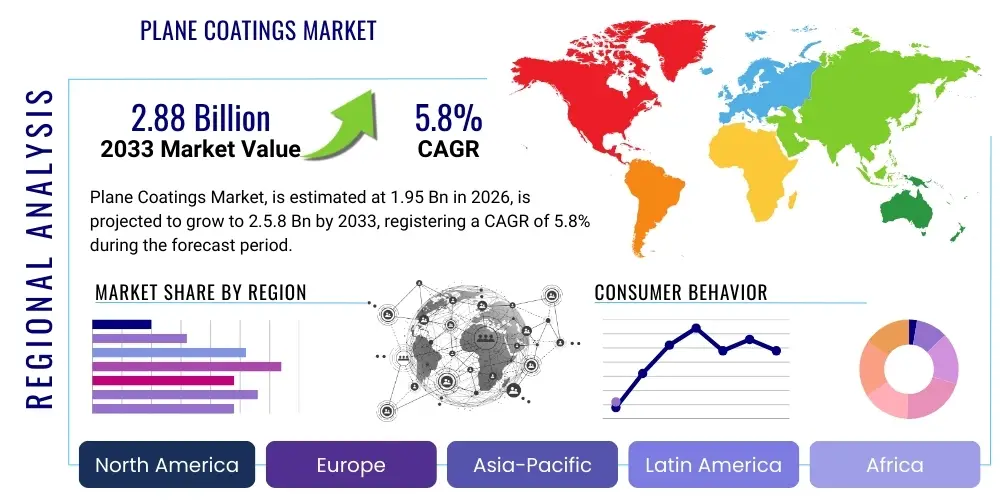

Plane Coatings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443123 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Plane Coatings Market Size

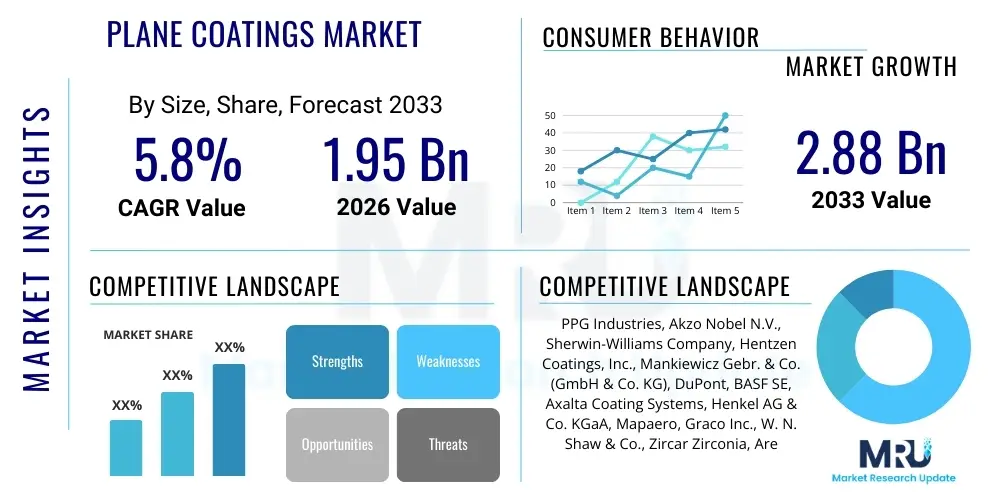

The Plane Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.88 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the robust delivery schedule of new commercial aircraft, particularly in emerging economies, coupled with significant modernization programs within the global military aviation sector. Furthermore, the increasing emphasis on optimizing aircraft performance through enhanced corrosion resistance, reduced aerodynamic drag, and improved fuel efficiency necessitates the use of high-performance specialty coatings, thereby securing sustained market growth throughout the projected timeline.

The valuation reflects the critical role coatings play in extending the operational lifespan and maintaining the structural integrity of both fixed-wing and rotary-wing aircraft. Demand is bifurcated across Original Equipment Manufacturers (OEMs) for new build programs and Maintenance, Repair, and Overhaul (MRO) services for existing fleets. The OEM segment often requires highly specialized, high-durability coatings applied under controlled conditions, while MRO services are focused on rapid, efficient turnaround times utilizing versatile and compliant coating systems. Regulatory adherence, particularly concerning Volatile Organic Compound (VOC) emissions and hexavalent chromium substitution, significantly influences product development and market penetration strategies, favoring suppliers capable of providing environmentally superior solutions.

Plane Coatings Market introduction

The Plane Coatings Market encompasses highly specialized chemical formulations designed for application on external and internal surfaces of aerospace vehicles, including fixed-wing commercial, regional, business, and military aircraft, as well as helicopters and space components. These coatings are distinct from general industrial paints, engineered to withstand extreme environmental conditions such as high altitude radiation, rapid temperature fluctuations, severe UV exposure, chemical erosion from fluids (hydraulic oil, de-icing solutions), and physical damage from particulate matter. Key product categories include primers, basecoats, clearcoats, specialized functional coatings (e.g., thermal barrier coatings, rain erosion coatings), and interior cabin finishes designed for fire resistance and durability. The primary functional benefits include superior corrosion protection, erosion resistance, aerodynamic efficiency improvement (reduced drag), thermal regulation, aesthetic branding, and compliance with stringent aviation safety standards.

Major applications span the entire aircraft lifecycle, beginning with OEM assembly lines where structural and aesthetic coatings are first applied, through to the extensive MRO segment covering heavy maintenance checks (C-checks and D-checks) and repainting cycles. Commercial aviation dictates high demand due to large fleets and strict scheduling adherence, making quick-curing and durable systems essential. Military applications, however, prioritize advanced functional properties, such as radar-absorbent materials (RAM) for stealth technology and robust camouflage systems, driving innovation in niche, high-performance chemistries. The continued focus on sustainability and lightweight materials is a primary market driver, compelling manufacturers to invest in chrome-free primers and water-borne or high-solids polyurethane topcoats that reduce environmental impact while enhancing performance metrics.

The market is characterized by long qualification cycles and high barriers to entry, driven by the requirement for approvals from major aircraft manufacturers (e.g., Boeing, Airbus) and regulatory bodies (FAA, EASA). These certifications ensure that coating systems meet rigorous standards for adhesion, flexibility, chemical resistance, and long-term durability essential for flight safety. The convergence of material science advancements, digitalization in application processes, and persistent pressure to reduce maintenance downtime positions the plane coatings market as a technically sophisticated and strategically vital component of the global aerospace industry value chain.

Plane Coatings Market Executive Summary

The Plane Coatings Market Executive Summary highlights robust growth trajectories fueled by the accelerated recovery and expansion of commercial air traffic globally, juxtaposed with sustained high expenditure on defense modernization, particularly in North America and Asia Pacific. Business trends indicate a definitive shift toward sustainable and technologically advanced coatings, including high-solids and water-borne polyurethane systems, as aerospace companies seek to align with global environmental mandates (VOC reduction, REACH compliance). Strategic collaborations between coating manufacturers and aircraft OEMs are intensifying, focusing on developing integrated coating solutions that offer verifiable weight savings and improved aerodynamic characteristics, directly translating to enhanced fuel efficiency, a critical operating cost determinant for airlines. The increasing complexity of modern aircraft structures, featuring extensive use of composite materials, further drives demand for specialized primers and barrier coatings compatible with non-metallic substrates, ensuring long-term structural integrity and minimizing galvanic corrosion potential.

Regional trends are strongly differentiated. The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, primarily attributed to the rapid expansion of middle-class air travel, resulting in large backlogs for new aircraft deliveries and the proliferation of regional MRO hubs. North America maintains market leadership in terms of sheer market size and technological development, heavily influenced by substantial military modernization programs and the presence of major aerospace primes and coating innovation centers. Europe emphasizes regulatory compliance, driving early adoption of chrome-free and non-toxic coating alternatives, often setting the global standard for environmental performance. The Middle East and Africa (MEA) and Latin America represent growing MRO opportunities, linked to localized fleet maintenance requirements and infrastructure investments.

Segment trends underscore the dominance of the polyurethane segment by technology type due to its unparalleled combination of durability, UV resistance, and aesthetic finish. By end-user, the MRO segment is gaining market share momentum over the OEM segment, although the latter commands higher value per unit, reflecting the extended service life of modern aircraft and the necessity of periodic refurbishment and heavy maintenance checks. Within the product type, primers continue to hold a significant market share due to their foundational role in ensuring optimal corrosion resistance and adhesion, while specialized functional coatings, such as anti-icing and hydrophobic layers, are the fastest-growing niche, driven by performance demands in challenging operational environments.

AI Impact Analysis on Plane Coatings Market

Common user questions regarding AI's impact on the Plane Coatings Market primarily revolve around how machine learning can optimize material formulation, improve quality assurance during application, and predict coating lifespan under various operational stressors. Users frequently inquire about the feasibility of AI-driven defect detection during curing and finishing processes, asking if autonomous systems can achieve higher precision than human inspectors, especially concerning thin-film uniformity and micro-cracking. Furthermore, there is significant interest in AI's role in accelerating the discovery of novel, environmentally compliant coating chemistries, particularly those substituting hazardous substances like chromates, by simulating molecular interactions and predicting performance characteristics without extensive physical testing. The key themes summarized from these inquiries center on efficiency gains, predictive maintenance integration, and rapid material innovation enabled by advanced computational analysis.

The integration of Artificial Intelligence and machine learning algorithms is poised to revolutionize the entire plane coatings value chain, transitioning from reactive quality control to proactive predictive material engineering and maintenance scheduling. In the research and development phase, AI tools analyze vast datasets of chemical properties and environmental testing results to rapidly screen potential formulations, drastically shortening the time-to-market for new high-performance systems, such as advanced fluoropolymers or nanocomposites. This computational approach allows formulators to precisely tailor properties like adhesion, flexibility, and anti-corrosion performance specific to composite or metallic substrates, maximizing compatibility and structural protection.

Operationally, AI enhances the application process and MRO efficiency. Computer vision systems combined with robotic applicators use machine learning models to monitor real-time thickness, uniformity, and adherence during spray operations, adjusting equipment parameters instantaneously to ensure optimal coverage and minimize material waste. For maintenance planning, predictive algorithms analyze real-time flight data (e.g., altitude, temperature cycles, humidity exposure) alongside historical coating degradation patterns to accurately forecast the remaining useful life of a coating system on specific aircraft. This capability allows airlines and military organizations to schedule repainting precisely when necessary, minimizing unnecessary downtime and maximizing fleet operational availability, thus transforming current scheduled maintenance protocols into condition-based maintenance strategies.

- AI accelerates new material discovery, optimizing formulations for chrome-free and low-VOC systems.

- Machine learning algorithms enhance quality control through real-time, non-destructive analysis of coating thickness and defect detection during application.

- Predictive maintenance schedules are generated by AI, forecasting coating degradation based on operational usage and environmental data, optimizing MRO timing.

- Robotic painting systems utilize AI for path planning and dynamic adjustment, ensuring uniform application across complex aerodynamic surfaces.

- Supply chain management benefits from AI-driven forecasting of raw material needs, stabilizing inventory and mitigating procurement risks for specialized resins and additives.

DRO & Impact Forces Of Plane Coatings Market

The Plane Coatings Market is primarily driven by rigorous safety requirements, the continuous delivery cycle of commercial aircraft (Airbus and Boeing backlogs), and the persistent need for fuel efficiency optimization, where coatings contribute significantly by reducing surface friction. Restraints include the extremely high cost and duration of the required aerospace qualification process, which acts as a substantial barrier to entry for innovative material providers, alongside the volatility in the pricing and supply chain of specialty chemical raw materials, such as titanium dioxide and specialized epoxy resins. Opportunities are abundant in the rapid development and commercialization of sustainable coating solutions, notably chrome-free primers and water-borne topcoats, driven by stringent global environmental regulations (e.g., REACH in Europe). The collective impact forces dictate that innovation must be balanced against regulatory compliance and demonstrable long-term performance under operational stress, favoring established suppliers with deep integration into OEM supply chains and robust R&D capabilities focusing on lightweight, high-performance, and environmentally sound chemistries.

Drivers: The global increase in commercial air traffic and fleet expansion mandates robust MRO activities and new aircraft deliveries, directly inflating demand for durable coatings. Furthermore, the strategic imperative for militaries globally to upgrade aging fleets and procure advanced defense platforms (which often incorporate specialized stealth or anti-corrosion coatings) provides a substantial, high-value demand segment. Airlines are increasingly prioritizing specialized exterior coatings, such as advanced clearcoats and surface treatments, specifically for their ability to maintain a pristine, low-drag finish over extended periods. This focus on aerodynamic efficiency is a direct response to rising fuel prices and corporate sustainability goals, making the return on investment for superior coating systems immediately quantifiable through reduced operating expenditure.

Restraints: The primary constraints relate to the complex regulatory landscape. The transition away from highly effective, yet toxic, materials like hexavalent chromium requires significant capital investment in R&D and subsequent lengthy certification trials to prove equivalent or superior performance of new alternatives. This lengthy qualification process, often spanning several years, slows the introduction of next-generation coatings. Moreover, the reliance on highly specialized raw materials, often sourced from a limited number of specialized chemical providers, exposes the market to supply chain bottlenecks and price fluctuations, complicating cost management and long-term contract pricing for major coating suppliers.

Opportunities: The substantial opportunity lies in the niche market of smart coatings and functionalized materials. This includes self-healing polymers that automatically repair minor damage, icephobic coatings that reduce de-icing fluid usage, and embedded sensors within coatings capable of monitoring structural health or temperature changes in real-time. Developing highly durable, rapid-curing coatings compatible with advanced composite structures is another key growth area, especially as composite usage increases in fuselage and wing construction (e.g., in Boeing 787 and Airbus A350 programs). Suppliers who successfully integrate sustainable practices with superior performance properties will capture significant market share in the coming decade, particularly among environmentally conscious European and North American carriers.

Segmentation Analysis

The Plane Coatings Market is meticulously segmented across key dimensions including Product Type, Technology, and End-User, reflecting the diverse requirements of the aerospace industry. This segmentation provides a granular view of market dynamics, illustrating where investment and demand are most concentrated. Product Type segmentation distinguishes between primers (essential for adhesion and corrosion), basecoats (color and functional layers), and clearcoats (UV protection and gloss retention), with specialized coatings often treated as a high-growth separate category. The Technology segment highlights the dominance of high-performance polyurethane systems but also tracks the increasing adoption of water-borne, epoxy, and advanced ceramic/fluoropolymer technologies, driven by regulatory compliance and extreme environment performance needs. End-User analysis is critical, dividing the market between Original Equipment Manufacturers (OEMs), who require high-volume, standardized application for new aircraft, and Maintenance, Repair, and Overhaul (MRO) service providers, who demand versatility, quick turnaround, and compatibility with legacy systems.

Analyzing these segments reveals shifts in market preference and regulatory influence. The demand for low-VOC, high-solids polyurethane topcoats remains robust across both OEM and MRO sectors due to their proven longevity and aesthetic superiority. Conversely, the growth rate for specialized functional coatings (e.g., anti-static, anti-erosion, rain-repellent) outpaces standard decorative coatings, indicative of the aerospace industry's increasing focus on marginal gains in operational performance and safety. The MRO segment, driven by the expanding global fleet and extended lifespans of aging aircraft, consistently shows greater resilience to economic downturns compared to the OEM segment, whose volumes are intrinsically tied to fluctuating aircraft order backlogs. Therefore, strategic focus for market players involves developing modular, high-performance systems optimized for MRO application ease and ensuring long-term qualification across major aircraft platforms.

Furthermore, internal segmentation, often overlooked, is gaining importance. Interior cabin coatings, including durable, fire-resistant protective layers for seats, galleys, and lavatories, are experiencing rising demand, driven by stringent fire safety standards and passenger experience expectations. Exterior coatings are further differentiated by military versus commercial use, with the former requiring highly specific stealth properties or extreme temperature resistance, while commercial coatings prioritize resistance to environmental degradation, ease of cleaning, and extended color retention. This multi-faceted segmentation allows stakeholders to accurately gauge market maturity, competitive intensity, and potential for technological disruption in specific aviation sub-sectors.

- By Product Type:

- Primers (Corrosion Inhibiting, Surface Preparation)

- Basecoats/Topcoats (Aesthetics, UV Resistance)

- Clearcoats (Gloss Retention, Protection)

- Specialized Functional Coatings (Thermal Barrier, Anti-Erosion, Rain Repellent)

- By Technology:

- Polyurethane Coatings (Dominant technology for exterior durability)

- Epoxy Coatings (Primarily used for internal structure and primers)

- Water-Borne Coatings (Growing segment due to environmental compliance)

- High-Solids Coatings (Low-VOC compliance)

- Specialty and Ceramic Coatings (High-temperature applications, engine components)

- By End-User:

- Original Equipment Manufacturers (OEM)

- Maintenance, Repair, and Overhaul (MRO)

- By Application:

- Exterior Coatings (Fuselage, Wings, Tail)

- Interior Coatings (Cabin, Cargo Hold, Cockpit)

- Engine and Component Coatings (High-temperature resistance)

Value Chain Analysis For Plane Coatings Market

The Plane Coatings Market value chain is highly specialized and begins with the upstream procurement of specialty chemicals, including high-purity resins (epoxies, polyurethanes, acrylics), advanced pigments (often military-grade or highly lightfast), solvents (decreasingly used), and performance additives (e.g., anti-corrosion agents, UV stabilizers). The upstream segment is characterized by a limited number of global chemical manufacturers providing certified materials that must meet rigorous aerospace standards, leading to high dependency and structured contractual relationships. R&D and formulation constitute the core value-add activity, where coating manufacturers convert raw materials into complex, multi-component systems (like two-part polyurethanes) tailored to specific substrate types (aluminum, titanium, carbon fiber composites) and demanding performance specifications set by regulatory bodies and aircraft OEMs. Intensive intellectual property surrounding chrome-free primer technology and advanced fluoropolymer chemistry defines competitive advantage at this stage.

The downstream segment involves the distribution, application, and subsequent MRO lifecycle support. Direct distribution channels are predominantly used for supplying major OEMs, involving technical sales teams, specialized logistics, and stringent quality control throughout the supply process. Major coating manufacturers often establish long-term supply agreements directly with primes like Airbus and Boeing. Indirect distribution becomes more prevalent in the vast global MRO market, utilizing a network of authorized distributors and specialized chemical suppliers who manage inventory, handle regional regulatory compliance, and provide localized technical support to MRO facilities and smaller third-party maintenance providers globally. The MRO application phase adds substantial value through specialized services, including surface preparation (stripping old coatings), complex masking, and controlled environmental application (humidity and temperature control), which require certified technicians and specialized hangar infrastructure.

The transition from product manufacturing to service integration is a key trend in the value chain. Leading coating providers are increasingly offering total solutions, encompassing the product, application training, equipment recommendations, and waste management services, particularly for major airline customers and defense contractors. This integrated approach ensures the optimal performance of the coating system and compliance with occupational health and environmental standards. The downstream focus on MRO efficiency—including faster drying times and easier repairability—is continually pushing upstream R&D efforts. Furthermore, digitalization, including digital color matching and inventory management systems, is being implemented across the distribution and MRO channels to enhance efficiency and traceability of highly regulated aerospace materials.

Plane Coatings Market Potential Customers

The primary end-users and buyers of plane coatings represent a highly concentrated group within the global aerospace and defense ecosystem, demanding certified, high-performance, and technically compliant materials. The most significant customer segment comprises Original Equipment Manufacturers (OEMs), notably large commercial aircraft manufacturers (e.g., Boeing, Airbus), regional jet producers (e.g., Embraer, Bombardier), and major military defense contractors (e.g., Lockheed Martin, Northrop Grumman). These customers require high-volume supply for new production lines, placing emphasis on coatings that integrate smoothly into automated application processes and offer verified weight savings and structural protection for the lifetime of the aircraft component. Procurement decisions at the OEM level are often locked in through multi-year contracts, making initial qualification a crucial strategic achievement for coating suppliers.

The second substantial customer segment is the Maintenance, Repair, and Overhaul (MRO) industry, which includes major airline MRO divisions (e.g., Lufthansa Technik, Air France-KLM Engineering & Maintenance), independent MRO providers, and dedicated military depot maintenance facilities. MRO buyers procure coatings for periodic heavy checks, general maintenance, and livery changes. Unlike OEMs, MRO customers prioritize coatings with short curing times to minimize aircraft grounding time, easy application capabilities (often brush or roller for localized repairs), and broad compatibility with existing older coating systems. Their buying decisions are driven by total cost of application, quick turnaround, and global availability of the required certified product grades, leading to reliance on well-established global distribution networks.

An emerging segment includes specialized aerospace component manufacturers and space agencies. Component manufacturers require coatings for landing gear, engine parts (high-temperature ceramics), and internal structural elements, demanding coatings tailored for extreme mechanical and thermal loads. Space agencies and commercial spaceflight operators purchase highly specialized functional coatings (e.g., thermal control paints, atomic oxygen resistance coatings) for satellite structures and launch vehicle components, where performance under vacuum and extreme radiation is paramount. These transactions are typically high-value, low-volume, and involve extremely specific technical requirements, often pushing the limits of current material science.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries, Akzo Nobel N.V., Sherwin-Williams Company, Hentzen Coatings, Inc., Mankiewicz Gebr. & Co. (GmbH & Co. KG), DuPont, BASF SE, Axalta Coating Systems, Henkel AG & Co. KGaA, Mapaero, Graco Inc., W. N. Shaw & Co., Zircar Zirconia, Aremco Products, Aerospace Coatings International, The Beckers Group, LMI Aerospace, Fiberlay Inc., IHI Corporation, KCC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plane Coatings Market Key Technology Landscape

The technological landscape of the Plane Coatings Market is defined by the pursuit of enhanced durability, reduced environmental impact, and specialized functional performance. Traditional high-performance polyurethane systems remain the industry standard for exterior topcoats due to their exceptional gloss retention, resistance to UV degradation, and mechanical toughness, but contemporary research is heavily focused on formulating these systems with high-solids content or transitioning to water-borne carriers to comply with stringent VOC regulations. The shift away from hexavalent chromium in primers has driven immense innovation in chrome-free primer technology, utilizing alternatives such as specialized silanes and rare-earth metal compounds, which are now undergoing rigorous testing to ensure comparable, long-term corrosion protection capability, especially on multi-material assemblies involving advanced alloys and composites.

Further technological advancements center on smart and functional coatings. Nanocomposite technology, incorporating nanoparticles (e.g., graphene, carbon nanotubes, or modified silicates) into polymer matrices, is being developed to create self-healing coatings that repair micro-cracks automatically, thereby preserving corrosion protection and reducing the need for localized touch-ups during maintenance. Aerodynamic performance enhancement is another critical area, leading to the development of specialized coatings that mimic sharkskin (riblets) or possess superhydrophobic properties, aiming to minimize drag and reduce ice accumulation, directly translating into tangible fuel savings for aircraft operators. These functional coatings represent the high-margin, fastest-growing segment of the market, requiring specialized application techniques and deep R&D partnerships.

Application technology also plays a crucial role, with the industry moving toward automated, robotic spray systems coupled with advanced plasma or thermal spray techniques, particularly for engine and component coatings (e.g., Thermal Barrier Coatings or TBCs). These TBCs, typically based on stabilized zirconia ceramics, protect critical hot sections of jet engines from extreme temperatures, extending component life and enabling higher operating temperatures for improved efficiency. The adoption of digital application management systems, including automated mixing, metering, and quality verification, ensures consistent film thickness and composition, reducing human error and material wastage, thereby integrating advanced material science with precision engineering on the factory floor and in MRO hangars globally.

Regional Highlights

The global Plane Coatings Market exhibits strong regional diversification, intrinsically linked to aerospace manufacturing density, military expenditure levels, and the maturity of regional MRO infrastructure. North America commands the largest market share, predominantly driven by the immense footprint of OEMs (Boeing, Bombardier) and substantial, persistent investment in military aerospace modernization and defense procurement, requiring advanced, high-specification coatings like stealth materials. The region possesses a highly developed MRO network and is often the earliest adopter of cutting-edge coating technologies, supported by robust regulatory frameworks (FAA) and a large base of domestic chemical suppliers focused on aerospace specifications.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This accelerated growth is propelled by the unprecedented expansion of commercial aviation, fueled by burgeoning middle-class populations in China and India, leading to high demand for new aircraft deliveries and the rapid establishment of large MRO centers in key regional hubs (e.g., Singapore, Malaysia). While APAC focuses heavily on standard commercial aviation coatings, there is a growing need for specialized coatings to withstand the diverse and often challenging climatic conditions, including high humidity and salinity, found throughout the region. Localized manufacturing capabilities are also increasing, though many specialty coatings are still imported from established global players.

Europe represents a highly mature and technologically advanced market, distinguished by its leadership in environmental compliance. The implementation of stringent regulations like REACH has made Europe the primary driver for the innovation and adoption of chrome-free primers, water-borne systems, and other low-toxicity coatings. The presence of major OEMs (Airbus) and world-class MRO providers ensures stable demand. Latin America, the Middle East, and Africa (MEA) constitute smaller but rapidly growing markets, primarily focused on MRO activities for existing commercial fleets and niche defense sales. The MEA region, capitalizing on its strategic location, is investing heavily in becoming a global MRO hub, particularly centered around the Gulf nations, thereby generating increasing demand for high-quality, long-lasting coatings suitable for desert operational environments.

- North America: Market leader by value, driven by high military spending, presence of major OEMs (Boeing), and advanced MRO infrastructure. Focus on high-performance and specialty defense coatings.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid commercial fleet expansion in China and India, and rising investment in localized MRO capabilities. Focus on high-volume commercial topcoats and regional fleet refurbishment.

- Europe: Key innovator in sustainable coatings (chrome-free, low-VOC) due to strict regulatory pressure (REACH). Stable demand linked to Airbus production and established MRO leaders.

- Latin America (LATAM): Growth centered on local MRO expansion and increasing domestic air travel, driving demand for standard repair and maintenance coatings.

- Middle East & Africa (MEA): Emerging MRO hub focused on servicing international wide-body fleets; growing demand for coatings optimized for hot, sandy environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plane Coatings Market.- PPG Industries

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Axalta Coating Systems

- Mankiewicz Gebr. & Co. (GmbH & Co. KG)

- Hentzen Coatings, Inc.

- BASF SE

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Mapaero

- Graco Inc. (Application Technology Provider)

- Chemetall GmbH (A BASF Company)

- Nippon Paint Holdings Co., Ltd.

- Indestructible Paint Ltd.

- Crompion International, LLC

- KCC Corporation

- W. N. Shaw & Co.

- Aerospace Coatings International

- Argosy International Inc.

- LMI Aerospace

Frequently Asked Questions

Analyze common user questions about the Plane Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the shift toward water-borne plane coatings?

The primary driver is stringent global environmental regulation, particularly concerning the reduction of Volatile Organic Compound (VOC) emissions mandated by agencies like the EPA and EASA. Water-borne systems offer significantly lower VOC content, improving occupational health and regulatory compliance without compromising required performance standards for durability and adhesion.

How does the transition from hexavalent chromium primers affect coating performance?

Hexavalent chromium (chrome) primers offer exceptional corrosion resistance, making the transition to chrome-free alternatives challenging. However, modern chrome-free primers utilize advanced technologies such as silanes and specialized rare-earth compounds to achieve comparable long-term corrosion protection, especially critical for protecting aluminum and composite aircraft structures under severe operational stress.

What role do functional coatings play in improving aircraft fuel efficiency?

Functional coatings, such as high-solids clearcoats and specialized surface treatments, are engineered to maintain a smoother aerodynamic surface finish. By minimizing surface roughness and drag (known as 'skin friction'), these coatings contribute directly to lower fuel consumption, offering quantifiable operational savings for airlines over the aircraft's lifecycle.

Which end-user segment drives the highest demand volume in the Plane Coatings Market?

The Maintenance, Repair, and Overhaul (MRO) segment typically accounts for the highest demand volume for coating materials annually. This is due to the large, aging global commercial fleet requiring periodic heavy checks (D-checks) and repaints every 5-8 years, contrasted with the relatively lower, although higher-value, volumes purchased by Original Equipment Manufacturers (OEMs) for new aircraft production.

How does composite material usage impact the requirement for specialized coatings?

The increasing use of carbon fiber reinforced polymers (CFRP) in modern aircraft requires specialized coatings, particularly primers, that ensure proper adhesion without damaging the substrate. Furthermore, these coatings must provide a crucial barrier against moisture ingress and protect metallic fasteners embedded in the composites from galvanic corrosion, which is amplified by dissimilar materials contact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager