Platform Screen Door System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443469 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Platform Screen Door System Market Size

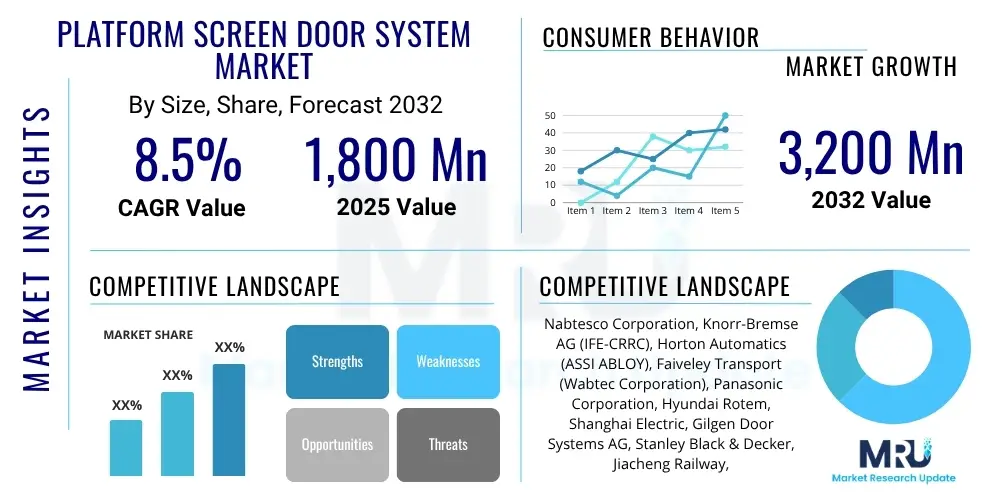

The Platform Screen Door System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Platform Screen Door System Market introduction

The Platform Screen Door (PSD) System Market encompasses specialized infrastructure solutions designed primarily for mass transit environments, such as metro systems, high-speed rail lines, and commuter railways. PSDs serve as physical barriers installed along the platform edge, separating the waiting area from the track and the train movement area. These systems are crucial for enhancing passenger safety by preventing accidental falls onto the tracks, reducing suicides, and eliminating the possibility of unauthorized track access. Furthermore, PSDs significantly improve operational efficiency by allowing trains to operate at higher speeds near platforms and facilitating precise docking, which is essential for seamless Automatic Train Operation (ATO) systems. The implementation of PSDs also contributes substantially to the environmental control within stations, helping to regulate temperature, minimize noise pollution, and ensure efficient operation of HVAC systems, particularly in underground or enclosed stations.

The core components of a modern PSD system include fixed screen panels, movable sliding doors, end emergency doors, the signaling interface, and the Supervisory Control and Data Acquisition (SCADA) system for centralized monitoring. Product variations, such as full-height PSDs, which extend from floor to ceiling, and half-height PSDs (or Automatic Platform Gates, APGs), which are generally around 1.5 meters high, cater to different operational requirements and budgetary constraints. Full-height systems are predominantly utilized in new metro lines and enclosed environments where complete separation and climate control are prioritized. In contrast, half-height systems are often chosen for retrofitting older stations or above-ground lines where ventilation is less of a concern but safety enhancement remains paramount. The seamless integration with train signaling systems, ensuring doors only open when the train is properly aligned and fully stopped, represents a critical functional requirement driving technology innovation in this sector.

Major applications for platform screen doors span across new infrastructure projects globally, driven heavily by rapid urbanization and increased investment in modern public transport networks, particularly in the Asia Pacific region. Beyond safety and efficiency, the benefits of PSD installation include optimized maintenance schedules, protection of sensitive trackside equipment from debris, and reduction of the "piston effect" caused by high-speed trains entering tunnels, thus improving passenger comfort. Driving factors propelling market growth include stringent global regulatory standards emphasizing railway safety (such as EN 50126/8/9 series), governmental initiatives supporting smart city infrastructure development, and the increasing global adoption of driverless and automated transit systems which necessitate the high precision and reliability afforded by PSD installations. Furthermore, the rising awareness among transit authorities regarding liability reduction and reputation management post-incidents is significantly accelerating the adoption curve.

Platform Screen Door System Market Executive Summary

The global Platform Screen Door (PSD) System Market is experiencing robust growth fueled by extensive modernization and expansion of urban rail infrastructure worldwide. Business trends indicate a strong shift towards highly integrated, IoT-enabled PSDs that incorporate advanced sensor technologies for improved fault detection and predictive maintenance capabilities. Key players are increasingly focusing on modular designs that facilitate easier retrofitting in existing, operational stations, thereby minimizing disruption and installation time. There is a competitive dynamic characterized by strategic partnerships between traditional door manufacturers and specialized signaling and control system integrators to offer comprehensive, turnkey solutions. Furthermore, sustainability is becoming a central theme, with manufacturers developing energy-efficient components, utilizing regenerative braking technology interfaces, and employing lighter, recyclable materials to meet green infrastructure requirements demanded by transit authorities in developed economies.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, primarily due to massive investments in new metro construction projects in densely populated countries like China, India, and Southeast Asian nations. These regions prioritize PSD systems from inception to ensure operational safety and capacity optimization in newly developed networks. Europe and North America, while having mature rail networks, contribute significantly through modernization and replacement projects, driven by aging infrastructure and increasingly stringent safety mandates. In these mature markets, the emphasis is less on new line construction and more on upgrading existing half-height systems to full-height where feasible, or incorporating advanced digital features like biometric access integration and improved emergency egress mechanisms. The Middle East and Africa (MEA) region show high potential, driven by major urban development projects in the Gulf Cooperation Council (GCC) states focusing on developing state-of-the-art, fully automated transit systems, which inherently require PSDs for safe operation.

In terms of segmentation, the Full-Height PSD segment dominates the market revenue share, correlating directly with the trend towards fully enclosed, climate-controlled, and automated metro systems. However, the Half-Height/Automatic Platform Gate (APG) segment is witnessing rapid growth, particularly in mature markets and for retrofitting existing elevated or ground-level rail lines where structural limitations preclude the installation of full-height systems. Technology segmentation highlights the increasing deployment of high-performance sliding door systems, favored for their reliability and rapid opening/closing cycles. Crucially, the Maintenance, Repair, and Overhaul (MRO) segment associated with PSDs is becoming highly important, offering stable recurring revenue streams for system integrators, reflecting the long service life (typically 20–30 years) and the critical need for zero-failure maintenance protocols required for essential safety infrastructure.

AI Impact Analysis on Platform Screen Door System Market

Common user and industry questions regarding AI's influence on Platform Screen Door Systems primarily revolve around enhancing system reliability, optimizing maintenance schedules, and integrating advanced safety features. Users frequently ask: How can AI prevent unforeseen door failures? Can AI systems predict component degradation before it affects operation? What role does computer vision and machine learning play in passenger flow management and emergency response at the platform edge? The analysis of these inquiries reveals a core expectation that AI will transition PSDs from purely reactive maintenance devices to proactive, intelligent safety assets. Key themes include the implementation of predictive analytics to minimize downtime, using AI-driven sensor fusion for accurate passenger counting and overcrowding detection, and leveraging deep learning algorithms to continuously verify door alignment and sealing integrity, thereby reducing risks associated with imperfect mechanical synchronization and wear-and-tear.

- AI-Enhanced Predictive Maintenance: Utilizing machine learning algorithms to analyze real-time sensor data (vibration, temperature, current draw) from door motors and control units, predicting potential mechanical failures days or weeks in advance, drastically reducing unplanned operational downtime.

- Optimized Operational Efficiency: Employing AI for dynamic door synchronization with Automatic Train Operation (ATO) systems, enabling faster and more precise docking, and reducing dwell times at stations, thereby increasing overall line throughput capacity.

- Advanced Safety Monitoring: Integrating computer vision and neural networks for identifying prohibited behaviors (e.g., leaning on doors, objects placed on the track, attempted unauthorized access) and triggering immediate alerts or slowdown protocols.

- Intelligent Passenger Flow Management: AI-driven analysis of passenger density near PSDs, allowing transit operators to dynamically manage platform access and adjust operational parameters during peak hours to prevent dangerous overcrowding scenarios.

- Cybersecurity and System Integrity: Applying AI-based anomaly detection to network traffic and control system data to identify and mitigate cyber threats targeting the critical signaling interfaces of the PSD systems.

DRO & Impact Forces Of Platform Screen Door System Market

The Platform Screen Door System Market is significantly shaped by a powerful interplay of growth drivers, regulatory restraints, and strategic opportunities, generating critical impact forces across the industry. Major drivers center on the global imperative for enhanced public safety within high-density urban transit environments and the accelerated adoption of driverless rail technology, which strictly mandates the use of PSDs for safety and operational repeatability. Additionally, government funding commitments towards massive infrastructure projects and smart city initiatives in high-growth regions like APAC and the Middle East continue to provide substantial market traction. Restraints primarily involve the high initial capital expenditure required for PSD installation, particularly for complex full-height systems, and the structural complexities and logistical challenges associated with retrofitting these systems into operational, century-old rail networks found in many North American and European cities. Furthermore, public sector procurement cycles are notoriously long, often causing delays in project execution and revenue realization for vendors.

Opportunities for market players are concentrated in two primary areas: technological innovation and geographic expansion. Technologically, the shift towards modular, lightweight, and energy-efficient designs offers significant competitive advantages, alongside the opportunity to develop and monetize advanced data analytics and predictive maintenance services. Geographically, emerging economies in Africa and Latin America that are planning their first modern metro systems represent untapped greenfield opportunities. The industry is also witnessing opportunities in specialized applications, such as airport transit systems and private high-capacity people movers, which require similar high-standard automated safety barriers. These opportunities encourage strategic mergers and acquisitions (M&A) aimed at consolidating signaling expertise with mechanical engineering capabilities to deliver seamless, integrated systems.

The collective impact forces resulting from these DRO factors create intense pressure on manufacturing efficiency and technological adaptation. The strong driving forces ensure sustained market demand, while the restraints compel vendors to innovate solutions that reduce lifecycle costs and simplify installation. The overriding impact force is the necessity for absolute reliability (fail-safe operation) and stringent compliance with international railway standards (SIL ratings), forcing manufacturers to invest heavily in robust quality assurance and complex certification processes. This market environment favors established, certified players with proven track records in complex signaling integration, raising the barriers to entry for smaller or less experienced competitors.

Segmentation Analysis

The Platform Screen Door System market is comprehensively segmented based on various factors including door type, technology utilized, deployment location, and the nature of the service required. Understanding these segmentations is critical for market participants to tailor their offerings and address specific operational needs globally. The primary segmentation by door type distinguishes between Full-Height PSDs and Half-Height PSDs (APGs), reflecting the varying levels of safety, environmental control, and cost requirements across different transit projects. Full-Height systems are generally chosen for their superior ability to manage climate and noise, essential in deep tunnels or fully enclosed driverless systems, while Half-Height systems offer a balance of safety enhancement and cost efficiency, suitable for elevated or open-air track segments. The segmentation analysis confirms the market's maturity and the necessity of offering highly specialized solutions tailored to the structural constraints and operational philosophies of different rail operators, which dictates the choice between sliding doors, swing doors (less common), and emergency egress mechanisms. The long-term segmentation trend points towards increasing digitization of all door types, enabling better remote diagnostics and operational control.

- By Door Type:

- Full-Height Platform Screen Doors (PSDs)

- Half-Height Platform Screen Doors (APGs)

- Platform Gate Systems (often used interchangeably with half-height)

- By Technology:

- Sliding Doors (Dominant technology due to rapid cycling and robust design)

- Swing Doors (Less common, primarily for emergency access)

- Fixed Screens and Panels

- By Application/Deployment:

- Metro/Subway Systems (Largest segment due to high density and automation requirements)

- Mainline/Commuter Railways

- High-Speed Rail

- Airport Transit Systems (People Movers)

- By Component & Service:

- System Hardware (Doors, Motors, Panels, Control Units)

- Software & Control Systems (Signaling Interface, SCADA Integration)

- Services (Installation, Maintenance, Repair, and Overhaul - MRO)

Value Chain Analysis For Platform Screen Door System Market

The value chain for the Platform Screen Door System Market is complex, involving highly specialized engineering and deep integration expertise, starting from upstream material sourcing and culminating in long-term maintenance services. Upstream analysis focuses on the procurement of high-grade materials, including specialized tempered glass or polycarbonate panels for screen stability, corrosion-resistant stainless steel or aluminum alloys for door frames and mechanisms, and advanced electromechanical components such as high-torque, reliable door motors, and precision sensors (e.g., laser scanners, proximity sensors). Suppliers of these specialized components must meet stringent quality and safety standards (e.g., fire resistance, impact resistance, and SIL certification), often requiring long-term partnership agreements with PSD manufacturers. Pricing power at the upstream level is moderate, dictated by global commodity prices for metals, but specialized component suppliers for control electronics and motors maintain a higher degree of influence due to their intellectual property.

The middle segment of the value chain involves the system integrators and manufacturers who design, assemble, and test the complete PSD solution. This stage includes sophisticated activities such as structural design customized for specific station environments, integration of the local door control units with the trainborne and trackside signaling systems (critical for safety interlocking), and factory acceptance testing. Downstream analysis focuses on the distribution and implementation process, primarily involving direct sales models where manufacturers bid directly on large public tender projects issued by transit authorities (TAs). Given the complexity and criticality of the system, indirect distribution through third-party distributors or resellers is rare; instead, system integrators often partner with local construction companies for on-site installation, leveraging their expertise in civil engineering and local labor laws.

The most lucrative part of the downstream value chain is the long-term Service segment, encompassing Maintenance, Repair, and Overhaul (MRO). Since PSDs are classified as safety-critical equipment, transit authorities typically mandate long-term maintenance contracts (often 10–20 years) with the original equipment manufacturer (OEM) or certified service providers. Direct channels dominate the MRO segment because proprietary knowledge of the control software and specialized components is essential for effective fault diagnosis and preventative care, ensuring minimal operational downtime. This reliance on the OEM for specialized services provides stability and predictability to the revenue streams of major market players, mitigating the cyclical nature of new construction projects and strengthening the manufacturer-client relationship across the entire lifecycle of the transit asset.

Platform Screen Door System Market Potential Customers

Potential customers for Platform Screen Door Systems are overwhelmingly governmental entities or quasi-governmental public transport operators responsible for urban mobility and railway infrastructure management. The primary buyers are Metropolitan Transit Authorities (MTAs) and city-level transportation departments managing extensive subway or light rail networks. These customers prioritize safety compliance (achieving high Safety Integrity Levels or SIL ratings), long-term system reliability, and seamless integration with existing signaling and rolling stock assets. Procurement decisions are highly complex, often involving multi-year public tenders that require vendors to demonstrate robust financial stability, a proven global track record, and extensive local technical support capabilities. Furthermore, emerging purchasers include authorities in developing nations initiating new metro projects, which often require comprehensive financing and build-operate-transfer (BOT) models, influencing vendor selection based on financial as well as technical merit.

A secondary, yet rapidly growing, customer segment includes operators of specialized, high-capacity private transit systems. This encompasses large international airports deploying automated people movers (APMs) between terminals, major theme parks, and increasingly, large private urban developers constructing integrated city hubs that include automated transit lines. These customers, while operating under slightly different regulatory frameworks than traditional public metros, still place paramount importance on passenger safety and operational uptime, driving demand for high-quality, customized PSD solutions. For these clients, aesthetics and integration with smart building management systems often play a larger role in the purchasing criteria compared to public transit operators, pushing manufacturers towards more customized finishes and enhanced monitoring interfaces.

In mature markets like Western Europe and North America, a significant portion of the customer base consists of established railway operators (e.g., national rail companies or regional commuter rail bodies) engaging in station modernization and upgrade projects. These customers are primarily focused on retrofitting solutions, specifically seeking PSDs or APGs that minimize required civil works, can be installed during narrow nighttime maintenance windows, and are designed to accommodate legacy station characteristics such as curved platforms or limited overhead clearances. Their purchasing decisions are heavily influenced by the total cost of ownership (TCO), maintenance accessibility, and the system's ability to interface reliably with decades-old signaling infrastructures without necessitating a complete system overhaul.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nabtesco Corporation, Knorr-Bremse AG (IFE), Faiveley Transport (Wabtec Corporation), Westinghouse, Horton Automatics, Beijing TieMa Rail Transit Equipment Co., Ltd., Shanghai Jiacheng Platform Screen Door Co., Ltd., Siemens Mobility, Gilgen Door Systems AG, Hyundai Elevator Co., Ltd., DASSAULT Systèmes (Software and Integration), Fangda Group, CGE T. S. CO., LTD, Toshi Automatic Doors, Mitsubishi Heavy Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Platform Screen Door System Market Key Technology Landscape

The technological landscape of the Platform Screen Door System market is defined by the integration of robust electromechanical engineering with sophisticated digital control and sensor technologies, ensuring operational reliability and high safety standards. The core technology centers around the door operating mechanism, predominantly utilizing synchronous sliding door motor systems, often powered by reliable permanent magnet synchronous motors (PMSMs) or brush-less direct current (BLDC) motors, selected for their precision, longevity, and low maintenance requirements. These motors are integrated with redundant control systems that ensure rapid closing and opening cycles while maintaining strict adherence to safety interlocks with the train signaling system. Crucially, modern PSDs rely on redundant mechanical and electrical braking mechanisms to ensure fail-safe operation, meaning that in the event of power loss or component failure, the doors default to a safe, closed position or facilitate immediate manual egress if necessary. The mechanical design incorporates features like obstacle detection (using pressure sensors or infrared light curtains) and resistance testing, vital for preventing injury or damage during closure.

Beyond the fundamental mechanical operation, the next layer of technology involves sophisticated electronic control units (ECUs) and communication protocols. Modern PSD systems are characterized by networked architectures that facilitate real-time monitoring and diagnostic reporting via Supervisory Control and Data Acquisition (SCADA) systems. The signaling interface is paramount, employing standardized, safety-critical communication protocols (e.g., Ethernet-based communications compliant with relevant railway standards like IEC 62280) to communicate constantly with the Automatic Train Protection (ATP) and Automatic Train Operation (ATO) systems. This communication ensures that the PSDs receive and confirm safety clearances, such as the exact train stopping position and door status, before the train doors or platform doors can be actuated. The deployment of decentralized control logic modules allows for segment-specific fault isolation, preventing minor local issues from cascading into system-wide failures, which is essential for maintaining the high availability demanded by transit operators.

The emerging technological frontier is heavily influenced by the Internet of Things (IoT) and advanced data analytics, primarily aimed at optimizing maintenance practices and enhancing operational intelligence. Manufacturers are embedding numerous sensors (acoustic, vibration, temperature) within critical moving parts like rollers, bearings, and door operators to gather Big Data on system performance. This data is fed into cloud-based platforms where AI algorithms perform predictive maintenance analysis, shifting the service model from time-based maintenance to condition-based maintenance, thereby reducing lifecycle costs and minimizing unexpected breakdowns. Further advancements include the use of sophisticated LiDAR and 3D camera systems for highly accurate door alignment verification and advanced passenger counting/behavior analysis, which further integrates the PSDs into the overall 'Smart Station' ecosystem, utilizing data fusion to provide a holistic view of platform safety and efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for the Platform Screen Door System market, dominating both in terms of installation volume and revenue contribution. This dominance is driven by unprecedented urbanization rates and corresponding massive government investment in new metro line construction in key economies like China, India, South Korea, and Southeast Asian nations (e.g., Vietnam, Thailand, Indonesia). China, with the world's most extensive and rapidly expanding metro network, is the single largest consumer of PSD systems, often incorporating full-height systems as standard in new projects to support high-density, fully automated operation. India's accelerating infrastructure development, focusing on metro rail expansion in major metropolitan areas, offers significant greenfield opportunities. The regional demand is characterized by a high focus on cost-efficiency and localized manufacturing partnerships.

- Europe: The European market is mature, characterized less by new construction and more by extensive modernization and retrofitting projects across legacy rail networks (e.g., London Underground, Paris Metro). Strict safety regulations (e.g., EU safety directives, SIL certification) drive steady demand for upgrades to comply with modern standards. Key market activities include the transition to driverless automation (e.g., major upgrades in France and Spain) which necessitates PSD installation, and the replacement of older generation half-height systems with advanced, technologically integrated full-height systems. Germany and the UK remain strong markets for specialized MRO services and advanced component supply.

- North America: North America presents a steady but measured growth trajectory. While new metro construction is less frequent than in APAC, major cities (e.g., New York, Toronto, Montreal) are undertaking multi-billion dollar infrastructure modernization programs. The market faces unique challenges due to the structural age and complex nature of existing subway tunnels and platforms, making retrofitting highly complex and often favoring half-height systems (APGs) or custom-engineered solutions. Demand is strongly concentrated in transit systems transitioning towards higher levels of automation and those seeking liability reduction against track intrusions.

- Middle East and Africa (MEA): This region exhibits high growth potential, primarily centered in the GCC states (Saudi Arabia, UAE, Qatar). Investment is heavily focused on developing state-of-the-art, fully automated transit systems, exemplified by the Riyadh Metro and expansion in Dubai, where PSDs are non-negotiable requirements for climate control and operation in harsh environments. The projects here are often high-specification, demanding the latest technology, including AI integration and robust climate-proof designs. Africa is an emerging market, driven by initial metro planning and construction in major cities like Cairo, offering long-term growth prospects.

- Latin America (LATAM): The LATAM market shows moderate growth, driven by metro expansion projects in major urban centers such as São Paulo, Mexico City, and Santiago. Economic volatility can sometimes slow down mega-projects, but the fundamental need for mass transit safety infrastructure provides underlying stability. The region primarily adopts established, reliable technology solutions, balancing cost-effectiveness with internationally recognized safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Platform Screen Door System Market.- Nabtesco Corporation

- Knorr-Bremse AG (IFE)

- Faiveley Transport (Wabtec Corporation)

- Westinghouse

- Horton Automatics

- Beijing TieMa Rail Transit Equipment Co., Ltd.

- Shanghai Jiacheng Platform Screen Door Co., Ltd.

- Siemens Mobility

- Gilgen Door Systems AG

- Hyundai Elevator Co., Ltd.

- DASSAULT Systèmes (Software and Integration)

- Fangda Group

- CGE T. S. CO., LTD

- Toshi Automatic Doors

- Mitsubishi Heavy Industries

- CNIM Group

- Guangzhou Zhixin Equipment Co., Ltd.

- Técnicas y Proyectos de Ingeniería (TYPSA)

- Schindler Group

- JES Platform Screen Doors

Frequently Asked Questions

Analyze common user questions about the Platform Screen Door System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety benefits of implementing Platform Screen Doors (PSDs) in metro systems?

The primary safety benefits include preventing accidental falls and suicides onto the track area, eliminating unauthorized access to the railway corridor, and ensuring passenger separation from high-speed trains. PSDs are essential safety components for achieving high Safety Integrity Levels (SIL) required for automated rail operation (ATO).

What is the key difference between Full-Height and Half-Height PSD systems?

Full-Height PSDs extend from the platform floor to the ceiling, providing complete separation, climate control, and noise reduction, typically used in underground or fully automated lines. Half-Height PSDs (APGs) are shorter (around 1.5m), focusing mainly on fall prevention and are often deployed in retrofitting projects or elevated/surface lines due to lower cost and simplified ventilation requirements.

How does technological integration, particularly IoT and AI, affect the operational lifespan and maintenance of PSDs?

IoT sensors and AI algorithms enable predictive maintenance (Condition-Based Monitoring) by analyzing real-time data on component wear (motors, rollers). This proactive approach drastically reduces the risk of unplanned failures, minimizes maintenance downtime, and optimizes the system's operational lifespan, leading to reduced total cost of ownership (TCO).

Which geographical region currently drives the highest demand for new Platform Screen Door installations?

The Asia Pacific (APAC) region, led by extensive metro network expansion in China, India, and Southeast Asia, currently drives the highest global demand for new PSD installations. This growth is linked to rapid urbanization and large-scale public infrastructure investments aimed at increasing urban transit capacity and safety.

What are the main challenges associated with retrofitting Platform Screen Doors onto existing, older rail infrastructure?

Retrofitting challenges include significant structural modifications to aging platforms, managing installation logistics during narrow operational windows (e.g., overnight), ensuring seamless compatibility with legacy signaling systems, and overcoming budgetary constraints associated with customized engineering solutions for non-standardized stations (e.g., curved platforms).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Platform Screen Door System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Platform Screen Door System Market Statistics 2025 Analysis By Application (Metro, Airport, Bus Stop), By Type (Full Height, Half Height), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager