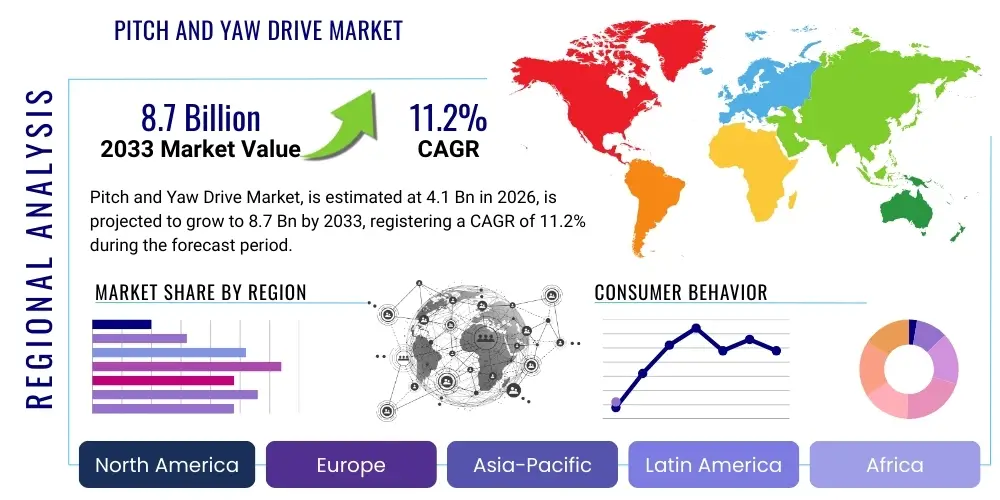

Pitch and Yaw Drive Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442984 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Pitch and Yaw Drive Market Size

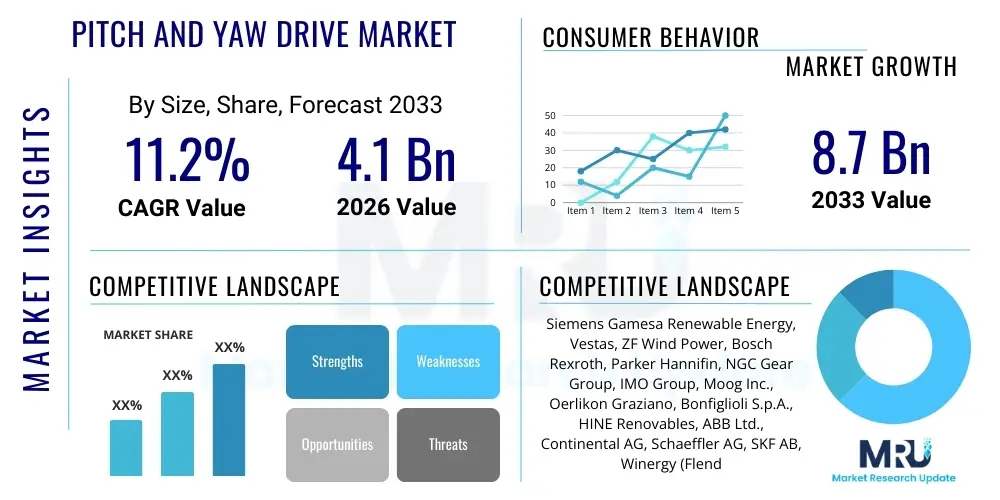

The Pitch and Yaw Drive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at $4.1 Billion in 2026 and is projected to reach $8.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is fundamentally driven by the accelerated global deployment of wind energy installations, particularly in high-capacity offshore environments where precision control of turbine blades and nacelle orientation is paramount for maximizing energy capture and ensuring structural integrity. The increasing capacity factors demanded by utility-scale wind farms necessitate robust, reliable, and technologically advanced pitch and yaw systems, thereby sustaining high market value.

The market valuation reflects the essential role these high-precision drive systems play in the operational efficiency and longevity of modern wind turbines. Pitch drives control the angle of the rotor blades (pitch) to regulate aerodynamic forces, optimizing power output under varying wind conditions or ensuring safe shutdown during extreme weather. Yaw drives, conversely, rotate the entire nacelle to orient the rotor plane perpendicular to the incoming wind direction, thereby maximizing energy generation. The inherent complexity, stringent quality requirements, and high cost of these electromechanical systems contribute significantly to the overall market size and revenue projection.

Pitch and Yaw Drive Market introduction

The Pitch and Yaw Drive Market encompasses the manufacturing, distribution, and service of crucial electromechanical systems responsible for controlling the orientation and aerodynamic profile of wind turbine rotors. These systems are non-negotiable components in variable-speed, utility-scale wind turbines, ensuring optimal energy capture, load reduction, and overall turbine safety. Product offerings primarily include gearboxes, motors (often servo or AC induction), hydraulic actuation units, brakes, bearings, and sophisticated electronic control units (ECUs) that manage real-time adjustments based on wind speed and direction data.

Major applications of pitch and yaw drive systems are almost exclusively centered around wind power generation, spanning both onshore and rapidly expanding offshore wind farms. These drives are fundamental to enhancing the annual energy production (AEP) of wind turbines. Key benefits realized by implementing advanced drive systems include increased power output optimization through precise blade angle adjustments, significant reduction in mechanical stresses (fatigue loads) on the turbine structure, improved noise reduction capabilities, and enhanced safety features like emergency feathering mechanisms for swift shutdown during grid failures or severe weather events. Modern systems increasingly incorporate digitalization for remote diagnostics and predictive maintenance.

The market growth is robustly driven by several macro-environmental factors, chiefly the global push towards decarbonization and meeting ambitious renewable energy targets set by national governments and international bodies. The declining Levelized Cost of Energy (LCOE) for wind power makes large-scale projects highly economically viable, consequently boosting demand for high-performance turbine components. Furthermore, the trend toward larger, multi-megawatt turbines—particularly in the challenging offshore environment—demands exceptionally powerful and reliable pitch and yaw systems capable of handling immense loads and operating in corrosive, harsh conditions, thereby stimulating innovation and market expansion.

Pitch and Yaw Drive Market Executive Summary

The Pitch and Yaw Drive Market is currently characterized by significant technological advancements focusing on improved reliability, reduced maintenance cycles, and enhanced system efficiency. A key business trend involves the consolidation of suppliers capable of delivering complete, integrated drive train solutions, moving away from fragmented component sourcing. The shift from hydraulic to fully electric pitch systems is a dominant trend, driven by the latter’s benefits in terms of precision, cleanliness, lower maintenance requirements, and higher efficiency. Furthermore, predictive maintenance models, leveraging sensor data and AI, are becoming standard offerings, drastically reducing unexpected downtime and operational costs for wind farm operators globally.

Regionally, the market exhibits a dichotomy: established markets like Europe and North America focus on retrofitting existing fleets and dominating offshore technology development, while emerging markets, predominantly in the Asia Pacific (APAC), are the primary source of new installations. China continues to lead global installations, propelling massive demand for domestically sourced pitch and yaw systems, often driving high-volume, cost-competitive manufacturing. Europe, leveraging its mature supply chain, remains the leader in developing high-torque, durable systems required for large-scale offshore projects exceeding 10 MW capacity, showcasing higher technology readiness levels and premium pricing.

Segmentation trends highlight the increasing dominance of electric drive systems over traditional hydraulic systems across both pitch and yaw applications, though hydraulics maintain a strong foothold in certain high-load legacy systems and specific offshore platforms. By application, the offshore segment is experiencing the fastest growth rate, fueled by substantial global investment and the trend towards deeper water installations requiring exceptionally robust, corrosion-resistant components. Component-wise, the demand is shifting towards smart servo motors and high-precision, low-maintenance bearings designed for 25-year operational lifespans without major overhauls, reflecting the industry's focus on maximizing asset utilization.

AI Impact Analysis on Pitch and Yaw Drive Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Pitch and Yaw Drive Market frequently revolve around improved operational efficiency, predictive failure detection, and the potential for autonomous optimization. Users are keen to understand how AI algorithms can minimize structural loads by preemptively adjusting pitch angles in turbulent conditions (smart load mitigation) and how machine learning can interpret complex sensor data to forecast component failure (e.g., gearbox wear, bearing fatigue) long before it becomes critical. Concerns also include data security, the cost of implementing AI infrastructure, and the need for specialized personnel to manage these complex systems. The overarching expectation is that AI integration will transform pitch and yaw systems from reactive mechanical units into proactive, self-optimizing electromechanical controls, leading to significant increases in turbine availability and reduction in lifetime operational expenditures.

- Predictive Maintenance Scheduling (PMS): AI analyzes vibration, temperature, current consumption, and acoustic data from drive components (motors, gearboxes) to predict potential component failures, shifting maintenance from scheduled to condition-based, minimizing downtime.

- Autonomous Pitch Optimization: Machine learning algorithms continuously refine pitch control strategies based on real-time wind patterns and historical turbine performance data, maximizing aerodynamic efficiency and annual energy production (AEP) beyond static programming limits.

- Smart Load Mitigation: AI-driven control systems anticipate extreme gust loads and turbulent conditions, making ultra-fast, micro-adjustments to the pitch angle to reduce transient mechanical stresses on blades and the hub, thereby extending turbine lifespan.

- Supply Chain Efficiency: AI and generative design tools are utilized to optimize the material composition and geometrical design of critical parts like gearboxes and bearings, leading to lighter, more durable, and cost-effective manufacturing processes.

- Fault Diagnostics and Root Cause Analysis: AI systems automate the diagnosis of complex system faults (e.g., communication errors, sensor drift), providing immediate, actionable insights to operators, significantly speeding up troubleshooting and repair times.

- Digital Twins Implementation: Creation of high-fidelity digital models of the pitch and yaw systems, governed by AI, allows for simulation of various operational scenarios and testing of control strategies in a virtual environment before deployment.

DRO & Impact Forces Of Pitch and Yaw Drive Market

The dynamics of the Pitch and Yaw Drive Market are shaped by a powerful interplay of global energy policy, technological maturity, and economic imperatives. Drivers are overwhelmingly linked to the exponential growth in global wind power installations, specifically the rising average size and capacity of new turbines which inherently require more powerful and resilient drive systems. Regulatory support, such as production tax credits (PTCs) and feed-in tariffs (FITs), along with binding national renewable energy targets, create a stable demand environment. Simultaneously, the relentless industry focus on maximizing wind farm asset utilization and minimizing LCOE necessitates investment in advanced, low-maintenance pitch and yaw technology. Furthermore, the expansion into complex offshore wind energy zones acts as a critical demand catalyst, requiring specialized, high-durability systems.

However, the market faces significant restraints. A primary hurdle is the relatively high initial capital expenditure (CapEx) associated with procuring and integrating sophisticated, large-scale drive systems, especially for electric pitch systems requiring precise servo motor technology. Furthermore, the specialized nature of these components means the industry is susceptible to supply chain bottlenecks, relying on a relatively limited number of high-quality gearbox and bearing manufacturers. Operational challenges include the harsh operating conditions (corrosion, icing, extreme temperature fluctuations) inherent in wind farm locations, which accelerate wear and necessitate expensive, highly skilled maintenance interventions, particularly for large offshore turbines where access is difficult and costly.

Opportunities for market growth are abundant, notably within the rapidly expanding offshore wind sector, where market demand is focused on developing integrated, sealed, and extremely robust systems designed for 25+ years of continuous operation. Another critical opportunity lies in the burgeoning market for retrofitting and upgrading aging wind turbine fleets across established markets in Europe and North America, replacing legacy hydraulic systems with modern electric solutions to enhance performance and life expectancy. Technological advancements, particularly in integrating advanced sensor technology, IoT, and AI for real-time health monitoring and control optimization, present long-term competitive advantages and new revenue streams centered on service agreements and digital solutions.

- Drivers: Global renewable energy capacity expansion; Increasing size and capacity of wind turbines (especially offshore); Favorable government policies and incentives supporting wind energy deployment; Focus on reducing Levelized Cost of Energy (LCOE).

- Restraints: High initial investment cost (CapEx) for sophisticated systems; Complex and costly maintenance procedures, particularly offshore; Supply chain volatility for specialized, high-precision components (bearings, large gears); Regulatory complexities across diverse geographical markets.

- Opportunities: Rapid expansion of high-capacity offshore wind projects; Market for retrofitting and upgrading older wind turbine fleets (hydraulic to electric conversion); Integration of smart technology (IoT, AI) for predictive maintenance and enhanced control; Development of lighter, high-torque density materials and designs.

- Impact Forces: Technological Innovation (rapid evolution of servo motor efficiency and sensor technology); Regulatory Environment (strict grid code compliance and safety standards); Economic Viability (dependence on global steel and material prices); Environmental Factors (demand for systems resilient to extreme weather and challenging corrosive environments).

Segmentation Analysis

The Pitch and Yaw Drive Market is systematically segmented based on the fundamental mechanisms used (Type), the operating environment and application scale (Application), and the primary physical components that constitute the drive system (Component). Understanding these segments is crucial for manufacturers to tailor their R&D and market strategies, addressing specific requirements such as high torque resistance in offshore applications or cost efficiency in high-volume onshore projects. The shift in market dominance among these segments, particularly the rise of electric drives, reflects the industry's pursuit of higher operational precision and reduced lifetime costs.

By Type, the market clearly differentiates between electric drive systems, which use AC or DC motors (often servo motors) and gearboxes for precise rotation, and hydraulic systems, which rely on pressurized fluid actuation. Electric systems are gaining prominence due to their superior control accuracy, environmental cleanliness, and lower maintenance frequency. The Application segmentation separates the requirements of Onshore Wind, which typically involve smaller to medium-capacity turbines in accessible locations, from Offshore Wind, which mandates highly robust, sealed, and extremely reliable multi-megawatt systems capable of withstanding severe marine conditions and requiring minimal intervention.

- By Type:

- Electric Pitch and Yaw Drives (Dominating growth)

- Hydraulic Pitch and Yaw Drives (Retaining market share in legacy and specific high-load applications)

- By Application:

- Onshore Wind Turbines (High volume, diverse capacity)

- Offshore Wind Turbines (High value, high capacity, stringent resilience requirements)

- By Component:

- Gearboxes/Slewing Drives (Primary torque transmission unit)

- Motors (AC Induction, DC Servo Motors, specialized variable-speed drives)

- Bearings (Pitch Bearings, Yaw Bearings)

- Brakes and Clutches (Safety mechanisms)

- Control Systems (Sensors, ECUs, Power electronics)

Value Chain Analysis For Pitch and Yaw Drive Market

The value chain for the Pitch and Yaw Drive Market begins with the highly specialized upstream analysis involving raw material extraction and processing, primarily high-grade steel, specialized plastics, and complex electronic components necessary for motors and control units. This phase is characterized by stringent quality controls, as the reliability of the entire drive system is fundamentally dependent on the metallurgical integrity of components like large gear rings and high-precision bearings. Key upstream suppliers include specialized steel mills and component manufacturers (e.g., bearing manufacturers like SKF or Schaeffler) whose expertise dictates the performance parameters and lifespan of the final product. Price fluctuations in raw materials, such as nickel and iron ore, directly impact the manufacturing costs downstream.

Midstream activities involve the design, manufacturing, assembly, and testing of the integrated pitch and yaw systems. Original Equipment Manufacturers (OEMs) or specialized Tier 1 suppliers like ZF Wind Power or Rexroth are crucial here, integrating purchased components (motors, gears, bearings) into a tested, certified module. The distribution channel analysis shows a highly concentrated market, with sales predominantly conducted through direct contracts between the system supplier (or the turbine OEM if integrated internally) and the wind farm developer or operator. Indirect sales via distributors are less common but occur for spare parts and retrofitting projects. Certification and quality assurance (e.g., ISO standards, DNV GL certification) are pivotal steps in this segment, ensuring compliance with rigorous operational and safety standards before deployment.

The downstream analysis focuses on installation, commissioning, operation, and maintenance (O&M). The primary buyers are large utility companies, independent power producers (IPPs), and major wind farm developers who integrate these drives into large turbine assemblies. Due to the critical nature of these components, long-term service agreements (LTSAs) are commonplace, providing stable post-sale revenue for the drive system manufacturers or specialized O&M providers. Direct engagement with end-users ensures that feedback on system performance under actual field conditions is rapidly incorporated into future design iterations, driving continuous product improvement, especially concerning reliability in harsh environments. The increasing adoption of remote monitoring and diagnostics significantly impacts the structure of the maintenance downstream.

Pitch and Yaw Drive Market Potential Customers

The primary customers for pitch and yaw drive systems are globally recognized wind turbine manufacturers (OEMs). These large industrial conglomerates, such as Vestas, Siemens Gamesa Renewable Energy, and Goldwind, require integrated, custom-designed drive solutions that seamlessly fit into their specific turbine models. OEMs demand high volume, guaranteed consistency, specialized technical integration support, and compliance with their specific internal quality and performance metrics. Relationships here are typically long-term strategic partnerships, focused on joint product development to ensure the pitch and yaw systems meet the evolving demands of larger, more complex turbines.

A second crucial customer group comprises the wind farm developers and Independent Power Producers (IPPs). While these entities typically purchase fully assembled turbines from the OEMs, they are increasingly involved in the decision-making process regarding the components' quality and serviceability, especially when negotiating long-term warranties and performance guarantees. For the aftermarket and retrofitting segment, IPPs and utility companies that own and operate existing wind farms become direct buyers of replacement drives or upgraded kits (e.g., converting hydraulic pitch systems to electric) to extend the lifespan and improve the efficiency of their assets.

Furthermore, specialized Maintenance, Repair, and Overhaul (MRO) service providers form a growing segment of potential customers. These companies often purchase pitch and yaw drive sub-components (such as brakes, motors, or specific gearbox parts) in large volumes to service their contracted fleets. Their purchasing behavior is primarily influenced by component availability, speed of delivery, and the cost-effectiveness of parts. The increasing reliance on specialized, condition-based monitoring services also draws technology companies offering sensor packages and data analytics solutions into the customer ecosystem, although they act more as enablers for the end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.1 Billion |

| Market Forecast in 2033 | $8.7 Billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Gamesa Renewable Energy, Vestas, ZF Wind Power, Bosch Rexroth, Parker Hannifin, NGC Gear Group, IMO Group, Moog Inc., Oerlikon Graziano, Bonfiglioli S.p.A., HINE Renovables, ABB Ltd., Continental AG, Schaeffler AG, SKF AB, Winergy (Flender), Nidec Corporation, Emerson Electric Co., Voith Turbo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pitch and Yaw Drive Market Key Technology Landscape

The technology landscape within the Pitch and Yaw Drive Market is rapidly evolving, driven by the need for enhanced reliability and smarter operational control. A cornerstone of modern systems is the utilization of advanced servo motor technology, particularly Permanent Magnet Synchronous Motors (PMSMs), which offer high torque density, excellent efficiency, and rapid response times crucial for dynamic pitch adjustments. Coupled with sophisticated variable frequency drives (VFDs) and power electronics, these motors enable precise speed and torque control, drastically improving the performance of electric pitch systems compared to traditional AC induction motors. Furthermore, the development of robust, sealed gearboxes (slewing drives) using advanced gear metallurgy and lubrication methods is critical for reducing maintenance needs, especially in inaccessible offshore locations.

The integration of the Industrial Internet of Things (IIoT) and sensor technology is paramount to the market's technological progression. Modern pitch and yaw drives are heavily instrumented with condition monitoring sensors—including accelerometers, strain gauges, temperature sensors, and encoders—that transmit continuous, high-fidelity data on system health back to centralized turbine control systems and cloud platforms. This data forms the backbone of AI-driven predictive maintenance programs, allowing operators to monitor lubricant degradation, detect early signs of bearing wear, and optimize control loops in real-time. Advanced control algorithms, often running on edge computing devices within the nacelle, ensure minimal latency in response to rapid wind shifts.

Another significant technological focus is on improving redundancy and safety mechanisms. Given that pitch and yaw drive failure can lead to catastrophic turbine damage or lengthy downtime, systems now incorporate multiple independent brake circuits (hydraulic or electromagnetic) and redundant control pathways. For pitch systems, battery backup units or dedicated uninterruptible power supplies (UPS) are mandatory, ensuring that the blades can be feathered (pitched to minimize lift) and the turbine safely shut down even during a complete grid power failure. Materials science innovation also plays a role, with research focusing on corrosion-resistant coatings and advanced composite materials to improve component durability in harsh marine environments, thus prolonging the operational lifespan of the entire drive system.

Regional Highlights

Regional dynamics heavily influence the type and volume of pitch and yaw drive demand, correlating directly with the maturity and governmental support for wind energy across different continents.

- Asia Pacific (APAC): Dominates the market in terms of volume of new installations, driven primarily by massive government investment in China and India. China's domestic supply chain is highly competitive, focusing on large-scale production of cost-effective components for both onshore and rapidly growing near-shore projects. High growth rate expected due to ambitious renewable capacity targets.

- Europe: Characterized by technological leadership and a strong focus on high-value, high-performance systems for the established and rapidly expanding offshore market (North Sea, Baltic Sea). Europe sets the benchmark for system durability, size (10 MW+ turbines), and advanced regulatory compliance, driving demand for electric, highly redundant drive systems suitable for severe environments.

- North America (NA): Exhibits steady growth, supported by favorable policy mechanisms (e.g., PTCs in the US) and significant repowering activities. The market here demands high reliability and robust components tailored for diverse climate conditions, ranging from arid deserts to icy northern plains, focusing on maintenance efficiency and minimizing LCOE.

- Latin America (LATAM): A rapidly emerging market, especially in Brazil and Chile, leveraging excellent wind resources. Demand is concentrated on proven, durable onshore systems that can handle fluctuating grid conditions and remote site logistics. Growth is contingent on infrastructure development and stable political commitment to renewable energy projects.

- Middle East and Africa (MEA): Currently a smaller market but projected for accelerated growth, particularly in the Middle East (Saudi Arabia, UAE) and South Africa, as nations diversify their energy mix away from fossil fuels. Demand initially focuses on standardized, desert-optimized onshore systems requiring high tolerance to dust and extreme heat.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pitch and Yaw Drive Market.- Siemens Gamesa Renewable Energy

- Vestas

- ZF Wind Power

- Bosch Rexroth

- Parker Hannifin

- NGC Gear Group

- IMO Group

- Moog Inc.

- Oerlikon Graziano

- Bonfiglioli S.p.A.

- HINE Renovables

- ABB Ltd.

- Continental AG

- Schaeffler AG

- SKF AB

- Winergy (Flender)

- Nidec Corporation

- Emerson Electric Co.

- Voith Turbo

- Rolls-Royce Power Systems (mtu)

Frequently Asked Questions

Analyze common user questions about the Pitch and Yaw Drive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Pitch and Yaw drives in wind turbines?

Pitch drives adjust the angle of the individual rotor blades (feathering) to control power output and limit structural loads, while Yaw drives rotate the entire nacelle to keep the rotor facing directly into the wind, maximizing energy capture and operational efficiency.

Why are electric pitch systems rapidly replacing hydraulic systems in new turbine designs?

Electric pitch systems offer superior control precision, faster response times, reduced maintenance requirements (no fluid leaks or contamination risk), higher energy efficiency, and are easier to integrate with sophisticated digital control and diagnostic systems.

How does the shift towards offshore wind impact the Pitch and Yaw Drive Market?

The shift to offshore mandates the development of larger, significantly more durable, and highly corrosion-resistant pitch and yaw systems capable of handling multi-megawatt loads (10MW+) and requiring minimal maintenance intervention over a 25-year lifespan.

What is the role of AI and predictive maintenance in these drive systems?

AI analyzes real-time sensor data (vibration, temperature, current) to predict component failure, enabling condition-based maintenance scheduling, reducing unexpected downtime, and optimizing control parameters for maximized AEP (Annual Energy Production).

Which geographical region exhibits the highest growth potential for Pitch and Yaw drive installations?

The Asia Pacific region, led by China and India, exhibits the highest growth potential due to aggressive national renewable energy targets and large-scale, ongoing new wind farm installations, although Europe leads in high-value, technological complexity for offshore applications.

This report provides a granular analysis of the Pitch and Yaw Drive Market, focusing on the interwoven factors of technological innovation, regional demand drivers, and the critical role of these systems in global renewable energy infrastructure. The detailed segmentation and executive summaries offer stakeholders actionable insights necessary for strategic planning, investment decisions, and navigating the evolving competitive landscape. The integration of advanced analytics, particularly AI and IIoT, is set to redefine system performance benchmarks, ensuring that future wind energy capacity factors remain highly competitive against traditional generation sources. The ongoing research and development into higher torque density gearboxes and ultra-reliable bearing solutions highlight the industry's commitment to extending operational lifecycles and mitigating O&M costs in challenging environments.

The global energy transition remains the foundational driver, necessitating continuous refinement of pitch and yaw technologies to support increasingly powerful and physically larger wind turbines. Supply chain resilience, especially concerning specialized bearing and gearbox manufacturers, will be a persistent challenge that market leaders must address through diversification and strategic partnerships. Moreover, the long-term success of offshore wind projects hinges critically on the flawless performance and easy serviceability of these precision drive mechanisms. Therefore, investments are heavily concentrated in developing modular, sealed units capable of remote diagnostics and rapid replacement, minimizing costly vessel time and specialized labor requirements. The market's structural integrity is directly tied to regulatory stability and global political commitment towards sustainable energy goals, making policy risk analysis a key consideration for new entrants and established players alike.

Further analysis of the competitive landscape reveals that vertical integration by major wind turbine OEMs (such as Vestas and Siemens Gamesa) often internalizes demand for these drives, pressuring independent component suppliers to focus on technological niches, high-value aftermarket services, or specialized applications outside the core turbine market. Innovation in power electronics and motor control algorithms is accelerating, enabling finer control over blade dynamics which, in turn, allows turbine designers to push the structural limits of blades, leading to even greater rotor swept areas and higher power ratings. This continuous cycle of demanding design constraints drives perpetual technological advancement within the Pitch and Yaw Drive component sector, cementing its critical importance to the future utility-scale electricity generation portfolio worldwide.

The forecasted market value reflects both the growing volume of installations and the increasing complexity and unit cost associated with higher capacity drives. Specifically, the high-torque, direct-drive yaw systems and redundant electric pitch systems needed for 15 MW+ offshore turbines command a significant premium over traditional systems. Geographically, APAC will dominate volume, but Europe will continue to drive innovation and high-value transactions. Investment strategies should therefore be bifurcated: volume efficiency in the East and technological leadership and specialization in the West. Strategic mergers and acquisitions are expected as OEMs seek to secure core technology suppliers and control key components in the turbulent global supply chain environment, further concentrating market power and expertise.

Regulatory harmonization, particularly across regional power grids and maritime safety standards, could unlock further efficiencies for global suppliers. Standardization of component interfaces, while challenging given the proprietary designs of major OEMs, represents an opportunity to reduce manufacturing costs and increase interoperability. The next generation of pitch and yaw systems will be defined not just by mechanical robustness but by their embedded digital intelligence, capable of functioning as an integral, self-aware part of a smart grid ecosystem. This evolution solidifies the market’s transition from mechanical engineering focus to integrated electromechanical and software solution delivery, offering significant long-term growth prospects for companies positioned to capitalize on digital transformation within the renewable energy sector.

The ongoing challenge of mitigating acoustic noise emissions from wind farms, particularly in densely populated onshore areas, also drives technological requirements. Pitch and yaw systems must operate with exceptionally low vibration and noise profiles. This requirement often necessitates the use of specialized, backlash-free gearboxes and advanced motor dampening technologies, adding another layer of complexity and engineering cost to the components. Furthermore, the imperative for sustainable manufacturing practices is pushing suppliers toward circular economy models, focusing on ease of material recycling and designing components for longer life extension and easier repairability, aligning with broader ESG (Environmental, Social, and Governance) investment criteria. This holistic approach ensures the market’s growth is sustainable and compliant with future environmental regulations.

Specific market barriers that warrant continued attention include the scarcity of highly skilled maintenance technicians trained to handle these sophisticated electronic and hydraulic systems, especially in developing markets. This constraint necessitates the design of systems that can be diagnosed remotely and require fewer physical interventions. Innovation in remote service tools and augmented reality (AR) support for field technicians represents a growing niche within the broader O&M services associated with pitch and yaw systems. The interaction between various turbine components, particularly the compatibility of the pitch system with the blade design and aerodynamic profile, requires continuous co-design efforts between drive manufacturers and blade specialists, underscoring the interconnected nature of the wind turbine component ecosystem.

The geopolitical landscape also introduces variability, particularly concerning global trade policies, tariffs on imported steel and components, and intellectual property protection, especially across cross-border manufacturing operations. Companies must adopt sophisticated risk management strategies to navigate these complexities while maintaining cost competitiveness. The convergence of high-precision manufacturing techniques with advanced embedded software and cybersecurity protocols is a non-negotiable requirement, ensuring the systems are resilient not only to mechanical failure but also to digital threats that could compromise operational control. This comprehensive analysis confirms the Pitch and Yaw Drive Market as a high-growth, high-technology sector integral to achieving global energy transition objectives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager