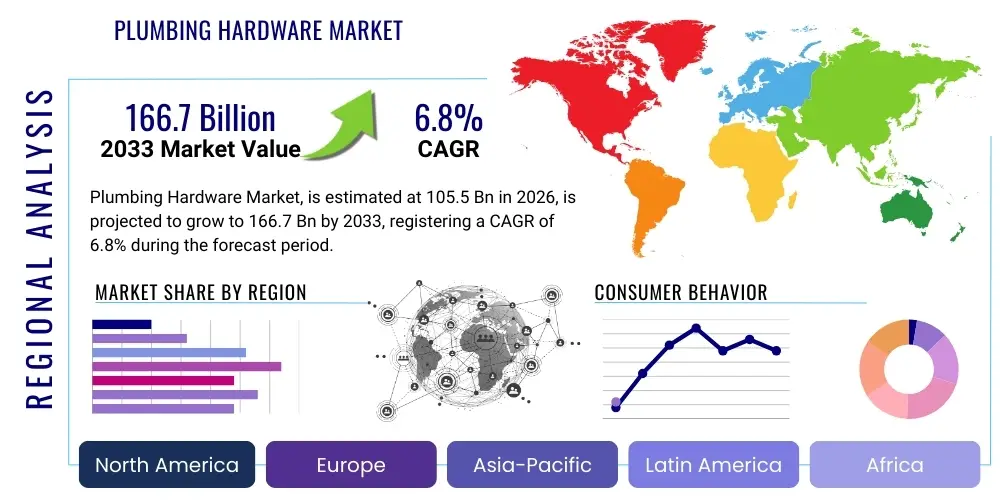

Plumbing Hardware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440941 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Plumbing Hardware Market Size

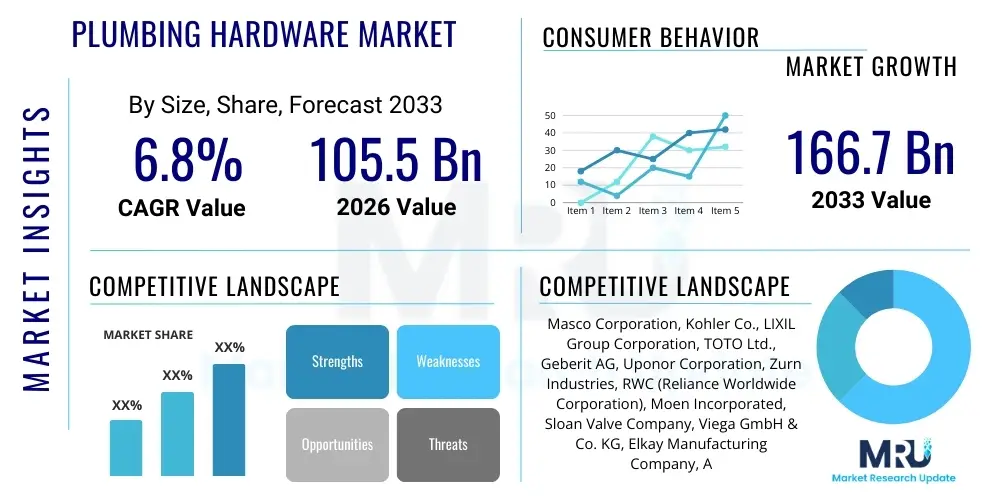

The Plumbing Hardware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 105.5 Billion in 2026 and is projected to reach USD 166.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by accelerated urbanization globally, coupled with substantial investments in both new construction and repair, maintenance, and renovation (RMR) activities across established infrastructure systems. The critical need for efficient water management and the stringent enforcement of building codes focused on water conservation are major underlying factors contributing to this consistent upward trajectory. Furthermore, the increasing consumer preference for aesthetically pleasing, technologically integrated, and sustainable plumbing solutions, particularly in developed economies, commands premium pricing and drives overall market valuation higher.

Plumbing Hardware Market introduction

The Plumbing Hardware Market encompasses a vast array of essential components and systems used for the conveyance, distribution, and control of water and waste within residential, commercial, and industrial structures. These products range from basic pipes, fittings, and connectors to sophisticated faucets, fixtures, valves, and water heating systems. Major applications include bathroom and kitchen installations, HVAC systems integration, public utility connections, and specialized industrial fluid handling operations. Key benefits derived from modern plumbing hardware include enhanced sanitation, improved water efficiency, durability, and user convenience. The market is currently being driven by rapid growth in global construction spending, particularly in emerging economies, coupled with regulatory pushes towards environmentally sound and water-saving technologies, such as low-flow fixtures and smart leak detection systems. The increasing prevalence of smart homes integrating Internet of Things (IoT) capabilities into plumbing fixtures is also acting as a substantial catalyst for innovation and market expansion.

Plumbing Hardware Market Executive Summary

The global Plumbing Hardware Market exhibits dynamic business trends characterized by consolidation among major manufacturers, a pronounced shift towards digitalization in both manufacturing and distribution, and an unwavering focus on sustainability-driven product innovation. Leading manufacturers are investing heavily in material science research to develop non-corrosive, lightweight, and recyclable materials, addressing growing environmental concerns and regulatory pressures. Regionally, the Asia Pacific (APAC) area remains the primary growth engine, propelled by massive governmental infrastructure projects and burgeoning middle-class populations driving new housing demand in countries like China and India. Conversely, North America and Europe demonstrate mature markets characterized by high RMR activity, driven by the need to replace aging infrastructure and mandatory adoption of sophisticated, high-efficiency plumbing standards. Segment-wise, the Faucets & Fixtures category is witnessing rapid technological evolution, particularly with the introduction of touchless operation, digital temperature control, and personalized water usage settings, thereby securing the largest revenue share, while the Pipes & Fittings segment continues to grow robustly due to large-scale infrastructure development.

Current market dynamics suggest that manufacturers who successfully integrate smart technology and prioritize water-saving features will secure significant competitive advantage. The commercial sector, driven by stricter hygiene standards and large-scale public construction, presents a high-value opportunity, especially for specialized valve and industrial fitting providers. Furthermore, the supply chain resilience post-2020 disruptions has prompted companies to diversify sourcing strategies and invest in localized manufacturing capabilities, altering traditional geographical dependencies. The emphasis on robust supply chain management, ensuring timely availability of high-quality components, is paramount to serving the high-frequency demands of the RMR sector, which often requires immediate solutions for critical replacements.

AI Impact Analysis on Plumbing Hardware Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the Plumbing Hardware Market predominantly revolve around predictive maintenance capabilities, optimization of manufacturing processes, and the development of 'truly smart' water systems. Common questions center on how AI can monitor water usage patterns to identify and prevent micro-leaks, how machine learning algorithms can enhance the durability of materials by simulating stress factors, and the feasibility of autonomous plumbing systems in commercial buildings. There is significant interest in AI's role in quality control during the production of complex components like valves and mixers, ensuring zero-defect output. Consumers and commercial clients also frequently inquire about the data privacy implications of sensor-heavy smart plumbing systems and the interoperability of AI-driven hardware with existing smart home ecosystems. Key expectations focus on dramatically reduced water waste, minimized operational downtime in industrial settings, and automated compliance reporting regarding water quality and consumption, driving a shift from reactive repair strategies to proactive system management.

- AI-driven Predictive Maintenance: Utilizing sensor data (pressure, flow, temperature) to forecast hardware failure (e.g., valve degradation, pipe stress) before critical failure occurs.

- Optimized Manufacturing & Quality Control (QC): Implementing computer vision and machine learning models for real-time inspection of fittings, ensuring precise tolerances and material integrity, reducing waste and recall rates.

- Smart Water Management Systems: AI algorithms governing flow rate and pressure based on demand prediction, leading to significant water and energy savings in large commercial properties.

- Automated Leak Detection and Mitigation: Sophisticated AI analysis of irregular flow patterns to pinpoint leak locations rapidly and, in some systems, automatically isolate the affected section.

- Demand Forecasting for Supply Chain: Using machine learning to predict regional demand for specific hardware categories, optimizing inventory levels, and enhancing distribution efficiency.

- Personalized Consumer Plumbing Experience: AI-learning thermostats and fixtures that adjust water temperature and pressure based on historical user preferences and time of day, enhancing comfort and efficiency.

DRO & Impact Forces Of Plumbing Hardware Market

The Plumbing Hardware Market is significantly influenced by a confluence of accelerating drivers, persistent restraints, compelling opportunities, and powerful external impact forces. A primary driver is the accelerating pace of global urbanization, which mandates continuous expansion of municipal water infrastructure and residential construction. This is compounded by strict global regulations promoting water efficiency and conservation, forcing immediate adoption of new, advanced hardware technologies. However, the market faces considerable restraints, including highly volatile raw material prices, particularly for copper, brass, and specialized polymers, which squeeze manufacturing margins. Furthermore, the reliance on a skilled workforce for complex installation and maintenance poses a geographical constraint, particularly in rapidly developing regions where training infrastructure lags behind construction speed. Opportunities abound in the retrofit market, particularly in established economies seeking to upgrade outdated systems to meet modern safety and efficiency standards. The rising demand for luxury and aesthetic plumbing fixtures, incorporating digital interfaces and customized finishes, also presents premiumization opportunities. Key impact forces include geopolitical instability affecting global trade flows of essential materials, rapid climate change necessitating drought-resistant and efficient water delivery methods, and technological disruption stemming from advanced materials science and IoT integration.

Specific market drivers include government stimulus spending on infrastructure revitalization, especially in North America and Europe, targeting replacement of aging pipe networks and upgrading public water utilities. The growing awareness among consumers regarding indoor air quality and water purity also necessitates higher quality filtration systems and robust piping materials, contributing positively to demand. Another strong driver is the increasing disposable income in APAC countries, shifting consumer preferences from purely functional fixtures to premium, design-centric products that align with contemporary architectural trends. The convergence of smart technology with plumbing, enabling features such as remote diagnostics and maintenance scheduling, further pushes market value.

In contrast, major restraints include the extensive product life cycle of plumbing hardware, which inherently limits frequent replacement cycles compared to consumer electronics, requiring manufacturers to rely heavily on new construction or RMR activities. The market also suffers from fragmentation in the lower-end segments, leading to intense price competition and difficulty in enforcing standardized quality across all tiers. Opportunity creation is concentrated in the development of modular and prefabricated plumbing systems, which significantly reduce installation time and labor costs on large-scale construction sites. The penetration of sustainable products, such as greywater recycling systems and solar-thermal water heaters, is also a long-term growth opportunity, supported by governmental subsidies and ESG (Environmental, Social, and Governance) investment criteria. Overall impact forces dictate that resilience and adaptability to sudden supply chain shocks and adherence to evolving international sustainability standards will determine long-term market leadership.

- Drivers: Global urbanization and infrastructural investment; Stringent water conservation regulations; Rising demand for smart and IoT-enabled fixtures; Growth in the Residential RMR (Repair, Maintenance, and Renovation) sector.

- Restraints: Volatility in raw material costs (metals and plastics); Long product lifecycle reducing replacement frequency; Shortage of skilled plumbing installation labor; Intense price competition from unorganized sector players.

- Opportunity: High growth potential in emerging economies' housing sectors; Retrofitting aging infrastructure with modern, efficient systems; Development of sustainable and eco-friendly plumbing materials; Integration of advanced digital diagnostic capabilities.

- Impact Forces: Climate change affecting water scarcity (driving efficiency demand); Geopolitical tensions disrupting global metal supply chains; Rapid technological obsolescence of traditional fixtures due to digital integration; Shifting consumer priorities towards hygiene and wellness.

Segmentation Analysis

The Plumbing Hardware Market is meticulously segmented based on product type, material composition, end-user application, and distribution channel, providing a granular view of market dynamics and targeted opportunities. Product segmentation is essential as it reflects the varying technological complexity and regulatory standards across categories like faucets, valves, and piping systems. Material analysis highlights the transition from traditional metals (brass, copper) to performance plastics (PEX, CPVC) driven by cost efficiency, ease of installation, and corrosion resistance. Application segmentation is crucial, distinguishing the high volume, aesthetic-driven residential sector from the durability and high-pressure requirements of the commercial and industrial segments. Distribution analysis maps the transition towards e-commerce platforms and specialized wholesale channels for large project procurement. This structured segmentation allows companies to align their product portfolios and marketing strategies precisely with specific high-growth niches within the broader market landscape, recognizing that the demands of a high-rise commercial bathroom differ fundamentally from a single-family residential kitchen.

- Product Type:

- Faucets and Fixtures (Mixers, Showerheads, Spouts)

- Pipes and Fittings (Metal Pipes, Plastic Pipes, Couplings, Adapters)

- Valves (Ball Valves, Gate Valves, Check Valves, Pressure Relief Valves)

- Water Heaters and Storage Tanks (Conventional, Tankless, Solar)

- Plumbing Accessories and Tools

- Material:

- Metals (Brass, Copper, Stainless Steel)

- Plastics (PVC, CPVC, PEX, HDPE)

- Ceramics and Composites

- Application/End-User:

- Residential (Single-family, Multi-family Housing)

- Commercial (Hotels, Offices, Healthcare, Retail)

- Industrial (Manufacturing Plants, Utilities, Chemical Processing)

- Distribution Channel:

- Wholesale/Distributors

- Retail Outlets (Home Centers, Specialty Stores)

- Online Platforms/E-commerce

Value Chain Analysis For Plumbing Hardware Market

The value chain for the Plumbing Hardware Market begins intensely at the upstream level with raw material procurement and advanced component manufacturing. Upstream activities involve sourcing primary materials such as brass ingots, zinc, various polymers (like PVC and PEX pellets), and stainless steel coils. Manufacturers often engage in specialized processes like casting, forging, and injection molding to create core components, with emphasis on material purity and structural integrity, crucial for product certification. Key upstream suppliers include major metal processing companies, specialized chemical firms for polymer creation, and component designers focusing on highly engineered parts like ceramic cartridges for faucets or specialized valve mechanisms. Cost control and consistent quality assurance at this initial stage are critical determinants of the final product's competitiveness and long-term durability. Effective management of commodity price volatility and securing long-term supply contracts characterize successful upstream operations in this industry.

The midstream phase involves the core manufacturing, assembly, and quality testing of the final hardware products. This stage is marked by significant investment in automation, precision machining, surface finishing (e.g., electroplating for faucets), and rigorous hydrostatic testing to ensure leak-free performance. Manufacturers must adhere to complex international standards (e.g., NSF, ISO, local building codes), requiring substantial compliance and certification efforts. Downstream analysis focuses on product distribution, which is bifurcated into direct sales to large construction project developers and indirect sales through extensive networks. Indirect distribution relies heavily on large wholesale distributors and specialized plumbing supply houses, which provide logistics support, credit facilities, and local technical expertise to plumbers and contractors. These channels are crucial for the rapid deployment of products in the RMR sector.

The direct channel, often utilized for very large governmental infrastructure projects or major industrial installations, involves manufacturers interacting straight with engineering procurement and construction (EPC) firms, offering customized solutions and bulk pricing. The rise of e-commerce represents a significant evolution in the downstream channel, particularly for standardized parts, accessories, and consumer-focused fixtures, offering greater price transparency and direct-to-consumer delivery, bypassing traditional middlemen for specific product lines. Successful value chain integration requires seamless information flow between material providers, core manufacturers, and distribution partners to ensure stock availability, manage fluctuating demand, and minimize lead times for bespoke or high-volume orders. The increasing complexity of smart hardware also necessitates that distribution channels provide adequate post-sales technical training and support, further influencing their role in the overall market structure.

Plumbing Hardware Market Potential Customers

Potential customers for the Plumbing Hardware Market are broadly segmented into three primary categories: Residential End-Users, Commercial Enterprises, and Industrial Operators, each possessing distinct procurement requirements and product preferences. Residential customers, driven by new home construction or renovation projects, typically prioritize aesthetic appeal, ease of use, water efficiency certifications, and consumer brand recognition; they often purchase through retail home improvement stores or via contractors. Commercial customers, including hotel chains, hospital networks, educational institutions, and large office complexes, focus intensely on durability, hygiene features (like touchless activation), high-volume performance metrics, maintenance ease, and adherence to public health codes, typically sourcing products through specialized wholesale distributors and large project tenders.

The industrial sector represents the third major customer base, encompassing manufacturing plants, power generation facilities, chemical processing units, and municipal water treatment plants. These customers require highly specialized, heavy-duty plumbing hardware, such as industrial valves, high-pressure piping systems, and robust filtering mechanisms, where compliance with process safety standards, material compatibility (corrosion resistance), and reliability under extreme operating conditions are the paramount selection criteria. Procurement decisions in the industrial sector are often based on detailed engineering specifications and long-term total cost of ownership (TCO) rather than upfront cost. Furthermore, specialized government bodies, including defense agencies and public utility departments responsible for urban water supply and sanitation, constitute a significant sub-segment of industrial and commercial customers, often requiring customized, large-scale components compliant with specific state or federal regulations, driving high-value, long-term contractual agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 105.5 Billion |

| Market Forecast in 2033 | USD 166.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Masco Corporation, Kohler Co., LIXIL Group Corporation, TOTO Ltd., Geberit AG, Uponor Corporation, Zurn Industries, RWC (Reliance Worldwide Corporation), Moen Incorporated, Sloan Valve Company, Viega GmbH & Co. KG, Elkay Manufacturing Company, American Standard, Grohe AG, AO Smith Corporation, Bradford White Corporation, Watts Water Technologies, C&S, Fernco, Grundfos. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Plumbing Hardware Market Key Technology Landscape

The technology landscape of the Plumbing Hardware Market is rapidly evolving, driven primarily by the need for increased water efficiency, enhanced user safety, and seamless integration into connected building management systems. A cornerstone technology development is the proliferation of sensor-based and IoT-enabled plumbing fixtures. These smart devices allow for remote monitoring, personalized usage profiles, proactive leak detection through flow sensors, and automated shut-off mechanisms, drastically reducing potential water damage and utility costs. This digital transformation extends beyond end-user fixtures to core infrastructure components; for instance, smart valves are now capable of modulating water pressure dynamically to prevent pipe bursts and optimize system longevity. The implementation of digital twin technology in large commercial and industrial plumbing system design is gaining traction, allowing engineers to simulate performance under various stress conditions before physical installation, thereby ensuring peak operational efficiency and regulatory compliance from the outset.

Another significant technological advancement lies in material science. The shift towards engineered polymers, such as cross-linked polyethylene (PEX) and high-performance thermoplastics, offers superior resistance to corrosion, scaling, and freezing compared to traditional metal piping, simplifying installation and extending system lifespan. Furthermore, anti-microbial coatings and materials are being increasingly integrated into fixtures and inner pipe linings, particularly in healthcare and food service applications, to mitigate the growth of Legionella and other waterborne pathogens, addressing critical public health concerns. Water heating technology is also undergoing a profound transformation, moving away from conventional storage tanks toward highly efficient, instantaneous tankless water heaters and solar thermal systems, often equipped with sophisticated electronic controls and self-diagnostic features to minimize energy consumption and maintenance demands. The combination of these material and digital technologies signals a fundamental shift in the industry, prioritizing long-term sustainable performance over short-term component costs, demanding higher technological expertise from both manufacturers and installers across the entire value chain.

Advanced manufacturing techniques are also critical technological drivers. Additive manufacturing (3D printing) is being increasingly explored for prototyping complex fittings and creating customized, high-end faucet designs with intricate internal geometries that are impossible to achieve through traditional casting or forging. Furthermore, automation, robotics, and advanced quality assurance systems utilizing artificial intelligence are being deployed in manufacturing plants to ensure components like ceramic disc cartridges and precision valves meet exceptionally tight tolerances required for leak-free, long-term operation. These manufacturing technology improvements not only enhance product quality but also enable faster design iteration and reduced time-to-market for innovative plumbing solutions. The adoption of these technologies ensures that modern plumbing hardware is not merely functional but integral to smart, sustainable, and highly efficient building infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, dominated by large-scale residential construction, massive government investment in urban infrastructure, and sanitation projects, particularly in China, India, and Southeast Asian countries. The sheer volume of new housing units being built drives demand for basic pipes, fittings, and entry-to-mid-level fixtures. Rapid industrialization also fuels demand for specialized industrial plumbing components.

- North America: This region is a mature market characterized by high RMR activity and stringent energy efficiency regulations (e.g., California’s water efficiency standards). Demand is centered on premium, smart, and water-saving hardware, including touchless faucets and smart leak detection systems. The replacement of aging municipal water infrastructure provides significant opportunities for piping and large-valve manufacturers.

- Europe: Europe exhibits a strong focus on sustainability and compliance with strict environmental standards (e.g., the European Water Framework Directive). The market demands high-quality, durable, and aesthetically superior products, driving innovation in material science and energy-efficient water heating solutions. Germany, France, and the UK are key markets driven by robust commercial construction and renovation of historic buildings.

- Latin America (LATAM): Growth in LATAM is variable but accelerating, driven by urbanization in major metropolitan areas (Brazil, Mexico). The primary focus is on expanding access to reliable potable water systems, leading to strong demand for basic infrastructure materials and valves. Economic instability can sometimes restrain investment, but sustained residential growth provides consistent underlying demand.

- Middle East and Africa (MEA): This region is characterized by high-value infrastructure megaprojects (especially in the GCC countries) and a critical need for efficient water management technologies due to pervasive water scarcity. Demand is high for high-end, luxury fixtures in commercial real estate (hotels) and advanced water recycling/desalination piping systems. Infrastructure development in South Africa and the UAE fuels market activity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Plumbing Hardware Market.- Masco Corporation

- Kohler Co.

- LIXIL Group Corporation

- TOTO Ltd.

- Geberit AG

- Uponor Corporation

- Zurn Industries

- RWC (Reliance Worldwide Corporation)

- Moen Incorporated

- Sloan Valve Company

- Viega GmbH & Co. KG

- Elkay Manufacturing Company

- American Standard

- Grohe AG

- AO Smith Corporation

- Bradford White Corporation

- Watts Water Technologies

- C&S

- Fernco

- Grundfos

Frequently Asked Questions

Analyze common user questions about the Plumbing Hardware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for smart plumbing hardware?

Demand is driven primarily by increasing consumer awareness regarding water conservation, the need for enhanced property protection through automated leak detection, and the desire for seamless integration of plumbing systems into broader smart home and building management platforms (IoT).

Which material segment is expected to show the highest growth?

The Plastics segment, particularly PEX and CPVC, is projected to show significant growth due to their cost-effectiveness, ease of installation, superior resistance to corrosion and scaling, and suitability for modular construction techniques used in high-volume residential projects globally.

How do volatile raw material prices impact the plumbing hardware industry?

Volatility in prices for metals like copper, brass, and zinc significantly impacts manufacturing margins and forces companies to either absorb costs or adjust consumer pricing, leading to strategic shifts towards alternative materials like specialized alloys and engineered plastics to mitigate risk.

What role does the Repair, Maintenance, and Renovation (RMR) sector play?

The RMR sector is crucial, especially in mature markets like North America and Europe, driving consistent demand for replacement parts and system upgrades necessary to comply with modern efficiency codes and replace aging infrastructure, providing stable revenue streams independent of new construction cycles.

What are the key differences between residential and commercial plumbing product demands?

Residential demand prioritizes aesthetics, user convenience, and initial cost, whereas commercial demand focuses intensely on high durability, water flow capacity, strict hygiene standards (e.g., touchless operation), minimal maintenance requirements, and overall compliance with public safety regulations.

Sustainability and Regulatory Drivers in the Plumbing Market

The global push for sustainability represents a transformative factor reshaping the Plumbing Hardware Market, moving it from a focus purely on water distribution efficiency to holistic environmental impact minimization. Regulatory bodies worldwide, including the EPA in the US, the European Union's directives on water quality, and various national building codes, are mandating the adoption of technologies designed to drastically reduce water consumption in both residential and commercial settings. This has driven the widespread integration of low-flow toilets, water-efficient showerheads, and highly precise metering systems. Manufacturers are responding by prioritizing the circular economy, focusing on products that use high levels of recycled content, minimize waste during production, and are easily recyclable at the end of their long lifecycles. Certification standards, such as WaterSense and comparable regional labels, have become essential for market entry in many jurisdictions, compelling continuous product innovation in hydraulic design and fixture performance. The requirement for detailed environmental product declarations (EPDs) is also increasing, particularly in large commercial projects seeking green building certifications like LEED or BREEAM, placing pressure on manufacturers to provide transparent reporting on material sourcing and energy consumption inherent in their production processes.

The regulatory framework extends beyond water conservation to encompass material safety and public health. Regulations concerning lead content (e.g., the US Safe Drinking Water Act) have fundamentally altered the composition of fittings and faucets, necessitating the shift to lead-free brass, stainless steel, and specialized polymers to ensure potable water safety. Furthermore, building codes increasingly mandate robust anti-scald protection in fixtures, driving the adoption of thermostatic mixing valves (TMVs) and pressure-balancing valves, particularly in healthcare and hospitality sectors where safety is paramount. These regulatory pressures, rather than acting as restraints, serve as powerful innovation drivers, compelling companies to invest in R&D to develop superior, compliant, and often patented technologies that command a premium in the market. The complex interplay of global and local standards means that market leaders must maintain highly agile compliance strategies, often tailoring product specifications region by region to meet diverse and evolving legal requirements, ensuring that every product from a simple coupling to a complex mixing valve meets the highest standards of environmental performance and human health protection.

Future regulatory trends are expected to place greater emphasis on resilient infrastructure capable of withstanding extreme weather events and increased digitalization of monitoring systems. For instance, regulations in flood-prone areas may require specialized backflow prevention devices or highly durable pipe materials. Simultaneously, governments are increasingly considering mandates for smart metering and leak detection systems in new construction to manage regional water resources more effectively. This anticipates a future where plumbing hardware is not a standalone system but an integral, communicative component of urban smart grids, where data on water usage and potential leaks is automatically reported and analyzed to optimize municipal resource planning. Manufacturers who proactively invest in these digital compliance solutions and resilient material technologies will be strategically positioned to capture public sector and large-scale industrial contract opportunities stemming directly from these evolving regulatory mandates.

Competitive Strategies and Market Dynamics

Competition in the Plumbing Hardware Market is fierce and multi-layered, ranging from global conglomerates competing on brand recognition, R&D capabilities, and supply chain efficiency, to regional specialized manufacturers focusing on niche product segments or specific material expertise. A core competitive strategy for market leaders involves relentless product differentiation through design innovation, emphasizing aesthetic appeal and user experience—a trend particularly prevalent in the Faucets & Fixtures segment. Companies leverage high-profile designers and utilize advanced finishing technologies (PVD coatings, specialized electroplating) to create premium product lines that justify higher price points and establish strong brand loyalty among architects and interior designers. Furthermore, strategic acquisitions remain a critical avenue for growth, allowing large players to quickly integrate specialized technologies (e.g., smart home sensors, advanced valve mechanisms) or gain immediate access to high-growth regional distribution networks, particularly in emerging markets where organic expansion can be slow and capital-intensive.

For players in the Pipes & Fittings segment, the competitive focus shifts towards supply chain optimization and standardization. Success is determined by the ability to offer certified, high-quality materials at competitive bulk pricing, backed by reliable just-in-time delivery for large construction sites. Manufacturers of PEX and other plastic piping systems compete vigorously on ease of installation—promoting features like crimp-free or push-to-connect fittings that significantly reduce labor time and the need for specialized tools, providing substantial cost savings to contractors. Technology licensing and the establishment of proprietary fitting systems create strong barriers to entry in this segment. Simultaneously, medium-sized enterprises often adopt a specialization strategy, focusing exclusively on complex industrial valves, wastewater management components, or specialized commercial applications (like healthcare plumbing) where regulatory knowledge and deep engineering expertise outweigh sheer scale, allowing them to maintain higher margins in these less price-sensitive, high-specification markets.

The emergence of e-commerce has introduced new competitive dynamics, placing pressure on traditional wholesale distribution models. Manufacturers are increasingly using online platforms, either their own or major marketplaces, to manage direct-to-consumer sales for standard RMR products and accessories, thereby gaining valuable market data on consumer behavior and demand patterns. Competitive success in the digital space relies on robust logistics, transparent pricing, detailed product information, and effective digital marketing targeting DIY consumers and small contractors. Overall, the market rewards companies that successfully manage the dual complexity of maintaining a global, resilient supply chain for raw materials while simultaneously developing hyper-localized, certified products that meet diverse regional building codes and aesthetic preferences. Strategic investment in training and certified installer programs also serves as a critical moat, ensuring proper installation and maximizing product performance, which is vital for maintaining brand reputation and minimizing warranty claims.

Challenges and Mitigation Strategies in Plumbing Hardware

A significant challenge facing the Plumbing Hardware Market is the persistent volatility and upward trend in the cost of crucial raw materials, particularly copper, zinc, and energy-intensive polymers. These cost pressures are exacerbated by global trade tariffs, logistical bottlenecks, and geopolitical instability affecting major mining and processing hubs. This uncertainty makes long-term forecasting and fixed-price contracts difficult, potentially jeopardizing profitability. Mitigation strategies employed by leading manufacturers include vertical integration where feasible, diversifying the supply base to reduce dependence on single regions, and implementing advanced hedging strategies for critical commodities. Furthermore, R&D efforts are heavily focused on material substitution, exploring cost-effective, high-performance alternatives like specialized stainless steels, high-grade engineering plastics, or composite materials that offer comparable durability and compliance but with a lower or more stable cost profile, effectively 'designing out' the price risk associated with highly volatile metals.

Another major challenge is the increasing complexity of regulatory compliance across numerous international and local jurisdictions. A single product line, such as a thermostatic mixing valve, might require different certifications for lead content, pressure rating, flow capacity, and energy efficiency depending on whether it is sold in Europe, the US, or the Middle East. Ensuring compliance across a broad product portfolio demands substantial investment in specialized legal teams, product testing, and continuous updating of engineering specifications. Mitigation involves developing highly modular product architectures where core mechanical components remain standard, but external parts and material compositions can be rapidly adapted to meet specific local codes. Furthermore, companies often invest in obtaining broad, internationally recognized certifications (like ISO standards) that simplify the subsequent process of achieving country-specific approvals, streamlining the market entry process and reducing compliance delays.

The industry also faces a persistent skilled labor gap. The installation of modern, high-tech plumbing hardware—especially smart systems, complex commercial piping networks, and advanced water heating units—requires highly specialized training in both mechanical and electronic fields. A shortage of certified, skilled plumbers and technicians can slow down project completion, lead to installation errors, and negatively impact the perception of product quality. Manufacturers mitigate this by heavily investing in installer training programs, offering certification courses, and partnering with vocational schools and professional organizations to develop standardized curricula focused on modern plumbing technology. Additionally, product design itself is being optimized for 'installer-friendliness,' incorporating push-fit connectors, pre-assembled modules, and digital setup guides that reduce the complexity and time required for correct installation, thereby lowering the barrier to entry for maintenance and repair personnel.

Future Outlook and Emerging Trends

The future outlook for the Plumbing Hardware Market is overwhelmingly positive, characterized by convergence with digital technologies and an accelerated commitment to environmental sustainability. One of the most significant emerging trends is the comprehensive integration of the Internet of Things (IoT) throughout the entire plumbing ecosystem, moving beyond simple smart faucets to networked pipe infrastructure. Future plumbing systems will function as fully connected, communicative networks capable of real-time monitoring of pressure, temperature, water quality, and structural integrity, feeding data back into central building management systems or municipal grids. This shift will create new market segments for data analysis services and predictive maintenance subscriptions, fundamentally transforming the traditional product sales model into a service-oriented offering. Furthermore, the adoption of digital technologies will simplify maintenance through augmented reality (AR) tools that guide technicians through complex repairs, increasing efficiency and precision.

Another dominant future trend is the mainstreaming of water reuse and greywater recycling systems, particularly in regions facing acute water stress. Plumbing hardware will increasingly incorporate specialized dual-piping systems, high-efficiency filtration units, and robust pumps designed specifically to process and redistribute non-potable water for irrigation, flushing, and industrial cooling. This mandates innovation in valve technology and material science to handle varied water compositions without premature corrosion or contamination risk. Moreover, the design aesthetic of plumbing hardware will continue its evolution toward hyper-customization and seamless integration into architectural spaces. High-end fixtures will feature customizable finishes, modular designs, and hidden technological components, reflecting a consumer demand for functional elements that also serve as integral design features, thereby increasing the average selling price and boosting revenue generation in the premium segment globally.

Finally, material innovation will focus on developing fully biodegradable or self-healing pipe and fitting materials that significantly reduce waste and minimize the environmental footprint associated with manufacturing and disposal. Research into bacteriostatic materials that actively prevent microbial growth within the water system will also gain traction, driven by public health concerns and tightening water quality standards. The integration of manufacturing automation, particularly robotics and advanced simulation software (digital twins), will become standard practice, enabling rapid prototyping, error minimization, and mass customization, securing the industry's ability to quickly adapt to rapidly changing consumer demands and infrastructural requirements. The cumulative effect of these trends is a market that will be fundamentally more intelligent, sustainable, and high-tech than its predecessor, demanding continuous investment in R&D and strategic digital partnerships from market participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager