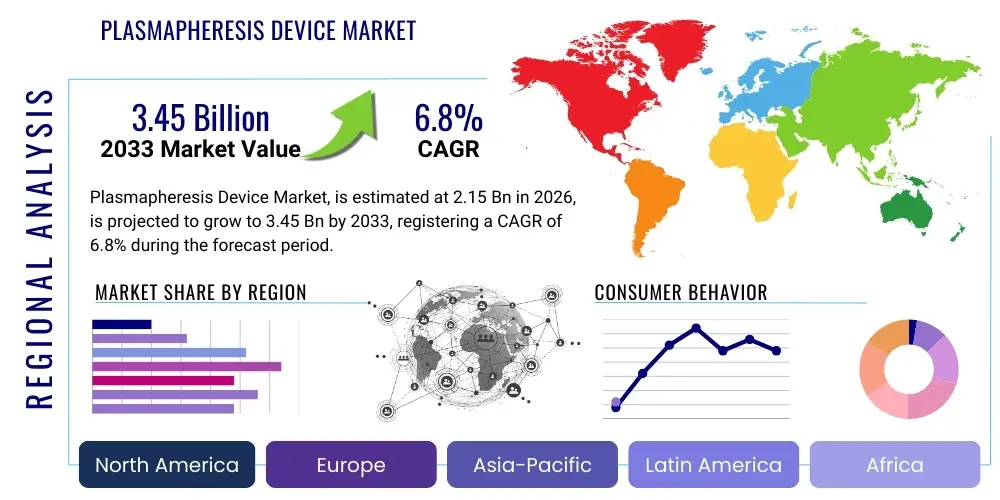

Plasmapheresis Device Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441849 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Plasmapheresis Device Market Size

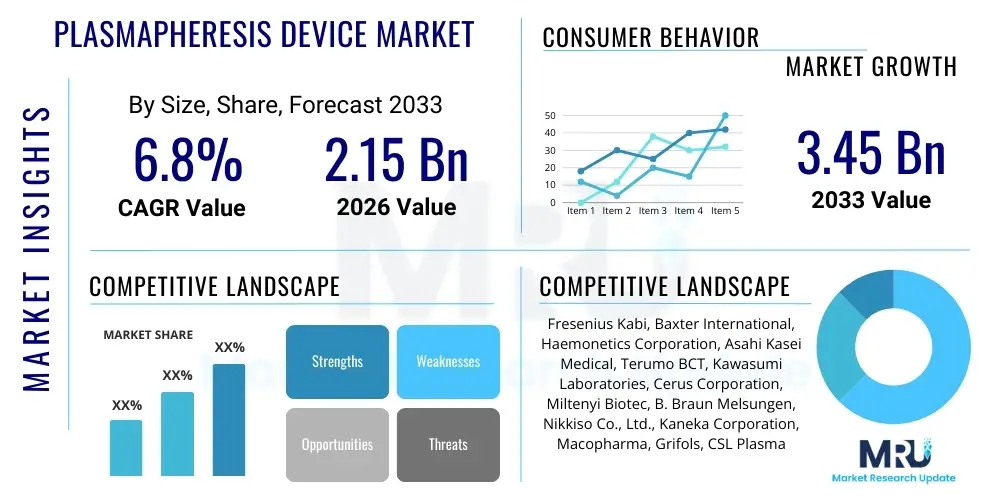

The Plasmapheresis Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.45 Billion by the end of the forecast period in 2033.

Plasmapheresis Device Market introduction

The Plasmapheresis Device Market encompasses specialized medical equipment utilized for the therapeutic or donor-related process of plasmapheresis—the separation of blood plasma from cellular components. This procedure is critical for treating various autoimmune, neurological, and hematological disorders by removing pathological substances, such as autoantibodies, immune complexes, or toxins, directly from the patient's plasma. The core products include sophisticated automated devices employing either centrifugal separation or membrane filtration technologies, alongside essential disposable kits, tubing sets, and plasma collection bags. The evolution of these devices emphasizes improved efficiency, enhanced patient safety profiles, and portability, allowing for wider adoption in diverse clinical settings.

Major applications of plasmapheresis devices span clinical areas such as myasthenia gravis, Guillain-Barré syndrome, chronic inflammatory demyelinating polyneuropathy (CIDP), thrombotic thrombocytopenic purpura (TTP), and certain hyperviscosity syndromes. Furthermore, a substantial segment of the market is dedicated to source plasma collection, vital for the manufacturing of plasma-derived medicinal products (PDMPs) like immunoglobulins, albumin, and clotting factors. The continuous demand for these life-saving therapies fuels the investment in higher throughput and gentler separation technologies. These devices offer significant benefits, including targeted removal of disease-causing components, faster symptom relief in acute conditions, and reduced reliance on systemic immunosuppressive drug regimens in specific cases.

Key driving factors accelerating market growth include the escalating global prevalence of chronic autoimmune diseases, particularly in developed economies where diagnostic rates are high, coupled with an aging population increasingly susceptible to neurological and immunological conditions requiring plasma exchange therapy. Technological advancements, specifically the refinement of hollow-fiber filters and improved automation features in centrifugation systems, are expanding the clinical utility and accessibility of plasmapheresis. Moreover, supportive reimbursement policies in key regions, coupled with growing public awareness regarding plasma donation and therapeutic apheresis, are setting the stage for robust market expansion over the forecast period.

Plasmapheresis Device Market Executive Summary

The Plasmapheresis Device Market is characterized by steady technological innovation focused on maximizing plasma yield and minimizing procedural complications, driving a robust growth trajectory, particularly within the therapeutic apheresis segment. Business trends indicate a strategic shift toward integrated systems that combine separation technology with automated fluid management and anticoagulant delivery, improving operational efficiency in hospitals and specialized blood centers. Leading manufacturers are focusing on securing regulatory approvals for next-generation disposable sets and optimizing hardware designs for easier maintenance and portability. Furthermore, collaborations between device manufacturers and pharmaceutical companies specializing in plasma-derived therapies are intensifying to ensure a sustainable supply chain for source plasma collection, which remains a cornerstone of market volume.

Regional trends reveal North America maintaining market dominance, attributed to advanced healthcare infrastructure, high awareness, established reimbursement frameworks, and significant research activity in autoimmune disease treatments. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily driven by expanding healthcare expenditure, increasing incidence of lifestyle-related chronic diseases, and the rapid establishment of dedicated blood centers and specialized clinics in emerging economies like China and India. Europe also holds a strong position, bolstered by rigorous quality standards for plasma collection and government initiatives supporting blood safety and disease management.

Segment trends underscore the supremacy of the Disposables category due to the mandatory single-use nature of tubing sets, filters, and collection bags required for every procedure, ensuring high replacement rates and continuous revenue streams. By application, Nephrology and Neurology segments are key growth drivers, reflecting the growing application of plasma exchange in managing kidney diseases, such as rapidly progressive glomerulonephritis, and severe neuro-immunological disorders. Centrifugation systems currently dominate the technology landscape due to their versatility and higher processing speeds, though membrane filtration systems are gaining traction for specific therapeutic applications where selective removal efficiency is prioritized.

AI Impact Analysis on Plasmapheresis Device Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Plasmapheresis Device Market frequently revolve around how AI can enhance procedural efficiency, optimize patient selection, and predict treatment outcomes. Users express specific interest in AI's role in improving safety parameters, especially concerning real-time monitoring of blood flow and identification of early complications during therapeutic apheresis. Key themes emerging from these questions include the integration of machine learning (ML) models for dynamic anticoagulant dosing, optimizing plasma volume replacement strategies based on individual patient parameters, and leveraging predictive analytics to determine the optimal timing and frequency of plasma exchange sessions for complex autoimmune conditions. There is also significant curiosity about AI-driven supply chain management for disposable kits and source plasma inventory, ensuring minimal wastage and maximum utilization in busy blood centers.

- AI-driven Predictive Maintenance: Utilizing sensor data from plasmapheresis devices to forecast component failure, reducing downtime and maintenance costs.

- Optimized Treatment Protocols: Machine learning algorithms analyze patient clinical data (e.g., antibody titers, inflammatory markers) to recommend personalized plasma exchange schedules and fluid balance.

- Real-Time Safety Monitoring: AI systems monitor procedural vitals, blood pressure changes, and anticoagulant levels, triggering alerts for immediate clinician intervention during adverse events.

- Enhanced Donor Screening: Leveraging AI and big data analytics to improve the efficiency and accuracy of source plasma donor eligibility screening processes.

- Automated Quality Control (QC): AI vision systems used for inspecting disposable kits and plasma bags post-collection to ensure product quality and integrity before processing.

- Supply Chain and Inventory Management: Predictive analytics used to forecast demand for disposable components across different regions, minimizing stockouts and optimizing logistics.

DRO & Impact Forces Of Plasmapheresis Device Market

The dynamics of the Plasmapheresis Device Market are primarily governed by the increasing global burden of autoimmune and neurological diseases, which mandate frequent therapeutic plasma exchange (TPE). This high incidence acts as a major driver (D). Furthermore, continuous advancements in device technology, shifting from batch processing to continuous flow systems and introducing highly selective membrane filters, significantly enhance clinical adoption and application scope. However, market growth faces substantial restraints (R), chiefly the high capital investment required for automated apheresis machines and the significant running costs associated with mandatory single-use disposable kits. Stringent regulatory frameworks for blood product safety and processing standards also pose operational challenges, particularly for smaller market entrants.

Opportunities (O) abound in emerging markets, characterized by rapid modernization of healthcare infrastructure and increasing government funding for specialized care units. The untapped potential in selective plasma adsorption technologies, which target specific pathogenic molecules while sparing essential plasma components, represents a major innovation opportunity. Additionally, the growing global requirement for source plasma used in the manufacturing of intravenous immunoglobulin (IVIG) and other plasma-derived therapies provides a stable, high-volume demand stream, irrespective of therapeutic device market fluctuations. Strategic partnerships with plasma collection centers and hospital groups are key to capitalizing on these opportunities.

The impact forces driving market evolution are strong, primarily propelled by favorable reimbursement policies in North America and Europe that cover TPE procedures for designated indications, providing financial feasibility for hospitals. Conversely, the market faces downward pressure from competition posed by alternative treatment modalities, such as high-dose intravenous immunoglobulin (IVIG) therapy, which can substitute TPE in certain conditions. The market’s sensitivity to public health crises, affecting blood donation rates and supply chain stability, further defines the risk landscape, making resilience and technological adaptability crucial components for long-term growth and sustained market presence.

Segmentation Analysis

The Plasmapheresis Device Market is comprehensively segmented based on product type, technology used for plasma separation, the therapeutic or clinical application, and the end-user setting where the devices are deployed. This detailed segmentation allows stakeholders to accurately gauge demand patterns, technological preferences, and regional adoption rates across the complex clinical and commercial landscape. The product segment is foundational, differentiating between the long-term capital expenditure associated with the main automated devices and the high-volume recurring expenditure of disposables. Understanding the segmentation by technology is crucial as it reflects the trade-offs between processing speed, selectivity, and cost efficiency, influencing device selection for specific clinical needs, such as high-volume source plasma collection versus intricate therapeutic exchanges.

Application-based segmentation highlights the clinical areas driving market demand. Neurological and immunological disorders historically necessitate the most frequent therapeutic plasma exchanges, while the application in hematology covers conditions like TTP. The end-user analysis provides insight into where the procurement power resides, identifying hospitals and specialized apheresis centers as the primary decision-makers, although dedicated blood centers dominate the source plasma collection segment. Market players strategically tailor their product features, marketing efforts, and distribution strategies to align with the unique demands and regulatory environments of these distinct segments, optimizing their market penetration and revenue streams.

- Product:

- Devices (Automated Plasmapheresis Systems)

- Disposables (Tubing Sets, Plasma Collection Bags, Separation Kits, Filters)

- Technology:

- Centrifugation (Continuous Flow, Intermittent Flow)

- Membrane Filtration (Hollow Fiber, Flat Sheet)

- Application:

- Neurology (Myasthenia Gravis, Guillain-Barré Syndrome, CIDP)

- Nephrology (Goodpasture’s Syndrome, Renal Transplant Rejection)

- Hematology (Thrombotic Thrombocytopenic Purpura (TTP), Hyperviscosity Syndrome)

- Immunology (Systemic Lupus Erythematosus (SLE), Vasculitis)

- Source Plasma Collection

- End-User:

- Hospitals and Clinics

- Blood Centers and Transfusion Centers

- Academic and Research Institutes

Value Chain Analysis For Plasmapheresis Device Market

The value chain for the Plasmapheresis Device Market begins with upstream activities centered on the procurement of high-grade raw materials, including specialized plastics (e.g., medical-grade polymers), sensitive membranes, sophisticated sensors, and electronic components necessary for automated systems. Key upstream challenges involve maintaining supply chain resilience and ensuring the biocompatibility and sterility of all contact materials, particularly those used in disposable kits. Manufacturing involves complex assembly processes, rigorous quality control, and adherence to global medical device standards (ISO, FDA, CE Mark). Research and development activities, focused on miniaturization, enhanced automation, and improving plasma separation efficiency, drive innovation at this stage, creating differentiated product offerings in a highly competitive landscape.

Midstream activities primarily focus on core manufacturing, assembly, and initial distribution logistics. The distribution channel is crucial, utilizing both direct and indirect sales models. Direct sales are often preferred for high-value automated devices to provide specialized installation, training, and ongoing technical support directly to major hospitals and blood centers. Indirect distribution, leveraging specialized medical device distributors and regional third-party logistics (3PL) providers, is more common for the high volume of disposable components and for penetrating smaller regional markets. Effective inventory management of disposables is a significant logistical task due to their critical, frequent-use nature.

Downstream activities involve market penetration, post-sale service, and end-user engagement. Key downstream players include major specialized distributors and local sales representatives who maintain relationships with clinical end-users (Hospitals, Blood Centers). After-sales support, including maintenance contracts for devices and guaranteed supply chain continuity for disposables, forms a critical part of the overall offering. Regulatory compliance at the point of care and user training are essential, influencing end-user satisfaction and repeat purchases. Success in the downstream segment is highly dependent on clinical evidence, product reliability, and a strong service network.

Plasmapheresis Device Market Potential Customers

The primary end-users and buyers of plasmapheresis devices and associated disposable products are institutions requiring critical blood management and therapeutic services. Hospitals, particularly large academic medical centers and specialized regional hospitals with dedicated Intensive Care Units (ICU), Neurology, Nephrology, and Hematology departments, represent the largest customer base for therapeutic apheresis devices. These institutions require high-throughput, reliable systems capable of managing acute and chronic patient care needs, driven by clinical guidelines for autoimmune and neurological emergencies. Their purchasing decisions are highly influenced by device reliability, operational costs (cost per procedure), and integration capabilities with existing hospital information systems (HIS).

A second, highly specialized customer segment includes dedicated Blood Centers, Plasma Collection Centers, and Blood Banks. These entities are primarily focused on large-scale source plasma collection for fractionation into pharmaceutical products. For this segment, the criteria shift toward maximizing plasma yield, ensuring donor safety, and achieving operational efficiency, often requiring continuous flow centrifugation systems optimized for speed and volume. The financial viability of these centers relies on securing high-volume, long-term contracts for their plasma supply, making system throughput and cost-effectiveness paramount purchasing considerations. This segment drives the bulk of demand for disposable collection kits.

Finally, smaller private clinics and specialized diagnostic centers focusing on specific niche conditions (e.g., autoimmune specialists) and academic research institutes also constitute valuable, albeit smaller, potential customer groups. These buyers often seek smaller, more portable, and sometimes more selective, membrane-based systems for research protocols or outpatient settings. Decision-makers across all segments include Chief Financial Officers (CFOs) managing capital budgets, Department Heads ensuring clinical efficacy, and Biomedical Engineers overseeing technical maintenance and safety compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fresenius Kabi, Baxter International, Haemonetics Corporation, Asahi Kasei Medical, Terumo BCT, Kawasumi Laboratories, Cerus Corporation, Miltenyi Biotec, B. Braun Melsungen, Nikkiso Co., Ltd., Kaneka Corporation, Macopharma, Grifols, CSL Plasma, Shandong Weigao Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plasmapheresis Device Market Key Technology Landscape

The core technology landscape of the Plasmapheresis Device Market is dominated by two primary methods of blood component separation: centrifugation and membrane filtration. Centrifugation technology utilizes centrifugal force to separate blood based on density. Continuous flow centrifugation (CFC) systems are particularly prevalent, offering efficient, high-volume processing required for both therapeutic exchange and large-scale source plasma collection. These systems minimize the extracorporeal volume, improving patient safety and procedure time. Technological advancements in centrifugation focus on optimizing bowl design, improving sensor accuracy for precise interface detection, and integrating automated anticoagulant management to further enhance operational efficiency and yield purity. The reliability and established clinical use of centrifugation technology ensure its sustained market leadership.

Membrane filtration, conversely, relies on semi-permeable membranes with specific pore sizes to separate plasma from cellular components under controlled pressure. This method often involves hollow-fiber filters and is preferred in specific therapeutic settings where rapid, low-volume processing is advantageous, or where high selectivity is needed (e.g., in double filtration plasmapheresis). Recent innovations are centered on developing highly selective adsorption columns and affinity membranes that specifically target and remove pathological substances (like LDL cholesterol or autoantibodies) from the plasma before returning the purified plasma, rather than requiring large-volume plasma replacement. This selectivity minimizes reliance on replacement fluids, reducing associated risks and costs, positioning membrane filtration as a key growth area for advanced therapeutic applications.

Beyond the core separation methods, significant technological efforts are directed towards ancillary improvements crucial for market acceptance. These include enhanced automation interfaces with intuitive touch screens, sophisticated monitoring systems that track venous access pressure and vital signs in real-time, and data logging capabilities to comply with stringent regulatory and quality reporting requirements. Portability and reduced footprint are also becoming key design parameters, enabling devices to be effectively deployed in smaller clinics and bedside environments. The convergence of these advanced engineering features with biological selectivity drives the market forward, improving the safety profile and expanding the clinical utility of plasmapheresis devices globally.

Regional Highlights

Geographically, the Plasmapheresis Device Market demonstrates distinct growth patterns and maturity levels across major regions, driven by variations in healthcare spending, disease prevalence, regulatory standards, and plasma collection volumes.

- North America (United States and Canada): This region commands the largest market share, characterized by high penetration of automated systems, favorable and comprehensive reimbursement structures for therapeutic apheresis, and an advanced infrastructure of specialized blood centers and hospitals. The high prevalence of autoimmune disorders, coupled with proactive adoption of new treatment guidelines and a strong presence of key market leaders (e.g., Haemonetics, Baxter), solidify its leading position. The demand here is equally split between therapeutic use and large-scale source plasma collection, which supports the region’s dominant role in the global supply of plasma-derived products.

- Europe (Germany, France, UK, Italy, Spain): Europe represents the second-largest market, marked by stringent quality controls for blood safety and robust public health systems. Germany, in particular, is a significant contributor due to its extensive network of specialized apheresis centers and high standards for device technology. Market growth is sustained by increasing therapeutic applications, technological acceptance, and continuous investment in upgrading hospital equipment. The regulatory landscape, influenced by the European Medicines Agency (EMA), drives innovation towards high-compliance and automated systems.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is poised to be the fastest-growing region during the forecast period. This rapid expansion is fueled by rising disposable incomes, improving access to advanced medical technology, and significant investment in healthcare infrastructure expansion. While Japan maintains high technical standards and a mature market similar to North America, emerging economies like China and India are characterized by immense unmet clinical needs, a large patient pool, and rapidly establishing plasma collection networks, presenting substantial market expansion opportunities for both therapeutic and donor applications.

- Latin America (LATAM): This region shows moderate growth, primarily driven by expanding medical tourism and the gradual integration of specialized treatments in major city hospitals (e.g., Brazil, Mexico). Market penetration is challenged by economic volatility and slower adoption of advanced capital equipment compared to developed regions, making cost-effective and rugged devices highly desirable.

- Middle East and Africa (MEA): Growth in MEA is sporadic, concentrated mainly in wealthy Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) which possess modern healthcare facilities and high per capita healthcare spending. Market development in Africa is limited by infrastructure constraints, lack of specialized personnel, and reliance on donations and foreign aid for high-cost devices and disposables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plasmapheresis Device Market.- Fresenius Kabi

- Baxter International

- Haemonetics Corporation

- Asahi Kasei Medical

- Terumo BCT

- Kawasumi Laboratories

- Cerus Corporation

- Miltenyi Biotec

- B. Braun Melsungen

- Nikkiso Co., Ltd.

- Kaneka Corporation

- Macopharma

- Grifols

- CSL Plasma

- Shandong Weigao Group

Frequently Asked Questions

Analyze common user questions about the Plasmapheresis Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary therapeutic applications driving the demand for plasmapheresis devices?

The primary drivers are neurological autoimmune disorders (such as Myasthenia Gravis and Guillain-Barré Syndrome), hematological conditions like Thrombotic Thrombocytopenic Purpura (TTP), and certain renal diseases (e.g., Goodpasture’s Syndrome). The devices are also crucial for large-scale source plasma collection used in manufacturing life-saving plasma-derived medicinal products (PDMPs).

How do centrifugation technology and membrane filtration differ in plasmapheresis?

Centrifugation separates plasma based on the density difference of blood components using rotational force, offering high throughput for both therapeutic and donor applications. Membrane filtration uses selective, semi-permeable filters to physically separate plasma, often favored for specialized therapeutic exchanges requiring higher selectivity or simpler operational setup.

Which geographical region exhibits the fastest growth potential for plasmapheresis devices?

The Asia Pacific (APAC) region, including countries such as China and India, is projected to demonstrate the highest growth rate. This acceleration is attributed to rapid improvements in healthcare infrastructure, increasing incidence of chronic diseases, and greater investment in establishing modern blood and plasma collection centers.

What is the main restraint impacting the widespread adoption of plasmapheresis systems?

The primary restraint is the significant cost associated with both the initial capital expenditure for the automated plasmapheresis devices and the ongoing, high-volume recurring cost of mandatory single-use disposable kits required for every therapeutic procedure, posing a barrier in cost-sensitive markets.

How is technological innovation affecting the future of plasmapheresis devices?

Innovation is focused on enhancing automation, improving procedural safety through integrated monitoring systems, and advancing selective adsorption technologies. These developments aim to personalize treatment, increase plasma yield purity, and expand the utility of plasmapheresis beyond traditional plasma exchange towards highly targeted therapeutic purification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager