Plastic Gear Resin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442910 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Plastic Gear Resin Market Size

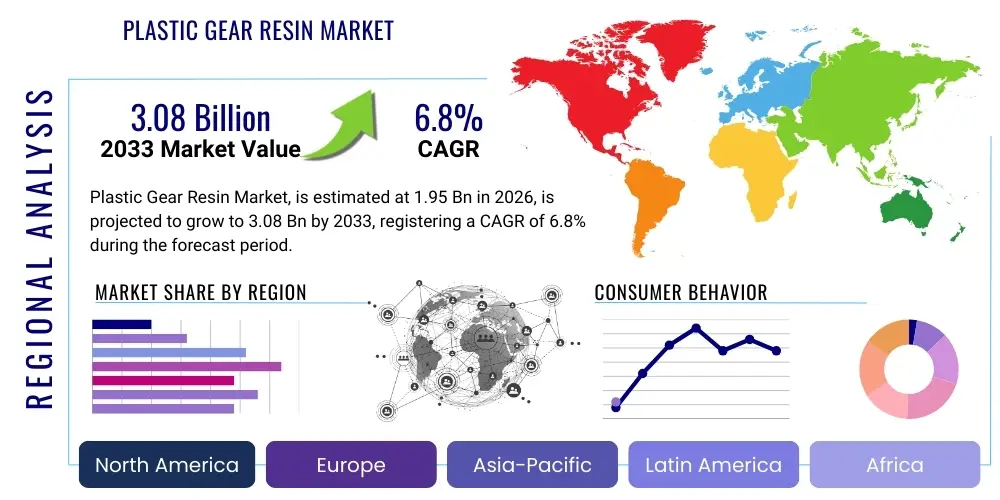

The Plastic Gear Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.08 Billion by the end of the forecast period in 2033.

Plastic Gear Resin Market introduction

The Plastic Gear Resin Market encompasses the production, distribution, and utilization of specialized thermoplastic and thermoset materials specifically engineered for manufacturing precision gears. These resins—including high-performance polymers like Polyoxymethylene (POM), Polyamide (PA, often referred to as Nylon), Polyether Ether Ketone (PEEK), and Polycarbonate (PC)—are crucial components across various mechanical systems where weight reduction, noise mitigation, self-lubrication, and chemical resistance are paramount requirements. Plastic gears offer significant advantages over traditional metallic gears, such as reduced mass, corrosion immunity, and the ability to operate effectively without external lubrication in many instances, leading to lower maintenance costs and enhanced operational efficiency. The market is witnessing robust growth driven by the proliferation of electric and hybrid vehicles (EVs/HEVs) which demand lightweight materials to maximize battery range and minimize operational noise, thereby necessitating a shift away from heavy metal components towards advanced engineered plastics capable of handling torque and wear stresses within demanding environments, particularly in automotive transmission systems and steering mechanisms. Furthermore, the inherent design flexibility offered by injection molding processes allows for complex gear geometries that are difficult or cost-prohibitive to achieve using traditional metal machining techniques, accelerating adoption across consumer electronics and specialized industrial machinery.

The product description for plastic gear resins emphasizes mechanical properties such as tensile strength, modulus of elasticity, thermal stability, and coefficient of friction. Resins are often compounded with various additives, including reinforcing fibers (like glass or carbon fiber) to enhance stiffness and strength, and internal lubricants (like PTFE or silicone) to improve wear resistance and reduce friction during meshing. For instance, POM is widely used for general-purpose applications due to its excellent dimensional stability and good balance of mechanical properties, while PEEK is reserved for highly demanding applications requiring extreme thermal resistance, chemical inertness, and superior mechanical performance under high load, often found in aerospace or medical device manufacturing. The ability to precisely tailor these material formulations to meet specific end-user specifications—such as operating temperature ranges, exposure to specific chemicals, or required torque transmission capabilities—is a key factor driving material selection and market dynamics. This customization allows manufacturers to optimize gear performance for applications ranging from delicate printer mechanisms to robust industrial power tools, thereby expanding the potential application scope beyond what traditional metallic materials could efficiently address. Continuous material innovation, focusing on nanocomposites and improved fiber reinforcement techniques, is enabling plastic gears to handle increasingly stringent load conditions.

Major applications of plastic gear resins span several high-growth industries. The automotive sector is the dominant consumer, utilizing plastic gears extensively in seating mechanisms, power windows, electric steering pumps, and especially in emerging drivetrain components of EVs where noise vibration and harshness (NVH) reduction is critical. The consumer goods sector employs these resins in appliances, toys, and handheld electronic devices, capitalizing on their lightweight nature and cost-effectiveness for mass production. In the medical field, plastic gears are vital for precision surgical instruments, fluid dispensing pumps, and diagnostic equipment due to their sterilizability, biocompatibility (for certain grades), and low inertia. The ongoing trend toward miniaturization across electronics and robotics further cements the role of plastic gear resins, as they facilitate the creation of smaller, more complex, and reliable motion control systems. The primary benefits driving adoption include significantly reduced component weight, which translates to fuel efficiency in transportation and portability in consumer electronics; superior resistance to corrosive agents; inherent dampening qualities that minimize operational noise compared to metal gears; and often lower overall system cost when considering mass production through efficient injection molding processes. These factors collectively underscore the market's trajectory, positioned favorably against global demands for lighter, quieter, and more energy-efficient mechanical solutions across multiple industrial verticals.

Plastic Gear Resin Market Executive Summary

The Plastic Gear Resin Market is characterized by intense technological innovation focused on developing high-performance polymer compounds capable of replacing metal components in critical load-bearing applications, thereby driving compelling business trends centered on sustainability and lightweight engineering across global manufacturing. Key business trends include the increasing integration of computer-aided engineering (CAE) and simulation tools into the material selection and gear design process, allowing manufacturers to predict wear, fatigue, and noise characteristics accurately before physical prototyping, thus accelerating time-to-market for complex systems, particularly those related to next-generation automotive transmissions and robotic actuators. Furthermore, strategic collaborations between polymer suppliers and end-use manufacturers (Tier 1 automotive suppliers, medical OEMs) are becoming common, aimed at co-developing customized resin formulations that meet stringent application-specific criteria, such as enhanced resistance to high temperatures generated by EV powertrains or resistance to harsh cleaning agents in medical environments. The competitive landscape is also seeing a rise in specialized compounding firms offering proprietary blended materials, challenging the dominance of major chemical conglomerates by focusing on niche, high-margin applications requiring unique material properties, such as enhanced tribological performance or static dissipation capabilities for electronic applications. The push for circular economy practices is influencing R&D, leading to greater efforts in developing recyclable and bio-based gear resins that offer comparable mechanical performance to traditional petroleum-derived polymers, reflecting a major shift in corporate responsibility and consumer preference.

Regional trends indicate that the Asia Pacific (APAC) region remains the largest and fastest-growing market for plastic gear resins, primarily fueled by the massive growth in automotive production, particularly in China and India, alongside the concentration of global consumer electronics and industrial machinery manufacturing in countries like South Korea, Japan, and Taiwan. APAC's rapid urbanization and subsequent expansion of infrastructure projects also drive demand for industrial machinery utilizing advanced polymer components. North America and Europe, while representing mature markets, exhibit strong demand for high-value, specialized resins like PEEK and high-end reinforced polyamides, driven by stringent regulatory frameworks concerning vehicle emissions (driving lightweighting efforts) and high standards in medical device manufacturing and aerospace applications, where reliability and traceability are non-negotiable. European markets, in particular, are pioneers in incorporating sustainable and recycled content into engineering plastics, setting a global precedent for environmentally conscious material sourcing. Latin America and the Middle East & Africa (MEA) are emerging regions, where adoption is accelerating due to increasing industrialization, particularly in sectors such as agriculture, oil & gas equipment, and automotive assembly operations, though these regions primarily focus on more conventional, cost-effective resins such as standard POM and PA6 components in mass-market applications.

Segmentation trends highlight the increasing prominence of high-performance resins (HPP) in terms of revenue growth, even though commodity resins like POM continue to dominate volumetric consumption. The Automotive segment maintains its position as the largest application area, driven significantly by the electric vehicle revolution, which relies heavily on plastic gears to ensure silent operation of auxiliary systems and minor mechanical components. Within the resin type segment, PEEK and specialized reinforced Nylon grades are experiencing rapid expansion due to their deployment in critical systems requiring superior wear resistance and thermal endurance beyond 150°C, such as under-the-hood applications or high-speed automation equipment. Conversely, the Industrial Machinery and Automation segment is increasingly embracing plastic gear solutions for robotics and linear motion systems, valuing the reduced inertia and precision capabilities offered by these lighter materials, which improve dynamic response and energy efficiency of automated equipment. Furthermore, the trend toward customizing gear modules—often involving inserts or overmolding dissimilar materials—is driving innovation in resin bonding technologies and multi-material injection molding techniques, providing engineers with greater flexibility in designing hybrid systems that capitalize on the strengths of both plastic and metal components in integrated assemblies. This focus on material synergy and application-specific formulation defines the current segment trajectories.

AI Impact Analysis on Plastic Gear Resin Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Plastic Gear Resin market reveals key thematic concerns centered around material discovery, manufacturing optimization, and predictive performance modeling. Users frequently inquire about how AI algorithms can accelerate the identification of novel polymer chemistries and additive combinations that yield superior mechanical properties, particularly focusing on optimizing parameters like fatigue life, friction coefficient, and noise profile without extensive, time-consuming physical testing. A significant concern revolves around the application of Machine Learning (ML) in injection molding—specifically, how AI can optimize process parameters (temperature, pressure, cycle time) in real-time to minimize defects (e.g., sink marks, warp) in complex gear geometries, thereby improving yield rates and reducing material waste, a major cost factor for high-value resins. Furthermore, end-users, especially in the automotive and aerospace sectors, are highly interested in AI-driven predictive maintenance models where sensor data from operational gears can be analyzed by ML systems to anticipate failure points and remaining useful life (RUL), thus enhancing system reliability and scheduling timely replacements. The overriding expectation is that AI will transition the market from an empirical, trial-and-error approach to a data-driven, predictive material science and manufacturing paradigm, significantly reducing R&D cycles and improving the consistency and lifetime of plastic gear components across all industrial applications, addressing the complexity inherent in predicting polymer behavior under dynamic load conditions.

The core implications of AI integration touch upon enhancing material synthesis and design verification, offering manufacturers unprecedented precision and efficiency. AI models, trained on vast datasets encompassing structure-property relationships of existing polymers and additives, can rapidly explore the combinatorial space of potential resin formulations, suggesting compositions that exhibit desired mechanical, thermal, and tribological characteristics. This capability drastically shortens the materials discovery phase for high-performance resins like reinforced nylons or advanced acetals, which traditionally rely on labor-intensive experimentation. By using generative design coupled with finite element analysis (FEA) validated by ML, engineers can quickly iterate on gear tooth profiles, pressure angles, and geometry optimizations specifically for plastic characteristics, mitigating common issues like root stress concentration or premature wear. The adoption of digital twin technology, underpinned by AI, allows for simulation of the entire life cycle of a plastic gear assembly within a digital environment, testing performance under extreme conditions (temperature fluctuations, high torque spikes) and providing reliable predictions about long-term durability, crucial for safety-critical applications like electric power steering systems.

In the manufacturing phase, the impact of AI is transforming injection molding operations, moving towards the concept of a self-optimizing factory floor. AI-powered quality control systems utilize machine vision and deep learning algorithms to inspect molded gears for minute surface defects, dimensional inconsistencies, and internal voids with greater accuracy and speed than human inspectors, ensuring higher product quality consistency, which is vital for noise-sensitive applications where even minor deviations can cause acoustic issues. Supply chain optimization benefits significantly from AI, helping resin producers and gear manufacturers forecast demand volatility, manage raw material inventory (especially specialty additives and fibers), and optimize logistics routes, thereby mitigating risks associated with supply chain disruptions that characterize the petrochemical industry. Overall, AI acts as an enabling technology that drives down costs through reduced material scrap and improved energy efficiency in molding processes, while simultaneously elevating the performance envelope of plastic gear resins by unlocking complex design spaces and facilitating the swift commercialization of advanced material compounds capable of competing directly with traditional metallic components in demanding industrial and automotive environments.

- AI accelerates the discovery and optimization of new resin formulations and additive packages, reducing R&D cycles for enhanced mechanical properties.

- Machine Learning (ML) optimizes injection molding parameters in real-time, minimizing manufacturing defects (e.g., warping, shrinkage) and improving yield rates significantly.

- AI-driven predictive maintenance systems utilize operational sensor data to forecast gear failure and Remaining Useful Life (RUL), increasing system reliability in critical applications.

- Generative design and optimization tools, powered by AI, enable the creation of complex, high-efficiency gear geometries specifically tailored for polymer characteristics.

- Advanced computer vision and deep learning algorithms enhance quality control, ensuring precise dimensional accuracy and surface finish compliance for noise-sensitive components.

- AI aids in simulating the long-term performance and fatigue life of plastic gears under various environmental and load conditions using sophisticated digital twin technology.

DRO & Impact Forces Of Plastic Gear Resin Market

The dynamics of the Plastic Gear Resin market are dictated by a confluence of accelerating drivers and persistent restraints, creating opportunities that shape strategic investments and technological advancements across the value chain. Primary market drivers include the pervasive global trend of vehicle lightweighting, critically intensified by the rapid adoption and scaling of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), where every kilogram saved directly contributes to increased battery range and enhanced energy efficiency. Plastic gears offer an average weight reduction of 50-70% compared to equivalent metal gears, making them indispensable for components such as electric pumps, actuators, and transmission auxiliary systems in next-generation mobility solutions. Another significant driver is the increasing demand for noise, vibration, and harshness (NVH) reduction across all mechanical assemblies, particularly in consumer electronics, medical devices, and quiet vehicle cabins; plastic gears inherently offer better damping characteristics and lower noise generation during operation due to their viscoelastic properties compared to metals, satisfying stringent acoustic requirements. Furthermore, the inherent design freedom and cost-efficiency associated with the mass production of complex plastic geometries via injection molding, especially when compared to the costly, multi-stage machining required for metal gears, provides a compelling economic incentive for manufacturers seeking scalable and reliable component sourcing. These factors collectively exert a powerful positive impact on market expansion, driving increased consumption of high-performance engineered resins capable of meeting stringent performance criteria.

Despite the powerful drivers, the market faces significant restraints that necessitate strategic mitigation and continued material innovation. A primary restraint is the performance ceiling of plastics, especially concerning high torque transmission and operation under extremely high temperatures or sustained high loads, which are environments traditionally dominated by steel or brass. While advanced polymers like PEEK offer substantial improvements, their cost remains prohibitively high for most mass-market applications, forcing a trade-off between performance and economic viability. Another constraint is the inherent coefficient of thermal expansion (CTE) of polymers, which is significantly higher than that of metals; this makes maintaining tight dimensional tolerances and consistent gear backlash challenging across wide temperature variations, potentially leading to operational failure or compromised efficiency, requiring specialized design compensation. Furthermore, the longevity and predictable fatigue life of plastic gears under dynamic loading, especially in humid or chemically aggressive environments, is sometimes viewed skeptically by engineers accustomed to the established durability standards of metallic materials, requiring extensive, application-specific validation and testing to build confidence. Lastly, processing complexities, particularly the accurate molding of fine-pitch, high-precision gears, demands highly sophisticated tooling and rigorous process control, creating a barrier to entry for smaller or less technologically advanced manufacturers.

The existing restraints and evolving technological landscape open substantial growth opportunities for the plastic gear resin market. The most prominent opportunity lies in the rapid advancement of Additive Manufacturing (AM), or 3D printing, which allows for rapid prototyping and low-volume production of highly complex, customized gear systems using engineering-grade polymers. This technology enables rapid iteration and immediate field testing of specialized designs, greatly benefiting highly customized machinery or niche industrial applications. Another significant opportunity stems from the development of advanced nanocomposites and bio-based polymers (e.g., specific grades derived from renewable resources), which aim to close the performance gap with traditional metals while meeting sustainability mandates. Integrating nanoparticles or specific reinforcing fillers can enhance strength, thermal conductivity, and wear resistance simultaneously, overcoming current performance limitations without sacrificing lightweighting benefits. Furthermore, the burgeoning robotics and factory automation sectors represent a high-growth end-user opportunity, demanding lightweight, low-inertia components for fast, precise movement, where the advantages of plastic gears in reducing inertia and minimizing operational noise are maximized. Strategic focus on specialized lubricants embedded within the resin matrix (self-lubricating composites) also addresses wear resistance concerns, thereby expanding the potential use of plastic gears into high-speed, demanding industrial applications previously reserved exclusively for lubricated metal systems, solidifying the market’s trajectory toward higher performance and greater ubiquity.

Segmentation Analysis

The Plastic Gear Resin Market is segmented based on critical parameters including Resin Type, Reinforcement Type, and End-use Application, providing granular insights into material preference and industry adoption patterns. The segmentation by resin type—covering categories such as POM, PA, PEEK, PC, and others (including high-performance specialty polyimides and polyesters)—is fundamental, reflecting the diverse performance needs across the market. POM and PA dominate the volume consumption due to their excellent balance of cost, mechanical strength, and moldability, suitable for consumer goods and standard automotive components. Conversely, PEEK and fluoropolymers constitute the high-value, niche segment, offering superior thermal and chemical resistance essential for aerospace, medical implantation, and demanding industrial applications where component failure is catastrophic. The ongoing shift toward high-speed and high-temperature environments in EV powertrains and advanced robotics necessitates a material evolution, favoring reinforced and specialized blends within these resin categories.

Analyzing the reinforcement type segment highlights the crucial role of additives in boosting the mechanical integrity of plastic gears. This segment is typically divided into Fiber-Reinforced (Glass Fiber, Carbon Fiber) and Unreinforced resins, in addition to specialty categories like PTFE/Silicone lubricated composites. Fiber reinforcement is essential for improving stiffness, tensile strength, and creep resistance, allowing plastic gears to withstand higher operational loads and temperatures, often substituting for metals in structural applications. Carbon fiber reinforcement, while more costly, offers exceptional strength-to-weight ratios and improved thermal stability, making it ideal for performance-critical components in racing and high-end industrial machinery. The inclusion of internal lubricants (e.g., PTFE, graphite, molybdenum disulfide) transforms the tribological properties of the plastic gear, allowing for dry running (self-lubrication) and significantly reducing friction and wear, thereby extending service life and eliminating the need for external grease or oil, a major benefit in contamination-sensitive applications like food processing or cleanroom environments.

The End-use Application segment demonstrates the market's dependence on industrial growth vectors, classifying demand into Automotive, Industrial Machinery/Automation, Consumer Goods, Medical Devices, and Aerospace & Defense. The Automotive sector remains the primary revenue generator, with increasing complexities in electrical systems (e.g., seat adjustment, throttle control, auxiliary pumps) driving sustained resin demand. The fastest growth, however, is projected in the Industrial Machinery and Automation segment, fueled by the global transition to Industry 4.0, which mandates precise, reliable, and maintenance-free motion control components for robotics and automated production lines. The Medical segment is characterized by stringent regulatory requirements but high-value consumption of specialty resins (e.g., PEEK, specific PAs) for sterilizable and biocompatible surgical tools and drug delivery systems. Understanding these segmentation nuances is crucial for resin manufacturers and compounders to align their product development strategies with the specific performance demands and regulatory landscape of key target industries.

- By Resin Type:

- Polyoxymethylene (POM)

- Polyamide (PA) / Nylon

- Polyether Ether Ketone (PEEK)

- Polycarbonate (PC)

- Others (e.g., Polyurethane, Acetal, Polyester, Polyimide)

- By Reinforcement Type:

- Unreinforced

- Fiber Reinforced (Glass Fiber, Carbon Fiber)

- Internally Lubricated (PTFE, Graphite)

- By Application:

- Automotive (Steering, Seating, Window Lifts, Transmission Auxiliaries, EV Components)

- Industrial Machinery and Automation (Robotics, Conveyor Systems, Valves)

- Consumer Goods (Appliances, Power Tools, Toys)

- Medical Devices (Pumps, Diagnostic Equipment, Surgical Tools)

- Aerospace and Defense

Value Chain Analysis For Plastic Gear Resin Market

The value chain for the Plastic Gear Resin Market is a complex structure involving multiple specialized stages, beginning with fundamental petrochemical production and culminating in the assembly of final mechanical systems, where efficiency and material quality are maintained through rigorous standards. The upstream segment is dominated by major chemical companies and petrochemical refineries responsible for producing the foundational monomers and base polymers (e.g., formaldehyde for POM, caprolactam for PA, and specialized monomers for PEEK). This stage involves energy-intensive polymerization processes and is highly sensitive to fluctuations in crude oil and natural gas prices, which directly impact the cost of raw materials. Key activities at this level include R&D focused on synthesizing new polymer backbone structures and ensuring consistent material purity required for demanding engineering applications. Suppliers in the upstream segment must possess extensive capacity and highly advanced chemical processing capabilities to meet the high volume and stringent quality specifications of engineering plastics used in gear manufacturing, establishing their role as critical price setters and innovation drivers for the entire market.

The midstream phase involves compounding, masterbatch formulation, and gear manufacturing, representing the critical transformation step where base polymers are converted into gear-ready resins. Compounding firms specialize in mixing the base polymer with reinforcing agents (glass fibers, carbon fibers), lubricants (PTFE, silicone), thermal stabilizers, and colorants to achieve the precise mechanical and tribological properties required by the end application, often requiring proprietary blending techniques and extrusion equipment. The efficiency and quality control within the compounding stage are paramount, as improper mixing or inadequate fiber dispersion can compromise the structural integrity and wear resistance of the final gear. Following compounding, specialized gear manufacturers utilize high-precision injection molding techniques, often employing advanced molds with high cavitation and tight tolerances, sometimes incorporating insert molding (combining plastic with metal hubs) to produce the final gear components. The focus at this stage is on minimizing dimensional variation (warp, shrinkage) and ensuring superior tooth profile accuracy, which directly correlates with gear noise levels and longevity, making technological expertise in tooling design and process control a major competitive differentiator.

The downstream segment covers distribution channels and the final integration into end-user products. Distribution relies on a mix of direct sales channels—where major resin suppliers sell compounded materials directly to large Tier 1 automotive or industrial component manufacturers—and indirect channels involving specialized distributors and agents who manage logistics, provide technical support, and supply materials to smaller manufacturers and custom shops. The efficiency of the distribution network is crucial for maintaining just-in-time (JIT) inventory management at assembly plants. The final assembly involves integrating the plastic gears into complex systems such as vehicle transmission units, medical pumps, or robotics arms. Key end-users (OEMs) prioritize reliable supply, material traceability, and consistency of mechanical properties. This downstream connectivity often drives feedback loops back to the upstream segment, where application failures or performance gaps inform future resin formulation R&D, ensuring continuous market alignment. The complexity of the components often requires specialized component testing and certification prior to final integration, particularly in safety-critical sectors, highlighting the importance of robust quality documentation throughout the entire value chain.

Plastic Gear Resin Market Potential Customers

Potential customers for plastic gear resins are primarily high-volume manufacturers and assemblers operating in industries where lightweighting, noise reduction, and corrosion resistance are critical performance differentiators, making Tier 1 automotive suppliers the largest and most strategically important segment. These suppliers, such as those providing complex modular systems like electric power steering (EPS), automatic climate control systems (HVAC), and window lift mechanisms, have a consistent, large-scale demand for materials that enable cost-effective, high-precision component manufacturing. The shift towards electric powertrains has amplified demand from EV component manufacturers who require extremely quiet auxiliary gears for cooling pumps, oil pumps, and range-extending actuators, preferentially selecting high-grade POM and specialized low-noise nylons. These customers seek materials that offer guaranteed performance consistency, adherence to stringent automotive standards (e.g., USCAR, ISO/TS 16949), and robust supply chain resilience, often entering into long-term strategic supply agreements with major resin producers to secure proprietary formulations and volumes necessary for global production lines and ensuring material performance under extreme temperature variations typically encountered in vehicular operations.

Another high-growth segment of potential customers includes manufacturers specializing in industrial machinery, factory automation, and specialized robotics. Companies producing linear actuators, conveyor systems, precision measuring equipment, and articulated robot arms require plastic gears for their low inertia, which permits faster acceleration and deceleration, leading to higher throughput and greater energy efficiency in automated processes. Furthermore, the self-lubricating properties of composite resins (e.g., PEEK compounded with PTFE) are highly valued in environments where external lubrication is impractical or undesirable, such as clean rooms, packaging machinery, and textile equipment, reducing maintenance downtime and contamination risks. These customers typically demand resins that offer superior wear resistance and dimensional stability under continuous heavy cycling, driving the consumption of reinforced and high-modulus polymers. The rise of Industry 4.0 dictates that these components must be highly reliable and compatible with sophisticated monitoring systems, increasing the preference for resins that offer predictable long-term performance and durability in dynamic operating conditions.

High-value, niche customers include medical device manufacturers and aerospace component producers. Medical OEMs utilize plastic gears in critical devices like insulin pumps, surgical robots, and diagnostic imaging equipment, requiring materials that are biocompatible, easily sterilized (e.g., resistance to gamma or ethylene oxide sterilization cycles), and capable of maintaining ultra-high precision over the life of the product, favoring specialized PEEK and medical-grade Nylon 12. Aerospace applications focus on highly reliable, lightweight components for non-structural, internal mechanisms in aircraft and defense systems, requiring res

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.08 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Inc., BASF SE, Solvay SA, Mitsubishi Chemical Corporation, SABIC, Victrex plc, Celanese Corporation, Ensinger GmbH, Evonik Industries AG, Toray Industries, Inc., Polyplastics Co., Ltd., EMS-Grivory (Ems-Chemie Holding AG), Ascend Performance Materials, RTP Company, Saint-Gobain S.A., Ticona GmbH, LG Chem, Formosa Plastics Corporation, LNP Engineering Plastics (now part of SABIC), Kuraray Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Gear Resin Market Key Technology Landscape

The technological landscape of the Plastic Gear Resin market is primarily defined by advancements in materials science, precision manufacturing, and simulation tools aimed at achieving higher strength-to-weight ratios and extended wear life under increasingly demanding operational conditions. A pivotal technology is the development of high-performance polymer matrix composites (PMCs), specifically integrating various reinforcing agents such as long and short carbon fibers, glass fibers, and aramid fibers into high-temperature resins like PEEK and reinforced PA. This compounding technology involves optimizing fiber length, orientation, and dispersion within the polymer matrix to maximize mechanical properties while maintaining moldability. Crucially, advancements in surface modification techniques—including plasma treatment and specialized coatings—are being employed to enhance the adhesion between the reinforcing fibers and the polymer base, which significantly reduces creep and improves fatigue resistance, enabling these plastics to withstand stresses previously manageable only by metal components, particularly in demanding automotive transmission sub-assemblies and heavy-duty industrial gearing systems.

Precision manufacturing techniques, especially high-cavitation, hot runner injection molding, are essential for mass-producing complex, fine-pitch plastic gears with the necessary dimensional accuracy. Technological innovation here focuses on tooling materials (often hardened steel or specialty alloys) and advanced sensor integration within the mold itself to monitor temperature and pressure profiles in real time. This highly controlled molding environment is necessary to counteract the inherent volume shrinkage and anisotropic behavior of semi-crystalline polymers like POM and PA, which can lead to warping or deviations in tooth profile crucial for silent operation. Furthermore, the integration of specialized post-molding processes, such as annealing or controlled cooling cycles, is critical to relieve internal stresses within the component, thereby stabilizing the dimensions and improving the long-term reliability of the gear, especially those intended for precision motion control in robotics or aerospace applications. The ability to consistently replicate complex geometries at scale while minimizing flash and defects defines the state-of-the-art in plastic gear production technology.

Additive Manufacturing (AM), or 3D printing, has emerged as a disruptive technology, particularly for rapid prototyping and low-volume production of specialty plastic gears, allowing for highly complex, customized designs that are impossible or too expensive to achieve via injection molding. Technologies like Selective Laser Sintering (SLS) and High-Speed Extrusion (HSE) using high-temperature engineering plastics offer a pathway for functional end-use parts. Concurrently, advanced simulation and modeling software, often incorporating AI/ML capabilities, form the cornerstone of the design phase. These tools allow engineers to accurately model viscoelastic behavior, predict wear rates based on material tribological data, simulate thermal stress distribution, and perform NVH analysis prior to manufacturing. This predictive capability significantly reduces development time and costs, ensuring that the chosen resin and geometry meet performance specifications under dynamic load conditions. The convergence of advanced materials, sophisticated molding process control, and predictive simulation technology is collectively accelerating the replacement of metal gears across various industrial sectors by offering lightweight, high-performance polymer alternatives with predictable service lives and superior acoustic properties.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Plastic Gear Resin Market, primarily driven by its status as the world’s manufacturing hub for automotive, consumer electronics, and industrial machinery. Countries like China, India, Japan, and South Korea exhibit massive production volumes of both traditional gasoline vehicles and, more importantly, Electric Vehicles (EVs). The demand for lightweight, low-noise components in new energy vehicles is the principal driver for the region’s high consumption rate of high-performance polyamides and acetals. Furthermore, rapid industrialization, expansion of automated factories, and high domestic demand for consumer electronics requiring miniature plastic gear systems contribute to APAC's sustained leadership in market size and growth rate.

- North America: North America represents a mature, high-value market, characterized by stringent performance standards, particularly in the aerospace, defense, and high-end automotive sectors. The region is a significant consumer of specialty resins such as PEEK and advanced reinforced composites, driven by the demand for highly reliable, traceable components in safety-critical applications. The increasing domestic production of sophisticated medical devices and the focus on industrial automation (robotics) within the U.S. and Canada sustain robust demand for resins that offer exceptional durability, chemical resistance, and precise dimensional stability, often justifying the higher material costs associated with premium grades.

- Europe: Europe is characterized by a strong emphasis on sustainability, coupled with demanding regulations regarding vehicle emissions and noise standards, driving rapid adoption of plastic gears for lightweighting and NVH reduction across the automotive industry (e.g., Germany, France). European manufacturers are pioneers in utilizing recycled and bio-based engineering plastics, creating a specialized market segment focused on eco-friendly resin solutions. The region's advanced industrial base and significant investments in precision industrial automation and robotics further stimulate demand, particularly for specialty materials offering long-term reliability and chemical resistance in corrosive environments.

- Latin America (LATAM): The LATAM market is experiencing steady growth, largely dependent on the expansion of local automotive assembly operations and infrastructure development, particularly in Brazil and Mexico. Consumption is primarily concentrated in standard and mid-range performance resins like POM and PA6 for cost-sensitive consumer goods and entry-level automotive components. Market expansion is closely tied to foreign direct investment in manufacturing and the ongoing urbanization trends, gradually increasing the technological sophistication required for localized production.

- Middle East and Africa (MEA): MEA is an emerging market with potential driven by industrial diversification efforts and large-scale infrastructure projects. The demand for plastic gear resins is concentrated in specific sectors like oil & gas equipment (requiring high chemical and temperature resistance) and localized assembly of consumer products. Growth is moderate and selective, heavily influenced by global commodity pricing and technological transfer from international manufacturing partners who introduce advanced plastic solutions into the regional supply chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Gear Resin Market.- DuPont de Nemours, Inc.

- BASF SE

- Solvay SA

- Mitsubishi Chemical Corporation

- SABIC

- Victrex plc

- Celanese Corporation

- Ensinger GmbH

- Evonik Industries AG

- Toray Industries, Inc.

- Polyplastics Co., Ltd.

- EMS-Grivory (Ems-Chemie Holding AG)

- Ascend Performance Materials

- RTP Company

- Saint-Gobain S.A.

- Ticona GmbH

- LG Chem

- Formosa Plastics Corporation

- LNP Engineering Plastics (now part of SABIC)

- Kuraray Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Plastic Gear Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of plastic gears over metal gears?

Plastic gears offer significant advantages including substantial weight reduction (up to 70%), inherent self-lubrication capabilities, superior noise dampening characteristics (NVH reduction), corrosion resistance, and simplified, cost-effective mass production through injection molding processes, critical for automotive and consumer applications.

Which resin types are commonly used for high-stress and high-temperature plastic gear applications?

For high-stress, high-temperature applications, specialty resins such as Polyether Ether Ketone (PEEK), specific grades of Polyimide (PI), and heavily reinforced Polyamide (PA, Nylon) compounded with carbon or glass fibers are predominantly used due to their superior thermal stability and mechanical strength under dynamic load conditions.

How is the Electric Vehicle (EV) industry impacting the demand for plastic gear resins?

The EV industry is a major growth driver, demanding plastic gears to achieve critical vehicle lightweighting for extended battery range and to ensure extremely quiet operation (low NVH) in auxiliary systems like pumps, actuators, and HVAC, accelerating the adoption of high-performance, low-noise polymer materials.

What role does 3D printing play in the Plastic Gear Resin Market?

Additive Manufacturing (3D printing) is primarily utilized for rapid prototyping, design iteration, and the low-volume production of highly customized, complex gear geometries using engineering-grade polymers, providing greater design freedom and shorter lead times compared to traditional injection molding for specialized machinery.

What are the main restraints hindering the broader adoption of plastic gears?

Key restraints include the relatively high cost of specialty high-performance resins (like PEEK), the challenge of maintaining dimensional stability under wide temperature fluctuations (high Coefficient of Thermal Expansion), and the performance limitations related to transmitting extremely high torque loads compared to traditional metallic alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager