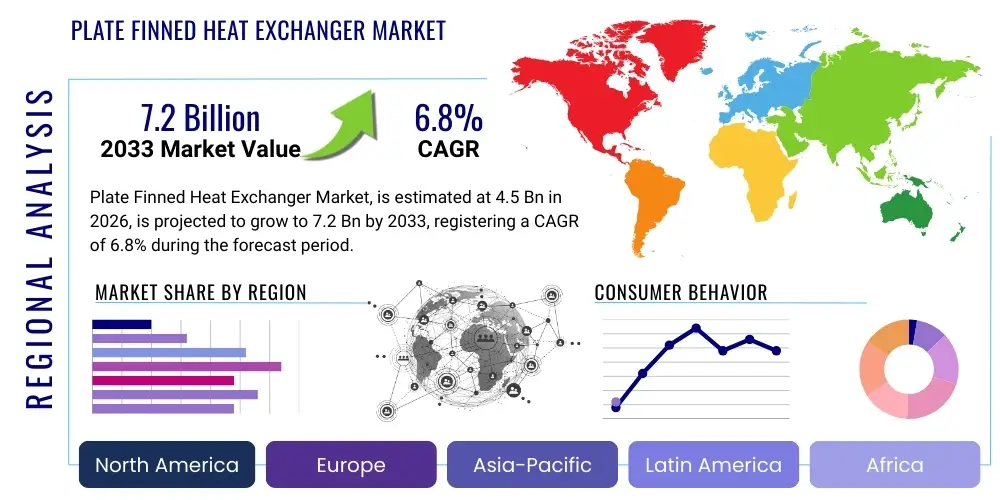

Plate Finned Heat Exchanger Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441988 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Plate Finned Heat Exchanger Market Size

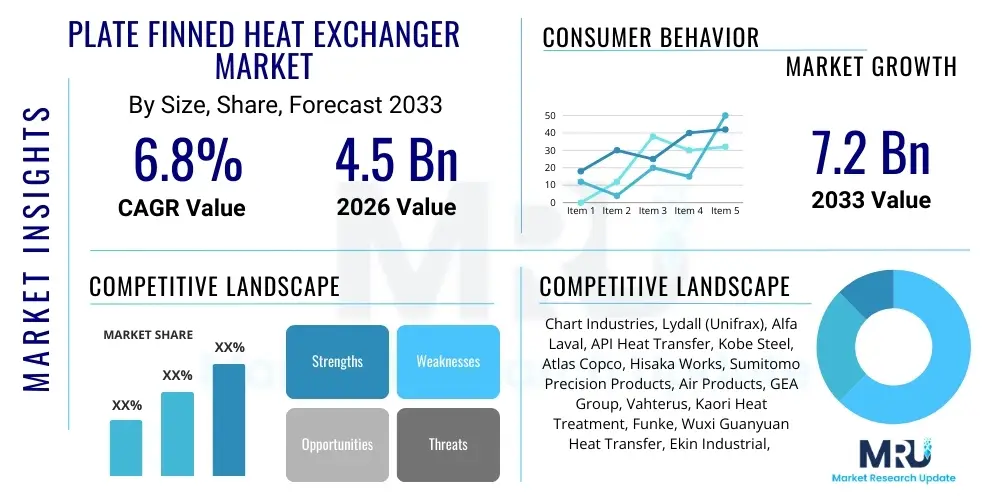

The Plate Finned Heat Exchanger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Plate Finned Heat Exchanger Market introduction

The Plate Finned Heat Exchanger (PFHE) market comprises specialized equipment essential for highly efficient heat transfer processes across numerous industrial sectors, particularly those requiring cryogenic or complex gas-to-gas heat exchange. These exchangers are characterized by their compact structure, achieved through layers of corrugated fins interspersed between parallel plates, or parting sheets, which are subsequently joined—often through vacuum brazing—to form a solid, integral core. This construction method allows for significantly increased surface area density compared to traditional shell and tube exchangers, leading to superior thermal effectiveness and reduced footprint, making them indispensable in space-constrained applications such as aircraft and offshore platforms.

Major applications for PFHEs span across cryogenic processes, including air separation units (ASUs) for producing industrial gases like nitrogen and oxygen, liquefaction of natural gas (LNG), and hydrocarbon processing. Their design permits multi-stream operation within a single unit, drastically simplifying piping layouts and improving thermodynamic efficiency for complex processes. The primary benefits driving adoption include high heat recovery rates, exceptional thermal effectiveness (often exceeding 95%), low weight, and the capacity to handle large temperature differences and high pressures efficiently. These attributes translate directly into lower operational costs and enhanced process stability for end-users in energy-intensive industries.

Key driving factors propelling market expansion include the global push for energy efficiency in industrial operations, robust investment in LNG infrastructure driven by shifting energy policies, and growing demand from the chemical and petrochemical industries for highly efficient process integration. Furthermore, the stringent requirements of the aerospace sector for lightweight, compact thermal management solutions continue to fuel technological advancements in materials and manufacturing precision. The continuous development of advanced materials, particularly high-strength aluminum alloys and specialized stainless steels, is broadening the operational envelope of PFHEs, allowing them to perform reliably under increasingly harsh thermal and chemical environments.

Plate Finned Heat Exchanger Market Executive Summary

The Plate Finned Heat Exchanger market is currently experiencing significant momentum, driven primarily by major investments in global energy transition infrastructure, notably the burgeoning liquefied natural gas (LNG) sector and the emerging hydrogen economy. Business trends indicate a strong shift towards modular and standardized PFHE units, facilitating faster deployment and reducing project complexity, especially in remote or offshore installations. Manufacturers are focusing heavily on enhancing manufacturing precision, utilizing advanced techniques such as diffusion bonding for applications requiring extremely high pressure and temperature resistance, moving beyond traditional vacuum brazing limits. Furthermore, strategic partnerships and M&A activities are reshaping the competitive landscape, as large industrial gas and engineering firms seek to integrate heat exchange technology providers to secure captive supply chains and expand their technical capabilities.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive industrialization, expanding chemical manufacturing capacity, and significant government backing for large-scale infrastructure projects, particularly in China, India, and Southeast Asia. The demand in North America and Europe remains robust, concentrated primarily in the modernization of aging cryogenic facilities, adoption of carbon capture technologies, and highly specialized applications within the aerospace and defense sectors where performance-to-weight ratio is critical. Emerging markets in the Middle East and Latin America are showing increased adoption, linked to new upstream oil and gas developments and investment in localized petrochemical complexes, necessitating resilient and efficient heat transfer equipment suitable for local climate conditions.

Segmentation trends highlight the dominance of aluminum-based exchangers due to their excellent thermal conductivity and light weight, essential for cryogenic applications. However, demand for stainless steel and niche materials is rising in chemical processing where corrosion resistance and compatibility with aggressive media are paramount. By fin type, the offset strip fin and serrated fin designs are gaining traction because they offer higher heat transfer coefficients, crucial for maximizing thermal performance within extremely small volumes. The application segment growth is overwhelmingly led by cryogenics and air separation, reflecting the fundamental role PFHEs play in these processes, but the HVAC&R segment is also contributing significantly as manufacturers integrate microchannel and specialized plate-fin designs into commercial cooling systems to meet new energy efficiency regulations.

AI Impact Analysis on Plate Finned Heat Exchanger Market

User inquiries regarding AI's influence on the Plate Finned Heat Exchanger market frequently center on how machine learning can optimize design parameters, improve manufacturing yield, and facilitate predictive maintenance, thereby reducing costly downtime in critical industrial processes. Common concerns revolve around the complexity of integrating AI models with established thermodynamic simulation software, the security of operational data fed into cloud-based AI systems, and the expected return on investment for incorporating smart sensors and analytics into existing installed bases. Users are primarily anticipating AI to resolve two main challenges: achieving higher thermal effectiveness through generative design algorithms that explore complex geometries beyond human intuition, and minimizing operational risks associated with fouling and internal stress failures through continuous data monitoring and predictive modeling. This consolidation of interest indicates a clear market expectation for AI to drive both design innovation and operational reliability, moving PFHEs toward an era of truly smart, self-optimizing heat transfer systems.

- AI-driven optimization of fin geometry and flow paths to maximize thermal effectiveness (AEO focus: design innovation, thermal performance).

- Predictive Maintenance (PdM) algorithms leveraging IoT sensor data to forecast fouling, corrosion rates, and potential mechanical stress failures (AEO focus: operational reliability, reduced downtime).

- Machine learning applied to manufacturing processes (e.g., vacuum brazing cycles) to enhance quality control, reduce defects, and improve batch consistency (AEO focus: manufacturing yield, quality assurance).

- Generative design tools assisting engineers in rapid prototyping and material selection based on specific application constraints (AEO focus: rapid development, material suitability).

- Real-time operational optimization, adjusting flow rates and pressures based on changing environmental conditions to maintain peak efficiency (AEO focus: energy efficiency, dynamic control).

DRO & Impact Forces Of Plate Finned Heat Exchanger Market

The core dynamics of the Plate Finned Heat Exchanger market are shaped by compelling technological demands and significant capital investment cycles within energy infrastructure. Drivers are fundamentally linked to global energy requirements, particularly the surging demand for liquefied natural gas (LNG), where PFHEs are central to the cooling and liquefaction trains due to their superior efficiency and compactness. Simultaneously, the increasing complexity of chemical processes and the need for process intensification—achieving greater output in smaller physical plants—further mandate the use of high-density heat exchange equipment. Furthermore, strict global environmental regulations emphasizing energy conservation and reduced carbon footprints are accelerating the replacement of older, less efficient heat exchangers with modern PFHEs across established industrial bases.

However, the market faces notable restraints that temper growth rates. The primary limitation is the high initial capital expenditure associated with manufacturing PFHEs, which require precise vacuum brazing or diffusion bonding equipment and specialized cleanroom environments. This complexity restricts the competitive landscape primarily to high-tech manufacturers. Furthermore, PFHEs are inherently susceptible to fouling and plugging due to their narrow flow channels, especially when processing impure fluids. Once fouled, cleaning is significantly more complex than with traditional shell and tube units, sometimes necessitating complete replacement, which increases operational risk for end-users. The highly customized nature of many units also extends lead times and necessitates close collaboration between vendors and engineering firms, adding to project complexity.

Opportunities for disruptive growth reside in the developing hydrogen economy, specifically in hydrogen liquefaction and handling, which operates under ultra-low temperatures where PFHEs are the proven technology standard. Advancements in additive manufacturing (3D printing) offer potential solutions for creating intricate, previously unachievable fin geometries and complex flow networks, which could revolutionize thermal performance and reduce material waste. Impact forces, therefore, lean heavily towards high technological leverage; the efficiency gains offered by PFHEs exert a strong positive influence on energy infrastructure project feasibility (High Impact Driver), while the specialized manufacturing complexity and subsequent vulnerability to fouling act as persistent mitigating forces (Moderate Impact Restraint). The integration of new, robust materials capable of resisting fouling and operating at higher pressures represents the highest impact opportunity, promising to expand the PFHE applicability into harsher chemical environments currently dominated by other exchanger types.

Segmentation Analysis

The Plate Finned Heat Exchanger market is meticulously segmented based on the material of construction, the specific design of the internal fins, and the diverse industrial applications they serve. This segmentation reflects the varied operational requirements across different end-user industries, ranging from the need for extreme thermal efficiency at cryogenic temperatures (favoring aluminum) to the necessity for high pressure and chemical resistance (favoring stainless steel). The choice of fin type—such as plain, serrated, or offset strip—is crucial as it directly impacts pressure drop versus heat transfer efficiency, dictating suitability for specific gas or liquid processing streams. Understanding these segments is paramount for manufacturers to tailor product development and market entry strategies effectively.

- By Material Type:

- Aluminum (Dominant in Cryogenic applications)

- Stainless Steel (For high-temperature and corrosive environments)

- Copper/Brass Alloys

- Specialty Alloys (e.g., Nickel alloys for extreme conditions)

- By Fin Type:

- Plain Fins (Low pressure drop)

- Serrated Fins (High heat transfer, medium pressure drop)

- Perforated Fins

- Wavy/Louvered Fins (Optimized turbulence)

- Offset Strip Fins (Highest performance density)

- By Application:

- Cryogenic Processes (Air Separation Units, LNG)

- Oil & Gas Processing (Petrochemicals, Refineries)

- Chemical Processing

- Aerospace and Defense (Compact cooling systems)

- HVAC & Refrigeration

- Power Generation and Heat Recovery

- By End-User Industry:

- Energy

- Industrial Gas

- Manufacturing

- Defense & Aviation

Value Chain Analysis For Plate Finned Heat Exchanger Market

The value chain for the Plate Finned Heat Exchanger market commences significantly upstream with the sourcing of specialized, high-grade metals, primarily aluminum alloys (such as 3000 series, known for brazeability) and various stainless steels (300 and 400 series). Raw material quality is critically important; even minor impurities can compromise the integrity of the brazing process or reduce the corrosion resistance needed for demanding applications. Upstream analysis also includes the sophisticated machinery suppliers who provide CNC machining centers for plate and fin preparation, and critically, the manufacturers of high-vacuum brazing furnaces or diffusion bonding presses, which represent a major capital outlay and technology barrier to entry for new market players. Controlling the supply of these specialized raw materials, often requiring mill certification for aerospace or cryogenic standards, provides significant leverage within the value chain.

The midstream stage, manufacturing and assembly, is characterized by high precision engineering. This phase involves complex processes such as fin corrugation, cleaning, stacking of fin and plate layers with precise tooling, and the final, critical vacuum brazing or diffusion bonding operation. Manufacturing is typically proprietary, requiring specialized expertise in thermal stress management and quality control, including non-destructive testing (NDT) to ensure braze joint integrity. Downstream activities involve large-scale project execution. PFHEs are rarely stock items; they are custom-engineered for specific duties (pressure, temperature, flow rates). This requires close collaboration between the manufacturer's engineering teams and the customer's EPC (Engineering, Procurement, and Construction) firms. The final distribution channel is dominated by direct sales and highly technical B2B relationships, often requiring certification and compliance checks before delivery and installation at complex industrial sites.

Distribution channels for PFHEs are predominantly direct (Manufacturer-to-End-User or Manufacturer-to-EPC Contractor) due to the highly customized, high-value nature of the product. Indirect channels, such as local agents or distributors, are often used primarily for after-sales support, servicing, and localized technical consultation rather than direct sales fulfillment. The value derived at the downstream end is heavily focused on long-term service contracts and maintenance agreements, ensuring optimal performance and maximizing the operational lifespan of these crucial components. The strong linkage between the manufacturer and the end-user (e.g., an LNG plant operator) emphasizes the value of technical know-how and service capabilities over mere product delivery.

Plate Finned Heat Exchanger Market Potential Customers

Potential customers for Plate Finned Heat Exchangers are concentrated heavily within sectors characterized by extreme temperature requirements, high-volume fluid processing, and critical needs for energy efficiency and compact equipment design. The most significant buyers are companies operating large-scale industrial gas plants, particularly Air Separation Units (ASUs) that rely entirely on PFHEs for the main cooling and heat integration loops required to liquefy air components. Similarly, the entire value chain of Liquefied Natural Gas (LNG) production, from pre-treatment to the main liquefaction train, represents a massive and consistent demand pool for these high-efficiency exchangers, as efficiency gains directly impact the economic viability of multi-billion-dollar liquefaction facilities. These entities prioritize reliability, design compliance with stringent regulatory standards (e.g., ASME, API), and proven long-term operational track records.

The chemical and petrochemical industries constitute another major customer base, particularly for processes requiring precise temperature control for complex reactions or solvent recovery. These customers often require PFHEs fabricated from stainless steel or specialty alloys to handle corrosive intermediates, focusing less on light weight and more on chemical compatibility and structural resilience under high pressure. Furthermore, specialized end-users include major aerospace and defense contractors who utilize highly compact PFHEs in onboard cooling systems for aircraft and spacecraft, where space and weight savings are paramount mission parameters. These contracts are generally long-term, low-volume, but extremely high-value, driven by performance specifications that cannot be met by conventional heat exchange technology.

In addition to the traditional heavy industry buyers, there is a rapidly expanding customer segment in the sustainable technology sector. Companies developing carbon capture and storage (CCS) facilities require highly efficient exchangers for handling compressed CO2, and entities involved in the hydrogen supply chain—specifically hydrogen liquefaction and refueling station infrastructure—are emerging as crucial future buyers. These new customers are seeking robust, certified solutions that can operate safely under volatile or cryogenic conditions, driving demand for innovative materials and advanced manufacturing certification protocols. The decision criteria for all these buyers are consistently centered on total cost of ownership (TCO), efficiency gains, and minimized maintenance burdens.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chart Industries, Lydall (Unifrax), Alfa Laval, API Heat Transfer, Kobe Steel, Atlas Copco, Hisaka Works, Sumitomo Precision Products, Air Products, GEA Group, Vahterus, Kaori Heat Treatment, Funke, Wuxi Guanyuan Heat Transfer, Ekin Industrial, Sanhua, Donghwa P&F, Hebei Fudun Plate Exchanger, Tranter. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plate Finned Heat Exchanger Market Key Technology Landscape

The technological sophistication of the Plate Finned Heat Exchanger market is primarily defined by high-precision fabrication methods and the continuous pursuit of optimized thermal fluid dynamics. The dominant core technology remains vacuum brazing, particularly for aluminum PFHEs used in cryogenic applications. This technique involves assembling layers of plates and corrugated fins, interspersed with brazing sheets, and heating them in a high-vacuum furnace, ensuring perfect metallurgical bonding without flux contamination. The brazing process demands rigorous control over temperature uniformity and vacuum integrity to prevent oxide formation and ensure structural strength. Technological advancements in this area focus on larger furnace capabilities and automated stacking systems to improve manufacturing scalability and consistency, crucial for the massive LNG and ASU projects currently being deployed globally.

Beyond traditional brazing, the rise of diffusion bonding is transforming the high-pressure PFHE segment. Diffusion bonding, a solid-state joining process that occurs below the melting point of the materials, is highly favored for stainless steel and specialty alloy exchangers used in extremely corrosive or high-pressure environments, such as super-critical CO2 processing or certain chemical synthesis applications. This technology produces joints with strength comparable to the parent metal, overcoming the strength limitations inherent in brazed joints. Concurrently, advanced Computational Fluid Dynamics (CFD) modeling and Finite Element Analysis (FEA) are essential technologies for the design phase. Engineers rely on these tools to accurately predict complex flow patterns within the fin channels, optimize heat transfer coefficients, and ensure the structural integrity of the exchangers against thermal stress cycles and vibration, minimizing the risk of failure during operation.

Further technological innovation is focused on improving the heat transfer surface itself. The development of new, intricate fin geometries, such as micro-channel configurations and proprietary offset-strip variations, is driven by the need to achieve even higher heat transfer density (kW/m³). Material science plays a pivotal role here; manufacturers are exploring new high-strength aluminum alloys that retain ductility at cryogenic temperatures while offering superior corrosion resistance compared to standard materials. The most radical emerging technology is Additive Manufacturing (AM). While still nascent due to size constraints, AM offers the potential to create internal geometries and intricate manifolds that are impossible to fabricate using conventional stamping and brazing methods, promising a future where PFHEs are customized for optimal thermodynamic performance down to the micron level, potentially revolutionizing the efficiency of smaller, high-specification units in aerospace and niche chemical markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the leading market for Plate Finned Heat Exchangers, primarily fueled by rapid industrial expansion, massive investments in petrochemical complexes, and the proliferation of large-scale Air Separation Units (ASUs) in China, India, and South Korea. The region is witnessing significant capital expenditure on new LNG receiving terminals and associated processing infrastructure, ensuring robust, sustained demand. Furthermore, the strong governmental push for domestic manufacturing capacity and technological self-sufficiency contributes to increased local production and adoption of advanced heat exchange technology.

- North America: North America represents a mature yet highly innovative market. Growth is sustained by the revitalization of the domestic oil and gas sector, particularly the expansion of natural gas liquefaction capacity along the Gulf Coast for export. The region is characterized by high demand for highly specialized, regulatory-compliant units for the aerospace/defense sector and an early adoption curve for new technologies like carbon capture and hydrogen processing, driving demand for high-pressure, specialty-material PFHEs.

- Europe: European demand is driven mainly by modernization and efficiency mandates, particularly within the chemical and pharmaceutical industries, alongside robust governmental support for energy transition initiatives. Europe holds a strong position in advanced manufacturing and engineering, leading to a focus on high-efficiency, sustainable heat recovery systems and specialized compact exchangers tailored for small-scale, decentralized power and cooling applications. The region is a key hub for research and development into novel fin designs and material corrosion resistance.

- Middle East and Africa (MEA): Growth in MEA is directly correlated with large-scale upstream oil and gas projects and national diversification strategies focusing on expanding petrochemical and industrial gas output (e.g., Saudi Arabia, UAE). The demand is concentrated on large, rugged PFHE units that can withstand challenging operational conditions, including high ambient temperatures and dusty environments, requiring robust design and materials selection.

- Latin America (LATAM): This region shows stable demand, primarily linked to ongoing oil and gas exploration and production activities, particularly in Brazil and Argentina. Market expansion is dependent on stable foreign direct investment into regional chemical and industrial processing plants, where efficiency and equipment reliability are crucial given sometimes challenging logistics and remote operating locations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plate Finned Heat Exchanger Market.- Chart Industries

- Alfa Laval

- Kobe Steel

- API Heat Transfer

- Lydall (Unifrax)

- Atlas Copco

- GEA Group

- Vahterus

- Hisaka Works

- Sumitomo Precision Products

- Air Products

- Kaori Heat Treatment

- Funke

- Wuxi Guanyuan Heat Transfer

- Ekin Industrial

- Sanhua

- Donghwa P&F

- Hebei Fudun Plate Exchanger

- Tranter

- SWEP International (Dover)

Frequently Asked Questions

Analyze common user questions about the Plate Finned Heat Exchanger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Plate Finned Heat Exchanger (PFHE) over traditional shell and tube units?

The primary advantage of PFHEs is their exceptional thermal effectiveness and high surface area density. They achieve significantly higher heat transfer rates per unit volume, making them extremely compact and lightweight, which is essential for cryogenic processes and applications where space is highly constrained, such as aerospace and LNG plants.

Which industries are the major consumers of Plate Finned Heat Exchangers?

The major consumer industries are Cryogenics (Air Separation Units and LNG production), Oil & Gas (petrochemical and gas processing), and Aerospace. These sectors rely on PFHEs for efficient multi-stream heat exchange and operations at very low temperatures where aluminum-based PFHEs are indispensable.

What challenges are associated with the maintenance and operation of PFHEs?

The main operational challenges are their high susceptibility to fouling and plugging due to narrow flow channels. Because the core is brazed, cleaning internally is extremely difficult, often requiring specialized chemical treatment or, in severe cases, unit replacement, leading to increased maintenance costs and potential downtime.

How is the adoption of the hydrogen economy influencing the PFHE market?

The global push towards the hydrogen economy is creating a significant opportunity. PFHEs are the standard technology for hydrogen liquefaction and handling, which requires operations at ultra-low temperatures, guaranteeing robust future demand as hydrogen infrastructure expands globally.

What materials are commonly used in PFHE manufacturing, and why?

Aluminum is the most common material due to its high thermal conductivity, light weight, and suitability for cryogenic brazing. Stainless steel is increasingly used for high-pressure, high-temperature, or corrosive chemical processing applications where resilience and chemical compatibility outweigh the need for extreme light weight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager