upstream segment, particularly for consumables like sterile pipette tips, where contamination risks must be mitigated through strict manufacturing standards. Suppliers of these high-specification materials, including specialized plastics manufacturers and electronic component providers, exert influence over production costs and lead times, particularly when specialized, certified materials are required for medical grade applications.

The core manufacturing and assembly phase involves Original Equipment Manufacturers (OEMs) who design, produce, and calibrate the finished instruments. This midstream process requires highly specialized tooling, precision engineering for volumetric accuracy, and rigorous quality control testing, including ISO 8655 compliance. After production, the distribution channel plays a critical role, involving a blend of direct and indirect sales methods. Direct sales are often preferred for high-value automated systems and key accounts (large pharmaceutical firms) where technical expertise and long-term service contracts are necessary. Indirect distribution utilizes established networks of specialized laboratory equipment distributors, catalog houses (e.g., Fisher Scientific, VWR), and regional sales agents, ensuring broader geographic reach and efficient inventory management for high-volume consumables like pipette tips.

The downstream analysis focuses on the end-users—academic labs, hospitals, and biotech firms—who consume the products and services. Crucially, the downstream segment includes post-sales service, calibration, and repair, which represent a significant recurring revenue stream and a point of differentiation for major market players. Direct channels facilitate closer customer relationships, enabling tailored solutions and faster feedback loops for product improvement. Indirect channels capitalize on established logistics infrastructure and regional market knowledge. The efficiency of the entire chain hinges on maintaining instrument calibration standards and ensuring a constant supply of compatible, certified tips, making the logistics of consumable supply equally as vital as the primary instrument sale.

Pipettes and Pipettors Market Potential Customers

The potential customer base for the Pipettes and Pipettors Market is inherently diverse yet highly concentrated within the life sciences and healthcare sectors, all sharing the fundamental requirement for accurate and repeatable fluid transfer. Primary end-users include large multinational Pharmaceutical and Biotechnology Companies that drive substantial demand for automated and multi-channel pipettes used in drug screening, quality control (QC) assays, and large-scale manufacturing of biologics. These corporate entities often prioritize high-throughput capability, robust data integration features, and validated compliance with global regulatory standards (e.g., FDA, EMA), making them key purchasers of premium electronic and robotic liquid handling systems, along with vast quantities of certified consumables.

A second major customer segment consists of Academic and Government Research Institutes, which represent a high volume purchaser of both manual and entry-level electronic pipettes due to their extensive basic research activities in genomics, cell biology, and biochemistry. While often budget-conscious, these institutes rely on the accuracy of standardized tools for publications and grant compliance. Finally, Clinical Diagnostic Laboratories and Hospitals form a critical, rapidly expanding customer segment. With the increasing reliance on complex molecular diagnostics (e.g., PCR testing, genetic sequencing), these labs require fast, reliable, and easily traceable pipetting systems to ensure patient sample integrity and rapid turnaround times for diagnostic results. This segment’s demand is driven by patient volumes, regulatory accreditation requirements, and the persistent need for contamination prevention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eppendorf AG, Thermo Fisher Scientific Inc., Sartorius AG (Biohit Oyj), Gilson, Inc., Hamilton Company, Mettler-Toledo International Inc., Corning Incorporated, Rainin Instrument, LLC (Mettler-Toledo), Brand Gmbh + Co KG, Greiner Bio-One International GmbH, Integra Biosciences, Socorex Isba SA, Nichiryo Co., Ltd., Sarstedt AG & Co. KG, Dragon Lab, Accumax, Hirschmann Laborgeräte GmbH, IKA Works GmbH & Co. KG, Axygen Scientific (Corning), VistaLab Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pipettes and Pipettors Market Key Technology Landscape

The technological landscape of the Pipettes and Pipettors Market is characterized by continuous advancements focused on enhancing precision, improving ergonomics, and integrating digital connectivity. A primary innovation is the maturation of electronic pipetting systems, which utilize microprocessors and motorized piston control to deliver extremely accurate, user-independent dispensing, thereby minimizing the common variability associated with manual thumb force. These electronic variants are increasingly incorporating intuitive touchscreens, multi-language interfaces, and pre-programmed dispensing modes tailored for common applications like serial dilution and mixing, significantly streamlining complex laboratory protocols and reducing training overhead. Furthermore, materials science innovation is crucial, leading to the development of chemically resistant and fully autoclavable pipette components, extending instrument lifespan and ensuring sterility required for sensitive biological applications.

A second pivotal technological trend is the robust development of automated liquid handling systems (ALHS). These systems leverage high-precision robotic arms equipped with specialized pipetting modules (often employing multi-channel technology, up to 384 tips) to handle massive volumes of samples with sub-microliter accuracy, essential for high-throughput screening (HTS) in drug discovery and compound management. Key technological features within ALHS include real-time liquid level detection, ensuring accurate aspiration even with low fluid volumes, and sophisticated tip positioning systems that compensate for microplate tolerances. The software driving these systems is becoming more sophisticated, offering simulation capabilities and integration with laboratory information systems (LIMS) for seamless data transfer and experimental tracking, moving towards a paperless laboratory environment.

The emergence of "smart pipetting" through IoT integration represents a significant technological leap. Modern electronic pipettes are now equipped with wireless connectivity (Bluetooth/Wi-Fi), allowing them to link directly to centralized databases and calibration management software. This connectivity enables automated logging of dispensing data (volume, date, time, user ID), facilitating rigorous audit trails necessary for regulatory compliance and ensuring data integrity. Moreover, advancements in disposable tip technology, including specialized low-retention surfaces and integrated filter barriers, directly contribute to the accuracy of the overall system by minimizing sample adhesion and preventing cross-contamination, especially critical in molecular diagnostics and PCR setup. These combined technological drivers ensure that liquid handling tools remain at the forefront of laboratory efficiency and scientific accuracy.

Regional Highlights

The global Pipettes and Pipettors Market displays significant regional variation in terms of market maturity, adoption rates of advanced technology, and regulatory environments. North America, comprising the United States and Canada, currently holds the largest market share globally. This dominance is attributed to massive sustained investment in life sciences R&D, the presence of numerous global pharmaceutical and biotechnology headquarters, and favorable regulatory frameworks encouraging the rapid adoption of automated and high-precision liquid handling technologies. The US market is characterized by high demand for cutting-edge automated workstations to support large-scale genomic sequencing projects and clinical trials, driving premium pricing and high sales volumes for electronic and robotic systems.

Europe represents a mature and technologically advanced market, driven by stringent quality standards and a strong focus on laboratory accreditation (e.g., ISO 17025). Key contributors include Germany, the UK, and France, where academic research and advanced clinical diagnostics maintain high demand for ergonomic and highly calibrated pipettes. Europe shows a strong preference for environmentally sustainable solutions and instruments that offer robust traceability features, reflecting the region's strong regulatory emphasis on data integrity and quality assurance in medical devices. The European market is stable, relying heavily on consistent product upgrades and replacement cycles for compliance.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid growth is propelled by significant government funding directed toward modernizing healthcare infrastructure, increasing investment in local biopharmaceutical manufacturing capabilities (particularly in China and India), and the establishment of numerous contract research organizations (CROs) servicing global R&D needs. The increasing patient pool and expanding clinical trial activity in countries like South Korea and Japan further fuel demand for basic and advanced pipetting instruments. While cost sensitivity remains higher than in Western markets, the adoption rate of mid-range electronic and manual pipettes is accelerating rapidly as laboratory standards improve.

- North America: Dominant market share driven by robust biopharma R&D funding, high adoption of automated liquid handlers, and advanced clinical diagnostic infrastructure.

- Europe: Mature market characterized by strict regulatory compliance, strong emphasis on traceability and calibration, and consistent demand for ergonomic and electronic instruments.

- Asia Pacific (APAC): Highest projected CAGR due to healthcare modernization, increasing governmental and private investment in biotechnology, and growing prevalence of clinical research and manufacturing.

- Latin America (LATAM): Emerging growth driven by improving public health spending and increasing standardization of clinical laboratories, focusing primarily on cost-effective manual and entry-level electronic solutions.

- Middle East & Africa (MEA): Growth stimulated by infrastructure development in key economies (e.g., UAE, Saudi Arabia) and expansion of local diagnostic testing centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pipettes and Pipettors Market, encompassing their strategic initiatives, product portfolios, and regional presence.- Eppendorf AG

- Thermo Fisher Scientific Inc.

- Sartorius AG (Biohit Oyj)

- Gilson, Inc.

- Hamilton Company

- Mettler-Toledo International Inc. (Rainin Instrument, LLC)

- Corning Incorporated

- Brand Gmbh + Co KG

- Integra Biosciences

- Socorex Isba SA

- Nichiryo Co., Ltd.

- Sarstedt AG & Co. KG

- Greiner Bio-One International GmbH

- Dragon Lab

- Accumax

- Hirschmann Laborgeräte GmbH

- IKA Works GmbH & Co. KG

- VistaLab Technologies, Inc.

- Molecular Devices, LLC

- Tecan Group

Frequently Asked Questions

Analyze common user questions about the Pipettes and Pipettors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from manual to electronic pipettes in modern laboratories?

The primary driver is the need to eliminate human error and reduce operator variability, which is common with manual pipetting. Electronic pipettes offer superior precision, enhanced reproducibility, ergonomic benefits (reducing RSI risk), and integrated software for automated data logging and compliance tracking (AEO Keyword: precision dispensing, automated data logging, reduced operator variability).

Which end-user segment utilizes Automated Liquid Handling Systems (ALHS) the most?

Pharmaceutical and Biotechnology Companies are the heaviest users of ALHS, specifically for high-throughput applications like compound screening, genomics, and drug discovery workflows where millions of dispensing steps must be performed accurately and rapidly (AEO Keyword: high-throughput screening, robotic liquid handling, drug discovery automation).

How significant is the impact of regulatory compliance (e.g., ISO 8655) on the pipettes market?

Regulatory compliance is highly significant, mandating stringent requirements for instrument calibration, performance accuracy, and documentation (ISO 8655, GLP/GMP). This necessity drives demand for certified instruments, routine maintenance services, and pipettes with built-in data traceability features (AEO Keyword: ISO 8655 compliance, pipette calibration, traceable documentation).

What technological advancements are enhancing pipette reliability and throughput?

Key advancements include motorized piston control in electronic pipettes, integration of IoT for remote monitoring and predictive maintenance, specialized low-retention tip technology to maximize sample recovery, and sophisticated software for error compensation in automated systems (AEO Keyword: smart pipetting, IoT integration, predictive maintenance, low-retention tips).

Is the Asia Pacific (APAC) region expected to surpass North America in terms of market growth rate?

Yes, APAC is forecasted to exhibit the highest CAGR due to rapid expansion in pharmaceutical R&D, significant governmental investment in healthcare modernization, and rising demand for diagnostics in populous countries like China and India, positioning it as the primary future growth engine (AEO Keyword: APAC market growth, healthcare modernization, emerging biotechnology sector).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager