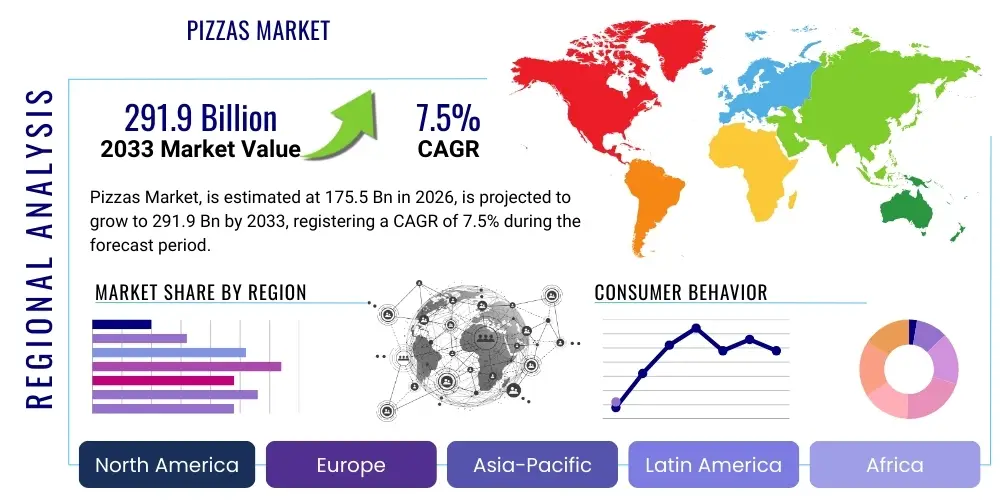

Pizzas Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443136 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Pizzas Market Size

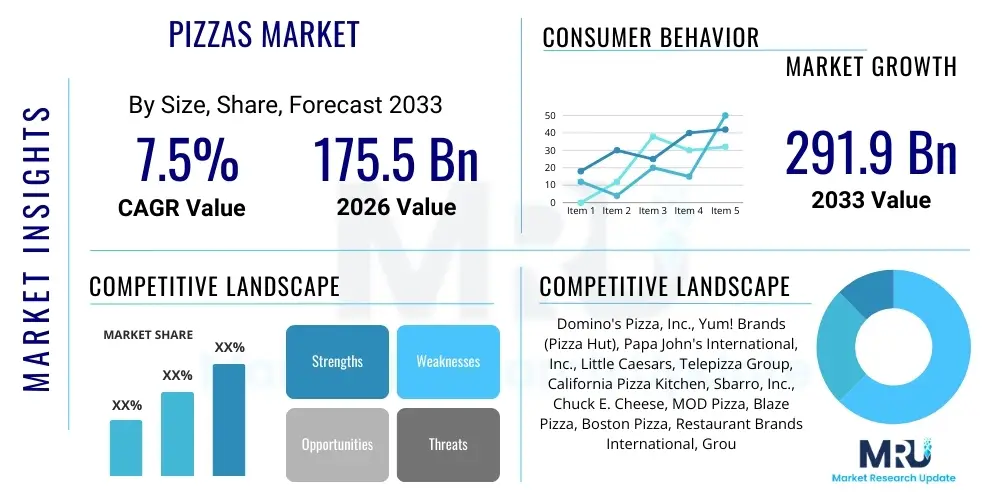

The Pizzas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 175.5 Billion in 2026 and is projected to reach USD 291.9 Billion by the end of the forecast period in 2033.

Pizzas Market introduction

The global Pizzas market encompasses the commercial production, distribution, and sale of prepared pizza products through various channels, including quick-service restaurants (QSRs), full-service restaurants (FSRs), retail outlets selling frozen pizzas, and digital delivery platforms. This market is characterized by high consumer demand driven by convenience, affordability, and the versatility of the product, catering to diverse global palates through continuous innovation in toppings, crust types, and preparation methods. The product itself, a highly customizable baked flatbread topped with tomato sauce, cheese, and various ingredients, serves as a staple food item across numerous cultures, cementing its position as a dominant segment within the global fast-food and casual dining industries.

Major applications of pizza consumption span casual dining, quick lunch solutions, family meals, and social gatherings, making it a highly adaptable offering. Key benefits driving its continued market expansion include speed of service, relative cost-effectiveness compared to complex dining options, and the efficiency offered by sophisticated delivery networks. Furthermore, the capacity for high customization allows providers to cater to specific dietary requirements (e.g., vegan, gluten-free) and regional flavor profiles, broadening the addressable market significantly. This adaptability is a crucial component of its sustained global appeal and resilience against economic fluctuations.

Driving factors propelling market growth include rapid urbanization and busy consumer lifestyles, which necessitate convenient meal solutions. Technological advancements, particularly the optimization of online ordering and third-party delivery services, have dramatically improved accessibility and reach, especially in emerging economies. The proliferation of digital marketing and robust supply chain management, ensuring the quality and consistency of ingredients globally, further bolster market growth. Additionally, product innovation focusing on premiumization (gourmet toppings) and health consciousness (whole-wheat crusts, lower-fat cheeses) maintains consumer interest and encourages higher frequency of purchase across different demographic segments.

Pizzas Market Executive Summary

The Pizzas Market is witnessing robust expansion, underpinned by globalization of consumption patterns and advancements in food technology and delivery infrastructure. Business trends indicate a strong shift toward digital integration, with major quick-service restaurant (QSR) chains investing heavily in proprietary ordering applications and leveraging AI-driven analytics for personalized marketing and efficient logistics. Furthermore, franchising models continue to dominate the expansion strategies of global players, enabling rapid penetration into previously untapped markets, particularly in Asia Pacific and Latin America. The competitive landscape is intensely focused on supply chain optimization to mitigate rising commodity costs and ensuring speed and quality in last-mile delivery, which is now a critical differentiator for consumer satisfaction and brand loyalty.

Regional trends highlight the mature markets of North America and Europe maintaining stable growth through menu innovation and premium offerings, while the Asia Pacific (APAC) region emerges as the fastest-growing market, driven by expanding middle-class populations, increased disposable incomes, and the adoption of Westernized fast-food culture. In APAC, adapting flavor profiles to local tastes (localization strategy) is crucial for success. Conversely, in the Middle East and Africa (MEA), market growth is correlated with infrastructural development and the establishment of sophisticated cold chains necessary for maintaining product integrity across vast geographical areas. Latin America demonstrates significant potential, with consumers showing a strong affinity for convenient, family-friendly food options, fueling the expansion of both international and domestic pizza chains.

Segment trends reveal that the distribution channel is undergoing transformation, with online delivery platforms and direct-to-consumer QSR apps capturing an increasingly dominant share, often surpassing traditional in-store dining. Product segmentation indicates a growing demand for specialty and customized pizzas, including options accommodating dietary restrictions such as gluten-free, keto-friendly, and plant-based alternatives, reflecting broader consumer focus on health and wellness. The frozen pizza segment, particularly the premium frozen category, is also experiencing a renaissance, benefiting from improved product quality and consumer preference for convenient in-home meal preparation, driven by hybrid work models persisting post-pandemic.

AI Impact Analysis on Pizzas Market

Common user questions regarding AI's impact on the Pizzas Market primarily revolve around operational efficiency, personalization of consumer experience, and future employment implications within the fast-food sector. Users frequently inquire about how AI optimizes supply chain logistics, predicting demand fluctuations (forecasting ingredient needs), and automating kitchen tasks (e.g., ingredient dispensing, quality control). A significant concern is the balance between AI-driven personalization—where menus and promotions are tailored based on historical ordering data—and potential data privacy risks. Users also show keen interest in the adoption of robotic kitchen assistants and autonomous delivery vehicles, questioning their deployment timelines and impact on speed and cost of service delivery.

The consensus summary indicates that AI is fundamentally reshaping the operational backbone of the pizza industry. It is moving beyond simple recommendation engines to becoming integral in inventory management, labor scheduling, and customer service (via chatbots). While AI adoption promises substantial improvements in waste reduction, order accuracy, and personalized engagement, leading to higher customer lifetime value, concerns persist regarding the initial capital investment required and the necessity for upskilling the existing workforce to manage these sophisticated systems. Furthermore, successful deployment hinges on generating high-quality, actionable data from both ordering platforms and point-of-sale systems across the global franchise network.

- AI optimizes ingredient forecasting and inventory management, reducing spoilage and operational costs significantly.

- Personalized marketing and dynamic pricing strategies are deployed using AI to maximize order value and customer retention.

- Robotics and automation (Robotic Pizza Makers) are enhancing consistency and speed in food preparation, particularly in high-volume settings.

- AI-powered chatbots and virtual assistants handle order taking and customer support, improving service efficiency and reducing wait times.

- Autonomous delivery vehicles (drones and ground robots) are being trialed to lower last-mile delivery costs and enhance delivery speed in dense urban areas.

- Data analytics derived from machine learning models provide deep insights into consumer preferences, driving targeted menu innovation and promotional effectiveness.

DRO & Impact Forces Of Pizzas Market

The Pizzas Market is influenced by a dynamic interplay of growth drivers (D), market restraints (R), compelling opportunities (O), and structural impact forces. Key drivers include accelerating digital penetration across consumer markets, facilitating rapid and efficient online ordering and delivery, coupled with sustained product innovation catering to niche dietary needs (such as plant-based and low-carb options). Conversely, market growth is primarily restrained by intense price competition and volatility in commodity prices for essential ingredients like cheese, flour, and processed meats, coupled with increasing regulatory scrutiny on nutritional labeling and health standards in developed markets. Significant opportunities arise from geographic expansion into high-growth emerging economies, the burgeoning demand for premium and gourmet pizza offerings, and strategic partnerships with third-party logistics providers to expand delivery radii.

Impact forces currently shaping the market include demographic shifts, particularly the rising population of millennials and Gen Z who prioritize convenience and digital interaction, accelerating the demand for seamless mobile ordering experiences. Economic impact forces relate to disposable income levels; while pizza remains an affordable indulgence, economic downturns can shift consumption patterns towards lower-priced QSR options. Technological impact is profound, with advancements in kitchen automation and cold chain technology ensuring global product consistency and quality. Regulatory forces, especially those pertaining to food safety, hygiene standards, and labor regulations, mandate continuous operational compliance, driving up the complexity of managing global supply chains, yet simultaneously assuring consumer trust in the product.

The balance between these forces determines the overall market trajectory. While drivers related to digital transformation are overwhelmingly positive, the constraints related to commodity volatility and labor shortages require strategic mitigation through forward-buying contracts and increased automation investment. Successful market players are those who can effectively leverage technological opportunities to overcome cost restraints while rapidly adapting their product portfolios to meet evolving consumer health and convenience demands across diverse global regions. The ultimate impact force is consumer preference, which dictates the success of new product launches and marketing campaigns, emphasizing the need for data-driven, localized menu development.

Segmentation Analysis

The Pizzas Market is comprehensively segmented based on various defining characteristics, including the type of crust, the composition of ingredients, the crucial distribution channel utilized for sales, and the primary end-user demographic. Analyzing these segments provides strategic insights into consumer behavior, preferred purchasing methods, and areas ripe for product innovation and targeted marketing efforts. Segmentation by crust type allows companies to target traditionalists versus those seeking specialized textures or healthier alternatives, while segmentation by ingredients directly addresses growing trends such as vegetarianism, veganism, and flexitarian diets. The distribution channel breakdown is vital for resource allocation, highlighting the accelerating dominance of digital platforms over traditional dine-in or physical retail models, necessitating a fundamental shift in operational focus toward delivery efficiency and packaging innovation.

- By Type: Thick Crust, Thin Crust, Deep Dish, Specialty (e.g., Stuffed Crust, Neapolitan Style)

- By Ingredient: Non-Vegetarian (Meat, Poultry), Vegetarian (Vegetables, Non-Meat Toppings), Vegan, Cheese-only

- By Distribution Channel: Quick Service Restaurants (QSR), Full-Service Restaurants (FSR), Retail/Grocery Stores (Frozen Pizza, Chilled Dough), Online Delivery Platforms (Aggregators, Direct QSR Apps)

- By End User: Household Consumption, Commercial Consumption (Catering, Institutions)

Value Chain Analysis For Pizzas Market

The value chain of the Pizzas Market begins with upstream activities focused on the procurement and processing of raw ingredients. This includes securing high-quality wheat (for flour), dairy products (primarily cheese), meats, vegetables, and proprietary sauces and spices. Upstream analysis involves managing complex global supply chains, negotiating favorable commodity contracts, and ensuring compliance with stringent food safety and sustainability standards. Efficiency in this stage, particularly minimizing material waste and optimizing processing costs, is crucial as ingredient costs represent a significant proportion of the final product's cost structure. Relationships with specialized suppliers for niche ingredients (like vegan cheese or organic flour) are becoming increasingly important for catering to premium and specialized segments.

Midstream activities involve the preparation, baking, and packaging of the pizza, whether in a restaurant setting (QSR/FSR) or a centralized manufacturing facility (for frozen or pre-made retail products). Downstream analysis focuses critically on distribution and final delivery. Distribution channels are highly fragmented, involving direct sales through company-owned stores, franchised operations, sales via third-party food delivery aggregators (indirect), and distribution to retail grocery stores (indirect). The success of downstream activities hinges on maintaining product quality during transit, maximizing delivery speed, and leveraging technology (GPS tracking, thermal packaging) to enhance the customer experience and satisfaction.

The prevalence of indirect channels, particularly online delivery aggregators like Uber Eats, DoorDash, and specialized local services, has significantly restructured the downstream segment, providing restaurants with wider market reach but often at the cost of high commission fees and reduced control over the final customer interaction. Direct distribution, managed through proprietary QSR apps, offers greater control over branding and customer data, fostering loyalty programs and direct marketing efforts. Overall value creation is maximized by seamlessly integrating digital ordering systems with efficient kitchen operations and optimized last-mile logistics, ensuring minimal latency between order placement and product consumption, a critical factor for competitive advantage.

Pizzas Market Potential Customers

The primary consumers and end-users of the Pizzas Market are incredibly diverse, spanning across almost all demographic and socio-economic groups globally due to the product’s universality and versatility. Potential customers range from individual consumers seeking a quick, convenient lunch option to large families ordering dinner, and commercial entities requiring catering services for events or institutional feeding. A key demographic segment consists of millennials and Gen Z, who exhibit a high propensity for utilizing digital ordering and delivery platforms, valuing speed, novelty, and the ability to customize their meals extensively. This group heavily drives demand for innovative crusts, unique toppings, and options aligning with current health and sustainability trends, such as plant-based ingredients.

Another significant customer base includes households with dual working parents or busy lifestyles, where convenience and time-saving meal solutions are paramount. For this segment, frozen pizzas purchased through retail channels and quick, reliable QSR delivery services represent crucial offerings. These buyers are often price-sensitive but prioritize consistent quality and sufficient portion sizes for family consumption. Furthermore, the commercial sector, encompassing institutions like schools, corporate cafeterias, hospitals, and airlines, serves as a substantial bulk purchaser of pre-prepared or ready-to-bake pizza products, focusing primarily on volume, consistency, and adherence to specific dietary and caloric guidelines required in institutional settings.

The increasing global connectivity and urbanization further expand the customer base in emerging economies. As disposable incomes rise in regions like Southeast Asia and Latin America, newly affluent consumers increasingly adopt Western dining habits, leading to a surge in first-time customers for international and localized pizza chains. Targeting strategies must therefore be granular, addressing the value-driven needs of budget-conscious consumers through competitive pricing, while simultaneously capturing the high-margin market of premium consumers seeking gourmet, authentic, or health-focused pizza experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 175.5 Billion |

| Market Forecast in 2033 | USD 291.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domino's Pizza, Inc., Yum! Brands (Pizza Hut), Papa John's International, Inc., Little Caesars, Telepizza Group, California Pizza Kitchen, Sbarro, Inc., Chuck E. Cheese, MOD Pizza, Blaze Pizza, Boston Pizza, Restaurant Brands International, Groupe Bertrand, Four Star Pizza, Papa Murphy's Holdings, Inc., Marco's Pizza, Cici's Pizza, Hungry Howie's Pizza, Godfather's Pizza, Round Table Pizza |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Pizzas Market Key Technology Landscape

The Pizzas Market is heavily leveraging digital technologies and automation to streamline operations, enhance customer experience, and improve efficiency. Critical technologies include advanced Point of Sale (POS) systems integrated with Customer Relationship Management (CRM) tools, allowing for comprehensive data capture on ordering habits and preferences, which fuels personalized marketing campaigns. Furthermore, robust cloud-based enterprise resource planning (ERP) systems are used by global chains to manage complex inventory across numerous locations, ensuring ingredient freshness and minimizing stockouts. The shift toward mobile-first strategies has led to significant investment in highly intuitive mobile ordering applications, designed for speed and minimizing steps in the checkout process, which is a key determinant of conversion rates in the QSR sector.

Operational technologies focusing on kitchen automation are gaining traction. These include robotic systems capable of performing repetitive tasks such as dough pressing, sauce dispensing, and cheese application with high precision and consistency. While full robotic kitchens are still niche, automated ovens and conveyor systems are standard in high-volume settings, dramatically reducing preparation time and ensuring uniform cooking results. Crucially, the cold chain management technology utilized for frozen and chilled pizza products is continuously being refined, employing sophisticated sensors and IoT (Internet of Things) devices to monitor temperature and humidity throughout the distribution lifecycle, guaranteeing product safety and quality upon reaching retail shelves.

Delivery technology represents the most visible frontier of innovation. Geospatial mapping and advanced routing algorithms are essential for optimizing driver routes and providing accurate estimated delivery times (EDTs), directly impacting customer satisfaction. The pilot deployment of drone delivery and autonomous ground vehicles, supported by 5G connectivity, is focused on solving the 'last mile' challenge, particularly in suburban and rural areas where traditional delivery costs are disproportionately high. Blockchain technology is also being explored by larger chains to enhance supply chain transparency, allowing consumers to verify the origin and quality assurance status of key ingredients, thereby building trust and addressing ethical sourcing concerns.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for pizza consumption globally. Characterized by high per capita consumption and the dominance of major international QSR chains, the region is a hub for technological innovation in ordering and delivery. Growth is currently driven by premiumization, where consumers demand higher-quality, artisan-style pizzas and highly customized offerings, alongside strong performance in the frozen pizza retail segment driven by convenience. Competition is fierce, focusing on delivery time guarantees and menu diversification to cater to health-conscious consumers (e.g., cauliflower crusts, low-sodium options). The market remains highly saturated, necessitating sophisticated marketing and loyalty programs for differentiation.

- Europe: Europe is a highly fragmented market, with strong regional variations in consumer preferences, ranging from traditional Neapolitan styles in Italy to deep-pan variants in the UK. Western Europe exhibits high market maturity, with growth primarily fueled by the expansion of QSR delivery services and the increasing popularity of vegetarian and plant-based toppings. Eastern European markets show faster growth rates, capitalizing on rising disposable incomes and rapid adoption of international fast-food concepts. Regulatory emphasis on ingredient transparency and sustainable sourcing significantly influences product formulation and labeling across the European Union.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, presenting vast market opportunities driven by immense population size, rapid urbanization, and the expanding middle class adopting Western dietary habits. Key markets like China, India, and Southeast Asian nations are experiencing double-digit growth in organized pizza retail. Success in this region heavily relies on localization strategies, where global brands adapt their menus to incorporate local flavors and preferences (e.g., spicy curries, specific sauces). The expansion of cold chain logistics and the proliferation of mobile internet access are crucial enablers of growth in this geographically diverse region.

- Latin America: The Latin American market exhibits robust growth, spurred by economic recovery and increasing consumer spending on out-of-home dining and convenient meal solutions. Brazil and Mexico are leading markets, characterized by a mix of international chains and strong domestic competitors. Digital adoption, particularly mobile ordering, is accelerating rapidly. The market structure often favors value propositions, although there is a growing segment of affluent consumers demanding premium, imported ingredients and artisanal preparation methods, signaling diversification in consumer demand across the economic spectrum.

- Middle East and Africa (MEA): Growth in the MEA region is closely tied to infrastructure development, particularly the expansion of modern retail and organized food service sectors. The GCC countries (Saudi Arabia, UAE) are mature and sophisticated, characterized by high disposable incomes and a preference for high-quality, international brands. Africa presents long-term potential, though challenges related to logistics, regulatory environments, and establishing reliable supply chains need addressing. Cultural and religious dietary requirements (Halal certification) are mandatory considerations that significantly influence product sourcing and preparation in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Pizzas Market.- Domino's Pizza, Inc.

- Yum! Brands (Pizza Hut)

- Papa John's International, Inc.

- Little Caesars

- Telepizza Group

- California Pizza Kitchen

- Sbarro, Inc.

- Chuck E. Cheese

- MOD Pizza

- Blaze Pizza

- Boston Pizza

- Restaurant Brands International (Burger King, Popeyes)

- Groupe Bertrand

- Four Star Pizza

- Papa Murphy's Holdings, Inc.

- Marco's Pizza

- Cici's Pizza

- Hungry Howie's Pizza

- Godfather's Pizza

- Round Table Pizza

Frequently Asked Questions

Analyze common user questions about the Pizzas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the global Pizzas Market?

The primary drivers include increased adoption of digital ordering and efficient delivery platforms, rapid urbanization and convenience-seeking consumer lifestyles, and continuous product innovation addressing specialized dietary preferences such as plant-based and gluten-free options. Geographic expansion into high-growth emerging economies, particularly in Asia Pacific, also significantly contributes to overall market expansion.

How is technology, specifically AI, influencing pizza preparation and delivery?

AI is critically used for optimizing inventory management and demand forecasting, minimizing food waste and costs. It also powers personalized marketing and dynamic pricing. In preparation, robotics and automation enhance consistency and speed. For delivery, AI algorithms optimize routing, and autonomous vehicles are being piloted to reduce last-mile logistical expenses and improve service speed.

Which distribution channel segment is experiencing the fastest growth?

The Online Delivery Platforms segment, encompassing proprietary QSR applications and third-party aggregators, is exhibiting the fastest growth. This acceleration is driven by consumer demand for convenience, widespread mobile connectivity, and strategic investments by major players to shift customer interactions toward digital, direct-to-consumer channels.

What are the main restraints impacting the profitability of pizza chains?

Key restraints include the extreme volatility and high costs of key raw ingredients such as cheese, flour, and specific meats, which compress operating margins. Intense price competition, especially among Quick Service Restaurants (QSRs), and challenges related to securing and retaining labor in a tight market also pose significant financial constraints on global operations.

Which geographic region is expected to lead market expansion through 2033?

The Asia Pacific (APAC) region is forecasted to lead market expansion through 2033. This growth is attributed to the region's expanding middle-class population, rising disposable incomes, and the ongoing cultural shift toward Westernized fast-food consumption, particularly where international brands successfully execute localized menu strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager