Plating Bath Analysis Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441019 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Plating Bath Analysis Services Market Size

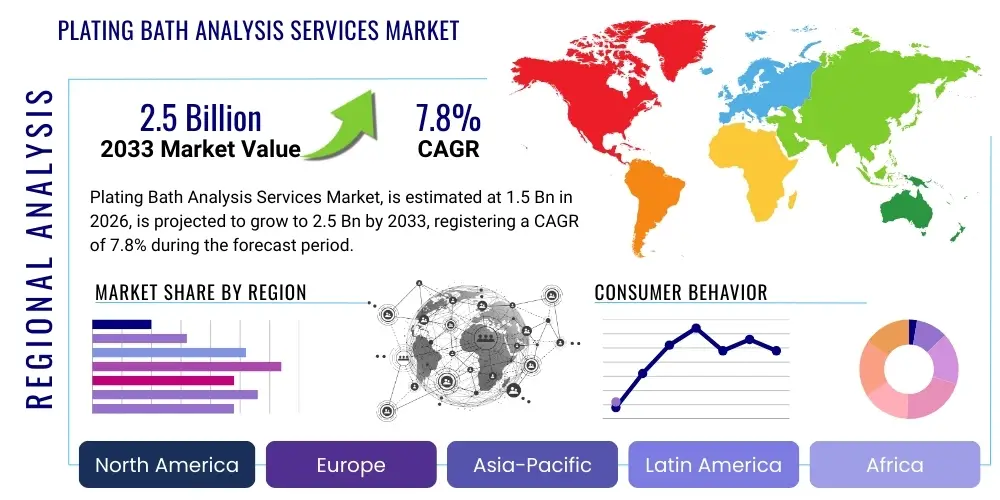

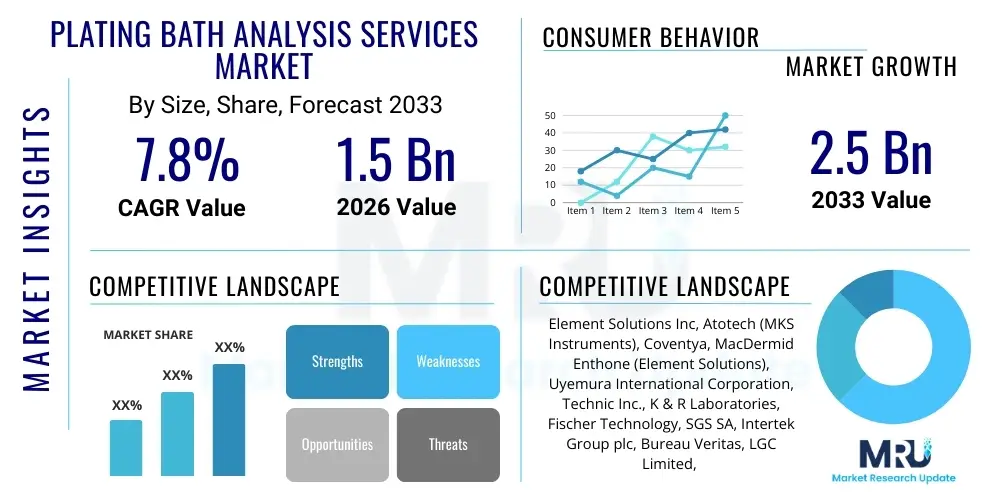

The Plating Bath Analysis Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [7.8%] between 2026 and 2033. The market is estimated at [USD 1.5 Billion] in 2026 and is projected to reach [USD 2.5 Billion] by the end of the forecast period in 2033.

Plating Bath Analysis Services Market introduction

The Plating Bath Analysis Services Market encompasses specialized laboratory and field services dedicated to monitoring and maintaining the chemical composition, purity, and operational efficiency of electroplating and surface finishing solutions. These services are crucial for quality control in manufacturing processes that rely on consistent coating performance, such as electronics, automotive component manufacturing, and aerospace engineering. The objective of plating bath analysis is to prevent defects, optimize material usage, reduce downtime, and ensure compliance with strict industry standards and environmental regulations. Comprehensive analysis ensures that the active metal concentrations, additives (brighteners, levelers, anti-pit agents), and contaminant levels remain within specified operational windows, directly impacting the final product quality and durability.

The scope of analysis services ranges from routine chemical titrations and specific gravity checks to highly complex instrumental techniques like Atomic Absorption Spectroscopy (AAS), Inductively Coupled Plasma (ICP) analysis, High-Performance Liquid Chromatography (HPLC), and advanced voltammetric methods. Product description for these services involves delivering actionable insights and recommendations based on the analytical results, often including replenishment instructions or troubleshooting guidance. Major applications span decorative chrome plating, functional nickel and copper plating for corrosion resistance, precious metal plating for electronic contacts, and specialized processes like electroless nickel plating (EN) used in hard disk drives and demanding industrial components. The rising demand for miniature components and high-performance coatings, particularly in the consumer electronics and electric vehicle (EV) sectors, is intensifying the need for precision bath management.

Key benefits derived from utilizing professional plating bath analysis services include extending the operational life of the plating bath, minimizing scrap rates, achieving tighter quality tolerances, and optimizing overall production costs. Driving factors for market expansion include stringent quality mandates from major end-use industries, particularly the shift towards zero-defect manufacturing in the automotive sector, and the increasing complexity of modern plating chemistries which require specialized analytical expertise often unavailable internally. Furthermore, continuous regulatory pressure regarding heavy metal discharge and waste minimization encourages proactive bath management, thereby boosting demand for accurate and timely analytical services that facilitate process optimization and sustainability efforts.

Plating Bath Analysis Services Market Executive Summary

The global Plating Bath Analysis Services Market is characterized by robust growth, driven primarily by the escalating demand for high-reliability, performance-driven surface finishes across core industrial sectors. Current business trends indicate a significant pivot towards outsourced analytical services, particularly among small and medium-sized enterprises (SMEs) that find investing in specialized internal laboratory equipment cost-prohibitive. There is also a strong trend toward integrating real-time monitoring solutions with conventional off-site laboratory analysis, fostering a hybrid service model focused on predictive maintenance rather than reactive troubleshooting. Technological advancements, notably the integration of electrochemical sensors and machine learning algorithms for pattern recognition in bath degradation, are redefining service offerings and enhancing the precision and speed of analysis.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the dominance of electronics manufacturing, the rapid expansion of the automotive industry, particularly in China and India, and the significant concentration of contract manufacturing facilities. North America and Europe, while mature markets, emphasize specialization, driven by stringent environmental regulations (like REACH in Europe) and high-value applications in aerospace and medical device plating, leading to sustained demand for highly specialized trace element analysis and impurity detection services. Emerging economies in Latin America and the Middle East and Africa (MEA) are also showing promising growth as they industrialize their manufacturing base and adopt global quality standards, necessitating more sophisticated process control measures.

Segment trends reveal that the most rapid growth is occurring within the instrument-based analysis segment, including ICP-OES and HPLC, due to their superior capability in detecting complex organic additives and trace metallic contaminants at sub-parts-per-million levels. Among end-use sectors, the electronics industry remains the dominant consumer of advanced services, requiring ultra-precise control over plating thickness and composition for printed circuit boards (PCBs) and semiconductor packaging. The third-party service provider segment is expected to maintain market leadership, leveraging economies of scale, extensive accreditation, and the ability to service diverse chemistries and client bases, contrasting with equipment manufacturers who focus on proprietary solutions and in-house labs that cater exclusively to internal quality requirements.

AI Impact Analysis on Plating Bath Analysis Services Market

User inquiries regarding AI's role in plating bath analysis frequently revolve around three core themes: the potential for predictive maintenance, the automation of complex analytical interpretation, and the reduction of human error in process control. Users are keen to understand if AI can effectively predict when a bath condition will deviate from optimal parameters, thus moving beyond traditional scheduled sampling. Concerns also center on the reliability of AI models trained on complex, multi-variable chemical systems and whether machine learning can truly correlate subtle spectroscopic changes or electrochemical responses with specific additive degradation or contamination ingress. There is high expectation that AI will standardize and expedite the recommendation phase of analysis, providing immediate, precise adjustments instead of relying solely on expert human interpretation, thereby enhancing production uptime and chemical efficiency.

The summary of key themes suggests a clear anticipation for AI to transform bath management from a periodic testing and reactive adjustment cycle into a continuous, self-optimizing system. Users expect AI to handle the voluminous data generated by continuous monitoring sensors, identifying non-obvious correlations between production throughput, temperature fluctuations, and chemical degradation kinetics. This shift promises significant cost savings through reduced chemical waste and minimized production defects, particularly for high-volume, continuous plating operations. The integration of AI tools is viewed as essential for maintaining competitiveness in industries demanding extremely tight tolerances and high material reliability, pushing analytical service providers to develop robust, cloud-based predictive platforms accessible to operators in real-time.

- AI enables predictive bath maintenance by analyzing historical and real-time sensor data, anticipating chemical imbalances before they impact quality.

- Machine learning algorithms enhance contamination identification by correlating spectroscopic signatures and electrochemical noise patterns with specific impurities.

- Automated recommendation engines utilize AI to calculate precise chemical additions required to return the bath to optimal operating parameters instantly.

- AI integration supports Generative Engine Optimization (GEO) by creating highly structured, data-driven reports that directly address user intent regarding process optimization and fault diagnostics.

- Advanced image recognition technologies powered by AI are used for automated defect analysis of plated parts, linking defects directly back to analyzed bath compositions.

DRO & Impact Forces Of Plating Bath Analysis Services Market

The market for Plating Bath Analysis Services is heavily influenced by a confluence of drivers, restraints, and opportunities (DRO), creating complex impact forces that shape investment and operational strategies. Primary drivers include the global expansion of electronics manufacturing, necessitating rigorous quality control for PCBs and connectors, coupled with the automotive industry’s transition to Electric Vehicles (EVs), which require high-performance plating for battery components and power electronics. Additionally, increasing environmental and occupational safety regulations mandate accurate monitoring of bath chemistry to minimize hazardous waste output and ensure worker safety, pushing manufacturers towards professional analytical services. These forces collectively exert a strong positive impact, prioritizing analytical accuracy and speed as crucial competitive differentiators.

Restraints primarily revolve around the high initial capital investment required for state-of-the-art analytical equipment (e.g., ICP-OES or XRF), which can deter smaller plating shops from establishing in-house labs, forcing reliance on external providers, although supply chain delays for specific instrumentation can sometimes affect service provider expansion. Another significant restraint is the scarcity of highly skilled analytical chemists and technicians capable of interpreting complex results derived from advanced methods like Cyclic Voltammetric Stripping (CVS). This skill gap impacts service availability and turnaround times in certain geographic regions. Furthermore, the volatility in raw material prices for plating chemicals can sometimes lead manufacturers to prioritize cost reduction over optimal analysis frequency, temporarily dampening market growth.

Opportunities for market players are abundant, notably through the development of miniaturized, portable analytical instrumentation suitable for on-site rapid testing, bridging the gap between basic titration and full laboratory analysis. The strongest opportunity lies in the digitization of services, specifically the integration of Internet of Things (IoT) sensors, cloud-based data platforms, and AI-driven predictive modeling (as discussed in the AI analysis), allowing for continuous and proactive bath management. This shift towards a service-as-a-solution (SaaS) model for chemical control presents a high-growth avenue. The combined impact forces result in a market where quality and technological sophistication are paramount; the pressure from zero-defect requirements in end-use sectors consistently overrides cost concerns related to basic chemical control, favoring specialized, high-accuracy service providers.

Segmentation Analysis

The Plating Bath Analysis Services market is meticulously segmented based on the type of analysis performed, the service provider model, the depth of chemical control required, and the specific end-use industry being served. This granular segmentation allows market participants to tailor their analytical capabilities and service delivery models to meet the precise technical and regulatory demands of diverse client bases. Segmentation is crucial because the analytical requirements for decorative chrome plating differ vastly from those for functional gold plating in mission-critical aerospace components, necessitating specialized chemistries and analytical techniques across segments. Understanding these nuances is essential for effective market penetration and strategy development, ensuring resource allocation aligns with high-growth, high-value opportunities within the market landscape.

- By Analysis Type

- Composition Analysis (Major constituents, metal concentration)

- Impurity and Trace Element Analysis (Fe, Cu, Zn, Cr, etc.)

- Additive Concentration Monitoring (Brighteners, Wetting Agents, Levelers)

- Physical and Electrochemical Testing (pH, Density, Conductivity, Hull Cell Testing, CVS)

- By Service Provider

- Third-Party Analytical Laboratories

- In-house Manufacturing Laboratories

- Plating Chemical/Equipment Supplier Labs

- By End-Use Industry

- Electronics and Semiconductors

- Automotive (Functional and Decorative)

- Aerospace and Defense

- Medical Devices

- General Metal Finishing and Industrial Coatings

- By Technique

- Titration and Wet Chemistry

- Instrumental Analysis (AAS, ICP-OES, UV-Vis Spectroscopy)

- Electrochemical Analysis (CVS, Potentiometry)

Value Chain Analysis For Plating Bath Analysis Services Market

The value chain for Plating Bath Analysis Services begins upstream with suppliers of specialized analytical equipment (like spectrophotometers, titrators, and chromatography systems) and high-purity laboratory chemicals and consumables. High costs associated with the procurement and maintenance of advanced instrumental analysis equipment (e.g., ICP-MS) significantly influence the operational expenses of service providers. The middle segment of the chain involves the core analytical service providers—third-party labs, captive labs, and supplier labs—who execute the sophisticated testing, data interpretation, and report generation, requiring high levels of technical expertise and often regulatory accreditation (like ISO 17025). Efficiency in this stage is determined by sample turnaround time and the accuracy of the recommendations provided to the end-user.

Downstream analysis focuses on the direct utilization of the analytical results by the end-user, typically manufacturing facilities involved in electroplating and surface finishing. The direct impact of the service is measured by improvements in yield, reduction in chemical consumption, and compliance maintenance. Effective communication and integration of results into the client's manufacturing execution system (MES) are critical downstream value-adds. The distribution channel is predominantly direct, especially for large industrial clients, where service contracts are established between the analytical lab and the manufacturing site, often involving scheduled sample collection and personalized consultation. Indirect channels may include equipment manufacturers offering bundled analysis packages through distributors or resellers to smaller workshops that lack direct supplier relationships. The transition toward real-time monitoring devices introduces a complexity where data is delivered instantaneously, shifting the value proposition from physical sample transport to secure, reliable data transmission and instantaneous interpretation.

Plating Bath Analysis Services Market Potential Customers

Potential customers for Plating Bath Analysis Services are manufacturers operating high-volume, high-value, or mission-critical electroplating lines where process stability and quality are non-negotiable prerequisites for operational success. The primary buyers are concentrated in industries that rely heavily on functional coatings for durability, conductivity, and corrosion resistance. These customers seek services to ensure continuous compliance with internal specifications and external quality certifications (e.g., AS9100 for aerospace or IATF 16949 for automotive), viewing analysis not merely as a cost, but as an essential investment in risk mitigation and process optimization. The complexity and cost of modern plating chemistries necessitate frequent, expert analysis to maximize bath life and minimize hazardous waste disposal.

End-user segments include large-scale Original Equipment Manufacturers (OEMs) who maintain captive plating facilities, as well as job shops and contract manufacturers specializing in surface finishing for multiple clients. Specifically, electronics manufacturers require analysis for intricate processes like through-hole plating and micro-via filling, demanding ultra-low impurity levels. Automotive suppliers utilize services for testing zinc, zinc-nickel, and chrome plating baths used in chassis, engine components, and external trim. Aerospace and defense buyers require certification-level analysis for specialized coatings (e.g., cadmium or electroless nickel) used in harsh environments. Smaller job shops often represent the strongest market for third-party services, lacking the economic incentive or technical staff to maintain sophisticated in-house laboratory capabilities, thus relying heavily on external experts for consistent chemical control advice.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 1.5 Billion] |

| Market Forecast in 2033 | [USD 2.5 Billion] |

| Growth Rate | [7.8% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Solutions Inc, Atotech (MKS Instruments), Coventya, MacDermid Enthone (Element Solutions), Uyemura International Corporation, Technic Inc., K & R Laboratories, Fischer Technology, SGS SA, Intertek Group plc, Bureau Veritas, LGC Limited, Anachem Services, Metrohm AG, Thermo Fisher Scientific, Agilent Technologies, SPECTRO Analytical Instruments, Columbia Chemical, Epner Technology, Plating Specialists Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plating Bath Analysis Services Market Key Technology Landscape

The technology landscape in the Plating Bath Analysis Services market is defined by a shift from traditional manual wet chemistry methods towards highly accurate, automated, and instrument-based techniques capable of detecting trace components and complex organic additives. Atomic Absorption Spectroscopy (AAS) and Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES) remain the backbone for analyzing major and minor metallic concentrations, offering high sensitivity and speed crucial for high-throughput plating operations. These instruments provide the necessary precision to meet the increasingly tight specifications mandated by industries like semiconductor manufacturing. Furthermore, the rising focus on organic contaminants and proprietary organic additives (such as brighteners and levelers) necessitates the adoption of advanced separation and detection technologies, primarily High-Performance Liquid Chromatography (HPLC) and specialized Ultraviolet-Visible (UV-Vis) spectroscopy, which allow for the measurement and control of these critical, non-metallic components.

A crucial technological advancement unique to plating bath analysis is the utilization of Electrochemical Analysis, specifically Cyclic Voltammetric Stripping (CVS). CVS is irreplaceable for measuring the concentration and activity of organic additives that directly control the deposit structure and leveling characteristics of the plated layer. Technological providers are enhancing CVS instruments with automation and integration capabilities, enabling faster processing of multiple samples and reducing reliance on manual operator expertise. Alongside laboratory instrumentation, the market is seeing massive investment in smart sensor technology and automated sampling systems for integration directly onto the plating line. These IoT-enabled devices provide continuous monitoring of parameters like pH, conductivity, temperature, and specific gravity, feeding real-time data into centralized process control systems. The combination of high-precision off-line lab analysis and robust on-line monitoring forms the current frontier of service offerings.

The future technology landscape is heavily influenced by digitalization and data analytics. Software platforms incorporating Statistical Process Control (SPC) are now standard offerings, enabling service providers to move beyond simple reporting to offer proactive consultation. The integration of AI and machine learning tools (as detailed previously) represents the next evolutionary step, optimizing maintenance schedules and chemical additions based on predictive modeling rather than rigid scheduling or post-failure testing. Furthermore, non-destructive testing techniques, such such as X-Ray Fluorescence (XRF) for coating thickness analysis, are becoming increasingly integrated with bath composition analysis to provide a holistic view of the plating process effectiveness. This technological convergence ensures that analytical services remain responsive to the high demands for quality and efficiency in modern manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, driven by massive manufacturing clusters in China, South Korea, Taiwan, Japan, and Southeast Asia. The region’s strength lies in its expansive electronics and semiconductor fabrication industry, requiring exceptionally high-purity plating analysis. The rapid growth of EV production and supporting supply chains further intensifies demand for complex functional plating analysis services. Governments in countries like China are also enforcing stricter environmental controls, compelling smaller manufacturers to utilize professional third-party services for compliance and chemical efficiency.

- North America: This region is characterized by a mature market with high demand for specialization, particularly in the aerospace, defense, and high-end medical device sectors. The focus here is less on volume and more on precision, accreditation (e.g., NADCAP certification requirements often specify analytical methods), and supply chain integrity. Innovation in analytical instrumentation and the early adoption of AI-driven predictive maintenance platforms are key regional trends. The United States accounts for the majority of the market share, driven by a stringent regulatory environment and the presence of major global OEM headquarters.

- Europe: The European market is highly regulated, particularly by directives such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which significantly drives demand for thorough impurity and trace element analysis. Germany, as a major automotive and industrial equipment manufacturing hub, is a cornerstone of the market. European service providers often focus on sustainable plating chemistries and robust analysis protocols to ensure minimal environmental impact and maximize resource efficiency, creating a specialized niche for green analytical services.

- Latin America (LATAM): LATAM is an emerging market with potential, particularly in Mexico and Brazil, which serve as key manufacturing and automotive assembly points. Growth is steady, driven by foreign direct investment and the harmonization of quality standards with North American and European counterparts. The market largely relies on third-party service providers due to limited local infrastructure for specialized in-house labs, presenting opportunities for international analytical firms.

- Middle East and Africa (MEA): This region represents the smallest segment but is expected to show growth linked to infrastructure development, burgeoning aerospace activities in the UAE and Saudi Arabia, and diversification away from oil economies. The demand is currently concentrated on functional coatings for infrastructure and resource industries, requiring strong corrosion resistance and reliable chemical control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plating Bath Analysis Services Market.- Element Solutions Inc

- Atotech (MKS Instruments)

- Coventya

- MacDermid Enthone (Element Solutions)

- Uyemura International Corporation

- Technic Inc.

- K & R Laboratories

- Fischer Technology

- SGS SA

- Intertek Group plc

- Bureau Veritas

- LGC Limited

- Anachem Services

- Metrohm AG

- Thermo Fisher Scientific

- Agilent Technologies

- SPECTRO Analytical Instruments

- Columbia Chemical

- Epner Technology

- Plating Specialists Inc.

Frequently Asked Questions

Analyze common user questions about the Plating Bath Analysis Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Plating Bath Analysis Services in manufacturing?

The primary role is ensuring continuous quality control and process stability in surface finishing operations. Analysis monitors chemical composition, purity, and additive functionality to prevent defects, optimize efficiency, and maintain compliance with stringent industry specifications.

Which analytical techniques are most critical for controlling organic additives in plating baths?

Cyclic Voltammetric Stripping (CVS) is the most critical technique for measuring the concentration and activity of organic brighteners and levelers. High-Performance Liquid Chromatography (HPLC) is also vital for identifying and quantifying specific organic contaminants and proprietary agents.

How does AI technology benefit plating bath analysis and process control?

AI benefits analysis by enabling predictive maintenance, automatically identifying subtle chemical degradation patterns, and generating precise, instantaneous chemical adjustment recommendations, thereby reducing downtime and improving overall yield consistency.

What are the typical turnaround times for specialized plating bath impurity analysis?

Turnaround times vary, but routine metal concentration analysis via AAS or ICP usually takes 24 to 48 hours. Highly specialized trace impurity detection (e.g., sub-parts-per-million levels) or complex organic identification can require 3 to 5 business days, depending on the service provider and region.

Why is the electronics industry the largest consumer of advanced plating analysis services?

The electronics industry requires extremely tight tolerances for plating thickness and composition on PCBs and semiconductor components. Failure risks are high, and the complexity of required coatings (e.g., gold, palladium, copper fills) necessitates frequent, high-precision analysis to ensure conductivity and reliability in critical micro-applications.

The imperative for high-reliability components across multiple industries—from advanced microelectronics to electric vehicle battery interconnects—has significantly elevated the necessity for proactive and precise plating bath management. Service providers are continually investing in instrumentation that offers lower detection limits and higher throughput, reflecting the industry's zero-defect mentality. This includes specialized testing for ultra-pure water systems and pre-treatment chemistries, which indirectly impact plating bath stability and quality. The market is witnessing consolidation among smaller specialized laboratories, which are being acquired by larger global testing, inspection, and certification (TIC) companies seeking to integrate comprehensive chemical analysis into their broader industrial service portfolios. This consolidation trend provides enhanced geographical reach and standardized quality protocols, appealing particularly to multinational manufacturing clients who require consistent service quality across their global production footprint. Furthermore, the development of reference materials and standardized calibration procedures specifically tailored for complex plating chemistries is driving confidence and accuracy in reported results, which is a foundational requirement for high-stakes industries like aerospace and defense where material failure is unacceptable. The synergy between analytical science and material engineering is becoming increasingly defined, necessitating service providers to offer consultation that extends beyond mere chemical reporting, encompassing recommendations on metallurgical impact and coating performance based on analytical findings.

The increasing complexity of environmental regulation globally, especially concerning chromium compounds and heavy metals, means that plating facilities must meticulously monitor their rinse waters and effluent streams, driving demand for analysis services that can simultaneously support process control and environmental compliance. Many service providers now offer packaged solutions that include both bath stability analysis and environmental monitoring, capitalizing on the need for integrated compliance management. Technological advancements are also evident in sample handling and logistics; temperature-controlled shipping and specialized sample containers are crucial to maintaining sample integrity, particularly for volatile organic additives. The efficiency of the logistical chain directly affects the overall turnaround time, which is a key performance indicator in this market. Service providers leveraging smart logistics and digital tracking gain a competitive edge by minimizing delays between sample collection and result delivery. Moreover, the long-term trend towards sustainable manufacturing practices is fueling research into bio-based and less toxic plating solutions. Analysis services must adapt quickly to these new chemistries, developing novel, validated analytical methods for components that may lack established testing standards. This constant need for methodological innovation keeps the market dynamic and highly reliant on R&D investment within the key service companies.

The automotive sector's rigorous quality framework, IATF 16949, places specific demands on the control of special processes, explicitly including surface treatments like electroplating. This mandates that analytical data be reliable, traceable, and statistically verifiable, reinforcing the demand for accredited and highly professional third-party laboratories. The market for in-house laboratory services, while significant for major OEMs, faces continuous challenges related to staff expertise retention and the high depreciation costs of sophisticated instrumentation, often making outsourcing a financially attractive and technically sound alternative for specialized testing. The economic incentive for optimal bath control is profound; a poorly maintained bath can rapidly lead to hundreds of thousands of dollars in scrapped product, necessitating analytical investment as a preventative measure. The ongoing global supply chain reorganization, influenced by geopolitical shifts and the desire for regional self-sufficiency, encourages localized service provision, benefiting regional analytical labs capable of rapid response and delivery. Furthermore, specialized niches, such as plating for decorative consumer goods (e.g., luxury accessories and jewelry), demand precise analysis of precious metal concentrations (gold, rhodium) to ensure cost control and adherence to aesthetic quality standards, highlighting the market's diversity in application and required analytical specialization. The continuous focus on process data generation and interpretation underscores the market's evolution into a data-driven chemical intelligence sector, positioning analysis services as critical partners in modern manufacturing quality assurance.

In summary, the confluence of technological advancement, regulatory pressure, and the escalating quality demands from end-user sectors dictates a positive growth trajectory for the Plating Bath Analysis Services Market. The future is characterized by digitalization, AI integration for predictive capabilities, and a continued emphasis on specialized analytical techniques capable of handling complex, next-generation plating chemistries. Strategic success in this market hinges on rapid turnaround, precision, and the capacity to translate complex chemical data into practical, immediate operational recommendations for manufacturers globally. This dedication to highly specialized chemical process intelligence affirms the market's sustained relevance and expansion throughout the forecast period.

The integration of statistical process control (SPC) tools within the service provider’s reporting structure is becoming mandatory, shifting the paradigm from simply reporting a deviation to providing the client with trend analysis and predicting the probability of future quality failures. This move towards preventive rather than corrective analysis adds significant value and supports client adherence to sophisticated quality management systems like Six Sigma. The proliferation of automated chemical dosing systems in manufacturing facilities also creates an immediate need for reliable, instantaneous analytical inputs. The service market is responding by developing API integrations and standardized data formats that allow seamless communication between the analytical report generation system and the client’s process automation infrastructure. This level of system interoperability is a major driver of customer loyalty and market share capture among digitally advanced service providers. Moreover, specialized analysis focusing on proprietary additives, often protected by intellectual property, requires specialized contracts and non-disclosure agreements, establishing a high barrier to entry for new, less established analytical firms and reinforcing the position of chemical suppliers and established third-party experts. The long-term maintenance of the integrity and consistency of proprietary plating baths is a unique service offering that commands premium pricing due to the necessity of reverse engineering and complex matrix analysis. These highly technical and confidential services contribute significantly to the overall market revenue and solidify the importance of trust and technical accreditation in the vendor selection process across all key end-use industries.

The regulatory emphasis on worker safety also promotes analysis services that evaluate harmful volatile organic compounds (VOCs) and aerosolized metals emanating from the plating tank. Environmental health and safety (EHS) analysis is increasingly cross-sold with core bath analysis services, providing clients with a single source for both process efficiency and regulatory compliance reporting. This bundled service approach enhances the average contract value and simplifies compliance management for manufacturers, especially those with limited EHS internal resources. The rise of micro-electro-mechanical systems (MEMS) and advanced semiconductor packaging techniques introduces requirements for extremely low contamination levels that exceed the capabilities of standard industrial laboratories. This drives demand for ultra-trace analysis using advanced mass spectrometry techniques (e.g., ICP-MS), which are typically exclusive to highly specialized, accredited analytical laboratories. The investment required for this high-end instrumentation further concentrates the market share towards globally recognized TIC organizations and major chemical suppliers. Furthermore, market development is seeing increased training and certification programs offered by service providers themselves, aimed at improving the internal capabilities of client personnel in sample preparation and basic on-site testing. While this might appear counterintuitive to service demand, it ensures the quality of samples submitted for complex analysis, improving the overall efficiency and reliability of the analytical cycle and strengthening the partnership between the service provider and the manufacturing client. This holistic approach to chemical management, combining basic internal testing with external specialized analysis, defines the current state of best practice in the industry and is key to long-term market growth.

Finally, the competitive landscape is intensely focused on global coverage and the ability to maintain consistent quality across disparate geographic regions. A global automotive supplier, for instance, requires the same level of analytical rigor for its plant in Germany as it does for its facility in Mexico or China. This global requirement favors large, internationally accredited laboratories that can deploy standardized methodologies and reporting formats worldwide. The move towards decentralized, regional supply chains necessitates that analytical service providers are strategically located near major manufacturing clusters to ensure short sample transit times, minimizing the risk of sample degradation or process downtime. The ongoing commitment to research into new plating alloys and coating functionalities, particularly in lightweight materials and corrosion barriers for renewable energy infrastructure, continuously opens new market sub-segments requiring bespoke analytical method development. Service providers that proactively engage in R&D partnerships with chemical suppliers and manufacturing clients to validate new analytical methods for these emerging chemistries are best positioned for long-term strategic growth and market differentiation. The comprehensive nature of the modern service offering—encompassing chemical analysis, regulatory reporting, process consultation, and predictive maintenance—transforms the plating bath analysis provider into an indispensable element of the high-performance manufacturing ecosystem, securing the market's strong position within industrial services.

The crucial distinction between mere analysis and true service lies in the interpretation and translation of analytical data into immediate, executable process adjustments. For instance, a titration result indicating low metal concentration is insufficient; the service must specify the exact amount of replenishment chemical (volume or mass) required to return the bath to its optimum operating point, accounting for variables such as drag-out rates and evaporation. The increasing sophistication of these recommendations, often facilitated by integrated software platforms, drives client satisfaction and perceived value. The market is also seeing a rise in specialized failure analysis services, where experts utilize the chemical data, coupled with microscopic examination (e.g., Scanning Electron Microscopy – SEM) and metallurgical cross-sections, to diagnose complex plating defects like pitting, peeling, or burnt deposits. This integrated approach connects the chemical health of the bath directly to the physical quality of the product, creating a compelling, premium service offering for quality-critical industries. The need for rapid response in fault scenarios further emphasizes the importance of regional analytical hubs capable of immediate sample processing and expert consultation, minimizing the period of production loss for the affected manufacturer. This responsiveness is a significant competitive differentiator, particularly in highly competitive markets where production uptime is directly correlated with profitability.

Furthermore, the long-term strategic planning for plating facilities increasingly incorporates analysis service data to guide capital expenditure decisions. For example, consistent analytical results pointing to high levels of specific metallic contamination might trigger an investment decision for new filtration or purification systems, rather than continuous chemical dumping and bath make-up. The analytical service acts as a strategic consultant, providing the data necessary for these high-level investment decisions that enhance sustainability and efficiency over several years. The adoption of lean manufacturing principles across the global industrial sector also favors services that minimize chemical consumption and waste generation. Plating bath analysis directly supports these lean goals by extending bath life and reducing the frequency of hazardous waste disposal, offering tangible cost savings that justify the service expenditure. The legal implications of hazardous waste generation, including disposal taxes and potential liabilities, further incentivize manufacturers to optimize their chemical usage through professional analytical monitoring. This convergence of quality, cost control, environmental responsibility, and regulatory compliance is cementing the Plating Bath Analysis Services Market as an indispensable component of modern industrial process management and sustainability initiatives.

The specialized nature of analytical instruments, particularly those required for ultra-trace level detection in complex matrices, necessitates highly specialized maintenance and calibration services. Many leading analytical service providers have integrated in-house equipment maintenance divisions, ensuring that their analytical instruments are always operating at peak performance and maintaining strict calibration traceability standards (e.g., NIST traceable). This internal control over instrument quality is critical for upholding accreditation and ensuring the defensibility of the analytical results in quality audits. The training and qualification of the technical staff performing the analysis are also significant value drivers. Certification programs specific to plating analysis, covering advanced techniques like CVS and HPLC method development, ensure a consistent level of expertise across the service organization. Customers place high value on the experience and certified competence of the analysts, recognizing that complex chemical systems require nuanced interpretation beyond simple numerical reporting. This human capital component—the expert interpretation—remains a cornerstone of the service market, complementing the rise of automated and AI-driven systems, particularly in non-routine troubleshooting scenarios or when validating methods for new plating chemistries. The synthesis of advanced technology, rigorous quality systems, and deep human expertise defines the modern market leader in Plating Bath Analysis Services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager