Pizza Conveyor Oven Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442765 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Pizza Conveyor Oven Market Size

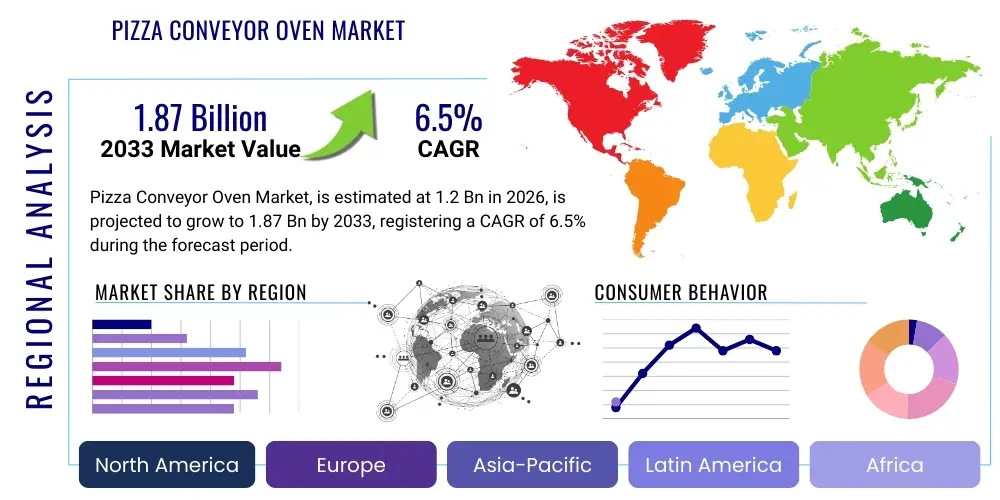

The Pizza Conveyor Oven Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.87 Billion by the end of the forecast period in 2033.

Pizza Conveyor Oven Market introduction

The Pizza Conveyor Oven Market encompasses the global trade of automated, high-volume cooking equipment designed specifically for baking pizzas and other related food items. These ovens utilize a continuous conveyor belt system to move food through a controlled heating chamber, ensuring consistent and rapid cooking results essential for commercial foodservice operations, particularly Quick Service Restaurants (QSRs) and institutional catering. The primary product differentiation lies in heating sources (gas or electric), size, throughput capacity, and advanced features such as impingement technology and precise temperature zone control. The increasing global demand for convenience food, coupled with the rapid expansion of organized fast-food chains and ghost kitchens, positions conveyor ovens as indispensable assets in maximizing operational efficiency and maintaining product standardization across multiple locations.

Major applications of these systems extend beyond traditional pizza preparation, including the baking of breadsticks, melting cheese on subs, toasting sandwiches, and warming various prepared dishes, highlighting their versatility within the commercial kitchen environment. Key benefits driving their adoption include significant labor savings due to automation, reduced training requirements for kitchen staff, and superior thermal efficiency compared to traditional deck or stone ovens. Furthermore, the inherent consistency provided by conveyor systems minimizes human error and reduces food waste, directly impacting the profitability of high-volume establishments. As global supply chains continue to optimize and foodservice operators prioritize speed of service, the technological integration within these ovens becomes a critical factor in purchasing decisions, focusing on energy consumption and smart connectivity.

The market growth is fundamentally driven by the relentless expansion of the global restaurant industry, especially in emerging economies where Western-style fast food penetration is accelerating. Urbanization trends and changing consumer lifestyles that favor quick and accessible dining options necessitate equipment capable of handling peak demand efficiently. Moreover, stringent food safety regulations and the industry shift towards sustainable kitchen operations are encouraging operators to upgrade to modern, energy-efficient conveyor ovens, further stimulating market demand. These factors collectively solidify the conveyor oven's role as foundational infrastructure for modern, scalable food production businesses.

Pizza Conveyor Oven Market Executive Summary

The Pizza Conveyor Oven Market is experiencing robust business trends characterized by heightened automation adoption and a focus on IoT integration to facilitate remote monitoring and predictive maintenance. Equipment manufacturers are prioritizing compact, modular designs to fit smaller urban kitchen spaces and ghost kitchen layouts, responding directly to evolving real estate costs and operational models. Financially, the market benefits from increasing capital expenditure by large multinational restaurant franchises aiming for global uniformity in food quality. Investment in high-efficiency gas models, despite initial higher costs, is trending upwards due to long-term operational savings associated with lower energy consumption and faster recovery times, presenting a critical business opportunity for specialized component suppliers and system integrators.

Geographically, North America and Europe maintain dominance owing to high levels of QSR saturation and established replacement cycles, however, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory. This APAC surge is fueled by rapid urbanization, increasing disposable incomes, and the aggressive expansion of both international and domestic quick-service chains, particularly in China and India. Regional trends also show a localized demand for smaller capacity ovens in specific markets like Latin America, where smaller, independent pizzerias are the primary consumers. Conversely, mature markets exhibit a preference for sophisticated, high-throughput models with advanced exhaust management systems to comply with stringent environmental standards.

Segmentation analysis reveals that the Quick Service Restaurant (QSR) segment remains the largest end-user, demanding maximum reliability and speed, primarily favoring gas-powered, high-capacity units. However, the emerging segment of institutional catering and large corporate cafeterias is showing a significant uptick in demand for electric conveyor ovens due to easier installation and lack of external venting requirements in many indoor, non-traditional kitchen settings. Technological segmentation highlights the transition from standard forced-air systems to highly efficient impingement technology, which provides superior heat transfer and dramatically reduced cooking times, directly influencing segment-specific purchasing strategies across the market.

AI Impact Analysis on Pizza Conveyor Oven Market

User queries regarding the impact of Artificial Intelligence (AI) on the Pizza Conveyor Oven Market predominantly center on how AI can enhance operational efficiency, ensure product quality consistency, and reduce energy costs. Key concerns revolve around the integration feasibility of complex AI systems with existing analog equipment, the necessary data infrastructure, and the return on investment (ROI) for small to medium-sized operators. Users are keenly interested in predictive maintenance schedules driven by machine learning algorithms, real-time quality control using integrated vision systems, and dynamic temperature adjustments based on incoming order volume and ambient kitchen conditions. The underlying expectation is that AI will transform the oven from a static heating device into an intelligent cooking platform that self-optimizes and minimizes human intervention, addressing labor shortages and rising utility expenses.

The implementation of AI/ML models is poised to revolutionize the operational lifecycle of conveyor ovens, moving beyond simple automation to genuine process optimization. AI-driven predictive maintenance utilizes sensor data collected from temperature probes, motor activity, and airflow sensors to forecast potential mechanical failures, allowing for scheduled interventions rather than costly emergency repairs. This dramatically increases oven uptime, a critical metric in high-volume foodservice. Furthermore, AI algorithms can analyze complex variables, such as humidity and dough thickness, to dynamically adjust belt speed and temperature zones on a per-pizza basis, ensuring maximum product quality consistency regardless of external environmental factors or variations in ingredient handling.

Beyond internal hardware optimization, AI plays a crucial role in broader kitchen management systems. Integration with Point-of-Sale (POS) systems allows the conveyor oven to receive real-time order flow data, enabling it to pre-heat or adjust energy consumption profiles during anticipated low-demand periods (load shedding) and ramp up efficiently during peak hours. This proactive energy management, facilitated by machine learning, significantly contributes to sustainability goals and reduced operating expenses. Manufacturers are increasingly positioning their next-generation models as 'smart appliances' where AI acts as the central cognitive layer managing energy, throughput, and quality control simultaneously, shifting the competitive landscape towards software and data capabilities rather than just raw hardware performance.

- Predictive Maintenance Scheduling: AI models analyze vibration and thermal data to forecast component failures, maximizing operational uptime.

- Real-Time Quality Control: Integrated AI vision systems monitor browning and rise, adjusting cooking parameters dynamically for consistent output.

- Energy Consumption Optimization: AI analyzes order flow data to dynamically modulate energy input, reducing utility costs during off-peak periods.

- Automated Recipe Management: Systems store and execute complex cooking profiles based on specific menu items, reducing staff training requirements.

- Remote Diagnostics and Troubleshooting: AI enables manufacturers to diagnose performance issues remotely, decreasing service call times and costs.

DRO & Impact Forces Of Pizza Conveyor Oven Market

The dynamics of the Pizza Conveyor Oven market are governed by powerful structural forces derived from global consumer behavior and technological mandates. The primary driving forces include the persistent global expansion of QSRs, particularly in emerging markets, necessitating standardized, high-volume cooking apparatus. This driver is strongly reinforced by the demand for labor-saving automation solutions in mature economies facing increasing minimum wages and chronic labor shortages in the hospitality sector. Opportunities are emerging through the rising trend of 'ghost kitchens' and centralized commissary operations which require high-capacity, industrialized cooking equipment. These facilities represent a new, highly concentrated consumer base for sophisticated conveyor technology, particularly those focusing on multi-product flexibility.

Conversely, the market faces notable restraints. The significant initial capital investment required for high-end conveyor ovens acts as a barrier to entry for small, independent operators who often opt for cheaper traditional ovens or refurbished equipment. Furthermore, the operational challenge of complex maintenance and specialized servicing required for sophisticated, digitally controlled ovens presents a logistical constraint, especially in remote or underserved geographical areas. Technological restraints include the constant pressure to improve energy efficiency amidst rising utility costs, forcing manufacturers to invest heavily in R&D, which can inflate end-product pricing, thereby impacting price sensitivity in competitive segments.

The key impact forces shaping the market's trajectory are threefold: technological innovation focused on impingement efficiency and compact design; economic pressures driven by escalating global energy prices which favor gas-fired units with superior BTUs per hour; and competitive intensity among a few dominant global manufacturers who leverage their service networks and brand recognition to secure long-term franchise contracts. These forces dictate not only unit pricing but also the speed of technological diffusion across different geographical and end-user segments. Opportunities are significantly influenced by regulatory trends towards sustainability, promoting the adoption of advanced heat recovery systems and eco-friendly manufacturing processes within the supply chain.

Segmentation Analysis

The Pizza Conveyor Oven Market is extensively segmented based on core functional characteristics, power source, and end-user application, allowing for a detailed analysis of specific demand drivers and competitive niches. The market categorization helps manufacturers tailor their product offerings, focusing either on high-throughput gas models preferred by large QSR chains or compact, versatile electric models suitable for smaller retail operations and non-traditional venues. Understanding these distinct segments is crucial for strategic market penetration, pricing strategies, and anticipating future technological requirements driven by specific user groups.

The segmentation by type, namely Electric and Gas, differentiates products based on operational environment and energy costs, with Gas ovens dominating high-volume sites due to lower running costs and faster heat recovery, while Electric ovens appeal to environments where venting is restricted or capacity demands are moderate. End-User segmentation provides insight into consumption patterns; QSRs emphasize speed and reliability, whereas Full-Service Restaurants and catering operations often seek better flexibility and precise control for varied menu items. Finally, segmentation by size (small, medium, large capacity) directly correlates with the scale of the customer's business, defining the core performance parameters required.

- By Type:

- Electric Conveyor Ovens

- Gas Conveyor Ovens

- By End-User:

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants (FSRs)

- Hotels and Catering

- Institutional (Cafeterias, Schools, Hospitals)

- Ghost Kitchens/Delivery-Only Units

- By Capacity/Size:

- Small (Belt widths under 24 inches)

- Medium (Belt widths 24 to 32 inches)

- Large (Belt widths over 32 inches)

- By Technology:

- Standard Forced Air

- Impingement Technology

Value Chain Analysis For Pizza Conveyor Oven Market

The value chain for the Pizza Conveyor Oven Market begins with upstream activities involving the sourcing of critical raw materials, primarily stainless steel, specialized alloys for heating elements, high-temperature insulation materials, and complex electronic control components (PCBs, sensors). Key suppliers in the upstream segment include specialized metal fabricators and global electronic component manufacturers. Maintaining strong relationships with these suppliers is crucial due to potential volatility in steel prices and increasing demand for sophisticated, durable electronic controls necessary for modern IoT and AI integration. Quality control at this stage directly dictates the longevity and thermal efficiency of the final product, compelling leading manufacturers to implement stringent supplier auditing processes.

The midstream stage involves the design, manufacturing, assembly, and testing of the conveyor oven systems. Major original equipment manufacturers (OEMs) typically operate highly automated fabrication plants, focusing on lean manufacturing techniques to manage costs. This stage includes sophisticated engineering processes to develop patented air impingement technologies and thermal management systems that differentiate products in terms of speed and energy efficiency. Direct distribution channels involve large OEMs selling directly to major restaurant chains under long-term supply agreements, often accompanied by extensive installation and training services. Indirect channels rely heavily on authorized distributors, catering equipment dealers, and specialized foodservice equipment brokers who serve independent restaurants and smaller regional chains, providing localized inventory and support.

Downstream activities focus on sales, installation, after-sales service, and maintenance. Given the complexity and mission-critical nature of these ovens, post-sale support is a crucial value differentiator. OEMs often establish extensive global service networks, employing highly specialized technicians trained in both mechanical and electronic diagnostics. End-users (restaurants, caterers) are the final customers, and their feedback drives innovation back up the chain, particularly concerning ease of cleaning, maintenance simplicity, and connectivity features. The growing reliance on digital controls necessitates robust software updates and cybersecurity measures to protect integrated POS systems, adding another layer of complexity to the downstream service offerings.

Pizza Conveyor Oven Market Potential Customers

Potential customers for Pizza Conveyor Ovens represent a diverse spectrum of the global foodservice industry, unified by the need for high-speed, consistent baking and warming capabilities. The primary and largest segment consists of Quick Service Restaurants (QSRs) and fast-casual dining concepts that specialize in pizza and other oven-baked items. These entities, especially large, multinational chains, rely on these ovens as core production machinery, demanding high throughput, maximum reliability, and standardized performance across thousands of global outlets. Purchasing decisions here are typically centralized, volume-based, and highly sensitive to overall operational costs and brand consistency.

A rapidly expanding secondary customer base includes institutional foodservice providers, such as large corporate cafeterias, university dining halls, hospitals, and military catering facilities. While their volume might be lower than QSRs, their requirement for versatile equipment capable of handling a wide variety of menu items—from pizza to baked goods and prepared meals—makes them significant consumers of medium-capacity, flexible conveyor ovens. For this group, durability, ease of cleaning, and compliance with strict sanitary regulations are often prioritized over sheer speed.

Emerging potential customers are the rapidly multiplying Ghost Kitchens, virtual restaurant brands, and centralized commissary kitchens dedicated exclusively to mass meal preparation for delivery and catering services. These operations prioritize energy-efficient, stacked oven configurations to maximize vertical space utilization and often invest in models with sophisticated IoT capabilities for remote management. These professional buyers are focused purely on industrial efficiency and throughput maximization in non-customer facing environments, representing the future growth nexus for high-capacity, industrialized oven technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Middleby Corporation, ITW (Hobart, Vulcan), Ali Group (Bakers Pride, Blodgett), Doyon Baking Equipment, Ovention, Garland/US Range, Moffat, XLT Ovens, Peerless Oven Company, Lincoln Foodservice Products, Star Manufacturing, CTI, Sveba Dahlen, Marra Forni, Wood Stone, Welbilt Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pizza Conveyor Oven Market Key Technology Landscape

The technological landscape of the Pizza Conveyor Oven Market is dominated by advancements in heat transfer efficiency, digital control systems, and integration capabilities. The cornerstone technology remains impingement heating, which utilizes high-velocity, forced hot air jets directed above and below the conveyor belt to strip away the cool boundary layer around the food product. This mechanism significantly reduces cooking times and ensures even heat distribution, drastically improving product consistency compared to older forced-air circulation systems. Manufacturers continuously refine nozzle design and air flow management to maximize energy utilization, leading to third and fourth-generation impingement systems that boast faster cook times with lower energy input per product.

Digitalization represents the second major technological frontier. Modern ovens are equipped with advanced microprocessors and touch-screen interfaces, allowing operators to store hundreds of custom cooking profiles, adjust multiple temperature zones with high precision, and monitor diagnostics remotely. The integration of Internet of Things (IoT) sensors is standard, enabling connectivity to cloud platforms for performance tracking, preventative maintenance alerts, and seamless communication with kitchen management software. This connectivity is crucial for large chains requiring centralized control and data analytics across their entire fleet of ovens, optimizing operational strategies based on real-time performance data aggregated from various store locations.

Further innovation is concentrated on sustainability and operational footprint. New heat recovery technologies are being implemented to capture and reuse waste heat, significantly improving the overall thermal efficiency rating of the units and reducing their environmental impact. Compact, modular designs, often featuring stackable components, are vital for urban environments where space is at a premium. Manufacturers are also experimenting with hybrid models that combine traditional electric or gas heating with supplementary infrared or microwave technology to achieve unique texture and speed benefits, catering to specialized fast-casual segments that demand high quality alongside high speed.

Regional Highlights

- North America: This region holds a dominant share, characterized by high market maturity, deeply embedded QSR infrastructure, and strong demand for replacement cycles featuring high-efficiency, advanced gas models. The U.S. market specifically drives innovation in connectivity and automation, supported by major domestic manufacturers who maintain extensive service networks.

- Europe: The market is mature but fragmented, exhibiting strong growth in the fast-casual pizza segment, particularly in Western and Southern Europe. Demand is shifting towards electric ovens in urban areas due to strict regulations regarding ventilation and gas installations, focusing on compact and energy-efficient designs to comply with EU environmental standards.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is driven by rapid economic development, Western fast-food adoption, and the explosive growth of domestic QSR chains in China, India, and Southeast Asia. This region primarily demands mid-to-large capacity, durable ovens for new market entrants and aggressive franchise expansion.

- Latin America (LATAM): This region shows stable growth, dominated by the proliferation of regional pizza chains and independent pizzerias. Price sensitivity remains high, leading to demand for cost-effective, reliable equipment. Opportunities are emerging with the professionalization of local foodservice infrastructure.

- Middle East and Africa (MEA): Growth is steady, fueled by tourism, hospitality sector expansion, and increasing food service standards in the GCC countries. The high initial capital investment is balanced by a focus on high-throughput equipment necessary to serve large, often centralized catering operations and growing urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pizza Conveyor Oven Market.- Middleby Corporation

- ITW Food Equipment Group (Hobart, Vulcan)

- Ali Group (Bakers Pride, Blodgett)

- Doyon Baking Equipment

- Ovention

- Garland/US Range

- Moffat

- XLT Ovens

- Peerless Oven Company

- Lincoln Foodservice Products

- Star Manufacturing

- CTI (Custom Thermal Industries)

- Sveba Dahlen

- Marra Forni

- Wood Stone

- Welbilt Inc.

- Somerville & Company

- PizzaMaster Ovens

- A.M. Manufacturing

- Electrolux Professional

Frequently Asked Questions

Analyze common user questions about the Pizza Conveyor Oven market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Pizza Conveyor Ovens?

The central driver is the global need for operational efficiency and product consistency within the Quick Service Restaurant (QSR) sector. Conveyor ovens ensure standardized cooking results at high volumes, crucial for franchise operations and reducing reliance on skilled labor.

Are gas or electric conveyor ovens generally preferred in the commercial sector?

Gas conveyor ovens are typically preferred by large, high-volume commercial users, such as major QSR chains, due to their lower long-term operating costs and superior heat recovery speed. Electric models are favored in smaller settings or locations with ventilation restrictions.

How is AI technology impacting the performance of modern conveyor ovens?

AI integration is primarily used for optimizing energy consumption, facilitating predictive maintenance by analyzing sensor data, and implementing real-time quality control mechanisms to automatically adjust cooking parameters for perfect consistency.

Which geographical region exhibits the fastest growth rate for conveyor oven adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, increasing disposable income, and aggressive expansion by international and regional fast-food chains.

What is impingement technology and why is it important in this market?

Impingement technology uses high-velocity jets of forced hot air to rapidly transfer heat to the product. It is critical because it significantly reduces cooking times (increasing throughput) and ensures highly uniform heating, making it the industry standard for high-performance pizza ovens.

What are the main restraints affecting market expansion?

The primary restraints include the high initial capital expenditure required for purchasing advanced conveyor systems and the logistical challenges associated with maintaining and servicing complex, specialized equipment, particularly for smaller independent operators.

What role do 'Ghost Kitchens' play in the future of the Pizza Conveyor Oven market?

Ghost Kitchens represent a significant growth opportunity as they require high-capacity, industrialized, and often stackable oven configurations for centralized food preparation focused entirely on delivery efficiency and throughput maximization.

How do manufacturers address sustainability concerns in their oven designs?

Manufacturers address sustainability by implementing advanced heat recovery systems to improve thermal efficiency, developing compact modular designs to reduce material usage, and integrating smart controls for AI-driven energy consumption optimization.

What is the typical lifespan for a commercial pizza conveyor oven?

While highly dependent on usage and maintenance, a high-quality commercial pizza conveyor oven typically has an operational lifespan of 10 to 15 years, with critical components such as motors and heating elements often requiring scheduled replacement or repair during that time.

Is there a noticeable trend towards connectivity in new conveyor oven models?

Yes, there is a strong trend towards enhanced connectivity via IoT, allowing ovens to communicate performance data to cloud platforms. This enables remote monitoring, software updates, centralized recipe management, and integration with Point-of-Sale (POS) systems.

How do size and capacity segment the conveyor oven market?

Ovens are segmented by belt width (small, medium, large). Small capacity ovens (under 24 inches) serve independent shops or light use; medium (24-32 inches) are common for regional QSRs; and large capacity (over 32 inches) are essential for industrial high-volume production facilities.

Who are the major end-users apart from Quick Service Restaurants?

Key end-users include Full-Service Restaurants, Hotels and large institutional catering operations (such as universities and hospitals), and emerging centralized food production facilities like commissary kitchens and ghost kitchen operators.

What specific materials are crucial in the manufacturing value chain?

Crucial materials include high-grade stainless steel for durability and sanitation, specialized alloys for resilient heating elements, and high-temperature insulation materials essential for maximizing energy retention and operational safety.

How does the volatile price of steel impact the market?

The volatile price of stainless steel, a key component, directly impacts the upstream manufacturing costs. Fluctuations in steel prices can lead to increased complexity in pricing strategies and often translate into higher final product costs for the end-user.

What competitive factors determine market dominance among key players?

Market dominance is determined by technological leadership (especially in impingement and digital controls), the strength of the global service and maintenance network, brand reputation, and the ability to secure large, long-term supply contracts with global restaurant franchises.

Are modular and stackable designs becoming more important?

Yes, modularity and stackability are increasingly important, especially in space-constrained urban areas and ghost kitchen environments. These designs maximize vertical space utilization and allow operators to scale production capacity flexibly without increasing the physical footprint.

What distinguishes forced-air systems from impingement technology?

Forced-air systems circulate hot air within the chamber, relying on convection. Impingement technology utilizes high-velocity jets directed at the product, resulting in significantly faster and more direct heat transfer, dramatically reducing cooking times compared to traditional forced air.

Do smaller, independent pizzerias contribute significantly to market volume?

While large QSR chains drive revenue volume, independent pizzerias contribute significantly to unit sales, often demanding small to medium-sized electric ovens, or refurbished/budget-friendly gas models, thus driving demand in the secondary and regional markets.

How do varying regional energy costs influence oven type selection?

In regions where natural gas is inexpensive relative to electricity (common in parts of North America), gas ovens are overwhelmingly preferred. In regions where gas installation is restricted or electricity is comparatively cost-effective (parts of Europe), electric ovens dominate the purchasing decisions.

What is the relevance of thermal efficiency in purchasing decisions?

Thermal efficiency is critically relevant as it dictates operating costs. Higher efficiency means less energy wasted, resulting in lower utility bills over the oven's lifespan, providing a strong return on investment (ROI) that outweighs the potentially higher initial cost of advanced models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager