Plastic Medical Packaging Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441892 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Plastic Medical Packaging Market Size

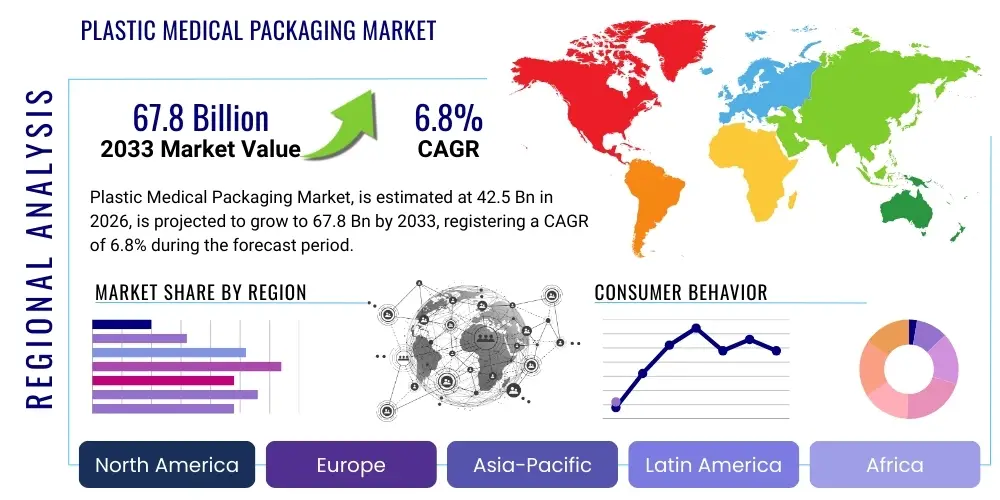

The Plastic Medical Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 42.5 Billion in 2026 and is projected to reach USD 67.8 Billion by the end of the forecast period in 2033.

Plastic Medical Packaging Market introduction

The Plastic Medical Packaging Market encompasses the design, manufacturing, and utilization of polymer-based materials for enclosing, protecting, and identifying sterile medical devices, pharmaceuticals, and biological products. This sector is critical to the healthcare ecosystem, ensuring product integrity, sterility maintenance, and patient safety throughout the supply chain. Key products range from rigid trays, blisters, pouches, and bags to specialized containers and bottles, utilizing polymers such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC), though PVC use is steadily declining due to regulatory and environmental pressures. The primary function is to provide an effective barrier against external contaminants, moisture, and light, while also facilitating compatibility with standard sterilization methods, including Ethylene Oxide (EtO), gamma irradiation, and steam sterilization.

Major applications of plastic medical packaging span diverse segments of the healthcare industry, including pharmaceutical packaging (e.g., blister packs, drug bottles, pre-filled syringes), medical device packaging (e.g., surgical kits, implants, catheters), and in-vitro diagnostics (IVD). The escalating global demand for single-use medical devices, coupled with the rapid expansion of the generic and specialty drug sectors, fuels market growth. Furthermore, the inherent benefits of plastic—lightweight nature, design flexibility, cost-effectiveness, and excellent barrier properties—make it the material of choice over traditional alternatives like glass or paperboard for many sterile applications.

Driving factors for this market include the aging global population increasing chronic disease prevalence, which subsequently boosts healthcare expenditure and the volume of medical procedures. Technological advancements in polymer science, leading to the development of high-performance barrier films and bio-compatible materials, are enabling sophisticated packaging solutions required by advanced minimally invasive surgeries and sensitive biologics. Regulatory stringency from bodies like the FDA and EMA mandates high standards for package integrity and material safety, pushing manufacturers toward consistent quality and innovation, particularly in tamper-evident and child-resistant designs, further solidifying the market’s positive trajectory.

Plastic Medical Packaging Market Executive Summary

The Plastic Medical Packaging Market is experiencing robust expansion driven by pronounced shifts in pharmaceutical delivery methods and evolving regulatory landscapes favoring patient safety and sterilization efficacy. Business trends highlight a strong industry focus on sustainable packaging solutions, with manufacturers increasingly investing in recycled content polymers (rPET, rPP) and mono-material structures to enhance recyclability without compromising sterile barrier integrity. Furthermore, the trend toward flexible packaging, particularly sterile barrier pouches and thermoformed trays utilizing specialized co-extruded films, is capturing significant market share due to superior cost profiles and suitability for high-speed automated packaging lines. Consolidation among major packaging providers is a persistent feature, aiming to offer integrated, global supply chain solutions to large multinational pharmaceutical and medical device corporations, emphasizing vertical integration from material sourcing to final conversion.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive government investment in healthcare infrastructure, rapidly expanding domestic pharmaceutical manufacturing bases in countries like China and India, and rising disposable incomes leading to greater access to advanced medical treatment. North America and Europe, while mature, maintain their dominance in revenue contribution due to stringent regulatory frameworks that mandate high-quality packaging for complex devices and biologics, spurring innovation in barrier technology and smart packaging features (e.g., RFID, NFC tags for traceability). The Middle East and Africa (MEA) and Latin America are showing accelerated growth, primarily driven by the increasing adoption of pre-packaged, disposable medical consumables and growing harmonization of local packaging standards with international guidelines.

Segmentation analysis reveals that the pharmaceutical segment, including primary packaging for injectable drugs and oral solids, retains the largest market share due to the sheer volume of production. However, the medical devices segment is projected to exhibit the highest CAGR, primarily fueled by the proliferation of minimally invasive surgical tools and high-value orthopedic implants that require customized, highly protective plastic packaging solutions (e.g., sterile header bags and rigid blisters compatible with terminal sterilization). In terms of material, Polypropylene (PP) and Polyethylene (PE) collectively dominate the market, favored for their excellent chemical resistance, sterilization compatibility (especially EtO and gamma), and versatility across various packaging formats, from films to rigid containers, supporting the overarching industry push towards performance-driven yet economically viable packaging choices.

AI Impact Analysis on Plastic Medical Packaging Market

Common user questions regarding AI's influence on the Plastic Medical Packaging Market frequently revolve around efficiency, quality control, and predictive maintenance. Users seek to understand how AI algorithms can enhance visual inspection systems to detect minute defects in films or seals, thereby reducing packaging failures and costly product recalls. Another key area of inquiry focuses on the application of machine learning (ML) to optimize the supply chain, specifically predictive modeling for raw material sourcing (e.g., polymer resins) and demand forecasting to minimize inventory waste. Furthermore, manufacturers are keenly interested in utilizing AI tools for R&D—simulating material performance under various sterilization conditions or predicting the shelf-life stability of new barrier films—thereby accelerating the development cycle for next-generation sterile packaging solutions. These themes reflect a clear industry expectation: AI must drive down operational costs while simultaneously elevating the stringent quality requirements dictated by healthcare regulators.

- AI-enhanced Quality Control: Implementation of deep learning algorithms in high-speed vision systems for detecting micro-cracks, pinholes, or sealing inconsistencies in sterile packaging, drastically reducing human error and improving integrity testing.

- Predictive Maintenance: Use of AI to analyze equipment sensor data (e.g., thermoforming machines, sealers) to anticipate component failure, optimizing maintenance schedules and minimizing costly unplanned downtime on critical production lines.

- Supply Chain Optimization: ML models deployed for forecasting raw material requirements (polymer resins, additives), optimizing logistics routes, and managing complex cold chain requirements for sensitive biological packaging.

- Packaging Design Simulation: AI assisting R&D teams in simulating the performance of new plastic packaging geometries and material combinations against stress factors like sterilization temperatures, physical handling, and long-term shelf-life degradation.

- Process Parameter Optimization: Utilizing AI and big data analytics to fine-tune sealing temperatures, pressure, and dwell times across different plastic film types to ensure optimal sterile barrier formation and repeatability.

- Regulatory Compliance Assistance: AI platforms used for automated document generation and compliance checks, ensuring that packaging specifications and validation reports meet evolving global standards (e.g., ISO 11607).

DRO & Impact Forces Of Plastic Medical Packaging Market

The dynamics of the Plastic Medical Packaging Market are fundamentally shaped by a powerful interplay of growth drivers, regulatory restraints, and technological opportunities, all filtered through significant impact forces that determine profitability and market direction. The primary driver is the pervasive global demand for enhanced healthcare accessibility and infrastructure expansion, particularly in emerging economies, alongside the relentless growth of the biotechnology and pharmaceutical sectors requiring specialized, high-barrier packaging for sensitive drugs. This demand is intrinsically linked to demographic shifts, specifically the aging population and the increasing prevalence of chronic diseases, necessitating continuous high-volume production of disposable medical supplies and unit-dose pharmaceuticals. Parallel to this, advances in packaging machinery automation and material science, enabling thinner, yet stronger, multilayer films and recyclable polymers, serve as crucial technological enablers that support market scalability and cost efficiency.

Conversely, the market faces significant restraints, most notably the escalating environmental concerns surrounding single-use plastics. Regulatory bodies and consumer pressure are intensely focused on reducing plastic waste, leading to mandates and voluntary commitments that challenge the status quo, especially for non-recyclable or difficult-to-recycle multi-layer medical packaging structures. Furthermore, the volatility of raw material prices, particularly petrochemical-derived polymer resins, introduces cost uncertainty and operational risk for manufacturers. Stringent and ever-evolving international standards (e.g., biocompatibility testing, leachables/extractables protocols) require substantial investment in validation and quality assurance, often acting as a barrier to entry for smaller manufacturers and slowing down the introduction of new packaging innovations.

Opportunities within the market largely center on material innovation and functional integration. The shift towards sustainable materials, including bio-plastics derived from renewable sources or truly recyclable mono-material barrier systems, represents a major untapped opportunity for competitive differentiation. Moreover, the integration of smart packaging features—such as temperature monitoring indicators, serialization, and authenticity verification tools—presents a high-value niche addressing patient adherence and supply chain security concerns. Key impact forces shaping the market trajectory include the rapid transition to home healthcare settings, which necessitates robust, easy-to-use, and highly durable packaging for complex device kits, and the constant pressure from healthcare purchasing organizations to reduce costs, forcing suppliers to innovate packaging designs that minimize material usage while maintaining uncompromising safety standards. These forces collectively dictate that successful market participation requires a balance between regulatory compliance, high performance, and environmental responsibility.

Segmentation Analysis

The Plastic Medical Packaging Market is comprehensively segmented based on material type, product format, application area, and geographical region, providing a granular view of market dynamics. Understanding these segments is crucial as material selection is heavily influenced by sterilization requirements and drug/device compatibility, while product format is determined by functional requirements such as ease of opening, barrier protection, and handling characteristics during surgical procedures or drug administration. The application segment, dividing the market into pharmaceuticals and medical devices, dictates the required regulatory oversight and performance specifications, with medical devices often requiring customized, highly rigid plastic solutions compared to the high-volume, standardized needs of the pharmaceutical sector.

- By Material Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC) - Declining Usage

- Polystyrene (PS)

- Other Plastics (e.g., Polyamides, EVOH, PCTFE)

- By Product Format:

- Bags and Pouches (Sterile barrier systems, IV bags)

- Containers and Bottles (Liquid formulations, tablets)

- Trays and Clamshells (Rigid thermoformed packaging for devices)

- Blister Packaging (Pharmaceutical tablets, unit dose)

- Closures and Seals

- Ampoules and Vials (Including plastic alternatives)

- By Application:

- Pharmaceuticals (Oral Solids, Liquids, Injectables, Biologics)

- Medical Devices (Surgical Instruments, Implants, Diagnostic Devices, Catheters)

- In-Vitro Diagnostics (IVD)

Value Chain Analysis For Plastic Medical Packaging Market

The value chain for plastic medical packaging begins with the upstream sourcing and production of raw materials, primarily petrochemical feedstocks which are converted into specialized polymer resins (PP, PE, PET, etc.) by major chemical companies. This stage is highly capital-intensive and subject to commodity price volatility. Suppliers in this segment focus on developing medical-grade resins that comply with strict biocompatibility standards (USP Class VI) and are certified for use with specific sterilization methods. The quality and purity of these resins directly impact the downstream packaging performance, making material standardization and traceability essential early in the chain. Differentiation at this stage often involves the creation of unique barrier resins or advanced multilayer film components.

The midstream comprises the converters and fabricators—companies that process the raw resins into final packaging formats such as thermoformed trays, injection-molded bottles, flexible films, and sterile pouches. This stage requires high precision manufacturing, including cleanroom operations (ISO Class 7 or 8) and specialized machinery for printing, lamination, co-extrusion, and sealing. Value addition occurs through customization, utilizing advanced barrier coatings (e.g., plasma coating) and designing intricate packaging solutions that integrate features like tamper evidence or child resistance. The complexity and regulatory burden of manufacturing sterile barrier systems mean that converters must maintain rigorous quality management systems (ISO 13485) to ensure compliance before product delivery.

The downstream distribution channel involves packaging manufacturers supplying directly to pharmaceutical companies, medical device manufacturers, and contract manufacturing organizations (CMOs). Distribution is highly specialized, often requiring direct sales models to manage complex packaging specifications and validation processes. Direct channels dominate for high-volume or highly customized packaging requirements. Indirect channels, involving specialized healthcare distributors or regional agents, are sometimes utilized for standard, off-the-shelf components. The end of the chain is characterized by the integration of the packaging onto the final product assembly line of the end-user (e.g., aseptic filling lines), where efficiency, reliability, and guaranteed sterility are paramount considerations for logistics and inventory management.

Plastic Medical Packaging Market Potential Customers

The primary customers for the Plastic Medical Packaging Market are multinational and regional pharmaceutical manufacturing firms, which constitute the largest volume segment. These customers require massive quantities of standard packaging solutions—such as blister foils, high-density polyethylene (HDPE) bottles for tablets, and specialized plastic components for injectable drug systems (e.g., syringe components, cartridges). Their purchasing decisions are driven by cost-effectiveness, regulatory acceptance (e.g., DMF registration), and guaranteed compatibility with high-speed automated filling and packaging lines. The increasing shift towards biological and personalized medicine necessitates collaboration with packaging providers to develop novel primary containers that protect sensitive formulations from oxygen, moisture, and light degradation.

A second major customer base comprises the global medical device and diagnostics companies. These entities require highly customized, often rigid, thermoformed plastic packaging solutions (trays, clamshells) for protecting complex, high-value items like surgical kits, orthopedic implants, and sophisticated electronic monitoring devices. Key procurement criteria in this sector include the ability of the plastic packaging to withstand terminal sterilization (EtO or gamma irradiation) without structural compromise, maintain sterility for extended periods (shelf-life), and facilitate aseptic presentation in operating theaters (peelability, tear resistance). Suppliers often work in partnership with device manufacturers from the early design stages to ensure packaging fits the product’s unique requirements.

Additional potential buyers include Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs), which handle outsourcing services for both pharma and device companies. These customers require flexible, high-capacity packaging supply that can adapt quickly to multiple client specifications and regulatory requirements. Furthermore, hospitals, clinics, and government healthcare purchasing agencies are direct purchasers of pre-packaged disposable medical supplies and kits, driving demand for secondary and tertiary plastic packaging that is efficient, easy to store, and minimizes waste in clinical settings. The burgeoning segment of home healthcare providers also represents a growing customer base, demanding packaging that is intuitive for patients and caregivers to handle outside of a professional medical environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 42.5 Billion |

| Market Forecast in 2033 | USD 67.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Berry Global Inc., WestRock Company, Gerresheimer AG, AptarGroup, Inc., Huhtamaki Oyj, Sealed Air Corporation, Constantia Flexibles, SCHOTT AG, Klöckner Pentaplast, TekniPlex, Inc., UDG Healthcare plc, Becton, Dickinson and Company (BD), Wihuri Group, Catalent, Inc., CCL Industries Inc., Placon Corporation, Sonoco Products Company, Printpack, Inc., SteriPackGroup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Medical Packaging Market Key Technology Landscape

The current technology landscape in plastic medical packaging is heavily focused on material science innovations aimed at enhancing barrier properties and sustainability, alongside advancements in manufacturing processes to ensure superior integrity and efficiency. A critical technology involves the development of high-performance, multilayer co-extruded films that utilize polymers like Ethylene Vinyl Alcohol (EVOH) or cyclic olefin copolymers (COC) to achieve exceptional oxygen and moisture barriers necessary for sensitive pharmaceuticals (e.g., biologics and vaccines). This multilayer approach ensures maximum shelf-life while minimizing material thickness. Parallel innovation is seen in anti-microbial packaging technologies, where active agents are embedded within the plastic matrix to reduce surface microbial load, an increasingly important feature for device packaging used in infection control.

Manufacturing process technologies are centered on advanced sealing and forming precision. High-speed thermoforming and form-fill-seal (FFS) equipment now incorporate sophisticated sensors and closed-loop control systems to ensure consistent sealing parameters (temperature, pressure, dwell time) critical for maintaining the sterile barrier integrity required by ISO 11607 standards. Furthermore, advancements in solvent-free lamination and extrusion coating are enabling the production of cleaner, more environmentally compliant flexible packaging structures. A key challenge being addressed technologically is the transition from conventional PVC, particularly in IV bags and tubing, towards alternatives like polyolefins (PP/PE blends) or specialized elastomers, driven by concerns over plasticizers and improved recyclability.

The integration of digital technologies represents another significant technological frontier. Serialization and track-and-trace capabilities are being implemented using high-resolution printing techniques for unique identifiers and integrated smart labels (RFID/NFC). These technologies allow real-time monitoring of product location and temperature conditions throughout the supply chain, essential for preventing counterfeiting and ensuring cold chain compliance. Additionally, the increasing reliance on automation in packaging lines requires plastics with optimized coefficient of friction (COF) and anti-static properties to facilitate smooth, high-speed handling without jamming or attracting particulates in cleanroom environments. The overall trend is towards integrated systems that offer verifiable performance, enhanced security, and minimized environmental footprint.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by the presence of global pharmaceutical and medical device giants, coupled with highly advanced healthcare infrastructure and stringent regulatory mandates (FDA). The market here is characterized by high adoption rates of advanced packaging solutions, including high-barrier films for complex drug delivery systems and specialized trays for minimally invasive surgical instruments. Innovation is focused on smart packaging features for traceability and compliance, and the region is leading the push towards sustainable, recyclable plastic solutions, often exceeding industry averages in rPET and rPP usage. The rapid growth of the biotechnology sector further contributes substantially to the demand for specialized primary containers compatible with sensitive biologics.

- Europe: Europe represents a mature but highly dynamic market, heavily influenced by the European Medicines Agency (EMA) regulations and strong industry commitments to circular economy principles. Key drivers include the massive output of generic drugs and the strong focus on patient safety, leading to high demand for child-resistant and tamper-evident plastic closures and blister packaging. Germany, France, and the UK are key contributors. Sustainability pressure is particularly high, forcing manufacturers to aggressively pursue mono-material structures, material lightweighting, and chemical recycling partnerships to meet ambitious recycling targets set by the EU directives.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, owing to rapid urbanization, increasing healthcare spending (especially in China, India, and Japan), and the expansion of local manufacturing capabilities. Government initiatives to improve access to essential medicines and the rise of medical tourism contribute significantly to demand. While cost remains a critical factor, the increasing adoption of international quality standards (like ISO 11607) in countries such as South Korea and Australia is accelerating the demand for high-quality, sterile plastic packaging, moving away from lower-cost, less-regulated alternatives. The market here is undergoing significant capacity expansion to meet regional drug production needs.

- Latin America (LATAM): The LATAM market is characterized by moderate but steady growth, driven by improvements in public health systems and increasing foreign investment in local pharmaceutical production facilities, particularly in Brazil and Mexico. The demand is heavily concentrated in essential pharmaceutical packaging (bottles, blister packs). Challenges include economic instability and fragmented regulatory environments, which sometimes slow the adoption of the latest technological advancements in sterile packaging, although harmonization efforts are improving market conditions.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with the Gulf Cooperation Council (GCC) countries leading in healthcare expenditure and infrastructure development, driving demand for advanced, imported medical packaging. Investment in local pharmaceutical manufacturing (e.g., in Saudi Arabia and UAE) is increasing the need for compliant primary plastic packaging materials. The African continent presents significant long-term potential, primarily for basic pharmaceutical containers and disposable medical supplies, driven by initiatives aimed at combating infectious diseases and improving access to primary healthcare.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Medical Packaging Market.- Amcor plc

- Berry Global Inc.

- WestRock Company

- Gerresheimer AG

- AptarGroup, Inc.

- Huhtamaki Oyj

- Sealed Air Corporation

- Constantia Flexibles

- SCHOTT AG

- Klöckner Pentaplast

- TekniPlex, Inc.

- UDG Healthcare plc

- Becton, Dickinson and Company (BD)

- Wihuri Group

- Catalent, Inc.

- CCL Industries Inc.

- Placon Corporation

- Sonoco Products Company

- Printpack, Inc.

- SteriPackGroup

Frequently Asked Questions

Analyze common user questions about the Plastic Medical Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory standards governing plastic medical packaging materials?

The primary regulatory standards include ISO 11607 (Packaging for terminally sterilized medical devices), which dictates performance requirements for sterile barrier systems. Materials must also adhere to biocompatibility guidelines such as USP Class VI and often comply with regional regulatory bodies like the FDA (U.S.) and EMA (Europe) regarding extractables and leachables testing to ensure patient safety.

How is the focus on sustainability impacting material choices in medical plastic packaging?

Sustainability is driving a significant shift away from multi-material, hard-to-recycle plastics toward mono-material structures (e.g., all-polyolefin solutions) that retain barrier properties while facilitating mechanical or chemical recycling. Manufacturers are also increasingly adopting bio-based polymers and post-consumer recycled (PCR) content, provided they meet strict medical-grade purity and sterilization compatibility requirements.

Which plastic materials are most compatible with common sterilization methods?

Polypropylene (PP) and Polyethylene (PE) are highly compatible with Ethylene Oxide (EtO) and gamma irradiation, making them favored choices for medical devices. High-density polyethylene (HDPE) bottles are standard for pharma. Steam sterilization (autoclaving) typically requires high-temperature tolerant materials, where certain grades of PP and specialized thermoplastic elastomers (TPEs) are essential.

What is the key difference in packaging needs between pharmaceuticals and medical devices?

Pharmaceutical packaging (blisters, bottles) focuses on mass-produced, high-volume consistency, moisture/oxygen barrier, and child safety. Medical device packaging (trays, pouches) requires highly customized, rigid protection against physical damage, superior seal integrity for sterility maintenance over long shelf lives, and aseptic presentation capability in a clinical setting.

How do smart packaging technologies enhance security and efficiency in this market?

Smart packaging integrates features like NFC tags, RFID labels, or printed temperature indicators, enhancing security by enabling verifiable product authentication and combating counterfeiting. For efficiency, these technologies allow for real-time traceability throughout the supply chain and ensure temperature compliance for cold chain logistics, minimizing product loss and improving inventory management accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager