Pitot Static Testers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441251 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Pitot Static Testers Market Size

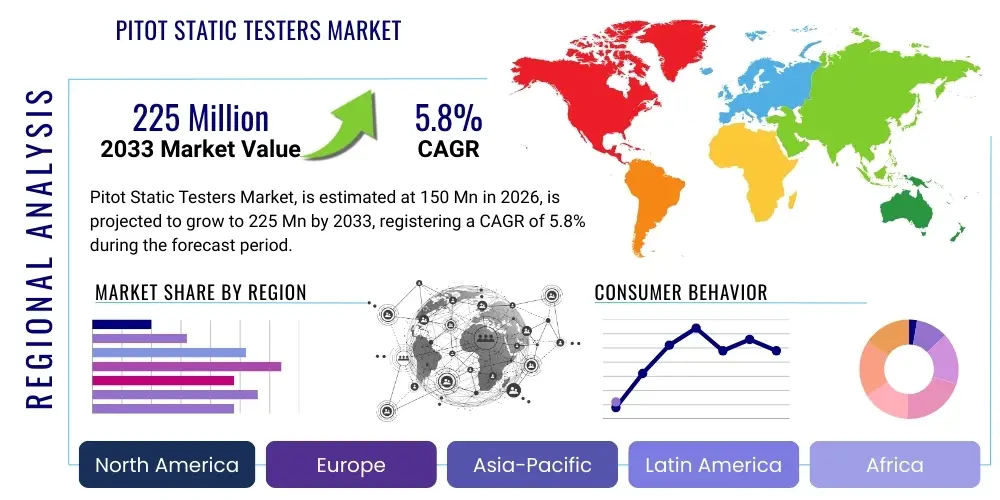

The Pitot Static Testers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 225 Million by the end of the forecast period in 2033.

Pitot Static Testers Market introduction

The Pitot Static Testers Market encompasses sophisticated electronic and pneumatic instruments essential for the precise verification and calibration of an aircraft's air data system. These systems, comprising the pitot probe and static ports, are crucial for measuring airspeed, altitude, and vertical speed—fundamental parameters for safe flight navigation and operational compliance. Modern testers are highly accurate digital instruments designed to simulate the various pressure conditions experienced during flight, ensuring the accuracy and reliability of altimeters, air data computers, vertical speed indicators, and airspeed indicators before aircraft release for service.

The primary application of Pitot Static Testers lies within Maintenance, Repair, and Overhaul (MRO) facilities, dedicated avionics workshops, and aircraft manufacturing environments. These devices are indispensable for meeting regulatory mandates, such as those imposed by the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), which require periodic certification and testing of air data systems, often dictated by compliance standards like RVSM (Reduced Vertical Separation Minimum). The testers provide highly controlled pneumatic pressure outputs, allowing technicians to verify the tolerance and calibration of onboard instruments, mitigating potential safety hazards associated with inaccurate flight data.

Driving factors for sustained market growth include the escalating global fleet size, particularly in the commercial aviation sector, and the increasing complexity of integrated digital avionics systems which demand more precise calibration techniques. Furthermore, the mandatory adoption of advanced navigation technologies, such as ADS-B (Automatic Dependent Surveillance–Broadcast), necessitates extremely accurate air data input, compelling MROs and airlines to invest in advanced, high-fidelity digital pitot static test sets. The inherent safety-critical nature of these systems ensures a continuous demand cycle for tester procurement, replacement, and periodic re-calibration services.

Pitot Static Testers Market Executive Summary

The Pitot Static Testers Market is characterized by robust growth driven primarily by stringent international aviation safety regulations and the cyclical maintenance requirements of the global commercial and military aircraft fleet. Business trends indicate a pronounced shift towards highly portable, battery-operated digital testers that offer superior accuracy, faster testing cycles, and integrated data logging capabilities suitable for line maintenance operations. Key manufacturers are focusing on integrating advanced touch-screen interfaces, remote control options, and automated test sequences to minimize human error and enhance efficiency in busy MRO environments, positioning the market for continued technological advancement.

Regionally, North America and Europe maintain dominance due to the high concentration of major aircraft OEMs, established MRO networks, and strict regulatory adherence mandating routine re-certification of air data systems. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, fueled by rapid expansion of low-cost carriers, significant investment in new airport infrastructure, and the accompanying proliferation of regional MRO facilities. This geographical shift is creating lucrative opportunities for tester suppliers to establish local partnerships and distribution channels catering to the growing regional fleet.

Segment trends reveal that the Digital Pitot Static Testers segment is rapidly eclipsing legacy analog systems, owing to their inherent precision, ease of use, and compatibility with modern air data computers. Within applications, Commercial Aviation continues to hold the largest market share due to sheer fleet volume and rigorous scheduled maintenance protocols, including critical RVSM checks. Furthermore, the burgeoning demand for testing services within specialized military and defense aviation applications, often involving unique, high-performance aircraft requirements, provides a stable, high-value niche characterized by long procurement cycles and specialized regulatory standards.

AI Impact Analysis on Pitot Static Testers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pitot Static Testers Market frequently center on automation, predictive maintenance capabilities, and the potential for reduced human intervention during complex calibration routines. Users are keen to understand how AI algorithms can analyze historical sensor drift data to optimize calibration schedules (predictive maintenance), how machine learning (ML) models can be integrated into the test sets to diagnose subtle pneumatic system anomalies that human operators might miss, and the feasibility of fully autonomous, end-to-end testing processes. The primary concern revolves around the certification burden associated with introducing AI-validated testing procedures into highly regulated safety-critical environments like aviation maintenance, necessitating robust validation frameworks to maintain FAA/EASA compliance while leveraging efficiency gains. Expectations are high for AI to streamline documentation and generate anomaly reports automatically, significantly reducing turnaround time (TAT) for aircraft inspections.

- AI-driven predictive calibration scheduling based on historical usage and environmental data analysis.

- Machine Learning integration for automated anomaly detection and fault isolation in air data systems.

- Enhanced automation of complex test sequences (e.g., RVSM profile simulation), minimizing operator error.

- Optimization of tester hardware performance through self-diagnostics and dynamic control adjustments.

- Automated generation of compliance reports and digital maintenance logs, improving traceability and audit readiness.

- Integration of Computer Vision systems for enhanced quality control during physical connection and setup verification.

- Development of smart remote diagnostic tools for manufacturer support and on-site troubleshooting guidance.

DRO & Impact Forces Of Pitot Static Testers Market

The Pitot Static Testers Market is profoundly influenced by a complex interplay of demand drivers (D), regulatory restraints (R), technological opportunities (O), and the overarching impact forces stemming from global aviation trends. The primary driver is the accelerating increase in commercial air traffic and the corresponding expansion of the global aircraft fleet, necessitating proportional growth in MRO capabilities and scheduled air data system certifications. Stringent governmental mandates, particularly the requirement for periodic RVSM compliance checks, serve as a non-negotiable demand stimulant, forcing airlines and MROs to maintain a current inventory of high-accuracy testing equipment. Furthermore, the obsolescence cycle of older analog testers is compelling a natural migration towards modern, highly precise digital solutions, contributing significantly to market volume.

Conversely, the market faces restraints rooted predominantly in the high initial acquisition cost of advanced digital pitot static test sets, which can be prohibitive for smaller, independent MRO operations or general aviation maintenance shops. The required complexity of calibration and certification, demanding highly skilled technicians and specialized laboratory environments, presents a substantial operational barrier. Economic downturns, which disproportionately affect airline profitability and investment in new maintenance tools, also periodically restrain market growth, leading to delays in capital expenditure for non-critical equipment upgrades, although regulatory necessity ensures continued basic demand.

Significant opportunities are emerging from the integration of Pitot Static Testers with augmented reality (AR) and IoT technologies, facilitating guided maintenance procedures and real-time data sharing across global networks. The ongoing widespread adoption of digital aerospace standards and the phasing out of older pneumatic systems in general aviation open new avenues for specialized, lower-cost digital portable testers. Impact forces such as geopolitics affecting defense budgets and supply chain stability for specialized sensor components (e.g., high-precision pressure transducers) intermittently affect manufacturing lead times and pricing. However, the critical safety impact of air data accuracy ensures that technological innovation focused on reliability and faster testing remains the dominant strategic imperative across the industry, outweighing most short-term economic fluctuations.

Segmentation Analysis

The Pitot Static Testers Market is comprehensively segmented based on Type, defining the physical form and operational environment; Application, categorizing the end-user industry; and Technology, differentiating between measurement and control methodologies. Understanding these segments is crucial for strategic market positioning, as each category exhibits distinct purchasing criteria, regulatory compliance needs, and price sensitivities. The evolution within these segments reflects the industry's drive toward greater automation, portability, and accuracy, particularly in supporting next-generation aircraft avionics that rely heavily on precise pressure measurements for navigation.

Segmentation by Type reveals a continuous market dynamic between fixed Benchtop systems, typically used in centralized calibration labs and heavy maintenance facilities where absolute accuracy is paramount, and the highly Portable units designed for rapid deployment on the ramp or flight line. Portable testers are dominating growth due to their ability to minimize aircraft downtime and support time-sensitive line maintenance checks. Application segmentation highlights the dominance of Commercial Aviation, characterized by high volume and standardized compliance (RVSM checks), contrasting with the highly specialized and ruggedized requirements of Military Aviation and the dispersed, cost-sensitive nature of the General Aviation segment.

Technological segmentation is currently undergoing a rapid transition from traditional Analog mechanical testers, which rely on Bourdon tube mechanisms, to Digital Electronic testers. Digital testers employ high-accuracy pressure transducers, microprocessors, and sophisticated algorithms to simulate flight conditions with exceptional precision, directly meeting the tighter tolerance requirements of modern sophisticated air data computers. This technological shift is fundamental to market strategy, as Digital testers offer integrated safety features, automated test scheduling, and superior data management capabilities, which are essential for fulfilling modern MRO documentation standards.

- By Type:

- Portable Pitot Static Testers

- Benchtop Pitot Static Testers

- By Application:

- Commercial Aviation

- Military Aviation

- General Aviation

- Maintenance, Repair, and Overhaul (MRO) Facilities

- Aerospace Manufacturing/OEMs

- By Technology:

- Digital Pitot Static Testers

- Analog Pitot Static Testers

Value Chain Analysis For Pitot Static Testers Market

The Pitot Static Testers value chain is complex, starting with highly specialized upstream suppliers of critical components. This upstream segment is dominated by manufacturers of ultra-high-precision pressure transducers, vacuum pumps, pneumatic valves, and specialized microcontrollers, which are essential for generating and regulating the precise pressure outputs required for air data simulation. Given the stringent accuracy requirements, these component suppliers must adhere to rigorous aerospace quality management standards (e.g., AS9100). The limited number of suppliers capable of producing aviation-grade, highly stable pressure sensors introduces a potential bottleneck but also ensures a high level of quality control and collaboration between component suppliers and final product assemblers.

The core segment involves the design, manufacturing, and final assembly of the test sets by key OEMs. These manufacturers focus heavily on research and development to integrate software control systems, intuitive user interfaces, and safety features necessary to protect sensitive aircraft instruments during testing. Distribution is managed through a hybrid model: direct sales channels are typically used for large-volume contracts with major airlines or military organizations, ensuring direct technical support and customized solutions. Simultaneously, indirect distribution relies on certified regional distributors and maintenance equipment specialists who offer localized sales, service, and calibration support to smaller MROs and general aviation customers, optimizing geographical market reach.

The downstream segment encompasses the end-users—primarily MRO facilities, airlines, and aerospace OEMs—who utilize the testers for air data system certification and maintenance. The service aspect of the value chain is critical; continuous revenue streams are generated through post-sales support, mandatory annual or bi-annual calibration services, software updates, and repair services. This service dependency ensures strong, long-term relationships between tester manufacturers and end-users, guaranteeing the longevity and regulatory compliance of the deployed equipment throughout its operational lifecycle.

Pitot Static Testers Market Potential Customers

The primary customers for Pitot Static Testers are entities involved in the operation, maintenance, and manufacturing of aircraft, all of whom are mandated by international regulations to ensure the integrity of air data systems. Commercial airlines, ranging from major flag carriers to regional and low-cost operators, represent the largest customer segment, driven by the need to maintain their entire fleet in continuous compliance with RVSM requirements, typically requiring testing every 12 to 24 months. These buyers prioritize reliability, speed, automation features, and traceable calibration records to minimize aircraft ground time.

Maintenance, Repair, and Overhaul (MRO) facilities, both independent (third-party) and airline-affiliated, form another foundational customer base. MROs act as specialized service providers who purchase testers to offer comprehensive avionics maintenance packages to multiple aircraft operators. Their buying decisions are influenced by the tester's versatility (ability to handle diverse aircraft types), accreditation status (e.g., ISO 17025 certification capability), and ease of integration into existing workshop environments and digital documentation systems.

Aerospace and Defense organizations constitute a crucial, albeit highly specialized, customer segment. Military air forces and government agencies require ruggedized, high-specification testers capable of handling the unique operational envelopes and environmental conditions encountered by military aircraft. Procurement in this sector is driven by specific defense standards, high-security requirements, and long lifecycle support contracts. Furthermore, aircraft Original Equipment Manufacturers (OEMs), such as Boeing and Airbus, acquire these testers for integration into their manufacturing lines and final assembly checks to ensure newly produced aircraft meet initial type certification criteria before delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 225 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barfield (Aviation Test Equipment), Nav-Aids Ltd., Laversab Inc., DMA Systems Ltd., TestVonics Inc., Viavi Solutions (Aeroflex), Fluke Calibration, Tel-Instrument Electronics Corp., GE Sensing, Ideal Aerosmith Inc., ATEQ SAS, Sagiom Ltd., Automatic Test Equipment (ATE), Intercont S.p.A., Saint-Gobain Performance Plastics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pitot Static Testers Market Key Technology Landscape

The technological landscape of the Pitot Static Testers Market is currently dominated by high-precision electronic digital control systems, moving away from labor-intensive manual or purely pneumatic systems. Modern testers utilize highly stable, crystal-based quartz pressure transducers and advanced temperature compensation techniques to ensure measurement stability across a wide range of operational and environmental conditions, critical for maintaining RVSM tolerances. The core technology lies in the precise control of pressure generation and vacuum application, achieved through proportional control valves and high-speed microprocessors that execute complex pressure profiles (altitude, airspeed, Mach number simulations) automatically, enhancing both safety and testing efficiency while significantly reducing the potential for instrument damage due to over-pressurization.

A major technological trend is the development and integration of advanced connectivity features. Current-generation testers often include Wi-Fi, Ethernet, and USB interfaces, enabling seamless data logging, remote operation, and easy software updates. This connectivity is vital for compliance documentation, allowing maintenance records to be instantly transferred to computerized maintenance management systems (CMMS). Furthermore, manufacturers are incorporating intuitive, graphic touch-screen interfaces that guide technicians through complex test procedures, minimizing training requirements and standardizing the testing process across different maintenance bases. Safety remains a paramount technological consideration, leading to the development of integrated relief valves and monitoring systems that automatically shut down operations if internal pressure limits are exceeded, protecting sensitive avionics.

The future technology trajectory points toward miniaturization and enhanced battery life for portable units, supporting extended deployment flexibility on the flight line. There is increasing focus on incorporating features related to the latest avionics standards, such as specialized testing for Angle of Attack (AoA) sensors and correlation with GPS-derived altitude information, especially as air data inputs become more integrated within flight control and navigation systems. The development of automated self-calibration routines and integrated diagnostic software that monitors the health of the tester itself is also becoming standard, ensuring the reliability of the test equipment and reducing reliance on external calibration laboratories for routine checks, optimizing the overall cost of ownership for end-users.

Regional Highlights

The global Pitot Static Testers market exhibits distinct regional dynamics influenced by the maturity of the aviation infrastructure, regulatory stringency, and the pace of fleet renewal.

- North America: This region holds the largest market share, characterized by an exceptionally mature and highly regulated aviation ecosystem. The presence of major OEMs (Boeing, Lockheed Martin), massive MRO networks, and strict adherence to FAA standards (particularly RVSM and ADS-B mandates) guarantee a consistent, high demand for certified, top-tier digital testers. Innovation adoption is high, with rapid incorporation of IoT and advanced automation features.

- Europe: Europe is the second-largest market, driven by the robust presence of OEMs (Airbus) and strict compliance with EASA regulations. The market here is characterized by demand for highly versatile testers capable of servicing diverse civil and military platforms. High investment in R&D and focus on precision engineering maintain a strong demand for sophisticated, traceable calibration equipment, especially within major hubs like Germany, France, and the UK.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by explosive growth in commercial aviation, massive investments in new MRO capabilities (particularly in China, India, and Southeast Asia), and the rapid expansion of regional low-cost carriers. While price sensitivity can be a factor, the sheer volume of new aircraft deliveries and the subsequent need for initial certification and scheduled maintenance checks drive the adoption of both portable and benchtop systems.

- Middle East & Africa (MEA): Growth in the MEA region is driven primarily by significant investment in airline expansion in the Gulf Cooperation Council (GCC) countries, establishing world-class MRO hubs. The need to service large, modern long-haul fleets creates specialized demand for high-capacity testers and accompanying long-term service contracts, often sourced directly from top-tier international manufacturers.

- Latin America: This region represents a developing market, with demand driven by fleet modernization initiatives and the expansion of regional MRO services. Market penetration relies heavily on the distribution network and localized support, with a growing emphasis on affordable, yet reliable, portable digital solutions to support dispersed maintenance operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pitot Static Testers Market.- Barfield (Aviation Test Equipment)

- Nav-Aids Ltd.

- Laversab Inc.

- DMA Systems Ltd.

- TestVonics Inc.

- Viavi Solutions (formerly Aeroflex)

- Fluke Calibration

- Tel-Instrument Electronics Corp.

- GE Sensing

- Ideal Aerosmith Inc.

- ATEQ SAS

- Sagiom Ltd.

- Automatic Test Equipment (ATE)

- Intercont S.p.A.

- Saint-Gobain Performance Plastics

- King Nutronics Corporation

- GECI Group

- Lighthouse Technologies

- Tifosi Logistics

- Tecnikabel S.p.A.

Frequently Asked Questions

Analyze common user questions about the Pitot Static Testers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Pitot Static Tester in aviation maintenance?

The primary function of a Pitot Static Tester is to simulate precise air pressure conditions corresponding to specific altitudes, airspeeds, and vertical speeds to verify, calibrate, and certify the accuracy and integrity of an aircraft’s pitot static system instruments (altimeters, airspeed indicators, air data computers). This ensures compliance with mandatory safety standards like Reduced Vertical Separation Minimum (RVSM).

Why is RVSM compliance critical for the demand for Pitot Static Testers?

RVSM (Reduced Vertical Separation Minimum) compliance mandates tighter altitude-keeping accuracy tolerances in modern airspace. This regulatory requirement necessitates the periodic, highly accurate certification of an aircraft’s air data system, directly driving the demand for advanced, digital Pitot Static Testers capable of meeting the stringent precision and traceability standards required for RVSM authorization.

What are the key technical differences between portable and benchtop Pitot Static Testers?

Portable testers are designed for line maintenance (ramp) use; they are lightweight, battery-operated, and prioritize speed and ruggedness, offering high convenience for minimizing aircraft downtime. Benchtop testers are typically larger, designed for fixed laboratory or heavy maintenance environments, offering the highest potential accuracy and stability for primary calibration and deep overhaul checks.

How is digital technology impacting the operational efficiency of MRO facilities using these testers?

Digital Pitot Static Testers significantly improve MRO efficiency by offering automated test sequences, reducing manual steps, and minimizing human error. They provide integrated data logging, automatic report generation, and direct connectivity to maintenance management systems (CMMS), streamlining the documentation process required for regulatory audits and shortening the overall maintenance turnaround time (TAT).

Which regions are exhibiting the highest growth rate for Pitot Static Testers and why?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate due to the rapid expansion of commercial airline fleets, substantial government investment in regional aviation infrastructure, and the corresponding proliferation of new Maintenance, Repair, and Overhaul (MRO) facilities needed to service this growing aircraft volume.

What role does Artificial Intelligence (AI) play in the future development of Pitot Static Testers?

AI is expected to enhance testers through predictive maintenance capabilities, analyzing historical drift data to optimize calibration schedules. Furthermore, AI and Machine Learning will be integrated into the test software to automatically detect subtle anomalies in the aircraft's air data system and refine control algorithms, increasing both testing accuracy and operational lifespan.

What regulatory body sets the primary standards for Pitot Static system checks in the United States?

The Federal Aviation Administration (FAA) sets the primary standards in the United States, mandating specific checks under Title 14 of the Code of Federal Regulations (CFR), particularly Part 91.411 and Part 43, which govern altimeter and static system tests and inspections, ensuring flight safety and regulatory adherence.

Why are specialized pressure transducers crucial for modern Pitot Static Testers?

Specialized aerospace-grade pressure transducers are crucial because they provide the necessary ultra-high accuracy and long-term stability required to simulate flight pressures precisely. They must be immune to environmental factors like temperature variation and vibration to maintain the tight tolerances necessary for RVSM certification, ensuring that aircraft instruments receive verifiable pressure inputs.

What is the main restraint preventing wider adoption of advanced digital testers among smaller general aviation maintenance facilities?

The main restraint is the high initial capital investment required for certified, high-accuracy digital Pitot Static Test Sets. Smaller general aviation maintenance facilities often operate on tighter budgets and may rely on older, less expensive analog systems or outsource the specialized testing required for complex regulatory checks.

Beyond altitude and airspeed, what other flight parameters are verified using these test sets?

Pitot Static Test Sets are also used to verify Vertical Speed Indication (VSI), Mach number simulation accuracy, and increasingly, to test the functionality and correlation of Angle of Attack (AoA) sensors, which utilize air pressure differential for critical flight control inputs, thus expanding the scope of air data system validation.

How does the value chain transition from upstream suppliers to downstream end-users in this market?

The value chain begins upstream with specialized component manufacturers supplying high-precision sensors and pneumatic controls. This flows to OEMs who integrate and assemble the final test sets. Distribution then moves through direct sales or certified resellers to the downstream segment, which includes MROs, airlines, and military users, where long-term revenue is secured through mandatory calibration and service contracts.

What is the significance of traceability in Pitot Static Tester calibration?

Traceability is paramount; it ensures that the measurements provided by the tester are accurately related to recognized national or international standards (such as NIST). This verifiable chain of accuracy is mandatory for regulatory compliance, guaranteeing that the aircraft’s air data instruments are certified against a known, accurate reference, which is critical for aviation safety audits.

How do manufacturers ensure the safety of sensitive aircraft avionics during testing?

Manufacturers incorporate multi-layered safety mechanisms, including physical pressure relief valves, software-controlled pressure limits, and automatic shutdown protocols. These features prevent over-pressurization of the delicate aircraft instruments, protecting expensive air data computers and indicators from potential damage during the simulation process.

Why is the military aviation segment considered a high-value niche market?

Military aviation requires ruggedized, highly specific testers capable of simulating extreme flight envelopes and hostile environmental conditions. While volume is lower than commercial aviation, the procurement cycles are often long, involving extensive R&D, customization, and long-term, high-value service contracts for maintaining specialized, high-performance aircraft platforms, making it a lucrative niche.

What future technological trends are expected to disrupt the Pitot Static Testers Market?

Future disruptions will involve the widespread integration of remote diagnostics and IoT connectivity, allowing manufacturers to monitor tester health and perform remote troubleshooting. Additionally, the development of Augmented Reality (AR) guided maintenance interfaces will further automate complex testing procedures and reduce reliance on static manuals.

How does global supply chain volatility affect the production of Pitot Static Testers?

Supply chain volatility, particularly concerning high-precision electronic components like specialized pressure transducers and microprocessors, can lead to extended manufacturing lead times and increased production costs. Since these components are sourced from a limited number of specialized vendors, disruptions have a disproportionate impact on the final product availability and pricing structure.

What role do third-party MRO facilities play in driving regional market demand?

Third-party MRO facilities act as aggregators of demand, purchasing testers to service multiple airlines and general aviation customers. Their regional expansion, particularly in high-growth areas like APAC, directly fuels localized demand for versatile and robust testing equipment that can handle a diverse range of aircraft types and testing requirements.

What is the estimated typical lifespan of a high-end digital Pitot Static Test Set?

A high-end digital Pitot Static Test Set, with regular maintenance, mandatory calibration, and software updates, typically has an operational lifespan exceeding 10 to 15 years. Longevity is sustained by consistent support from the OEM, particularly for component replacement and ensuring compliance with evolving digital communication standards.

How do Pitot Static Testers contribute to the adoption of ADS-B technology?

ADS-B (Automatic Dependent Surveillance–Broadcast) relies heavily on highly accurate air data inputs, especially GPS-derived altitude data correlated with the aircraft's internal altimetry. Pitot Static Testers ensure the altimeter inputs are flawlessly calibrated and certified to the high precision required by ADS-B transponders, making them fundamental tools for mandatory compliance.

What financial metrics do airlines primarily consider when purchasing new testing equipment?

Airlines primarily consider Total Cost of Ownership (TCO), which includes initial purchase price, mandatory annual calibration costs, expected reliability (uptime), and the tester's impact on maintenance turnaround time (TAT). Equipment that minimizes aircraft ground time and reduces labor intensity offers the greatest long-term financial benefit.

Why is temperature compensation a vital feature in high-accuracy digital testers?

Temperature compensation is vital because the performance and stability of pressure transducers are highly sensitive to thermal changes. Integrating compensation technology ensures that the tester maintains its specified accuracy across the often-wide ambient temperature variations experienced in hangar or ramp environments, which is crucial for valid regulatory certification.

How are Pitot Static Testers being adapted for unmanned aerial vehicle (UAV) maintenance?

For larger UAVs that operate in regulated airspace, Pitot Static Testers are adapted by focusing on smaller, highly portable units designed to test micro air data systems. The demand emphasizes lower pressure ranges and specialized interface connectors suitable for smaller platforms, integrating simplified automation features suitable for less complex, high-volume testing.

What is the significance of the shift from pneumatic control to electronic proportional control in new testers?

The shift from traditional pneumatic control to electronic proportional control valves allows for significantly faster, smoother, and more precise control over pressure changes. This electronic precision is essential for accurately simulating complex flight profiles and preventing pressure spikes that could damage delicate digital air data computers, resulting in superior safety and repeatability.

How do manufacturers support the calibration needs of international customers?

Manufacturers support international calibration needs by establishing a global network of authorized service centers and distributors that maintain ISO 17025 accreditation. This structure allows customers to access traceable calibration services locally, minimizing shipping costs and downtime associated with sending the highly sensitive equipment back to the original manufacturing facility.

What challenges does the market face concerning the technical skills gap among maintenance personnel?

The increasing complexity of digital testers and integrated avionics systems creates a technical skills gap. MROs need technicians trained not only in pneumatic systems but also in software operation, data analysis, and digital troubleshooting, driving manufacturers to integrate intuitive user interfaces and provide comprehensive, hands-on training programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager