Plastic Medical Stopcock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443346 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Plastic Medical Stopcock Market Size

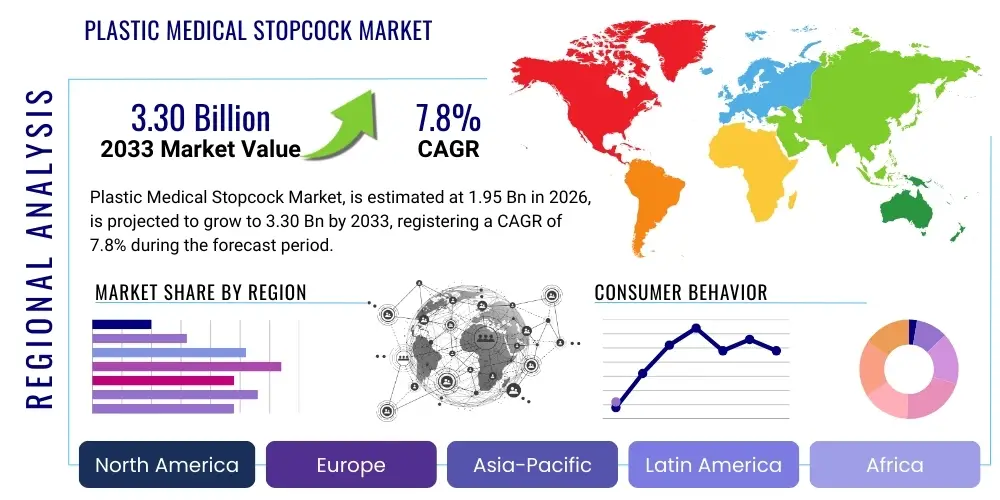

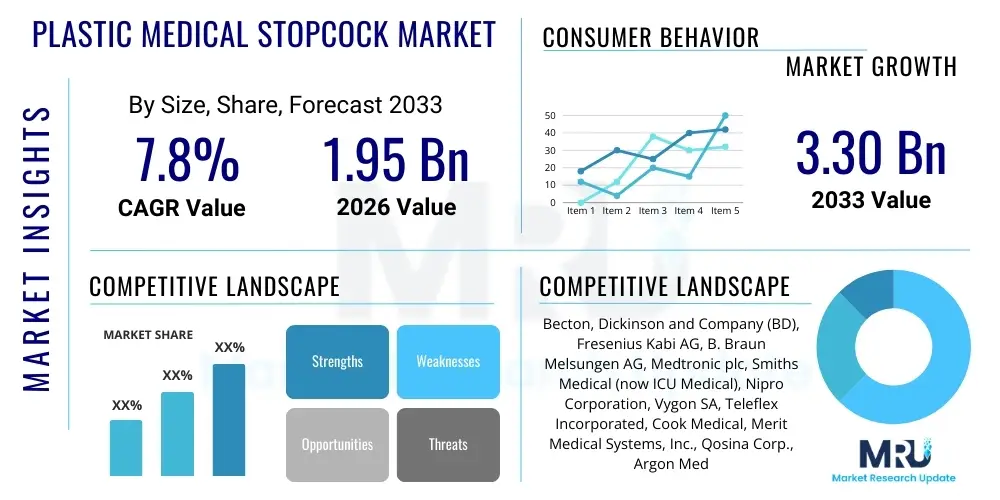

The Plastic Medical Stopcock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.30 Billion by the end of the forecast period in 2033. This expansion is primarily driven by the increasing global volume of surgical procedures, the rising prevalence of chronic diseases necessitating continuous intravenous drug administration, and the stringent regulatory requirements promoting the use of disposable, sterile fluid management components in critical care settings. The intrinsic properties of plastic materials, offering cost-effectiveness, disposability, and chemical inertness, position them as the preferred choice over traditional metal components, further fueling market growth across developed and emerging healthcare economies.

Plastic Medical Stopcock Market introduction

The Plastic Medical Stopcock Market encompasses the global trade and utilization of multi-way fluid control devices crafted primarily from medical-grade plastics such as polycarbonate, polyethylene, and PVC, essential for directing and controlling the flow of intravenous fluids, medications, and monitoring solutions within patient care environments. These crucial components are indispensable in complex medical procedures, including anesthesia, hemodialysis, angiography, and intensive care monitoring, serving as a sterile junction point to connect, divert, or stop fluid lines safely and efficiently. The core product function revolves around meticulous fluid management, ensuring precise dosing and preventing cross-contamination, which are fundamental requirements for improving patient outcomes and maintaining the integrity of sterile circuits in hospitals and ambulatory surgical centers.

Key applications of plastic medical stopcocks span across various clinical departments, particularly in infusion therapy where multiple lines converge (e.g., administering simultaneous drugs and nutritional solutions), blood pressure monitoring systems (to zero out pressure transducers), and in catheterization laboratories where controlled fluid delivery is paramount. The increasing complexity of patient management, often requiring multiple concurrent infusions, elevates the demand for reliable, multi-port stopcocks. Furthermore, the global shift towards single-use disposable medical devices to mitigate the risks associated with Healthcare-Associated Infections (HAIs) acts as a persistent structural driver for this market segment, solidifying the plastic stopcock's role as a ubiquitous disposable consumable in modern healthcare infrastructure. The inherent benefits, including reduced risk of fluid leakage, ease of operation, compatibility with various drugs, and superior cost performance compared to reusable components, continue to propel adoption globally.

Driving factors for sustained market expansion include the exponential increase in the geriatric population worldwide, which consequently leads to a greater incidence of chronic cardiovascular, renal, and neurological disorders requiring advanced fluid management systems and prolonged hospital stays. Regulatory bodies, especially the FDA and EU MDR, have continually emphasized patient safety and sterility, mandating high-quality manufacturing processes for all contact medical devices, including stopcocks, which inadvertently favors established manufacturers capable of meeting these stringent quality benchmarks. Moreover, technological advancements focusing on features such as integrated safety mechanisms (e.g., lipid-resistant materials, luer locks with clear tactile feedback) and low-dead-space designs to minimize residual volume and bacterial contamination are constantly enhancing product utility and driving replacement cycles in key clinical areas.

Plastic Medical Stopcock Market Executive Summary

The global Plastic Medical Stopcock Market is characterized by robust business trends centered on consolidation, innovation in material science, and a strong regulatory emphasis on safety and standardization, driving consistent demand across acute care settings. Regionally, North America and Europe maintain dominance due to established healthcare infrastructure, high healthcare spending, and rapid adoption of advanced monitoring technologies, while the Asia Pacific region is demonstrating the highest growth trajectory, fueled by expanding surgical volumes, increasing penetration of health insurance, and infrastructural development in large emerging economies such as China and India. Segment-wise, the 3-way stopcocks remain the dominant product type owing to their versatility in complex multi-infusion protocols, and angiography and radiology procedures constitute the fastest-growing application segment due to the increasing volume of minimally invasive diagnostics and therapeutic interventions worldwide.

Key business strategies observed include strategic partnerships between stopcock manufacturers and major infusion pump and IV set providers to offer integrated fluid delivery solutions, which enhances supply chain efficiency and market penetration. Furthermore, manufacturers are increasingly investing in automation and lean manufacturing processes to manage costs and maintain competitive pricing, particularly in light of escalating raw material costs and global supply chain volatility. The trend toward stopcocks made from specialized, high-performance plastics that are resistant to aggressive lipid emulsions and chemotherapy drugs is a critical area of product development, ensuring compatibility and reducing the risk of material degradation in specialized therapies. Sustainability is also emerging as a minor but growing trend, prompting research into bio-based or easily recyclable medical-grade plastics, though regulatory compliance remains the primary constraint in material selection.

The competitive landscape is fragmented yet characterized by the strong presence of global medical device giants who leverage extensive distribution networks and robust regulatory compliance records to maintain market share. Pricing pressure is intense in volume-driven segments, necessitating continuous operational excellence and technological differentiation for sustainable profitability. The rise of sophisticated, automated fluid control systems and smart infusion pumps, while complementary, also sets a higher benchmark for stopcock design, requiring seamless integration and reliable performance under varied pressure conditions. Addressing the distinct regional needs—such as providing high-volume, cost-effective stopcocks in APAC versus specialized, feature-rich stopcocks in North America—is essential for maximizing global market coverage and achieving scale efficiencies in this highly necessary medical consumables sector.

AI Impact Analysis on Plastic Medical Stopcock Market

User questions regarding the impact of Artificial Intelligence (AI) on the Plastic Medical Stopcock Market primarily revolve around whether AI could automate the manufacturing process, optimize quality control to eliminate defects, and potentially revolutionize inventory management and supply chain logistics for these high-volume consumables. Users seek clarity on how predictive analytics might influence raw material procurement, anticipating demand fluctuations based on epidemic patterns or surgical schedules, and whether AI-driven vision systems can ensure zero-defect production, thereby enhancing the overall reliability and safety of these critical components. The consensus expectation is that AI's influence will be indirect but profound, focusing almost entirely on the upstream production and logistical phases rather than the device's passive clinical function itself.

AI's primary influence is expected to dramatically enhance the operational efficiency and quality assurance aspects of stopcock production. By implementing sophisticated machine learning algorithms for predictive maintenance on injection molding equipment, manufacturers can minimize unplanned downtime and ensure high utilization rates, which is crucial for meeting the continuous, high-volume demand characteristic of this market. Furthermore, AI-powered vision systems are being deployed for real-time inspection, capable of detecting microscopic material flaws, molding inconsistencies, and minor component misalignments far faster and more reliably than traditional human inspection methods, leading directly to reduced waste and higher compliance with strict medical device standards. This technological integration ensures that the plastic stopcocks entering the supply chain are optimized for safety and performance, indirectly supporting the clinical confidence in their use.

In the supply chain realm, AI and deep learning models are transforming inventory management by analyzing historical consumption data, seasonal variations, and regional healthcare utilization rates to create highly accurate demand forecasts. This predictive capability allows manufacturers and distributors to optimize stocking levels, reduce obsolescence, and ensure timely delivery to critical care units globally, effectively minimizing the risk of supply shortages, especially during unpredictable events like pandemics. While the stopcock itself remains a simple, non-electronic device, the surrounding ecosystem of its production, distribution, and consumption is becoming increasingly intelligent, leading to substantial cost savings and enhanced responsiveness, ultimately stabilizing the cost and availability of this essential medical consumable worldwide.

- AI optimizes injection molding parameters for reduced cycle time and material waste.

- Machine vision systems powered by AI ensure 100% defect detection in manufacturing.

- Predictive maintenance algorithms reduce equipment downtime in high-volume production lines.

- AI-driven supply chain analytics improve demand forecasting and inventory management precision.

- Generative AI assists in designing complex geometries for low-dead-space stopcocks.

DRO & Impact Forces Of Plastic Medical Stopcock Market

The dynamics of the Plastic Medical Stopcock Market are shaped by powerful forces encompassing increasing global healthcare expenditures and rising surgical volumes (Drivers), coupled with intense pricing pressure and stringent material quality requirements (Restraints). Opportunities lie predominantly in integrating stopcocks with advanced monitoring kits and exploiting the high-growth potential of emerging markets, particularly in Asia Pacific and Latin America, where infrastructural development is accelerating. The most significant impact force stems from the pervasive necessity of fluid management in nearly all acute care settings and the uncompromising demand for single-use disposables to prevent Hospital-Acquired Infections, creating a highly resilient and inelastic demand curve for these products regardless of economic fluctuations.

Key drivers include the global demographic shift toward an aging population, which requires more frequent and complex medical interventions, necessitating precise fluid and pressure management using multi-port stopcocks. Furthermore, the expansion of minimally invasive procedures, such as interventional cardiology and radiology, requires specialized, high-pressure stopcocks compatible with power injectors and contrast media, broadening the product's functional scope and overall market size. Conversely, the market faces significant restraints, including the high volatility of polymer raw material prices, which directly impacts manufacturing costs and profit margins, and the rigorous regulatory hurdles, particularly in obtaining approvals for new materials or designs under frameworks like the EU MDR, which can slow down innovation and market entry for smaller players. Moreover, the constant pressure from group purchasing organizations (GPOs) to lower per-unit cost poses a continuous challenge to maintaining high-quality production standards while remaining cost-competitive.

Market opportunities are significant in developing value-added stopcock systems, such as those pre-assembled onto infusion sets or integrated with needle-free connectors, simplifying setup for clinicians and reducing touchpoints, thereby minimizing contamination risk. Expansion into home healthcare and long-term care facilities, which are increasingly managing chronic conditions requiring continuous infusion therapy, presents a largely untapped market segment. The impact forces are further amplified by the consolidation of healthcare systems globally, leading to larger centralized purchasing power, which intensifies competitive pressure among vendors. Technological impact forces, particularly the development of stopcocks with enhanced chemical resistance (e.g., lipid resistance) and integrated anti-microbial coatings, continue to drive premium pricing in specialized clinical applications where device performance is absolutely critical to patient safety, setting a higher barrier for entry and forcing continuous innovation within the established product categories.

Segmentation Analysis

The Plastic Medical Stopcock Market is comprehensively segmented based on product type, material, application, and end-user, reflecting the diverse clinical needs and operational environments where these devices are utilized. Product segmentation, differentiating between 1-way, 2-way, 3-way, and 4-way configurations, is crucial as it dictates the complexity of fluid management the stopcock can handle, with 3-way stopcocks dominating due to their optimal balance of functionality and simplicity in multi-infusion therapies. Material segmentation emphasizes medical-grade polymers like PC, PVC, and HDPE, where selection is governed by required chemical compatibility, pressure resistance, and cost-effectiveness. The application landscape is broad, covering critical areas such as anesthesia, interventional radiology, and intensive care units, each demanding specific performance characteristics, driving tailored product development and strategic marketing efforts across these specialized medical fields.

The end-user segment clearly delineates the primary consumers, dominated by hospitals and specialized clinics, which account for the vast majority of consumption due to the high volume of acute care procedures performed. Ambulatory Surgical Centers (ASCs) represent a high-growth segment, driven by the shift of less complex procedures out of traditional hospital settings, increasing demand for reliable, cost-efficient disposables. Furthermore, the segmentation by pressure capacity—standard pressure versus high-pressure stopcocks—is becoming increasingly relevant, especially with the proliferation of high-flow administration sets and automated power injectors utilized in contrast media delivery, requiring devices capable of safely handling pressures up to 1200 psi. This granular segmentation allows market players to target their innovation and sales efforts precisely, optimizing product portfolios for maximum impact across varied healthcare settings and clinical needs, recognizing that a stopcock used in basic IV therapy differs significantly from one used in cardiac angiography.

The meticulous segmentation analysis confirms the maturity of the market while highlighting pockets of rapid growth, particularly within the segment of stopcocks designed for use with blood products and chemotherapeutic agents, which require enhanced material integrity and specific safety features to prevent accidental disconnection or drug incompatibility. Understanding these segment dynamics is critical for forecasting, allowing stakeholders to anticipate shifts in demand based on changes in surgical trends or the adoption rate of new monitoring technologies. The overarching trend across all segments is the increasing requirement for standardization, often manifesting as color-coded handles or clearly labeled flow direction indicators, which directly addresses clinical concerns regarding medication errors and improves procedural efficiency in high-stress clinical environments.

- Product Type: 1-Way Stopcocks, 2-Way Stopcocks, 3-Way Stopcocks, 4-Way Stopcocks, Integrated Stopcock Systems

- Material: Polycarbonate (PC), Polyvinyl Chloride (PVC), Polyethylene (PE), Other Medical-Grade Polymers

- Application: Infusion Therapy, Pressure Monitoring, Anesthesia, Interventional Radiology & Cardiology, Respiratory Care

- End User: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Home Healthcare Settings

- Pressure Rating: Standard Pressure Stopcocks, High-Pressure Stopcocks

Value Chain Analysis For Plastic Medical Stopcock Market

The value chain for the Plastic Medical Stopcock Market begins with the upstream sourcing of specialized medical-grade polymer resins, predominantly from chemical manufacturers, where strict quality control over polymerization and purity is paramount, often necessitating specialized compounding facilities to achieve the required biocompatibility and physical properties. This phase involves negotiating long-term supply contracts, managing raw material price volatility (a major cost driver), and ensuring compliance with global material safety standards (e.g., USP Class VI, ISO 10993). The midstream phase involves the core manufacturing process, dominated by high-precision injection molding, automated assembly, and stringent sterilization (typically ETO gas or irradiation), requiring significant capital investment in cleanroom facilities and advanced robotics to maintain the high-volume, low-cost production demanded by the market. Efficiency in this manufacturing stage, including tooling design and minimizing material scrap, directly dictates final product cost and competitive advantage.

The downstream distribution channel is critical, marked by a dual approach involving both direct sales to large hospital networks and Group Purchasing Organizations (GPOs), and indirect distribution through a complex network of specialized medical device distributors and wholesalers. Direct sales offer greater control over pricing and customer relationships, often preferred for large-volume contracts, while indirect channels provide essential market reach into smaller clinics, rural hospitals, and international markets where local regulatory expertise is necessary. The relationship between manufacturers and distributors is often complex, requiring careful management of inventory levels, ensuring product traceability, and providing comprehensive technical support and training to end-users on safe and proper device usage. Efficiency in logistics, given the global nature of stopcock consumption, is paramount to minimize storage costs and ensure rapid delivery to critical care centers.

The final stage of the value chain involves the end-user interaction within the healthcare system, focusing on procurement, clinical application, and subsequent disposal. End-users (hospitals/clinics) prioritize product reliability, ease of use, compatibility with existing equipment (especially luer connections and infusion pumps), and bundled pricing offers from GPOs. Manufacturers who invest in effective clinical education, packaging designed for aseptic presentation, and robust post-market surveillance gain a competitive edge by minimizing clinical errors and enhancing perceived product value. Ultimately, the entire value chain is governed by the necessity for complete sterility and regulatory compliance, making vertical integration of quality control processes, from raw material inspection to final packaging, a critical success factor in this highly regulated medical consumables market.

Plastic Medical Stopcock Market Potential Customers

The primary and largest segment of potential customers for plastic medical stopcocks includes general acute care hospitals, encompassing all levels of patient complexity, from routine post-operative care to specialized critical care and trauma units. These institutions are massive consumers due to the ubiquitous use of stopcocks in intravenous fluid administration, drug delivery, central venous pressure monitoring, and arterial line management across virtually every department, particularly intensive care units (ICUs), operating rooms (ORs), and emergency departments (EDs). The procurement decisions in this segment are heavily influenced by centralized GPO contracts, requiring manufacturers to provide bulk volumes, stringent quality documentation, and competitive pricing structures to secure large, multi-year supply agreements. The sheer volume of procedures performed globally within hospital settings secures their position as the market's foundational demand source.

A rapidly expanding customer base is represented by specialized clinics and Ambulatory Surgical Centers (ASCs), which focus on high-volume, less invasive procedures like ophthalmology, endoscopy, and pain management. As healthcare systems increasingly push procedures toward outpatient settings to reduce costs, ASCs require high-quality, reliable, and standardized stopcocks, prioritizing compact packaging and ease of integration into streamlined procedural kits. This customer segment is characterized by faster decision cycles and a preference for direct supplier relationships or specialized regional distributors who can offer personalized service and manage smaller, more frequent deliveries. The growth of interventional radiology centers and cardiac catheterization labs, which require specialized high-pressure stopcocks for rapid contrast injection, further solidifies the importance of specialty clinics as a distinct and lucrative customer demographic.

Finally, the long-term care facilities and the emerging home healthcare market constitute a significant, albeit challenging, customer segment. As chronic diseases are managed increasingly outside the hospital environment, patients require ongoing infusion therapies (e.g., parenteral nutrition, long-term antibiotics). Stopcock demand in this area is driven by the need for simple, highly reliable, user-friendly devices suitable for non-clinical caregivers or self-administration, often packaged as components of comprehensive infusion kits. While the volume per facility is lower than a major hospital, the large number of these sites and the trend towards decentralized care ensure sustained, incremental growth. Manufacturers must adapt their distribution strategies to reach smaller, dispersed points of care, often relying on specialized medical supply retailers and integrated pharmacy services to serve this geographically widespread and sensitive customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.30 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), Fresenius Kabi AG, B. Braun Melsungen AG, Medtronic plc, Smiths Medical (now ICU Medical), Nipro Corporation, Vygon SA, Teleflex Incorporated, Cook Medical, Merit Medical Systems, Inc., Qosina Corp., Argon Medical Devices, Inc., Codan Medical, SCW Medicath Ltd., Dispomedicor Zrt., Plasti-med, Neomedic International, Romsons Group, Halyard Health, Vogt Medical Vertrieb GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plastic Medical Stopcock Market Key Technology Landscape

The technology landscape in the Plastic Medical Stopcock Market is primarily centered on advancements in polymer science, precision manufacturing techniques, and ergonomic design aimed at enhancing safety, reducing contamination risk, and ensuring compatibility with increasingly specialized medical fluids. Key technological innovations involve the development of high-performance, lipid-resistant polycarbonate and polysulfone materials that maintain structural integrity when exposed to aggressive drug carriers like intravenous lipid emulsions (ILEs), crucial for Total Parenteral Nutrition (TPN) and certain chemotherapy protocols. Furthermore, the integration of advanced anti-microbial technologies, such as silver-impregnated plastics or specific surface treatments, aims to inhibit bacterial colonization on the external and internal surfaces of the stopcock, thereby reducing the critical risk of catheter-related bloodstream infections (CRBSIs), a major focus area for hospital quality metrics.

Manufacturing technology emphasizes ultra-precise injection molding and automated assembly processes to produce stopcocks with minimal "dead space," which refers to the residual volume left within the component that can harbor microbes or cause unwanted drug mixing. Low-dead-space design is a significant technological differentiator, ensuring accurate drug delivery and minimizing contamination risk, particularly relevant in neonatal and pediatric critical care where dosing precision is paramount. Automated leak testing and pressure validation techniques, often employing highly sophisticated sensor arrays and robotics, ensure that every unit can withstand the dynamic pressures inherent in infusion and monitoring systems (e.g., up to 1200 psi for high-pressure applications), guaranteeing patient safety and system reliability under stress.

Ergonomic and user-interface technologies, while seemingly minor, play a crucial role in reducing human error. This includes incorporating clear, standardized color-coding systems for ports, developing locking mechanisms (such as robust luer locks or luer slip combinations) that provide clear auditory and tactile feedback upon secure connection, and designing stopcock handles for intuitive, unidirectional flow control. The increasing trend towards stopcocks being pre-assembled into specialized, integrated manifold systems is another key technological approach, where multiple stopcocks are molded together with extension lines and safety caps, reducing the need for manual connection in the clinical setting and streamlining complex setups, offering tangible improvements in procedural efficiency and sterility control for end-users across critical and acute care environments globally.

Regional Highlights

- North America: This region maintains its position as the largest market, characterized by high adoption rates of advanced fluid management systems, significant healthcare expenditure, and the presence of major global medical device manufacturers. Stringent regulatory standards (FDA) necessitate high-quality, compliance-driven product offerings. The demand is heavily focused on integrated stopcock manifolds and specialized high-pressure stopcocks used in interventional procedures. The large volume of complex surgeries and critical care admissions drives continuous, high-value consumption.

- Europe: The second-largest market, Europe is driven by robust healthcare infrastructure, particularly in Germany, France, and the UK. The implementation of the new Medical Device Regulation (MDR) has forced manufacturers to consolidate product lines and enhance documentation, favoring established players with proven quality systems. The region shows strong demand for stopcocks with lipid-resistant properties and those compliant with regional standards for material safety and environmental impact, pushing innovation in specialized polymers.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR due to burgeoning healthcare investments, rapid infrastructure development, and a massive, increasing patient pool requiring medical interventions. Countries like China, India, and Japan are expanding their hospital capacities and modernizing existing facilities. While cost-sensitivity remains a factor, the focus is shifting towards quality and safety, driving rapid uptake of standard 3-way plastic stopcocks and attracting increased investment in local manufacturing capabilities to serve the immense market size.

- Latin America (LATAM): Growth in this region is stimulated by improving access to healthcare, increasing insurance penetration, and foreign direct investment in private healthcare facilities, particularly in Brazil and Mexico. The market often balances cost-effectiveness with necessary quality, leading to mixed sourcing strategies involving both global premium brands and more cost-efficient local or Asian suppliers. Standardization and basic fluid management systems are primary demand drivers.

- Middle East and Africa (MEA): Market growth is concentrated in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to ambitious healthcare vision programs and high per capita healthcare spending. These regions import advanced medical technology, leading to demand for premium, high-quality stopcocks. In contrast, the African continent presents significant long-term growth potential, contingent on improving healthcare access and infrastructure, currently favoring high-volume, cost-effective product solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plastic Medical Stopcock Market.- Becton, Dickinson and Company (BD)

- B. Braun Melsungen AG

- Fresenius Kabi AG

- Medtronic plc

- Smiths Medical (now ICU Medical)

- Nipro Corporation

- Vygon SA

- Teleflex Incorporated

- Cook Medical

- Merit Medical Systems, Inc.

- Qosina Corp.

- Argon Medical Devices, Inc.

- Codan Medical

- SCW Medicath Ltd.

- Dispomedicor Zrt.

- Plasti-med

- Neomedic International

- Romsons Group

- Halyard Health

- Vogt Medical Vertrieb GmbH

Frequently Asked Questions

Analyze common user questions about the Plastic Medical Stopcock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Plastic Medical Stopcock Market?

The fundamental driver is the global increase in surgical procedures, the rising prevalence of chronic conditions requiring continuous intravenous therapy, and the universal mandate for disposable fluid control devices to mitigate the risk of healthcare-associated infections (HAIs) across all critical care settings.

What are the key differences between 3-way stopcocks and integrated manifold systems?

A 3-way stopcock offers a single control point to manage three fluid lines, providing versatility for basic infusion protocols. Integrated manifold systems combine multiple stopcock units and extension lines into a single, pre-assembled, sterile component, drastically reducing setup time and minimizing contamination risk in complex, multi-infusion procedures.

How does the type of plastic material affect stopcock performance in clinical applications?

Material selection, such as polycarbonate or PVC, dictates critical performance characteristics, including pressure resistance (especially for high-flow radiology applications), chemical compatibility (resistance to aggressive lipid emulsions or solvents in chemotherapy drugs), and the overall biocompatibility required for direct patient contact as regulated by agencies like the FDA and ISO standards.

Which geographic region currently dominates the Plastic Medical Stopcock Market in terms of market share?

North America holds the largest market share, attributed to its advanced and heavily financed healthcare infrastructure, high volume of sophisticated medical procedures, and the swift adoption of premium, safety-engineered fluid management products, though the Asia Pacific region is expected to demonstrate the fastest growth rate over the forecast period.

What impact do supply chain challenges, particularly raw material cost volatility, have on stopcock manufacturers?

Raw material cost volatility, especially concerning medical-grade polymer resins, is a significant restraint as it directly affects the manufacturing cost base for these high-volume consumables. Manufacturers often counter this through long-term supply contracts, operational efficiency improvements like lean manufacturing, and adopting higher levels of automation in production to maintain competitive pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager